Home>Finance>What Happens To A Refund On A Cancelled Credit Card

Finance

What Happens To A Refund On A Cancelled Credit Card

Published: October 26, 2023

Discover what happens to a refund on a cancelled credit card in the world of finance. Learn about the process and steps involved to ensure a smooth transaction.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Reasons for Credit Card Cancellations

- Process of Cancelling a Credit Card

- What Happens to Pending Refunds?

- Automatic Statement Credits

- Transferring Refunds to Another Card

- Receiving Refunds via Check

- Lost or Expired Credit Cards and Refunds

- Seeking Assistance from the Credit Card Issuer

- Conclusion

Introduction

When it comes to managing your finances, credit cards have become an essential tool for many individuals. They offer convenience, security, and a range of benefits such as cashback rewards, travel perks, and purchase protection. While credit cards serve as a valuable financial tool, there are instances when you may need to cancel a credit card.

Life is full of unexpected events and circumstances that might necessitate the cancellation of a credit card. Whether you’re looking to reduce your credit card portfolio, switch to a different card with better terms, or have encountered fraudulent activity, understanding what happens to a refund on a cancelled credit card is crucial.

In this article, we will explore the process of cancelling a credit card and the implications it has on any pending refunds. We will also discuss the various options available for receiving a refund, whether through automatic statement credits, transferring the refund to another card, or receiving a check.

While each credit card issuer may have slightly different policies, we will provide you with a general overview of what to expect when it comes to refunds on a cancelled credit card. Remember, always consult your credit card issuer directly for specific details regarding their policies and procedures.

Reasons for Credit Card Cancellations

There are various reasons why individuals might choose to cancel a credit card. Understanding these reasons can help shed light on the circumstances that may lead to a cancellation. Here are some common scenarios:

- High Fees: Some credit cards come with annual fees or other charges that may no longer align with your financial goals. If the benefits or rewards no longer outweigh the costs, it may be time to cancel the card.

- Unmanageable Debt: If you find yourself struggling to pay off credit card debt, cancelling a credit card can be a strategic move to avoid further temptation and gain control over your finances.

- Inactive Card: If a credit card has been lying unused for an extended period, you might decide to cancel it to streamline your financial accounts and minimize potential security risks.

- Switching to a Better Card: Sometimes, you may come across a credit card with more favorable terms, lower interest rates, or better rewards. In such cases, canceling your current card and transitioning to the new one can be a smart move.

- Fraudulent Activity: If you suspect unauthorized transactions or fraudulent activity on your credit card, it’s crucial to contact your credit card issuer immediately. In some cases, they may advise canceling the card to protect your finances.

These are just a few examples of common reasons for credit card cancellations. Remember, everyone’s financial situation is unique, and the decision to cancel a credit card should be based on careful consideration of your individual needs and circumstances.

Process of Cancelling a Credit Card

Cancelling a credit card is not as simple as cutting it up or disposing of it. There is a proper process that should be followed to ensure a smooth cancellation and to address any pending refunds. Here are the general steps to cancel a credit card:

- Contact the Credit Card Issuer: Start by calling the customer service number provided by your credit card issuer. Inform them of your intent to cancel the card and request any necessary instructions or forms that need to be completed.

- Verify Your Identity: Credit card issuers have security measures in place to protect their customers’ accounts. During the cancellation process, you may be asked to verify your identity through personal information or security questions.

- Pay off Any Outstanding Balance: Before canceling your credit card, make sure to clear any outstanding balances. This ensures that you don’t owe any further payments and avoids any potential complications during the cancellation process.

- Confirm the Cancellation: Once all necessary steps have been completed, confirm with the credit card issuer that the cancellation request has been successfully processed.

- Follow Up: After cancelling your credit card, monitor your account to ensure that it is closed and that no unauthorized transactions occur. It is also essential to confirm that any automatic payments or recurring charges linked to the card are updated with your new payment information.

Keep in mind that specific procedures may vary depending on your credit card issuer. It is always recommended to contact your credit card issuer directly to get accurate and up-to-date information on their cancellation process.

What Happens to Pending Refunds?

When you cancel a credit card, one of the primary concerns is what happens to any pending refunds you may have. Whether it’s a refund from a returned item, a billing error correction, or a credit due to a canceled service, here’s what you need to know:

In most cases, when a credit card is canceled, any pending refunds will still be processed. The credit card issuer is typically obligated to provide you with the refund, regardless of the status of your credit card account. However, the way you receive the refund may vary depending on your particular situation and the policies of your credit card issuer.

If your credit card account is still active at the time the refund is processed, the refund will typically be credited back to your credit card account. You would see this reflected in your statement as a credit or reduction in your outstanding balance. This process is typically straightforward and automated.

However, if your credit card account has already been closed at the time the refund is initiated, it may be handled differently. There are typically a few options available:

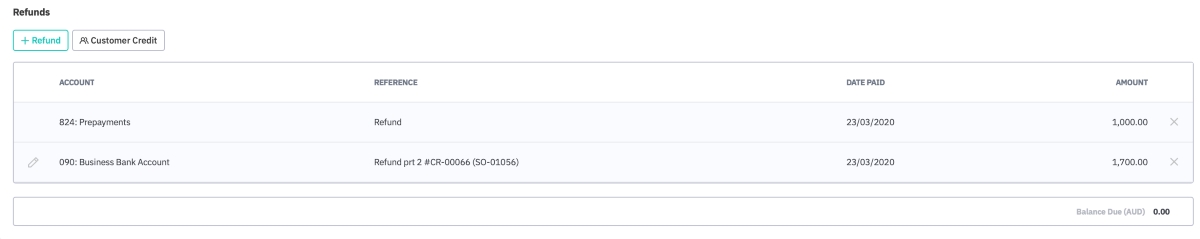

- Automatic Statement Credits: Some credit card issuers will automatically apply the refund as a statement credit, even if the account is closed. This means that the refund amount will be subtracted from any remaining balance on the account, and you may receive a final statement reflecting the credit.

- Transferring Refunds to Another Card: In some cases, the credit card issuer may ask you to provide them with the details of an active credit card that they can transfer the refund to. This option allows you to receive the funds on a different card if you have one.

- Receiving Refunds via Check: If neither of the above options is available, the credit card issuer may send you a physical check for the refund amount. This typically takes a bit longer than the other methods, as it involves mailing and processing time.

If you have any concerns or questions about pending refunds on a cancelled credit card, it is best to contact your credit card issuer directly. They will be able to provide you with specific information on their refund policies and procedures.

Automatic Statement Credits

Automatic statement credits are a common method used by credit card issuers to handle refunds on cancelled credit cards. When your credit card account is closed, but a refund is initiated, the refund amount may be automatically applied as a credit on your final statement.

This means that instead of receiving the refund as a separate payment or transfer, it is applied towards any remaining balance on your credit card account. The refund amount is subtracted from your outstanding balance, resulting in a lower or zero balance on your final statement.

The benefit of automatic statement credits is that they provide a straightforward and simplified process for handling refunds. You don’t need to worry about arranging for the funds to be transferred to another account or receiving a physical check. Instead, the refund is seamlessly integrated into the closure of your credit card account.

It’s important to note that if there are any outstanding charges or fees on your credit card account at the time of cancellation, these will still need to be paid. The automatic statement credit will only apply towards the refundable amount.

To ensure that you are aware of any remaining balance or statement credits on your cancelled credit card, it is recommended to carefully review your final statement. This will provide you with a clear overview of any adjustments made due to the refund and confirm that the closure of your credit card account is accurate.

If you have any questions or concerns about automatic statement credits or how refunds are handled on a cancelled credit card, it is best to reach out to your credit card issuer directly. They will be able to provide you with specific information based on their policies and procedures.

Transferring Refunds to Another Card

In certain situations, when you cancel a credit card and have a pending refund, the credit card issuer may provide an option to transfer the refund to another active credit card that you own. This allows you to receive the refund on a different card instead of the cancelled one.

Transferring refunds to another card can be beneficial if you have multiple credit cards and would prefer to consolidate your funds or if you are in the process of transitioning to a new credit card with better terms or rewards.

Here’s what you need to know about transferring refunds to another card:

- Contact your Credit Card Issuer: Once you are aware of a pending refund on your cancelled credit card, get in touch with your credit card issuer’s customer service. Inquire about the option to transfer the refund to another active credit card.

- Provide Details of the New Card: The credit card issuer will likely ask for specific details of the card you would like the refund transferred to. This may include the card number, expiration date, and security code.

- Verify Account Ownership: To ensure the security of your financial information, the credit card issuer may require you to verify your ownership of the new card. This can be done by providing personal information, answering security questions, or following any additional steps necessary.

- Confirm the Transfer: Once the transfer details have been provided and verified, the credit card issuer will initiate the transfer of the refund amount to your chosen card. The new card should reflect the refund as a credit or adjustment on its next statement.

It’s important to note that not all credit card issuers offer the option to transfer refunds to another card. It may depend on their specific policies and procedures. If this option is not available, you may be provided with alternative methods such as receiving a physical check or an automatic statement credit on the cancelled credit card.

If you have any questions or concerns about transferring refunds to another card, it is recommended to reach out to your credit card issuer directly. They will be able to provide you with the necessary information and guidance based on their specific policies.

Receiving Refunds via Check

In certain cases, when you cancel a credit card and have a pending refund, the credit card issuer may issue a physical check as the method of refund. This typically happens when automatic statement credits or transferring refunds to another card are not feasible options.

Here’s what you need to know about receiving refunds via check:

- Contact your Credit Card Issuer: Once you become aware of a pending refund on your cancelled credit card, get in touch with your credit card issuer’s customer service. Inquire about the process for receiving a refund via check.

- Provide Necessary Information: The credit card issuer may ask you to provide your current mailing address and any other required information to ensure that the check is sent to the correct location.

- Confirm Timing and Delivery: Ask the credit card issuer about the estimated timeframe for processing and mailing the refund check. They should be able to provide you with an approximate date range for when you can expect to receive the check.

- Monitor Mailbox: Keep an eye on your mailbox for the arrival of the refund check. Depending on the postal service and the distance the check needs to travel, it may take a few days or even weeks to reach you.

- Cash or Deposit the Check: Once you receive the refund check, you can either cash it or deposit it into your bank account, depending on your preference and financial needs.

Receiving refunds via check can be a straightforward and secure method, ensuring that you have physical documentation of the refund transaction. However, it’s important to remember that the process of receiving a refund via check may take longer than other methods, as it involves mailing and processing time.

If you have any concerns or questions about receiving refunds via check on a cancelled credit card, it is best to contact your credit card issuer directly. They will be able to provide you with specific information regarding their policies and procedures for issuing refund checks.

Lost or Expired Credit Cards and Refunds

Lost or expired credit cards present different challenges when it comes to handling refunds. In these situations, it’s important to take the necessary steps to ensure that you can still receive any pending refunds:

- Contact your Credit Card Issuer: If your credit card is lost or expired, the first step is to reach out to your credit card issuer as soon as possible. Inform them about the situation and request assistance in receiving any pending refunds.

- Card Replacement: If your credit card has been lost, the credit card issuer will usually issue a replacement card. During this process, confirm with the issuer if any pending refunds will automatically transfer to the new card or if there are any additional steps you need to take to ensure the refund is received.

- Expired Cards: In the case of an expired credit card, the credit card issuer may automatically issue a new card with an updated expiration date. However, if any refunds are pending during the card expiration period, it’s crucial to inform the issuer and provide them with the necessary information to process the refunds.

- Update Payment Information: If a refund cannot be directly transferred to a replacement or new card, it may be necessary to update your payment information with the merchant or service provider from whom you are expecting the refund. This ensures that the refund is directed to your updated payment method.

- Monitor Account Communications: Throughout the card replacement or renewal process, make sure to closely monitor communications from your credit card issuer. They may provide specific instructions or additional information regarding the handling of refunds during this time.

It’s important to note that the exact procedures and policies regarding lost or expired credit cards and the handling of refunds may vary among different credit card issuers. To ensure that you receive the necessary guidance and support, it is recommended to contact your credit card issuer directly.

By taking proactive steps and maintaining open communication with your credit card issuer, you can ensure a smooth process for handling pending refunds, even in the event of a lost or expired credit card.

Seeking Assistance from the Credit Card Issuer

If you have any concerns or questions regarding the cancellation of a credit card and the handling of refunds, it’s important to seek assistance directly from your credit card issuer. They are the best resource for providing guidance and resolving any issues related to your specific credit card account.

Here’s how you can seek assistance from your credit card issuer:

- Contact Customer Service: Reach out to the customer service department of your credit card issuer. This can typically be done through a dedicated customer service phone number or online chat support.

- Explain Your Situation: Clearly communicate your concerns, providing relevant details about the cancellation of your credit card and any pending refunds you may have. Be sure to include any specific questions or issues you would like them to address.

- Listen Carefully: Pay close attention to the information provided by the customer service representative. They may have specific instructions or policies regarding the handling of refunds or other related matters.

- Ask for Clarification: If there is anything you don’t understand or need further clarification on, don’t hesitate to ask questions. It’s important to have a clear understanding of the next steps or any actions required from your end.

- Document Conversations: Keep a record of your conversations with the credit card issuer, including the date, time, and the name of the representative you spoke with. This can be helpful for reference if you need to follow up or refer back to any details discussed.

- Follow Up if Needed: If your concerns are not fully resolved or if you have additional questions later on, don’t hesitate to follow up with the credit card issuer. Persistence can often lead to a satisfactory resolution.

Remember, credit card issuers have dedicated customer service departments to assist cardholders with their inquiries and concerns. They are there to provide assistance and ensure that you have a positive experience with their services.

If you are unable to resolve your concerns with the credit card issuer or have further issues, you may consider seeking guidance from a consumer protection agency or seeking legal advice from a professional.

Conclusion

Cancelling a credit card is a common occurrence for many individuals, whether it’s due to changing financial needs, seeking better terms and rewards, or addressing fraudulent activity. Understanding what happens to a refund on a cancelled credit card is crucial to ensure a smooth process and peace of mind.

In this article, we’ve explored various aspects related to credit card cancellations and pending refunds. We discussed common reasons for credit card cancellations and the process involved in cancelling a credit card. We also covered different scenarios for handling pending refunds, including automatic statement credits, transferring refunds to another card, and receiving refunds via check. Additionally, we addressed the specific considerations when dealing with lost or expired credit cards and seeking assistance from the credit card issuer.

It’s essential to remember that each credit card issuer may have their own policies and procedures when it comes to handling refunds on cancelled credit cards. Therefore, it’s always recommended to reach out and consult with your credit card issuer directly for specific information and guidance.

By understanding the refund process and communicating effectively with your credit card issuer, you can ensure that any pending refunds are handled promptly and appropriately. While cancelling a credit card may have its complexities, being informed and proactive can help you navigate the process with confidence.

Remember, when it comes to managing your financial accounts, staying informed is key. Consider regularly reviewing the terms and conditions of your credit cards, understanding their cancellation policies, and keeping track of any pending refunds. This knowledge will empower you to make informed decisions and maintain control over your financial well-being.