Finance

What Is Normal Balance In Accounting

Modified: February 21, 2024

Understand the concept of normal balance in accounting and its significance in finance. Explore how it affects financial statements and reporting accuracy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to the world of accounting, maintaining balance is of utmost importance. Every transaction has a corresponding impact on financial statements, and it is crucial to identify the appropriate categories to record these impacts accurately. This is where the concept of “normal balance” comes into play.

Normal balance refers to the expected side or category where an account balance should appear. It is a fundamental concept in accounting that helps ensure accuracy and consistency in financial reporting. Understanding the normal balance of accounts is essential for recording transactions and preparing financial statements.

In this article, we will delve deeper into the definition of normal balance, provide examples to illustrate its application, discuss its relationship to assets, liabilities, and equity, highlight its importance in accounting, explore its role in financial statements, and touch on the concept of normalizing entries in accounting.

Whether you are a business owner, an accounting professional, or simply have an interest in financial matters, having a solid understanding of normal balance in accounting can greatly contribute to your decision-making and financial management capabilities. So, let’s dive in and explore the world of normal balance in accounting!

Definition of Normal Balance

In accounting, every account has a normal balance, which is the side of the account where increases are recorded. The normal balance can be either a debit or a credit, depending on the type of account. Understanding the normal balance of different accounts is crucial for accurately recording transactions.

Generally, asset and expense accounts have a debit normal balance, while liability, equity, and revenue accounts have a credit normal balance. To better understand this concept, let’s break it down further:

- Debit Normal Balance: Asset accounts such as cash, accounts receivable, and inventory have a debit normal balance. Additionally, expense accounts like salaries, utilities, and rent also have a debit normal balance. When there is an increase in these accounts, it is recorded on the debit side.

- Credit Normal Balance: Liability accounts like accounts payable, loans payable, and accrued expenses have a credit normal balance. Moreover, equity accounts such as owner’s capital and retained earnings, as well as revenue accounts like sales and interest income, also have a credit normal balance. When there is an increase in these accounts, it is recorded on the credit side.

It is important to note that the normal balance is not an indication of whether an account has a positive or negative balance. Instead, it simply identifies the side of the account where increases are recorded. For example, a negative cash balance is still recorded on the debit side, as it represents an increase in the cash account to correct the negative balance.

To maintain the balance sheet equation, which states that the assets must equal liabilities plus equity, every transaction must be recorded with proper debits and credits. This ensures that the equation remains balanced and that the financial statements accurately represent the financial position and performance of a business.

Having a clear understanding of the normal balance of different accounts is essential for maintaining accuracy and consistency in accounting practices. It allows for proper classification of transactions and ensures that financial statements reflect the true financial standing of the entity.

Now that we have defined the concept of normal balance, let’s move on to examining some examples to further clarify its application.

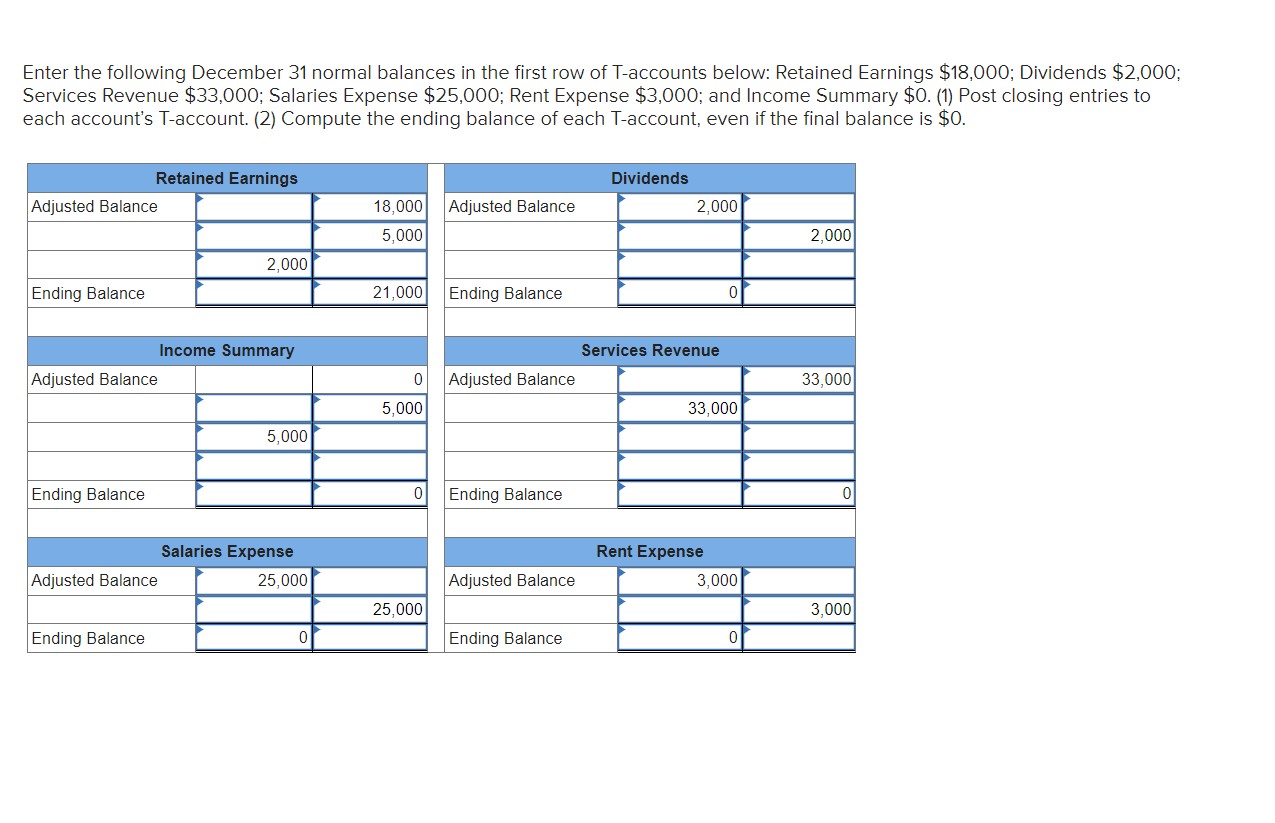

Examples of Normal Balances

Understanding the normal balance of different accounts is crucial for accurately recording transactions and preparing financial statements. Let’s take a look at some examples to illustrate the application of normal balances in accounting:

- Cash: Cash is an asset account with a debit normal balance. When a business receives cash, it increases the cash account on the debit side. Conversely, when cash is spent or used for payments, it decreases the cash account on the debit side.

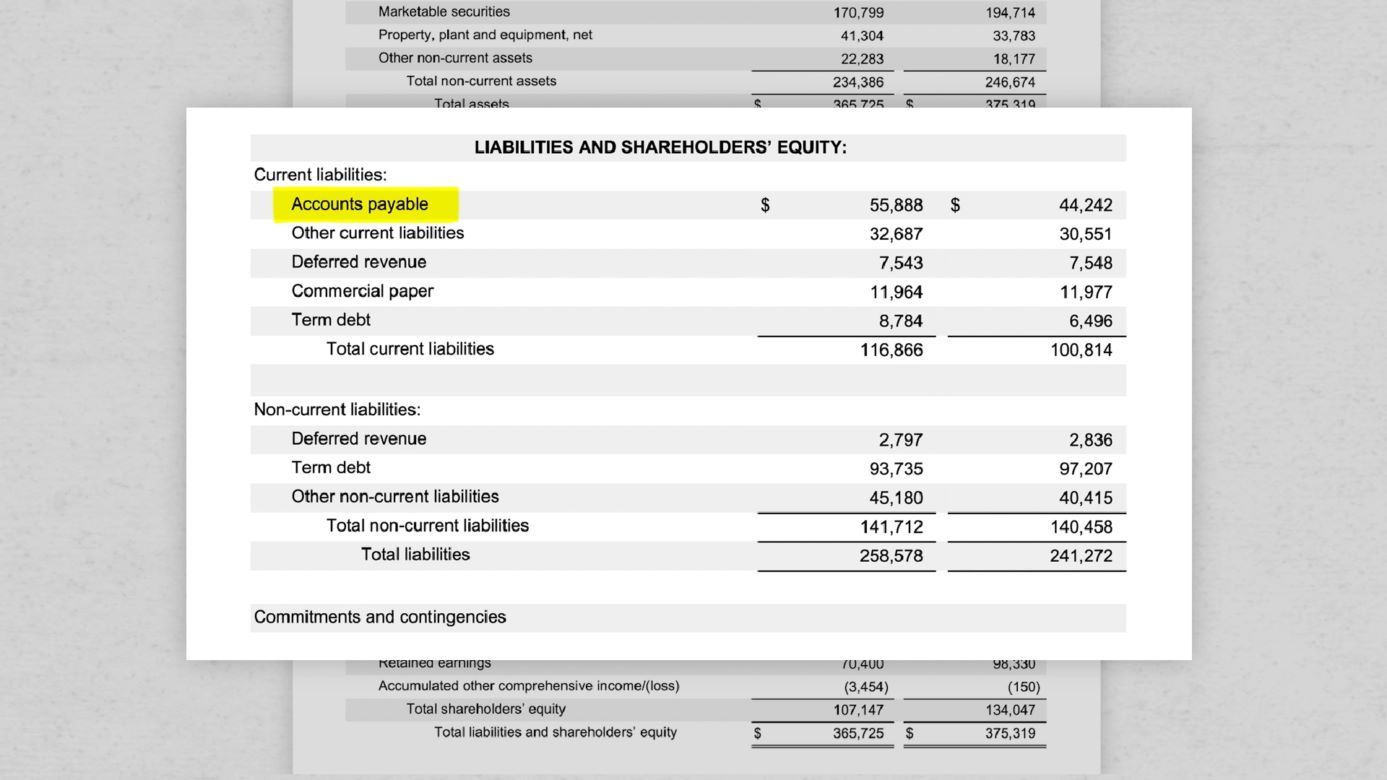

- Accounts Payable: Accounts payable is a liability account with a credit normal balance. When a business incurs expenses or purchases goods or services on credit, it increases the accounts payable account on the credit side. As payments are made to settle the accounts payable, it decreases the account on the credit side.

- Owner’s Capital: Owner’s capital is an equity account with a credit normal balance. When an owner invests additional funds into the business, it increases the owner’s capital account on the credit side. Similarly, when the owner withdraws funds from the business, it decreases the owner’s capital account on the debit side.

- Sales Revenue: Sales revenue is a revenue account with a credit normal balance. When a business sells its products or services and generates revenue, it increases the sales revenue account on the credit side. Conversely, returns or discounts given to customers reduce the sales revenue account on the debit side.

These are just a few examples of accounts and their normal balances. It is essential to consult the accounting framework and relevant standards to determine the normal balances of specific accounts in a particular industry or organization.

By understanding the normal balances, accountants can properly record and classify transactions, maintain accurate financial records, and prepare reliable financial statements. This knowledge allows for consistency across different businesses and facilitates the analysis and comparison of financial information.

Next, let’s explore the relationship between normal balances and the categories of assets, liabilities, and equity in accounting.

Relationship to Assets, Liabilities, and Equity

The concept of normal balance in accounting is closely tied to the categories of assets, liabilities, and equity. Understanding this relationship is fundamental to accurately recording and representing financial transactions. Let’s examine how normal balances relate to assets, liabilities, and equity:

Assets: Assets are economic resources owned or controlled by a business. Common examples include cash, accounts receivable, inventory, and property. Asset accounts typically have a debit normal balance. This means that increases in asset accounts are recorded on the debit side, while decreases are recorded on the credit side. The normal balance of asset accounts reflects the inflow and outflow of resources as the business engages in transactions.

Liabilities: Liabilities are obligations or debts owed by a business to external parties. They include accounts payable, loans payable, and accrued expenses. Liability accounts generally have a credit normal balance. This means that increases in liability accounts are recorded on the credit side, while decreases are recorded on the debit side. The normal balance of liability accounts reflects the business’s indebtedness to external entities.

Equity: Equity represents the residual interest in the assets of a business after deducting liabilities. It includes owner’s capital, retained earnings, and any additional capital contributions. Equity accounts typically have a credit normal balance. Increases in equity accounts, such as when the owner invests additional funds into the business, are recorded on the credit side, while decreases, such as when the owner withdraws funds, are recorded on the debit side. The normal balance of equity accounts captures the owner’s claims to the business’s assets.

The relationship between normal balances and the categories of assets, liabilities, and equity ensures that the accounting equation remains in balance. The accounting equation states that assets equal liabilities plus equity. By recording transactions with the appropriate normal balances, the equation stays in equilibrium, and the financial statements accurately represent the financial position and performance of the business.

Understanding the relationship between normal balances and the categories of assets, liabilities, and equity is crucial for accurate financial recording and reporting. It provides a solid foundation for maintaining balance in the accounting system and aids in decision-making and financial analysis.

Now that we have explored the relationship between normal balances and assets, liabilities, and equity, let’s move on to discussing the importance of normal balances in accounting.

Importance of Normal Balances in Accounting

The concept of normal balances plays a crucial role in maintaining accuracy, consistency, and reliability in accounting practices. Understanding the normal balance of different accounts is of utmost importance. Let’s explore the significance of normal balances in accounting:

1. Accurate Recording: Normal balances ensure that transactions are recorded accurately. By identifying the appropriate side of the account to record increases, accountants can maintain a clear and organized record of the business’s financial activities. This accuracy is fundamental in preparing financial statements and assessing the financial health of the organization.

2. Consistency: The use of normal balances promotes consistency across different businesses and industries. By following the established norms, accountants can ensure that financial transactions are recorded uniformly. This consistency facilitates comparison and analysis of financial data, both within the organization and with other entities in the industry.

3. Financial Statement Preparation: Normal balances are integral to the preparation of financial statements. Financial statements, such as the balance sheet, income statement, and statement of cash flows, rely on accurate recording and classification of transactions. Normal balances provide the framework for organizing and presenting financial information in a standardized and meaningful manner.

4. Error Detection and Correction: Understanding normal balances helps in detecting errors in financial records. If a transaction is recorded on the wrong side of an account, it can disrupt the balance and accuracy of financial statements. By comparing the normal balances to the recorded transactions, accountants can identify and rectify errors, ensuring the reliability of the financial information.

5. Decision-Making: Normal balances aid in making informed business decisions. By accurately recording and classifying transactions, accountants can provide reliable and timely information to management. This information is crucial for evaluating the financial performance of the business, identifying areas of improvement, and making strategic decisions that drive growth and profitability.

6. Audit and Compliance: Normal balances contribute to the audit and compliance processes. External auditors rely on properly recorded and classified transactions to assess the accuracy and compliance of financial statements. By adhering to normal balances, organizations ensure transparency, adherence to accounting standards, and regulatory compliance.

Overall, the importance of normal balances in accounting cannot be overstated. They serve as a foundation for accurate financial recording, facilitate the preparation of reliable financial statements, aid in error detection and correction, inform decision-making processes, and contribute to audit and compliance requirements. By understanding and applying normal balances, accountants can ensure the integrity and usefulness of financial information.

Now, let’s move on to the next section, where we will explore the role of normal balance in financial statements.

The Role of Normal Balance in Financial Statements

Financial statements are vital tools for assessing the financial health and performance of a business. The role of normal balance in financial statements is critical as it ensures accurate presentation and meaningful interpretation of financial information. Let’s delve into the specific ways in which normal balance influences financial statements:

1. Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Normal balances determine how assets, liabilities, and equity are presented on the balance sheet. Assets with a debit normal balance are listed on the left side (assets side), while liabilities with a credit normal balance and equity with a credit normal balance are listed on the right side (liabilities and equity side).

2. Income Statement: The income statement summarizes a company’s revenue, expenses, gains, and losses over a specified period. Normal balances play a crucial role in classifying revenues, expenses, gains, and losses. Revenues and gains, with credit normal balances, contribute to the top line (revenue section) of the income statement, while expenses and losses, with debit normal balances, are deducted to determine the bottom line (net income).

3. Statement of Cash Flows: The statement of cash flows shows the inflows and outflows of cash during a specific period. Normal balances help classify the cash flows into operating, investing, and financing activities. Operating activities involve changes in revenue and expenses, investing activities relate to the acquisition or sale of assets, and financing activities pertain to the issuance or repayment of liabilities and equity.

By following the expected normal balances, accountants can ensure that the financial statements accurately represent the financial position, performance, and cash flows of the business. Consistency in the presentation and classification of accounts enhances the comparability of financial statements across different periods and entities.

Additionally, the normal balance affects financial ratios derived from the financial statements. For example, the debt-to-equity ratio compares liabilities (credit normal balance) to equity (credit normal balance), while the current ratio assesses the relationship between current assets (debit normal balance) and current liabilities (credit normal balance). Using normal balances ensures that these ratios are calculated correctly and reflect the intended analysis.

Furthermore, understanding the normal balance in financial statements aids in financial analysis and decision-making. It allows stakeholders to assess the financial health, profitability, and liquidity of the company by evaluating the trends and relationships within the financial statements.

Taking into consideration the role of normal balance in financial statements is crucial for preparing accurate and meaningful reports that support decision-making, financial analysis, and compliance requirements. By adhering to the expected normal balances, accountants maintain the integrity and usefulness of the financial statements.

Now, let’s move on to discussing the concept of normalizing entries in accounting.

Normalizing Entries in Accounting

In accounting, normalizing entries are adjustments made to financial records to ensure accurate reporting and remove any abnormal or non-recurring transactions or events. These entries are important for presenting a more accurate and reliable picture of a business’s financial performance. Let’s explore the concept of normalizing entries in accounting:

1. Correcting One-Time Events: Normalizing entries are often used to adjust for one-time events or transactions that do not reflect the typical operations of a business. For example, if a company received a large insurance settlement that significantly boosted its revenue for a specific period, a normalizing entry may be made to exclude that amount from the financial statements to provide a clearer picture of the company’s ongoing operations.

2. Adjusting Seasonal or Cyclical Fluctuations: Normalizing entries are also employed to account for seasonal or cyclical variations in a business’s revenue and expenses. For instance, if a company experiences higher sales and expenses during the holiday season, a normalizing entry may be made to spread out the impact of those seasonal fluctuations to better represent the average performance throughout the year.

3. Removing Extraordinary Items: Normalizing entries also help eliminate extraordinary items or events that are not expected to recur in the future. These could include one-time gains, losses, or expenses that do not represent the typical operating activities of the business. By making normalizing entries to exclude these items, the financial statements provide a more accurate reflection of the company’s ongoing performance.

4. Correcting Accounting Errors: Normalizing entries are used to rectify accounting errors or omissions. If a transaction was recorded on the wrong side of an account or if an amount was incorrectly posted, a normalizing entry can be made to adjust the accounts and correct the error.

Normalizing entries are typically made at the end of an accounting period to ensure that the financial statements accurately represent the business’s ongoing operations. These adjustments help remove distortions caused by extraordinary or non-recurring events, allowing for a more meaningful analysis of the business’s financial performance and trends.

It’s important to note that normalizing entries should be supported by proper documentation and justification. They should comply with generally accepted accounting principles (GAAP) or any applicable accounting regulations, ensuring transparency and reliability in financial reporting.

By applying normalizing entries in accounting, businesses can present financial statements that provide a more accurate and reliable depiction of their performance, making it easier for stakeholders to make informed decisions based on the true underlying financial condition of the business.

Now, let’s summarize the key points we have discussed.

Conclusion

Normal balance is a fundamental concept in accounting that determines the expected side or category where an account balance should appear. It helps ensure accurate recording, consistent classification, and reliable reporting of financial transactions. By understanding the normal balances of different accounts, accountants can maintain the integrity and usefulness of financial information.

In this article, we explored the definition of normal balance and its significance in accounting. We discussed examples of normal balances for different types of accounts, including assets, liabilities, equity, revenues, and expenses. Understanding the relationship between normal balances and the categories of assets, liabilities, and equity is crucial for maintaining balance in the accounting system.

We also highlighted the importance of normal balances in accounting, including their role in accurate recording, consistency, financial statement preparation, error detection and correction, decision-making, and audit and compliance processes.

Furthermore, we examined the role of normal balance in financial statements. Normal balances determine the presentation and classification of assets, liabilities, and equity on the balance sheet, as well as the categorization of revenues, expenses, gains, and losses on the income statement. By following the expected normal balances, accountants ensure that financial statements accurately represent the financial position, performance, and cash flows of the business.

Lastly, we discussed the concept of normalizing entries in accounting, which involve adjustments made to financial records to remove abnormal or non-recurring transactions or events. Normalizing entries help provide a more accurate picture of a business’s ongoing operations, correcting for one-time events, seasonal fluctuations, extraordinary items, and accounting errors.

Having a solid understanding of normal balance in accounting is essential for business owners, accounting professionals, and individuals with an interest in financial matters. It enhances decision-making, financial analysis, and compliance with accounting standards and regulations.

In conclusion, the concept of normal balance is a fundamental aspect of accounting that ensures accuracy, consistency, and reliability in financial reporting. By applying the principles of normal balance, businesses can maintain balance in their financial records and present transparent and meaningful financial information to stakeholders.