Finance

What Is The Biggest Challenge When Budgeting

Published: October 11, 2023

Discover the biggest challenge people face when budgeting their finances and learn effective strategies to overcome it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

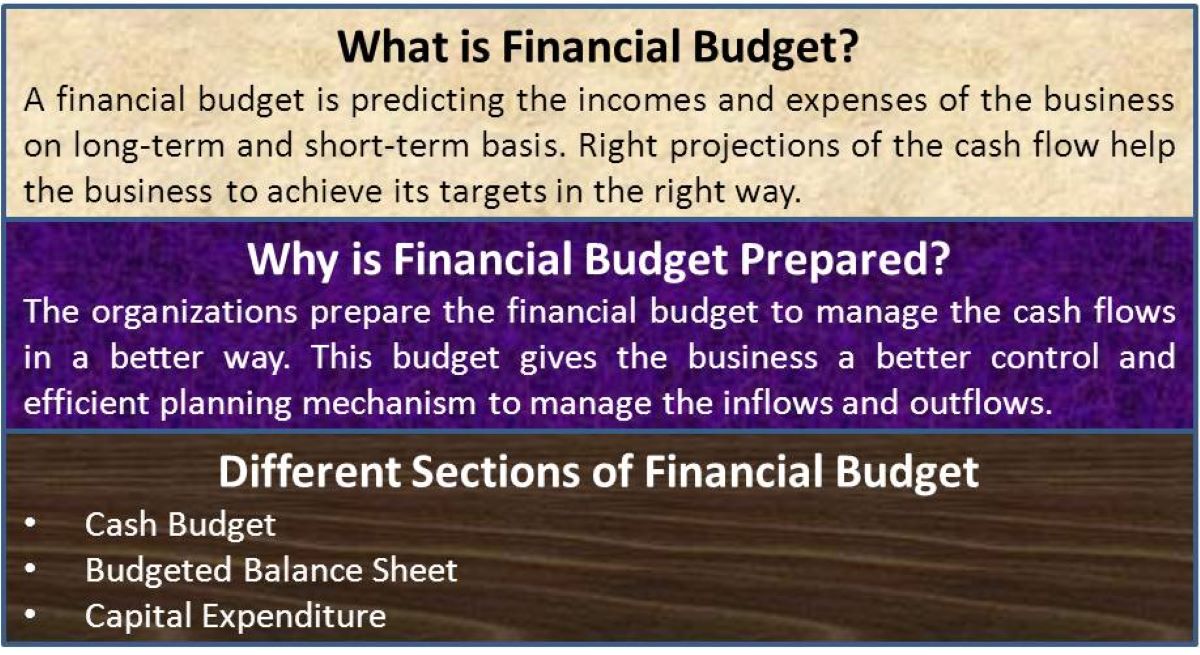

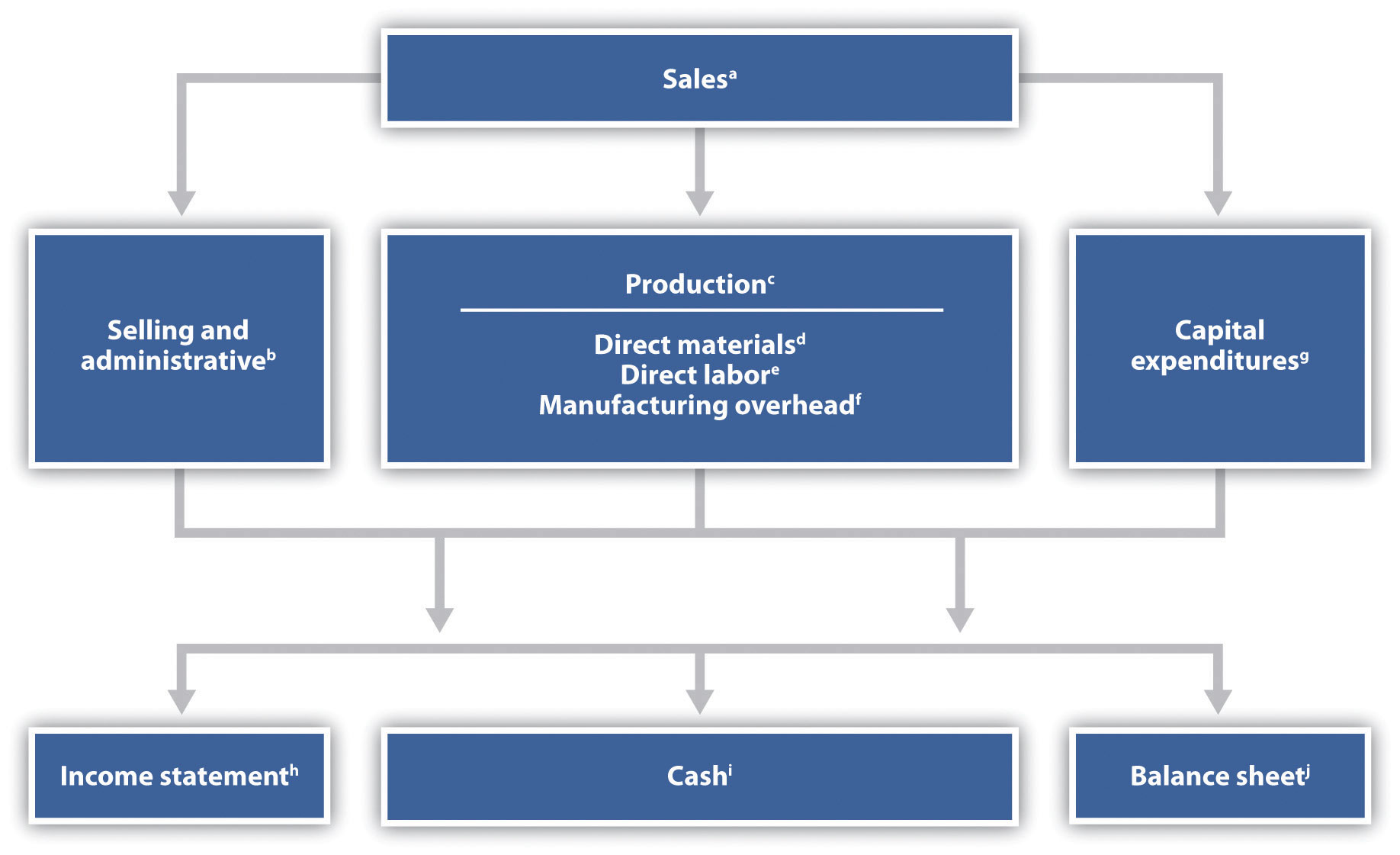

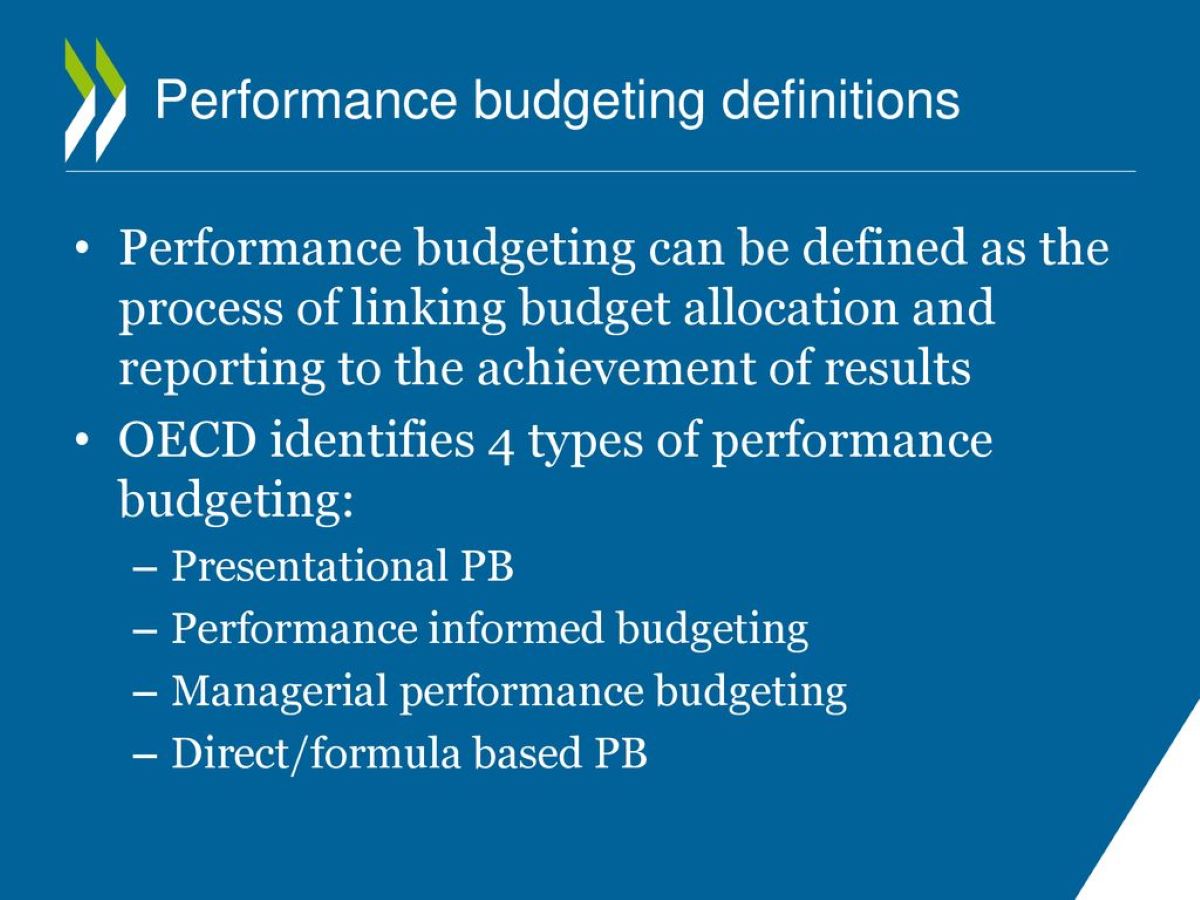

Budgeting is an essential component of financial management, allowing individuals and households to effectively manage their income and expenses. It involves creating a plan for allocating financial resources to meet different needs and goals. However, budgeting is not without its challenges, and many individuals find it difficult to stick to a budget consistently.

Budgeting requires discipline, self-control, and a deep understanding of one’s financial situation. It involves making tough decisions about spending and saving, and it can be overwhelming for those who are not well-versed in personal finance. In this article, we will explore the biggest challenges people face when budgeting and discuss strategies to overcome them.

While budgeting challenges can vary from person to person, there are common hurdles that many people encounter along the way. These challenges can make it difficult to stay on track with financial goals and create unnecessary stress. By understanding and addressing these challenges, individuals can develop stronger budgeting skills and gain control over their finances.

Lack of Financial Awareness

One of the biggest challenges individuals face when it comes to budgeting is a lack of financial awareness. Many people have a limited understanding of basic financial concepts, such as budgeting, savings, investments, and debt management. This lack of knowledge can hinder their ability to create an effective budget that aligns with their financial goals.

Without a clear understanding of their income and expenses, individuals may struggle to prioritize their spending and make informed decisions about where to allocate their money. They may not fully grasp the impact of their financial choices and fail to see the long-term consequences of overspending or neglecting to save.

To overcome this challenge, it is crucial for individuals to educate themselves about personal finance. This can be done through reading books, attending financial literacy workshops, or consulting with a financial advisor. By acquiring financial knowledge and understanding key concepts, individuals can make better-informed decisions about their budget and effectively manage their money.

Additionally, there are plenty of resources available online, such as budgeting apps and websites, that can help individuals gain a better understanding of their finances. These tools provide insights into spending patterns, track expenses, and categorize spending to give users a clear picture of where their money is going.

By increasing financial awareness, individuals can develop the necessary skills and confidence to create a budget that reflects their financial goals and priorities. With a solid foundation of financial knowledge, they can make smarter financial decisions and achieve greater financial stability.

Unexpected Expenses

Another significant challenge that can disrupt even the most well-planned budget is unexpected expenses. Life is full of surprises, and unforeseen expenses can arise at any time. Whether it’s a sudden medical bill, car repairs, or home maintenance, these unexpected costs can throw a budget off balance.

When faced with unexpected expenses, individuals may find themselves resorting to using credit cards or dipping into their savings, which can disrupt their overall financial plan. This can lead to increased debt or a depletion of emergency funds.

To overcome this challenge, it is vital to incorporate a contingency plan into the budget. Setting aside a portion of income specifically for unexpected expenses can help individuals handle these unforeseen costs without derailing their budget. Building an emergency fund can provide a safety net for when unexpected expenses arise, ensuring that individuals can cover these costs without any major financial setbacks.

Additionally, having appropriate insurance coverage can also help mitigate the impact of unexpected expenses. Whether it’s health insurance, auto insurance, or home insurance, having the right coverage can provide financial protection and minimize the burden of unexpected costs.

It’s important to review and adjust the budget periodically to account for any changes in financial circumstances or lifestyle. By anticipating and preparing for unexpected expenses, individuals can maintain better financial stability and avoid unnecessary stress when faced with unforeseen costs.

Debt Repayment

Dealing with debt is a major challenge when it comes to budgeting. High-interest rates, multiple loans, and mounting debt can make it difficult to allocate funds for other financial goals and expenses. Debt repayment becomes a priority, but it can be overwhelming to tackle, especially if the debt is significant.

One strategy to overcome this challenge is to develop a debt repayment plan. This involves identifying all current debts, prioritizing them based on interest rates and repayment terms, and creating a strategy to pay them off systematically. This might involve focusing on high-interest debts first or utilizing debt consolidation methods to simplify payments and potentially lower interest rates.

Another approach is to increase income or decrease expenses to allocate more funds toward debt repayment. This could include taking on a side job, cutting unnecessary expenses, or negotiating with creditors to reduce interest rates or create more manageable payment plans.

Seeking professional help from credit counseling agencies or financial advisors can also be beneficial in developing a debt repayment plan and gaining valuable insights on managing and reducing debt. They can provide guidance on budgeting, negotiating with creditors, and exploring debt relief options.

It’s important to remember that debt repayment takes time and requires discipline. Sticking to a well-defined debt repayment plan and avoiding additional debt accumulation is crucial for long-term financial stability.

By prioritizing debt repayment and incorporating it into the budget, individuals can take control of their financial situation, alleviate stress, and work towards a debt-free future.

Prioritizing Expenses

One common challenge when budgeting is prioritizing expenses. With limited income and competing financial obligations, individuals often find it challenging to determine which expenses should take precedence over others.

To overcome this challenge, it’s essential to identify and prioritize necessary expenses. These include essential items like housing, utilities, food, transportation, and healthcare. These expenses are crucial for maintaining a basic standard of living and should be given the highest priority in the budget.

After covering the necessary expenses, individuals can then allocate funds to other important categories, such as debt repayment, savings, and investments. Prioritizing debt repayment can help individuals reduce financial stress and improve their overall financial health. Saving and investing, on the other hand, can build long-term financial stability and help individuals achieve their future goals.

Non-essential expenses, such as entertainment, dining out, and hobbies, can be evaluated and adjusted based on available resources. While these discretionary expenses may bring joy and fulfillment, it is crucial to strike a balance between enjoying life and staying within budgetary constraints.

It’s important to regularly review and reassess expenses to ensure they align with one’s financial goals. This might involve cutting unnecessary expenses or finding more cost-effective alternatives. For example, individuals can explore ways to reduce utility bills, find affordable options for transportation, or shop smarter by looking for deals and discounts.

By prioritizing expenses, individuals can ensure that their budget focuses on meeting essential needs, managing debt, saving for the future, and allowing for occasional indulgences. This approach provides a clear and structured way to manage expenses and make the most of the available financial resources.

Creating Realistic Goals

Setting financial goals is an important aspect of budgeting, but creating realistic goals can be a challenge. Unrealistic or overly ambitious goals can lead to frustration and disappointment, making it difficult to stay motivated and adhere to the budget.

To overcome this challenge, individuals should take a realistic and practical approach to goal setting. Start by identifying short-term, medium-term, and long-term financial goals. Short-term goals can include building an emergency fund, paying off a specific debt, or saving for a vacation.

Medium-term goals may involve purchasing a home, saving for a child’s education, or starting a business. Long-term goals could include retirement planning, achieving financial independence, or leaving a financial legacy for future generations.

When setting goals, it’s important to consider the current financial situation, income level, and expenses. Setting achievable goals that align with these factors increases the likelihood of success and keeps individuals motivated throughout the budgeting process.

Breaking down larger goals into smaller, manageable milestones can also make them more attainable. For example, if the long-term goal is to save a certain amount for retirement, it can be beneficial to set smaller monthly or yearly savings targets that contribute to the overall objective.

Regularly tracking progress towards goals and celebrating milestones can provide motivation and reinforce positive financial habits. It’s also essential to regularly review and adjust goals as circumstances change. Flexibility allows individuals to adapt to unexpected situations and stay on track with their financial objectives.

Ultimately, creating realistic goals allows individuals to have a clear vision of what they want to achieve and provides direction for their budgeting efforts. Realistic goals are more within reach, increasing the likelihood of success and helping individuals stay focused on their financial journey.

Tracking and Monitoring Expenses

One of the most critical aspects of effective budgeting is tracking and monitoring expenses. However, this can be a significant challenge for many individuals. Without a clear understanding of where their money is going, it becomes challenging to make informed decisions and identify areas where adjustments can be made.

To overcome this challenge, it is essential to establish a system for tracking expenses. This can be done using various methods, such as manually recording expenses in a notebook or using budgeting apps that automatically track and categorize expenses.

Regularly reviewing bank statements, credit card statements, and receipts can provide insights into spending patterns and help identify areas where expenses can be reduced or eliminated. This practice promotes greater accountability and allows individuals to make more informed decisions about their financial choices.

With the advancement of technology, there are now numerous budgeting apps available that can simplify the process of tracking and monitoring expenses. These apps provide real-time insights into spending habits, categorize expenses, and even send notifications when certain spending limits are reached.

In addition to tracking expenses, monitoring and analyzing expenses are equally important. This involves reviewing spending patterns and comparing them to the budgeted amounts. By doing so, individuals can identify any discrepancies and make adjustments as needed.

Regular monitoring of expenses also helps individuals identify areas where they may be overspending or areas where they can potentially save more money. It allows for proactive decision-making and empowers individuals to take control of their finances.

By consistently tracking and monitoring expenses, individuals gain a better understanding of their financial habits and can make necessary adjustments to align their spending with their financial goals. This practice promotes accountability, helps identify areas for improvement, and ultimately leads to more effective and successful budgeting.

Adapting to Changes

One of the ongoing challenges individuals face when budgeting is the need to adapt to changes. Life is dynamic, and circumstances can change unexpectedly. From changes in income to unexpected expenses or shifting financial goals, being able to adapt the budget accordingly is crucial.

Adapting to changes requires flexibility and the ability to reassess and modify the budget as needed. It’s essential to regularly review financial goals and priorities to ensure they still align with current circumstances. This may involve revisiting and adjusting savings targets, debt repayment plans, or expense categories.

Changes in income can significantly impact a budget. Whether it’s a salary increase, a decrease in income, or a change in employment, it’s essential to factor these changes into the budgeting process. This may involve adjusting spending habits, reallocating funds to different categories, or exploring new income-generating opportunities.

Unexpected expenses can also require adjustments to the budget. These expenses may arise from medical emergencies, home repairs, or a sudden change in circumstances. Having an emergency fund can provide a buffer to handle these unexpected costs without derailing the budget. If necessary, reallocating funds from other categories temporarily may be necessary to address these unforeseen expenses.

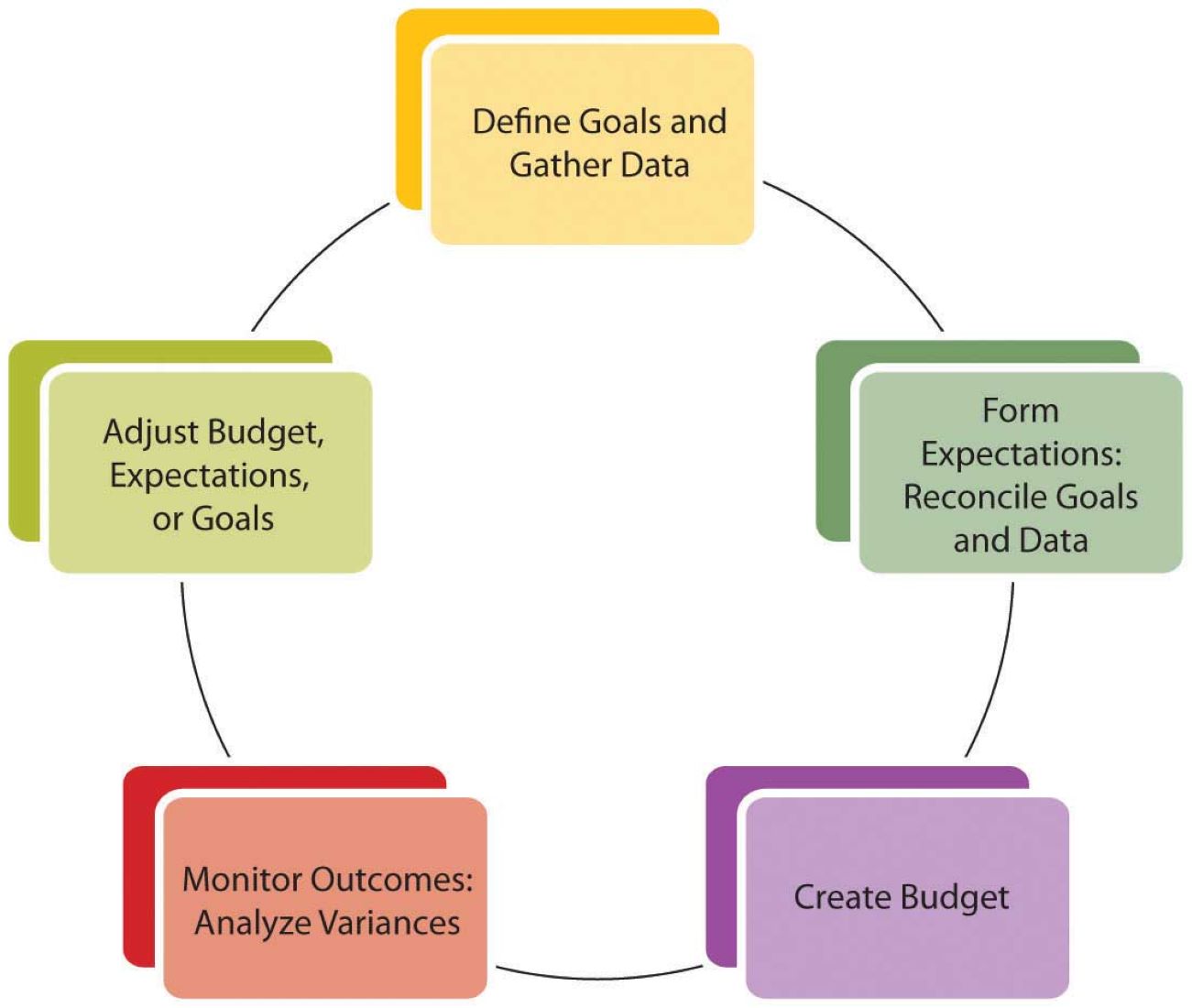

Budgeting is an iterative process, and it’s important to be adaptable and willing to make changes when necessary. This adaptability ensures that the budget remains effective and relevant to one’s current financial situation and goals. It also promotes a proactive approach to financial management and allows individuals to navigate through any challenges that may arise.

Regularly monitoring the budget and conducting periodic reviews can help individuals identify the need for adjustments and make informed decisions. Seeking guidance from financial advisors or financial planning resources can also be beneficial during times of change or uncertainty.

By embracing change and being open to modifying the budget as needed, individuals can maintain financial stability, overcome challenges, and continue to work towards their financial goals.

Conclusion

Budgeting is a crucial tool for managing personal finances and achieving financial goals. However, it comes with its fair share of challenges. From a lack of financial awareness to unexpected expenses, debt repayment, and the need to prioritize expenses, budgeting requires discipline, adaptability, and a sound understanding of one’s financial situation.

To overcome these challenges, individuals must prioritize financial education to gain a clear understanding of personal finance concepts. Building financial awareness allows for informed decision-making and effective budgeting.

Creating realistic goals and regularly tracking and monitoring expenses are integral parts of successful budgeting. By setting achievable goals and consistently monitoring spending habits, individuals can maintain focus on financial objectives and make necessary adjustments as circumstances change.

Adapting to changes is another key aspect of successful budgeting. Life is unpredictable, and being flexible and adaptable allows individuals to navigate unexpected expenses, changes in income, and shifting financial priorities.

In conclusion, budgeting is a continuous process that requires commitment, financial literacy, and the ability to adapt. By overcoming challenges such as a lack of financial awareness, handling unexpected expenses, debt repayment, prioritizing expenses, creating realistic goals, tracking and monitoring expenses, and adapting to changes, individuals can take control of their finances and work towards achieving long-term financial stability.

Remember, budgeting is an ongoing journey that requires patience and perseverance. With determination, discipline, and a proactive mindset, individuals can overcome these challenges and build a solid financial foundation for a brighter future.