Home>Finance>The Four Accounting Statements Required By GAAP Are Prepared In A Certain Order. What Is The Order?

Finance

The Four Accounting Statements Required By GAAP Are Prepared In A Certain Order. What Is The Order?

Published: October 8, 2023

Learn the correct order to prepare the four essential accounting statements required by GAAP in the field of finance. Master your finance skills and achieve accurate financial reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial reporting, accuracy and consistency are of utmost importance. Companies follow certain guidelines and standards to ensure that their financial statements provide an accurate understanding of their financial position and performance. In the United States, the Generally Accepted Accounting Principles (GAAP) is the standard framework used for financial accounting.

GAAP provides a set of rules and principles that dictate how companies should prepare and present their financial statements. These statements not only help in evaluating a company’s financial health but also serve as a tool for stakeholders such as investors, creditors, and regulatory bodies to assess the company’s performance and make informed decisions.

There are four main accounting statements that companies must prepare in accordance with GAAP. These statements are arranged in a certain order, each providing unique insights into different aspects of a company’s financial operations.

In this article, we will explore the order in which these accounting statements are prepared, understand their significance, and delve into the details of each statement to gain a comprehensive understanding of GAAP financial reporting.

Overview of GAAP

GAAP stands for Generally Accepted Accounting Principles, which is a set of accounting rules and standards developed by the Financial Accounting Standards Board (FASB) in the United States. These principles provide a framework for financial reporting that ensures consistency, comparability, and transparency in financial statements across different organizations.

The primary goal of GAAP is to provide users of financial statements with reliable and relevant information about a company’s financial position, performance, cash flows, and changes in equity. It helps stakeholders make informed decisions, assess risk, and evaluate the overall financial health of a company.

GAAP encompasses a wide range of accounting topics, including revenue recognition, expense recognition, asset valuation, liabilities, financial statement presentation, and disclosure requirements. Compliance with GAAP is mandatory for publicly traded companies in the United States and highly encouraged for private companies to maintain consistency and credibility.

One of the key principles of GAAP is the accrual basis of accounting. Under this principle, revenues are recognized when earned, and expenses are recognized when incurred, regardless of when cash is received or paid. This provides a more accurate representation of a company’s financial performance by matching revenues with the expenses incurred to generate those revenues.

Another important aspect of GAAP is the concept of comparability. Financial statements prepared in accordance with GAAP allow for meaningful comparisons between different companies in the same industry or over different periods for the same company. This comparability is achieved through the standardized accounting principles, terminology, and reporting formats prescribed by GAAP.

Regular updates and revisions are made to GAAP in response to changing business practices, market conditions, and the evolution of accounting standards internationally. The FASB works closely with other standard-setting bodies, such as the International Accounting Standards Board (IASB), to align GAAP with international financial reporting standards to promote global convergence.

By adhering to GAAP, companies demonstrate their commitment to financial integrity and transparency, which enhances the confidence of investors, creditors, and other stakeholders in the company’s financial statements. It ensures that financial information is presented consistently and accurately, enabling informed decision-making and promoting trust in the financial markets.

Importance of Accounting Statements

Accounting statements play a crucial role in providing stakeholders with valuable insights into a company’s financial position, performance, and cash flows. These statements are essential tools that help investors, creditors, management, and regulatory bodies make informed decisions and evaluate the financial health of a company. Here are some key reasons why accounting statements are important:

1. Evaluation of Financial Performance: Accounting statements, such as the income statement and statement of retained earnings, provide information about a company’s revenues, expenses, and net income. This allows stakeholders to assess how well the company is performing and if it is generating profits or incurring losses.

2. Assessment of Financial Position: The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps stakeholders understand the company’s liquidity, solvency, and overall financial strength.

3. Decision-Making: Investors and creditors rely on accounting statements to make investment decisions and determine the creditworthiness of a company. These statements provide insights into a company’s profitability, cash flows, and ability to meet its financial obligations.

4. Financial Planning and Budgeting: Accounting statements aid in the development of budgets and financial plans. By analyzing historical financial data, companies can project future revenues, expenses, and cash flows, which helps in setting realistic goals and making effective financial decisions.

5. Regulatory Compliance: Many regulatory bodies require companies to submit financial statements prepared in accordance with GAAP. Compliance with these reporting standards ensures transparency, accuracy, and consistency in financial reporting, which is vital for regulatory compliance.

6. Facilitation of Stakeholder Communication: Accounting statements serve as a means of communication between the company and its stakeholders. They provide a clear, concise, and standardized format to present financial information, enabling stakeholders to understand and interpret the company’s financial performance easily.

7. Evidence of Financial Health: Accounting statements are often used as evidence of a company’s financial health in various legal and business contexts. They can be used as supporting documents in loan applications, mergers and acquisitions, and legal disputes.

8. Transparency and Accountability: Companies that prepare and present accurate and reliable accounting statements demonstrate a commitment to transparency and accountability. This fosters trust among stakeholders and enhances the company’s reputation in the market.

In summary, accounting statements are essential financial reporting tools that provide stakeholders with valuable information about a company’s financial performance, position, and cash flows. They aid in decision-making, financial planning, regulatory compliance, and communication between the company and its stakeholders, ultimately contributing to the overall success and sustainability of the business.

The Four Accounting Statements

Under GAAP, companies are required to prepare four main accounting statements that provide a comprehensive overview of their financial operations. These statements are:

1. Income Statement: Also known as the statement of operations or profit and loss statement, the income statement summarizes a company’s revenues, expenses, gains, and losses over a specific period. It reflects the company’s ability to generate profit by comparing its total revenues with its total expenses. The income statement helps stakeholders assess the profitability of the company’s operations.

2. Statement of Retained Earnings: The statement of retained earnings shows how the company’s retained earnings have changed during a specific period. Retained earnings represent the accumulated profits or losses that are reinvested in the company rather than distributed to shareholders as dividends. This statement provides insights into the portion of earnings that is retained and how it is allocated for future growth or used to cover accumulated losses.

3. Balance Sheet: The balance sheet presents the company’s financial position at a specific point in time, usually the end of the reporting period. It consists of three main components: assets, liabilities, and equity. The balance sheet shows what the company owns (assets), what it owes to creditors (liabilities), and the residual interest of the owners (equity). It provides a snapshot of the company’s financial health and helps stakeholders assess its liquidity, solvency, and overall financial strength.

4. Cash Flow Statement: The cash flow statement provides information about the company’s cash inflows and outflows during a specific period. It categorizes cash flows into three main activities: operating, investing, and financing activities. The cash flow statement helps stakeholders understand how cash is generated and used by the company, highlighting its ability to generate cash flow from its core operations, make investments, and raise funds through financing activities.

These four accounting statements are interconnected and provide a holistic view of a company’s financial performance, position, and cash flows. They each serve a unique purpose and provide valuable information that helps stakeholders assess the company’s financial health and make informed decisions.

It’s important to note that these statements are usually prepared in a specific order, with the income statement being prepared first, followed by the statement of retained earnings, balance sheet, and finally, the cash flow statement. This order ensures that the information flows logically from the income statement, which reflects the company’s profitability, to the balance sheet, which presents the financial position, and ultimately to the cash flow statement, which shows how the company generated and used cash during the period.

Understanding and analyzing these four accounting statements is essential for investors, creditors, management, and other stakeholders to evaluate the financial performance and position of a company, make strategic decisions, and assess its ability to generate future cash flows.

Order of Preparation

When preparing financial statements in accordance with GAAP, there is a specific order that companies follow. This order ensures that the information flows logically and provides a comprehensive understanding of the company’s financial performance, position, and cash flows. The four accounting statements are prepared in the following order:

1. Income Statement: The income statement is typically prepared first. It summarizes the company’s revenues, expenses, gains, and losses over a specific period, usually a fiscal quarter or year. By calculating the net income or net loss, the income statement shows whether a company has generated profits or incurred losses during the period. It provides insights into the company’s ability to generate revenue and control expenses.

2. Statement of Retained Earnings: The statement of retained earnings is prepared after the income statement. It shows the changes in the company’s retained earnings during the period. Retained earnings are the accumulated profits or losses that are reinvested in the company rather than distributed as dividends to shareholders. The statement of retained earnings reflects the net income or net loss from the income statement and accounts for any dividends paid to shareholders. It helps stakeholders understand how earnings are retained or distributed.

3. Balance Sheet: After the income statement and the statement of retained earnings, the balance sheet is prepared. It provides a snapshot of the company’s financial position at a specific point in time, usually the end of the reporting period. The balance sheet consists of three main sections: assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what it owes to creditors, and equity represents the residual interest of the owners. The balance sheet helps stakeholders assess the company’s liquidity, solvency, and overall financial strength.

4. Cash Flow Statement: The cash flow statement is the final statement to be prepared. It reports the cash inflows and outflows of the company during the period and shows how cash was generated and used. The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. It provides valuable insights into the company’s ability to generate cash flow from its core operations, invest in assets, and secure financing. The cash flow statement helps stakeholders evaluate the company’s liquidity and cash management practices.

By following this specific order of preparation, companies provide a systematic view of their financial performance, position, and cash flows. Starting with the income statement, which captures the revenues and expenses, then moving to the statement of retained earnings, balance sheet, and finally the cash flow statement, stakeholders can analyze and interpret the financial information in a logical and comprehensive manner. This sequential order ensures the proper alignment and integration of financial data, allowing stakeholders to make informed decisions and assess a company’s financial health effectively.

Income Statement

The income statement, also known as the statement of operations or profit and loss statement, is one of the four main accounting statements prepared under GAAP. It provides a summary of a company’s revenues, expenses, gains, and losses over a specific period, such as a fiscal quarter or year. The income statement helps stakeholders understand the profitability of the company’s operations and assess its ability to generate profits.

The structure of an income statement typically consists of several key components:

- Revenue: This section includes all the income generated from the company’s primary business activities, such as sales of goods or services. Revenue can be further classified into different categories, such as sales revenue, service revenue, or rental revenue.

- Cost of Goods Sold (COGS) or Cost of Services: This section includes the direct costs associated with producing goods or providing services. It typically includes the cost of raw materials, direct labor, and any other expenses directly related to the production process.

- Gross Profit: Also known as gross income or gross margin, this is the revenue left after deducting the cost of goods sold. It represents the profitability of the company’s core operations and indicates how efficiently the company is utilizing its resources.

- Operating Expenses: This section includes all the expenses incurred in running the day-to-day operations of the business. It encompasses expenses such as salaries and wages, rent, utilities, marketing, and administrative costs.

- Operating Income: Also known as operating profit or operating earnings, this is the difference between the gross profit and the total operating expenses. It represents the profitability of the company’s core operations, excluding any non-operating items or one-time expenses.

- Non-Operating Income or Expense: This section includes any income or expenses that are not directly related to the company’s core operations. It may include investment income, interest expenses, gains or losses from the sale of assets, or other non-recurring items.

- Net Income: Net income, also referred to as net profit or the bottom line, is the final figure on the income statement. It represents the company’s total earnings after deducting all expenses, including operating expenses and non-operating items. Net income indicates the overall profitability of the company.

The income statement is an important tool for stakeholders to assess the financial performance of a company. It provides insights into whether the company is generating profits or incurring losses, as well as the profitability of its core operations. Investors, creditors, and other stakeholders use the income statement to evaluate a company’s revenue growth, cost management, and overall financial viability.

It is worth noting that the income statement is prepared on an accrual basis, meaning that revenues and expenses are recognized when earned or incurred, regardless of when the cash is received or paid. This provides a more accurate representation of the company’s financial performance by matching revenues with the expenses incurred to generate those revenues.

Overall, the income statement is a key component of a company’s financial reporting and provides valuable information for stakeholders to assess the company’s profitability, make investment decisions, and evaluate its financial health.

Statement of Retained Earnings

The statement of retained earnings is an important accounting statement that provides insights into the changes in a company’s retained earnings over a specific period. Retained earnings are the portion of a company’s profits that are reinvested in the business rather than distributed to shareholders as dividends. The statement of retained earnings helps stakeholders understand how earnings are retained or distributed and how they contribute to the company’s overall financial position.

The structure of a statement of retained earnings typically includes the following components:

- Beginning Retained Earnings: This figure represents the retained earnings from the previous reporting period. It serves as the starting point for calculating changes in retained earnings.

- Net Income or Net Loss: The net income (or net loss) figure from the company’s income statement is transferred to the statement of retained earnings. If the company generates a profit, the net income is added to the beginning retained earnings. If the company incurs a loss, the net loss is subtracted.

- Dividends Paid: Dividends are the distributions made to shareholders as a return on their investment. This section represents the amount of dividends paid during the reporting period. It is deducted from the net income to calculate the final retained earnings.

- Ending Retained Earnings: The ending retained earnings figure represents the final amount of retained earnings at the end of the reporting period. It is calculated by adding the net income to the beginning retained earnings and subtracting any dividends paid.

The statement of retained earnings helps stakeholders understand how a company’s earnings are retained and reinvested for future growth, or distributed to shareholders. It enables a clear view of how the company’s profitability impacts its financial position and the accumulation of retained earnings over time.

This statement is particularly important for investors and shareholders as it provides insights into the company’s dividend policy and the percentage of earnings that are reinvested back into the business. It helps investors evaluate the company’s commitment to growth and the potential for future dividends or capital appreciation.

The statement of retained earnings also plays a role in calculating the book value per share, a metric used by investors to assess the intrinsic value of a company’s shares. By dividing the ending retained earnings by the number of issued shares, investors can determine the book value per share, which can be compared to the market price per share to assess the company’s financial health and potential for growth.

Overall, the statement of retained earnings provides stakeholders with valuable information on how a company’s earnings are reinvested or distributed. It helps investors, shareholders, and other stakeholders understand the financial implications of the company’s profit or loss and evaluate the company’s ability to generate consistent returns in the long term.

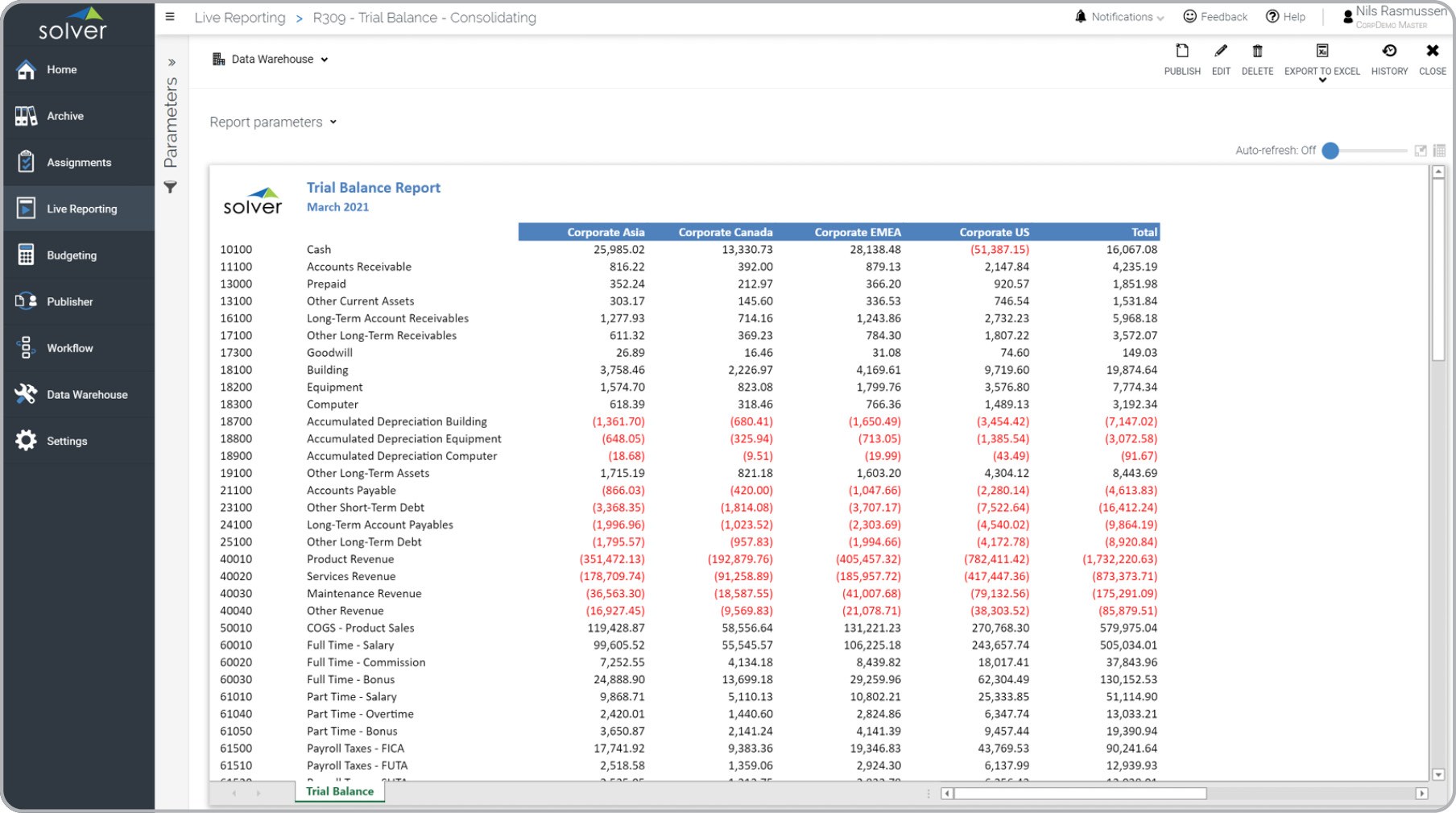

Balance Sheet

The balance sheet is a fundamental accounting statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity, allowing stakeholders to understand the company’s financial health and overall stability.

The structure of a balance sheet typically consists of the following components:

- Assets: Assets represent what the company owns and controls. They are categorized as current assets and non-current assets. Current assets include cash, accounts receivable, inventory, and other assets expected to be converted into cash within a year. Non-current assets, such as property, plant, and equipment, long-term investments, and intangible assets, are held for longer periods.

- Liabilities: Liabilities represent the company’s obligations and debts to creditors. Like assets, liabilities are categorized as current liabilities and non-current liabilities. Current liabilities include accounts payable, accrued expenses, and short-term borrowings that are due within a year. Non-current liabilities include long-term debts and obligations that are due beyond the next year.

- Shareholders’ Equity: Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It can be further categorized into share capital, retained earnings, and additional paid-in capital. Share capital represents the value of shares issued to shareholders. Retained earnings are the accumulated profits or losses that the company has retained and reinvested. Additional paid-in capital represents the amount of capital contributed by shareholders through equity financing.

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. This equation ensures that the total value of assets is equal to the total value of liabilities and shareholders’ equity, providing a sense of balance and accuracy in the financial position of the company.

The balance sheet is a crucial tool for stakeholders to assess the liquidity and solvency of a company. It helps evaluate the company’s ability to meet short-term obligations (current liabilities) using its current assets, as well as its capital structure and long-term financial stability. It also serves as a basis for calculating important financial ratios, such as the current ratio and debt-to-equity ratio, which provide insights into the company’s financial health and risk profile.

By analyzing the components of the balance sheet, stakeholders can make informed decisions about the company’s financial health. For example, investors can assess the company’s ability to generate returns, creditors can evaluate the company’s creditworthiness, and management can identify areas for improvement in the capital structure or allocation of resources.

It is important to note that the balance sheet represents a snapshot of the company’s financial position at a specific point in time. As such, it should be read in conjunction with other financial statements, such as the income statement and cash flow statement, to gain a comprehensive understanding of the company’s financial performance and cash flows.

In summary, the balance sheet is a vital accounting statement that provides a detailed overview of a company’s financial position. It helps stakeholders evaluate the company’s assets, liabilities, and shareholders’ equity, enabling them to make informed decisions about investment, credit, and overall financial health.

Cash Flow Statement

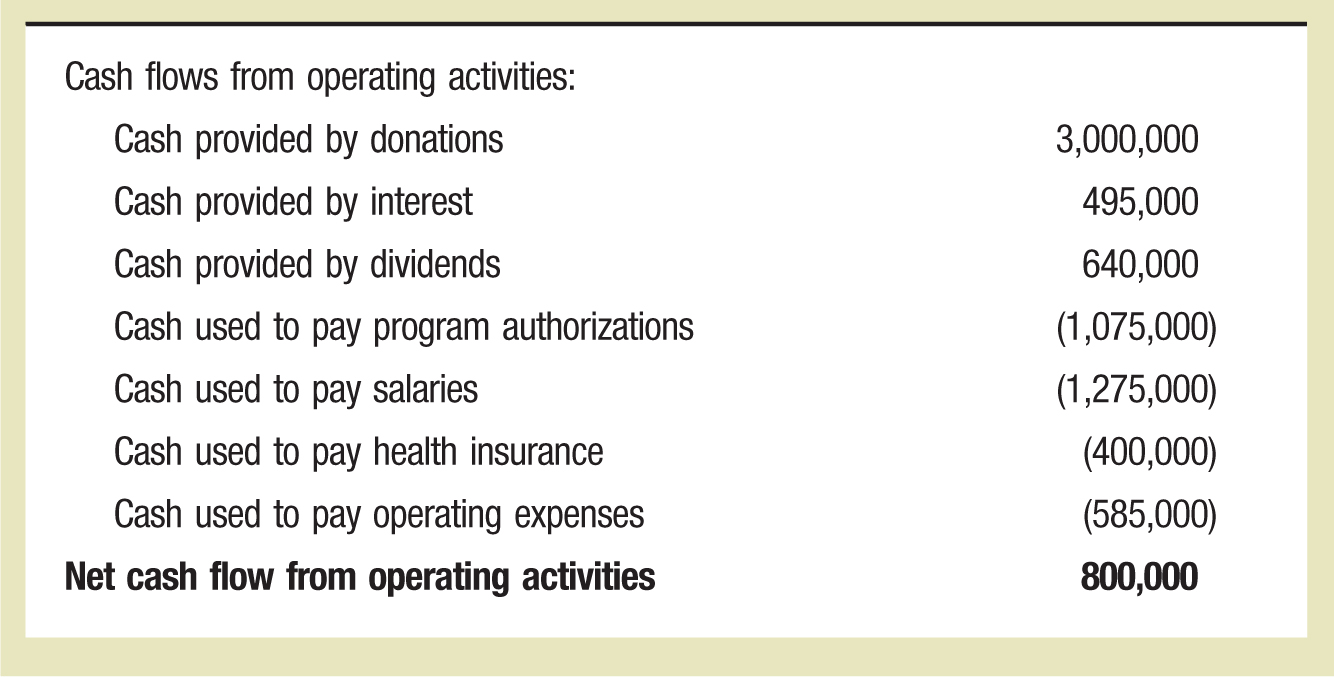

The cash flow statement is a crucial accounting statement that provides insights into the cash inflows and outflows of a company over a specific period. It shows how cash is generated and used by the company, offering valuable information about its liquidity, operating activities, investing activities, and financing activities.

The structure of a cash flow statement typically consists of the following sections:

- Operating Activities: This section focuses on the cash flows generated or used in the company’s core operations. It includes cash receipts from sales, interest, and dividends received, as well as cash payments for expenses, salaries, and taxes. The operating activities section helps assess the company’s ability to generate cash flow from its primary business operations.

- Investing Activities: This section reports cash flows related to the acquisition and disposal of long-term assets, such as property, plant, and equipment, as well as investment securities. It includes cash inflows from the sale of assets or investments and cash outflows from the purchase of new assets or investments. The investing activities section helps evaluate the company’s capital expenditures and investment decisions.

- Financing Activities: This section covers cash flows related to obtaining and repaying capital. It includes cash inflows from issuing stock, borrowing money, or generating funds through debt financing. Cash outflows related to dividend payments, debt repayments, and share buybacks are also reported in this section. The financing activities section helps assess the company’s financing sources and its ability to meet its financial obligations.

- Net Cash Flow: The net cash flow figure represents the overall change in cash and cash equivalents during the reporting period. It is calculated by summing up the cash flows from operating activities, investing activities, and financing activities. The net cash flow indicates whether the company had a net increase or decrease in its cash balance during the period.

The cash flow statement provides crucial insights into a company’s cash position, its ability to generate cash flow, and how it is utilized for operational needs, investment, and financing activities. By analyzing the cash flow statement, stakeholders can gain a deeper understanding of the company’s financial health and its capacity to meet its financial obligations.

Investors and creditors use the cash flow statement to evaluate a company’s cash-generating abilities and its ability to manage cash effectively. Positive cash flows from operating activities indicate that the company is generating sufficient cash from its core operations to meet its obligations. Negative cash flows from investing or financing activities may be indicative of investment or financing decisions that require further analysis.

The cash flow statement also helps identify trends and patterns in cash flow generation or utilization over time. It enables stakeholders to evaluate changes in working capital, the impact of investing activities on cash flows, and the company’s financing activities in terms of debt and equity.

It is important to note that the cash flow statement complements the income statement and balance sheet by enhancing the understanding of a company’s financial performance and overall financial position. Together, these three statements provide a comprehensive view of a company’s financial operations and help stakeholders make informed decisions.

In summary, the cash flow statement is a critical accounting statement that provides valuable insights into a company’s cash inflows and outflows. It helps stakeholders assess a company’s liquidity, cash-generating abilities, and the utilization of cash for operational, investment, and financing activities. By analyzing the cash flow statement, stakeholders can gain a comprehensive understanding of a company’s cash management practices and overall financial health.

Conclusion

In conclusion, the four accounting statements required by GAAP provide a comprehensive and systematic view of a company’s financial performance, position, and cash flows. These statements, prepared in a specific order, allow stakeholders to evaluate the company’s profitability, financial health, and ability to generate cash flow. The income statement summarizes the company’s revenues, expenses, gains, and losses, providing insights into its profitability. The statement of retained earnings shows changes in retained earnings over time, reflecting how earnings are retained or distributed. The balance sheet presents a snapshot of the company’s assets, liabilities, and equity, providing a view of its financial position. Finally, the cash flow statement reveals the sources and uses of cash, offering valuable insights into liquidity and cash management.

Understanding and analyzing these accounting statements are crucial for investors, creditors, management, and other stakeholders to make informed decisions regarding the company. By examining the income statement, statement of retained earnings, balance sheet, and cash flow statement, stakeholders can assess the company’s financial health, evaluate its profitability, liquidity, solvency, and evaluate the effectiveness of its operations, investments, and financing activities. These statements provide a standardized framework that facilitates comparability and transparency in financial reporting.

It is important to note that while individual accounting statements provide valuable information, they are interconnected and should be analyzed collectively to gain a comprehensive understanding of a company’s financial performance and position. Additionally, these accounting statements should be read alongside other financial data, such as footnotes and management discussions, for a complete assessment.

By adhering to GAAP and preparing these accounting statements in the specified order, companies can provide stakeholders with accurate, reliable, and standardized financial information. This promotes transparency, accountability, and trust in the financial reporting process. Investors can make informed investment decisions, creditors can assess creditworthiness, and management can make strategic decisions based on a thorough understanding of the company’s financial situation.

In summary, the four accounting statements are essential components of financial reporting under GAAP. They provide stakeholders with valuable insights into a company’s financial performance, position, and cash flows, enabling informed decision-making and contributing to the overall assessment of a company’s financial health and stability.