Home>Finance>What Is A Bull? Definition In Investing, Traits, And Examples

Finance

What Is A Bull? Definition In Investing, Traits, And Examples

Published: October 20, 2023

Discover the meaning of a bull in finance, explore its defining characteristics, and gain insights from real-life examples for a better understanding.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

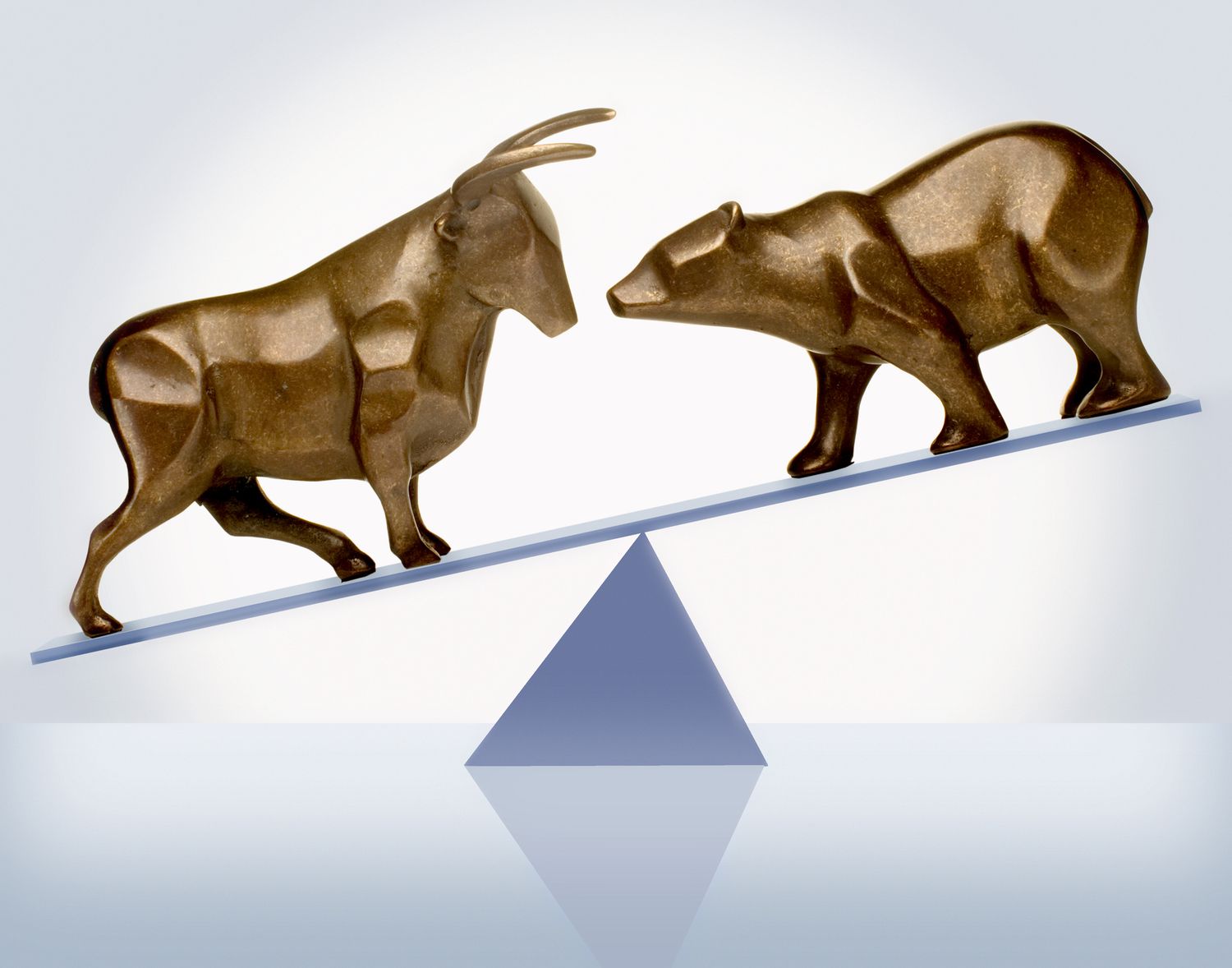

Understanding Bulls in Investing

When it comes to investing, there are a number of terms and concepts that can be quite confusing, particularly for beginners. One such term is “bull.” If you’re new to investing, you might be wondering, what is a bull and why is it important? In this article, we’ll dive into the definition of a bull in investing, discuss the traits or characteristics associated with this term, and provide examples to help you understand it better.

Key Takeaways

- A bull in investing refers to a market condition characterized by rising stock prices and optimistic sentiment among investors.

- The traits of a bull market include strong investor confidence, increased buying activity, and a generally positive economic outlook.

Defining a Bull in Investing

So, what exactly is a bull in the world of investing? A bull refers to a market condition when stock prices are rising or expected to rise, typically accompanied by an optimistic outlook from investors. In a bull market, the demand for stocks exceeds the supply, leading to a general uptrend in the stock market. This positive market sentiment is often fueled by factors such as strong economic growth, low interest rates, or positive earnings reports.

During a bull market, investors are generally more willing to take on risk, as they anticipate higher returns on their investments. This increased risk appetite can result in increased buying activity, as investors seek to capitalize on the upward momentum of the market.

Traits of a Bull Market

Now that we know what a bull market is, let’s explore some of its key traits:

- Strong Investor Confidence: One of the defining traits of a bull market is the high level of investor confidence. When investors feel optimistic about the direction of the market, they are more likely to buy stocks, contributing to the upward movement of stock prices.

- Increased Buying Activity: In a bull market, there tends to be increased buying activity as investors rush to take advantage of the rising stock prices. This increased demand for stocks further fuels the upward trend.

- Positive Economic Outlook: Bull markets are often associated with a positive economic outlook. Factors such as low unemployment rates, robust GDP growth, and a favorable business environment can contribute to the optimistic sentiment among investors.

Examples of Bull Markets

To better illustrate the concept of a bull market, let’s look at a few historical examples:

- The Dotcom Boom: The late 1990s and early 2000s witnessed a remarkable bull market, fueled by the rise of internet companies. Investors were highly optimistic about the potential of these tech companies and stock prices soared to unprecedented levels. The euphoria eventually led to the dotcom bubble burst, marking the end of the bull market.

- The Post-Financial Crisis Recovery: Following the global financial crisis in 2008, central banks implemented measures to stimulate economic growth. These efforts, combined with improving economic indicators, led to a bull market that lasted for several years. Stock prices steadily climbed higher, and investors regained confidence in the market.

In conclusion, a bull in investing refers to a market condition characterized by rising stock prices and optimistic sentiment among investors. Understanding the traits and examples of a bull market can help investors make informed decisions and navigate the complexities of the financial world.