Home>Finance>What Is A Bank Statement: Definition, Benefits, And Requirements

Finance

What Is A Bank Statement: Definition, Benefits, And Requirements

Published: October 13, 2023

Learn the definition, benefits, and requirements of a bank statement in finance. Understanding the importance of this financial document is crucial for managing your money effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is a Bank Statement: Definition, Benefits, and Requirements

Welcome to the FINANCE category of our blog! In this post, we will take a closer look at one of the fundamental documents in the world of banking – the bank statement. Whether you’re an individual or a business owner, understanding the importance and purpose of a bank statement is crucial for managing your financial affairs effectively.

Key Takeaways:

- A bank statement is a document provided by a bank that provides a summary of your financial transactions during a specific period.

- Bank statements offer numerous benefits, including monitoring your cash flow, reconciling accounts, and providing proof of income for loans or financial reporting.

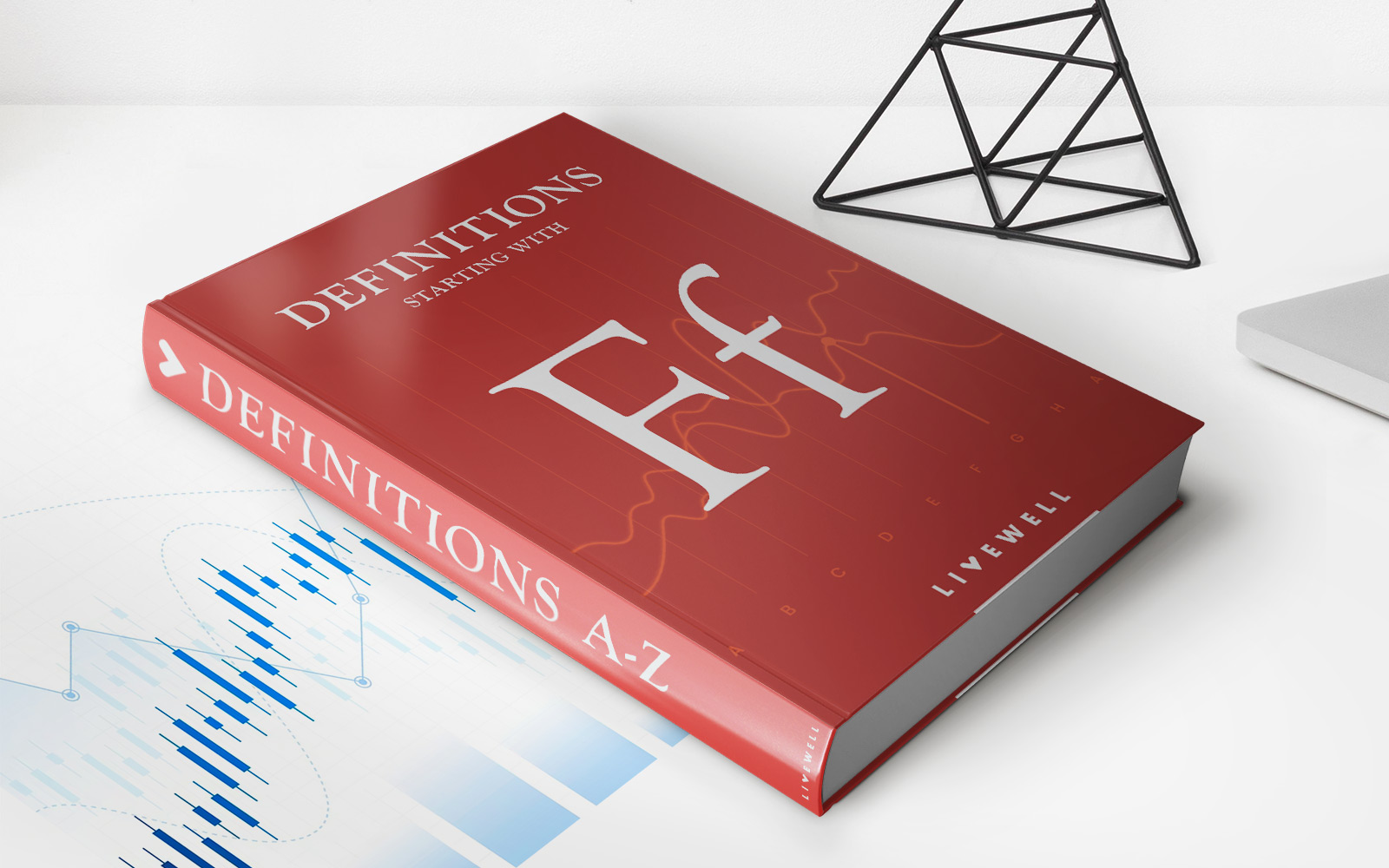

So, what exactly is a bank statement? In simple terms, it is a statement of your financial activities with a particular bank account. It includes details of deposits, withdrawals, transfers, and any fees or charges associated with your account. Usually issued monthly, bank statements are an essential tool for keeping track of your finances and ensuring they align with your records.

Now, you might be wondering why bank statements are so important. Here are two key takeaways to highlight their significance:

- Monitoring Cash Flow: Bank statements provide a comprehensive overview of your income and expenses, making it easier to understand your cash flow patterns. By analyzing these statements, you can identify areas where you can save, invest, or cut expenses.

- Reconciliation and Proof of Income: Comparing your bank statement with your own records helps you reconcile any discrepancies and ensures your financial records are accurate. Additionally, bank statements can serve as proof of income when applying for loans, mortgages, or even during tax audits.

While the specifics may vary depending on the bank, the basic information included in a bank statement typically comprises the account holder’s name, account number, transaction details, balance, and any additional charges or interest. Some banks also include a summary of total deposits and withdrawals for the given period.

Obtaining a bank statement is generally a straightforward process. Most banks offer their customers the option to access their statements through online banking platforms or by requesting a printed copy at a branch. The frequency of statement issuance can also vary, with some institutions offering weekly or daily statements for specific account types.

In conclusion, a bank statement is a crucial document for anyone with a bank account. It helps you monitor your financial activities, reconcile your records, and provide proof of income when necessary. By understanding the benefits and requirements of a bank statement, you can take control of your finances and make informed decisions about your financial goals.

Thank you for reading! Stay tuned for more informative articles on finance and other exciting topics in our blog.