Finance

What Does CCAR Stand For In Banking

Published: November 2, 2023

Learn what CCAR stands for in banking and how it affects the finance industry. Discover the significance of CCAR and its impact on financial institutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where acronyms abound and industry-specific terms can seem like a foreign language. One such acronym you may have come across in the banking sector is CCAR. But what exactly does CCAR stand for, and what role does it play in the world of finance?

CCAR stands for Comprehensive Capital Analysis and Review. It is a regulatory framework implemented by the Federal Reserve in the United States to assess the capital adequacy, internal capital planning processes, and resilience of large, complex financial institutions. In simple terms, CCAR is a stress testing program that evaluates banks’ ability to withstand severe economic downturns and maintain adequate capital to support their operations.

The importance of CCAR cannot be overstated. Since the global financial crisis of 2008, regulators have placed greater emphasis on ensuring the stability and resilience of the banking sector. The implementation of CCAR serves as a proactive measure to prevent another financial crisis by assessing the capital positions and risk management practices of banks.

By subjecting banks to rigorous stress tests, CCAR helps regulators identify potential weaknesses and vulnerabilities within individual institutions as well as across the banking system as a whole. This allows for the early detection of any capital shortfalls and the implementation of corrective measures to protect depositors, borrowers, and the overall financial system.

Definition of CCAR

CCAR stands for Comprehensive Capital Analysis and Review. It is a regulatory framework developed by the Federal Reserve in the United States to evaluate the capital adequacy and internal capital planning processes of large, complex financial institutions. The goal of CCAR is to ensure that banks have sufficient capital to weather severe economic downturns and maintain stability in the financial system.

Under the CCAR framework, banks are required to submit annual capital plans to the Federal Reserve, which are then subjected to rigorous stress tests. These stress tests simulate various economic scenarios, including severe recessions, market disruptions, and significant losses in the banking industry. The purpose is to assess how these adverse conditions would impact the bank’s capital levels and ability to continue operating.

In addition to evaluating capital adequacy, CCAR also examines various risk management practices and internal controls within banks. This includes assessing the bank’s risk identification and measurement processes, risk governance, and stress testing capabilities. The Federal Reserve considers these factors in determining whether a bank has a sufficient capital buffer to absorb losses and maintain stability during times of stress.

CCAR applies to banks that have consolidated assets of $250 billion or more, as well as other banks that are deemed to be significant to the financial system. These institutions are required to undergo the CCAR process annually and must demonstrate their ability to remain well-capitalized even under adverse economic conditions.

Overall, CCAR serves as a critical safeguard to protect the stability of the banking sector. By assessing and addressing potential risks and weaknesses in large financial institutions, regulators aim to enhance the resilience and stability of the financial system as a whole.

Purpose of CCAR in Banking

The Comprehensive Capital Analysis and Review (CCAR) program plays a crucial role in the banking industry by serving several important purposes. Let’s explore some of the key objectives and benefits of CCAR.

First and foremost, the main purpose of CCAR is to promote the stability and resilience of the banking sector. By subjecting banks to rigorous stress tests, regulators can assess their ability to withstand severe economic downturns. This helps to identify any vulnerabilities or weaknesses in the banks’ capital positions and risk management practices, allowing for early detection and remediation.

CCAR also helps to ensure that banks maintain sufficient capital levels to support their ongoing operations and protect depositor funds. By evaluating the adequacy of capital buffers, regulators can determine if the banks have enough capital to absorb potential losses and continue lending during times of economic stress. This helps to enhance the overall safety and soundness of the banking system.

Another purpose of CCAR is to improve risk management practices within banks. Through the CCAR process, regulators assess the banks’ risk identification, measurement, and mitigation strategies. This encourages banks to strengthen their risk management frameworks and implement robust controls to mitigate potential risks. By doing so, CCAR helps to mitigate the probability of future financial crises and protect the interests of depositors and borrowers.

The CCAR program also promotes transparency and accountability in the banking industry. Banks are required to submit detailed capital plans to the Federal Reserve, including projections of revenue, expenses, and capital ratios over the planning horizon. This allows regulators to assess the reasonableness and accuracy of the banks’ financial projections and ensure that they align with the banks’ risk profiles and operating strategies.

Furthermore, CCAR encourages banks to adopt a forward-looking approach to capital planning. By subjecting banks to stress tests under different economic scenarios, CCAR provides valuable insight into potential risks and challenges that banks may face in the future. This helps banks to enhance their capital planning processes and make informed decisions regarding capital allocation, risk appetite, and business strategies.

In summary, the key purpose of CCAR in banking is to promote stability, safeguard depositor funds, enhance risk management practices, ensure transparency, and encourage forward-looking capital planning. By fulfilling these objectives, CCAR contributes to the overall resilience and soundness of the banking sector, benefiting both banks and the broader economy.

CCAR Stress Testing

CCAR stress testing is a critical component of the Comprehensive Capital Analysis and Review (CCAR) program. It involves subjecting banks to rigorous assessments to evaluate their ability to withstand severe economic downturns and maintain adequate capital levels. Let’s delve into the process and significance of CCAR stress testing.

The CCAR stress testing process involves simulating a variety of adverse scenarios to assess the impact on a bank’s capital position. These scenarios include severe recessions, market disruptions, and significant losses in the banking industry. By subjecting banks to these stress tests, regulators aim to gauge the resilience and viability of their capital levels under adverse economic conditions.

The stress testing scenarios used in CCAR are carefully designed by the Federal Reserve to be comprehensive and severe. They take into account various macroeconomic factors, such as GDP growth, unemployment rates, interest rates, and housing prices, considering both the domestic and global economic environment. This ensures that the stress tests are robust and reflective of potential risks faced by financial institutions.

During the stress testing process, banks are required to project their capital positions over a defined planning horizon, typically nine quarters. The projections include estimates of revenue, expenses, loan losses, and the impact of the stress test scenarios on capital ratios. Banks must demonstrate that they will remain well-capitalized and maintain required capital ratios even in the most adverse stress test conditions.

The results of CCAR stress testing are crucial for regulators, as they reveal any potential capital shortfalls or vulnerabilities in banks. If a bank fails the stress test, it must take immediate action to rectify the identified deficiencies and resubmit an improved capital plan to the Federal Reserve. This process ensures that banks are held accountable for maintaining sufficient capital buffers and effectively managing risks.

CCAR stress testing is a dynamic and iterative process. Each year, the stress test scenarios can change based on evolving economic conditions and new risks to the banking sector. This allows regulators to stay ahead of emerging threats and continuously assess the resilience of banks in the face of evolving challenges.

The significance of CCAR stress testing cannot be overstated. It helps regulators and banks to identify potential weaknesses, implement necessary corrective measures, and safeguard the stability of the overall financial system. By ensuring that banks maintain sufficient capital levels and can withstand economic shocks, CCAR stress testing contributes to the long-term sustainability and resilience of the banking industry.

Requirements for CCAR Compliance

To ensure compliance with the Comprehensive Capital Analysis and Review (CCAR) program, banks must meet several requirements set forth by the Federal Reserve. These requirements are designed to promote the stability and soundness of the banking sector. Let’s examine some of the key elements of CCAR compliance.

1. Capital Planning Process: Banks are required to establish a robust and comprehensive capital planning process. This includes developing policies, procedures, and methodologies for assessing and managing capital adequacy. Banks must also have mechanisms in place to monitor and update their capital plans regularly.

2. Scenario Analysis: CCAR mandates that banks perform scenario analyses to assess the potential impact of adverse economic conditions on their capital levels. These scenarios are provided by the Federal Reserve and include factors such as GDP growth, unemployment rates, and interest rates. Banks must carefully analyze and project their capital positions under these scenarios.

3. Stress Testing: As part of CCAR compliance, banks must undergo rigorous stress testing. This involves subjecting their capital plans to various stress scenarios designed to assess the bank’s ability to absorb losses and maintain adequate capital levels under adverse economic conditions. Banks must demonstrate that their capital positions remain above regulatory thresholds during the stress tests.

4. Risk Management Framework: CCAR compliance requires banks to develop and maintain robust risk management frameworks. This includes having effective systems and controls in place to identify, measure, monitor, and manage risks across various areas, such as credit risk, market risk, and operational risk. Banks must demonstrate the ability to assess and manage risks effectively.

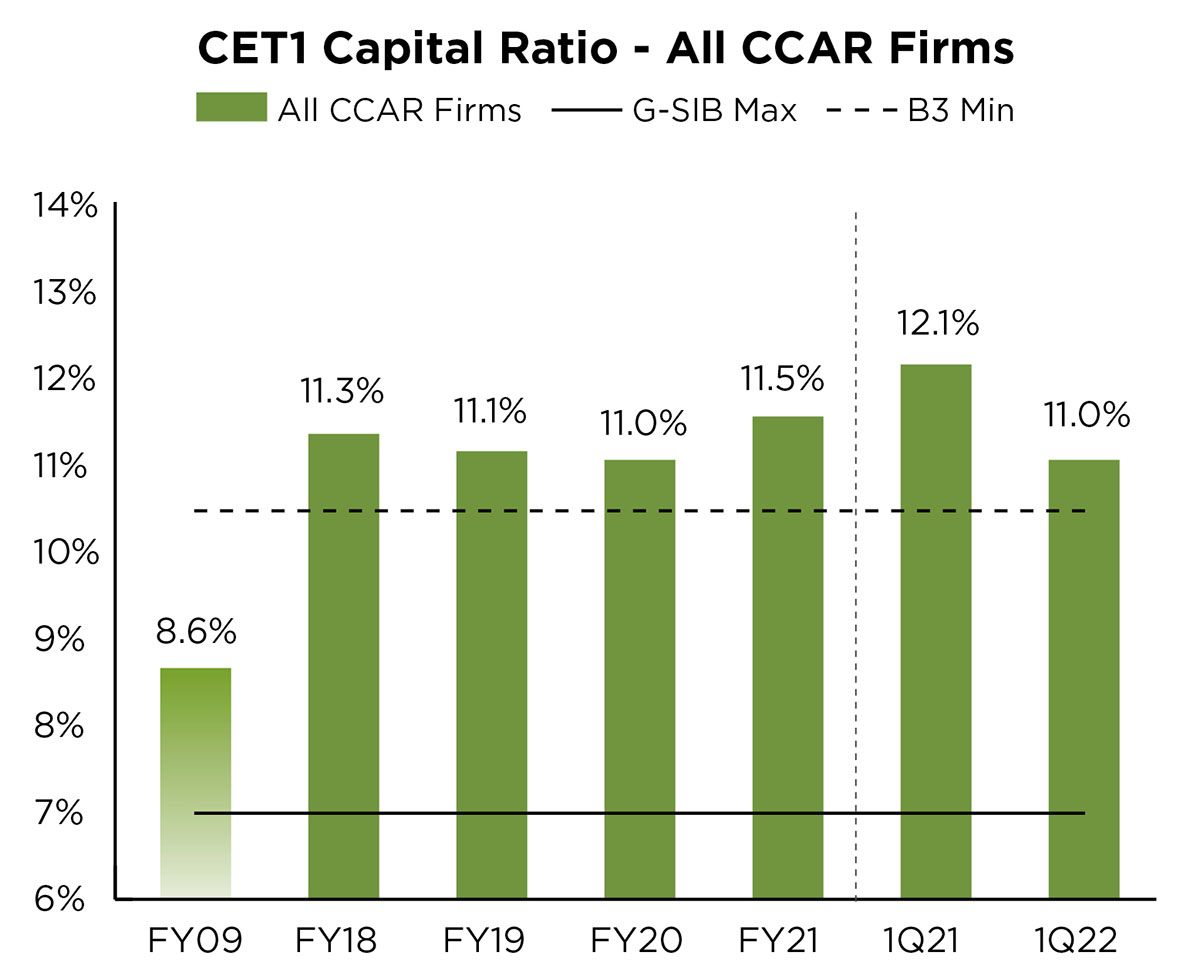

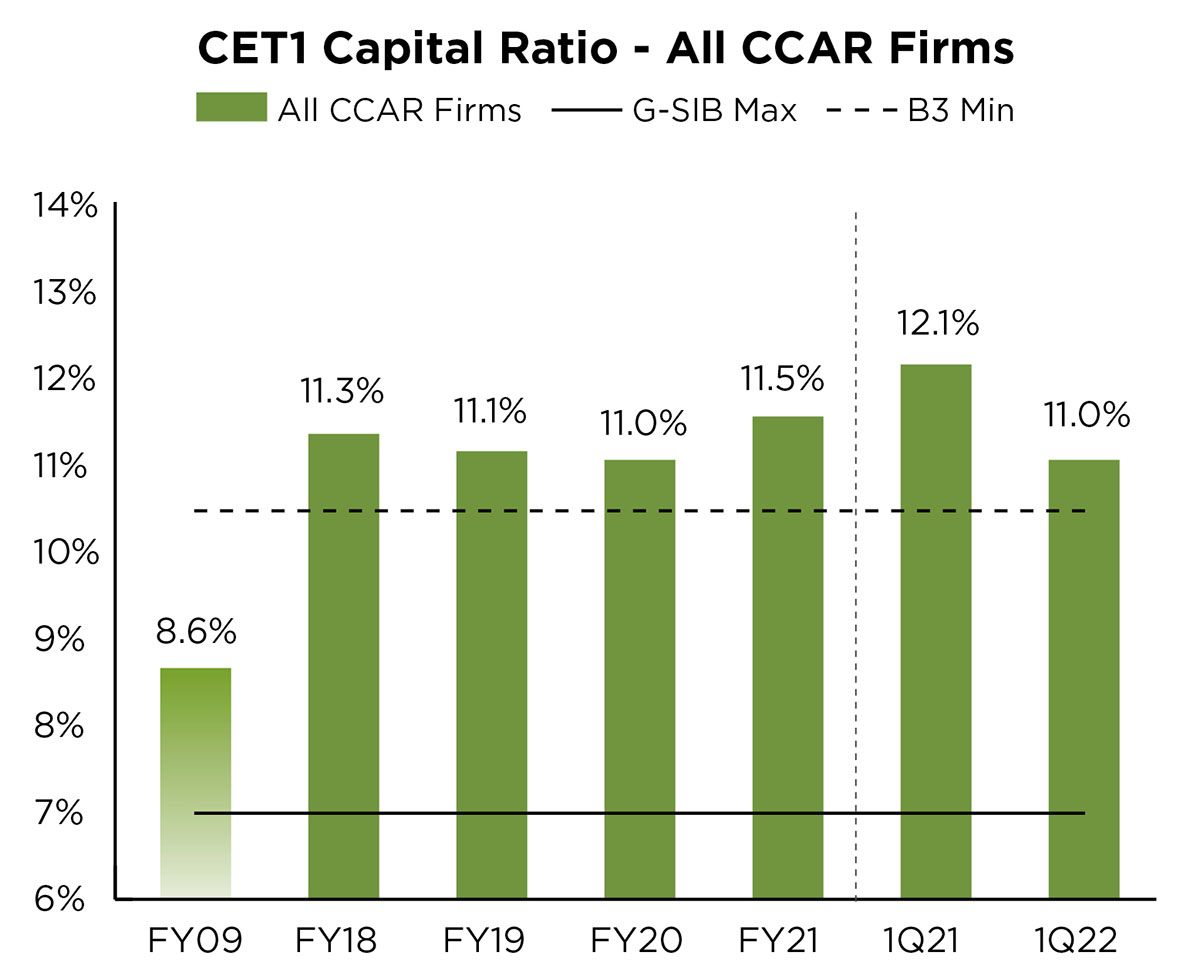

5. Regulatory Capital Ratio Requirements: Banks must meet regulatory capital ratio requirements to comply with CCAR. These ratios include the Common Equity Tier 1 (CET1) ratio, Tier 1 capital ratio, and Total Capital ratio. Banks must maintain capital ratios above the minimum thresholds set by the regulatory authorities.

6. Documentation and Reporting: Banks are required to maintain extensive documentation to support their capital planning process and CCAR compliance. They must provide detailed reports to the Federal Reserve, including descriptions of their capital planning processes, stress testing methodologies, and results. The reports must be accurate, transparent, and aligned with regulatory expectations.

7. Remediation and Corrective Actions: If a bank fails to meet the CCAR requirements or demonstrates inadequate capital planning, it must take immediate remedial actions. This may involve revising the capital plan, addressing identified deficiencies in risk management practices, or implementing corrective measures to ensure compliance with CCAR standards.

8. Governance and Oversight: Banks are expected to have effective internal governance and oversight mechanisms in place to ensure CCAR compliance. This includes having a dedicated capital planning team, establishing board-level oversight, and regular engagement with regulators to discuss capital planning and stress test results.

By adhering to these requirements, banks can demonstrate their commitment to maintaining strong capital positions, effectively managing risks, and contributing to the stability and resilience of the banking sector.

Benefits and Challenges of CCAR

The Comprehensive Capital Analysis and Review (CCAR) program brings both benefits and challenges to the banking industry. Understanding these can provide insight into the overall impact and effectiveness of CCAR in promoting financial stability. Let’s explore the benefits and challenges associated with CCAR.

Benefits of CCAR:

1. Enhanced Financial Stability: CCAR ensures that banks maintain sufficient capital buffers, enabling them to withstand economic shocks and maintain stability. This benefits not only banks but also the broader financial system, protecting depositors, borrowers, and investors.

2. Improved Risk Management: CCAR encourages banks to enhance their risk management practices. By subjecting banks to rigorous stress tests and scenario analyses, CCAR prompts banks to identify and mitigate potential risks, resulting in stronger risk management frameworks.

3. Greater Transparency and Accountability: CCAR promotes transparency by requiring banks to provide detailed capital plans and stress testing results to regulators. This helps regulators assess the reasonableness and accuracy of the banks’ projections, ensuring transparency and accountability in the banking industry.

4. Forward-Looking Capital Planning: Through CCAR stress testing, banks are prompted to adopt a forward-looking approach to capital planning. This helps them anticipate potential risks and challenges, enabling informed decision-making for capital allocation and risk appetite.

5. Early Detection of Weaknesses: CCAR allows regulators to identify weaknesses and vulnerabilities within banks, both at the individual bank level and across the banking system as a whole. This enables swift corrective actions to address any capital shortfalls or risk management deficiencies before they escalate into larger issues.

Challenges of CCAR:

1. Compliance Costs: Implementing CCAR compliance requires significant resources for banks. This includes investing in advanced risk analytics, technology infrastructure, and hiring specialized personnel. Compliance costs can be a challenge, especially for smaller banks with limited resources.

2. Complexity of Stress Testing: Conducting stress tests can be complex and resource-intensive. Banks need to develop sophisticated models and analytical capabilities to accurately project capital positions under various stress scenarios. This complexity can pose challenges, particularly for banks with limited expertise and resources.

3. Subjectivity in Evaluation: The evaluation of capital plans and stress test results by regulators involves some level of subjectivity. This introduces the potential for inconsistencies or differences in evaluation methods, which can lead to uncertainties and variations in the outcomes of CCAR assessments.

4. Potential for Capital Constraints: While CCAR aims to ensure adequate capital levels, banks may face constraints on capital distribution, such as dividend restrictions or limitations on share repurchases, if their capital plans are not approved. This can restrict banks’ ability to return capital to shareholders or invest in growth opportunities.

5. Evolving Regulatory Requirements: The regulatory landscape is dynamic, and CCAR requirements can change over time. Banks must stay updated with evolving regulations and ensure ongoing compliance, which can pose challenges in terms of adaptability and resource allocation.

Despite these challenges, the benefits outweigh the difficulties associated with CCAR. The program strengthens the stability of the banking sector, enhances risk management practices, and promotes transparency and accountability, ultimately contributing to the overall resilience of the financial system.

Conclusion

The Comprehensive Capital Analysis and Review (CCAR) program plays a vital role in the banking industry, ensuring the stability and resilience of financial institutions. By subjecting banks to rigorous stress tests and comprehensive evaluations, CCAR aims to promote sound risk management, maintain adequate capital levels, and protect the interests of depositors and borrowers.

Through CCAR, regulators can identify potential weaknesses and vulnerabilities within banks and take necessary corrective actions. The program encourages banks to adopt forward-looking capital planning processes, enhancing their ability to assess and mitigate risks. CCAR also promotes transparency and accountability by requiring banks to provide detailed reports and capital plans to regulatory authorities.

The benefits of CCAR include improved financial stability, enhanced risk management practices, greater transparency, forward-looking capital planning, and early detection of weaknesses. However, there are challenges associated with compliance costs, complexity in stress testing, potential subjectivity in evaluation, constraints on capital distribution, and evolving regulatory requirements.

In conclusion, CCAR serves as a crucial tool in maintaining the stability of the banking sector and protecting the financial system from potential risks and crises. Its requirements and stress testing processes enable banks to identify and address weaknesses, improve risk management practices, and maintain sufficient capital buffers. By continuing to refine and adapt the CCAR framework, regulators can ensure its effectiveness in promoting a robust and resilient banking industry.