Home>Finance>What Does Minimum Payment Mean On A Credit Card

Finance

What Does Minimum Payment Mean On A Credit Card

Published: February 26, 2024

Learn what the minimum payment on a credit card means and how it affects your finances. Understand the implications of making only the minimum payment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding the Minimum Payment on Your Credit Card

Introduction

If you own a credit card, you’ve likely come across the term "minimum payment" on your monthly statement. While it may seem like a straightforward concept, understanding its implications and significance is crucial for managing your finances effectively.

The minimum payment is the smallest amount you are required to pay each month to keep your credit card account in good standing. It is typically calculated as a percentage of your total outstanding balance, subject to a minimum fixed amount. While it may be tempting to make only the minimum payment, doing so can have long-term financial repercussions.

In this article, we will delve into the intricacies of minimum payments on credit cards, exploring how they are calculated, their impact on your overall debt, and the risks associated with making only minimum payments. Additionally, we will provide valuable tips for managing minimum payments to help you navigate the complex terrain of credit card debt more effectively.

Understanding the minimum payment is essential for maintaining a healthy financial profile and avoiding the pitfalls of excessive debt. Let's embark on a journey to unravel the nuances of minimum payments and empower ourselves with the knowledge to make informed financial decisions.

Understanding Minimum Payment

At its core, the minimum payment on a credit card represents the minimum amount of money you are required to pay by the due date each month. Failing to meet this obligation can result in late fees, penalty interest rates, and a negative impact on your credit score. While the minimum payment offers a degree of flexibility, it is essential to comprehend its implications beyond the immediate billing cycle.

When you receive your credit card statement, you will notice that the minimum payment is typically calculated as a percentage of your total outstanding balance, often ranging from 1% to 3% of the balance, with a minimum fixed amount. This calculation method allows for a degree of adjustability based on your current balance, ensuring that the minimum payment remains proportionate to your outstanding debt.

It is important to recognize that the minimum payment primarily serves as a mechanism for credit card companies to ensure a steady stream of revenue while providing cardholders with a manageable payment option. However, while it offers short-term relief by spreading out the payment burden, it can lead to long-term financial strain if not managed judiciously.

By understanding the purpose and calculation of the minimum payment, you can gain insight into the dynamics of credit card debt and make informed decisions regarding your payment strategy. It is crucial to view the minimum payment as a starting point rather than a definitive solution, as making only the minimum payment can prolong the repayment period and significantly increase the total interest paid over time.

As we delve deeper into the intricacies of minimum payments, we will uncover the nuances of their calculation and the broader implications they carry for your financial well-being. By grasping the significance of the minimum payment, you can navigate the terrain of credit card debt more effectively and work towards achieving greater financial stability.

How Minimum Payment is Calculated

The calculation of the minimum payment on a credit card is a pivotal aspect of managing your financial obligations. Understanding how this figure is derived can shed light on the dynamics of credit card debt and empower you to make informed decisions regarding your payment strategy.

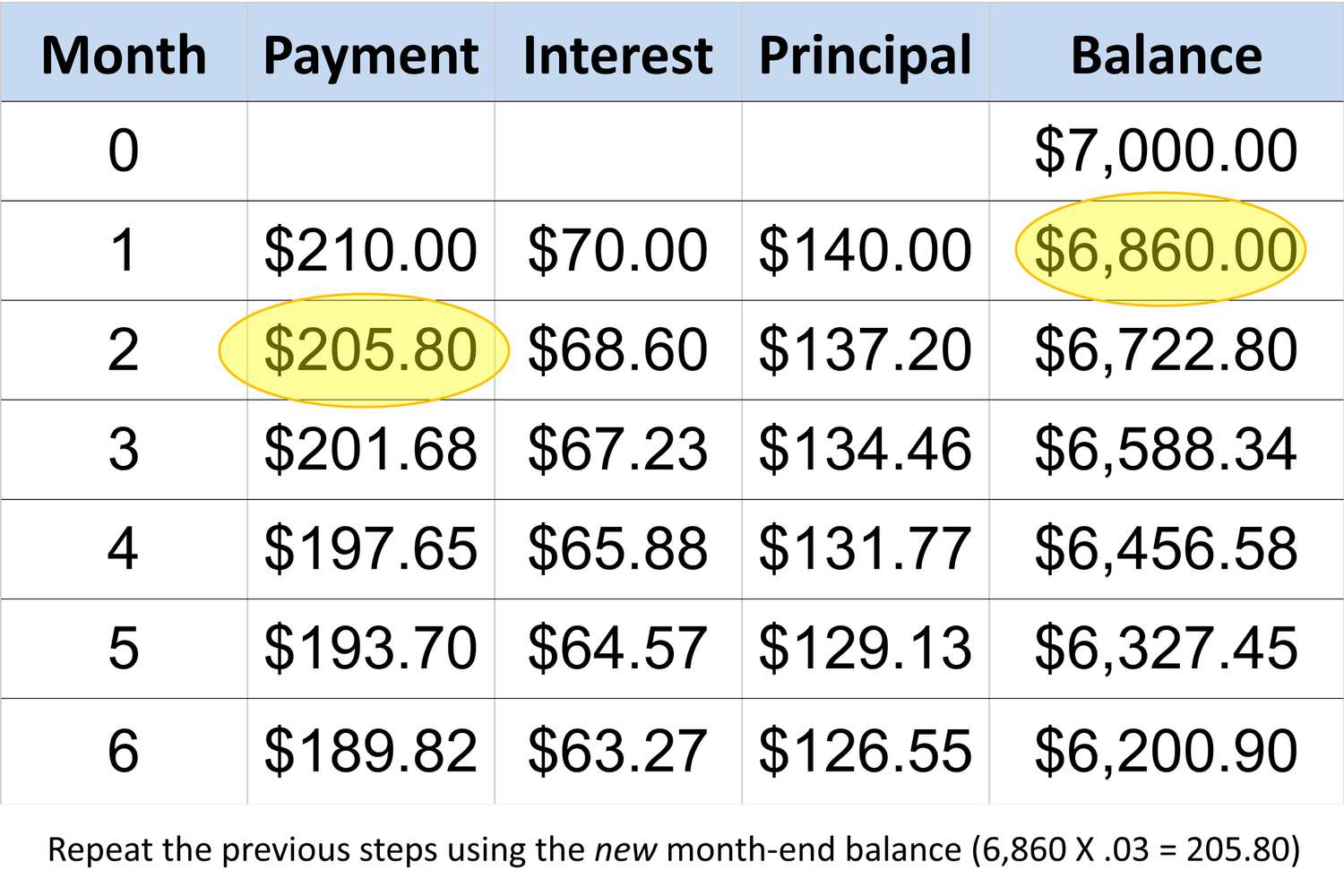

Typically, the minimum payment is calculated as a percentage of your total outstanding balance, often ranging from 1% to 3% of the balance, with a minimum fixed amount. This method allows for a degree of flexibility, as the minimum payment adjusts in proportion to your outstanding debt. For example, if your total balance is $1,000, a minimum payment of 2% would amount to $20.

It is important to note that credit card companies often impose a minimum fixed amount, such as $25, to ensure that the minimum payment does not become disproportionately low for larger balances. This safeguard prevents the minimum payment from dwindling to an insignificant sum, thereby enabling the credit card issuer to maintain a reasonable level of revenue.

When calculating the minimum payment, it is essential to consider any additional fees, accrued interest, and late payment charges that may contribute to your outstanding balance. These factors can impact the total amount due and subsequently influence the minimum payment for the following billing cycle.

By comprehending the methodology behind the calculation of the minimum payment, you can gain insight into the factors that shape your monthly financial obligations. This understanding empowers you to assess the implications of your outstanding balance and make strategic decisions regarding your repayment plan.

As we unravel the intricacies of minimum payments, it becomes evident that the calculation process plays a pivotal role in shaping your financial landscape. By mastering the nuances of minimum payment calculations, you can navigate the terrain of credit card debt more effectively and work towards achieving greater financial stability.

Impact of Minimum Payment on Credit Card Debt

The minimum payment on a credit card exerts a profound impact on the trajectory of your overall debt. While it offers a degree of flexibility in managing your monthly financial obligations, making only the minimum payment can have far-reaching consequences that extend beyond the immediate billing cycle.

One of the primary impacts of adhering to the minimum payment is the prolonged duration of debt repayment. By consistently making only the minimum payment, you extend the timeline for settling your outstanding balance, leading to a protracted cycle of debt accumulation. As a result, the total interest paid over the extended repayment period significantly inflates the overall cost of the debt, amplifying the financial burden borne by the cardholder.

Furthermore, the minimum payment’s impact on credit card debt is compounded by the accrual of interest. When you make only the minimum payment, a substantial portion of your outstanding balance continues to accrue interest, perpetuating the cycle of debt accumulation. This interest accrual can impede your progress in reducing the principal balance, further exacerbating the long-term financial implications of adhering solely to the minimum payment requirement.

Additionally, the impact of the minimum payment on credit card debt is manifested in the erosion of your financial flexibility. As the outstanding balance lingers over an extended period, the burden of debt repayment can impede your capacity to allocate financial resources towards other essential expenses and long-term financial goals. This erosion of financial flexibility underscores the importance of devising a strategic approach to managing credit card debt beyond the confines of the minimum payment.

By recognizing the multifaceted impact of the minimum payment on credit card debt, you can gain a deeper understanding of the long-term implications of adhering solely to the minimum payment requirement. This awareness empowers you to reassess your approach to debt repayment and explore alternative strategies to mitigate the adverse effects of prolonged debt accumulation.

As we unravel the intricate dynamics of the minimum payment’s impact on credit card debt, it becomes evident that adopting a proactive and informed approach to debt management is essential for achieving greater financial stability and mitigating the long-term repercussions of credit card debt.

Risks of Making Only Minimum Payments

While the minimum payment on a credit card offers a seemingly convenient option for managing monthly financial obligations, adhering solely to this requirement poses significant risks that can undermine your long-term financial well-being. Understanding the inherent risks associated with making only minimum payments is essential for navigating the complex terrain of credit card debt and devising a proactive approach to debt management.

One of the primary risks of making only minimum payments is the proliferation of debt accumulation. By consistently remitting the minimum payment, you extend the duration of debt repayment, leading to a protracted cycle of debt accumulation. This prolonged timeline not only amplifies the total interest paid but also perpetuates the burden of debt, impeding your financial progress and eroding your overall financial stability.

Furthermore, the accrual of interest represents a significant risk associated with making only minimum payments. As a substantial portion of your outstanding balance continues to accrue interest, the total cost of the debt escalates over time, exacerbating the financial strain borne by the cardholder. This interest accrual perpetuates the cycle of debt accumulation, hindering efforts to reduce the principal balance and impeding your journey towards financial freedom.

Another inherent risk of adhering solely to the minimum payment requirement is the potential impact on your credit score. Failing to address the outstanding balance beyond the minimum payment can result in a higher credit utilization ratio, which may adversely affect your credit score. A lower credit score can impede your ability to access favorable financial products and secure competitive interest rates, thereby limiting your financial flexibility and opportunities for future financial growth.

By recognizing the multifaceted risks associated with making only minimum payments, you can gain a comprehensive understanding of the potential pitfalls inherent in this approach to debt management. This awareness empowers you to reassess your payment strategy, explore alternative avenues for debt repayment, and proactively mitigate the long-term repercussions of adhering solely to the minimum payment requirement.

As we delve into the risks associated with making only minimum payments, it becomes evident that adopting a proactive and informed approach to debt management is essential for safeguarding your financial well-being and working towards achieving greater financial stability.

Tips for Managing Minimum Payments

Effectively managing minimum payments on your credit card is crucial for maintaining financial stability and mitigating the long-term repercussions of debt accumulation. By implementing strategic approaches to navigate the complexities of minimum payments, you can proactively address your outstanding balance and work towards achieving greater financial well-being.

1. Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due. By remitting a higher payment, you can accelerate the reduction of your outstanding balance and minimize the long-term impact of interest accrual, ultimately expediting your journey towards debt freedom.

2. Create a Repayment Plan: Develop a structured repayment plan that outlines your strategy for addressing your credit card debt. Prioritize higher-interest balances and consider consolidating debts to streamline repayment and potentially secure more favorable interest rates.

3. Monitor Your Spending: Exercise prudence in your spending habits to avoid exacerbating your outstanding balance. By monitoring your expenditures and adhering to a budget, you can mitigate the accumulation of additional debt and create a conducive environment for effective debt repayment.

4. Explore Balance Transfer Options: Consider transferring high-interest balances to credit cards with lower interest rates or introductory 0% APR offers. This can provide temporary relief from interest accrual, allowing you to make more significant strides in reducing your outstanding balance.

5. Seek Financial Guidance: If you find yourself overwhelmed by credit card debt, consider seeking guidance from financial advisors or credit counseling services. These professionals can provide tailored strategies for managing your debt and offer valuable insights into effective debt repayment techniques.

6. Automate Payments: Set up automated payments for your credit card to ensure timely remittance of at least the minimum amount due. This can help you avoid late fees and penalties while maintaining a consistent approach to managing your credit card debt.

By implementing these tips for managing minimum payments, you can proactively address your credit card debt and navigate the complexities of debt repayment with greater confidence and efficacy. These strategic approaches empower you to mitigate the long-term repercussions of adhering solely to the minimum payment requirement, ultimately fostering a path towards financial stability and debt freedom.

Conclusion

Understanding the intricacies of minimum payments on credit cards is paramount for maintaining financial stability and effectively managing debt. While the minimum payment offers a degree of flexibility in addressing monthly financial obligations, its implications extend far beyond the immediate billing cycle, profoundly influencing the trajectory of credit card debt and the overall financial well-being of cardholders.

By comprehending the calculation and impact of the minimum payment, individuals can gain insight into the dynamics of credit card debt and make informed decisions regarding their payment strategy. It is crucial to view the minimum payment as a starting point rather than a definitive solution, as making only the minimum payment can lead to prolonged debt repayment, increased interest costs, and diminished financial flexibility.

The risks associated with adhering solely to the minimum payment requirement underscore the importance of adopting proactive approaches to debt management. By paying more than the minimum, creating structured repayment plans, monitoring spending, and exploring balance transfer options, individuals can navigate the complexities of minimum payments and work towards achieving greater financial stability and debt freedom.

As we unravel the multifaceted implications of minimum payments, it becomes evident that a proactive and informed approach to debt management is essential for mitigating the long-term repercussions of credit card debt. By implementing strategic approaches to address outstanding balances and minimize interest accrual, individuals can pave the way towards financial well-being and embark on a journey towards sustainable debt management.

Ultimately, the knowledge and insights gained from understanding minimum payments empower individuals to navigate the complexities of credit card debt with confidence and efficacy. By embracing proactive strategies and exercising financial prudence, individuals can transcend the limitations of minimum payments and cultivate a path towards financial stability, resilience, and long-term prosperity.