Finance

What Health Insurance Do The Rich Have?

Published: October 30, 2023

Discover the health insurance options that the wealthy choose to safeguard their finances. Gain insights about finance and healthcare for the affluent.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s world, health insurance is a crucial aspect of financial planning. It not only helps protect individuals and families from unforeseen medical expenses but also provides access to quality healthcare services. When it comes to the rich, their approach to health insurance can be quite different from the average person.

While everyone needs health insurance to cover medical costs, the rich often have the means to explore more exclusive and personalized options. They can afford to prioritize tailored healthcare solutions and additional benefits that go beyond the standard coverage provided by traditional insurance plans.

In this article, we will delve into the various types of health insurance that the wealthy opt for to meet their specific needs. From private health insurance to executive health programs, we will explore the options that cater to the unique requirements of affluent individuals.

It’s important to note that these options are not limited to the rich alone; they simply tend to have more resources at their disposal to explore such avenues. Let’s now explore the diverse landscape of health insurance choices available to the wealthy.

Private Health Insurance

Private health insurance offers individuals and families the opportunity to go beyond the coverage provided by public health insurance programs. The rich often opt for private health insurance plans as they offer a wider range of benefits, greater flexibility, and access to top-notch healthcare providers.

Private health insurance plans typically offer coverage for a variety of medical services, including doctor visits, hospital stays, surgeries, and prescription medications. They often have a more extensive network of specialists and hospitals to choose from, giving policyholders access to the best medical expertise.

One of the key advantages of private health insurance for the rich is the ability to customize their coverage according to their specific needs. They can choose plans that offer additional benefits such as coverage for alternative therapies, elective procedures, or access to exclusive medical facilities.

Private health insurance also offers shorter wait times for medical procedures, ensuring prompt access to healthcare services. This can be crucial for the rich, who may have busy schedules and limited time to wait for treatments.

Additionally, private health insurance plans often provide access to comprehensive wellness programs, including preventive care services, health screenings, and personalized health coaching. These programs allow the rich to proactively manage their health and prevent potential health issues from arising.

While private health insurance plans come with a higher price tag compared to public health insurance options, the rich are willing to pay the premium to receive the enhanced benefits and personalized care that come with it.

It’s important to note that private health insurance is not just limited to the wealthy. Many individuals and families from various socioeconomic backgrounds choose to invest in private health insurance as it provides them with greater control and flexibility over their healthcare options.

Concierge Medicine

Concierge medicine, also known as boutique medicine or retainer medicine, is a healthcare model that offers personalized and exclusive medical care to individuals, including the wealthy. In this model, patients pay an annual or monthly fee to gain enhanced access to their chosen healthcare provider.

With concierge medicine, the rich have the advantage of having a dedicated and highly accessible primary care physician who offers extended appointment times, same-day or next-day visits, and even 24/7 direct contact availability. This personalized attention allows for more thorough and proactive healthcare management.

Concierge medicine practices often have a limited number of patients, allowing physicians to provide more personalized and unhurried care. Patients can expect longer consultations, comprehensive health assessments, and tailored treatment plans.

In addition to the enhanced access to primary care, concierge medicine often includes additional benefits such as access to specialized services, expedited referrals to specialists, and coordination of care with other medical providers. Some concierge practices even provide in-home visits and personalized health and wellness programs.

One of the key attractions of concierge medicine for the wealthy is the convenience it offers. With direct and easy communication with their physician and a focus on preventive care, concierge medicine allows the rich to receive prompt and quality healthcare services without the hassle of waiting in long lines or dealing with bureaucratic processes.

It’s worth noting that concierge medicine can come at a significant cost. The annual retainer fees can range from a few thousand dollars to tens of thousands of dollars, depending on the level of service and exclusivity provided. While it may be an expensive option, the rich are often willing to invest in concierge medicine for the personalized care and convenience it offers.

However, it’s important to emphasize that concierge medicine is not limited to the wealthy alone. Many individuals, including those from middle-income families, choose this model of care for its benefits and personalized approach to healthcare.

Executive Health Programs

Executive health programs are specialized healthcare offerings designed specifically for busy professionals, including executives and high-net-worth individuals. These programs aim to provide comprehensive health assessments, personalized medical care, and preventive screenings tailored to the specific needs and demanding schedules of executives.

One of the primary advantages of executive health programs for the rich is the efficient and time-saving nature of the services. These programs often offer a streamlined and expedited experience, minimizing wait times and maximizing the efficiency of medical appointments and tests.

Executive health programs typically include an array of comprehensive health assessments, including thorough physical examinations, detailed medical history evaluations, and advanced diagnostic screenings. These screenings can encompass a wide range of tests, such as cardiovascular assessments, cancer screenings, and bloodwork to assess overall health and identify potential health risks.

Moreover, these programs often offer personalized health coaching and lifestyle management services. Executives can receive guidance on nutrition, exercise, stress management, and other key factors that contribute to overall well-being. These services aim to optimize their health, increase energy levels, and improve work productivity.

Executives also benefit from the convenience and confidentiality provided by these programs. They can have their medical examinations and consultations conducted in private settings, away from the general public. This level of privacy and personalized attention is particularly important for individuals in high-profile positions.

While the cost of executive health programs can be significant, the rich often view it as an investment in their well-being and longevity. By prioritizing their health and proactively addressing any potential health issues, executives can maintain peak performance, minimize downtime, and sustain their professional success.

However, it’s essential to emphasize that executive health programs are not solely reserved for the wealthy. Many companies offer these programs as part of their employee benefits packages, making them accessible to a broader range of individuals.

High-Deductible Health Plans

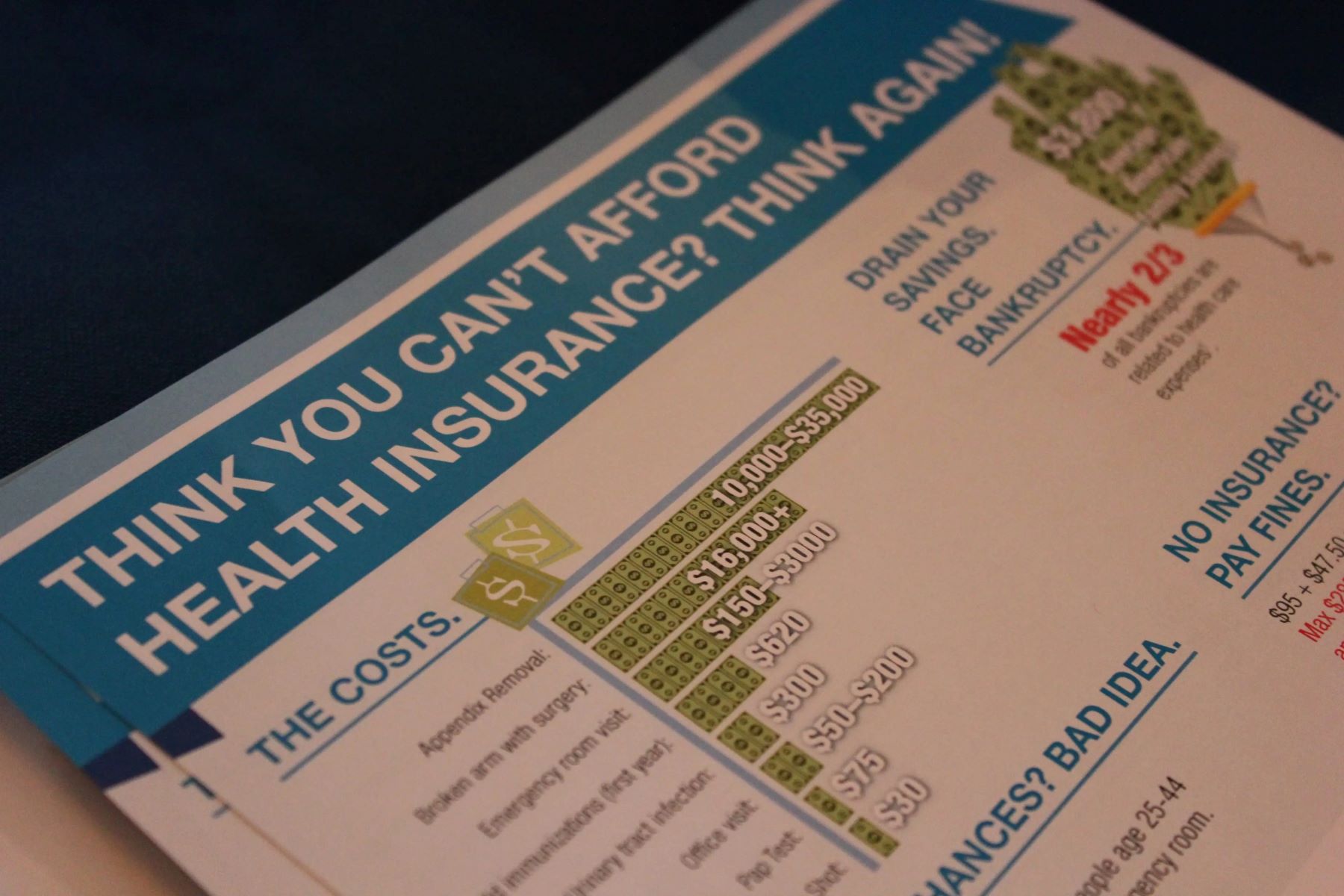

High-deductible health plans (HDHPs) are another option embraced by the rich when it comes to health insurance. These plans offer lower monthly premiums but higher deductibles compared to traditional insurance plans.

With an HDHP, individuals are required to pay a higher amount out of pocket before their insurance coverage kicks in. This deductible can be several thousand dollars, making it a suitable choice for those who are financially well-off and can afford to cover the higher upfront costs.

The wealthy often opt for HDHPs as they provide a level of cost-sharing and control over their healthcare expenses. They have the financial flexibility to handle the higher deductibles while still accessing the coverage benefits for catastrophic events or major medical expenses.

One attractive feature of HDHPs for the affluent is the ability to pair them with a Health Savings Account (HSA). An HSA allows individuals to contribute pre-tax dollars towards qualified medical expenses. The contributions grow tax-free, and withdrawals are tax-free when used for eligible healthcare expenses. This provides an additional avenue for the rich to save and invest their healthcare funds.

HDHPs are particularly beneficial for individuals who are in good health, have predictable healthcare needs, and can afford to pay higher out-of-pocket costs. These plans offer flexibility when it comes to choosing healthcare providers and can be combined with additional insurance options or self-funding for added coverage.

It’s important to note that while HDHPs can provide financial benefits and flexibility for the wealthy, they may not be suitable for everyone. Those with chronic health conditions or frequent medical needs may find the high deductibles and out-of-pocket costs burdensome. It’s crucial to carefully assess individual healthcare needs and financial situations before opting for an HDHP.

Despite being a preferred choice for the rich, HDHPs have become more widespread in recent years, with many employers offering them as part of their employee benefits packages. This has made them accessible to a broader range of individuals, regardless of economic status.

Health Savings Accounts

Health Savings Accounts (HSAs) are tax-advantaged accounts that individuals, including the rich, can use to save and invest money specifically for medical expenses. HSAs are typically paired with High-Deductible Health Plans (HDHPs) and offer individuals greater control and flexibility over their healthcare expenses.

HSAs allow individuals to make tax-free contributions, which can be used to pay for qualified medical expenses, including doctor visits, prescription medications, and medical equipment. The contributions made to an HSA are tax-deductible, and any growth or earnings on the account are tax-free. This makes HSAs an attractive option for the rich, as they can save on taxes while accumulating funds for future healthcare needs.

One of the key advantages of HSAs for the wealthy is the ability to invest the funds within the account, similar to a retirement savings account. The investment growth potential allows affluent individuals to grow their healthcare savings over time, potentially accumulating a substantial amount for future medical expenses.

HSAs offer the freedom to choose healthcare providers and treatments outside of the constraints of traditional insurance networks. This flexibility is particularly valuable for the rich, who may prefer to seek out specialized or alternative medical services that may not be covered by standard insurance plans.

Moreover, HSAs have the added benefit of being portable. The funds in the account remain with the individual even if they change jobs or insurance plans. This portability adds to the appeal of HSAs for the wealthy, who value the ability to maintain control over their healthcare savings regardless of their employment or insurance situation.

While HSAs offer significant advantages, there are certain eligibility requirements that individuals must meet to open and contribute to an HSA. The individual must be enrolled in a qualifying High-Deductible Health Plan, not be covered by any other health insurance, and not be claimed as a dependent on someone else’s tax return.

It’s important to note that HSAs are not just exclusive to the rich. Individuals from various income brackets can benefit from the tax advantages and flexibility offered by HSAs. However, the rich often have the financial resources to contribute larger amounts to their HSAs and take full advantage of the investment growth potential.

Supplemental Health Insurance

Supplemental health insurance is an additional coverage option that individuals, including the wealthy, can consider to complement their existing health insurance plans. It is designed to fill gaps in coverage and provide extra financial protection against specific medical expenses or unforeseen circumstances.

Supplemental health insurance typically offers coverage for expenses not covered by traditional health insurance plans, such as deductibles, copayments, and certain medical services or treatments. It can also provide benefits for specific conditions or events, such as critical illness insurance or accident insurance.

The rich often opt for supplemental health insurance to further enhance their overall coverage and protect their financial well-being. This additional layer of insurance can provide peace of mind and a higher level of protection against unexpected medical expenses.

Supplemental health insurance plans can vary widely in terms of coverage options and benefits. Some common types of supplemental insurance include dental and vision insurance, hospital indemnity insurance, disability insurance, and long-term care insurance.

One key advantage of supplemental health insurance for the wealthy is the ability to choose tailored plans that suit their specific needs. They can select coverage for services or treatments that are relevant to their lifestyle or that may not be adequately covered by their primary health insurance.

Supplemental health insurance can also provide access to enhanced benefits, such as coverage for alternative therapies, private hospital rooms, or expanded prescription drug coverage. These additional benefits align with the preferences and priorities of the rich, who often seek customized and high-quality healthcare services.

It’s important to note that the cost of supplemental health insurance can vary depending on the type of coverage and the level of benefits desired. The wealthy are often willing to invest in these additional plans to ensure comprehensive coverage and mitigate any potential gaps in their primary health insurance.

Supplemental health insurance is not exclusive to the rich; individuals from various economic backgrounds can benefit from these plans. It offers an opportunity to enhance coverage and address specific healthcare needs that may not be fully met by traditional health insurance alone.

International Health Insurance

International health insurance is a specialized type of coverage that provides medical protection for individuals traveling or residing outside of their home country for an extended period of time. This type of insurance is particularly relevant for the rich who often engage in international travel or have multiple residences across different countries.

International health insurance offers a range of benefits and coverage options that go beyond what traditional travel insurance typically provides. It ensures access to quality healthcare services, including emergency medical treatment, hospitalization, and specialized care, no matter where the individual is located in the world.

One of the key advantages of international health insurance for the wealthy is the flexibility it provides. They can choose coverage that suits their specific travel patterns and personal preferences, such as coverage for multiple countries, access to top-tier medical facilities, or the ability to visit any healthcare provider of their choice.

International health insurance often includes benefits such as medical evacuation and repatriation coverage. This is particularly crucial for wealthy individuals who may travel to remote or less-developed areas where access to quality healthcare may be limited. With medical evacuation coverage, they can be transported to a better-equipped medical facility quickly and safely in the event of a medical emergency.

Moreover, international health insurance can offer additional perks and services, such as travel assistance, translation services, and personalized support for medical appointments and procedures. This level of convenience and attention caters to the discerning needs of the rich, who value seamless and premium healthcare experiences no matter where they are in the world.

While international health insurance may come at a higher cost compared to regular travel insurance, the rich prioritize the peace of mind and comprehensive coverage it provides. They understand the importance of having access to top-quality medical care and the financial protection it offers, even when they are far away from their home country.

It’s worth noting that international health insurance is not reserved solely for the wealthy. Individuals from various economic backgrounds who engage in frequent international travel or live abroad can benefit from this type of coverage. It ensures they are well-protected and have access to necessary medical services, regardless of their location.

Conclusion

When it comes to health insurance, the rich have the advantage of being able to explore a wide range of options to meet their specific needs and preferences. They have the means to prioritize personalized care, access exclusive medical services, and fill any gaps in coverage with supplemental or international health insurance.

Private health insurance allows the wealthy to go beyond the standard coverage offered by public health insurance programs. They can customize their plans, access a broader network of healthcare providers, and receive enhanced benefits and services.

Concierge medicine provides personalized, VIP-level healthcare services that cater to the rich’s busy schedules and high expectations. With extended appointment times, same-day access, and comprehensive wellness programs, concierge medicine ensures they receive prompt and thorough care.

Executive health programs offer comprehensive assessments, screenings, and personalized care tailored specifically for busy executives. These programs prioritize efficiency, convenience, and maintaining peak performance for the affluent who need to balance their demanding professional lives.

High-deductible health plans and health savings accounts provide the wealthy with more control over their healthcare expenses and potential tax advantages. They can afford the higher upfront costs and harness the investment potential of the funds in their health savings accounts.

Supplemental health insurance provides additional coverage and fills any gaps in traditional health insurance plans for the rich. It offers customized options for specific healthcare needs and helps protect their financial well-being against unforeseen medical expenses.

International health insurance ensures that the wealthy have comprehensive medical coverage and access to quality healthcare services anywhere in the world. It provides peace of mind during international travel or living in multiple countries.

In conclusion, the rich have a wide array of health insurance options to choose from, allowing them to customize their coverage, prioritize personalized care, and protect their financial well-being. These options offer flexibility, convenience, and the ability to access top-tier healthcare services, catering to the unique needs and preferences of the affluent.

However, it’s important to note that many of these options are not exclusive to the wealthy. Individuals from various socioeconomic backgrounds can also benefit from these health insurance choices, whether it’s through employer-sponsored programs, individual plans, or utilizing available resources.

Ultimately, health insurance plays a crucial role in providing financial security and access to quality healthcare services for individuals of all walks of life. Whether rich or not, everyone should carefully assess their healthcare needs and explore appropriate options to ensure comprehensive coverage and peace of mind.