Finance

What Does Gap Up Mean In Stocks

Published: January 18, 2024

Learn what gap up means in stocks and how it impacts your finance. Explore the significance of this stock market term and its implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in stocks, understanding market patterns and indicators is essential. One such phenomenon that traders often encounter is a “gap up” in stock prices. A gap up refers to a significant increase in the opening price of a stock compared to its previous day’s closing price. This sudden jump creates a gap on the price chart between the closing and opening prices, hence the term “gap up.”

Gap ups can occur for a variety of reasons, such as positive news announcements, strong earnings reports, favorable market conditions, or even external events that impact a company or sector. Traders and investors closely monitor gap ups as they provide valuable insights into investor sentiment and potential trading opportunities.

In this article, we will explore the concept of gap up in stocks in more detail. We will examine the causes of gap ups, the effects they have on stock prices, and strategies for effectively trading gap up stocks. Additionally, we will discuss the risks and challenges associated with trading gap up stocks and provide examples to illustrate the concept. By the end of this article, you’ll have a solid understanding of gap ups and how to navigate this phenomenon in the stock market.

Definition of Gap Up

A gap up in the stock market refers to a situation where the opening price of a stock is significantly higher than its previous day’s closing price, resulting in a visible gap on the price chart. In technical analysis, gaps are areas on a chart where no trading activity has occurred. Gaps can occur in both upward and downward directions, but in this section, we will focus specifically on gap ups.

Gap ups can occur in various scenarios and can be further categorized into three types:

- Common Gap: A common gap occurs when the opening price of a stock is higher than the previous day’s closing price but does not have any significant implications on the stock’s overall trend. It often arises due to regular market fluctuations or minor news events that do not have a long-lasting impact.

- Breakaway Gap: A breakaway gap is a significant gap up that occurs when a stock price breaks out of a well-defined trading range or chart pattern. It indicates a shift in investor sentiment and can signify the beginning of a new upward trend or a reversal from a downward trend. Breakaway gaps are often accompanied by high trading volume and can lead to substantial price movements.

- Exhaustion Gap: An exhaustion gap typically occurs at the end of a strong trend and signifies a final surge in buying or selling pressure. In the case of a gap up, it indicates that buyers are still enthusiastic about the stock despite its already extended price. In some cases, exhaustion gaps can mark a short-term peak, leading to a subsequent reversal or consolidation in the stock price.

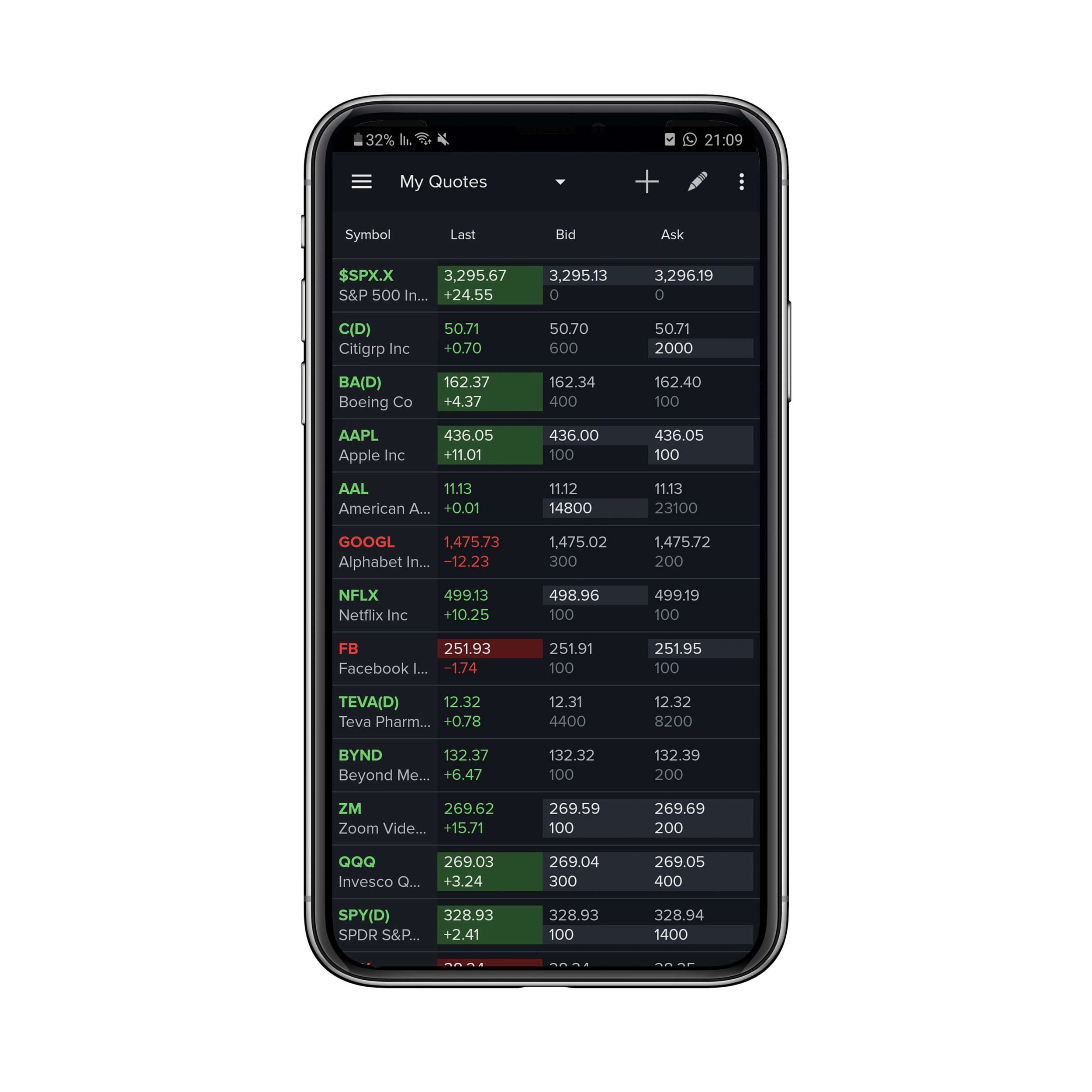

It is important to note that gap ups can be identified both on individual stocks and broad market indices such as the S&P 500 or Dow Jones Industrial Average. They can provide valuable insights into market sentiment and short-term price movements. Traders and investors use various technical analysis tools and indicators to identify and interpret gap ups, including chart patterns, moving averages, and volume analysis.

Causes of Gap Up in Stocks

Gap ups in stocks can be attributed to a variety of factors, ranging from company-specific news to broader market conditions. Understanding the causes behind gap ups can help traders and investors make more informed decisions and capitalize on potential trading opportunities. Here are some common reasons for gap ups:

- Positive Earnings Reports: One of the most influential factors that can lead to a gap up is a company’s earnings report. If a company reports better-than-expected profits or revenue, investors may react positively and bid up the stock, causing a gap up. Similarly, positive guidance from management or other favorable financial metrics can also trigger a gap up in the stock price.

- Positive News or Announcements: Positive news or announcements related to a company, such as product launches, mergers and acquisitions, partnerships, or regulatory approvals, can generate investor enthusiasm and lead to a gap up. This could be in the form of a breakthrough drug for a pharmaceutical company, a contract win for a defense contractor, or a successful product launch for a technology company.

- Upgrades and Analyst Recommendations: When respected analysts or brokerage firms upgrade a stock or issue positive recommendations, it can create buying pressure and cause a gap up. These endorsements carry significant weight in the market and can attract new investors to the stock.

- Sector or Market Catalysts: Sometimes, gap ups occur due to broader market or sector catalysts. For example, positive economic data, government policies, or industry trends can impact an entire sector and cause stocks within that sector to gap up collectively.

- Short Squeezes: In certain situations, a gap up can be the result of a short squeeze. A short squeeze occurs when short sellers rush to cover their positions, leading to a sharp increase in buying demand. This can occur when there is unexpected positive news that catches short sellers off guard, forcing them to quickly exit their positions and causing the stock to gap up.

It’s important to note that these factors are not exhaustive, and gap ups can happen due to a combination of multiple catalysts or even unexpected events. Traders and investors should stay updated on relevant news, earnings reports, analyst recommendations, and overall market conditions to identify potential causes of gap ups and make well-informed trading decisions.

Effects of Gap Up on Stock Prices

When a stock experiences a gap up, it can have significant effects on its price and market behavior. Understanding these effects is crucial for traders and investors looking to capitalize on gap up opportunities. Here are some key effects of gap up on stock prices:

- Increase in Bullish Sentiment: A gap up in stock prices often signals a surge in bullish sentiment among investors. The gap up indicates that buyers are willing to pay a higher price for the stock, reflecting positive expectations and optimism for the company’s performance. This increased bullish sentiment can lead to further buying activity and drive the stock price even higher.

- Enhanced Price Momentum: Gap ups can result in heightened price momentum for a stock. The sudden influx of buying pressure can push the stock price to new highs, attracting more attention from traders and investors. This momentum can create a self-fulfilling prophecy, as more market participants join in the buying frenzy, further driving up the stock price.

- Breakout from Previous Resistance Levels: In technical analysis, a gap up can often serve as a breakout signal, indicating the stock has surpassed a previous resistance level. This breakout can trigger a wave of buying interest, as it suggests that the stock has the potential to continue its upward trajectory. Traders often look for gap ups as an opportunity to enter or add to a position, anticipating further price gains.

- Institutional Interest: Gap ups in stock prices can attract attention from institutional investors, such as hedge funds and mutual funds. These institutional investors typically have significant resources and can influence market movements. When they spot a gap up, it may prompt them to investigate the stock further and potentially initiate or increase their positions. This institutional interest can further contribute to the upward momentum of the stock.

- Liquidation of Short Positions: A gap up can put pressure on short sellers who have taken bearish positions on the stock. As the stock price rises, short sellers may be forced to cover their positions by buying back the stock, contributing to further upward price movement. This phenomenon, known as a short squeeze, can amplify the price momentum of a stock experiencing a gap up.

While gap ups generally have positive connotations, it is important to approach them with caution. Not all gap ups lead to sustained price increases, and there is always the potential for a price reversal or consolidation. Traders and investors should perform thorough analysis, consider risk management strategies, and closely monitor the stock’s behavior after a gap up to make informed trading decisions.

Strategies for Trading Gap Up Stocks

Trading gap up stocks requires a specific set of strategies to effectively capitalize on the potential opportunities they present. Here are some popular strategies utilized by traders:

- Breakout Trading: One common strategy is to identify gap ups as potential breakout signals. Traders watch for stocks that gap up above significant resistance levels or chart patterns, indicating a potential bullish breakout. They may enter a long position, anticipating further price gains as momentum builds.

- Gap and Go Trading: Gap and go trading involves entering a position on the open when a stock gaps up and shows immediate strength. Traders look for stocks that continue to move higher after the initial gap up, using strong volume and positive price action as confirmation. They aim to ride the momentum and capture short-term gains.

- Retracement Trading: Another strategy is to wait for a gap up to occur, then observe if the stock retraces back towards the previous day’s closing price. Traders may enter a position when the stock starts to show signs of support or buyers stepping in at the retracement level, expecting the stock to bounce back and continue its upward move.

- Gap Fade Trading: Gap fade trading involves taking a contrarian approach and betting against the gap up. Traders watch for stocks that quickly fill the gap and start to reverse direction. They may enter a short position, anticipating that the initial gap will be filled, and the stock will move lower. This strategy requires careful risk management and close monitoring of price action.

- News-Based Trading: If the gap up is driven by specific news or announcements, traders may focus on the underlying catalyst and its potential implications. They analyze the news, the company’s fundamentals, and the market reaction to make informed trading decisions. This strategy requires quick decision-making and the ability to react to changing market dynamics.

Regardless of the strategy chosen, risk management is crucial when trading gap up stocks. Setting stop-loss orders, monitoring volume and price action, and being prepared to exit the trade if the anticipated move does not materialize are essential aspects of trading these volatile stocks.

It is worth mentioning that gap up strategies can be enhanced by utilizing additional technical analysis tools and indicators. Traders often combine gap analysis with other techniques such as moving averages, trendlines, and oscillators to validate their trading decisions and improve the probability of successful trades.

Risks and Challenges of Trading Gap Up Stocks

While trading gap up stocks can offer exciting opportunities for profit, it is important to be aware of the associated risks and challenges. Here are some key considerations to keep in mind:

- Price Reversals: Not all gap ups result in sustained price increases. After the initial gap up, the stock may reverse its direction and move lower. Traders need to be prepared for price reversals and have appropriate stop-loss orders in place to protect against significant losses. It is crucial to have a well-defined trading plan and stick to it.

- Market Volatility: Gap up stocks often exhibit increased volatility, especially in the initial phases after the gap. Rapid price movements and large price swings can make it challenging to accurately gauge market sentiment and make informed trading decisions. Traders need to be comfortable with volatility and have strategies in place to manage risk.

- False Breakouts: Some gap ups may appear as breakout signals but fail to sustain the upward momentum. Traders need to be cautious of false breakouts and be able to differentiate between genuine moves and temporary spikes. This requires thorough analysis and confirmation from other technical indicators before initiating trades.

- Liquidity Concerns: Gap up stocks with low trading volume can present liquidity challenges. Limited liquidity can result in wider bid-ask spreads, making it difficult to enter or exit positions at desired prices. Traders should assess the liquidity of the stock before trading and adjust their position size accordingly to avoid slippage.

- Overvalued Stocks: Gap ups can cause stocks to become overvalued, with prices exceeding their intrinsic value. It is essential to assess the fundamentals of the company and the overall market conditions to ensure that the gap up is supported by meaningful factors. Buying overvalued stocks without proper justification increases the risk of potential losses.

Additionally, it is crucial to stay informed about market news, earnings releases, and company-specific developments that may impact gap up stocks. Failure to stay updated can result in missed opportunities or increased exposure to unforeseen risks.

Successful trading of gap up stocks requires discipline, risk management, and a thorough understanding of market dynamics. Traders should approach these stocks with caution, conduct proper analysis, and be prepared to adapt their strategies based on changing market conditions.

Examples of Gap Up Stocks

To better understand gap up stocks and their potential impact on trading, let’s look at a few examples from the past:

- Apple Inc.: In January 2020, Apple reported strong Q4 earnings that exceeded market expectations. As a result, the stock gapped up significantly at the open, reflecting positive investor sentiment and the anticipation of continued growth. This gap up marked a breakout from a previous resistance level and led to a sustained uptrend in the stock over the following months.

- Tesla Inc.: Tesla is a well-known example of a stock that has experienced multiple gap ups during its incredible run. In February 2020, the stock gapped up after a positive earnings report and continued to surge amidst increasing demand for electric vehicles and significant investor interest. These gap ups signaled strong bullish momentum and attracted more attention from both institutional and retail investors.

- GameStop Corp.: In January 2021, GameStop made headlines as it experienced an unprecedented gap up driven by a short squeeze. As a group of individual retail investors coordinated efforts to push up the stock price, it gapped up significantly, catching many short sellers off guard. The sudden rise attracted substantial media attention and created a unique trading situation with extreme volatility.

These examples highlight the diverse reasons behind gap ups, ranging from positive earnings reports and industry trends to short squeezes driven by retail investor activism. Each of these gap ups presented different opportunities and challenges for traders, illustrating the importance of thorough analysis and adapting strategies based on the specific circumstances surrounding the gap up.

It’s worth noting that while these examples showcase significant gap ups, not all gap up stocks experience such dramatic movements. Gap ups can range in size and impact, and it is important for traders to evaluate each gap up based on its individual characteristics and market conditions.

Conclusion

Gaining a solid understanding of gap up stocks is a valuable tool for traders and investors in navigating the stock market. Gap ups signal a significant increase in stock prices at the opening, often driven by positive news, strong earnings reports, or broader market catalysts. Traders can utilize various strategies, such as breakout trading, gap and go trading, or retracement trading, to capitalize on gap up opportunities.

However, trading gap up stocks comes with inherent risks and challenges. Price reversals, increased market volatility, false breakouts, liquidity concerns, and the potential for overvalued stocks are important factors to consider. Traders must focus on risk management, stay informed about market developments, and be prepared to adapt their strategies accordingly.

Examples such as Apple, Tesla, and GameStop demonstrate the diverse nature of gap ups and their impact on stock prices. It is important for traders to conduct thorough analysis and choose trading opportunities based on the specific characteristics and market dynamics surrounding each gap up.

In conclusion, gap up stocks offer both potential opportunities for lucrative trades and risks that demand careful consideration. By understanding the causes and effects of gap ups, employing suitable trading strategies, and managing risk effectively, traders can enhance their chances of success and make informed decisions in the exciting world of gap up stocks.