Finance

What Is The Working Capital Cycle

Published: December 19, 2023

Understanding the working capital cycle in finance is crucial for businesses. Learn more about it and optimize your financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Working Capital Cycle

- Components of Working Capital Cycle

- Steps in the Working Capital Cycle

- Importance of Working Capital Cycle

- Factors Affecting the Working Capital Cycle

- Calculation and Analysis of Working Capital Cycle

- Managing the Working Capital Cycle

- Challenges in Managing the Working Capital Cycle

- Conclusion

Introduction

Welcome to the world of finance, where numbers rule and every decision can have a profound impact on an organization’s success. One key aspect of financial management that plays a crucial role in the smooth functioning of businesses is the working capital cycle.

The working capital cycle is a fundamental concept in finance that measures the time it takes for a company to convert its current assets into cash to cover its short-term obligations. It reflects the company’s ability to manage its cash flow efficiently and maintain a healthy liquidity position.

This article aims to provide a comprehensive understanding of the working capital cycle, its components, and its significance in financial management. We will explore the steps involved in the working capital cycle, the factors that influence it, and the methods used to calculate and analyze it. Additionally, we will delve into the strategies employed to effectively manage the working capital cycle and address the challenges that businesses may face in doing so.

Whether you are a business owner, a financial professional, or simply someone interested in learning more about finance, understanding the working capital cycle is essential. It can help you make informed decisions regarding cash management, inventory control, and supplier relationships, ultimately contributing to the financial health and stability of your organization.

So, let’s dive into the world of the working capital cycle and explore its intricacies to unlock the secrets of financial success!

Definition of Working Capital Cycle

The working capital cycle, also known as the cash conversion cycle, is a financial metric that measures the time it takes for a company to convert its current assets into cash to meet its short-term obligations. It represents the duration between the company’s payment to its suppliers for raw materials, inventory production, and the collection of cash from customers for the sale of goods or services.

Note: It is important to ensure that the working capital cycle is optimized to strike a balance between liquidity and profitability.

The working capital cycle comprises three main components:

- Accounts Receivable: This represents the amount of money owed to the company by its customers for goods or services provided on credit. It reflects the company’s sales that have not yet been converted into cash.

- Inventory: Inventory includes raw materials, work-in-progress, and finished goods that the company holds for sale or use in its production process. It represents the resources tied up in the company’s operations.

- Accounts Payable: Accounts payable consists of the company’s unpaid bills or invoices owed to suppliers for goods or services received. It reflects the company’s short-term obligations that need to be settled within a specific timeframe.

The working capital cycle can be calculated using the following formula:

Working Capital Cycle = Average Inventory Holding Period + Average Receivables Collection Period – Average Payables Payment Period

The goal of managing the working capital cycle is to ensure that the company has sufficient liquidity to meet its short-term obligations while minimizing excess investment in working capital. A longer working capital cycle indicates inefficiency and can lead to increased financing costs and reduced profitability.

By understanding and effectively managing the working capital cycle, companies can optimize their cash flow, enhance their financial stability, and improve their overall operational efficiency.

Components of Working Capital Cycle

The working capital cycle consists of several interconnected components that reflect the flow of funds within a company’s operations. Understanding these components is crucial for managing the working capital effectively. Let’s explore the key components:

- Accounts Receivable: This component represents the money owed to the company by its customers for goods or services provided on credit. It includes outstanding invoices and reflects the company’s sales that have not yet been converted into cash. Managing accounts receivable involves monitoring and controlling credit terms, establishing efficient invoicing and collection processes, and implementing appropriate credit risk assessment measures.

- Inventory: Inventory refers to the goods held by a company for sale or use in its production process. It encompasses raw materials, work-in-progress, and finished goods. Effective inventory management involves determining optimal inventory levels, minimizing carrying costs, optimizing order quantities and timing, and ensuring proper inventory turnover. Balancing inventory levels is crucial to avoid stockouts, excess inventory, and storage costs while meeting customer demand and achieving operational efficiency.

- Accounts Payable: Accounts payable represent the company’s unpaid bills or invoices owed to suppliers for goods or services received. It reflects the company’s short-term obligations that need to be settled within a specific timeframe. Managing accounts payable involves maintaining good relationships with suppliers, negotiating favorable payment terms, taking advantage of early payment discounts, and streamlining the payment process to optimize cash outflows.

- Cash Management: Cash is the lifeblood of any business, and effective cash management is crucial for the smooth functioning of the working capital cycle. It involves monitoring and forecasting cash flows, ensuring sufficient cash on hand to meet operational needs, optimizing the timing of cash inflows and outflows, and investing surplus cash wisely to generate additional returns.

This interconnectedness of the components highlights the importance of a holistic approach to managing the working capital cycle. Any inefficiency or imbalance in one component can have a ripple effect on the others and disrupt the overall cycle. Successful management of the working capital cycle requires a careful balancing act to ensure that the company maintains adequate liquidity, minimizes excess investment in working capital, and optimizes cash flow.

Steps in the Working Capital Cycle

The working capital cycle involves a series of interconnected steps that illustrate the flow of funds within a company’s operations. These steps describe the progression of activities from the conversion of raw materials into finished goods to the collection of cash from customers. Let’s delve into the key steps in the working capital cycle:

- Procurement of Raw Materials: The cycle begins with the purchase of raw materials required for production or the acquisition of goods for resale. This step involves selecting suppliers, negotiating favorable terms, and ensuring timely delivery of raw materials.

- Inventory Management: Once the raw materials are procured, they are transformed into work-in-progress and subsequently into finished goods. Managing inventory effectively includes maintaining optimal stock levels, monitoring production processes, ensuring product quality, and minimizing the risk of obsolescence or wastage.

- Sales and Accounts Receivable: The finished goods are then sold to customers. This step involves setting competitive prices, marketing products or services, invoicing customers, and offering credit facilities as applicable. Accounts receivable are created when sales are made on credit, and the company awaits payment from customers within a specified period.

- Customer Payments and Cash Collection: After the sales are made, the company focuses on collecting payments from customers. This step involves following up on outstanding invoices, implementing efficient and timely collection processes, and managing customer relationships to ensure prompt payment.

- Accounts Payable Management: As the company receives payments from customers, it simultaneously manages its accounts payable. This step includes reviewing and verifying supplier invoices, establishing payment terms, and making timely payments to suppliers to maintain good supplier relationships and take advantage of any early payment discounts.

- Cash Management: Lastly, the cash received from customers is used to cover various expenses, such as wages, rent, utilities, and other operating costs. Effective cash management involves monitoring cash flow, forecasting cash needs, and ensuring the availability of sufficient cash to meet financial obligations.

These steps encapsulate the working capital cycle’s progression, starting from the procurement of raw materials and ending with the collection of cash. Proper management of each step is vital to maintain a healthy cash flow, optimize working capital, and support the long-term financial stability and growth of the organization.

Importance of Working Capital Cycle

The working capital cycle holds significant importance in financial management due to its impact on a company’s operational efficiency, liquidity, and profitability. Let’s explore why understanding and effectively managing the working capital cycle is crucial:

- Operational Efficiency: A well-managed working capital cycle ensures smooth operations by maintaining the necessary resources to meet production and sales demands. A balanced inventory level, efficient accounts receivable management, and timely payment of accounts payable contribute to streamlined operations, minimized stockouts, and optimized production processes.

- Liquidity: The working capital cycle directly affects a company’s liquidity position. By effectively managing accounts receivable, inventory, and accounts payable, a company can optimize its cash flow and ensure that it has adequate funds to meet its short-term obligations, such as paying bills, salaries, loans, and other operating expenses. Adequate liquidity supports business stability and flexibility, especially during challenging economic times.

- Cash Flow Management: The working capital cycle provides valuable insights into a company’s cash flow dynamics. By monitoring and analyzing the components of the cycle, businesses can identify any bottlenecks that might delay cash inflows or increase cash outflows. This enables proactive cash flow management, allowing companies to forecast and plan for cash needs, optimize receivable collection periods, and negotiate favorable payment terms with suppliers.

- Profitability: Effective management of the working capital cycle can enhance a company’s profitability. By minimizing excess investment in working capital and reducing financing costs, companies can improve their profitability margins. Additionally, optimizing inventory levels to meet demand without incurring excessive carrying costs, while also collecting receivables promptly and strategically managing payables, contributes to improved cash flow and financial performance.

- Financial Stability: A well-functioning working capital cycle supports the financial stability of a company. By maintaining a balanced cash flow, efficient use of resources, and the ability to meet financial obligations, businesses are better equipped to withstand financial shocks and navigate through turbulent times. Financial stability builds investor confidence, enhances creditworthiness, and opens up opportunities for growth and expansion.

Ultimately, understanding and managing the working capital cycle effectively allows businesses to optimize their operations, maintain liquidity, improve cash flow, enhance profitability, and achieve long-term financial stability. It is a critical aspect of financial management that requires careful attention and strategic decision-making to unlock the full potential of an organization.

Factors Affecting the Working Capital Cycle

The working capital cycle of a company can be influenced by a variety of factors that impact its cash flow, inventory management, and accounts receivable and payable. By understanding these factors, businesses can proactively manage their working capital cycle and optimize their financial operations. Here are some key factors that affect the working capital cycle:

- Industry and Seasonality: The industry in which a company operates plays a significant role in determining the length of its working capital cycle. Certain industries, such as manufacturing or retail, may have longer production or sales cycles, resulting in extended collection periods and inventory turnover. Additionally, seasonal fluctuations can impact the working capital cycle, as companies may experience peak demand or lower sales during specific times of the year.

- Payment Terms: The payment terms offered by a company to its customers can impact the working capital cycle. Longer payment terms, such as offering credit to customers, can increase the accounts receivable period and delay cash inflows. Shorter payment terms, on the other hand, can help accelerate the collection process and improve cash flow but may impact customer relationships or competitiveness.

- Supplier Relationships: The nature of relationships with suppliers can influence the working capital cycle. Establishing strong partnerships with suppliers can result in favorable payment terms, discounts, or extended payment periods, which can impact the accounts payable period. Efficient supplier management, including negotiating optimal terms and maintaining open lines of communication, can help balance the cash outflows and ensure prompt payment.

- Inventory Management: Effective inventory management practices play a crucial role in the working capital cycle. Maintaining excessive levels of inventory can tie up resources and lead to increased carrying costs and the risk of obsolescence. On the other hand, insufficient inventory levels can result in stockouts and missed sales opportunities. Balancing inventory levels, implementing just-in-time practices, and adopting inventory management systems can optimize the working capital cycle.

- Market Demand and Competition: The demand for a company’s products or services and the level of competition in the market can impact the working capital cycle. Higher market demand may require increased inventory levels and shorter collection periods. Competitive pressures may also result in offering more favorable payment terms to customers or negotiating better terms with suppliers.

- Operating Efficiency: The efficiency of a company’s operational processes can significantly impact the working capital cycle. Streamlined production processes, efficient order fulfillment, accurate demand forecasting, and effective cash management practices can all contribute to a shorter working capital cycle. Conversely, operational inefficiencies can lead to delays, increased costs, and a longer cycle.

By recognizing and proactively managing these factors, businesses can optimize their working capital cycle, improve cash flow, and enhance overall financial performance. Regular monitoring, analysis, and adjustment of these factors are essential to ensure a healthy and efficient working capital cycle that supports the long-term success of the organization.

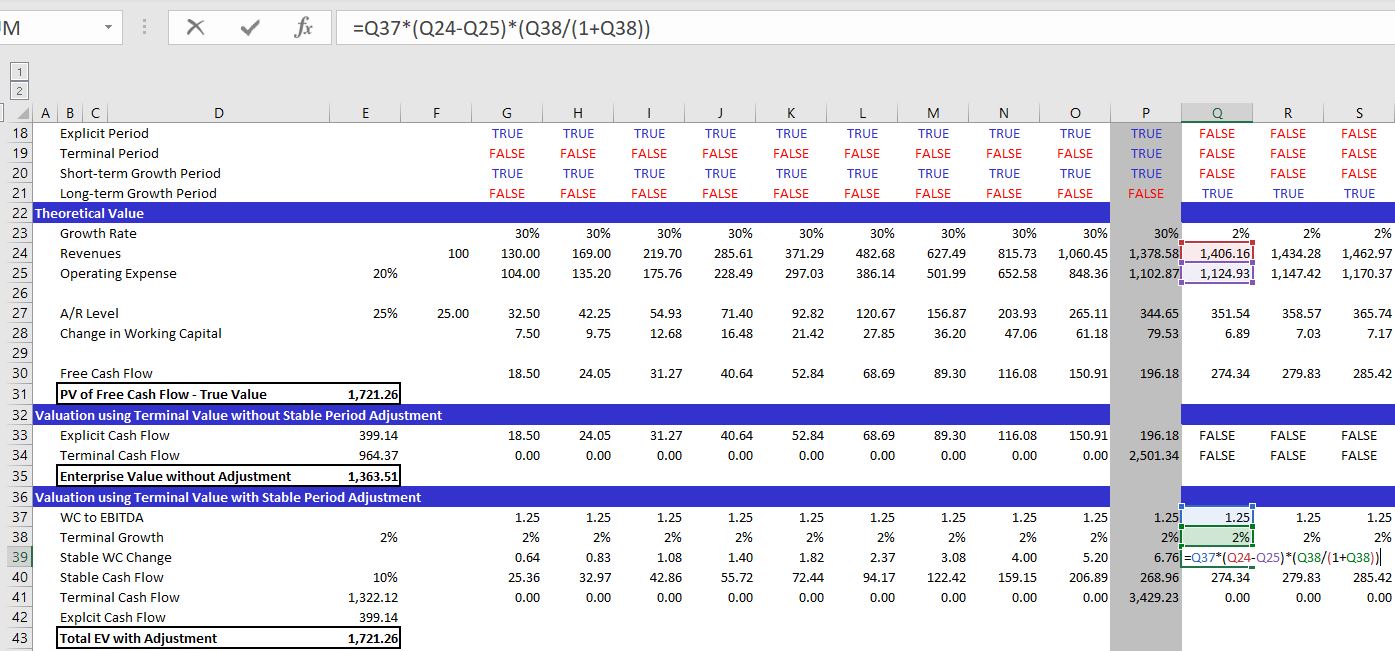

Calculation and Analysis of Working Capital Cycle

Calculating and analyzing the working capital cycle provides valuable insights into a company’s cash flow management, operational efficiency, and liquidity. By understanding the components of the cycle and applying key financial ratios, businesses can gain a deeper understanding of their working capital dynamics. Let’s explore how to calculate and analyze the working capital cycle:

The working capital cycle can be calculated using the following formula:

Working Capital Cycle = Average Inventory Holding Period + Average Receivables Collection Period – Average Payables Payment Period

Inventory Holding Period: This represents the average amount of time it takes for a company to convert its inventory into sales. It is calculated as:

Inventory Holding Period = (Average Inventory / Cost of Goods Sold) x 365

Receivables Collection Period: This reflects the average number of days it takes for a company to collect payments from its customers. It is calculated as:

Receivables Collection Period = (Accounts Receivable / Sales) x 365

Payables Payment Period: This represents the average number of days it takes for a company to pay its suppliers. It is calculated as:

Payables Payment Period = (Accounts Payable / Cost of Goods Sold) x 365

Once the working capital cycle is calculated, it can be analyzed to assess the efficiency of a company’s cash flow management and operational effectiveness. Here are some key considerations:

- Trend Analysis: Analyzing the working capital cycle over time allows businesses to spot trends and patterns. A decreasing working capital cycle indicates improved cash flow management and increased operational efficiency. Conversely, an increasing cycle may indicate potential issues in inventory management, receivables collection, or payables payment.

- Industry Benchmarks: Comparing the working capital cycle to industry benchmarks provides useful insights into a company’s relative performance. It helps identify areas where the company may be lagging behind or excelling, allowing for targeted strategic improvements.

- Cash Flow Management: By analyzing the working capital cycle, businesses can identify areas that negatively impact cash flow. For example, a high inventory holding period or receivables collection period suggests inefficiencies that may lead to cash shortages. Adjustments can then be made to improve cash flow, such as implementing inventory control measures, revising credit terms, or renegotiating payment terms with suppliers.

- Working Capital Optimization: Analyzing the working capital cycle helps identify opportunities for optimization. For instance, reducing the receivables collection period by implementing more efficient invoicing and collection processes can accelerate cash inflows. Similarly, optimizing inventory levels and negotiating favorable payment terms with suppliers can improve the payables payment period, reducing the need for excessive working capital.

By regularly calculating and analyzing the working capital cycle, businesses can identify areas for improvement, enhance cash flow management, optimize operational efficiency, and make informed decisions to support long-term financial stability and growth.

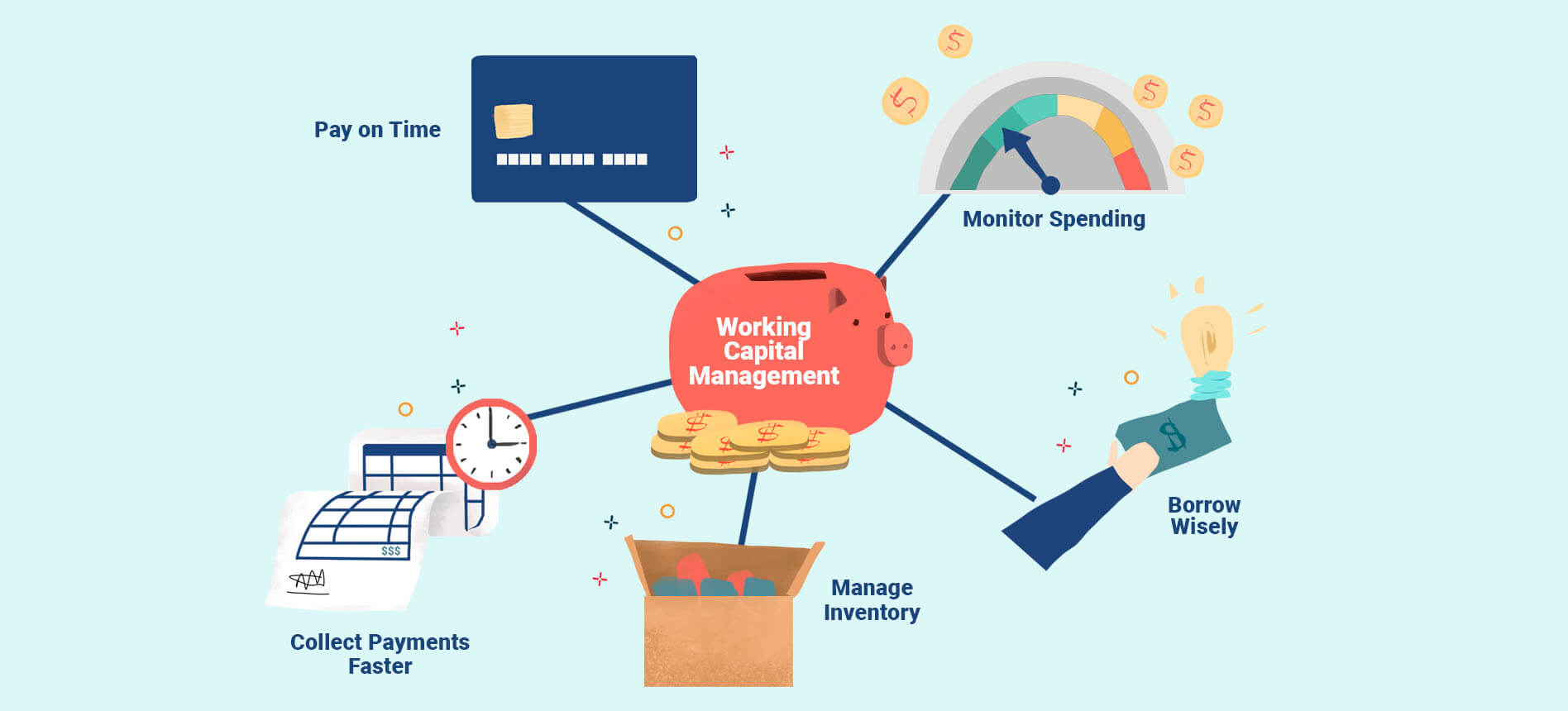

Managing the Working Capital Cycle

Managing the working capital cycle is crucial for maintaining a healthy cash flow, optimizing operational efficiency, and ensuring the financial stability of a business. Here are some key strategies and practices to effectively manage the working capital cycle:

- Inventory Management: Implementing robust inventory management practices plays a vital role in managing the working capital cycle. This includes regularly monitoring inventory levels, optimizing order quantities, forecasting demand accurately, and identifying slow-moving or obsolete inventory. By balancing inventory levels and improving inventory turnover, businesses can minimize carrying costs and free up cash for other operational needs.

- Streamlining Receivables: Efficient management of accounts receivable is essential to maintain a healthy working capital cycle. This involves establishing clear and consistent credit policies, performing thorough credit assessments on customers, and setting appropriate payment terms. Additionally, maintaining regular communication with customers and implementing effective invoicing and collection processes can enhance receivables collection and accelerate cash inflows.

- Optimizing Payables: Managing accounts payables strategically is equally important. Negotiating favorable payment terms with suppliers, taking advantage of early payment discounts, and extending payment periods where possible can help optimize the payables side of the working capital cycle. However, it is important to maintain good relationships with suppliers and ensure timely payment to avoid damaging those relationships.

- Cash Flow Forecasting: Accurate cash flow forecasting enables businesses to anticipate their cash inflows and outflows, enabling proactive management of the working capital cycle. By forecasting near-term and long-term cash needs, businesses can make informed decisions about managing inventory levels, adjusting credit terms, and optimizing payment schedules to maintain a healthy cash flow position.

- Efficient Cash Management: Effectively managing cash is critical to the working capital cycle. This involves optimizing cash collection efforts, implementing efficient cash conversion processes, and investing surplus cash wisely to generate additional returns. By monitoring cash flows, businesses can identify excess cash reserves that can be deployed to reduce debt, invest in income-generating assets, or fund growth initiatives.

- Technology and Automation: Leveraging technology and automation solutions can significantly improve the management of the working capital cycle. Implementing robust accounting software, customer relationship management (CRM) systems, and inventory management tools can streamline processes, reduce manual errors, and provide real-time insights into cash flow and working capital management.

Managing the working capital cycle requires a proactive and holistic approach that takes into account the specific needs and characteristics of the business. By implementing effective strategies and practices in inventory management, receivables and payables management, cash flow forecasting, and leveraging technology, businesses can optimize their working capital cycle, enhance cash flow, improve operational efficiency, and maintain a strong financial position.

Challenges in Managing the Working Capital Cycle

Managing the working capital cycle can be a complex task that presents businesses with several challenges. Effectively overcoming these challenges is essential for maintaining a healthy cash flow and optimizing operational efficiency. Let’s explore some common challenges in managing the working capital cycle:

- Inventory Management: Balancing inventory levels to meet customer demand while minimizing carrying costs and avoiding stockouts can be a delicate balancing act. Predicting demand accurately, managing seasonality, and addressing shifts in customer preferences add complexity to inventory management.

- Accounts Receivable: Timely and complete collection of receivables can be challenging, particularly when dealing with customers who may delay payments or encounter financial difficulties. Striking the right balance between maintaining customer relationships and ensuring prompt payment is vital.

- Accounts Payable: Managing relationships with suppliers while optimizing payment terms can be challenging. Balancing the need to maintain good supplier relationships while extending payment terms or negotiating favorable discounts requires effective communication and negotiation skills.

- Working Capital Constraints: Limited access to working capital can hinder efforts to optimize the working capital cycle. For instance, a lack of cash reserves or difficulty obtaining financing may limit a business’s ability to invest in inventory, offer favorable credit terms to customers, or negotiate advantageous payment terms with suppliers.

- Changing Business Environment: The working capital cycle can be influenced by external factors such as economic fluctuations, changes in regulations, and shifts in market dynamics. Adapting to these changes and updating strategies accordingly is necessary to effectively manage the working capital cycle.

- Operational Inefficiencies: Inefficient operational processes can negatively impact the working capital cycle. Bottlenecks in production, delays in order fulfillment, errors in inventory management, or ineffective cash collection processes can disrupt the smooth flow of the cycle and hinder cash flow optimization.

- Information and Data Management: Access to accurate and timely financial data is vital for effectively managing the working capital cycle. Challenges related to data collection, integration, and analysis can hinder decision-making and the ability to identify areas of improvement in the cycle.

- Resistance to Change: Successfully managing the working capital cycle often requires implementing new processes, adopting technology solutions, or changing established practices. Overcoming resistance to these changes and fostering a culture of continuous improvement is essential for optimizing the cycle.

Addressing these challenges requires a proactive approach, effective communication, and strategic decision-making. Businesses need to continuously assess and adapt their working capital management strategies in response to internal and external factors. By doing so, they can navigate the challenges, optimize the working capital cycle, and maintain a strong financial position.

Conclusion

The working capital cycle is a critical aspect of financial management that measures the efficiency of a company’s cash flow and its ability to convert current assets into cash to meet short-term obligations. Understanding and effectively managing the working capital cycle is vital for businesses to maintain liquidity, optimize operational efficiency, and ensure financial stability.

In this article, we explored the various components of the working capital cycle, including accounts receivable, inventory, and accounts payable. We discussed the steps involved in the cycle, such as procurement, inventory management, sales, and cash collection. Additionally, we highlighted the importance of the working capital cycle in driving operational efficiency, maintaining liquidity, and enhancing profitability.

We also discussed the factors that influence the working capital cycle, such as industry dynamics, payment terms, supplier relationships, market demand, and operating efficiency. Understanding these factors allows businesses to make informed decisions and implement strategies to optimize the working capital cycle.

Furthermore, we explored the calculation and analysis of the working capital cycle, emphasizing trends analysis, industry benchmarks, cash flow management, and working capital optimization. By regularly calculating and analyzing the working capital cycle, businesses can identify areas for improvement, forecast cash needs, and make informed decisions to optimize their financial operations.

Managing the working capital cycle comes with its challenges, including inventory management, accounts receivable and payable management, working capital constraints, changing business environments, operational inefficiencies, and data management. However, by addressing these challenges through proactive strategies, effective communication, and continuous improvement, businesses can successfully optimize their working capital cycle.

In conclusion, mastering the management of the working capital cycle is essential for businesses to maintain a healthy cash flow, optimize operational efficiency, and ensure financial stability. By implementing effective strategies and practices, businesses can enhance their financial performance, make informed decisions, and position themselves for long-term success in today’s competitive business landscape.