Finance

What Is Operating Cash Flow?

Modified: February 21, 2024

Learn about operating cash flow in finance and how it impacts a company's financial stability. Get insights into its importance and calculation methods.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on operating cash flow. In the world of finance and accounting, understanding the concept of operating cash flow is essential for evaluating the financial health and operational efficiency of a company. Operating cash flow, often referred to as cash flow from operations, provides valuable insights into a company’s ability to generate cash from its core business activities. It is a key measure of a company’s liquidity and financial viability.

Operating cash flow is an important metric for both investors and analysts, as it helps assess the company’s ability to generate sufficient cash to cover its operating expenses, invest in growth opportunities, pay off debts, and distribute dividends to shareholders. By analyzing a company’s operating cash flow, stakeholders can gain a deeper understanding of its financial performance and make more informed investment decisions.

In this guide, we will delve into the definition, importance, calculation, components, interpretation, and limitations of operating cash flow. We will explore how this metric can be used to evaluate a company’s financial health and its ability to generate sustainable cash flows. Whether you are an investor, an analyst, or simply someone looking to expand their financial knowledge, this guide will provide you with a comprehensive understanding of operating cash flow and its significance in financial analysis.

So, let’s get started and unravel the intricacies of operating cash flow. By the end of this guide, you will have a solid grasp of this vital financial metric and be equipped to incorporate it into your investment analysis and decision-making process.

Definition of Operating Cash Flow

In finance and accounting, operating cash flow is a measure of the cash generated by a company’s core business operations during a specific period. It represents the net cash inflows and outflows resulting from the company’s day-to-day operational activities, such as sales and expenses. Operating cash flow excludes cash flows from investing and financing activities, focusing solely on the cash generated or used in the regular operations of the business.

Operating cash flow is a fundamental component of a company’s cash flow statement, which provides a comprehensive overview of the sources and uses of cash over a given period. It is a crucial metric for assessing a company’s ability to generate cash internally, without relying on external financing or investment activities.

Operating cash flow is derived from the net income of a company, adjusted for non-cash items such as depreciation and amortization, changes in working capital, and other non-operating items. It represents the actual cash flow generated by the company’s operations and is therefore considered a more accurate measure of financial performance compared to net income alone.

A positive operating cash flow indicates that a company is generating more cash from its operations than it is spending. This is generally seen as a positive sign, as it demonstrates the company’s ability to fund its daily operations, meet its financial obligations, and potentially invest in growth opportunities.

On the other hand, a negative operating cash flow suggests that a company is spending more cash on its operations than it is generating. This could be a red flag, signaling potential liquidity issues and the need for external financing to sustain operations.

In summary, operating cash flow is a measure of the cash generated or used by a company’s core operations, providing valuable insights into its financial health and ability to generate sustainable cash flows. It is an essential metric for investors and analysts to assess the operational efficiency and profitability of a company.

Importance of Operating Cash Flow

Operating cash flow is a vital metric for assessing the financial health and sustainability of a company. It provides valuable insights into a company’s ability to generate cash from its core operations and is widely used by investors, analysts, and financial professionals for several reasons.

1. Measure of Financial Viability: Operating cash flow indicates a company’s ability to generate sufficient cash to cover its day-to-day operational expenses, such as salaries, rent, and utilities. It is a critical measure of a company’s financial viability and ability to meet its short-term obligations. A consistently positive operating cash flow demonstrates that the company’s operations are generating enough cash to sustain its business activities without relying on external financing.

2. Indicator of Profitability: Operating cash flow is closely tied to a company’s profitability. While net income reflects profit on an accounting basis, it does not necessarily represent the actual cash generated by a company. Operating cash flow, on the other hand, provides a more accurate picture of the cash flow generated from operations after accounting for non-cash items such as depreciation and changes in working capital. By analyzing the trend and magnitude of operating cash flow, investors and analysts can gauge the company’s profitability and efficiency in converting revenue into cash.

3. Assessing Cash Flow Adequacy: Operating cash flow helps evaluate a company’s ability to fund its growth initiatives, repay debts, and distribute dividends to shareholders. A positive operating cash flow allows a company to reinvest in its operations, undertake expansion projects, or make strategic acquisitions. By analyzing the magnitude and stability of operating cash flow, stakeholders can assess whether a company has sufficient cash flow to meet its future financing needs and sustain its growth trajectory.

4. Comparison and Benchmarking: Operating cash flow enables investors and analysts to compare a company’s financial performance with industry peers and competitors. By assessing a company’s operating cash flow in relation to its revenue, profitability, and cash flow margins, stakeholders can gauge the company’s operating efficiency and competitiveness within the industry. This comparative analysis provides valuable insights into a company’s relative standing and performance in the market.

5. Predictive Value: Operating cash flow is often considered a leading indicator of a company’s future financial performance. A strong and consistently positive operating cash flow indicates a robust business model that is generating sustainable cash flows. On the other hand, a negative or declining operating cash flow can be an early warning sign of potential financial distress. By monitoring operating cash flow trends, stakeholders can make better-informed decisions and take appropriate actions regarding their investment in a company.

Overall, operating cash flow is a crucial metric for evaluating a company’s financial health, profitability, and sustainability. It provides valuable insights into a company’s ability to generate cash from its operations and is an essential tool for investors and analysts in making sound investment decisions.

Calculation of Operating Cash Flow

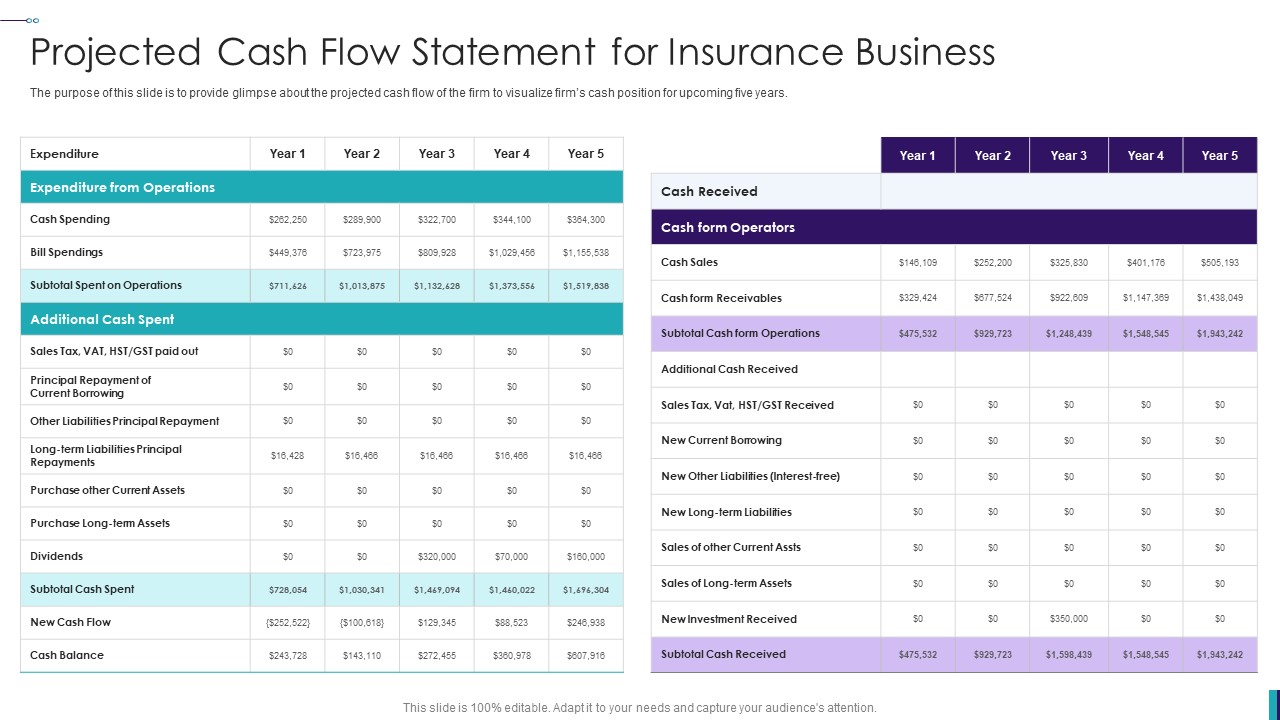

Calculating operating cash flow involves analyzing the cash flows from a company’s core operations during a specific period. The formula for calculating operating cash flow is as follows:

Operating Cash Flow = Net Income + Non-Cash Expenses – Changes in Working Capital

The components of the formula are as follows:

1. Net Income: The first component of the formula is the net income of the company, which represents the total revenue minus all expenses and taxes. Net income can be found on the company’s income statement.

2. Non-Cash Expenses: This component accounts for non-cash expenses such as depreciation and amortization. These expenses do not involve an actual cash outflow but are recorded to allocate the cost of assets over their useful lives.

3. Changes in Working Capital: Working capital refers to a company’s current assets and liabilities used in day-to-day operations. It includes items such as accounts receivable, inventory, accounts payable, and accrued expenses. Changes in working capital reflect the difference between the current period’s working capital and the previous period’s working capital. A decrease in working capital adds to operating cash flow, while an increase in working capital reduces it.

By calculating the operating cash flow, stakeholders can gain insights into the actual cash generated by the company’s operations after accounting for non-cash expenses and changes in working capital.

It is important to note that the operating cash flow formula represents a broad measure of cash flow from operations and does not capture the entire cash flow picture of a company. To obtain a more comprehensive understanding of a company’s cash flow, investors and analysts may also consider other components such as cash flows from investing activities and financing activities.

Understanding the calculation of operating cash flow is crucial for evaluating a company’s ability to generate cash from its core operations and for assessing its financial health and sustainability.

Components of Operating Cash Flow

The operating cash flow of a company is derived from various components that contribute to the overall cash flow generated by its core operations. By breaking down the operating cash flow into its key components, investors and analysts can gain a deeper understanding of the drivers behind the cash flow generation. Here are the main components of operating cash flow:

- Net Income: Net income is the starting point for calculating operating cash flow. It represents the total revenue of the company minus all expenses and taxes. Net income provides an indicator of the profitability of a company, but it does not necessarily reflect the actual cash flow generated by its operations.

- Depreciation and Amortization: Depreciation and amortization are non-cash expenses that are added back to the net income to calculate operating cash flow. They represent the allocation of the cost of assets over their useful lives. Although there is no actual cash outflow associated with depreciation and amortization, adding them back to net income helps reflect the operating cash flow more accurately.

- Changes in Working Capital: Working capital refers to a company’s current assets and liabilities that are used in day-to-day operations. Changes in working capital have a direct impact on operating cash flow. An increase in current assets such as accounts receivable and inventory or a decrease in current liabilities such as accounts payable will reduce operating cash flow, as more cash is tied up in operations. Conversely, a decrease in current assets or an increase in current liabilities will increase operating cash flow, as more cash is freed up.

- Non-Cash Expenses: Apart from depreciation and amortization, there may be other non-cash expenses that are added back to net income to calculate operating cash flow. These expenses could include non-cash items such as stock-based compensation or non-recurring expenses that do not involve an actual cash outflow.

- Interest and Taxes: In some cases, interest expense and taxes paid by a company may be considered as part of operating cash flow. This treatment is applicable if interest and taxes are considered to be a part of the operating activities of the business rather than financing or investing activities. However, it is important to note that industry practices may vary in this regard.

By considering these components, stakeholders can gain a comprehensive view of a company’s operating cash flow and better evaluate its ability to generate cash from its core operations. Analyzing these components can provide insights into the company’s profitability, efficiency in managing working capital, and overall financial health.

Interpretation of Operating Cash Flow

Interpreting the operating cash flow of a company is crucial for understanding its financial performance and assessing its ability to generate sustainable cash flows. By analyzing the operating cash flow, investors and analysts can gain valuable insights into the company’s operational efficiency, liquidity, and overall financial health. Here are the key points to consider when interpreting operating cash flow:

- Positive Operating Cash Flow: A positive operating cash flow indicates that the company is generating more cash from its core operations than it is spending. This is generally seen as a positive sign, as it demonstrates the company’s ability to cover its day-to-day operational expenses, invest in growth opportunities, and potentially distribute dividends to shareholders.

- Negative Operating Cash Flow: A negative operating cash flow implies that the company is spending more cash on its operations than it is generating. This could be concerning, as it suggests potential liquidity issues and the need for external financing to sustain its operations. However, it is important to consider the reasons behind the negative operating cash flow, as it could be due to temporary factors such as high capital expenditures or investment in growth initiatives.

- Operating Cash Flow vs. Net Income: Comparing operating cash flow to net income is essential to evaluate the quality of earnings. If a company’s net income is consistently higher than its operating cash flow, it may indicate that the company is relying on non-cash items or aggressive accounting practices to inflate its profits. On the other hand, if a company’s operating cash flow exceeds its net income, it suggests that the company is generating strong cash flows from its operations, which is a positive sign.

- Operating Cash Flow Margin: Analyzing the operating cash flow margin, which is the operating cash flow divided by total revenue, helps assess the efficiency of a company’s operations. A higher operating cash flow margin indicates that the company is generating a larger proportion of cash flow from its revenue, suggesting stronger operational efficiency and profitability.

- Trends in Operating Cash Flow: Evaluating the trend of operating cash flow over time is essential for assessing a company’s financial performance. A consistent or improving operating cash flow trend indicates a healthy and sustainable business model. Conversely, a declining or volatile operating cash flow trend may raise concerns and warrant further investigation into potential operational or financial issues.

- Comparison to Industry Peers: Comparing a company’s operating cash flow to its industry peers is important for benchmarking and determining its competitive position. If a company consistently outperforms its peers in terms of operating cash flow, it may suggest a more efficient and profitable business model.

Interpreting operating cash flow requires a comprehensive analysis of various factors, including profitability, liquidity, and overall financial performance. It is essential to consider the company’s specific industry dynamics, business model, and historical trends when interpreting operating cash flow, as this metric provides valuable insights into the company’s ability to generate cash from its core operations.

Limitations of Operating Cash Flow Analysis

While operating cash flow analysis provides valuable insights into a company’s financial performance, it is important to recognize its limitations and consider other financial metrics for a comprehensive evaluation. Here are some key limitations of operating cash flow analysis:

- Non-Cash Items: Operating cash flow does not account for non-cash items such as non-cash expenses, changes in non-cash working capital, or non-operating gains or losses. These items can significantly impact a company’s overall financial position and should be considered alongside operating cash flow for a more complete analysis.

- Timing of Cash Flows: Operating cash flow does not provide information on the timing of cash flows. It does not distinguish between cash inflows and outflows within a given period. As a result, it may not reflect the true liquidity of a company at a given point in time, particularly if there are significant fluctuations in cash flows throughout the reporting period.

- Capital Expenditures: Operating cash flow does not directly consider capital expenditures, which are essential for maintaining and expanding a company’s operations. Capital expenditures require significant cash outflows that may affect a company’s ability to generate positive operating cash flow despite strong operational performance.

- Quality of Earnings: Operating cash flow can be influenced by factors that might distort the quality of earnings. For example, aggressive revenue recognition practices, changes in accounting policies, or non-recurring items can impact the comparability and reliability of operating cash flow across different periods or industry peers. Therefore, it is essential to consider other financial metrics and perform a thorough analysis of the underlying factors driving operating cash flow.

- Business Model Variations: Different industries and business models can impact the reliability and comparability of operating cash flow. For instance, capital-intensive industries with extended cash conversion cycles might have lower operating cash flow margins than industries with faster cash cycles. Comparing operating cash flow between companies requires understanding the specific dynamics and characteristics of their respective industries.

- External Factors: Operating cash flow analysis may not fully capture the impact of external factors such as macroeconomic conditions, industry trends, or regulatory changes. These factors can have significant effects on a company’s cash flow generation and financial performance. Therefore, it is important to consider the broader economic and industry landscape when evaluating operating cash flow.

While operating cash flow analysis is a valuable tool, it should be used in conjunction with other financial metrics and a comprehensive understanding of the company’s specific circumstances and industry dynamics. By considering these limitations and conducting a holistic analysis, stakeholders can obtain a more accurate picture of a company’s financial health and make well-informed investment decisions.

Conclusion

Operating cash flow is a critical metric for evaluating the financial health and sustainability of a company. It provides valuable insights into a company’s ability to generate cash from its core operations and serves as a key indicator of its liquidity and profitability. By calculating and interpreting operating cash flow, stakeholders can make informed investment decisions and gain a deeper understanding of a company’s financial performance.

Throughout this guide, we have explored the definition, importance, calculation, components, interpretation, and limitations of operating cash flow. We have learned that operating cash flow reflects the cash generated or used by a company’s core operations, excluding cash flows from investing and financing activities. A positive operating cash flow signifies that a company is generating more cash than it is spending on its operations, demonstrating a strong financial position.

Operating cash flow analysis allows investors and analysts to assess a company’s ability to meet its day-to-day expenses, invest in growth opportunities, and generate sustainable cash flows. By comparing operating cash flow to net income, evaluating trends, examining the components, and benchmarking against industry peers, stakeholders can gain deeper insights into a company’s operational efficiency and financial performance.

However, it is important to acknowledge the limitations of operating cash flow analysis. It does not account for non-cash items, timing of cash flows, capital expenditures, and other external factors that can influence a company’s financial position. Therefore, operating cash flow should be used in conjunction with other financial metrics and a comprehensive analysis of a company’s specific circumstances and industry dynamics.

In conclusion, operating cash flow is a powerful tool for evaluating a company’s financial health and understanding its ability to generate cash from its core operations. By considering the calculation, interpretation, and limitations of operating cash flow, stakeholders can make well-informed decisions and gain a more accurate understanding of a company’s financial performance in order to achieve their investment objectives.