Finance

Municipal Bond Arbitrage Definition

Published: December 28, 2023

Explore the definition of municipal bond arbitrage and its significance in the world of finance. Gain insights into this financial strategy and its potential advantages.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Municipal Bond Arbitrage Definition: Maximizing Your Investments

As an investor, it’s important to explore various strategies that can help maximize your investments. One such strategy is municipal bond arbitrage, a financial concept that allows investors to take advantage of the price inefficiencies between different municipal bonds. In this blog post, we will delve into the definition of municipal bond arbitrage and how it can be used to gain an edge in the finance market.

Key Takeaways:

- Municipal bond arbitrage involves exploiting price differences between various municipal bonds.

- Investors can profit from municipal bond arbitrage by buying bonds at a lower price and simultaneously selling them at a higher price.

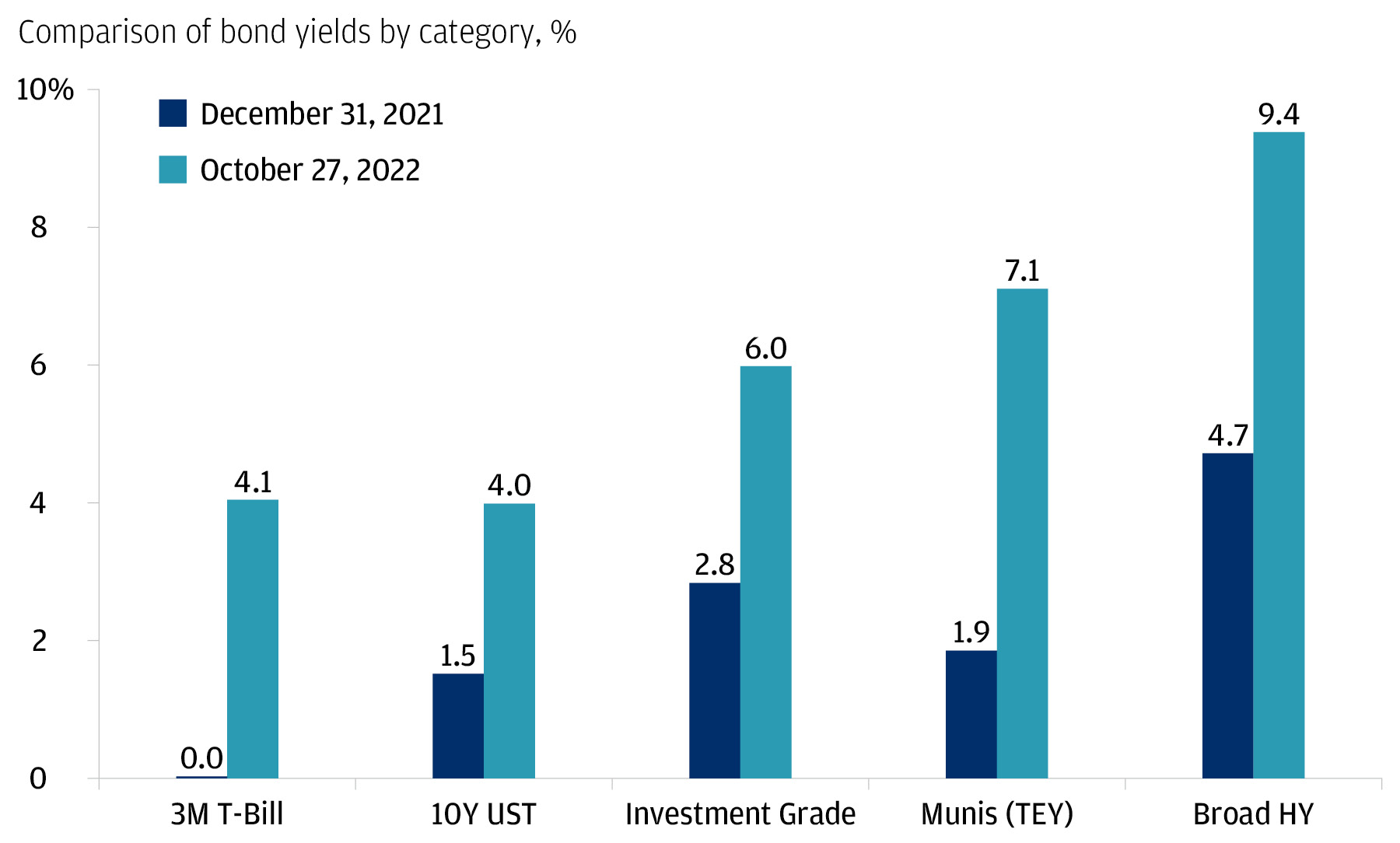

So, what exactly is municipal bond arbitrage? Simply put, it’s a strategy that takes advantage of price deviations in municipal bonds. Municipal bonds are debt instruments issued by state or local governments to raise funds for public projects such as infrastructure development. These bonds are considered relatively safe investments due to their low default rates and tax advantages. However, their prices can vary based on factors such as credit rating, interest rates, and market demand.

The main principle of municipal bond arbitrage is to identify and exploit these price discrepancies. Let’s say you notice two similar municipal bonds with different prices. By purchasing the cheaper bond, you can simultaneously sell the more expensive one, profiting from the price difference. This strategy requires careful analysis and monitoring of the bond market to identify favorable opportunities.

To execute municipal bond arbitrage effectively and minimize risk, investors often use leverage. By borrowing funds at a lower interest rate than the coupon rate earned on the bonds, investors can increase their potential returns. However, it’s essential to factor in associated risks, such as interest rate changes, credit risk, and liquidity risk.

Now that we understand the basics of municipal bond arbitrage, let’s explore some key advantages and considerations of this strategy:

Advantages of Municipal Bond Arbitrage:

- Potential for higher returns: By taking advantage of price discrepancies, investors can potentially earn higher returns compared to traditional buy-and-hold strategies.

- Diversification: Municipal bond arbitrage offers a way to diversify investment portfolios by adding an alternative strategy to existing holdings.

- Lower market risk: Municipal bonds are considered less volatile compared to other investment options, providing a more stable investment environment.

Considerations for Municipal Bond Arbitrage:

- Market analysis: Proper analysis and understanding of the municipal bond market is vital to identify favorable opportunities and mitigate risks.

- Risk management: As with any investment strategy, it’s crucial to have a risk management plan in place to protect against adverse market conditions.

- Regulatory changes: Monitoring regulatory changes and tax implications is crucial, as they can impact the profitability of municipal bond arbitrage.

Overall, municipal bond arbitrage can be an effective strategy for investors looking to maximize their investments. However, it’s important to approach this strategy with caution and thorough analysis. By understanding the definitions, advantages, and considerations of municipal bond arbitrage, investors can make informed decisions to optimize their investment returns in the dynamic finance market.