Finance

Where To Send IRS Form 3911

Published: November 1, 2023

Discover where to send IRS Form 3911 and get your financial documents processed quickly. Contact our finance experts to ensure hassle-free submission.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction:

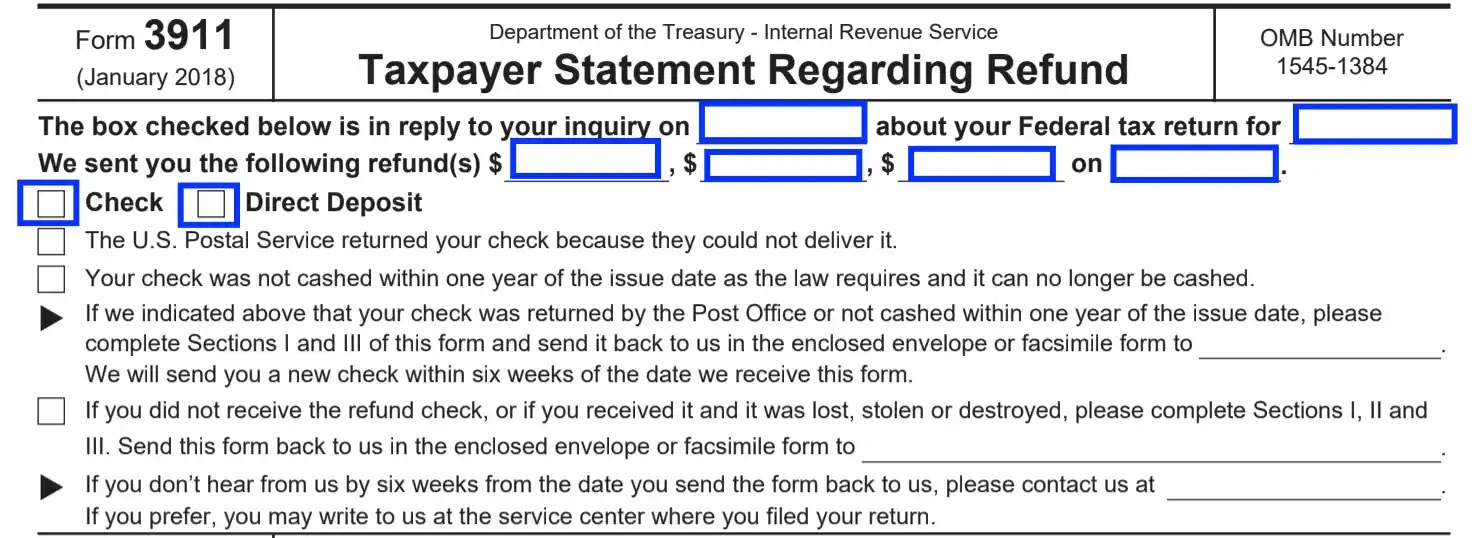

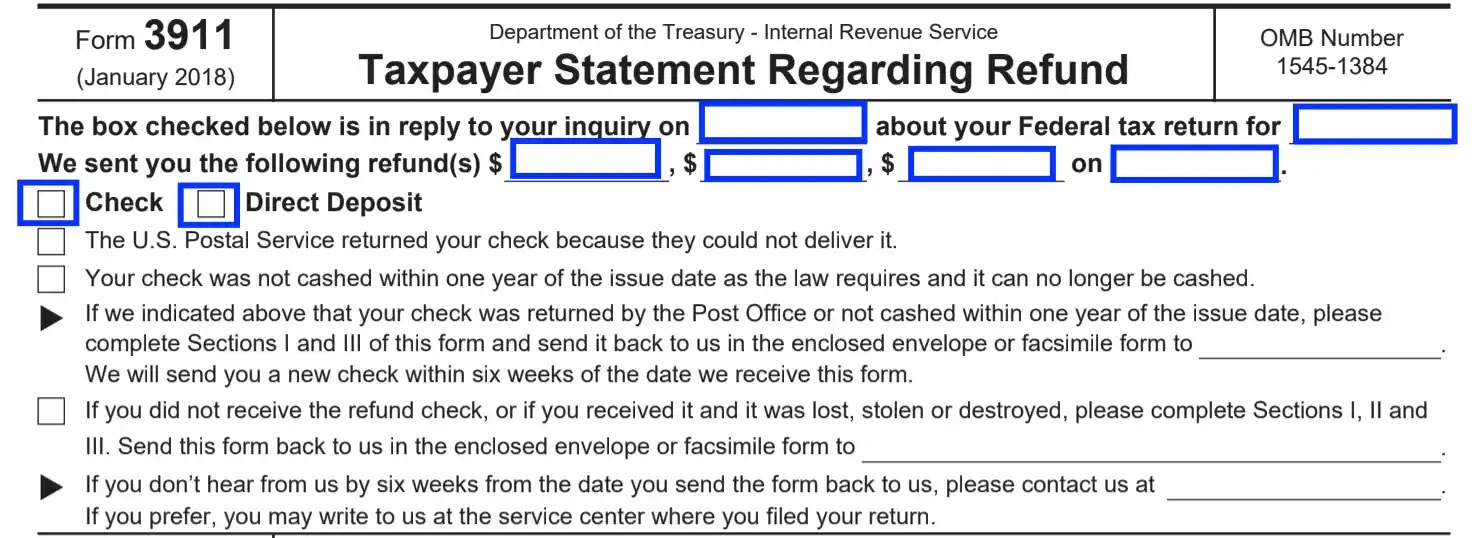

Welcome to this comprehensive guide on where to send IRS Form 3911. Dealing with the IRS can be an overwhelming task, especially when it comes to submitting important forms. Form 3911, officially known as the “Taxpayer Statement Regarding Refund,” plays a vital role in cases where you have not received your tax refund or have received a refund check that is lost, stolen, or damaged.

This article will walk you through the purpose of IRS Form 3911, the steps to fill it out correctly, and where to mail it. We will also discuss the option of submitting the form online and how to request a copy of Form 3911 if needed. So, whether you’re an individual taxpayer, a business owner, or a tax professional, this guide will provide you with the information you need to navigate the process effectively.

Before we jump into the details, it’s important to note that IRS Form 3911 is not used for requesting a refund that hasn’t been received. Instead, it is specifically designed for situations where you have received a refund check and need assistance in resolving issues related to it.

Purpose of IRS Form 3911:

IRS Form 3911 serves a crucial purpose in helping taxpayers recover their missing or damaged refund checks. The form acts as a formal request to the Internal Revenue Service (IRS) for assistance in resolving issues related to refund payments. Whether your refund check was lost, stolen, destroyed, or expired, Form 3911 provides a platform to initiate the necessary actions to resolve the matter.

The primary purpose of Form 3911 is to notify the IRS about the situation and provide them with the information they need to investigate and rectify the issue. By completing this form, you are essentially requesting the IRS to issue a new refund or take appropriate measures to address the problem.

It’s important to understand that Form 3911 is not intended for cases where you haven’t received a refund that you are expecting. In such instances, you should follow the appropriate procedures outlined by the IRS, such as checking the status of your refund online using the IRS Where’s My Refund tool.

When it comes to lost or damaged refund checks, Form 3911 is an essential tool in ensuring that you receive the refund amount you are entitled to. It provides a structured format for you to provide all the necessary details and document the circumstances surrounding the missing or damaged check.

Additionally, Form 3911 helps the IRS in maintaining accurate records and safeguarding against fraudulent activities. By submitting this form, you assist the IRS in investigating any potential fraud associated with your refund check and taking appropriate measures to protect your financial interests.

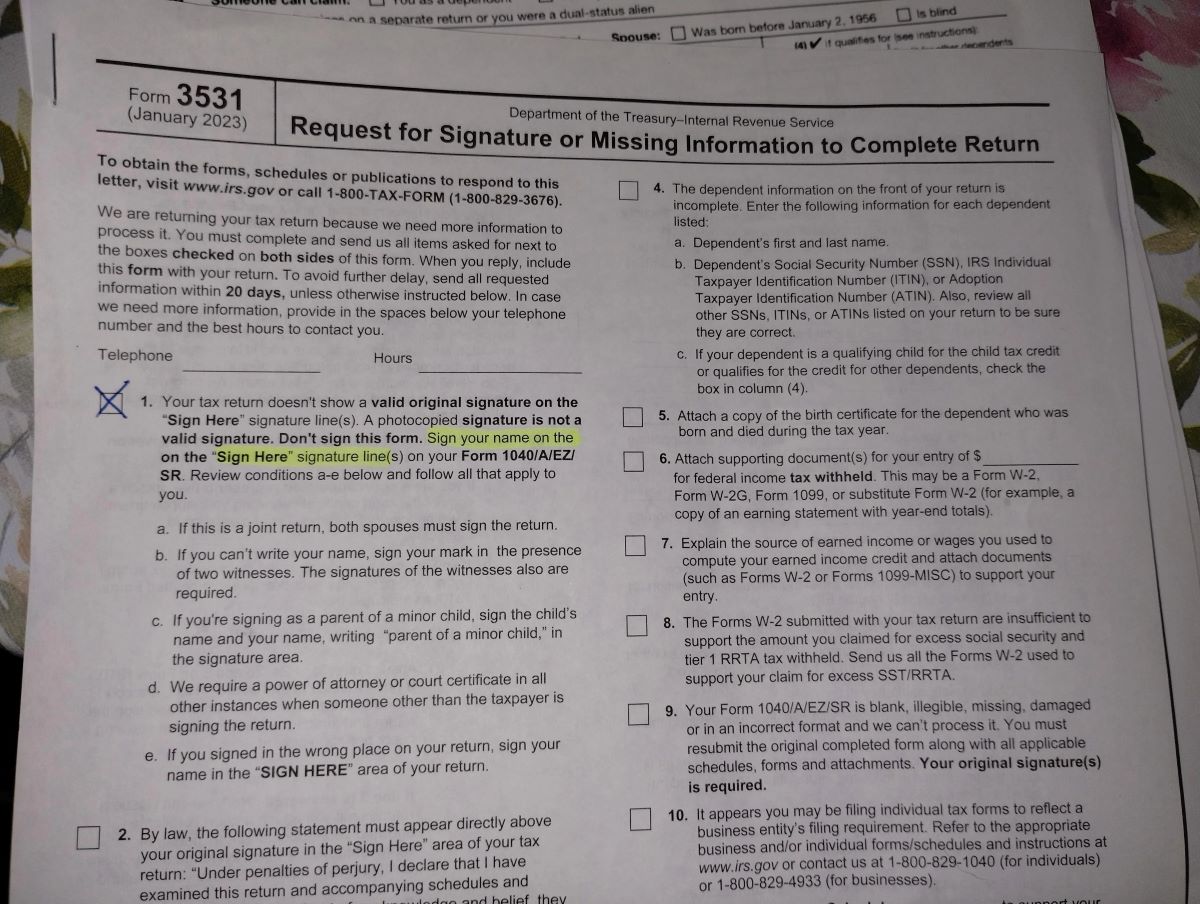

Steps to Fill Out IRS Form 3911:

Completing IRS Form 3911 is a relatively straightforward process. By following these steps, you can ensure that you provide accurate and detailed information to facilitate the resolution of your refund issues:

- Download the form: Start by obtaining a copy of IRS Form 3911 from the official IRS website or request a physical copy by calling the IRS helpline.

- Provide your personal information: Fill in the top section of the form, including your name, social security number (or employer identification number for businesses), and contact details.

- Indicate the type of return: Check the appropriate box to indicate the type of tax return for which the refund was issued, such as individual, business, or estate/trust return.

- Specify the tax year: Enter the tax year for which the refund relates. Ensure that you select the correct year to avoid any processing delays.

- Explain the issue: In the “Explanation of Requested Action” section, provide a clear and concise statement explaining the issue you are experiencing with your refund check. Be specific and provide relevant details, such as when and how the check was lost or damaged.

- Include supporting documentation: If available, attach any supporting documents that can substantiate your claim or help the IRS in resolving the issue. This may include copies of prior correspondence with the IRS, receipts, or any other relevant evidence.

- Sign and date the form: Sign and date the completed form to certify that the information provided is accurate and complete.

- Make a copy for your records: Before sending the form, make a copy for your records. This will serve as proof of your submission and assist you in tracking the progress of your request.

It is crucial to double-check all the information entered, ensuring that it is accurate and legible. Any inconsistencies or errors may delay the processing of your request. Once you have completed the form and made a copy, you are ready to proceed to the next step: mailing the form to the appropriate IRS location.

Where to Mail IRS Form 3911:

After filling out IRS Form 3911, the next step is to mail it to the appropriate IRS address. The mailing address you should use depends on the state in which you live and whether you are including a payment with your form. Below are the mailing addresses based on these factors:

For taxpayers who DO NOT include a payment:

If you are not including a payment with IRS Form 3911, use the following address:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0035

It is important to note that this address is the same for taxpayers from all states, regardless of where you reside.

For taxpayers who DO include a payment:

If you are including a payment with IRS Form 3911, the mailing address you should use depends on your state of residence. The payment addresses are specific to each state and differ from the non-payment address. To determine the correct address for your state, visit the IRS website or consult the instructions provided with the form.

Remember to make your payment payable to the “United States Treasury” and include it along with your completed Form 3911. Be sure to double-check that the payment amount is correct to avoid any processing delays or discrepancies.

When mailing IRS Form 3911, it is recommended to use certified mail or a reputable mail delivery service that provides tracking information. This will allow you to keep a record of when the form was sent and delivered, providing additional proof of submission.

Keep in mind that mailing times may vary, so it is advisable to send the form well in advance of any deadline to ensure it reaches the IRS within the required timeframe.

Online Submission of Form 3911:

In addition to mailing IRS Form 3911, you also have the option to submit the form online. The IRS provides an online platform called the “Where’s My Refund” tool, which allows taxpayers to electronically request assistance with their refund issues.

Here are the steps to submit Form 3911 online:

- Access the ‘Where’s My Refund’ tool: Visit the official IRS website and navigate to the “Refunds” section. Look for the “Where’s My Refund” tool and click on it to access the online platform.

- Provide your personal information: Enter the required information in the designated fields, including your social security number, filing status, and the exact refund amount as shown on your tax return. This information will help the IRS identify your case and route it to the appropriate department.

- Select the ‘Refund Inquiry’ option: Once you have entered your information, look for the option to request a refund inquiry. Select this option to proceed.

- Complete the online form: The IRS will prompt you to complete a digital version of Form 3911. Follow the instructions and provide all the necessary information, just as you would on the paper form. Make sure to provide a detailed explanation of the issue you are experiencing with your refund.

- Confirm your submission: Before submitting the form, carefully review all the information you have entered to ensure its accuracy. Double-check the details and make any necessary corrections.

- Submit the form: Once you are confident that all the information is correct, submit the form electronically. The IRS will process your request and provide you with updates through the online platform.

Submitting Form 3911 online offers the convenience of instant submission and faster processing times. It also allows you to track the progress of your request electronically and receive updates on the status of your refund inquiry.

Note that while online submission is available, it does not completely replace the option to mail a physical copy of Form 3911. If you prefer or are unable to access the online platform, you can still fill out the paper form and mail it to the appropriate IRS address as previously mentioned.

Requesting a Copy of IRS Form 3911:

If you need a copy of IRS Form 3911, there are a few different ways to obtain one. Having an extra copy of the form can be helpful if you made a mistake on the original form or need to submit a new request for a lost or damaged refund check. Here’s how you can request a copy of IRS Form 3911:

Option 1: Download from the IRS Website

The easiest and most convenient way to get a copy of IRS Form 3911 is to visit the official IRS website. You can download the form directly from the IRS Forms and Publications page. Look for Form 3911 and click on the link to download it in PDF format.

Once you have downloaded the form, you can save it to your computer or print it out for future use. Make sure you have a PDF reader installed on your device to open and view the form.

Option 2: Call the IRS

If you prefer not to download the form online or encounter any issues, you can contact the IRS directly to request a physical copy of Form 3911. Call the IRS toll-free number at 1-800-829-1040 to speak with a representative.

When contacting the IRS, be prepared to provide your personal information, including your name, social security number, and address. Inform the representative that you need a copy of Form 3911, and they will assist you in sending one to your mailing address.

Option 3: Visit Your Local IRS Office

Another option is to visit your local IRS Taxpayer Assistance Center (TAC) to request a copy of Form 3911 in person. Use the IRS Office Locator tool on the IRS website to find the nearest TAC location.

When visiting the TAC, bring a valid form of identification, such as a driver’s license or passport, along with your social security number. Inform the IRS representative that you require a copy of Form 3911, and they will provide you with the necessary assistance.

Regardless of the method you choose, ensure that you have a copy of IRS Form 3911 readily available when needed. It’s always a good idea to keep an extra copy of important tax forms on hand for future reference or any unforeseen circumstances that may arise.

Frequently Asked Questions (FAQs):

Here are some common questions and answers regarding IRS Form 3911:

1. What should I do if I haven’t received my tax refund?

If you haven’t received your tax refund, you should first check the status of your refund using the IRS Where’s My Refund tool. If the tool indicates that your refund has been issued but you have not received it, you can proceed with submitting IRS Form 3911 to request assistance with the issue.

2. Can I use Form 3911 to request a refund for multiple tax years?

No, IRS Form 3911 is only used for addressing issues related to a specific tax year. If you need to request a refund for multiple tax years, you should submit separate Form 3911 for each tax year involved.

3. How long does it take for the IRS to process Form 3911?

The processing time for Form 3911 varies depending on the complexity of the case and the current workload of the IRS. Generally, it can take anywhere from six to eight weeks for the IRS to process your request and resolve the issue related to your refund check. It is important to be patient and allow sufficient time for the IRS to investigate and take appropriate action.

4. Can I track the status of my refund inquiry submitted with Form 3911?

Yes, if you submit Form 3911 online through the IRS website using the Where’s My Refund tool, you will be able to track the progress of your refund inquiry. The tool provides real-time updates on the status of your request and any associated actions taken by the IRS to resolve the issue.

5. What if I made a mistake on my submitted Form 3911?

If you made a mistake on your submitted Form 3911, it is important to notify the IRS as soon as possible to ensure accurate processing of your request. You can call the IRS helpline at 1-800-829-1040 or submit a corrected form through the online platform, if available. Be sure to include a clear explanation regarding the correction and any supporting documentation, if applicable.

These FAQs provide general information and answers to common queries. For more specific inquiries or complex situations, it is recommended to consult the IRS website or seek professional advice from a tax professional or CPA.

Conclusion:

IRS Form 3911 is a valuable tool for taxpayers who have encountered issues with their refund checks. By understanding the purpose of the form, following the correct steps to fill it out, and knowing where to mail it or how to submit it online, you can effectively navigate the process and seek assistance from the IRS.

When dealing with Form 3911, it is important to provide accurate and detailed information to facilitate the resolution of your refund issues. Take the time to carefully fill out the form, ensure its accuracy, and include any necessary supporting documentation. This will help the IRS investigate and take appropriate action to address your specific case.

Whether you choose to mail your Form 3911 or submit it online through the Where’s My Refund tool, keep in mind that processing times may vary. It is essential to be patient and allow sufficient time for the IRS to investigate and resolve your refund issue.

Lastly, remember to keep a copy of Form 3911 and any related documentation for your records. This will serve as proof of your submission and assist you in tracking the progress of your request.

If you have any specific questions or encounter difficulties with Form 3911, it is advisable to consult the official IRS website, contact the IRS helpline, or seek guidance from a tax professional. They can provide you with the most accurate and up-to-date information based on your individual circumstances.

By following the guidelines and resources provided in this article, you can navigate the process of resolving refund check issues effectively and ensure that you receive the refund amount you are entitled to.