Finance

Where Is Preferred Stock On Balance Sheet

Published: December 27, 2023

Learn about the placement of preferred stock on a balance sheet in finance and understand its significance for businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When analyzing a company’s financial health, one key document that provides valuable insights is the balance sheet. The balance sheet is a snapshot of a company’s financial position at a specific point in time, showcasing its assets, liabilities, and shareholders’ equity. While most people are familiar with common stock, there is another type of equity that often appears on the balance sheet – preferred stock.

Preferred stock is a unique type of investment that sits between debt and common stock in terms of its characteristics and rights. It represents ownership in a company but typically does not carry voting rights like common stock does. Instead, holders of preferred stock receive preferential treatment in certain aspects, such as receiving dividends before common stockholders.

In this article, we will explore where preferred stock appears on the balance sheet and its implications for financial analysis. Understanding the position and classification of preferred stock on the balance sheet is essential for investors, analysts, and other stakeholders as it provides a deeper understanding of a company’s capital structure and financial position.

Let’s dive into the details of preferred stock and how it is represented on the balance sheet.

Definition of Preferred Stock

Preferred stock is a type of equity investment that represents ownership in a company, just like common stock. However, it differs from common stock in several key ways. Unlike common stockholders, who have voting rights in the company, preferred stockholders typically do not have voting rights or have limited voting rights.

What sets preferred stock apart is its preferential treatment in terms of dividend payments and liquidation rights. Preferred stockholders are entitled to receive dividends before common stockholders. In the event of a company’s liquidation or bankruptcy, preferred stockholders have a higher claim on the company’s assets than common stockholders do.

Preferred stock can be issued with different features, such as cumulative or non-cumulative dividends. Cumulative preferred stock guarantees that if a company fails to pay dividends in a given year, the unpaid dividends accumulate and must be paid out to preferred stockholders before any dividends can be paid to common stockholders. Non-cumulative preferred stock, on the other hand, does not accumulate unpaid dividends.

Another important aspect of preferred stock is its fixed dividend rate. Unlike common stock, which pays dividends at the discretion of the company’s board of directors, preferred stock has a predetermined dividend rate specified at the time of issuance. This fixed dividend rate provides preferred stockholders with a predictable income stream.

It is important to note that while preferred stock represents ownership in a company, it is considered a hybrid security as it combines aspects of both equity and debt. The fixed dividend rate, preference in dividends, and higher claim in the event of liquidation give preferred stock certain characteristics of debt instruments.

With a clear understanding of preferred stock and its unique features, we can now explore where it appears on a company’s balance sheet.

Balance Sheet Overview

The balance sheet is one of the key financial statements used by investors, analysts, and other stakeholders to assess a company’s financial position. It provides a snapshot of the company’s assets, liabilities, and shareholders’ equity at a specific point in time.

The balance sheet follows the fundamental accounting equation, which states that assets equal liabilities plus shareholders’ equity. This equation ensures that the balance sheet remains balanced, with the company’s resources (assets) funded either by liabilities (debt) or shareholders’ equity (ownership).

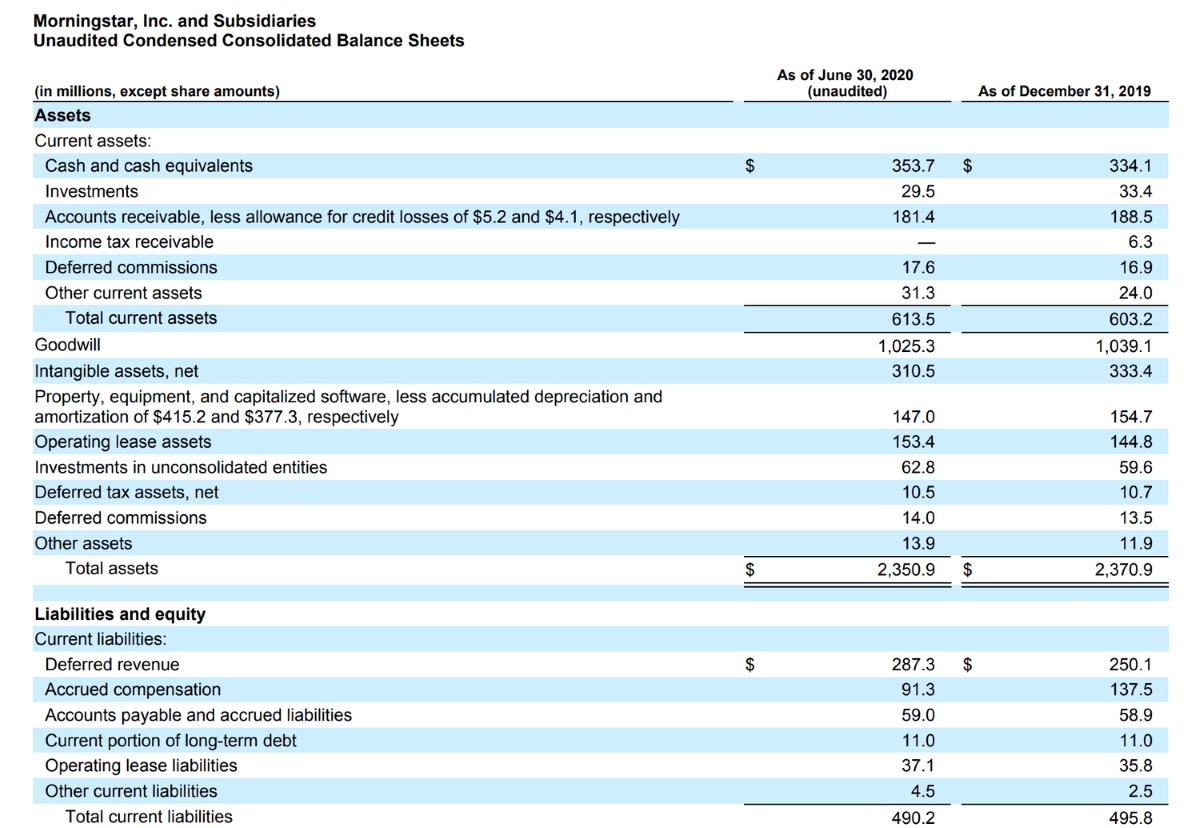

Assets are categorized into two main groups on the balance sheet – current assets and non-current assets. Current assets are expected to be converted into cash or used up within one year, while non-current assets are typically used in the long-term operations of the business.

Liabilities are also classified into current liabilities and non-current liabilities. Current liabilities are those that are expected to be settled within one year, such as accounts payable or short-term debt. Non-current liabilities, on the other hand, represent the company’s long-term obligations, such as long-term debt or deferred tax liabilities.

Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It includes common stock, retained earnings, and, importantly for this article, preferred stock.

By examining the balance sheet, investors can gain insights into a company’s liquidity, solvency, and overall financial health. The balance sheet provides a comprehensive picture of a company’s resources, obligations, and the claims of its shareholders.

Now that we have a general understanding of the balance sheet, let’s take a closer look at its components and where preferred stock fits in.

Components of a Balance Sheet

The balance sheet is composed of various components, each representing different aspects of a company’s financial position. Understanding these components is crucial for a comprehensive analysis of the balance sheet and the overall financial health of the company.

1. Assets: Assets are the resources owned or controlled by the company that have economic value. They are categorized into two main groups:

- Current Assets: Current assets include cash, short-term investments, accounts receivable, inventory, and other assets that are expected to be converted into cash or used up within one year.

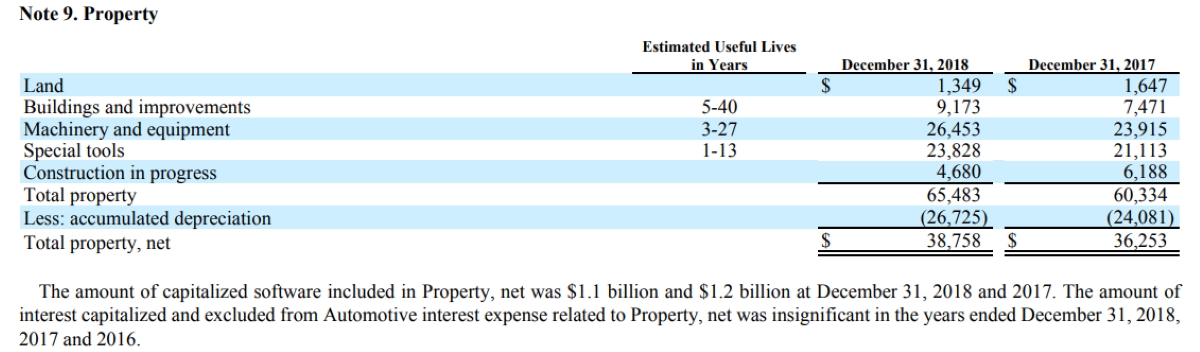

- Non-Current Assets: Non-current assets are long-term assets that are not expected to be converted into cash or used up within one year. They include property, plant, and equipment, intangible assets, long-term investments, and other long-term assets.

2. Liabilities: Liabilities represent the company’s obligations to external parties. Like assets, liabilities are also divided into two main categories:

- Current Liabilities: Current liabilities are the obligations that are expected to be settled within one year. Accounts payable, short-term debt, and accrued expenses are examples of current liabilities.

- Non-Current Liabilities: Non-current liabilities are the long-term obligations of the company that are not expected to be settled within one year. Long-term debt, deferred tax liabilities, and pension liabilities are examples of non-current liabilities.

3. Shareholders’ Equity: Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It consists of the following components:

- Common Stock: Common stock represents the ownership interest of the common stockholders in the company.

- Retained Earnings: Retained earnings are the cumulative earnings of the company that have been retained and reinvested in the business.

- Preferred Stock: Preferred stock represents the ownership interest of the preferred stockholders and is the focus of this article. Preferred stockholders have preferential rights over common stockholders, such as preference in dividend payments and liquidation.

By analyzing the components of the balance sheet, investors can gain insights into a company’s liquidity, solvency, and the allocation of resources among different stakeholders. Now that we understand the components of a balance sheet, let’s explore where preferred stock fits into this financial statement.

Where Preferred Stock Appears on the Balance Sheet

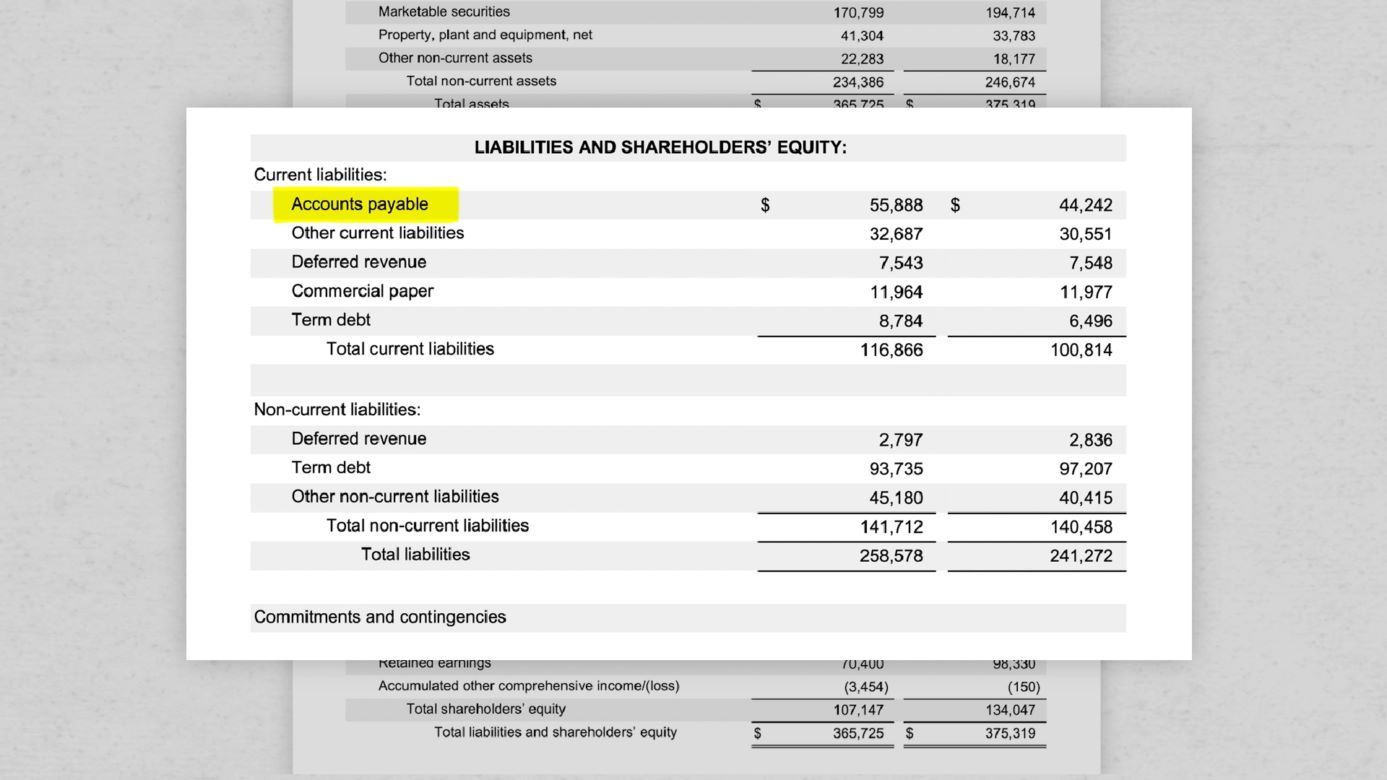

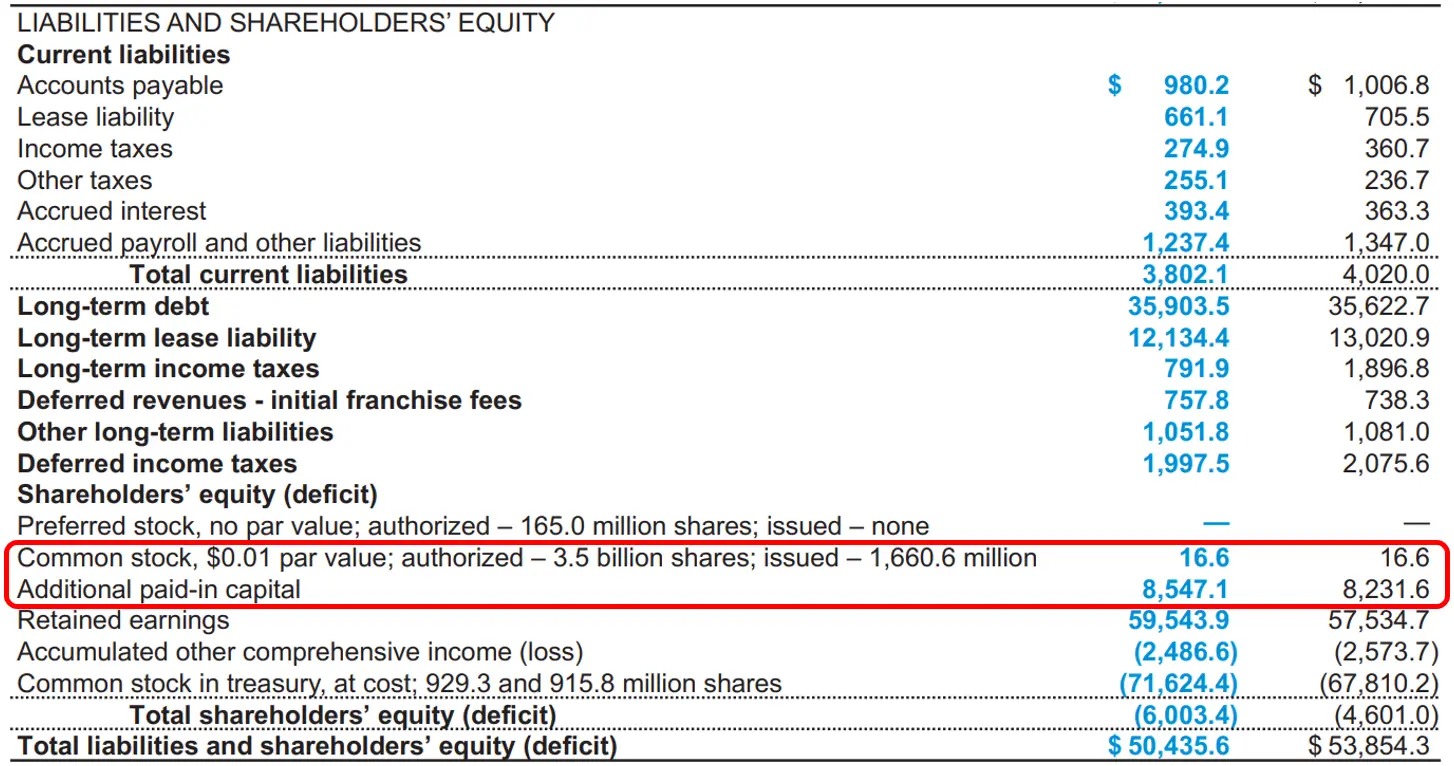

Preferred stock is reported in the shareholders’ equity section of the balance sheet. It is typically listed after common stock and before retained earnings. The precise location can vary depending on the reporting format of the balance sheet, but preferred stock is consistently classified as part of shareholders’ equity.

Within the shareholders’ equity section, preferred stock is often further broken down into different classes or series. Each class or series may have unique features, such as different dividend rates or voting rights. The breakdown allows for a detailed presentation of the various types of preferred stock issued by the company.

Under the preferred stock section, you will typically find the following information:

- Preferred stock description: This includes the name or series of the preferred stock and any additional relevant details, such as the dividend rate and any redemption provisions.

- Number of shares issued: This indicates the total number of preferred stock shares that have been issued by the company.

- Par value: Par value is the nominal value assigned to each share of preferred stock. It is essentially an arbitrary amount and does not reflect the actual market value of the stock.

- Preferred stock value: This represents the total value of the preferred stock issued, calculated by multiplying the number of shares issued by the par value.

- Dividends in arrears (if applicable): If the preferred stock is cumulative and there are unpaid dividends from previous periods, this will be disclosed. It shows the amount of dividends that have accumulated but not yet been paid to preferred stockholders.

It’s important to note that preferred stock does not have a maturity date like debt instruments. It remains on the balance sheet until it is redeemed or retired by the company.

By clearly identifying the preferred stock and its characteristics on the balance sheet, companies provide transparency to investors and allow them to assess the impact of preferred stock on the overall capital structure and financial health of the company.

Now that we know where preferred stock appears on the balance sheet, let’s discuss the different classifications of preferred stock.

Classification of Preferred Stock

Preferred stock can be classified into different categories based on various characteristics and rights it possesses. These classifications provide insights into the specific features and benefits associated with each type of preferred stock. Let’s explore some common classifications:

- Cumulative Preferred Stock: Cumulative preferred stock entitles holders to receive any unpaid dividends in future periods before common stockholders can receive dividends. If a company fails to pay dividends in a particular year, the unpaid dividends accumulate and must be paid out to preferred stockholders before any dividends can be paid to common stockholders.

- Non-cumulative Preferred Stock: Non-cumulative preferred stock does not accumulate unpaid dividends. If a company skips paying dividends in a specific year, preferred stockholders will not receive the missed dividends in the future.

- Convertible Preferred Stock: Convertible preferred stock offers the option for shareholders to convert their shares into a specified number of common shares of the issuing company. This conversion feature provides an opportunity for preferred stockholders to participate in potential future growth and capital appreciation.

- Callable Preferred Stock: Callable preferred stock allows the issuing company to redeem the shares, usually at a predetermined price, before their specified maturity date. This gives the company the flexibility to retire the preferred stock if it becomes economically advantageous or if there are changes in the company’s capital structure.

- Participating Preferred Stock: Participating preferred stock entitles holders to receive additional dividends on top of their fixed dividend rate if the company achieves a certain level of profitability. This means that preferred stockholders not only receive their fixed dividend but also have the opportunity to share in the company’s surplus profits.

These are just a few examples of the various classifications of preferred stock. It’s important to note that companies can also issue preferred stock with unique or customized features that may not fit into these common classifications.

Understanding the classification of preferred stock is crucial for investors to evaluate the specific rights, risks, and potential returns associated with each type. The classification also aids in understanding the capital structure of the company and its implications for financial analysis.

Now that we understand the different classifications of preferred stock, let’s discuss the impact of preferred stock on financial analysis.

Impact of Preferred Stock on Financial Analysis

Preferred stock plays a significant role in the financial analysis of a company. Its presence on the balance sheet can have both direct and indirect impacts on various financial metrics and ratios. Let’s explore how preferred stock influences financial analysis:

1. Dividend Coverage Ratio: The dividend coverage ratio is a measure of a company’s ability to pay dividends to its shareholders, including preferred stockholders. The existence of preferred stock and its dividend obligations need to be accounted for when assessing the company’s ability to generate enough cash flow to cover these dividend payments.

2. Debt-to-Equity Ratio: The debt-to-equity ratio is a measure of a company’s financial leverage and its reliance on debt financing. Preferred stock is typically classified as part of the equity component on the balance sheet, which contributes to the denominator of the debt-to-equity ratio. The inclusion of preferred stock in the equity portion affects the overall ratio and provides a more comprehensive view of the company’s capital structure.

3. Return on Equity (ROE): ROE is a measure of a company’s profitability and is calculated by dividing net income by shareholders’ equity. Since preferred stock is included in the shareholders’ equity section, the presence of preferred stock may impact the overall ROE calculation. Preferred stock typically requires dividend payments, which can reduce the amount of net income available to common stockholders and therefore impact the ROE ratio.

4. Liquidity Analysis: Preferred stock’s classification on the balance sheet as part of shareholders’ equity provides insights into the company’s equity position and its ability to meet long-term obligations. It allows analysts to assess the company’s overall liquidity position and potential cash flows available for both preferred stock and common stock dividends.

5. Investor Perception and Risk Assessment: The presence of preferred stock and its specific classification can impact investor perception and risk assessment. Different classifications, such as cumulative or non-cumulative preferred stock, can provide insights into the reliability and stability of dividend payments, thus influencing investor confidence and risk perception.

It is important to consider the impact of preferred stock on financial analysis and adjust the relevant metrics and ratios accordingly. This ensures a comprehensive evaluation of the company’s financial health and a more accurate understanding of its capital structure.

Now, let’s consider other important considerations for preferred stock on the balance sheet.

Other Considerations for Preferred Stock on the Balance Sheet

While the classification and impact of preferred stock on the balance sheet have been discussed, there are other important considerations to keep in mind when analyzing preferred stock:

1. Redemption Provisions: Preferred stock may have redemption provisions that allow the issuing company to redeem the shares at a specified price or within a specific timeframe. Understanding these provisions is crucial as they can impact the potential return on investment for preferred stockholders.

2. Tax Implications: Preferred stock dividends may have different tax implications compared to common stock dividends. It’s important to consider how these tax factors can affect the overall return and tax planning strategies for investors and the issuing company.

3. Market Demand and Pricing: The market demand for preferred stock can greatly influence its pricing and liquidity. Factors such as interest rates, company performance, and investor sentiment can impact the market value of preferred stock. This should be taken into account when evaluating the overall financial picture of a company.

4. Company’s Capital Structure Strategy: The presence of preferred stock on the balance sheet reflects the company’s capital structure strategy. Some companies may use preferred stock as a means of raising capital without diluting existing common stockholders. Analyzing the company’s capital structure decisions and understanding the rationale behind issuing preferred stock can provide valuable insights into management’s financial strategy.

5. Comparative Analysis: Comparing a company’s use of preferred stock to industry peers and competitors can provide insights into industry norms and potential risks or advantages of a company’s capital structure. Assessing how preferred stock is integrated into the overall financial strategy of the company can contribute to a more comprehensive analysis.

Taking these considerations into account when analyzing preferred stock on the balance sheet allows for a more nuanced assessment of a company’s financial position, risk profile, and capital structure decisions.

Now, let’s conclude the article with a summary of the key points discussed.

Conclusion

Preferred stock is an important component of a company’s balance sheet and provides unique characteristics and rights for investors. It represents an ownership interest that falls between debt and common stock, offering preferential treatment in terms of dividend payments and liquidation rights.

Understanding where preferred stock appears on the balance sheet is crucial for analyzing a company’s financial health. It is typically listed in the shareholders’ equity section, alongside common stock and retained earnings. Analyzing the specific details provided, such as the number of shares, par value, and any dividends in arrears, helps to gain deeper insights into the preferred stock’s impact on the overall financial position.

Classifications of preferred stock, such as cumulative, non-cumulative, convertible, callable, and participating, further enhance our understanding of the rights and risks associated with each type. These classifications influence financial analysis and metrics such as dividend coverage, debt-to-equity ratio, return on equity, and liquidity assessment.

When analyzing preferred stock, it is important to consider other factors beyond the balance sheet, such as redemption provisions, tax implications, market demand, and the company’s capital structure strategy. These factors provide a more comprehensive assessment of the preferred stock’s value and its implications for both investors and the company’s overall financial strategy.

In conclusion, preferred stock on the balance sheet represents a unique class of equity with its distinct characteristics and impacts on financial analysis. By understanding its position, classification, and implications, investors, analysts, and other stakeholders can gain valuable insights into a company’s capital structure, financial health, and the potential risks and rewards associated with preferred stock investments.

Now equipped with this knowledge, investors can make more informed decisions and conduct thorough financial analysis when assessing companies that issue preferred stock.