Finance

How To Send 1099-NEC To The IRS

Published: November 1, 2023

Learn how to send 1099-NEC forms to the IRS and stay compliant with your finance obligations. Simplify tax reporting with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Form 1099-NEC?

- Who needs to file Form 1099-NEC?

- Understanding the deadline for submitting Form 1099-NEC

- Steps to complete and file Form 1099-NEC

- Gathering the necessary information

- Filling out the Form 1099-NEC

- Sending Form 1099-NEC to the IRS

- Providing copies to the recipients

- Consequences of non-compliance with Form 1099-NEC filing requirements

- Frequently Asked Questions (FAQs) about Form 1099-NEC

- Conclusion

Introduction

Welcome to our comprehensive guide on how to send Form 1099-NEC to the IRS. Form 1099-NEC, also known as the Nonemployee Compensation form, is an essential document for reporting payments to independent contractors and freelancers. Filing this form accurately and on time is crucial to ensuring compliance with tax regulations and avoiding penalties.

Whether you are a business owner, a freelancer, or a tax professional, understanding how to complete and submit Form 1099-NEC is essential for proper tax reporting. This guide will walk you through the process step by step, from gathering the necessary information to sending the form to the IRS.

Form 1099-NEC was reintroduced by the IRS in 2020 to separate the reporting of nonemployee compensation from other types of payments previously reported on Form 1099-MISC. By using Form 1099-NEC, businesses can clearly report the payments made to independent contractors, simplifying the tax filing process for both the payer and the recipient. It is important to note that not all businesses are required to file Form 1099-NEC. Understanding who needs to file this form is the first step in ensuring compliance with IRS regulations.

In this guide, we will explain the eligibility criteria for filing Form 1099-NEC and provide a detailed overview of the filing process. We will cover important topics such as the deadline for filing the form, the information needed to complete it accurately, and the consequences of failing to comply with the filing requirements.

Whether you are new to filing Form 1099-NEC or need a refresher, this guide will provide you with the information and resources you need to effectively complete and submit this important tax form. Let’s get started!

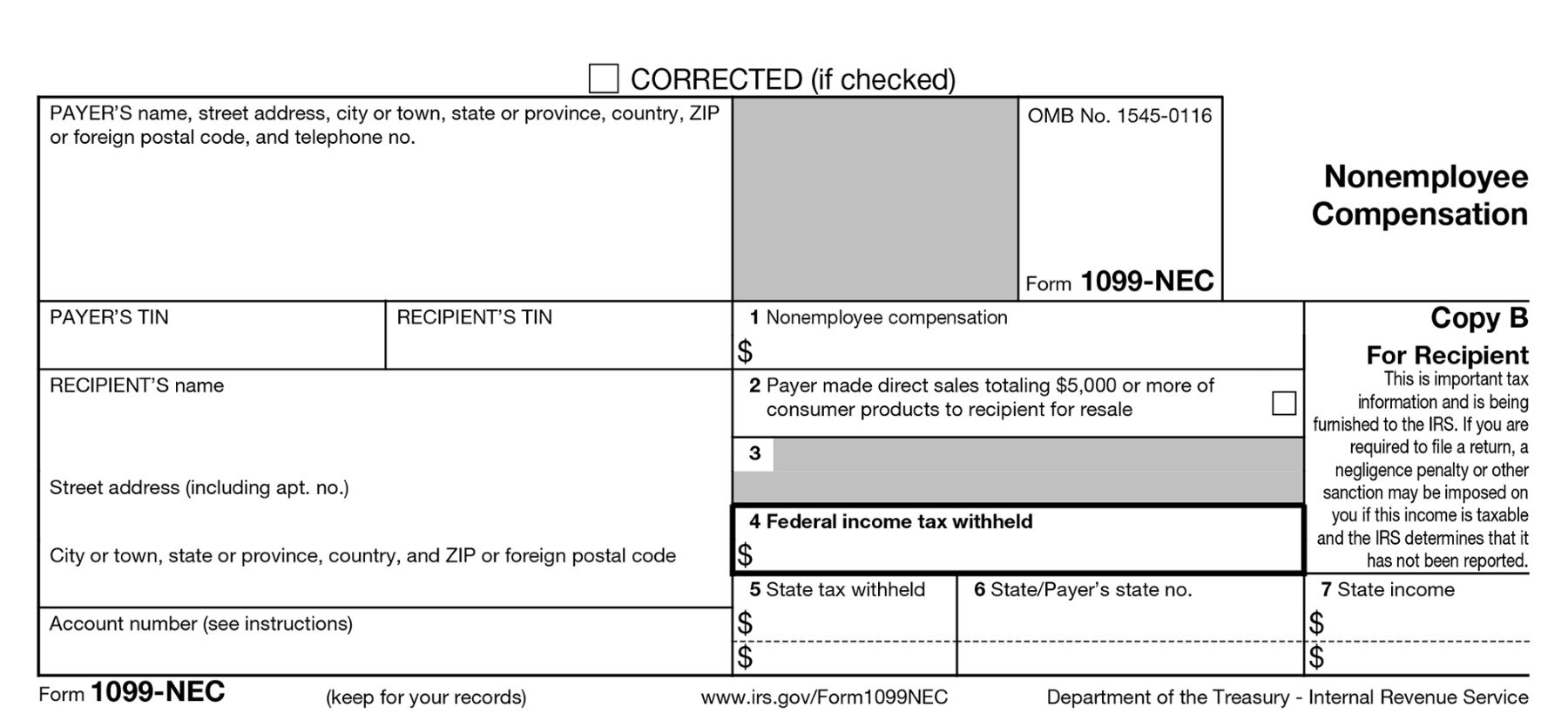

What is Form 1099-NEC?

Form 1099-NEC is an IRS tax form used to report nonemployee compensation. Nonemployee compensation refers to payments made to individuals who are not employees of a company but provide services as independent contractors or freelancers. This form is crucial for accurately reporting the income earned by these individuals and ensuring proper tax compliance.

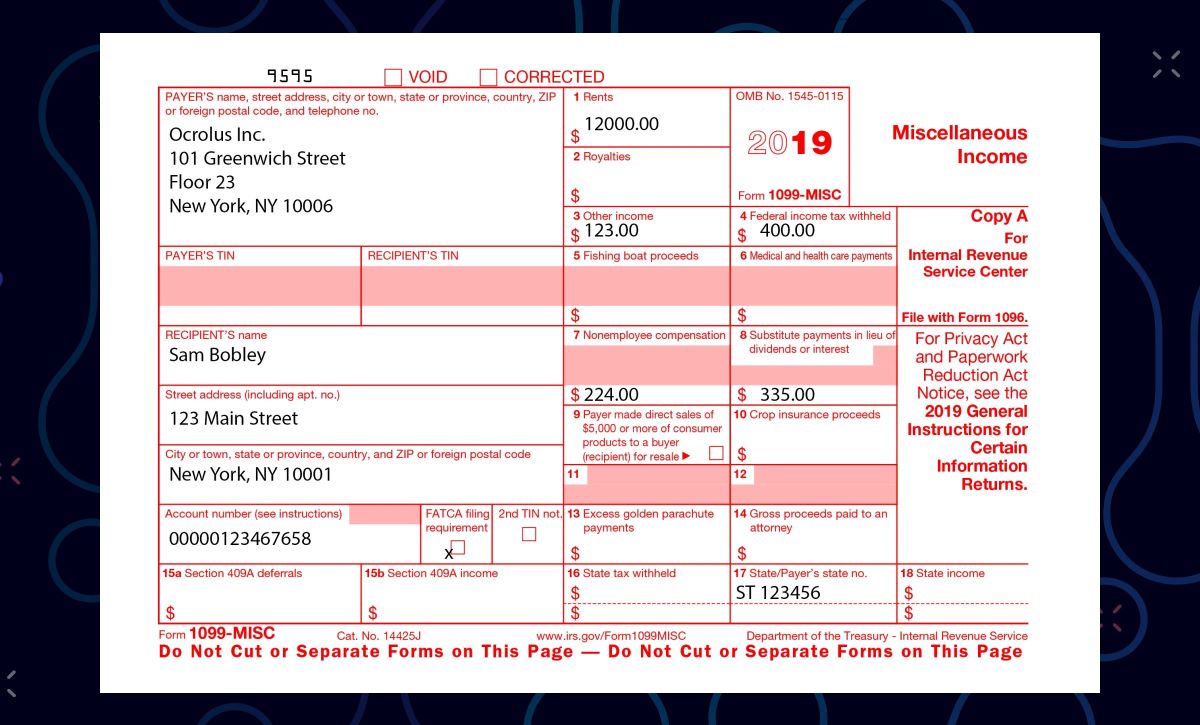

Prior to 2020, nonemployee compensation was reported on Form 1099-MISC along with other types of miscellaneous income. However, to streamline the reporting process and provide clearer distinction, the IRS reintroduced Form 1099-NEC specifically for reporting nonemployee compensation.

Nonemployee compensation includes various types of payments, such as fees for professional services, freelance work, and contract work. Examples of individuals who may receive nonemployee compensation and require a Form 1099-NEC include consultants, freelancers, independent contractors, and self-employed individuals.

When reporting nonemployee compensation, it is essential to accurately report the total amount paid to the individual or business throughout the tax year. This includes both cash payments and the fair market value of any other forms of compensation provided, such as goods or services. It is important to note that the threshold for reporting nonemployee compensation is $600 or more in a calendar year.

Form 1099-NEC consists of several parts that need to be completed. These include the payer’s information, the recipient’s information, and the details of the nonemployee compensation paid. The completed form must be filed with the IRS by the applicable deadline, and a copy must also be provided to the recipient for their tax filing purposes.

Form 1099-NEC is an important document for both the payer and the recipient. For the payer, it ensures compliance with IRS reporting requirements and avoids penalties for noncompliance. For the recipient, it serves as documentation of the income earned and assists in accurate tax reporting.

Now that we have an understanding of what Form 1099-NEC is and its significance, let’s explore who needs to file this form and the deadline for doing so.

Who needs to file Form 1099-NEC?

Form 1099-NEC is required to be filed by businesses or individuals who have made payments of $600 or more in nonemployee compensation during the tax year. It is important to determine whether you meet the criteria for filing this form to ensure compliance with IRS regulations.

Here are some key points to consider when determining who needs to file Form 1099-NEC:

- Businesses: If you are a business owner and you have paid $600 or more to an individual or a non-corporate entity for services provided as an independent contractor or freelancer, you are required to file Form 1099-NEC.

- Self-employed individuals: If you are a self-employed individual and have received $600 or more in nonemployee compensation from a business or individual, you may be subject to receiving Form 1099-NEC. It is important to note that even if you do not receive the form, you are still responsible for reporting your income accurately on your tax return.

- Nonprofit organizations: Nonprofit organizations are also subject to filing Form 1099-NEC if they have made payments of $600 or more in nonemployee compensation.

It is important to remember that nonemployee compensation is not limited to monetary payments only. If you have provided non-monetary compensation with a fair market value of $600 or more, it should also be reported on Form 1099-NEC.

It is crucial to gather the necessary information from the individual or entity to whom you made the payments. This includes their legal name, address, and taxpayer identification number (TIN). The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Exceptions to filing Form 1099-NEC may apply in certain circumstances. For example, payments made to corporations generally do not need to be reported on this form unless the corporation is being paid for legal or medical services or fishing boat proceeds. Additionally, payments made via credit card, debit card, or third-party payment network providers are not required to be reported on Form 1099-NEC; they are already reported on Form 1099-K by the payment processor.

It is important to consult with a tax professional or refer to the IRS guidelines to determine your specific reporting requirements for Form 1099-NEC. Failing to file or inaccurately reporting nonemployee compensation can result in penalties and additional tax liabilities.

Now that we know who needs to file Form 1099-NEC, let’s move on to understanding the deadline for submitting this form.

Understanding the deadline for submitting Form 1099-NEC

It is crucial to be aware of the deadline for submitting Form 1099-NEC to the IRS. The due date for filing this form typically falls at the end of January, following the close of the tax year.

Here are the key details to keep in mind regarding the deadline:

- The deadline for filing Form 1099-NEC with the IRS is January 31st of the following tax year, for both electronic and paper filings.

- If the deadline falls on a weekend or a federal holiday, it is extended to the next business day.

- If you are filing 250 or more Forms 1099-NEC, you must file electronically with the IRS.

- If you are filing fewer than 250 forms, you have the option to file electronically or by mail.

- It is important to note that providing a copy of Form 1099-NEC to the recipient is also required by January 31st.

Meeting the deadline is crucial to avoid penalties for late filing or noncompliance. Failing to file Form 1099-NEC by the due date can result in penalties ranging from $50 to $280 per form, depending on the length of the delay. Additionally, intentional disregard for filing can lead to higher penalties.

It is highly recommended to start the process of gathering the necessary information and completing the form well before the deadline. This allows for any potential errors or missing information to be addressed in a timely manner.

If you anticipate challenges in meeting the deadline, you may request an automatic 30-day extension by filing Form 8809, Application for Extension of Time to File Information Returns. However, this extension only applies to the filing of the forms with the IRS, and the deadline for providing a copy to the recipient remains unchanged.

Understanding the deadline and taking appropriate measures to ensure timely filing will help you remain compliant with IRS regulations and avoid any unnecessary penalties or issues.

Now that we have covered the deadline, let’s proceed to the next section and learn about the steps involved in completing and filing Form 1099-NEC.

Steps to complete and file Form 1099-NEC

Filing Form 1099-NEC involves several steps that need to be followed carefully to ensure accurate reporting and compliance with IRS regulations. Let’s walk through the process step by step:

Step 1: Gathering the necessary information

The first step is to collect all the required information from the individual or entity to whom you made payments of $600 or more for nonemployee compensation. This includes their legal name, address, and taxpayer identification number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Step 2: Filling out the Form 1099-NEC

Once you have the required information, you can proceed to fill out Form 1099-NEC. The form consists of several parts:

- Part 1: Payer’s information – Enter your business’s name, address, and taxpayer identification number.

- Part 2: Recipient’s information – Enter the recipient’s legal name, address, and TIN.

- Part 3: Nonemployee compensation – Report the total amount paid to the recipient for nonemployee compensation during the tax year.

Ensure that you accurately report the information in the appropriate sections and double-check for any errors or omissions before proceeding to the next step.

Step 3: Sending Form 1099-NEC to the IRS

After completing the form, you need to submit it to the IRS. The method of filing depends on the number of forms you are submitting:

- Electronic filing: If you are filing 250 or more Forms 1099-NEC, electronic filing is mandatory. You can e-file through the IRS’s Fire system or use approved tax software.

- Paper filing: If you are filing fewer than 250 forms, you have the option to file by mail. Mail the completed forms to the appropriate IRS address, which can vary depending on your location.

Ensure that you retain a copy of the submitted Form 1099-NEC for your records.

Step 4: Providing copies to the recipients

In addition to filing with the IRS, you are also required to provide a copy of Form 1099-NEC to the recipient for their tax reporting purposes. This copy must be provided by January 31st of the following tax year.

You can either mail or electronically deliver the copy to the recipient. Make sure to keep a record of the delivery method and date for your records.

Completing and filing Form 1099-NEC can be a detailed process, but following these steps will help ensure that you meet the compliance requirements set by the IRS.

Now that we have covered the steps to complete and file Form 1099-NEC, let’s move on to the next section and discuss the consequences of noncompliance with the filing requirements.

Gathering the necessary information

Before filling out Form 1099-NEC, it is important to gather all the required information from the individuals or entities to whom you made payments of $600 or more in nonemployee compensation. Gathering this information ensures accurate reporting and compliance with IRS regulations.

Here are the key pieces of information you need to gather:

1. Legal Name: Obtain the legal name of the recipient. This should match the name associated with their tax identification number.

2. Address: Collect the recipient’s mailing address. Make sure to include the street address, city, state, and zip code. It is important to have an accurate address to ensure proper delivery of the Form 1099-NEC.

3. Taxpayer Identification Number (TIN): The TIN is a crucial piece of information needed for reporting nonemployee compensation. The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). It is important to verify the TIN with the recipient to ensure accuracy.

4. Type of TIN: Determine whether the recipient’s TIN is an SSN or an EIN. This is essential for proper reporting on Form 1099-NEC.

Collecting this information ahead of time allows for a smooth and efficient filing process. It is important to communicate with the recipients and request the necessary information in a timely manner to avoid any delays or errors in reporting.

Additionally, it is important to keep in mind any exceptions when gathering information. For example, if the recipient is a corporation, the TIN may not be required as reporting nonemployee compensation paid to corporations is generally not necessary unless it is for legal or medical services or fishing boat proceeds.

Having a systematic approach to gather the necessary information will help ensure accurate reporting on Form 1099-NEC and help you meet the compliance requirements set by the IRS.

Now that we have covered gathering the necessary information, let’s move on to the next section and explore the steps involved in filling out Form 1099-NEC.

Filling out the Form 1099-NEC

Completing Form 1099-NEC accurately and correctly is crucial for reporting nonemployee compensation to the IRS. It is important to carefully fill out each section of the form to ensure compliance with tax regulations. Let’s go through the key components of Form 1099-NEC:

Part 1: Payer’s Information

In this section, provide your business’s information as the payer:

- Box 1: Enter your business’s name, address, and taxpayer identification number (TIN). The TIN can be an Employer Identification Number (EIN) or your Social Security Number (SSN) if you are a sole proprietor.

Part 2: Recipient’s Information

In this section, provide the recipient’s information:

- Box 2: Enter the recipient’s legal name. It should match the name associated with their tax identification number.

- Box 3: Enter the recipient’s address, including the street address, city, state, and zip code.

- Box 4: Enter the recipient’s tax identification number (TIN), which can be an EIN or an SSN.

- Box 5: Check the applicable box to indicate the type of TIN provided (EIN or SSN).

Part 3: Nonemployee Compensation

In this section, report the total amount of nonemployee compensation paid to the recipient:

- Box 1: Enter the total amount of nonemployee compensation paid to the recipient during the tax year. This includes both cash payments and the fair market value of any other forms of compensation provided.

Ensure that you accurately report the information in each section. Double-check all entries to avoid any errors or omissions. It’s a good practice to review the completed form and compare it with the information you gathered from the recipient.

Remember, you must complete a separate Form 1099-NEC for each recipient of nonemployee compensation. If you made payments to multiple recipients, you will need to duplicate and fill out the form for each recipient.

Once you have completed the Form 1099-NEC accurately, you can proceed to submit it to the IRS. Remember to retain a copy of the form for your records.

Now that we have discussed filling out Form 1099-NEC, let’s move on to the next section and learn about sending it to the IRS.

Sending Form 1099-NEC to the IRS

Once you have completed Form 1099-NEC and gathered the necessary information, the next step is to submit the form to the IRS. The method of submission depends on the number of forms you are filing:

Electronic Filing:

If you are filing 250 or more Forms 1099-NEC, electronic filing is mandatory. Here’s how you can electronically submit the form:

- Use IRS-approved tax software or a tax professional to e-file your forms. The software will guide you through the process and generate an electronic file that meets IRS specifications.

- Submit the electronic file through the IRS’s Fire system, which is the online platform for filing information returns.

- Ensure that you have completed the e-filing process and received confirmation from the IRS that your forms have been successfully filed.

Paper Filing:

If you are filing fewer than 250 Forms 1099-NEC, you have the option to file by mail. Follow these steps for paper filing:

- Print out the completed Form 1099-NEC for each recipient. Make sure the forms are legible and printed on the official IRS-approved paper.

- Mail the forms to the appropriate IRS address based on your location. Refer to the instructions provided with the Form 1099-NEC or visit the IRS website for the correct mailing address.

- Ensure that you retain a copy of the forms and the proof of mailing for your records.

It is important to note that the filing deadline for Form 1099-NEC is January 31st. If you are unable to meet the deadline, you may request an automatic 30-day extension by filing Form 8809, Application for Extension of Time to File Information Returns. However, the extension only applies to the filing of the forms with the IRS, and the deadline for providing a copy to the recipient remains unchanged.

Remember that filing Form 1099-NEC with the IRS is a critical step in ensuring compliance with tax regulations. Failure to submit the form or submitting it late can result in penalties and other consequences.

Now that we have covered the process of sending Form 1099-NEC to the IRS, let’s proceed to the next section and discuss the importance of providing copies of the form to the recipients.

Providing copies to the recipients

In addition to filing Form 1099-NEC with the IRS, it is essential to provide a copy of the form to the recipients of nonemployee compensation. This allows them to report their income accurately on their own tax returns. The deadline for providing the recipient copy is January 31st of the following tax year.

There are two methods for providing copies to the recipients:

1. Paper Copy:

You can mail a paper copy of Form 1099-NEC directly to the recipient’s mailing address. When preparing the paper copy, make sure it is legible and follows the guidelines set by the IRS. Each recipient should receive their own individual copy.

Include a cover letter or a brief explanation to inform the recipient that the form they received is for their tax reporting requirements. It is also helpful to provide contact information in case the recipient has any questions or concerns.

2. Electronic Copy:

If the recipient agrees to receive the Form 1099-NEC electronically, you have the option to provide it through a secure online platform or by email. However, it is crucial to obtain consent from the recipient beforehand and ensure that the electronic delivery method meets IRS requirements.

When providing an electronic copy, make sure the form is in a format that the recipient can access and retain for their records. It should also include all the necessary information, such as the payer’s details, recipient’s information, and the total nonemployee compensation paid.

Remember to keep a record of the delivery method and the date you provided the copies to the recipients. This documentation will be useful in case of any inquiries or audits by the IRS.

Providing copies of Form 1099-NEC to the recipients is an essential step in the reporting process. It ensures that both the payer and the recipient have a complete set of records for tax reporting purposes.

Now that we have covered providing copies to the recipients, let’s move on to discuss the consequences of noncompliance with Form 1099-NEC filing requirements.

Consequences of non-compliance with Form 1099-NEC filing requirements

Failure to comply with the filing requirements for Form 1099-NEC can have significant consequences, ranging from financial penalties to potential legal issues. It is crucial to understand and meet the requirements to avoid these consequences and ensure compliance with IRS regulations.

Penalties for late or non-filing:

If you fail to file Form 1099-NEC with the IRS by the deadline or submit an incomplete or incorrect form, you may face penalties. The penalties vary depending on the delay period and the number of forms involved:

- For small businesses with gross receipts of $5 million or less, the penalties range from $50 to $280 per form, depending on the time it takes to correct the filing errors.

- For large businesses with gross receipts exceeding $5 million, the penalties range from $110 to $560 per form.

These penalties can add up quickly and become a financial burden to businesses or individuals who fail to comply with the filing requirements.

Increased risk of an audit:

Noncompliance with Form 1099-NEC filing requirements can raise red flags with the IRS, potentially increasing the likelihood of an audit. Inaccurate or missing filings may lead to further scrutiny of a taxpayer’s overall tax reporting and compliance practices. An audit can be time-consuming, costly, and result in additional penalties if further compliance issues are discovered.

Negative impact on recipients:

Failure to provide recipients with their copy of Form 1099-NEC can also have repercussions. Recipients rely on this form to accurately report their income on their tax returns. Without the form, they may face difficulties in accurately reporting their income, potentially leading to discrepancies and further scrutiny from the IRS.

Legal implications:

Noncompliance with Form 1099-NEC filing requirements can also have legal consequences. In cases where intentional disregard for filing is found, penalties can increase, and additional legal actions may be pursued. Noncompliance can damage a business’s reputation, potentially leading to loss of clients or business opportunities.

To avoid these consequences, it is crucial to familiarize yourself with the filing requirements, meet the deadlines, accurately complete the form, and provide copies to the recipients as necessary.

If you anticipate difficulties in meeting the filing deadline, consider requesting an extension or seeking professional assistance to ensure compliance and minimize the risk of penalties.

Now that we have discussed the consequences of non-compliance with Form 1099-NEC filing requirements, let’s move on to a section that addresses frequently asked questions related to Form 1099-NEC.

Frequently Asked Questions (FAQs) about Form 1099-NEC

Here are some common questions and answers related to Form 1099-NEC:

1. What is the difference between Form 1099-NEC and Form 1099-MISC?

Prior to 2020, nonemployee compensation was reported on Form 1099-MISC. However, starting from tax year 2020, nonemployee compensation is reported on Form 1099-NEC. Form 1099-MISC is still used to report other types of miscellaneous income, such as rent, royalties, and vendor payments.

2. When do I need to file Form 1099-NEC?

You need to file Form 1099-NEC if you have made payments of $600 or more in nonemployee compensation to an individual or non-corporate entity during the tax year.

3. Do I need to file Form 1099-NEC for payments made to corporations?

In general, payments made to corporations do not require filing Form 1099-NEC, except for certain exceptions. Form 1099-NEC may be required for payments made to corporations for legal or medical services or fishing boat proceeds. It is always advisable to consult the IRS guidelines or a tax professional to determine specific filing requirements.

4. Can I file Form 1099-NEC electronically?

Yes, the IRS encourages electronic filing, especially for businesses filing 250 or more forms. Electronic filing is mandatory for businesses filing 250 or more forms. Electronic filing ensures efficient processing and reduces the risk of errors.

5. Can I request an extension for filing Form 1099-NEC?

Yes, you can request an automatic 30-day extension by filing Form 8809, Application for Extension of Time to File Information Returns. However, the extension only applies to the filing of the forms with the IRS and does not extend the deadline for providing copies to the recipients.

6. What happens if I make a mistake on Form 1099-NEC?

If you make a mistake on Form 1099-NEC, you may need to correct it by filing a corrected form, known as Form 1099-NEC in box 1. Ensure that you mark the “Corrected” box on the form and provide the correct information where necessary. It is crucial to promptly correct any errors to avoid penalties and ensure accurate reporting.

These are just a few frequently asked questions about Form 1099-NEC. It is important to consult the IRS guidelines or seek professional advice for specific questions related to your situation.

Now that we have addressed some common questions, let’s wrap up this guide on sending Form 1099-NEC to the IRS.

Conclusion

Understanding how to send Form 1099-NEC to the IRS is essential for businesses, freelancers, and tax professionals alike. Form 1099-NEC is a critical tax form used to report nonemployee compensation payments accurately and ensure compliance with IRS regulations.

In this comprehensive guide, we have covered the key aspects of sending Form 1099-NEC, including what it is, who needs to file it, the deadline for submission, the steps involved in completing and filing the form, providing copies to recipients, and the consequences of non-compliance.

By gathering the necessary information, accurately completing the form, and submitting it to the IRS on time, you can avoid penalties, reduce the risk of an audit, and ensure accurate tax reporting.

It is important to stay updated on any changes or updates to IRS guidelines regarding Form 1099-NEC. Consulting a tax professional or referring to official IRS resources can provide additional guidance and support.

Remember, compliance with tax regulations not only helps you avoid penalties but also contributes to the proper functioning of the tax system and fosters trust and transparency in business transactions.

We hope this guide has provided you with valuable insights and practical information on how to send Form 1099-NEC to the IRS. As with any tax-related matter, it is always advisable to seek professional advice tailored to your specific circumstances.

Thank you for reading, and we wish you success in your tax reporting endeavors!