Home>Finance>When Will The IRS Be Accepting 2016 Tax Returns?

Finance

When Will The IRS Be Accepting 2016 Tax Returns?

Published: November 1, 2023

Find out when the IRS will start accepting 2016 tax returns and stay ahead of your finance game.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Filing your tax returns is an essential part of managing your personal finances. It’s important to stay up to date with the IRS’s tax filing deadlines to avoid any penalties or late fees. The IRS typically sets a specific start date for accepting tax returns each year, and it’s crucial to know when that date is in order to file your taxes in a timely manner.

However, it’s important to note that tax filing deadlines can change from year to year, so it’s always a good idea to stay informed about the latest updates from the IRS. In recent years, there have been some changes to the tax filing deadlines due to various reasons, including legislation changes or unforeseen circumstances.

Understanding when the IRS will be accepting tax returns for a specific year is critical to ensuring that you can file your taxes on time and avoid any unnecessary stress or complications. In this article, we will delve into the important details regarding the start date for filing tax returns, important dates to remember for filing taxes, various ways to file taxes, and common mistakes to avoid during the tax filing process.

Whether you’re a seasoned taxpayer or a first-time filer, this comprehensive guide will provide you with the information you need to navigate the tax filing process successfully and with confidence.

Changes to Tax Filing Deadlines

Over the years, there have been several changes to tax filing deadlines that taxpayers should be aware of. These changes can affect both individual taxpayers and businesses. Understanding the current regulations and deadlines is crucial to avoid any potential penalties or late filing fees.

One of the notable changes to tax filing deadlines occurred in 2016 when the IRS implemented a new law known as the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015. Under this law, the deadline for filing tax returns for partnerships, S corporations, and certain other entities was moved up from April 15th to March 15th. This change was implemented to allow partners and shareholders to receive their Schedule K-1 forms in a timely manner, enabling them to file their individual tax returns more accurately and efficiently.

Another significant change to tax filing deadlines came into effect in 2017. The deadline for filing individual tax returns (Form 1040) was moved from April 15th to April 18th in that year due to the observance of Emancipation Day in Washington, D.C., which falls on April 16th. This change provided taxpayers with an additional three days to file their returns.

It’s important to note that tax filing deadlines can also differ for taxpayers residing in certain states. For example, residents of Maine and Massachusetts have until April 19th to file their tax returns due to the observance of Patriots’ Day. Additionally, taxpayers living abroad may be granted an automatic extension until June 15th to file their tax returns.

It’s crucial to stay updated with the latest changes to tax filing deadlines by regularly checking the IRS website or consulting with a tax professional. Failing to meet the appropriate tax filing deadlines can result in penalties, interest charges, and even a delay in receiving any refunds owed to you.

Start Date for Filing Tax Returns

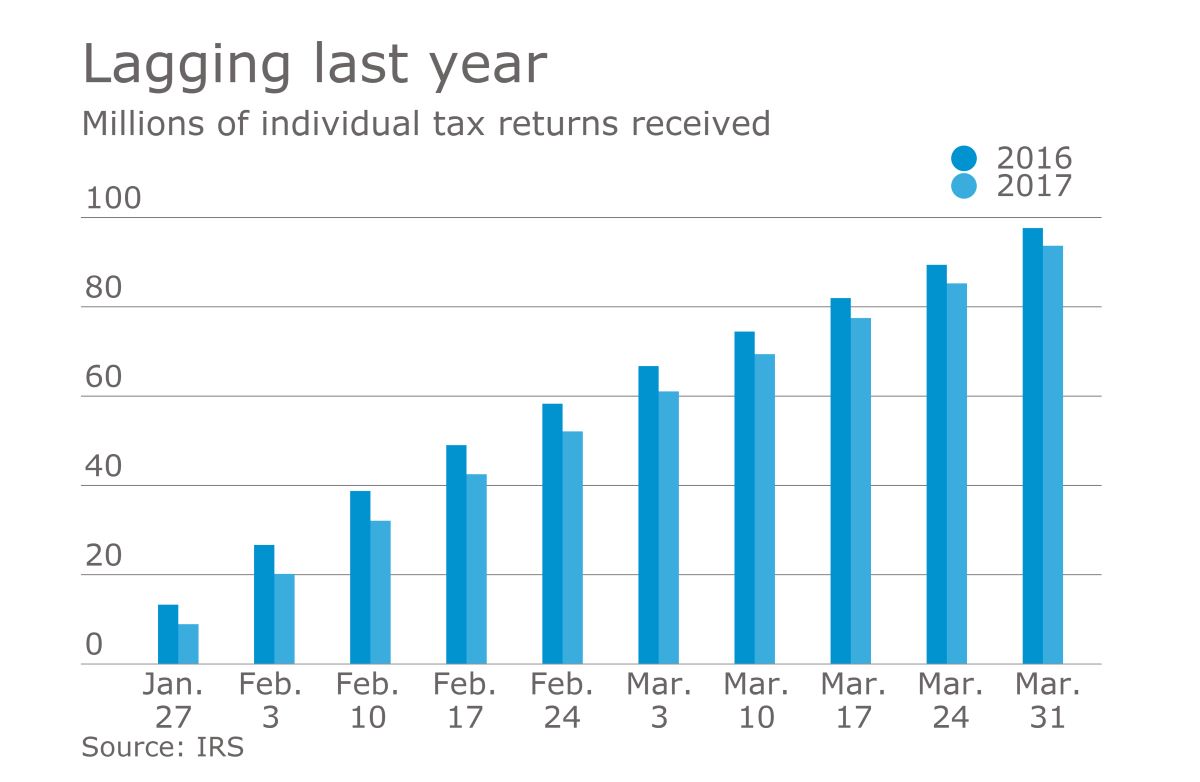

The start date for filing tax returns can vary from year to year, and it’s important to be aware of when the IRS will begin accepting returns. Generally, the IRS starts accepting tax returns in late January or early February, but this can be subject to change based on various factors.

In recent years, the IRS has made efforts to expedite the tax filing process by opening the filing season as early as possible. This allows taxpayers to file their returns sooner and potentially receive any refunds owed to them in a timely manner. However, it’s essential to note that the start date for filing tax returns may differ for different types of tax forms.

For example, in the 2016 filing season, the IRS began accepting individual income tax returns (Form 1040) from taxpayers on January 19th. This was the official start date for most taxpayers to submit their returns electronically or by mail. However, some taxpayers, like those claiming certain tax credits or deductions, had to wait until mid-February to file their returns due to additional forms and processing requirements.

In general, electronic filing (e-filing) is the fastest and most convenient way to file your tax return. It allows for quicker processing and reduces the chances of errors compared to paper filing. Moreover, e-filing provides a faster refund if one is owed to you. The IRS typically processes electronic returns within 21 days, while paper returns can take longer to process.

To determine the specific start date for filing tax returns for a particular year, it’s recommended to visit the IRS website or consult with a tax professional. Being aware of the start date will allow you to gather all the necessary documents, organize your financial records, and be prepared to file your taxes in a timely manner.

Important Dates for Filing Taxes

When it comes to filing your taxes, it’s crucial to be aware of the important deadlines set by the IRS. Knowing these dates will help you stay organized and ensure that you meet all necessary requirements, avoid penalties, and receive any refunds owed to you in a timely manner.

Here are some of the key dates to remember for filing your taxes:

- April 15th: This is the traditional deadline for filing your individual tax return (Form 1040) and for paying any taxes owed. However, please note that this date can vary depending on weekends and holidays. If April 15th falls on a weekend or holiday, the deadline is typically extended to the next business day.

- October 15th: This is the deadline for filing a tax return if you requested an extension of time to file your individual tax return. It’s important to remember that an extension to file is not an extension to pay any taxes owed. You are still required to estimate and pay any taxes due by the original April 15th deadline.

- March 15th: This is the deadline for filing tax returns for partnerships, S corporations, and certain other entities. It’s important to submit these returns in a timely manner to avoid any penalties or late filing fees.

In addition to these deadlines, it’s important to keep track of other important dates related to tax filings, such as:

- Estimated tax payments: If you are self-employed or have other sources of income not subject to withholding, you may need to make quarterly estimated tax payments. These payments are typically due on April 15th, June 15th, September 15th, and January 15th of the following year. It’s important to estimate your tax liability accurately and pay the required amount to avoid penalties.

- Form W-2 and 1099-MISC: Employers are required to provide their employees with Form W-2, which shows their wages and tax withholding for the year. If you are self-employed or receive income as an independent contractor, you may receive Form 1099-MISC. These forms should be sent to you by January 31st each year, allowing you to accurately report your income on your tax return.

It’s important to stay organized and plan ahead to ensure that you meet all tax deadlines. Missing deadlines may result in penalties, interest charges, and potential delays in receiving any refunds owed to you.

Ways to File Taxes

When it comes to filing your taxes, there are several options available to suit your preferences and convenience. Whether you prefer to handle the process yourself or seek professional assistance, here are the common ways to file your taxes:

- Traditional Paper Filing: This method involves completing a paper tax return form, such as Form 1040, and mailing it to the IRS. While this option may be suitable for those who prefer a hands-on approach or have more complex tax situations, it can be time-consuming and potentially lead to errors. It is recommended to double-check all calculations and ensure that you have included all necessary supporting documents.

- Electronic Filing (E-filing): E-filing is a popular and convenient option for most taxpayers. It involves using tax preparation software or online platforms to complete and submit your tax return electronically to the IRS. E-filing is faster, more accurate, and typically results in quicker processing and refund turnaround times. It also offers built-in error-checking features and helps to ensure that you claim all eligible deductions and credits.

- Free File: The IRS offers the Free File program, which allows eligible taxpayers to use free tax preparation software to file their federal tax returns. Free File is available to individuals with an adjusted gross income (AGI) of $72,000 or less in the tax year. The program provides step-by-step guidance and helps to identify any tax credits or deductions that you may be eligible for.

- Hiring a Tax Professional: For those who prefer professional guidance or have complex tax situations, hiring a tax professional can be a wise choice. Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys have in-depth knowledge of tax laws and regulations. They can assist with tax planning, ensure accurate and optimized tax filing, and provide valuable advice on maximizing deductions and minimizing tax liability. However, it’s important to consider the associated costs of hiring a tax professional.

It’s important to choose the filing method that best suits your needs and circumstances. Consider factors such as the complexity of your taxes, time availability, budget, and comfort level with technology. Whichever option you choose, ensure that you have all the necessary documents and information on hand to accurately prepare your tax return.

Common Mistakes to Avoid When Filing Taxes

Filing taxes can be a complex process, and it’s important to avoid common mistakes that can lead to errors, penalties, or delays in processing your return. Here are some common mistakes to watch out for:

- Math Errors: Math errors are one of the most common mistakes made when filing taxes. Simple mistakes like miscalculating income or deductions can result in incorrect tax liability and potential penalties. Take extra care to double-check all calculations and ensure accuracy when preparing your tax return.

- Incorrect or Missing Social Security Numbers: Ensure that you enter all Social Security numbers correctly on your tax return, including those of your dependents. An incorrect or missing Social Security number can lead to delays in processing your return and possible issues with tax credits or deductions.

- Filing under the Wrong Status: Your filing status determines your tax rates, deductions, and eligibility for certain credits. Choose the correct filing status based on your situation (e.g., single, married filing jointly, head of household) to avoid errors and potential penalties.

- Omitting Income: It’s crucial to report all sources of income on your tax return, including wages, self-employment income, rental income, and investment income. The IRS receives copies of your income statements (such as W-2s and 1099s), so failing to report an income source can trigger an audit or result in penalties.

- Forgetting to Sign and Date: It may seem obvious, but many taxpayers forget to sign and date their tax return. A missing signature makes your return incomplete and may delay processing. Ensure that you sign and date all necessary forms before submitting your tax return.

- Incorrect Bank Account Information: If you are expecting a refund and choose to have it directly deposited into your bank account, double-check your bank account information for accuracy. Providing incorrect information can lead to deposit delays or even rerouting your refund to the wrong account.

- Ignorance of Tax Credits and Deductions: Be aware of the available tax credits and deductions for which you may be eligible. Claiming all applicable credits and deductions can significantly reduce your tax liability. Stay informed about tax law changes and seek professional advice if needed to ensure you are capturing all eligible tax breaks.

By avoiding these common mistakes and taking the time to review and double-check your tax return before filing, you can greatly reduce the chances of errors, penalties, and delays. If you are unsure about any aspect of your tax situation, consider consulting with a tax professional who can provide guidance and assist you in preparing an accurate and optimized tax return.

Conclusion

Filing your taxes accurately and on time is crucial for maintaining good financial standing and avoiding penalties. By staying informed about important tax filing deadlines, being aware of any changes in tax laws, and avoiding common mistakes, you can ensure a smooth and successful tax filing experience.

We discussed the changes that can occur to tax filing deadlines, such as the shift in the deadline for partnerships and S corporations, as well as the occasional extension of the individual tax return deadline due to observances or holidays. It’s important to keep track of these changes to avoid any potential confusion or missed deadlines.

We also explored the start date for filing tax returns, highlighting the benefits of electronic filing (e-filing) and the convenience of using tax preparation software or online platforms. Being aware of the start date and using electronic filing methods can speed up the process, reduce the chance of errors, and potentially result in faster refunds.

Furthermore, we discussed important dates related to filing taxes, including the traditional April 15th deadline, the October 15th deadline for those who have requested an extension, and the estimated tax payment deadlines for self-employed individuals. Understanding these dates and corresponding obligations is crucial for staying compliant and avoiding penalties.

We also explored different ways to file taxes, such as traditional paper filing, electronic filing (e-filing), utilizing the Free File program, or seeking professional assistance. Each method has its own advantages and suits different needs, so it’s important to choose the approach that works best for your situation.

Lastly, we covered some common mistakes to avoid when filing taxes, from mathematical errors and omissions to incorrect filing statuses and missing signatures. By being mindful of these mistakes and taking the time to review your tax return, you can reduce the risk of errors and ensure a smoother filing process.

Remember, preparing and filing your taxes accurately is essential for your overall financial well-being. If you have any questions or concerns, it’s always advisable to seek professional advice or consult with a tax expert to ensure compliance and optimize your tax liability.

By staying informed, being organized, and taking the necessary steps to file your taxes correctly and on time, you can confidently navigate the tax filing process and stay in good standing with the IRS.