Finance

Why Does The IRS Send Certified Mail?

Published: October 31, 2023

Discover why the IRS sends certified mail and how it relates to finance. Gain insight into this important communication method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to matters of taxation and financial compliance, the Internal Revenue Service (IRS) plays a crucial role in ensuring that individuals and businesses meet their obligations. One of the ways in which the IRS communicates with taxpayers is through the use of certified mail. This method of communication serves as a reliable and secure way for the IRS to deliver important notices, documents, and correspondences to taxpayers.

Certified mail is a service provided by the United States Postal Service (USPS) that offers proof of mailing and delivers a receipt to the sender as well as a record of delivery to the recipient. It provides an added layer of security, tracking, and confirmation that regular mail does not offer. Additionally, certified mail requires the recipient to sign for the delivery, ensuring that the intended party receives the correspondence directly.

The use of certified mail is of particular importance when it comes to the IRS. As an authoritative government agency responsible for administering the nation’s tax laws, the IRS exercises significant power in collecting taxes and enforcing tax compliance. Therefore, it is essential for the IRS to use a reliable method of correspondence to ensure that taxpayers receive important notices and information regarding their tax obligations.

In this article, we will explore the reasons why the IRS chooses to send certified mail and why it is crucial for taxpayers to pay attention to and respond promptly to any certified mail received from the IRS. We will also discuss the benefits of using certified mail for the IRS, as well as provide some tips for dealing with certified mail from the IRS. So, if you have ever wondered why the IRS uses certified mail or what you should do if you receive certified mail from them, read on to find out.

What is Certified Mail?

Certified mail is a service offered by the United States Postal Service (USPS) that provides proof of mailing and delivers a receipt to the sender as well as a record of delivery to the recipient. It is a method of sending important documents or correspondences that guarantees added security, tracking, and confirmation of delivery.

When sending a certified mail, the sender receives a unique tracking number that allows them to monitor the progress of the delivery through the USPS website. The recipient of certified mail must sign for the delivery, providing proof of receipt. This ensures that important documents or correspondences are received by the intended party and provides a level of security and accountability that regular mail does not offer.

In addition to the recipient’s signature, the USPS also keeps a record of the date and time of delivery. This information is valuable for both the sender and the recipient, as it serves as evidence of when and to whom the mail was delivered. In the case of the IRS, this proof of delivery is particularly important when it comes to legal matters or disputes concerning tax obligations.

To send certified mail, the sender must complete a PS Form 3800 at the post office. This form includes details such as the recipient’s name and address, the sender’s name and address, and any additional instructions for delivery. The sender will then receive a receipt with a tracking number, which can be used to track the progress of the delivery online.

Overall, certified mail provides a secure and reliable method of communication, particularly when it comes to important or sensitive documents. It offers peace of mind for both the sender and the recipient, ensuring that important correspondences are delivered and received in a timely and accountable manner.

The Importance of Certified Mail for the IRS

For the Internal Revenue Service (IRS), the use of certified mail is of utmost importance in effectively communicating with taxpayers. As an authoritative government agency responsible for administering and enforcing tax laws, the IRS relies on certified mail to ensure that taxpayers receive important notices, forms, and other correspondences regarding their tax obligations. Here are a few reasons why certified mail is crucial for the IRS:

- Proof of Delivery: By sending important documents through certified mail, the IRS obtains proof of delivery. This proof serves as evidence that the correspondence was sent and received by the intended recipient, providing a crucial paper trail in case of any disputes or legal proceedings.

- Security and Accountability: Certified mail offers a higher level of security compared to regular mail. The requirement of a recipient’s signature ensures that the IRS correspondence is delivered directly to the intended party, reducing the risk of documents getting lost or falling into the wrong hands.

- Timely Communication: The IRS depends on certified mail to deliver time-sensitive notifications to taxpayers. This may include reminders for upcoming tax deadlines, requests for additional information, or notifications of changes to tax laws or regulations. By using certified mail, the IRS can ensure that taxpayers receive these communications promptly and have sufficient time to take necessary action.

- Legal Compliance: In some cases, the IRS may need to serve official legal notices to taxpayers. Certified mail provides a legally recognized method to fulfill this requirement and ensures that the recipient has received the documents within the allotted timeframe. This helps the IRS fulfill its legal obligations and ensures fair treatment to taxpayers.

- Audit and Appeals: Certified mail is often used during the audit and appeals process. The IRS may send examination reports, appeal notifications, and settlement offers via certified mail to ensure that taxpayers have a documented record of these important communications. This helps maintain transparency and accountability throughout the process.

In summary, the use of certified mail is vital for the IRS to ensure secure and reliable communication with taxpayers. It provides proof of delivery, enhances security and accountability, facilitates timely communication, complies with legal requirements, and supports transparency in the audit and appeals process. Taxpayers should pay close attention to any certified mail received from the IRS and respond promptly to the communications to stay in compliance with their tax obligations.

Reasons why the IRS Sends Certified Mail

The Internal Revenue Service (IRS) utilizes certified mail as a means of communication with taxpayers for a variety of reasons. Sending important documents and correspondences through certified mail provides a secure and trackable method to ensure that taxpayers receive and acknowledge critical information. Here are some of the main reasons why the IRS sends certified mail:

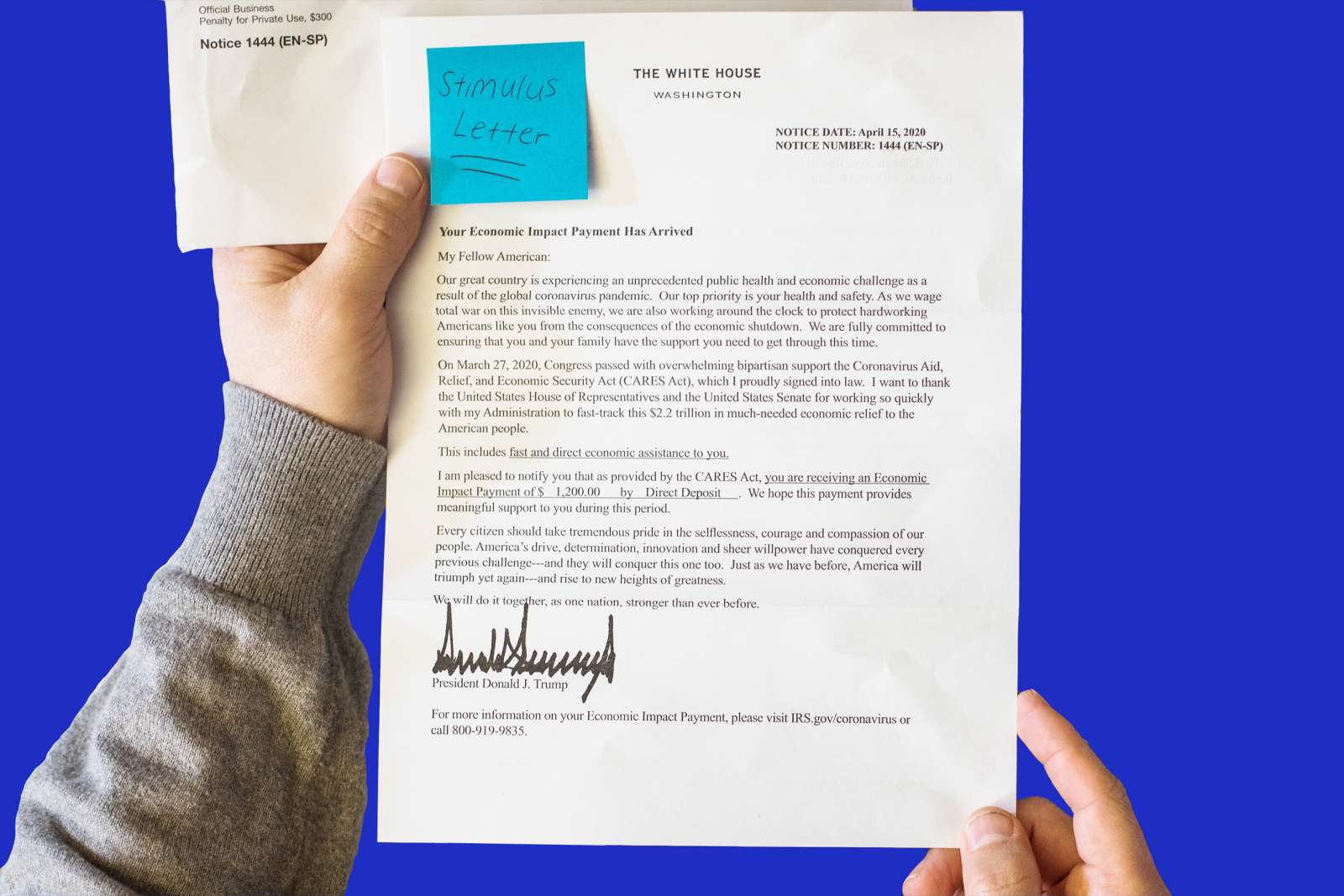

- Official Notices: The IRS sends certified mail for official notices such as tax assessments, audit notifications, payment reminders, and changes to tax laws or regulations. These notices require the recipient’s attention and prompt action. By using certified mail, the IRS ensures that the notices are delivered directly to the taxpayer and establishes a verifiable record of delivery.

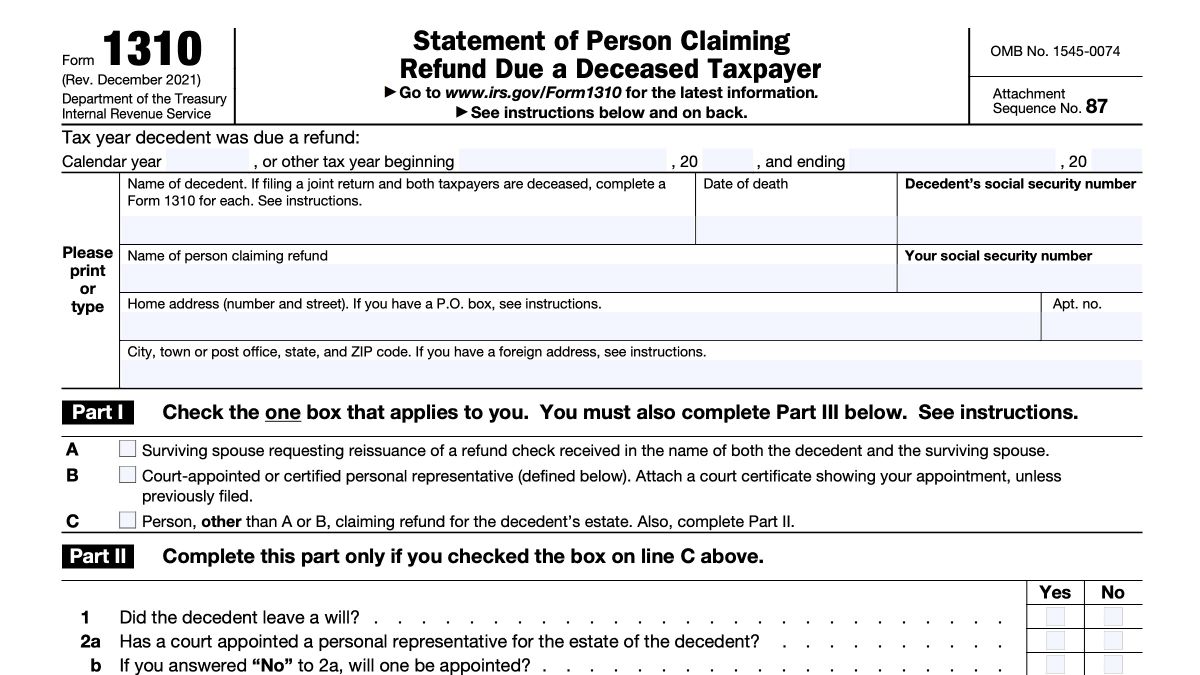

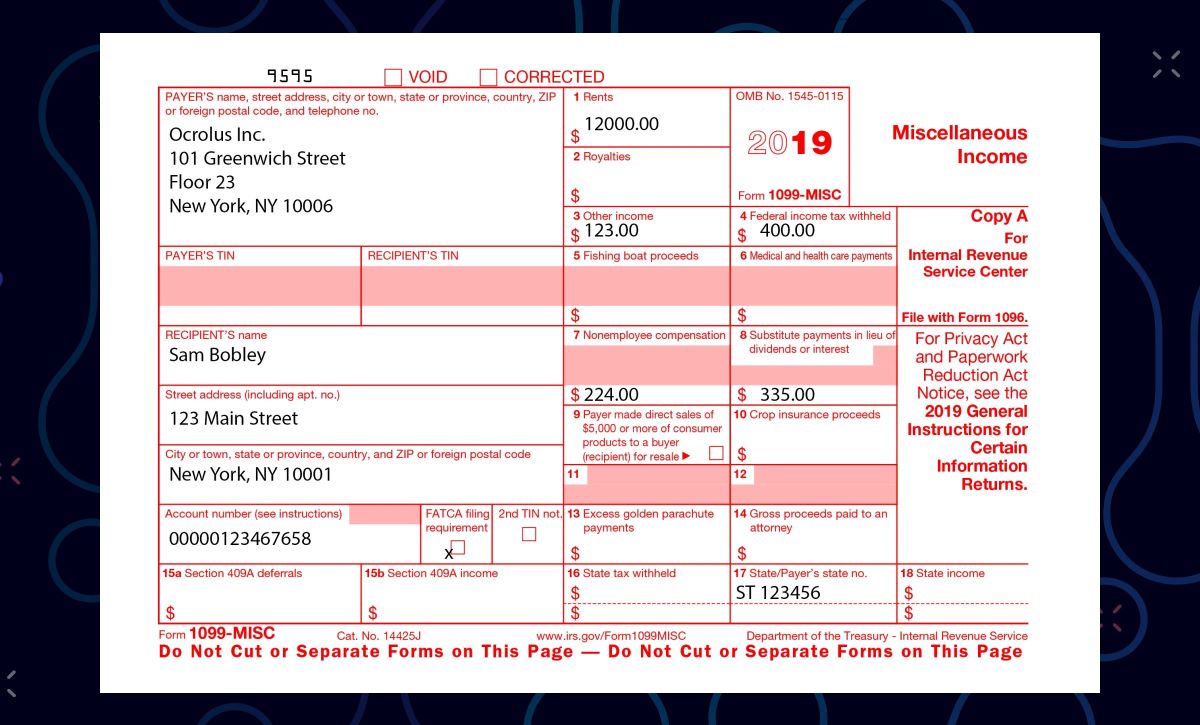

- Delicate or Confidential Documents: In certain situations, the IRS may need to send delicate or confidential documents to taxpayers. These could include sensitive taxpayer information, requests for additional documentation, or notifications related to taxpayer rights. Certified mail offers a heightened level of security and confidentiality compared to regular mail, reducing the risk of unauthorized access and providing peace of mind for both the IRS and the taxpayer.

- Legal Notifications: When the IRS is involved in legal proceedings with a taxpayer, such as initiating a tax lien or seizing assets, certified mail is used to deliver the necessary documents and notifications. The IRS relies on certified mail to fulfill legal requirements and ensure that the taxpayer is aware of their rights and obligations in such situations.

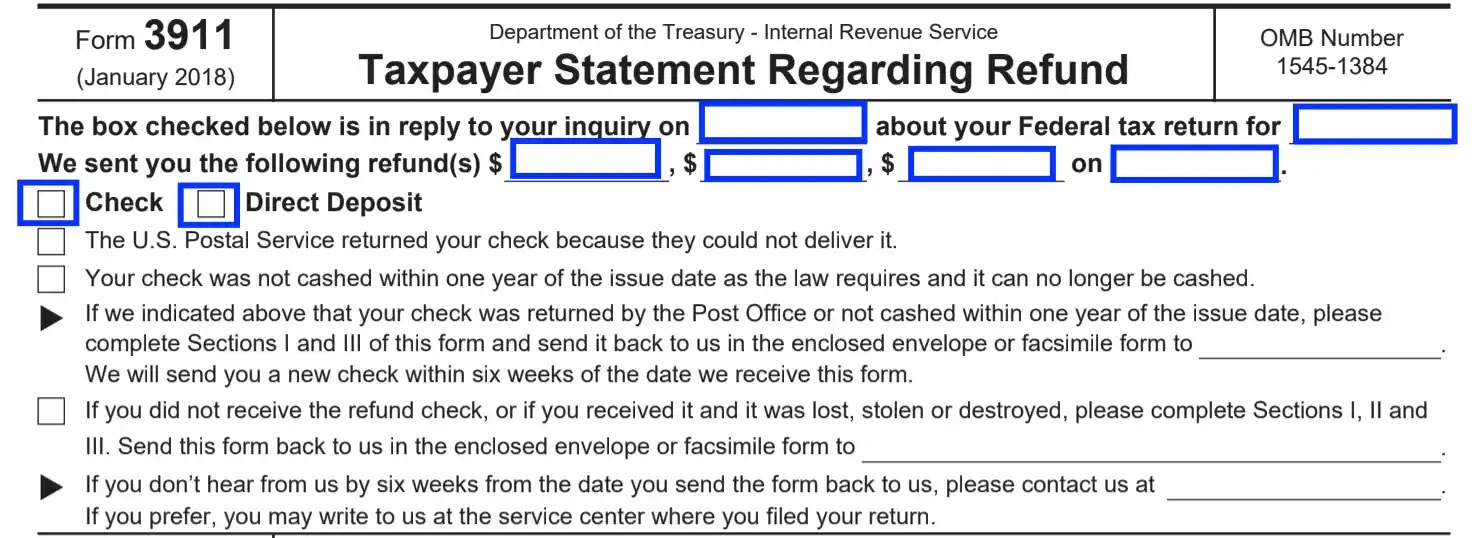

- Correspondence Verification: In cases where the IRS requests additional information or clarification from a taxpayer, certified mail allows for a verifiable exchange of documents. By sending and receiving certified mail, both parties have proof of the communication, which can be crucial in resolving disputes and ensuring a fair and accurate tax assessment.

- Audit and Appeals: Certified mail is commonly used during the audit and appeals process. The IRS may send examination reports, appeal notifications, settlement offers, and other important documents via certified mail. This method ensures that the taxpayer receives crucial information within the required timelines and establishes a clear record of communication for all parties involved.

Overall, the IRS sends certified mail for various reasons, including official notices, sensitive documents, legal notifications, correspondence verification, and audit/appeals proceedings. By utilizing this method, the IRS can ensure secure delivery, establish a clear record of communication, and provide taxpayers with the necessary information to fulfill their tax obligations and exercise their rights.

Benefits of Using Certified Mail for the IRS

The Internal Revenue Service (IRS) leverages the use of certified mail as a valuable tool in their communications with taxpayers. The utilization of certified mail offers several benefits that support the IRS’s mission of ensuring effective tax administration and compliance. Here are some of the key advantages of using certified mail for the IRS:

- Proof of Delivery: Certified mail provides the IRS with proof of delivery. This is vital in situations where the IRS needs to demonstrate that they have sent specific correspondences to taxpayers. The proof of delivery can serve as evidence in case of disputes or inquiries about whether the taxpayer received the communication or took the necessary actions.

- Accountability: Certified mail holds both the IRS and the taxpayer accountable for the communication process. By requiring a signature upon delivery, certified mail ensures that the IRS correspondence reaches the intended recipient directly. This reduces the risk of miscommunication or documents being lost or misplaced, providing a clear chain of custody.

- Security and Tracking: Using certified mail guarantees a higher level of security for important IRS documents and notifications. The tracking feature allows the IRS to monitor the progress of the delivery and confirm when it has been successfully received. This added level of security ensures that sensitive taxpayer information and important correspondences are safeguarded during transit.

- Timely Notifications: Certified mail allows the IRS to provide timely notifications and documents to taxpayers. Whether it is a payment reminder, a deadline notice, or a request for additional information, using certified mail ensures that the communication reaches the taxpayer in a timely manner. This helps taxpayers stay informed and take necessary actions promptly to fulfill their tax obligations.

- Legal Compliance: The use of certified mail by the IRS helps ensure legal compliance in various tax-related matters. Sending legal notifications or requests for documentation via certified mail ensures that the IRS meets the legal requirements for delivering such information to taxpayers. It provides a verifiable record that the taxpayer has been properly informed and allows them to respond within the specified timeframes.

Overall, the benefits of using certified mail for the IRS include proof of delivery, accountability, security and tracking, timely notifications, and legal compliance. By leveraging certified mail, the IRS can establish a reliable means of communication that protects sensitive information, maintains transparency, and strengthens the relationship between the IRS and taxpayers.

Potential Consequences of Ignoring Certified Mail from the IRS

Ignoring certified mail from the Internal Revenue Service (IRS) can have serious consequences for taxpayers. The IRS relies on certified mail as a reliable method of communication to deliver important notices, notifications, and requests to taxpayers. Failing to respond or take appropriate action after receiving certified mail from the IRS can result in various negative outcomes. Here are some potential consequences of ignoring certified mail from the IRS:

- Missed Deadlines: Certified mail from the IRS often includes important deadlines for responding or providing necessary documentation. If these deadlines are ignored, taxpayers may miss crucial opportunities to address any outstanding issues or comply with tax obligations. This can lead to penalties, interest charges, and further escalation of the situation.

- Increased Weights of Penalties: Ignoring certified mail can result in the accumulation of penalties and interest on unpaid taxes or unresolved matters. The IRS may impose penalties for late filing, late payment, or underpayment of taxes, and these penalties can increase over time if the issue is not addressed promptly. Ignoring certified mail can exacerbate the situation, leading to higher financial liability.

- Enforcement Actions: If a taxpayer consistently ignores certified mail from the IRS, it may trigger further enforcement actions. The IRS has the authority to take legal action, such as filing tax liens on property, seizing assets, or initiating wage garnishments. These actions can have severe financial and personal consequences and should be taken seriously.

- Missed Opportunities for Resolution: Certified mail from the IRS may also include offers of settlement, requests for additional information, or opportunities to resolve any disputes. Ignoring this communication can result in missed chances to address issues through negotiation or alternative dispute resolution methods. By engaging with the IRS and responding to certified mail, taxpayers may be able to find more favorable resolutions.

- Legal Ramifications: In certain cases, disregarding certified mail from the IRS can lead to legal consequences. The IRS may initiate legal proceedings against a taxpayer, such as tax court litigation or criminal charges related to tax evasion. Ignoring certified mail only compounds the seriousness of the situation and can result in severe penalties, fines, or even imprisonment.

In summary, ignoring certified mail from the IRS can have significant consequences for taxpayers, including missed deadlines, increased penalties, enforcement actions, missed opportunities for resolution, and potential legal ramifications. It is crucial for taxpayers to respond promptly and take appropriate actions when they receive certified mail from the IRS to protect their financial well-being, preserve their rights, and maintain compliance with tax obligations.

Tips for Dealing with Certified Mail from the IRS

Receiving certified mail from the Internal Revenue Service (IRS) can be an anxiety-inducing experience. However, it is essential to handle it promptly and appropriately to ensure compliance with tax obligations and minimize any potential negative consequences. Here are some helpful tips for effectively dealing with certified mail from the IRS:

- Open and Read the Mail Promptly: Upon receiving certified mail from the IRS, it is crucial to open and read it as soon as possible. Ignoring or delaying the process can lead to missed deadlines and escalation of the situation. Take the time to carefully review the contents and understand the purpose of the communication.

- Take Note of Deadlines: Certified mail from the IRS often includes deadlines for response or action. Make a note of these deadlines and ensure that you have sufficient time to gather any required information and take necessary steps to comply with the IRS’s requests. Set reminders or calendar alerts to avoid missing these important deadlines.

- Seek Professional Assistance: If you are unsure about how to proceed or if the matter is complex, consider seeking professional assistance. Tax professionals, such as accountants or tax attorneys, can provide guidance and help you navigate through the process. They can advise you on the best course of action and ensure that you understand your rights and obligations.

- Respond in Writing: When dealing with certified mail from the IRS, it is often advisable to respond in writing. Draft a clear and concise letter that addresses the issues raised in the communication. Include any requested documentation or information and provide a detailed explanation if necessary. Keep a copy of the letter and send it via certified mail to maintain a record of your response.

- Keep Records: It is essential to maintain thorough and organized records of all interactions with the IRS. This includes certified mail receipts, letters, emails, and any other related documents. Having a comprehensive record of communication can be valuable in case of disputes or inquiries in the future.

- Ask for Clarification if Needed: If you have any questions or require further clarification regarding the certified mail communication from the IRS, do not hesitate to ask. Contact the IRS directly using the provided contact information or consult with a tax professional to better understand the nature of the correspondence and what is required of you.

- Seek Resolution Opportunities: In certain cases, certified mail from the IRS may include settlement offers or opportunities to resolve disputes. Take advantage of these opportunities and explore options for resolving the matter amicably. Engaging with the IRS and showing a willingness to cooperate can often lead to more favorable outcomes.

- Stay Calm and Professional: It is important to remain calm and professional throughout the process. Remember that the certified mail from the IRS is not a personal attack but rather a means for them to carry out their duties in enforcing tax compliance. Responding with respect and professionalism can help in building a constructive relationship with the IRS.

By following these tips, you can effectively navigate the process of dealing with certified mail from the IRS. Taking prompt action, seeking professional advice when needed, maintaining thorough records, and engaging in clear and professional communication will help ensure that you address any issues or obligations in a timely and compliant manner.

Conclusion

Certified mail serves as a vital communication tool for the Internal Revenue Service (IRS) when it comes to reaching out to taxpayers regarding their tax obligations. The use of certified mail ensures proof of delivery, enhances security and accountability, facilitates timely communication, complies with legal requirements, and supports transparency in the tax administration process. When receiving certified mail from the IRS, it is crucial to open and read it promptly, take note of deadlines, seek professional assistance when necessary, and respond in writing. Keeping organized records, seeking resolution opportunities, and maintaining a calm and professional demeanor are also essential for effectively dealing with certified mail from the IRS.

Ignoring certified mail from the IRS can have serious consequences, including missed deadlines, increased penalties, enforcement actions, missed opportunities for resolution, and potential legal ramifications. It is incumbent upon taxpayers to give certified mail the attention it deserves and respond promptly and appropriately. By doing so, taxpayers can ensure they fulfill their tax obligations, protect their financial well-being, and maintain a positive relationship with the IRS.

In summary, certified mail from the IRS is a channel through which important notices, documents, and correspondences are delivered to taxpayers. Understanding the importance of certified mail, adhering to the provided tips for dealing with it, and taking appropriate actions can help taxpayers navigate through the process smoothly while ensuring compliance with tax laws and regulations.