Home>Finance>What Happens If The IRS Sends You To Collections

Finance

What Happens If The IRS Sends You To Collections

Published: November 1, 2023

Discover what happens when the IRS sends you to collections and how it can impact your finances. Gain valuable insights and take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with tax debt can be a daunting experience, especially if the IRS sends you to collections. The Internal Revenue Service (IRS) has the authority to pursue unpaid taxes through a series of actions, which can have serious consequences for your financial well-being. Understanding the collections process and your rights as a taxpayer is crucial in navigating this challenging situation.

In this article, we will delve into what happens if the IRS sends you to collections, the potential repercussions of being in this situation, and the various options available to resolve your tax debt.

It’s important to note that the IRS does not jump straight to collections. Typically, they will first send you an official notice of tax debt and provide an opportunity to respond. If the debt remains unpaid or unresolved, the IRS may then escalate the matter to collections.

Being sent to collections by the IRS can result in financial hardships and potentially damage your credit score. However, it’s essential to understand that there are avenues for resolving tax debt and getting back on track.

Throughout this article, we will explore the different steps in the IRS collections process, the potential consequences of being sent to collections, and the options available to you to address your tax debt. Whether you have received a collection notice or are currently dealing with tax debt, this information will equip you with the knowledge necessary to navigate the situation effectively.

Understanding IRS Collections Process

The IRS collections process is a series of actions taken by the IRS to collect unpaid taxes. If you owe taxes and have not made arrangements to pay, the IRS may initiate collections proceedings. It’s important to have a clear understanding of how this process works to better navigate your situation.

The collections process typically starts with the IRS sending you a notice of the debt, also known as a CP14 or CP501 notice. This notice will outline the amount you owe, including penalties and interest, and provide instructions on how to address the debt. It is essential to respond promptly and appropriately to this notice to avoid further complications.

If you fail to respond or make payment arrangements, the IRS will escalate the collection process. They may send additional notices, such as a CP503 or CP504, which will warn of the potential consequences of continued non-payment. These consequences can include wage garnishment, asset seizure, or a tax lien being placed on your property.

If you still do not resolve the tax debt, the IRS may take further actions, such as filing a federal tax lien. This lien is a legal claim on your property, notifying creditors that the IRS has a right to your assets as repayment for the tax debt. A tax lien can greatly impact your creditworthiness and make it challenging to obtain loans or credit in the future.

In more severe cases, the IRS may resort to levying your wages or seizing your assets. Wage garnishment involves the IRS instructing your employer to withhold a portion of your wages to satisfy the tax debt. Asset seizure, on the other hand, involves the IRS taking possession of your property, such as bank accounts, real estate, or vehicles, to sell and satisfy the unpaid taxes.

Understanding the IRS collections process is crucial to take appropriate action and minimize the potential consequences. It is essential to address tax debt promptly and explore available options to resolve the outstanding balance.

Consequences of Being Sent to Collections

Being sent to collections by the IRS can have significant ramifications for your finances and overall well-being. It is essential to understand the potential consequences of this situation to take the necessary steps to address your tax debt.

One of the immediate consequences of being sent to collections is the accumulation of penalties and interest on your unpaid tax debt. The IRS charges penalties for late payment, failure to file, and accuracy-related issues. These penalties can quickly add up, making it even more challenging to pay off your tax debt.

In addition to financial penalties, being sent to collections can negatively impact your credit score. The IRS has the authority to file a federal tax lien against your property to secure its claim on your assets. A tax lien can appear on your credit report, making it difficult to obtain credit, secure loans, or even rent a home. This can have long-term consequences for your financial well-being.

Another potential consequence of being sent to collections is wage garnishment. The IRS can legally require your employer to withhold a portion of your wages to satisfy the tax debt. Wage garnishment can significantly impact your take-home pay and make it difficult to cover your living expenses.

If your tax debt remains unresolved, the IRS may also choose to seize your assets. This can involve taking possession of your bank accounts, real estate, vehicles, or other valuable assets to satisfy the unpaid taxes. Asset seizure can be a devastating blow to your financial stability and may take a significant toll on your personal and professional life.

Furthermore, being sent to collections can result in increased stress and pressure. Dealing with the IRS and the potential consequences of unpaid taxes can take an emotional toll on individuals and their families. It is crucial to address tax debt and seek support when needed to alleviate the mental and emotional burden.

Understanding the consequences of being sent to collections can motivate you to take action and seek resolution for your tax debt. By addressing the issue promptly and exploring the available options, you can mitigate the potential long-lasting impact on your financial and personal life.

Communication from the IRS

When the IRS sends you to collections, you can expect to receive various forms of communication regarding your tax debt. It is essential to understand the types of correspondence you may receive and how to respond to them.

The initial communication you will likely receive from the IRS is a notice of tax debt, such as a CP14 or CP501. This notice will inform you of the amount you owe, including penalties and interest, and provide instructions on how to address the debt. It is crucial to carefully review this notice and take appropriate action by the specified deadline.

If you do not respond to the initial notice or fail to make payment arrangements, the IRS may send additional notices, such as a CP503 or CP504. These notices serve as reminders and warnings of the potential consequences of continued non-payment. They will emphasize the importance of resolving the tax debt promptly.

In some cases, the IRS may also initiate contact through phone calls or in-person visits. It is essential to verify the authenticity of these contacts before providing any personal or financial information. The IRS will never demand immediate payment through a specific payment method, such as prepaid debit cards or wire transfers. If you are unsure about the legitimacy of a communication, it is recommended to contact the IRS directly using the contact information provided on their official website.

Throughout the communication process, it is crucial to maintain accurate records. Keep copies of all correspondence, including letters, notices, and emails, as well as a record of any phone conversations or in-person meetings. These records will serve as evidence of your efforts to resolve the tax debt and may be useful in case of disputes or appeals.

If you are unable to pay the full amount of your tax debt, it is important to communicate with the IRS and explore alternative payment options. The IRS may be willing to set up a payment plan, known as an installment agreement, based on your financial situation. Additionally, you may be eligible for other debt resolution programs, such as an offer in compromise or currently not collectible status. Open and transparent communication with the IRS is crucial in finding a resolution that works for both parties.

Understanding the communication process with the IRS is vital in effectively addressing your tax debt. Responding to notices promptly, maintaining accurate records, and seeking assistance when needed can help navigate the collections process more efficiently.

Options to Resolve Tax Debt

If you find yourself in a situation where the IRS has sent you to collections, it’s important to know that you have options for resolving your tax debt. Here are some of the common options available:

- Installment Agreement: An installment agreement allows you to make monthly payments towards your tax debt over an extended period. This option provides flexibility and allows you to pay off your debt in manageable installments. To qualify for an installment agreement, you will need to demonstrate your inability to pay the full amount upfront.

- Offer in Compromise: An offer in compromise (OIC) is an agreement between you and the IRS to settle your tax debt for less than the full amount owed. This option is suitable for those who are unable to pay their entire tax debt or can prove that paying the full amount would cause financial hardship. The IRS carefully reviews your financial situation to determine if an OIC is appropriate.

- Currently Not Collectible (CNC) Status: If you are experiencing significant financial hardship and cannot afford to make any payments towards your tax debt, you may qualify for currently not collectible status. This status temporarily suspends IRS collection activities while you get back on your feet. However, interest and penalties continue to accrue, and the IRS may revisit your case in the future.

- Bankruptcy: In certain circumstances, filing for bankruptcy can help resolve tax debt. However, it is important to understand that not all tax debt is dischargeable through bankruptcy, and specific criteria must be met. Consulting with a bankruptcy attorney who specializes in tax-related issues is crucial in determining if this option is suitable for your situation.

- Payment in Full: If you have the means to do so, paying your tax debt in full is always an option. This eliminates any ongoing interest and penalties and allows you to settle your debt completely. Consider using savings, borrowing from friends or family, or exploring other sources of funds to pay off your tax debt.

It’s important to note that each option has its own eligibility requirements and considerations. Before deciding on a course of action, it is advisable to consult with a tax professional or seek assistance from a reputable tax resolution service. These professionals can assess your situation, explore the available options, and guide you towards the most suitable resolution strategy.

Remember, resolving tax debt may take time and effort, but taking proactive steps towards resolving your tax debt is crucial to avoid further consequences and regain your financial stability.

Installment Agreement

One option for resolving tax debt with the IRS is through an installment agreement. An installment agreement allows you to make monthly payments toward your tax debt over a specified period of time. This option provides flexibility and can help alleviate the financial burden of paying off your tax debt all at once.

To qualify for an installment agreement, you will need to meet certain criteria and provide information about your financial situation. The IRS will review your income, expenses, and assets to determine the appropriate monthly payment amount. It’s important to be honest and thorough when providing the necessary financial information to the IRS.

There are different types of installment agreements available based on the amount you owe and your ability to pay. The most common type is a streamlined installment agreement, which is available if you owe $50,000 or less in tax debt. With a streamlined agreement, you can typically avoid submitting detailed financial statements and can set up the installment plan online or by mail.

If you owe more than $50,000, or if you need more time to repay your tax debt, you may need to provide additional documentation and negotiate the terms of the installment agreement with the IRS. In some cases, the IRS may request a Collection Information Statement (Form 433-A or 433-F) to evaluate your ability to pay and determine the monthly installment amount.

It’s important to note that an installment agreement can accrue interest and penalties until the tax debt is fully paid. However, establishing an installment agreement can prevent more severe consequences, such as wage garnishment or asset seizure. By making consistent and timely payments, you will gradually reduce your tax debt and eventually resolve it.

To request an installment agreement, you can use the IRS Online Payment Agreement tool or submit Form 9465, Installment Agreement Request, by mail. The IRS will review your request and notify you of its acceptance or any adjustments to the terms. It’s crucial to continue making the monthly payments as agreed upon to maintain the installment agreement and avoid defaulting.

If you encounter financial difficulties and are unable to make the monthly payments, it is important to contact the IRS immediately. They may be able to adjust the payment amount or temporarily suspend collections through a hardship deferment. Open communication with the IRS is key to ensuring the success of your installment agreement and avoiding any potential issues.

An installment agreement is an effective option for resolving tax debt by providing a structured and manageable approach to repay what you owe. It is advisable to seek professional guidance from a tax expert or a reputable tax resolution service to help you navigate the installment agreement process and ensure the best possible outcome for your situation.

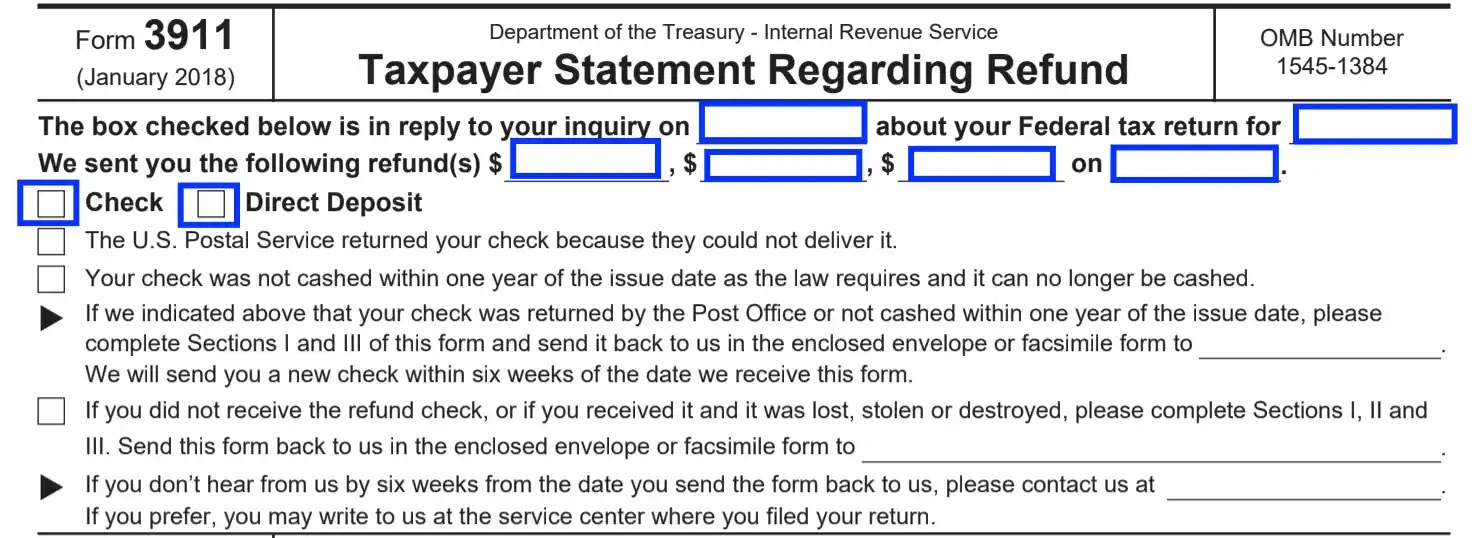

Offer in Compromise

If you are unable to pay your tax debt in full, an offer in compromise (OIC) is an option that allows you to settle your tax debt for less than the full amount owed. This program is designed for individuals who are facing financial hardship and can’t afford to pay their tax debt in its entirety.

Qualifying for an offer in compromise requires demonstrating to the IRS that paying the full amount would create significant financial hardship. The IRS will evaluate several factors, including your income, expenses, asset equity, and future earning potential, to determine the reasonable collection potential (RCP) – the amount they believe you can pay.

To apply for an offer in compromise, you must complete and submit Form 656, Offer in Compromise, along with a detailed financial statement (either Form 433-A for individuals or Form 433-B for businesses). Along with the forms, you will need to provide supporting documentation to validate your financial situation.

It’s important to note that applying for an OIC entails a non-refundable application fee, unless you meet specific low-income criteria. The fee amount depends on the type of offer you are submitting and can be found on the IRS website or in the offer in compromise booklet.

Once your offer in compromise is submitted, the IRS will evaluate your application and may request additional documentation or clarification. They have the authority to accept, reject, or counteroffer your proposal. If your offer is accepted, you will be given a specific timeframe to pay the agreed-upon amount, and your tax debt will be considered resolved.

If your offer is denied, it is possible to appeal the decision. It’s crucial to carefully review the reasons for denial and work with a tax professional or a reputable tax resolution service to determine the best course of action. Appeals must be filed within a certain timeframe, and proper documentation and arguments must be provided to support your case.

It’s important to note that an offer in compromise should be pursued after considering all other available options for resolving tax debt. While it can be an effective way to settle your tax liability for less than the full amount, the IRS has stringent guidelines for acceptance. It’s essential to fully understand the process, consult with a tax professional, and carefully consider the implications before submitting an offer in compromise.

Overall, an offer in compromise can provide a viable solution for individuals struggling to pay their tax debt. It offers the potential for financial relief and a fresh start, allowing you to move forward with your finances and regain control over your situation.

Currently Not Collectible Status

If you’re facing financial hardship and are unable to pay your tax debt, currently not collectible (CNC) status may be an option worth exploring. CNC status temporarily suspends IRS collection efforts, providing you with temporary relief from payment while you regain your financial stability.

To qualify for currently not collectible status, you must convince the IRS that your current financial situation makes it impossible for you to make any payments towards your tax debt. You will need to provide detailed information about your income, expenses, assets, and liabilities to support your claim. This information is typically provided on the Collection Information Statement (Form 433-A for individuals or Form 433-B for businesses).

When evaluating your request for CNC status, the IRS will carefully review your financial information to determine if you have any surplus income or assets that could be used to pay the tax debt. If they find that you do not have any disposable income after accounting for necessary living expenses, they may grant you currently not collectible status.

If your request is approved, the IRS will temporarily halt all collection activities, including levies, wage garnishments, and asset seizures. However, it’s important to note that interest and penalties will continue to accrue on the outstanding tax debt, and the IRS may periodically review your financial situation to determine if your status should be changed.

While currently not collectible status provides temporary relief from collection efforts, it does not eliminate your tax debt. The IRS will still consider the debt as owed, and they may resume collection activities in the future if your financial situation improves.

It’s important to stay in communication with the IRS during this period. If your financial situation changes or you receive any additional income or assets, you are required to notify the IRS so that they can reassess your CNC status. Failing to provide updated information could result in the removal of your currently not collectible status.

It’s worth noting that currently not collectible status does not prevent the IRS from filing a federal tax lien against your property. However, in many cases, the IRS may choose not to file a tax lien if you are unable to pay your tax debt due to financial hardship.

If you believe you qualify for currently not collectible status, it is best to consult with a tax professional or seek assistance from a reputable tax resolution service. These experts can help you navigate the process, gather the necessary documentation, and communicate effectively with the IRS to increase your chances of obtaining currently not collectible status.

Currently not collectible status can provide much-needed relief for individuals facing financial hardship. It allows you the time and opportunity to improve your financial situation without the immediate pressure of paying off your tax debt.

Appealing IRS Collections Actions

If you disagree with the actions taken by the IRS regarding your tax debt, you have the right to appeal their decision. The appeal process allows you to challenge the collection actions, penalties, or assessments levied by the IRS.

Before filing an appeal, it’s important to exhaust all other available options for resolving your tax debt, such as payment plans or offers in compromise. However, if you believe there has been an error or you have valid reasons to challenge the IRS’s decision, you can initiate the appeals process.

The first step in the appeals process is to request a conference with an IRS appeals officer. This can usually be done by completing Form 9423, Collection Appeal Request, or by submitting a written request outlining your reasons for appeal. You must file your appeal within the specified timeframe indicated on the notice you received from the IRS.

During the appeals conference, you will have the opportunity to present your case and provide any supporting documentation or evidence to support your position. The appeals officer will review the facts and circumstances of your case and evaluate whether the IRS’s actions were appropriate or if an alternative resolution can be reached.

If you are unable to reach a resolution during the appeals conference, you can further pursue your case by seeking external assistance. This may involve engaging legal representation or working with a tax professional experienced in tax dispute resolution. These professionals can provide guidance, review your case, and represent your interests during the appeals process.

It’s important to note that the appeals process can take time, and patience is required. The appeals officer will carefully consider your arguments, review the evidence, and provide a decision based on the merits of your case. If you are dissatisfied with the outcome of the appeals conference, you may have the option to further escalate your case to the Office of Appeals or even pursue litigation in tax court.

When pursuing an appeal, it’s crucial to gather all relevant documents, keep accurate records of your interactions with the IRS, and maintain open lines of communication. Consulting with a tax professional or a reputable tax resolution service can provide invaluable assistance in navigating the appeals process and maximizing your chances of a favorable outcome.

Appealing IRS collections actions allows you to challenge the decisions made by the IRS regarding your tax debt. It is an important safeguard to ensure your rights as a taxpayer are protected, and to seek a fair resolution to your tax dispute.

Seeking Professional Help

Dealing with tax debt and navigating the IRS collections process can be complex and overwhelming. In such situations, seeking professional help can provide the expertise and guidance needed to address your tax issues effectively.

A tax professional, such as a tax attorney, certified public accountant (CPA), or enrolled agent (EA), specializes in tax law and can offer valuable assistance in resolving your tax debt. These professionals have in-depth knowledge of the tax code, IRS procedures, and negotiation tactics to help you navigate through the complexities of your tax situation.

One of the significant advantages of seeking professional help is that these experts can analyze your financial situation, evaluate your options, and recommend the best course of action tailored to your unique circumstances. They can help you explore different avenues for resolving your tax debt, such as installment agreements, offers in compromise, or currently not collectible status.

In addition to providing guidance and representation during the collections process, tax professionals can also assist with IRS communications, help you gather and organize the necessary financial documentation, and ensure you are fully compliant with IRS requirements.

When selecting a tax professional, it’s important to choose someone with experience in tax resolution and a solid track record of successfully assisting clients with similar tax issues. Look for professionals who are licensed, registered with appropriate tax authorities, and have a good reputation in the industry.

It’s also crucial to discuss fees upfront and ensure you have a clear understanding of the costs involved. Professional fees can vary, depending on the complexity of your tax situation and the services required. However, it’s important to weigh the potential savings and benefits of resolving your tax debt correctly against the cost of professional assistance.

Even if you opt to seek professional help, it’s essential to stay involved and informed throughout the process. Ask questions, review any documents or agreements carefully, and maintain open communication with your tax professional.

Remember, seeking professional help does not guarantee a specific outcome, nor does it absolve you of your responsibility to address your tax debt. However, having a knowledgeable and experienced advocate on your side can significantly increase your chances of achieving a favorable resolution with the IRS.

Ultimately, seeking professional help provides you with the expertise and support you need to effectively navigate the complexities of tax debt and IRS collections. With the guidance of a tax professional, you can make informed decisions and work towards resolving your tax issues in the most advantageous way possible.

Conclusion

Dealing with tax debt and being sent to collections by the IRS can be a daunting and stressful experience. However, understanding the collections process, the potential consequences, and the options available to resolve your tax debt can help you navigate this challenging situation more effectively.

If you find yourself facing tax debt and collections actions, it is important to respond promptly to the IRS notices and communicate with them throughout the process. Ignoring the issue will only compound the problem and potentially lead to harsher consequences.

Exploring various options such as installment agreements, offers in compromise, currently not collectible status, or appealing IRS collections actions can provide avenues for resolving your tax debt in a way that suits your financial circumstances.

Seeking professional help from tax experts, such as tax attorneys, CPAs, or enrolled agents, can help you navigate the complexities of the IRS collections process, provide guidance tailored to your specific situation, and increase your chances of a successful resolution.

Remember, it is crucial to stay informed, keep accurate records, and maintain open communication with the IRS throughout the process. Being proactive and taking the necessary steps to resolve your tax debt will help you regain control of your finances and alleviate the stress associated with IRS collections.

While dealing with tax debt can feel overwhelming, addressing the issue head-on and exploring your options will empower you to find a resolution and move forward toward financial stability. Don’t hesitate to seek professional assistance and utilize available resources to navigate the process effectively and achieve a favorable outcome.

By taking action, staying informed, and seeking support when needed, you can overcome the challenges associated with tax debt and regain your financial footing.