Finance

What Are Credit Sales On A Balance Sheet

Modified: February 21, 2024

Learn about credit sales on a balance sheet and how they impact a company's financial position. Explore the importance of finance in managing credit and sales transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers, transactions, and balances dictate the flow of business operations. In any organization, the concept of credit sales plays a crucial role in shaping the financial landscape. Understanding the significance of credit sales on a balance sheet is fundamental for accountants, financial analysts, and business owners alike.

Credit sales refer to goods or services that are sold on credit, allowing customers to pay at a later date instead of making an immediate payment. This practice is prevalent in various industries, from retail to manufacturing, as it enables businesses to increase their customer base and expand their sales potential.

Credit sales are important because they do not only impact a company’s revenue and cash flow but also influence the overall financial health of the business. Properly recording credit sales on a balance sheet is crucial for accurate financial reporting, assessing creditworthiness, and making informed business decisions.

In this article, we will delve deeper into the concept of credit sales on a balance sheet, understand the essential components involved in recording them, and explore their impact on a company’s financial statements.

Definition of Credit Sales

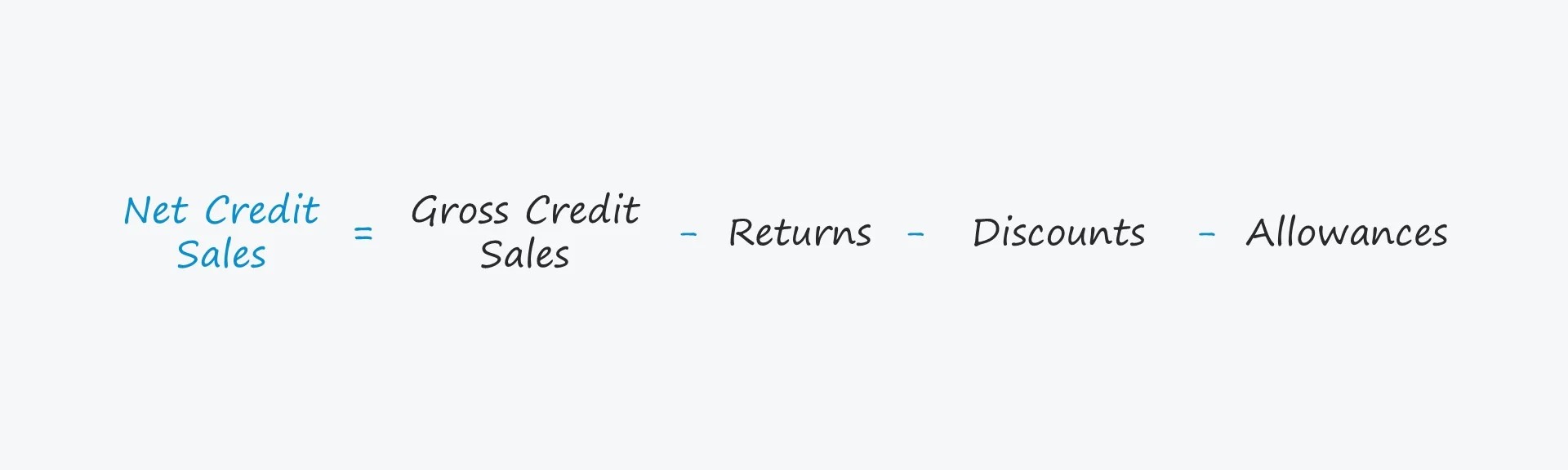

Credit sales refer to transactions where goods or services are sold on credit, allowing customers to defer payment until a later date. Instead of paying upfront, customers receive an invoice or a statement indicating the amount owed and the terms of payment, such as the due date or any applicable interest charges.

When a business engages in credit sales, it essentially extends credit to its customers. This means that the business is trusting the customer to fulfill their payment obligations according to the agreed-upon terms. Credit sales are typically recorded as accounts receivable on the balance sheet, representing the amount owed by customers for goods or services that have been delivered.

It’s important to note that credit sales differ from cash sales, where customers make immediate payment at the time of purchase. Credit sales provide customers with flexibility in managing their cash flow and allow businesses to attract customers who may not have the immediate funds to make a purchase outright.

The terms and conditions of credit sales can vary depending on the business and industry. It may include factors such as the payment period, interest charges for late payments, early payment discounts, and credit limits imposed on customers to manage credit risk.

By offering credit sales, businesses can foster customer loyalty, increase sales, and improve cash flow by collecting payment over an extended period. However, it also introduces the risk of non-payment or delayed payment, which must be carefully managed to maintain a healthy financial position.

Importance of Credit Sales on a Balance Sheet

Credit sales play a crucial role on a balance sheet as they directly impact a company’s financial position and provide insights into its revenue recognition and cash flow management. Here are some key reasons why credit sales are important:

- Revenue Recognition: Credit sales contribute to a company’s revenue. By recording credit sales on a balance sheet, businesses can accurately reflect their earnings and measure the success of their sales operations. This information is valuable for investors, creditors, and stakeholders who rely on accurate financial reporting to evaluate a company’s performance.

- Cash Flow Management: Offering credit sales allows businesses to manage cash flow effectively. While it delays the receipt of cash, it enables a company to generate revenue and maintain a steady flow of sales. This is particularly beneficial for businesses with seasonal or cyclical sales patterns, as it provides them with additional liquidity during slower periods.

- Customer Relations: Credit sales can help build strong customer relationships by providing flexibility in payment options. By allowing customers to make purchases on credit, businesses can attract and retain loyal customers who may prefer the convenience of deferred payments.

- Competitive Advantage: In many industries, offering credit sales is a standard practice. By providing this option, businesses can remain competitive and gain an edge over competitors who may only accept immediate payment. This can help attract new customers and increase market share.

- Working Capital Management: Credit sales contribute to accounts receivable, which is an important component of working capital. By efficiently managing accounts receivable, businesses can optimize their cash conversion cycle, ensuring they have enough funds to cover expenses and invest in growth opportunities.

In summary, credit sales have a significant impact on a company’s balance sheet by influencing its revenue recognition, cash flow, customer relations, competitive positioning, and working capital management. By carefully managing credit sales and balancing the risks associated with extending credit, businesses can leverage this practice to drive growth and achieve their financial goals.

Recording Credit Sales on a Balance Sheet

Properly recording credit sales on a balance sheet is essential for accurate financial reporting and maintaining the integrity of a company’s financial statements. Here are the key steps involved in recording credit sales:

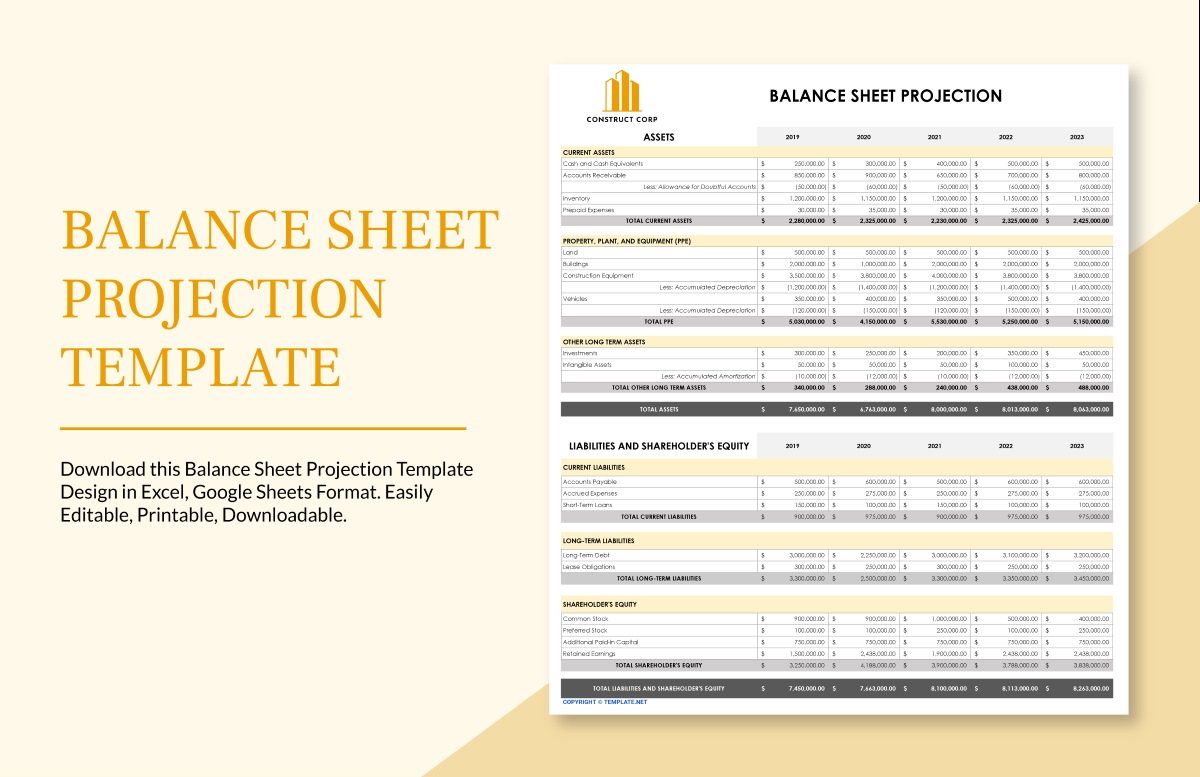

- Create an Accounts Receivable Account: When a credit sale occurs, an accounts receivable account is created on the balance sheet. This account represents the amount owed to the company by its customers for goods or services delivered on credit.

- Record the Sale: The credit sale is recorded in the sales revenue account on the income statement, increasing the company’s revenue. Simultaneously, the accounts receivable account is also updated, reflecting the increase in the amount owed by customers.

- Assign Payment Terms: The payment terms, such as the due date and any applicable interest charges, are documented for each credit sale. This information is crucial for managing cash flow and following up on outstanding payments.

- Track Accounts Receivable: As time progresses, the accounts receivable balance is adjusted to account for payments received and any additional credit sales. This allows the company to monitor its outstanding receivables and follow up with customers on overdue payments.

- Consider Allowance for Doubtful Accounts: Since there is a risk of non-payment or delayed payment, it is common to establish an allowance for doubtful accounts. This is a contra-asset account that reduces the total accounts receivable to reflect the estimated amount that may not be collected. The allowance for doubtful accounts is based on historical data, industry norms, and individual customer payment history.

- Recognize Bad Debt Expense: If a customer defaults or is unable to make the payment, the company needs to recognize bad debt expense. This is an expense that reduces the accounts receivable and reflects the amount deemed uncollectible.

By following these steps, businesses can accurately record credit sales on a balance sheet, maintain an up-to-date accounts receivable balance, and make informed decisions regarding credit management and cash flow.

Accounts Receivable

Accounts receivable is a key component on a balance sheet that represents the amount owed to a company by its customers for goods or services provided on credit. It is classified as a current asset since it is expected to be collected within a year. Accounts receivable plays a crucial role in measuring a company’s liquidity, assessing its creditworthiness, and monitoring its cash flow.

When a credit sale occurs, the amount of the sale is recorded as a debit to accounts receivable and a credit to sales revenue, increasing both accounts. This reflects the increase in the amount owed to the company by its customers.

Managing accounts receivable is vital to maintaining a healthy financial position. Here are a few key considerations:

- Credit Policy: Establishing a clear and consistent credit policy is essential to mitigate the risk associated with credit sales. This policy should outline the terms and conditions for credit sales, including credit limits, payment terms, and credit evaluation procedures.

- Accounts Receivable Aging: Regularly reviewing and analyzing the accounts receivable aging report allows businesses to monitor outstanding payments and identify customers with overdue balances. This helps prioritize collection efforts and reduces the risk of bad debts.

- Collection Efforts: Timely and proactive collection efforts are necessary to ensure prompt payment from customers. This may involve sending reminders, making phone calls, or offering payment incentives to encourage timely settlement.

- Allowance for Doubtful Accounts: As mentioned earlier, it is common to establish an allowance for doubtful accounts to account for potential non-payment or delayed payment. This contra-asset account reduces the accounts receivable balance to reflect the estimated portion that may become uncollectible.

- Write-offs: In some cases, when a customer defaults or becomes insolvent, the amount deemed uncollectible needs to be written off. This ensures that the accounts receivable balance accurately represents the amount that is expected to be collected.

- Financial Reporting: Accounts receivable is presented on the balance sheet as a current asset, and any potential allowance for doubtful accounts is disclosed separately. In the notes to the financial statements, additional information may be provided regarding credit policies, significant customers, and any concentration risks.

A well-managed accounts receivable process ensures timely collection of payments, improves cash flow, and minimizes the risk of bad debts. By monitoring accounts receivable effectively, businesses can enhance their financial performance and maintain a healthy balance sheet.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is a contra-asset account that is established to offset the potential risk of non-payment or delayed payment from customers. It is created to reflect the estimated portion of accounts receivable that may become uncollectible in the future. By maintaining an allowance for doubtful accounts, businesses can provide a more accurate representation of their accounts receivable and assess the financial impact of potential bad debts.

Here are key points to understand about the allowance for doubtful accounts:

- Estimation Process: The estimation process for the allowance for doubtful accounts involves analyzing historical data, assessing payment history, and considering industry norms. This estimation is typically based on a percentage of the total outstanding receivables or on specific customer balances.

- Income Statement Impact: Once the allowance is established, it is recorded as an expense on the income statement, referred to as “bad debt expense”. This expense reduces the net income, reflecting the potential reduction in revenue due to uncollectible accounts.

- Balance Sheet Presentation: The allowance for doubtful accounts is reported as a contra-asset account on the balance sheet, reducing the total accounts receivable. The net accounts receivable amount (total accounts receivable minus the allowance) reflects the estimated amount that the company expects to collect.

- Monitoring and Adjusting: It is important to regularly review and adjust the allowance for doubtful accounts based on changing circumstances and the aging of receivables. As payments are received or accounts become uncollectible, the allowance is adjusted accordingly to maintain its accuracy.

- Disclosure and Financial Reporting: In the financial statements, businesses may disclose the methodology used to calculate the allowance, any significant changes in the estimation, and additional information on the aging of receivables. This provides transparency to shareholders, investors, and stakeholders regarding the company’s credit risk management.

- Credit Risk Assessment: The allowance for doubtful accounts helps businesses assess the creditworthiness of their customers and make informed decisions regarding collections, credit limits, and potential write-offs. It allows them to manage credit risk effectively and protect their financial health.

Establishing an appropriate allowance for doubtful accounts ensures that a company’s balance sheet reflects the estimated amount of accounts receivable that is expected to be collected. By accurately assessing the credit risk associated with accounts receivable, businesses can mitigate the impact of potential bad debts on their financial statements and maintain a healthy financial position.

Bad Debt Expense

Bad debt expense is an accounting term that represents the portion of accounts receivable that a company considers uncollectible. It reflects the expense incurred when a customer defaults on payment or is unable to fulfill their payment obligations. Bad debt expense is an important component of a company’s financial statements as it directly affects the net income.

Here are key points to understand about bad debt expense:

- Uncollectible Accounts: Bad debt expense is incurred when it is determined that a customer’s account is uncollectible. This may happen due to various reasons, such as a customer’s bankruptcy, financial hardship, or refusal to pay.

- Matching Principle: The concept of bad debt expense is based on the matching principle in accounting. It ensures that expenses are recognized in the same period as the related revenue. Therefore, if a credit sale was recorded in a particular period, but it is determined to be uncollectible later, the bad debt expense is recognized in the same reporting period.

- Estimation Process: Estimating bad debt expense involves considering historical data, analyzing the aging of accounts receivable, and assessing the collectibility of specific customer balances. This estimation provides a reasonable approximation of the uncollectible accounts.

- Income Statement Impact: Bad debt expense is recorded as an expense on the income statement, reducing the net income of the company. This reduction in net income directly affects the profitability of the business.

- Balance Sheet Impact: The bad debt expense is simultaneously deducted from the allowance for doubtful accounts, which is a contra-asset account, using a journal entry. This adjustment reduces the net accounts receivable, providing a more accurate representation of the collectible amount.

- Financial Reporting: In the financial statements, bad debt expense is typically disclosed in the income statement, allowing stakeholders to analyze the impact on the company’s profitability. Additionally, any significant changes in the estimation or write-offs of bad debts may be provided in the notes to the financial statements.

- Importance of Monitoring: Regularly monitoring the aging of accounts receivable and assessing the collectibility of outstanding balances is crucial. By promptly identifying potential bad debts, businesses can adjust the allowance for doubtful accounts and recognize the corresponding bad debt expense.

Properly recognizing and recording bad debt expense ensures accurate financial reporting and reflection of the impact of uncollectible accounts. By carefully estimating and monitoring bad debt expense, businesses can manage their cash flow, mitigate risks, and make informed financial decisions.

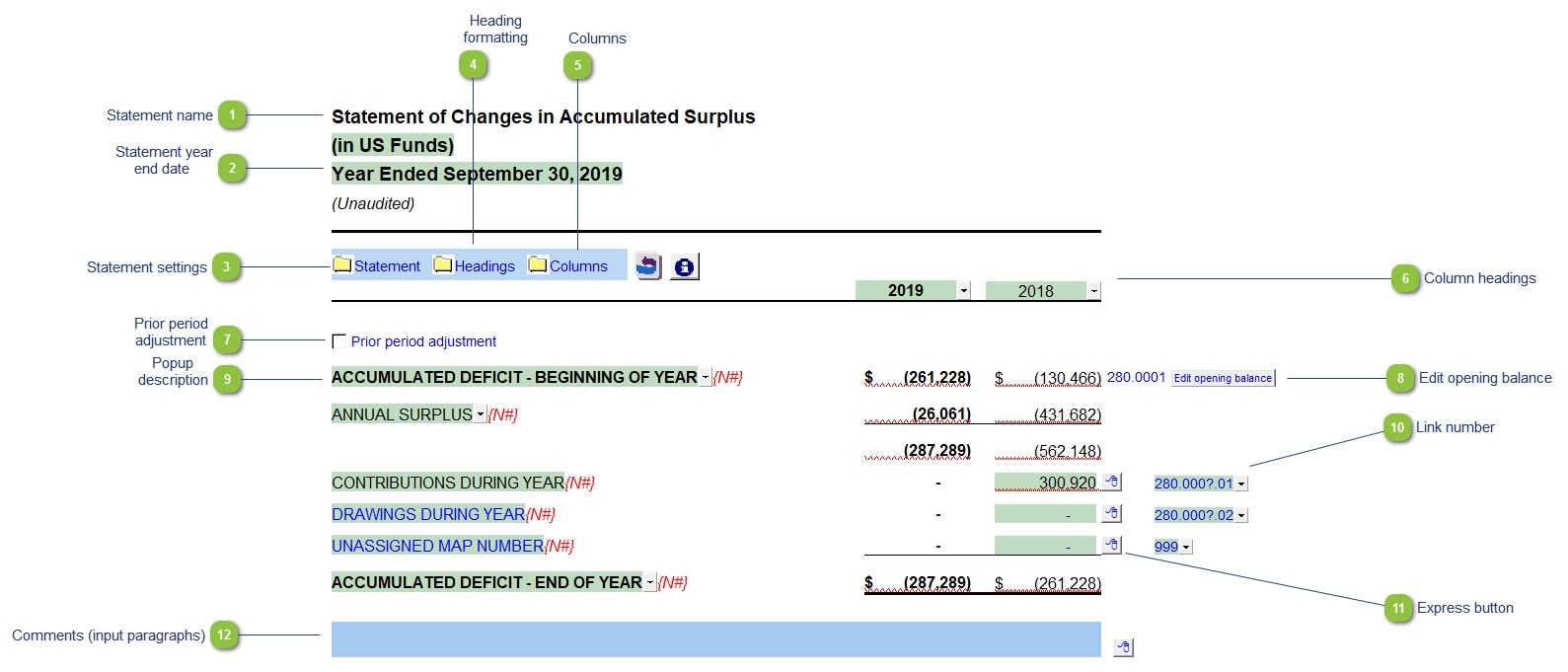

Impact on Balance Sheet and Financial Statements

Credit sales and the associated components, such as accounts receivable, allowance for doubtful accounts, and bad debt expense, have a significant impact on a company’s balance sheet and financial statements. Understanding this impact is crucial for analyzing a company’s financial health and making informed business decisions.

Here are the key impacts on the balance sheet and financial statements:

- Balance Sheet: Credit sales impact the balance sheet by increasing the accounts receivable, which is a current asset. Accounts receivable represents the amount owed to the company from credit sales that are expected to be collected within a year. Additionally, the allowance for doubtful accounts, a contra-asset account, is established to offset the potential risk of uncollectible accounts. The net impact on accounts receivable is reflected in the balance sheet, providing a more accurate representation of the collectible amount.

- Income Statement: Credit sales contribute to the revenue recognized on the income statement. The revenue reflects the total amount earned from credit sales during a specific period. However, if a customer defaults or is unable to pay, the bad debt expense is recognized as an expense on the income statement. This expense reduces the net income, impacting the profitability of the company.

- Cash Flow Statement: The impact of credit sales on the cash flow statement depends on the timing of the collections. While credit sales increase the revenue, the associated cash inflow is recognized when the customers make the payments later. The cash flow statement provides insights into the operating, investing, and financing activities of the company, including the cash collected from credit sales.

- Financial Ratios: Credit sales and their impact on accounts receivable influence several financial ratios. For example, the accounts receivable turnover ratio measures the efficiency of the company in collecting its receivables. A higher turnover ratio indicates faster collections, while a lower ratio may indicate potential issues with credit management or collections. The allowance for doubtful accounts and bad debt expense also affect the analysis of liquidity, profitability, and creditworthiness of the company.

- Investor and Stakeholder Perception: The accurate reporting of credit sales, accounts receivable, and their impact on the financial statements is crucial for investors, creditors, and stakeholders. These parties rely on the financial statements to assess the performance, financial health, and creditworthiness of the company. Transparent and accurate reporting helps build trust and confidence among external parties.

Overall, credit sales have a profound impact on the balance sheet and financial statements, providing insights into a company’s revenue recognition, liquidity, credit risk management, and profitability. By understanding these impacts, businesses can effectively manage credit sales, analyze financial performance, and make informed strategic decisions.

Conclusion

Credit sales on a balance sheet play a vital role in the financial operations of businesses across various industries. Understanding the definition, importance, and impact of credit sales is crucial for financial professionals and business owners alike. By properly recording credit sales, managing accounts receivable, establishing an allowance for doubtful accounts, and recognizing bad debt expense, businesses can ensure accuracy in financial reporting and make informed decisions.

Credit sales offer businesses the opportunity to increase their customer base, foster customer loyalty, and manage cash flow effectively. However, it also exposes businesses to the risk of non-payment or delayed payment. By establishing clear credit policies, monitoring accounts receivable, and proactive collection efforts, businesses can mitigate the risk associated with credit sales and maintain a healthy financial position.

The impact of credit sales is reflected on the balance sheet and financial statements. Accounts receivable represents the amount owed to the company, while the allowance for doubtful accounts and bad debt expense address the potential risks of uncollectible accounts. These components influence the company’s liquidity, profitability, and creditworthiness. Financial ratios and investor perception are affected by these factors, shaping the overall assessment of a company’s performance and financial health.

In conclusion, credit sales are an integral part of a company’s financial operations, providing opportunities for growth while managing risks. By understanding and effectively managing credit sales, businesses can maintain a strong financial position, improve cash flow, and make informed financial decisions that contribute to long-term success.