Finance

What Is Ach Credit Tax Refund

Modified: January 15, 2024

Learn about Ach credit tax refund in finance. Understand how it works and how you can benefit from it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of tax refunds, where a little extra cash can bring a lot of cheer! If you’re like most people, you eagerly await your annual tax refund as a reward for all those hours spent gathering receipts and filing paperwork. But did you know that there’s a more convenient way to receive your tax refund? It’s called Ach Credit Tax Refund.

Ach Credit Tax Refund is a modern and efficient method of receiving your tax refund directly in your bank account. The term “Ach” stands for Automated Clearing House, a network that facilitates electronic transactions between financial institutions in the United States. Thanks to Ach Credit Tax Refund, you can say goodbye to waiting for a paper check to arrive in the mail and instead have your refund deposited directly into your bank account.

In this article, we will explore the ins and outs of Ach Credit Tax Refund, including how it works, its benefits, drawbacks, and how you can sign up for this convenient service.

So, if you’re tired of the hassle of traditional tax refund methods and are ready to embrace a faster and more convenient way of receiving your hard-earned money, buckle up and let’s dive deeper into the world of Ach Credit Tax Refund!

Definition of Ach Credit Tax Refund

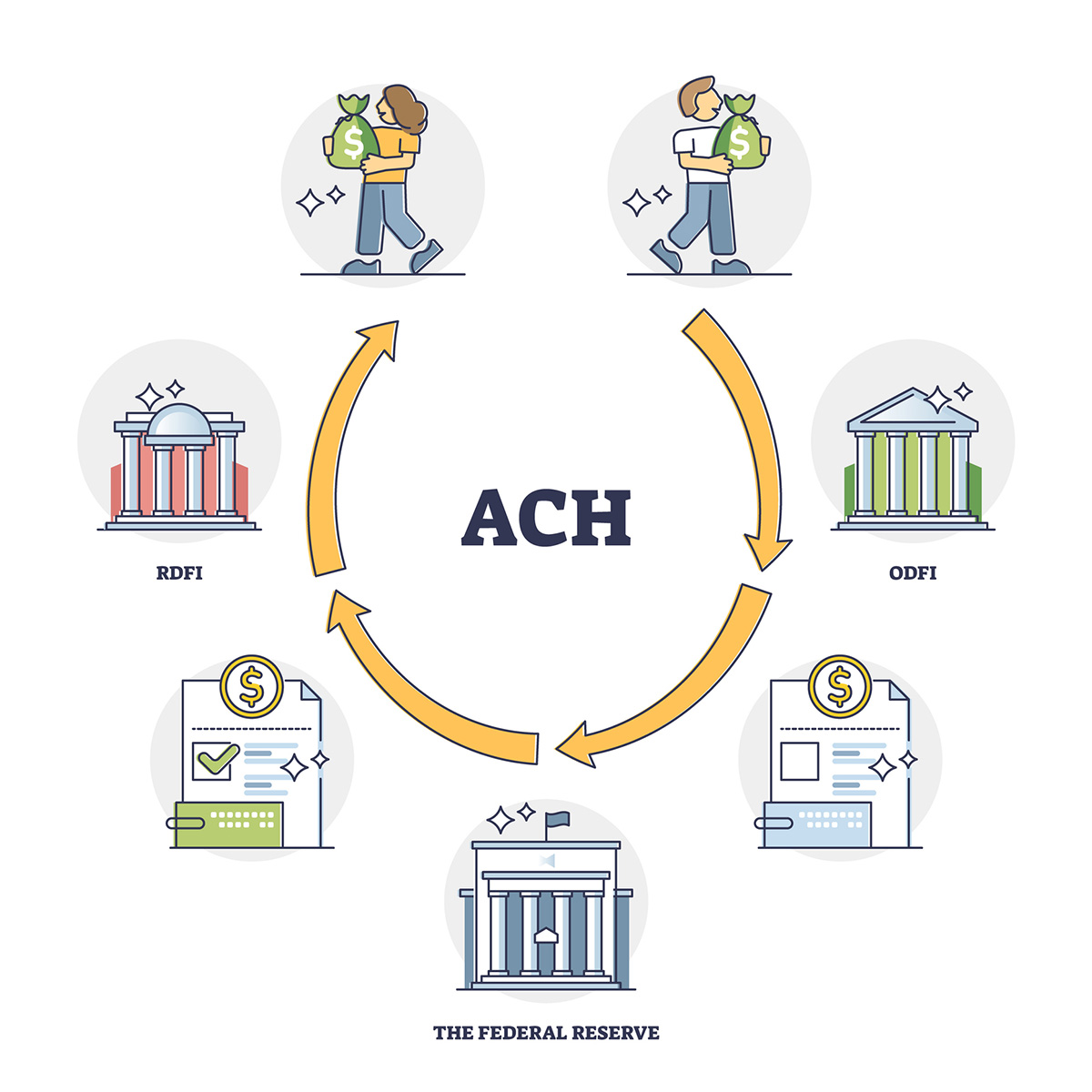

Ach Credit Tax Refund is a method of receiving your tax refund directly in your bank account through the Automated Clearing House (Ach) network. Instead of waiting for a paper check to arrive in the mail, the funds are electronically transferred to your designated bank account, providing a quicker and more secure way to access your tax refund.

The Ach network serves as the intermediary between the government agency issuing the tax refund, such as the Internal Revenue Service (IRS), and your financial institution. This electronic transfer of funds eliminates the need for physical checks and the risk of them getting lost or delayed in the mail.

When you opt for Ach Credit Tax Refund, the funds are typically deposited into your bank account within a few business days after the IRS processes your tax return. The exact timing can vary depending on factors such as the volume of refund requests being processed and the efficiency of your financial institution.

It’s important to note that Ach Credit Tax Refund is only available for refunds owed to you by the government. If you owe taxes or have outstanding debts, the Ach Credit method cannot be used to pay those obligations.

Overall, Ach Credit Tax Refund provides a convenient and reliable way to receive your tax refund. It eliminates the need to wait for a check in the mail and allows you to access your funds faster, providing greater flexibility and convenience in managing your finances.

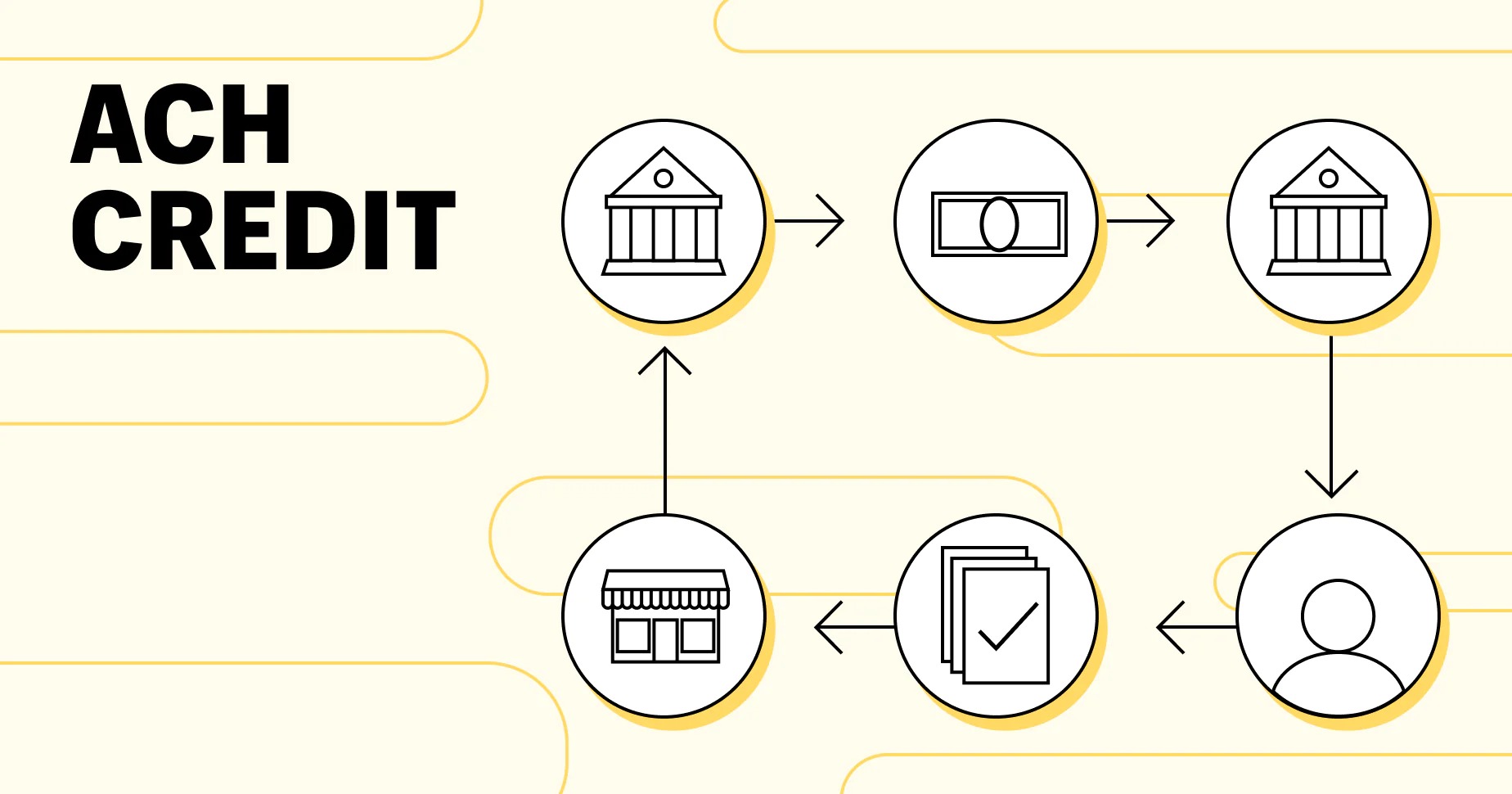

How Ach Credit Tax Refunds Work

Now that we understand what Ach Credit Tax Refund is, let’s explore how this process works. Here are the key steps involved:

- Filing your tax return: The first step in receiving an Ach Credit Tax Refund is to file your tax return with the appropriate government agency, such as the IRS. Whether you choose to file your taxes online or by mail, make sure to enter your bank account information accurately for the direct deposit.

- Verification and processing: Once your tax return is filed, the government agency will verify the information and process your refund request. This involves reviewing your tax documents, calculating the refund amount based on deductions and credits, and ensuring that there are no errors or discrepancies.

- Approval and transfer: After your tax return is processed and approved, the government will initiate the transfer of funds through the Ach network to your designated bank account. This electronic transfer is secure and eliminates the need for physical checks.

- Bank deposit: Once the funds are transferred, your bank will receive the deposit and credit it to your account. Typically, you will receive an email or notification from your bank confirming the deposit. The exact timing of the deposit may vary depending on the processing times of both the government agency and your financial institution, but it generally takes a few business days.

- Accessing the funds: Once the funds are deposited into your bank account, you can easily access them through ATM withdrawals, online banking, or using a debit card linked to your account. You now have the freedom to use your tax refund as you see fit, whether it’s to pay off debts, save for the future, or enjoy a well-deserved treat.

It’s important to ensure that you provide accurate bank account information when filing your tax return to avoid any delays or errors in receiving your Ach Credit Tax Refund. Additionally, be aware that if there are any issues with your return or if the refund amount is adjusted, the government agency may notify you and provide details regarding the changes.

Overall, Ach Credit Tax Refunds simplify the process of receiving your tax refund, allowing for faster access to your funds and minimizing the risk of lost or delayed checks.

Benefits of Ach Credit Tax Refund

Ach Credit Tax Refund offers several benefits compared to traditional methods of receiving tax refunds. Here are some of the key advantages:

- Speed and convenience: One of the primary advantages of Ach Credit Tax Refund is the speed at which you receive your refund. Instead of waiting for a paper check to arrive in the mail, the funds are electronically transferred to your bank account, typically within a few business days. This eliminates the need to visit a bank to deposit the check and allows for immediate access to your funds.

- Security: Ach Credit Tax Refund provides a more secure way to receive your tax refund. With physical checks, there is always a risk of them getting lost or stolen in the mail. By having the funds directly deposited into your bank account, you eliminate this risk and ensure the safe receipt of your refund.

- Accuracy: When you opt for Ach Credit Tax Refund, the chances of errors or discrepancies with your refund are minimized. The electronic transfer process is automated, reducing the likelihood of manual entry errors that can occur with paper checks. This helps to ensure that you receive the correct refund amount without any additional delays or complications.

- Convenience and flexibility: Having your tax refund deposited directly into your bank account offers greater convenience and flexibility in managing your finances. You can easily access the funds through ATM withdrawals, online banking, or by using your debit card. This allows you to immediately use the money for essential expenses, savings, or other financial goals.

- Environmentally friendly: By choosing Ach Credit Tax Refund, you contribute to a more sustainable future. Electronic transfers eliminate the need for paper checks, reducing paper waste and the environmental impact associated with printing and mailing physical documents.

Overall, Ach Credit Tax Refund streamlines the process of receiving your tax refund, providing numerous benefits such as speed, security, accuracy, convenience, flexibility, and environmental sustainability. It’s a modern and efficient way to access your hard-earned money without the hassle of traditional refund methods.

Drawbacks of Ach Credit Tax Refund

While Ach Credit Tax Refund offers many advantages, it’s important to consider the potential drawbacks as well. Here are some of the key limitations:

- Lack of physical check: Unlike traditional tax refunds, Ach Credit Tax Refund does not provide you with a physical check that you can hold in your hands. This may be a drawback for individuals who prefer the tangible nature of a paper check or who have difficulty accessing electronic banking services.

- Banking requirements: To receive an Ach Credit Tax Refund, you must have a bank account that is compatible with direct deposits. If you do not have a bank account or if your bank does not support Ach transfers, you may need to open a new account or find an alternative method of receiving your tax refund.

- Account issues and delays: In some cases, delays or complications may occur during the Ach transfer process. It’s possible that the transfer could be delayed due to technical issues, incorrect account information, or other unforeseen circumstances. If such issues arise, it may take additional time and effort to resolve them and receive your refund.

- Privacy concerns: When opting for Ach Credit Tax Refund, you need to provide your bank account information to the government agency processing your refund. While security measures are in place to protect your personal information, some individuals may have concerns about sharing sensitive financial data.

- Limited payment options: Unlike receiving a paper check, Ach Credit Tax Refund limits your payment options to electronic banking services. This means that you may not be able to deposit the funds in alternative ways, such as through a check cashing service or at a physical bank branch.

It’s important to weigh these drawbacks against the benefits of Ach Credit Tax Refund and consider your personal preferences and circumstances. If the drawbacks present significant challenges for you, exploring other refund options may be more suitable.

Overall, while Ach Credit Tax Refund offers many advantages, it’s essential to be aware of the potential limitations and determine if this method aligns with your banking preferences and needs.

How to Sign Up for Ach Credit Tax Refund

Signing up for Ach Credit Tax Refund is a straightforward process that involves providing your bank account information when filing your tax return. Here are the steps to follow:

- Gather the necessary information: Before starting the tax filing process, gather the required information, such as your Social Security Number, income documents, and other relevant tax-related documents. Additionally, ensure that you have your bank account information readily available, including the account number and routing number.

- Choose a tax preparation method: You have several options for preparing and filing your taxes, including using tax preparation software, hiring a professional tax preparer, or filing your taxes manually. Select the method that best suits your preferences and needs.

- Enter your bank account details: When prompted during the tax filing process, provide your bank account information accurately. This typically includes entering the account number and routing number. Double-check the information before submitting to avoid any errors or delays in receiving your refund.

- Complete and file your tax return: Proceed with completing your tax return, ensuring that all necessary information is entered correctly. Review the return for accuracy and make any necessary adjustments or corrections before submitting it.

- Select direct deposit: As part of the tax filing process, you will have the option to choose how you want to receive your refund. Select the direct deposit option, indicating that you would like to receive your refund through Ach Credit Tax Refund.

- Submit your tax return: After completing the necessary steps and reviewing your tax return, electronically submit it to the appropriate government agency, such as the IRS. If you are filing a paper return, include your bank account information on the provided form.

- Track your refund: Once your tax return is submitted, you can track the status of your refund using the online tracking tools provided by the government agency. These tools will provide updates on the processing and deposit of your Ach Credit Tax Refund.

Keep in mind that the process may vary slightly depending on the tax preparation method and online platform you choose. Always follow the instructions provided by the tax software or preparer to ensure a smooth process.

By providing your bank account information and selecting direct deposit, you can sign up for Ach Credit Tax Refund and enjoy the benefits of faster, more convenient access to your tax refund.

Frequently Asked Questions about Ach Credit Tax Refund

Here are answers to some common questions about Ach Credit Tax Refund:

-

How long does it take to receive an Ach Credit Tax Refund?

The timing of the refund deposit can vary depending on various factors, such as the volume of refund requests being processed and the efficiency of your financial institution. Usually, Ach Credit Tax Refunds are deposited into your bank account within a few business days after the government agency processes your tax return. -

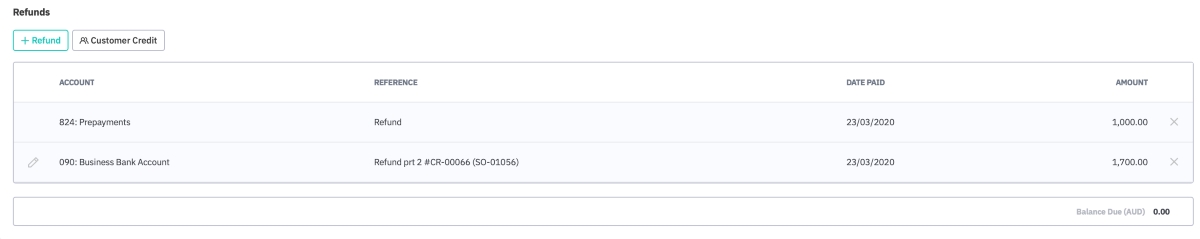

Can I split my tax refund into multiple accounts through Ach Credit?

Yes, you may have the option to split your tax refund into multiple accounts. During the tax filing process, you can allocate specific amounts or percentages to different bank accounts. This allows you to direct a portion of your refund to different financial goals or accounts, such as savings, checking, or investment accounts. -

Can I change my bank account information for Ach Credit Tax Refund?

If you need to change your bank account information after submitting your tax return, you should notify the government agency as soon as possible. Depending on the stage of processing, they may be able to update your account details. It’s crucial to provide accurate information to ensure the smooth and timely deposit of your tax refund. -

What if my Ach Credit Tax Refund is deposited into the wrong bank account?

If your refund is mistakenly deposited into an incorrect bank account, you should contact the government agency responsible for issuing the refund immediately. They will guide you through the process of rectifying the situation and recovering the funds. It’s essential to address this issue promptly to avoid any complications. -

Are there any fees associated with Ach Credit Tax Refund?

In most cases, receiving an Ach Credit Tax Refund does not incur any additional fees. However, fees may apply depending on your specific bank account terms and conditions. It’s advisable to review the fee structure of your bank account and consult with your financial institution if you have any concerns or questions.

Remember, if you have specific questions or concerns about Ach Credit Tax Refund, it’s best to consult with the government agency responsible for issuing your refund or seek guidance from a tax professional. They can provide accurate and personalized information based on your unique circumstances.

Conclusion

Ach Credit Tax Refund offers a convenient and efficient way to receive your tax refund directly in your bank account through the Automated Clearing House network. By choosing this method, you can enjoy several benefits, including speed, security, accuracy, convenience, flexibility, and environmental sustainability.

With Ach Credit Tax Refund, you no longer have to wait for a paper check to arrive in the mail or worry about the risk of lost or stolen checks. Instead, the funds are electronically transferred to your bank account, typically within a few business days. This provides you with immediate access to your tax refund, enabling you to manage your finances more effectively.

While there may be some limitations, such as the lack of a physical check and banking requirements, the advantages of Ach Credit Tax Refund outweigh these drawbacks for most individuals. The process of signing up for Ach Credit Tax Refund is straightforward, requiring you to provide your bank account information when filing your tax return.

Remember, it’s important to provide accurate bank account details and select direct deposit to ensure a smooth and timely deposit of your Ach Credit Tax Refund. You can track the status of your refund online, and if any issues arise, it’s crucial to contact the government agency promptly to address them.

Overall, Ach Credit Tax Refund simplifies the process of receiving your tax refund, providing a quicker, safer, and more convenient way to access your funds. So, why wait for a paper check when you can embrace this modern and efficient method? Consider opting for Ach Credit Tax Refund and experience a hassle-free way to enjoy your hard-earned tax refund.