Finance

What Happens If The IRS Rejects A Tax Return?

Published: November 1, 2023

Discover what to do if the IRS rejects your tax return in this comprehensive financial guide. Stay informed and take appropriate measures for a hassle-free tax filing process.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Filing your taxes is an essential part of maintaining compliance with the Internal Revenue Service (IRS) and fulfilling your financial obligations as a taxpayer. However, there might be instances where the IRS rejects your tax return. This can be a frustrating experience, leading to questions about what went wrong and what steps to take next.

Understanding why and how the IRS rejects a tax return is crucial for anyone navigating the world of taxes. In this article, we will explore the reasons behind IRS rejections, common errors that lead to rejections, the potential consequences of a rejected return, and the necessary steps to correct and resubmit your tax return.

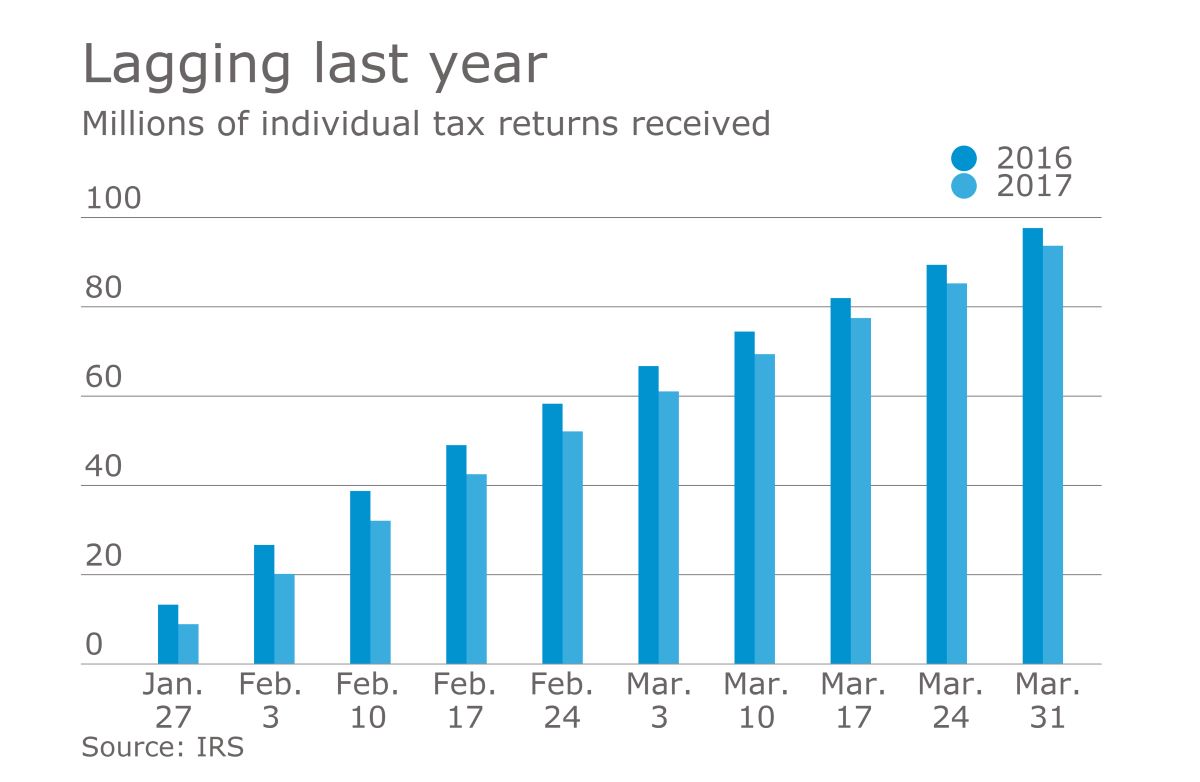

Receiving a notice of a rejected tax return from the IRS can be disheartening, but it is not uncommon. The IRS processes millions of tax returns each year, and with this volume of documentation, errors and discrepancies are bound to occur. It’s important to remember that a rejected return does not necessarily indicate wrongdoing on your part, but rather a need for correction or additional information.

By understanding the reasons behind IRS rejections and the steps to address them, you can navigate the process with ease and ensure compliance with tax laws while avoiding unnecessary delays or penalties.

In the following sections, we will explore the common reasons for IRS rejection, the most frequent errors that lead to rejections, the potential consequences of a rejected return, the correct steps to correct and resubmit your tax return, and how seeking professional help can enhance your chances of a successful resolution.

Reasons for IRS Rejection

There are various reasons why the IRS might reject a tax return. Understanding these reasons can help you identify potential issues and take the necessary steps to avoid rejection. Here are some common reasons for IRS rejection:

Inaccurate or Missing Information

One of the primary reasons for IRS rejection is inaccurate or missing information on the tax return. This includes errors in your personal information, such as your name, social security number, or address, as well as inaccuracies in reporting income, deductions, or credits. It is crucial to double-check all the information you provide on your tax return to ensure accuracy and completeness.

Mathematical Errors

Another common reason for IRS rejection is mathematical errors. Simple mistakes in calculations, such as addition or subtraction errors, can lead to discrepancies that trigger a rejection. It is essential to carefully review and verify all calculations to minimize the risk of mathematical errors.

Filing Status Errors

Choosing the incorrect filing status can also result in an IRS rejection. The filing status determines the tax rates and deductions you are eligible for, so it is vital to select the appropriate option based on your marital status and other relevant factors.

Submission of Outdated Forms

The IRS frequently updates tax forms and instructions to reflect changes in tax laws and regulations. Using outdated forms or instructions can lead to rejection. It is essential to download the latest forms and instructions from the official IRS website or consult with a tax professional to ensure you are using the correct versions.

Failure to Sign the Return

For a tax return to be considered valid, it must be signed by the taxpayer or authorized representative. Failure to sign the return will result in rejection. Ensure that you sign your tax return before submitting it to the IRS.

These are just a few examples of the reasons why the IRS might reject a tax return. It is crucial to be diligent and thorough when preparing and reviewing your tax return to minimize the risk of rejection. Taking the time to avoid these common errors can save you valuable time and effort in the long run.

Common Errors in Tax Returns

Even the most careful individuals can make mistakes when preparing their tax returns. Unfortunately, these errors can lead to the rejection of your tax return by the IRS. To avoid unnecessary delays and complications, it is essential to be aware of the most common errors that occur in tax returns. Here are some of the most frequent mistakes to watch out for:

Incorrect or Missing Social Security Numbers

One of the most common errors is entering an incorrect or missing Social Security number (SSN). It is crucial to double-check your SSN and ensure that it matches the information on your Social Security card. Additionally, if you’re filing a joint return, make sure to enter the correct SSNs for both you and your spouse.

Misreporting Income

Another common error is misreporting income. This can include failing to report income from all sources, such as freelance work or rental properties, or incorrectly reporting the amount of income earned. It is crucial to gather all the necessary documents, such as W-2s and 1099s, and accurately report all sources of income on your tax return.

Inaccurate Deductions and Credits

Errors when claiming deductions and credits can also lead to a rejected tax return. Some common mistakes include claiming deductions or credits that you are not eligible for, failing to provide sufficient documentation to support your deductions, or miscalculating the amount to be claimed. It is important to carefully review the eligibility criteria for each deduction and credit and ensure that you have the necessary documentation to support your claims.

Mathematical Errors

Mathematical errors, such as basic calculation mistakes, can also result in the rejection of your tax return. It is crucial to review all calculations, including additions, subtractions, and multiplications, to ensure accuracy. Using tax software or double-checking your calculations with a calculator can help minimize the risk of mathematical errors.

Failure to Sign or Date the Return

Another common error is forgetting to sign or date your tax return. Every tax return must be signed and dated to be considered valid. Make sure to sign and date your return before submitting it to the IRS. If you’re filing a joint return, both you and your spouse must sign and date the document.

These are just a few examples of common errors that can lead to a rejected tax return. By being aware of these potential errors and taking the necessary precautions, you can minimize the risk of rejection and ensure a smooth and efficient filing process.

Consequences of IRS Rejection

Receiving a rejection notice from the IRS can have several consequences that can impact your financial situation and overall tax compliance. It’s important to understand the potential repercussions of an IRS rejection to effectively address the issue. Here are some of the consequences you may face:

Delayed Refunds

If your tax return is rejected, it can significantly delay the processing of your refund. The IRS will not begin processing your return until the issues leading to the rejection are resolved. This can result in a longer wait to receive any refund you may be entitled to, which can be frustrating if you were relying on that money.

Penalties and Interest

In some cases, an IRS rejection may trigger penalties and interest. If the rejection is due to errors or omissions that result in underpayment of tax, you may be subject to penalties and interest on the outstanding amount. It’s important to rectify the issues promptly to minimize any potential penalties or interest charges.

Missed Deadlines

A rejected tax return can cause you to miss important tax deadlines. For example, if your return is rejected after the tax filing deadline, you may be subject to late filing penalties if you fail to address the issues and resubmit your return in a timely manner. It’s crucial to take prompt action to avoid missing any critical deadlines.

Increased Audit Risk

Frequent rejections can increase your risk of being audited by the IRS. While a single rejection is unlikely to trigger an audit, consistent errors or omissions on your tax returns can draw unwanted attention from the IRS. It’s important to address the issues that led to the rejection and take preventive measures to ensure accuracy in future filings.

Additional Stress and Time Consumption

Dealing with an IRS rejection can be stressful and time-consuming. You may need to gather additional documentation, correct errors, and resubmit your return, all while managing other aspects of your financial life. It’s crucial to approach the situation with patience and seek assistance if needed to minimize the stress and streamline the process.

Understanding the potential consequences of an IRS rejection can help you navigate the situation with greater awareness and take appropriate measures to resolve the issues. By addressing the rejection promptly and taking steps to avoid future rejections, you can maintain good standing with the IRS and ensure a smoother tax-filing experience.

Correcting and Resubmitting a Rejected Tax Return

Receiving a rejection notice from the IRS does not signify the end of the tax-filing process. It is important to understand the steps involved in correcting and resubmitting a rejected tax return. By taking the necessary actions, you can address the issues and ensure that your tax return is successfully processed. Here’s what you need to do:

Review the Rejection Notice

Carefully review the rejection notice from the IRS. The notice will provide specific details about the reasons for the rejection, including error codes and explanations. Understanding the underlying issues is crucial to correcting them effectively.

Make the Necessary Corrections

Based on the information provided in the rejection notice, make the necessary corrections to your tax return. This may involve updating inaccurate or incomplete information, correcting mathematical errors, or addressing any other issues identified by the IRS. Use the correct tax forms and instructions provided by the IRS for the current tax year.

Gather Supporting Documentation

If the rejection was due to missing or insufficient documentation, gather the required supporting materials. This may include income statements, receipts, or any other relevant documents that validate the information reported on your tax return. Keep these documents organized to avoid future rejection or audit issues.

Resubmit your Tax Return

Once you have made the necessary corrections and gathered all the required documentation, resubmit your tax return to the IRS. This can typically be done electronically using e-file, or you can mail a physical copy of your corrected return. If you choose to mail your return, ensure you include all necessary attachments and signed forms.

Track the Status of your Return

After resubmitting your tax return, track the status of your return using the IRS’s online “Where’s My Refund?” tool or by calling their automated hotline. This will allow you to monitor the progress of your return and ensure that it is being processed correctly.

Seek Professional Assistance if Needed

If you’re unsure about how to correct the issues or encounter complexities in the process, consider seeking assistance from a tax professional. They can provide guidance, review your return for accuracy, and help ensure that you adequately address the rejection issues.

By following these steps and taking the necessary actions, you can correct any errors, address the rejection issues, and resubmit your tax return successfully. It’s important to be proactive and timely in resolving the rejection to avoid further complications or penalties.

Seeking Professional Help

Dealing with a rejected tax return can be overwhelming, especially if you’re unfamiliar with tax laws and regulations. In such cases, seeking professional help can provide valuable guidance and ensure that you navigate the process effectively. Here are some reasons why you may consider seeking professional assistance:

Expertise and Knowledge

Tax professionals, such as certified public accountants (CPAs) and enrolled agents (EAs), have extensive knowledge and expertise in tax laws and regulations. They stay up-to-date with the latest changes and can provide accurate guidance regarding your specific tax situation. Their expertise can help you understand the reasons behind the rejection, navigate complex tax codes, and ensure compliance with IRS requirements.

Efficiency and Accuracy

Tax professionals are experienced in preparing and reviewing tax returns. They know how to identify potential errors, minimize mistakes, and maximize deductions and credits. By entrusting your rejected tax return to a professional, you can improve the accuracy and efficiency of the correction process, increasing the likelihood of a successful resubmission.

Handling Complex Situations

If your tax situation is complex, such as owning a business, multiple income sources, or investments, a tax professional can provide invaluable assistance. They have the knowledge and experience to handle complex tax scenarios, ensuring that all relevant information is accurately reported and addressing any complicated issues that may have led to the rejection.

Representation in Audits or Disputes

In some cases, a rejected tax return may lead to an audit or further disputes with the IRS. If this happens, having a tax professional on your side can be beneficial. They can represent you during IRS audits, handle communications with the IRS, and help you navigate the process with confidence.

Peace of Mind

Seeking professional help can provide peace of mind, knowing that your tax return is in the hands of an experienced and knowledgeable expert. This can alleviate stress and allow you to focus on other important aspects of your financial life, knowing that your tax matters are being handled competently.

Whether you choose to work with a CPA, EA, or another tax professional, it’s important to select someone with a solid reputation and relevant experience. Take the time to research and interview potential professionals to find the one who best meets your needs and offers the expertise necessary to address your specific tax situation.

While professional assistance comes at a cost, the benefits and peace of mind it provides can outweigh the expense. Consider seeking professional help if you’re unsure about how to correct your rejected tax return or want to ensure a smooth and accurate filing process.

Conclusion

Filing taxes is an important responsibility, and the possibility of having your tax return rejected by the IRS can create stress and confusion. However, with awareness and the right approach, you can successfully navigate the process of correcting and resubmitting a rejected tax return. By understanding the common reasons for rejection, avoiding common errors, and taking prompt corrective action, you can increase your chances of a successful resubmission.

It is crucial to review the rejection notice carefully, make the necessary corrections, and submit all required documentation. Furthermore, tracking the status of your resubmitted return and seeking professional help if needed can further streamline the process and ensure accuracy.

Remember that a rejected tax return does not necessarily imply any wrongdoing on your part. It simply means that the IRS needs additional information or corrections to process your return accurately. By staying proactive, patient, and thorough, you can resolve the issues efficiently and minimize any potential penalties or delays.

In the future, take preventive measures to avoid rejections by double-checking your information, using updated forms and instructions, and seeking professional assistance if your tax situation is complex. By being proactive and diligent, you can maximize your chances of a smooth tax-filing experience.

Always keep in mind that taxes can be complex, and seeking professional help is a viable option. A qualified tax professional can provide guidance, prepare accurate returns, and represent you in case of audits or disputes.

In conclusion, by understanding the reasons behind an IRS rejection, being aware of common errors, taking prompt corrective action, and seeking professional assistance when needed, you can successfully navigate the process of correcting and resubmitting a rejected tax return. By doing so, you can fulfill your tax obligations, maintain compliance with the IRS, and ensure a smoother tax-filing experience in the future.