Finance

What Is A High APR For A Credit Card?

Published: March 3, 2024

Learn about high APR for credit cards and how it impacts your finances. Understand the importance of managing your credit card APR for better financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding APR for Credit Cards

Credit Card APR: A Crucial Metric

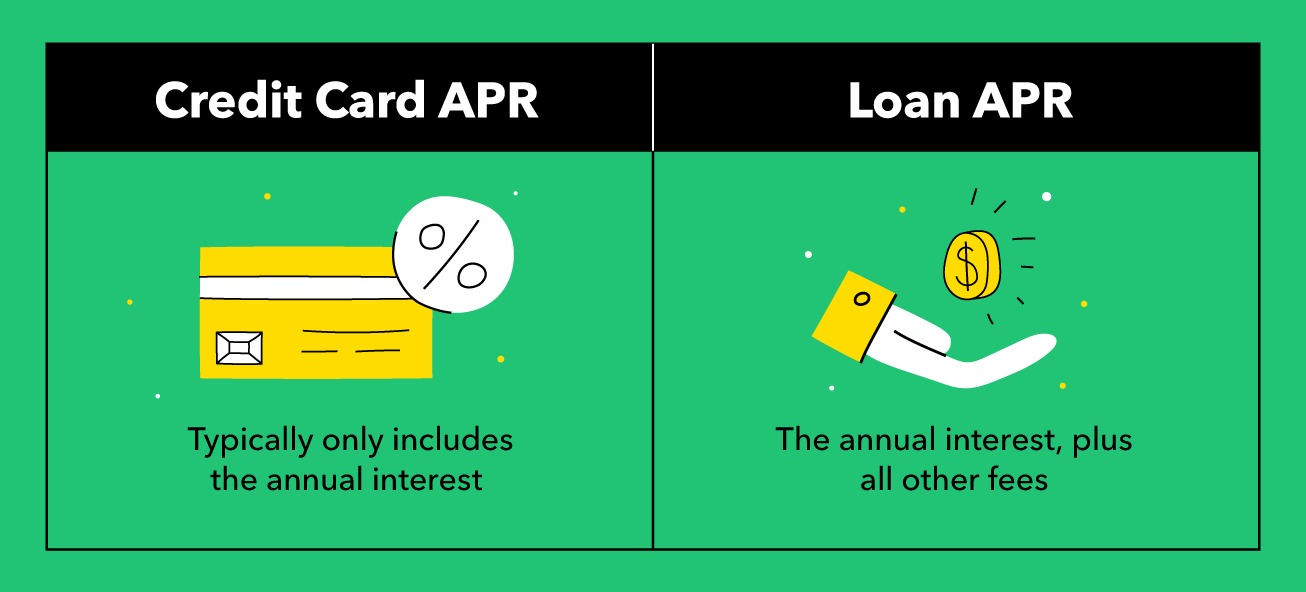

Annual Percentage Rate (APR) is a fundamental aspect of credit cards, representing the annualized interest rate applied to outstanding balances. It serves as a key determinant of the cost of borrowing on a credit card. Understanding APR is vital for responsible financial management, as it directly impacts the overall expense incurred when carrying a balance on a credit card.

Importance of APR

The APR encompasses not only the interest charged by the card issuer but also additional fees and costs associated with borrowing. It provides a comprehensive view of the true cost of credit, enabling cardholders to make informed decisions regarding their financial transactions.

Variable vs. Fixed APR

Credit card APRs can be either fixed or variable. Fixed APRs remain constant throughout the year, offering predictability and stability in terms of interest expenses. On the other hand, variable APRs are tied to an underlying index, such as the prime rate, and fluctuate in accordance with market conditions. Understanding the nature of the APR is essential for evaluating the potential impact on one’s finances.

Grace Periods and APR

Many credit cards offer a grace period during which no interest is accrued on new purchases if the statement balance is paid in full by the due date. However, this grace period does not apply to cash advances and balance transfers, which typically start accruing interest immediately. It is crucial for cardholders to comprehend the specific terms and conditions governing the APR to optimize their financial strategies.

By grasping the significance of APR, individuals can make well-informed decisions regarding credit card usage, debt management, and financial planning, ultimately empowering them to navigate the complex landscape of personal finance with confidence and prudence.

Factors Affecting Credit Card APR

Influential Determinants of Credit Card APR

Credit card APR is influenced by several key factors that play a pivotal role in determining the cost of borrowing and the overall financial implications for cardholders. Understanding these factors is essential for individuals seeking to comprehend the dynamics of APR and make informed decisions regarding credit card usage and debt management.

Credit Score

One of the primary determinants of credit card APR is the cardholder’s credit score. Lenders use credit scores to assess the risk associated with extending credit, with higher scores typically resulting in lower APRs. Individuals with excellent credit profiles are often eligible for credit cards with more favorable terms, including lower APRs, reflecting the lender’s confidence in their creditworthiness.

Market Conditions

Credit card APRs are influenced by broader market conditions, particularly prevailing interest rates and economic factors. In a rising interest rate environment, credit card APRs tend to increase, impacting the cost of carrying balances and leading to higher interest expenses for cardholders. Conversely, during periods of declining interest rates, credit card APRs may decrease, offering potential savings for consumers.

Cardholder Risk Profile

Lenders assess the risk profile of individual cardholders based on various factors, including income, employment status, and debt-to-income ratio. Cardholders perceived as higher risks may be subject to elevated APRs, reflecting the lender’s assessment of the potential default probability associated with extending credit under such circumstances.

Regulatory Changes

Regulatory developments and changes in legislation can impact credit card APRs, as they may introduce new requirements or restrictions on interest rate practices. Understanding the regulatory environment and its potential influence on credit card APR is crucial for cardholders navigating the financial landscape.

By considering these influential factors, individuals can gain valuable insights into the dynamics of credit card APR and its determinants, enabling them to make informed financial decisions and effectively manage their credit card accounts.

What Constitutes a High APR for a Credit Card?

Understanding the Threshold of Elevated APRs

Assessing what qualifies as a high APR for a credit card entails considering various contextual factors and industry standards that influence the perception of interest rates as being elevated. While specific definitions may vary based on individual perspectives and prevailing market conditions, certain benchmarks and considerations can shed light on the notion of a high APR in the credit card landscape.

Comparison with Market Averages

One approach to evaluating the competitiveness of a credit card’s APR is to compare it with prevailing market averages. Industry data and financial reports often provide insights into the average APRs for different types of credit cards, enabling consumers to gauge the relative positioning of a specific card’s interest rate. An APR significantly higher than the prevailing average may be deemed as high in the current market context.

Relative to the Prime Rate

The prime rate, which serves as a benchmark for many lending products, can serve as a reference point for assessing the level of credit card APRs. Credit card APRs that substantially exceed the prime rate may be considered high, signaling a significant premium charged by the card issuer relative to the baseline interest rate in the financial markets.

Impact on Affordability

Beyond numerical comparisons, the impact of a credit card’s APR on affordability and financial well-being is a critical consideration. An APR that imposes a substantial burden on cardholders, leading to challenges in managing balances and servicing interest expenses, may be viewed as high from a practical standpoint, irrespective of industry benchmarks.

Perception of Risk

Lenders assess the risk associated with extending credit, and this risk perception can influence the APR offered to individual cardholders. Consequently, an APR deemed high for a specific cardholder may be indicative of the lender’s risk assessment, reflecting the individual’s creditworthiness and financial circumstances.

By considering these perspectives, individuals can gain a nuanced understanding of what constitutes a high APR for a credit card, empowering them to make informed comparisons, assess affordability, and navigate the credit card landscape effectively.

Impact of High APR on Credit Card Debt

Navigating the Financial Ramifications

The implications of a high Annual Percentage Rate (APR) on credit card debt can significantly influence the financial well-being of cardholders, amplifying the challenges associated with managing and repaying outstanding balances. Understanding the profound impact of elevated APRs on credit card debt is crucial for individuals striving to make informed financial decisions and effectively address their debt obligations.

Accumulation of Interest Charges

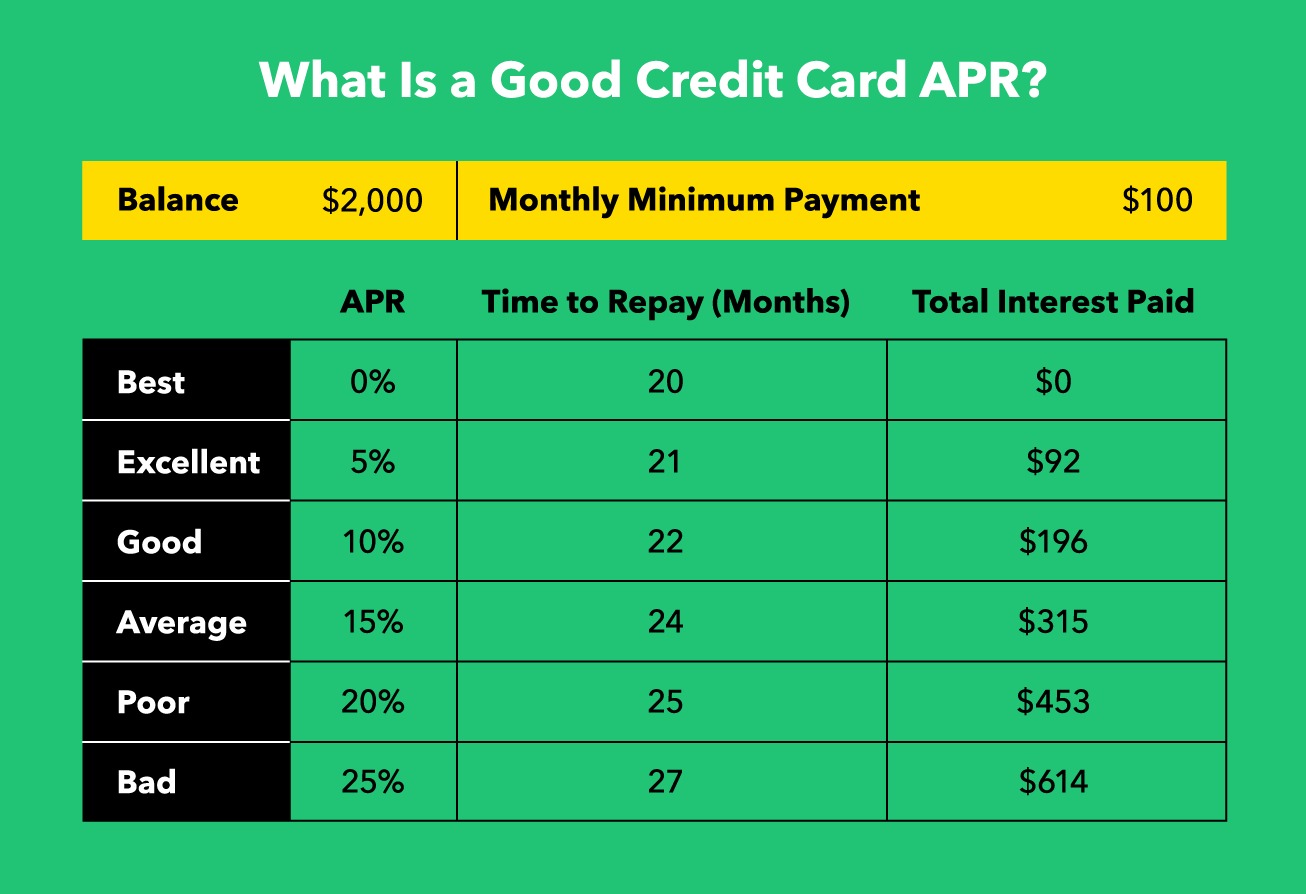

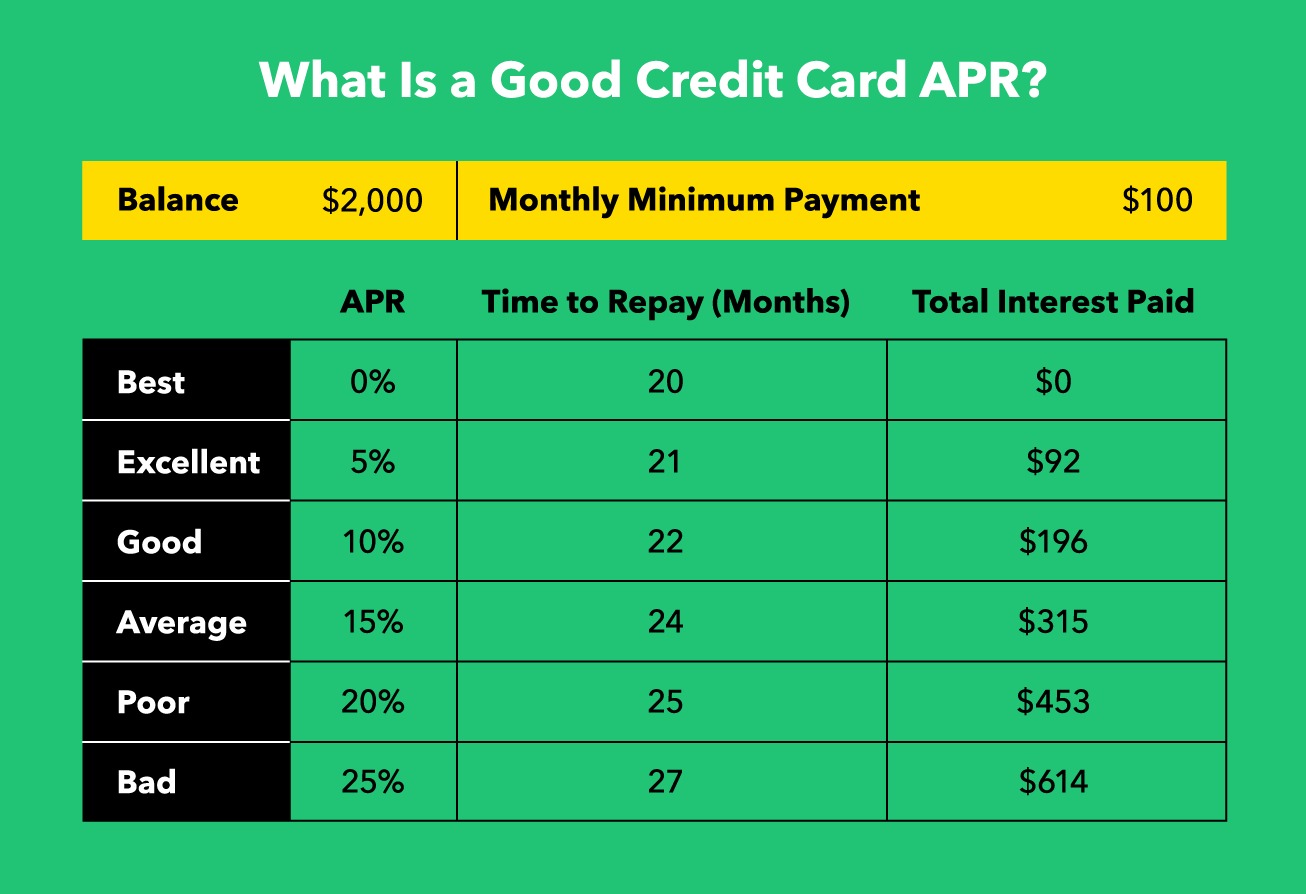

A high APR contributes to the rapid accumulation of interest charges on outstanding credit card balances. As interest accrues on the principal amount, the overall debt burden grows, potentially leading to a cycle of increasing indebtedness if not effectively managed. Cardholders with high APRs may find it challenging to make meaningful progress in reducing their balances due to the substantial portion of payments allocated towards interest expenses.

Extended Repayment Durations

The presence of a high APR can prolong the duration required to repay credit card debt, as a significant portion of each payment is directed towards interest rather than principal reduction. This extended repayment timeline can result in heightened financial stress and limit the ability to achieve debt-free status within a reasonable timeframe, potentially impacting long-term financial goals and stability.

Financial Strain and Budgetary Constraints

High APRs can exert substantial financial strain on cardholders, constraining their ability to allocate funds towards savings, investments, and essential expenses. The burden of servicing interest charges may impede the pursuit of other financial objectives, leading to a compromised financial outlook and reduced flexibility in managing unexpected expenses or capitalizing on opportunities for financial growth.

Cycle of Minimum Payments

For individuals contending with high APRs, the reliance on minimum payments to service credit card debt may perpetuate a cycle of indebtedness. Minimum payments primarily address interest obligations, resulting in minimal progress towards reducing the principal balance. This cycle can perpetuate the accumulation of interest charges and impede efforts to achieve debt freedom.

By recognizing the impact of high APRs on credit card debt, individuals can proactively explore strategies to mitigate these effects, such as pursuing balance transfer options, consolidating debt, or implementing disciplined repayment plans. Empowered with insights into the implications of elevated APRs, cardholders can navigate their debt management journey with greater resilience and financial acumen.

Tips for Managing High APR Credit Cards

Navigating Financial Prudence and Debt Management

Effectively managing high Annual Percentage Rate (APR) credit cards requires strategic financial acumen and proactive measures to mitigate the impact of elevated interest expenses. By implementing prudent financial strategies and leveraging available resources, individuals can navigate the challenges posed by high APRs and work towards optimizing their debt management approach.

1. Pursue Balance Transfer Options

Explore balance transfer offers from credit card issuers, allowing for the consolidation of high APR balances onto a card with a lower or 0% introductory interest rate. This can provide temporary relief from accruing substantial interest charges, enabling more efficient repayment of outstanding balances.

2. Prioritize Repayment Focus

Allocate additional funds towards repaying high APR credit card balances, focusing on reducing the principal amount to minimize long-term interest expenses. By prioritizing debt repayment, individuals can expedite their journey towards financial freedom and mitigate the impact of elevated APRs.

3. Negotiate with Card Issuers

Engage in proactive communication with credit card issuers to explore potential options for lowering APRs or negotiating more favorable terms. Demonstrating responsible financial behavior and a commitment to debt reduction may incentivize card issuers to consider accommodating requests for APR reductions.

4. Explore Debt Consolidation Loans

Consider the option of obtaining a debt consolidation loan to combine high APR credit card balances into a single, more manageable loan with a potentially lower interest rate. This approach can streamline debt repayment and reduce the overall interest burden, facilitating a structured and disciplined approach to debt management.

5. Practice Prudent Credit Card Usage

Exercise restraint and discretion in credit card usage to prevent the accumulation of additional high APR debt. By adhering to a budget, monitoring spending habits, and avoiding unnecessary charges, individuals can mitigate the expansion of high-interest balances and focus on reducing existing debt obligations.

6. Enhance Creditworthiness

Work towards improving credit scores and enhancing creditworthiness through responsible financial behavior, timely payments, and prudent credit utilization. A stronger credit profile can position individuals to qualify for credit cards with more favorable APRs, potentially mitigating the impact of high interest expenses in the future.

By implementing these proactive strategies and embracing a disciplined approach to debt management, individuals can effectively navigate the challenges posed by high APR credit cards and progress towards achieving greater financial stability and freedom.