Finance

What Are The Advantages Of Consumer Credit

Published: January 14, 2024

Learn about the benefits of consumer credit in managing your finances and improving your purchasing power. Unlock opportunities for growth and financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Consumer credit is a financial tool that allows individuals to borrow money to fund their purchases and expenditures. It is a system that has become increasingly popular in today’s society, providing people with the flexibility and convenience to access funds when needed. Whether it is for buying a home, purchasing a car, or simply making everyday purchases, consumer credit offers numerous advantages that can greatly enhance an individual’s financial well-being.

In this article, we will delve into the advantages of consumer credit and why it is important to understand how to use it responsibly. From the flexibility and convenience it offers to the ability to build credit history, consumer credit has significant benefits that can positively impact your financial journey.

It is important to note that while consumer credit can be a valuable financial tool, it should be used with caution and proper understanding. Before engaging in any form of consumer credit, it is essential to do proper research, understand the terms and conditions, and assess your own financial situation to ensure you are making responsible choices.

Now, let’s explore some of the key advantages of consumer credit:

Flexibility and Convenience

One of the primary advantages of consumer credit is the flexibility and convenience it offers. Unlike traditional forms of payment, such as cash or debit cards, consumer credit allows individuals to make purchases and pay for them over time. This means that you can spread out the cost of a large purchase and pay it off in manageable installments, rather than having to pay the full amount upfront.

Additionally, consumer credit provides the convenience of making purchases online or in-store without the need for immediate cash. This is especially beneficial for larger purchases or unexpected expenses that may arise. With consumer credit, you can enjoy the flexibility of accessing funds when you need them, allowing you to meet your financial needs without significant delay or inconvenience.

Furthermore, many consumer credit options come with the convenience of credit cards. Credit cards offer a secure and widely accepted form of payment, enabling you to make purchases globally and have the peace of mind that your transactions are protected. They also provide you with a detailed record of your spending, making it easier to track your expenses and manage your personal finances effectively.

Overall, the flexibility and convenience of consumer credit make it a valuable tool in today’s fast-paced and digitally connected world. Whether it’s making online purchases, funding a vacation, or covering unexpected expenses, consumer credit allows you to have instant access to funds and the flexibility to manage your financial obligations in a way that suits your lifestyle.

Immediate Access to Funds

One of the major advantages of consumer credit is the ability to have immediate access to funds when needed. Unlike other financing options that may require lengthy approval processes or collateral, consumer credit provides quick and convenient access to funds, allowing you to meet your financial needs promptly.

Whether it’s an unexpected medical expense, a home repair, or a once-in-a-lifetime opportunity, consumer credit can provide you with the necessary funds to address these situations. With options such as credit cards, personal loans, or lines of credit, you can have the peace of mind knowing that you have a financial safety net available to you at any time.

Another advantage of immediate access to funds is the ability to take advantage of time-sensitive opportunities. For example, if you come across a limited-time offer on a product or service that you have been eyeing, consumer credit enables you to make the purchase immediately and take advantage of the deal. This can save you money and ensure that you don’t miss out on valuable opportunities.

Moreover, having immediate access to funds through consumer credit can help in managing cash flow. It allows you to smooth out any temporary cash shortages or unexpected expenses without disrupting your day-to-day financial obligations. This flexibility can be particularly useful for individuals who are self-employed or have irregular income streams.

Overall, the ability to have immediate access to funds through consumer credit empowers individuals to address urgent financial needs and take advantage of time-sensitive opportunities. It provides a sense of financial security and flexibility, allowing you to maintain control over your financial situation and make informed decisions based on your individual circumstances.

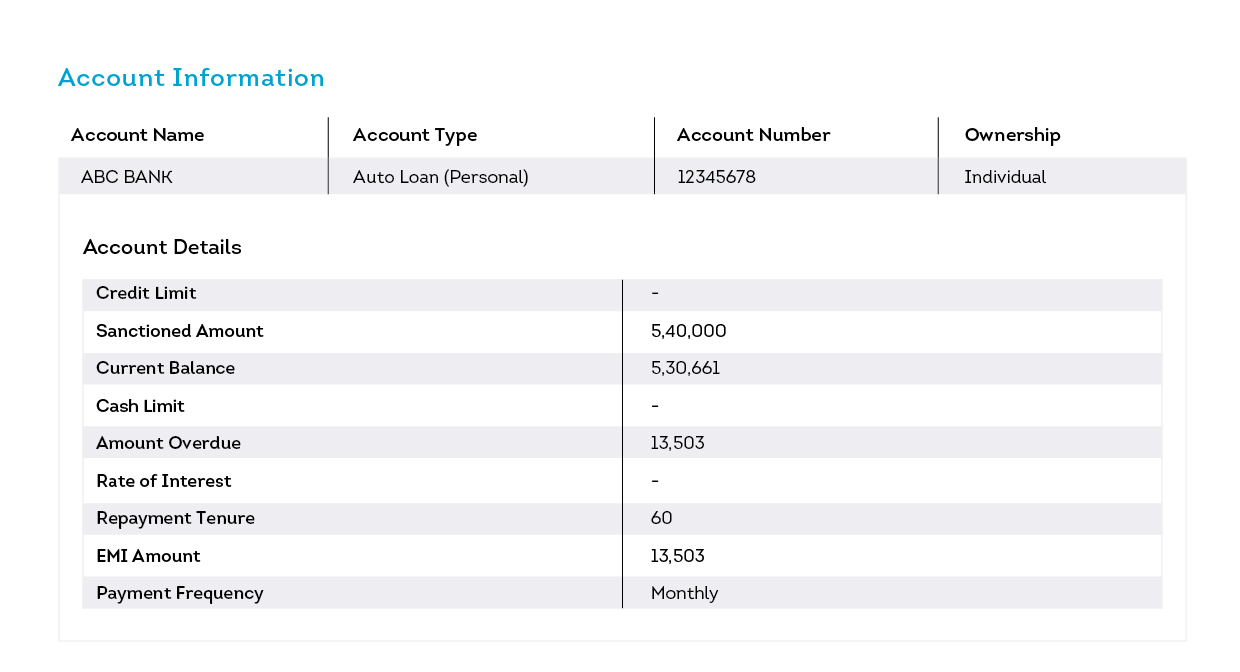

Ability to Make Larger Purchases

Consumer credit offers individuals the advantage of being able to make larger purchases that may be otherwise out of reach with immediate cash on hand. Whether it’s buying a new car, investing in home improvements, or purchasing high-value electronics, consumer credit provides the financial flexibility to make these significant purchases.

By spreading out the cost of a large purchase over time, consumer credit allows you to manage your budget more effectively. Instead of having to save up for months or even years to afford a substantial expense, you can take advantage of consumer credit options such as installment loans or credit lines to make those purchases right away.

In addition, consumer credit offers the convenience of structured repayment plans that are designed to fit your budget. Instead of being burdened by the immediate full cost of a large purchase, you can make affordable monthly payments over an extended period. This ensures that the purchase remains manageable and doesn’t strain your finances.

Another advantage of utilizing consumer credit for larger purchases is the potential for favorable interest rates. Depending on your credit score and the type of credit you acquire, you may qualify for lower interest rates than other financing options. This can save you money over time and allow you to invest in higher-quality products or services.

Furthermore, making larger purchases with consumer credit can also offer additional benefits such as warranties, extended protection, or rewards programs. Many credit cards, for instance, provide perks such as cashback, travel rewards, or purchase protections, allowing you to maximize the value of your purchase.

Overall, the ability to make larger purchases through consumer credit empowers individuals to achieve their financial goals without having to wait or compromise on the quality of their purchases. It provides the flexibility to manage these expenses over time and take advantage of favorable terms and benefits, making consumer credit a valuable tool for those looking to make significant investments.

Build Credit History

Consumer credit plays a crucial role in building and establishing a strong credit history. Your credit history is a record of your past borrowing and repayment behavior, and it is a key factor that lenders consider when assessing your creditworthiness for future loans or financing options.

By utilizing consumer credit responsibly, such as making timely payments and managing your debts effectively, you can demonstrate to lenders and financial institutions that you are a reliable borrower. This positive credit behavior contributes to building a favorable credit history, which is vital when applying for larger loans such as a mortgage or a business loan.

In addition, having a positive credit history opens doors to better interest rates and more favorable loan terms. Lenders are more likely to offer competitive rates to borrowers with a proven track record of responsible credit management. This can potentially save you thousands of dollars over the life of a loan.

Consumer credit also provides an opportunity to diversify your credit mix, which is another essential aspect of building a strong credit history. Credit mix refers to the different types of credit accounts you have, such as credit cards, installment loans, or a mortgage. By responsibly managing a variety of credit accounts, you can showcase your ability to handle different types of credit and enhance your creditworthiness.

It is important to note that building credit history takes time and consistency. It requires responsible use of consumer credit, such as keeping balances low, making payments on time, and avoiding excessive debt. It is also essential to regularly review your credit reports to ensure the accuracy of the information and address any discrepancies promptly.

By focusing on building a positive credit history through consumer credit, you are not only improving your chances of securing future financing options but also setting yourself up for better financial opportunities and flexibility in the long run.

Rewards and Benefits

One of the enticing advantages of utilizing consumer credit is the potential to earn rewards and benefits. Many credit cards and other consumer credit options offer rewards programs that allow you to earn points, cashback, airline miles, or other perks based on your spending habits.

These rewards programs can provide significant value and enhance your overall financial experience. For example, cashback rewards allow you to earn a percentage of your purchases back as cash, which can accumulate over time and be used towards future expenses or savings. Similarly, airline miles or travel rewards can help offset the cost of flights, hotel stays, or other travel-related expenses, making your dream trips more accessible and affordable.

Furthermore, some credit cards extend additional benefits such as purchase protection, extended warranties, and fraud protection. These features provide an extra layer of security and peace of mind when making purchases, protecting you against faulty products or unauthorized transactions.

In addition to the tangible rewards and benefits, consumer credit with rewards programs can also incentivize responsible credit behavior. By using your credit responsibly and making timely payments, you can potentially earn higher reward tiers or unlock additional benefits, further enhancing the value of your consumer credit experience.

It is important to note that while rewards and benefits can be appealing, it is crucial to use consumer credit responsibly and avoid overspending simply to earn rewards. It is essential to stay within your budget and only make purchases that you can comfortably afford to pay off.

By leveraging rewards and benefits offered through consumer credit, you can maximize the value of your purchases and enhance your overall financial well-being. Whether it’s earning cashback on everyday expenses, enjoying travel perks, or having extra peace of mind with purchase protection, consumer credit rewards programs can provide tangible benefits and enhance your overall financial experience.

Emergency Funds

Having access to emergency funds is crucial for handling unexpected expenses that may arise in life. Consumer credit can serve as a valuable tool in building and maintaining emergency funds to navigate through unforeseen circumstances.

Emergencies can come in various forms, such as medical bills, car repairs, or home maintenance issues. These unexpected expenses can put a strain on your finances if you are not prepared. Consumer credit provides a safety net by allowing you to access funds quickly and efficiently during times of need.

By having a designated credit card or line of credit for emergencies, you can ensure that you have readily available funds to address any urgent situations. This can provide you with peace of mind, knowing that you have a financial cushion to rely on when unexpected expenses occur.

Unlike traditional loans or borrowing options that may take time to approve and process, consumer credit allows for immediate access to funds. This means that you can handle emergencies promptly, such as paying for medical treatment or fixing a broken appliance, without delay.

When using consumer credit for emergency funds, it is important to have a repayment plan in place. Ideally, you should aim to repay the debt as soon as possible to avoid excessive interest charges. Planning and budgeting can help ensure that you can repay the borrowed amount in a timely manner without falling into a cycle of debt.

Having emergency funds through consumer credit can provide a sense of financial security and reduce the overall stress associated with unexpected expenses. It allows you to handle emergencies smoothly without disrupting your day-to-day financial obligations or depleting your savings.

However, it is important to note that consumer credit should not be solely relied upon for emergency situations. It is still essential to have a separate emergency savings account to serve as the primary source of funds. Building an emergency fund should be a priority, as it provides the convenience and peace of mind that comes with having readily available cash in times of need.

In summary, consumer credit can be a valuable tool in creating and maintaining emergency funds. It offers immediate access to funds during unexpected situations, providing financial security and peace of mind. However, it should be used responsibly and in conjunction with building a dedicated emergency savings account for long-term financial stability.

Deferred or Interest-Free Payments

One of the advantages of consumer credit is the option for deferred or interest-free payments. This feature allows individuals to make purchases and delay the payment or avoid paying interest on the amount for a specific period.

Deferred payment plans are often offered by retailers or credit card companies as a promotional incentive. With deferred payments, you can make a purchase and have the flexibility to defer the payment for a certain period, typically ranging from a few months to a year or more. This can be especially helpful when making larger purchases, as it allows you to spread out the cost over time without incurring any interest charges.

Interest-free payment options are also commonly available with certain consumer credit products. For example, credit cards may offer an introductory period during which you are not charged interest on purchases or balance transfers. This can be beneficial if you plan to make a significant purchase and need some time to pay it off without accruing interest charges.

Deferred or interest-free payments can provide financial flexibility, allowing you to manage your expenses more effectively. It can be particularly useful when faced with unexpected financial circumstances or when you want to take advantage of limited-time offers without immediately depleting your funds.

However, it’s important to note that while deferred payment plans and interest-free periods provide short-term benefits, there are a few key considerations to keep in mind. First, it’s crucial to understand the terms and conditions of the offer, including the duration of the deferred or interest-free period, any potential penalties for late payments, and the interest rate that will apply once the promotional period ends.

Additionally, it’s important to budget and plan for the deferred or interest-free payment to avoid excessive debt or financial strain when the payment comes due. Failure to make the necessary payments within the specified period or maintaining a high balance beyond the interest-free period can result in substantial interest charges and negatively impact your financial well-being.

In summary, consumer credit options that provide deferred or interest-free payments can offer short-term financial relief and flexibility. They can be useful for spreading out the cost of larger purchases or taking advantage of promotional offers. However, it’s crucial to understand the terms and plan accordingly to avoid unnecessary interest charges and maintain good financial health.

Financial Protection and Dispute Resolution

Consumer credit offers valuable financial protection and dispute resolution mechanisms that can safeguard your interests as a consumer. Whether it’s fraudulent charges, billing errors, or unsatisfactory products or services, consumer credit provides a layer of protection and recourse to address these issues.

Credit card companies, for instance, often have robust fraud protection measures in place. If unauthorized charges appear on your credit card statement, you can report them promptly and have the charges investigated. In many cases, you are not held liable for fraudulent transactions, providing you with peace of mind and financial protection against identity theft or unauthorized use of your credit card.

In addition to fraud protection, consumer credit also offers dispute resolution mechanisms for billing errors or disputes with merchants. If you encounter an issue with a purchase, such as being charged for items not received or receiving defective products, you can dispute the charge with your credit card issuer. They will investigate the matter and, if the dispute is found to be valid, ensure that you are not responsible for the disputed amount.

Furthermore, consumer credit options often provide the ability to initiate chargebacks. A chargeback is a mechanism that allows you to request a refund for a transaction directly from your credit card issuer. This can be particularly helpful if you have made a purchase from a merchant who is unresponsive or refuses to resolve the issue.

Having these financial protection mechanisms in place can provide peace of mind and ensure that you are not left financially responsible for fraudulent charges or unsatisfactory purchases. It allows you to shop with confidence, knowing that you have recourse if something goes wrong.

However, it’s important to note that financial protection and dispute resolution mechanisms are subject to specific terms and conditions outlined by your credit card issuer or consumer credit provider. It’s essential to familiarize yourself with these terms and be proactive in reporting any issues or disputes in a timely manner to maximize your chances of a successful resolution.

In summary, consumer credit offers valuable financial protection and dispute resolution mechanisms that can help safeguard your interests as a consumer. From fraud protection to dispute resolution and chargeback options, consumer credit provides a layer of security and recourse when faced with issues or disputes related to your purchases or credit transactions.

Conclusion

Consumer credit offers a range of advantages that can enhance your financial well-being and provide flexibility in managing your expenses. From the convenience and immediate access to funds to the ability to make larger purchases and build credit history, consumer credit plays a significant role in today’s financial landscape.

The flexibility and convenience of consumer credit allow individuals to spread out the cost of purchases and access funds when needed, whether for everyday expenses or unexpected emergencies. This can provide a sense of financial security and peace of mind, knowing that you have the ability to address financial needs promptly.

Furthermore, consumer credit enables individuals to make larger purchases and seize time-sensitive opportunities that may otherwise be out of reach with immediate cash on hand. It can also help build credit history, showcasing responsible credit behavior and opening doors to better financing options in the future.

Additionally, consumer credit offers rewards and benefits programs that allow you to earn cashback, airline miles, or other perks based on your spending habits. These rewards can maximize the value of your purchases and provide additional financial advantages.

In times of emergencies, consumer credit provides quick access to funds and acts as a safety net, allowing you to navigate unexpected expenses without disrupting your financial stability.

Moreover, consumer credit offers the option for deferred or interest-free payments, providing financial flexibility and helping manage expenses over time. It is essential to use these options responsibly and plan for repayment to avoid unnecessary interest charges.

Lastly, consumer credit offers financial protection and dispute resolution mechanisms, ensuring that you are protected against fraudulent charges, billing errors, and unsatisfactory purchases.

In conclusion, consumer credit can be a valuable financial tool when used responsibly. By understanding the advantages it offers and using it wisely, you can enhance your financial well-being, meet your financial goals, and navigate the ups and downs of everyday life with greater ease and convenience.