Finance

What Is A Counter Credit On A Bank Statement

Published: January 13, 2024

Discover the meaning of a counter credit on a bank statement and its importance in finance. Gain insights about financial transactions and track your funds effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Counter Credit

- Explanation of Bank Statement

- Importance of Counter Credits on Bank Statements

- Common Examples of Counter Credits

- How to Identify Counter Credits on a Bank Statement

- Understanding the Impact of Counter Credits on Account Balances

- Potential Issues with Counter Credits on Bank Statements

- Conclusion

Introduction

When reviewing a bank statement, you may come across various terms and transactions that might seem unfamiliar. One such term that you may encounter is a “counter credit.” But what exactly is a counter credit on a bank statement?

A counter credit refers to a specific type of transaction that increases the balance in your bank account. It is essentially a deposit or credit made into your account by the bank. This could occur via various channels, such as direct deposits, interest payments, or even reimbursement of fees.

Understanding counter credits is crucial for accurately tracking and managing your finances. By comprehending the nature of these transactions and their impact on your bank statement, you can better monitor your account balances and identify any potential errors or discrepancies.

In this article, we will delve deeper into the concept of counter credits on bank statements. We will discuss their definition, their significance in financial management, how to identify them, and their potential implications on your account balance.

So, if you’ve ever wondered about those mysterious counter credits on your bank statement, join us as we uncover the secrets behind these transactions.

Definition of Counter Credit

A counter credit, in the context of banking, refers to a type of transaction that increases the balance in your bank account. It represents funds deposited into your account by the bank itself. This can occur through various means, such as interest payments, direct deposits, refunds, reimbursements, or any other form of credit provided by the financial institution.

Counter credits are essentially the opposite of debits or withdrawals, which decrease the balance in your account. They serve to increase the available funds you have at your disposal and can have a significant impact on your overall account balance.

These credits may be automatically generated by the bank, or they may be initiated by a third party and processed by the bank on your behalf. For example, if you have set up direct deposit for your salary, your employer will send the funds directly to your bank account, resulting in a counter credit.

It is important to note that while counter credits are typically associated with positive transactions, they are not limited to monetary deposits. In some cases, counter credits may also represent the reversal of previously charged fees or the reimbursement of certain expenses by the bank.

Overall, counter credits play a vital role in financial management as they contribute to the growth of your account balance and provide access to additional funds for spending or saving.

Explanation of Bank Statement

A bank statement is a detailed document provided by a bank that summarizes all the transactions and activities that have occurred within a given period in a specific bank account. It is an essential tool for managing personal or business finances as it provides a comprehensive overview of your financial transactions.

Bank statements typically include several key elements that help you understand your account activity:

- Account Information: The statement will display your account number, account holder’s name, and other relevant details to ensure accurate identification.

- Opening and Closing Balances: The statement will indicate the balance in your account at the beginning and end of the statement period. This allows you to track the changes in your available funds over time.

- Transactions: The statement will provide a detailed list of all transactions that have taken place within the statement period. This includes both debits (withdrawals) and credits (deposits), allowing you to review and reconcile your finances.

- Date and Description of Transactions: Each transaction on the statement will be accompanied by a date and a description, providing you with a clear timeline and reference of the transaction details.

- Fees and Charges: Bank statements also include any fees or charges incurred during the statement period, such as monthly maintenance fees, ATM fees, or overdraft charges.

- Additional Information: Depending on the bank, the statement may also provide supplementary information, such as check images, account-specific notices, or promotional offers.

Bank statements are typically generated on a monthly basis, but some banks also offer quarterly or annual statements. These statements can be accessed through various channels, including mail, email, or online banking platforms. It is important to review your bank statement regularly to ensure the accuracy of transactions, detect any unauthorized activity, and maintain an up-to-date understanding of your financial status.

Now that we have a clear understanding of bank statements, let’s explore the significance of counter credits on these statements and how they impact your overall account balance.

Importance of Counter Credits on Bank Statements

Counter credits play a significant role in managing your finances and understanding your bank statement. Here are the key reasons why counter credits are important:

- Account Balance Growth: Counter credits are crucial for increasing your account balance. They represent additional funds that are deposited into your account, whether it’s through interest payments, direct deposits, or other forms of credit. By consistently monitoring the counter credits on your bank statement, you can track the growth of your funds and make informed financial decisions.

- Accuracy and Reconciliation: Checking your bank statement allows you to verify the transactions and ensure their accuracy. By reviewing the counter credits listed on the statement, you can compare them to your records and identify any discrepancies or missing deposits. This process enables you to reconcile your account balance and maintain an accurate representation of your finances.

- Expense Tracking: A bank statement with clearly documented counter credits helps you track and monitor your income sources. By understanding where the credits are coming from, such as salary deposits or interest earnings, you can evaluate your financial progress and make informed decisions about budgeting and expense management.

- Identifying Errors or Fraudulent Activity: Regularly reviewing counter credits on your bank statement is essential for detecting any errors or fraudulent activity. If you notice unexpected or unauthorized counter credits, it may indicate identity theft, unauthorized deposits, or errors made by the bank. Promptly reporting such issues to your bank can help resolve the situation and protect your financial security.

- Financial Planning: Understanding the counter credits on your bank statement provides valuable insights for financial planning. By analyzing the patterns and sources of your credits, you can assess your cash flow, savings growth, and overall financial stability. This information enables you to make strategic plans for investment, debt repayment, or savings goals.

By recognizing the importance of counter credits, you gain a better understanding of the dynamics of your bank account and can effectively manage your finances. It is essential to review your bank statement regularly and carefully inspect the counter credits to stay in control of your financial situation.

In the next section, we will explore some common examples of counter credits you might encounter on your bank statement.

Common Examples of Counter Credits

Counter credits can take various forms, and understanding their common examples will help you identify them on your bank statement. Here are some typical instances of counter credits:

- Direct Deposits: One of the most common forms of counter credits is a direct deposit. This occurs when funds are electronically deposited into your account, such as your salary, pension, or government benefits. Direct deposits are usually recurring and can be set up to go directly into your account.

- Interest Payments: If you have a savings account or a certificate of deposit (CD), you may earn interest on your funds. The interest accrued is often credited to your account periodically, typically on a monthly or quarterly basis. These interest payments are considered counter credits.

- Refunds and Reimbursements: If you return a purchased item or cancel services, you may receive a refund from the merchant or service provider. These refunds are often directly credited back into your bank account, appearing as counter credits on your statement. Similarly, if you were previously charged a fee that is later reimbursed by the bank, it will be reflected as a counter credit.

- Loan Repayments: If you have lent money to someone or provided a loan, the repayment installments made by the borrower will be credited to your account as a counter credit.

- Dividend Payments: If you own stocks or shares in a company, you may receive dividends as a shareholder. These dividends, typically distributed quarterly or annually, are credited to your bank account as counter credits.

- Tax Refunds: If you have overpaid your taxes or are eligible for tax credits, you may receive a refund from the government. These tax refunds are directly deposited into your bank account, appearing as counter credits.

These are just a few examples of the counter credits you may encounter on your bank statement. It’s important to review your statement regularly to ensure that all expected counter credits have been correctly deposited into your account.

In the next section, let’s explore how you can identify counter credits on your bank statement.

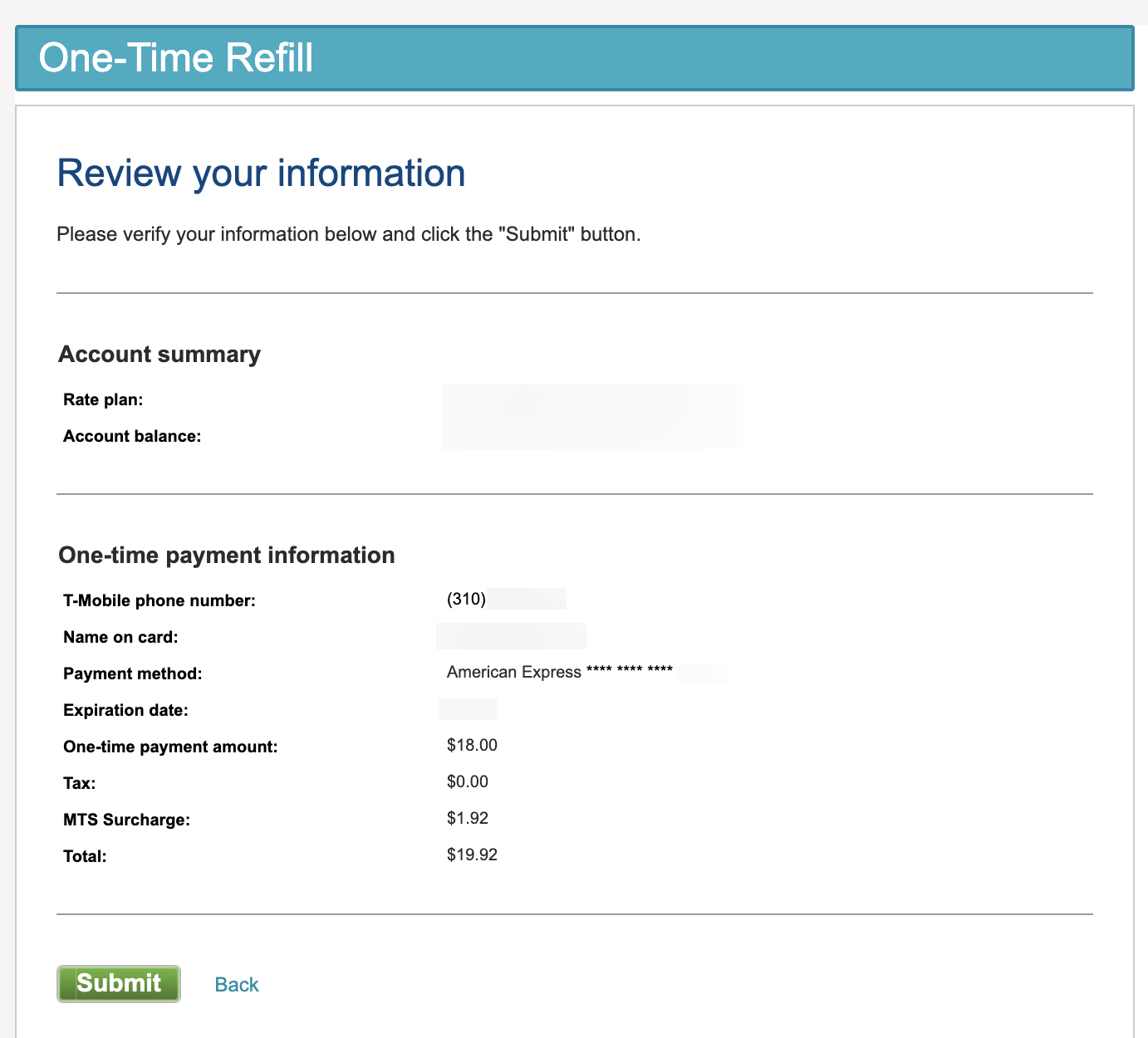

How to Identify Counter Credits on a Bank Statement

Identifying counter credits on a bank statement is essential for understanding your account activity and keeping track of your finances. Here are some key steps to help you identify counter credits on your bank statement:

- Review the Transaction Descriptions: Go through each transaction listed on your bank statement and carefully read the descriptions. Look for keywords such as “deposit,” “credit,” or “interest” to identify potential counter credits.

- Identify Recurring Deposits: If you have set up recurring direct deposits or have regular income sources, look for consistent deposits in your statement. These are likely counter credits.

- Compare with your Records: Cross-reference the transactions on your bank statement with your own financial records, such as pay stubs, receipts, or account statements from other institutions. This will help you verify the accuracy of the counter credits.

- Check for Interest Payments: If you have a savings account or a CD, look for any interest payments credited to your account. These will typically have a specific description related to interest, such as “interest earned” or “savings interest.”

- Identify Refunds or Reimbursements: Look for transactions labeled as refunds or reimbursements. These are often counter credits resulting from returned purchases, canceled services, or fee reimbursements.

- Check for Dividend Payments: If you own stocks or shares, look for any dividend payments credited to your account. These will typically have a description related to the company or stock name.

- Pay Attention to Tax Refunds: During tax season, keep an eye out for any tax refunds credited to your account. These refunds are often clearly labeled as such.

- Contact your Bank: If you are unable to identify a particular transaction or have concerns about the accuracy of the counter credits on your bank statement, don’t hesitate to reach out to your bank’s customer service for clarification or assistance.

By following these steps and paying close attention to the transaction descriptions on your bank statement, you can effectively identify counter credits and gain a clearer understanding of your account activity.

In the next section, let’s explore the impact of counter credits on your account balances and financial management.

Understanding the Impact of Counter Credits on Account Balances

Counter credits have a direct impact on your account balances and play a crucial role in managing your finances. Here’s how counter credits affect your account balances:

Increasing Account Balances: Counter credits, such as direct deposits, interest payments, or refunds, effectively increase the balance in your bank account. These credits add funds to your account, providing you with more money to utilize for expenses, savings, or investments.

Offsetting Debits: Counter credits can offset or balance out any debits or withdrawals from your account. For example, if you had a withdrawal for a bill payment or a purchase, a counter credit in the form of a direct deposit can offset the decrease in your balance, ensuring your account remains positive.

Stabilizing Cash Flow: Regular and consistent counter credits, such as steady direct deposits from your salary, pension, or government benefits, can help stabilize your cash flow. These credits ensure a predictable inflow of funds, enabling you to manage your expenses, savings, and financial obligations effectively.

Aiding in Financial Planning: By understanding the impact of counter credits on your account balances, you can better plan and budget your finances. The presence of counter credits allows you to estimate your available funds, assess your savings potential, and allocate your money towards specific financial goals.

Tracking Income Sources: Counter credits provide valuable insights into your income sources. By identifying the various counter credits on your bank statement, you can track the origin of each credit – whether it’s your salary, investments, or other sources of income. This knowledge helps in evaluating your income streams and making informed financial decisions.

Spotting Discrepancies and Errors: Regularly reviewing counter credits on your bank statement is crucial for detecting any discrepancies or errors. If you notice any missing or incorrect counter credits, it is important to notify your bank promptly. Timely identification of errors ensures accurate accounting and helps maintain the integrity of your financial records.

Understanding the impact of counter credits on your account balances allows you to manage your finances more effectively and make informed decisions about spending, saving, and investments.

In the next section, we will explore potential issues that may arise with counter credits on bank statements.

Potential Issues with Counter Credits on Bank Statements

While counter credits on bank statements are generally positive and beneficial, there can be potential issues that may arise. It’s important to be aware of these potential issues to ensure accurate and smooth financial management. Here are some common concerns:

- Missing or Delayed Counter Credits: Sometimes, counter credits may fail to appear on your bank statement or may be delayed in posting to your account. This can occur due to processing issues, technical glitches, or delays in communication between the bank and the source of the credit. It’s important to keep track of expected counter credits and notify your bank if you notice any delays or discrepancies.

- Errors in Counter Credit Amounts: Occasionally, counter credits may be recorded for incorrect amounts. This could happen due to human error or system glitches. It’s crucial to carefully review each counter credit on your bank statement and compare it to the expected amount. If you identify any discrepancies, promptly contact your bank for clarification and correction.

- Unauthorized Counter Credits: While rare, there is a possibility of unauthorized counter credits appearing on your bank statement. This could be a result of fraudulent activity, such as someone depositing funds into your account without your knowledge or permission. If you notice any suspicious or unauthorized counter credits, contact your bank immediately to report the issue and take appropriate action.

- Inadequate Documentation: Sometimes, the descriptions of counter credits on bank statements may be unclear or insufficient, making it difficult to identify the source or purpose of the credit. This lack of documentation can cause confusion and make it challenging to reconcile your account or track your income sources accurately. In such cases, reaching out to your bank for additional information or seeking clarification can help resolve the issue.

- Inconsistencies with Expected Counter Credits: If you have set up recurring counter credits, such as direct deposits, and notice any inconsistencies in the timing or amount of these credits, it could indicate an issue. It’s essential to regularly monitor your bank statement and notify your bank if you observe any deviations from your expectations.

It’s important to remember that banks strive to maintain accurate and reliable records of transactions, including counter credits. However, human errors, technical glitches, and external factors can sometimes lead to issues or discrepancies. By actively reviewing your bank statements, promptly addressing any concerns, and maintaining open communication with your bank, you can resolve potential issues and ensure the integrity of your financial records.

Now, let’s summarize the key points discussed in this article.

Conclusion

In conclusion, counter credits on bank statements are essential transactions that increase the balance in your account. They come in various forms, such as direct deposits, interest payments, refunds, reimbursements, and more. Understanding counter credits is crucial for accurately tracking and managing your finances.

By reviewing your bank statement regularly, you can identify counter credits and ensure their accuracy. They play a vital role in increasing your account balance, offsetting debits, stabilizing cash flow, and aiding in financial planning. Counter credits also help track income sources, spot discrepancies, and make informed financial decisions.

However, potential issues can arise, such as missing or delayed counter credits, errors in amounts, unauthorized credits, inadequate documentation, and inconsistencies with expected credits. It’s important to be vigilant and promptly address any concerns with your bank to maintain accurate financial records.

To stay on top of your financial health, keep a close eye on your bank statement, verify the counter credits, and reconcile your account balances. By doing so, you can effectively manage your finances, identify errors or discrepancies, and make informed financial decisions.

Remember, counter credits are an indication of the money flowing into your bank account, and understanding them helps you stay in control of your finances.