Home>Finance>How To Create An Income Statement, Balance Sheet, And Retained Earnings

Finance

How To Create An Income Statement, Balance Sheet, And Retained Earnings

Published: March 2, 2024

Learn how to create essential financial statements including income statement, balance sheet, and retained earnings. Get expert guidance on finance fundamentals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the financial health of a business is crucial for making informed decisions and strategizing for future growth. Three essential financial statements play a pivotal role in providing insights into a company's performance and financial position: the income statement, balance sheet, and retained earnings statement. These documents not only offer a snapshot of a company's financial standing but also help stakeholders, including investors, creditors, and management, in assessing its profitability, liquidity, and overall stability.

In this comprehensive guide, we will delve into the intricacies of these financial statements, exploring their significance, components, and the process of creating them. By gaining a deeper understanding of the income statement, balance sheet, and retained earnings statement, you will be better equipped to interpret financial data, analyze the financial standing of a business, and make informed decisions.

Throughout this journey, we will demystify the complexities often associated with financial statements, breaking down the key elements and providing practical insights to empower you with the knowledge needed to navigate the world of finance with confidence. Whether you are a business owner, a finance professional, or an aspiring entrepreneur, mastering the art of interpreting and creating these financial statements is a fundamental step towards achieving financial acumen and driving sustainable business growth.

Join us as we embark on an enlightening exploration of the income statement, balance sheet, and retained earnings statement, unraveling their significance and empowering you with the expertise to harness their insights for informed decision-making and strategic financial management.

Understanding the Income Statement

The income statement, also known as the profit and loss statement, provides a summary of a company’s revenues and expenses over a specific period, typically a fiscal quarter or year. This financial statement offers a comprehensive view of a business’s operational performance, revealing its ability to generate profits and manage expenses effectively. By analyzing the income statement, stakeholders can gauge the company’s profitability, assess the efficiency of its operations, and identify potential areas for improvement.

Key components of the income statement include:

- Revenue: This encompasses the total income generated from the sale of goods or services. It is a vital indicator of a company’s ability to attract customers and drive sales.

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing goods or delivering services. Calculating the COGS is essential for determining the gross profit margin.

- Operating Expenses: These encompass the costs incurred in the day-to-day operations of the business, such as rent, utilities, salaries, and marketing expenses.

- Net Income: Also referred to as the bottom line, net income reflects the company’s total profits after deducting all expenses, including taxes and interest.

By comprehending the nuances of the income statement, individuals can gain valuable insights into a company’s revenue streams, cost management strategies, and overall financial performance. This understanding is instrumental in making informed investment decisions, evaluating the financial health of a business, and formulating effective strategies for sustainable growth and profitability.

Creating an Income Statement

Developing an income statement involves a systematic process of compiling and organizing financial data to present a clear and accurate depiction of a company’s financial performance. The following steps outline the essential components of creating an income statement:

- Compile Revenue Data: Gather comprehensive information on the revenue generated from the sale of goods or services. Categorize the revenue streams to provide a detailed breakdown of the income sources.

- Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with production or service delivery. This includes expenses such as raw materials, labor, and manufacturing overhead.

- Account for Operating Expenses: Identify and categorize the various operating expenses incurred during the reporting period, including administrative costs, marketing expenses, and research and development expenditures.

- Compute Gross Profit: Subtract the COGS from the total revenue to ascertain the gross profit, which reflects the profitability of the core business operations.

- Factor in Non-Operating Income and Expenses: Include any additional income or expenses not directly related to the primary business activities, such as interest income, interest expenses, and gains or losses from asset sales.

- Calculate Net Income: Deduct all expenses, including operating and non-operating costs, from the total revenue to arrive at the net income, which represents the company’s overall profitability.

Utilizing accounting software or engaging the expertise of a qualified accountant can streamline the process of creating an income statement, ensuring accuracy and compliance with accounting standards. By following these steps and leveraging financial data effectively, businesses can construct an income statement that serves as a valuable tool for analyzing performance, identifying financial trends, and making informed strategic decisions.

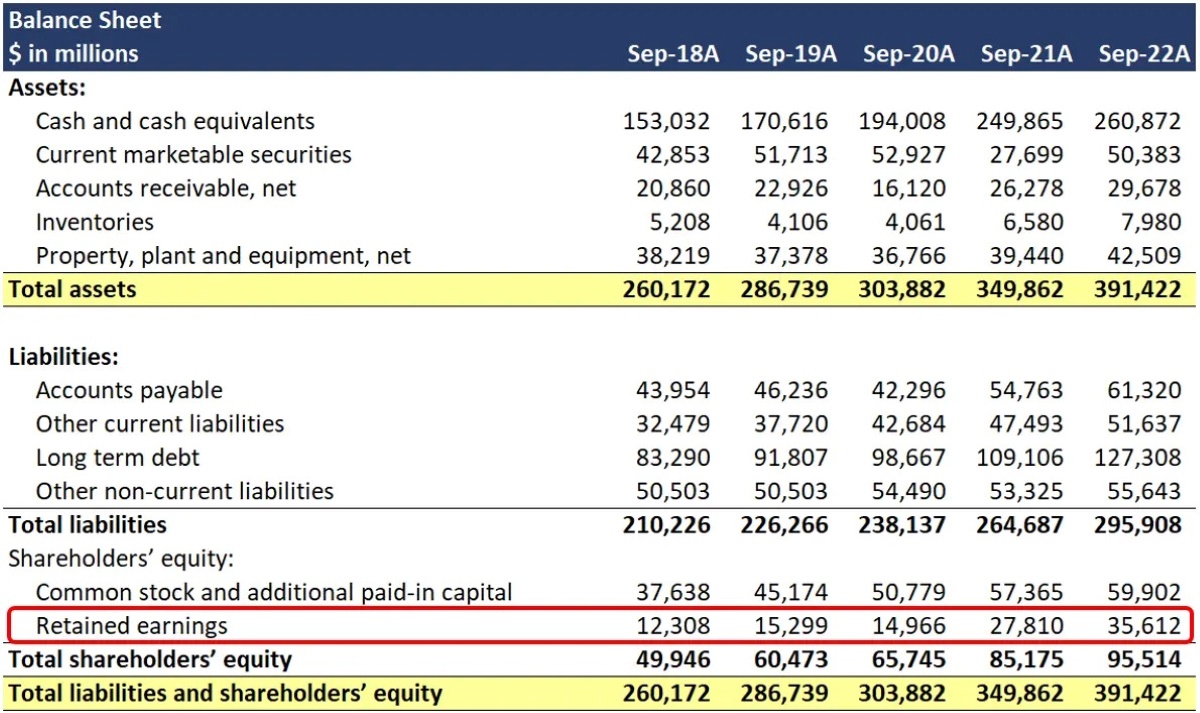

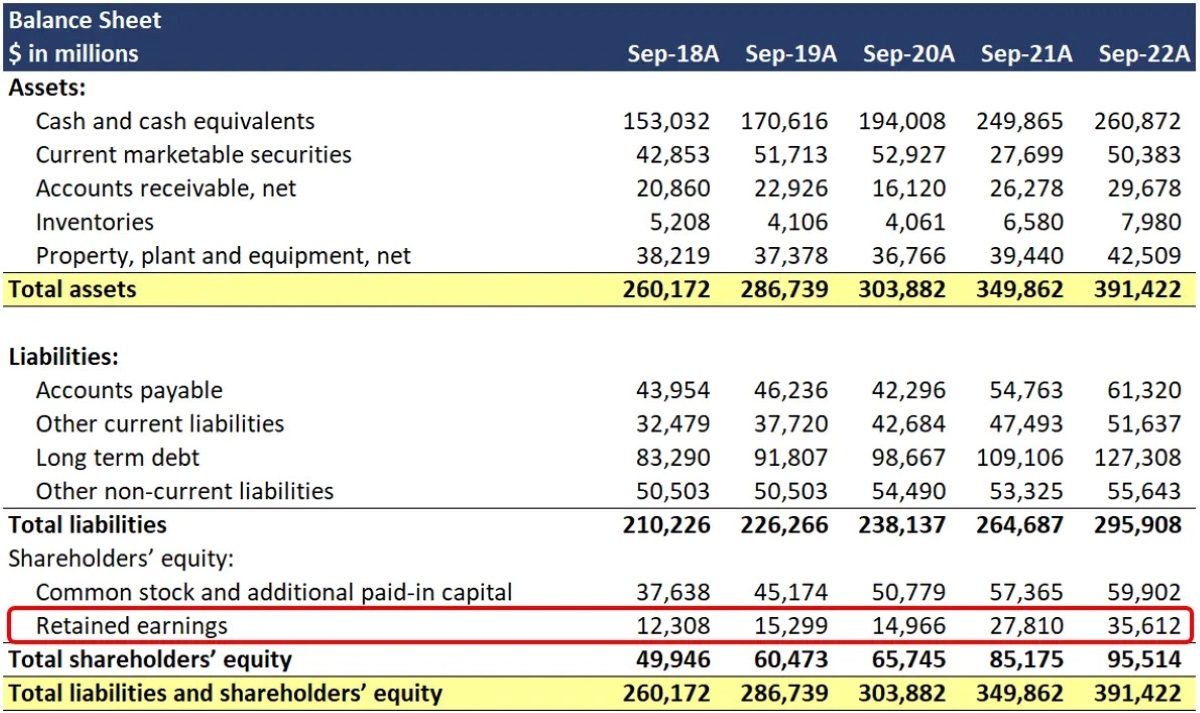

Understanding the Balance Sheet

The balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time, typically the end of a fiscal period. It presents a detailed overview of a company’s assets, liabilities, and shareholders’ equity, offering insights into its solvency, liquidity, and overall financial health. By understanding the components of a balance sheet, stakeholders can assess a company’s ability to meet its financial obligations, evaluate its capital structure, and analyze its net worth.

Key components of the balance sheet include:

- Assets: These encompass all the resources owned by the company, including cash, accounts receivable, inventory, property, plant, equipment, and intangible assets. Assets are categorized as current (short-term) or non-current (long-term) based on their liquidity and expected utilization within the business.

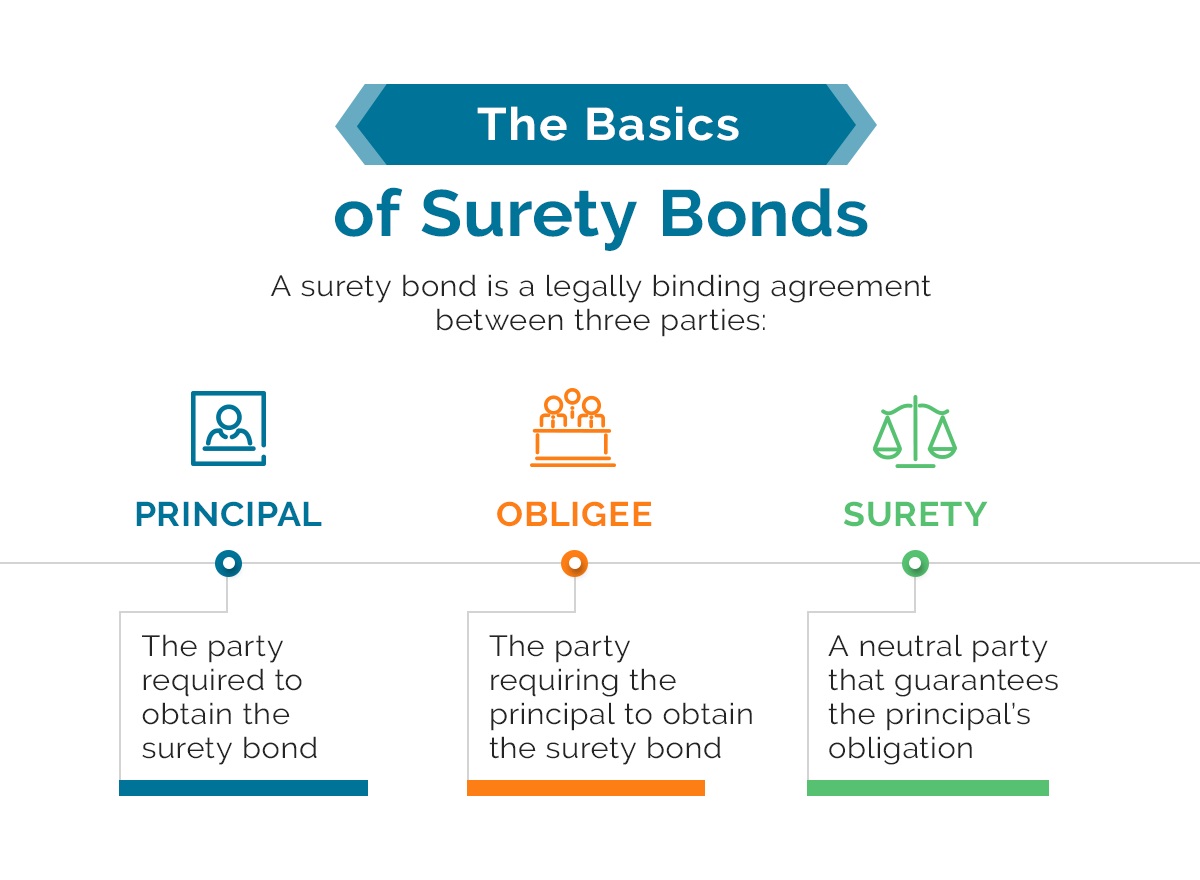

- Liabilities: Liabilities represent the company’s financial obligations, such as accounts payable, loans, accrued expenses, and long-term debts. Similar to assets, liabilities are classified as current or non-current based on their maturity and settlement timelines.

- Shareholders’ Equity: This reflects the residual interest in the company’s assets after deducting its liabilities. It comprises common stock, preferred stock, additional paid-in capital, retained earnings, and other comprehensive income.

By examining the balance sheet, stakeholders can gain valuable insights into a company’s liquidity, leverage, and overall financial stability. This understanding is crucial for investors assessing the risk and return potential of their investments, creditors evaluating a company’s creditworthiness, and management making strategic decisions to optimize the capital structure and enhance financial performance.

Creating a Balance Sheet

Developing a balance sheet involves a meticulous process of compiling and organizing financial information to accurately represent a company’s financial position at a specific point in time. The following steps outline the essential components of creating a balance sheet:

- Compile Asset Data: Gather comprehensive details of the company’s assets, including cash, accounts receivable, inventory, investments, and property. Classify assets as current or non-current based on their liquidity and expected utilization.

- Account for Liabilities: Identify and categorize the company’s financial obligations, such as accounts payable, short-term loans, long-term debts, and accrued expenses. Classify liabilities as current or non-current based on their maturity and settlement timelines.

- Calculate Shareholders’ Equity: Determine the company’s shareholders’ equity by accounting for the contributed capital, retained earnings, and other comprehensive income. This represents the residual interest in the company’s assets after deducting its liabilities.

- Ensure Balance: Verify that the total assets equal the sum of liabilities and shareholders’ equity, adhering to the fundamental accounting principle of the balance sheet equation: Assets = Liabilities + Shareholders’ Equity.

- Provide Disclosures: Include relevant footnotes and disclosures to provide additional context and transparency regarding the company’s accounting policies, significant accounting estimates, and any contingent liabilities.

Utilizing accounting software or seeking the expertise of a professional accountant can facilitate the process of creating a balance sheet, ensuring accuracy and adherence to accounting standards. By following these steps and meticulously organizing financial data, businesses can construct a balance sheet that serves as a vital tool for assessing financial health, facilitating informed decision-making, and providing stakeholders with a comprehensive view of the company’s financial position.

Understanding Retained Earnings

Retained earnings represent the cumulative net profits or losses of a company that have been retained for reinvestment into the business, rather than distributed to shareholders in the form of dividends. This vital component of the balance sheet reflects the company’s ability to generate profits and its reinvestment strategies for sustaining and expanding its operations. Understanding retained earnings is essential for stakeholders to assess a company’s profitability, dividend policy, and long-term growth prospects.

Key aspects of retained earnings include:

- Accumulation of Profits: Retained earnings accumulate over time as a result of profitable operations, signifying the portion of earnings that are not distributed as dividends but retained within the company.

- Impact on Shareholders’ Equity: Retained earnings directly contribute to the shareholders’ equity, reflecting the total value of the company’s assets that belong to the shareholders after deducting liabilities. This underscores the role of retained earnings in enhancing the company’s net worth.

- Reinvestment and Growth: Companies often utilize retained earnings for funding expansion initiatives, research and development projects, debt reduction, and other strategic investments aimed at bolstering long-term growth and competitiveness.

- Dividend Policy: The level of retained earnings influences a company’s dividend policy, as it reflects the management’s decision on whether to distribute profits to shareholders or retain them for future growth opportunities.

By comprehending the significance of retained earnings, stakeholders can evaluate a company’s financial prudence, capital allocation strategies, and its capacity to weather economic uncertainties while pursuing sustainable growth. This understanding is instrumental for investors assessing a company’s reinvestment potential, creditors evaluating its financial stability, and management formulating dividend distribution policies that align with the company’s long-term objectives.

Creating a Retained Earnings Statement

Developing a retained earnings statement involves a structured process of documenting the changes in retained earnings over a specific accounting period. This statement provides a comprehensive overview of the factors influencing the accumulation or depletion of retained earnings, offering insights into a company’s profit retention and distribution strategies. The following steps outline the essential components of creating a retained earnings statement:

- Beginning Retained Earnings: Identify the balance of retained earnings at the beginning of the accounting period, which is carried forward from the previous period’s financial records.

- Add Net Income: Incorporate the net income or net loss for the current accounting period, reflecting the company’s profitability or losses after accounting for all revenues, expenses, gains, and losses.

- Subtract Dividends: Deduct any dividends declared or distributed to shareholders during the accounting period, as these represent the portion of earnings that are not retained but distributed as returns to the shareholders.

- Adjust for Prior Period Errors: Rectify any material errors or misstatements from prior periods that impact the retained earnings, ensuring the accuracy and integrity of the statement.

- Calculate Ending Retained Earnings: Compute the ending balance of retained earnings by adding the net income and deducting the dividends from the beginning retained earnings balance.

Utilizing accounting software or engaging the expertise of a qualified accountant can streamline the process of creating a retained earnings statement, ensuring accuracy and compliance with accounting standards. By following these steps and meticulously documenting the changes in retained earnings, businesses can construct a statement that provides stakeholders with a transparent view of the company’s profit retention, dividend policies, and overall financial performance over the accounting period.

Conclusion

Mastering the art of interpreting and creating financial statements is a fundamental aspect of financial acumen and strategic decision-making for businesses. The income statement, balance sheet, and retained earnings statement collectively offer a comprehensive view of a company’s financial performance, position, and wealth accumulation strategies. By understanding the intricacies of these essential financial statements, stakeholders can gain valuable insights into a company’s profitability, liquidity, and long-term growth prospects.

From the income statement’s portrayal of a company’s revenue generation and expense management to the balance sheet’s reflection of its assets, liabilities, and shareholders’ equity, these financial statements serve as indispensable tools for investors, creditors, and management in evaluating a company’s financial health and making informed decisions.

Furthermore, the retained earnings statement provides a window into a company’s profit retention, reinvestment strategies, and dividend policies, enabling stakeholders to assess its long-term sustainability and growth trajectory. By comprehending the impact of retained earnings on a company’s financial position and shareholders’ equity, stakeholders can gauge the company’s financial prudence and capital allocation strategies.

As businesses navigate the dynamic landscape of finance, the ability to construct and interpret these financial statements is paramount for driving sustainable growth, enhancing financial transparency, and fostering investor confidence. Whether you are an aspiring entrepreneur, a seasoned investor, or a finance professional, the knowledge and proficiency in navigating the complexities of financial statements are indispensable for informed decision-making and strategic financial management.

Embracing the insights gained from this exploration of the income statement, balance sheet, and retained earnings statement equips you with the expertise to harness financial data effectively, evaluate a company’s financial standing, and steer it towards enduring success and prosperity.