Home>Finance>What Is The Relationship Between Unemployment And Inflation?

Finance

What Is The Relationship Between Unemployment And Inflation?

Published: October 19, 2023

Discover the dynamic relationship between unemployment and inflation in the field of Finance. Explore the impact, theories, and strategies involved in managing these interconnected economic factors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Unemployment and inflation are two key economic indicators that have a significant impact on the overall health and stability of an economy. While they are distinct concepts, there exists a complex relationship between the two. Understanding this relationship can provide valuable insights into the workings of an economy and help policymakers make informed decisions.

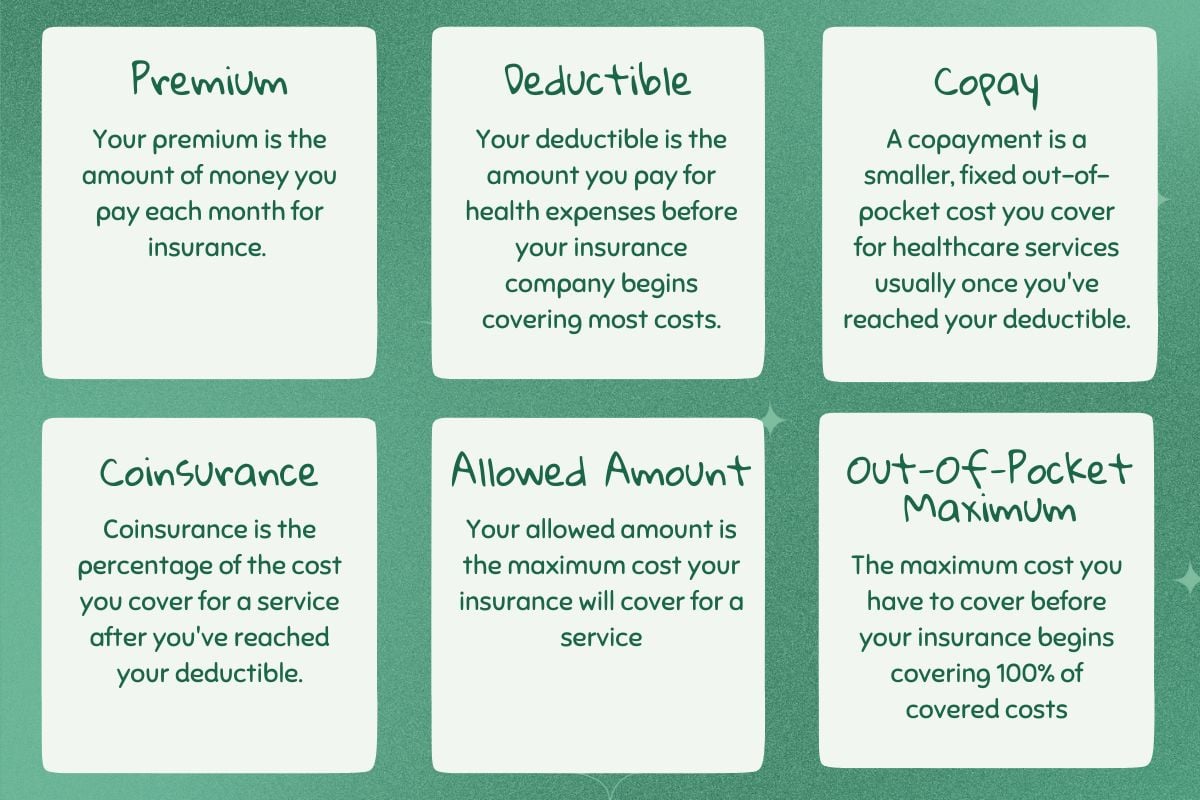

Unemployment refers to the number of individuals who are actively seeking employment but are unable to find work. It is a measure of the underutilization of labor resources within an economy. In contrast, inflation refers to the sustained increase in the general price level of goods and services over time. It erodes the purchasing power of a currency and affects the cost of living for individuals.

The relationship between unemployment and inflation is often analyzed using the Phillips Curve. This economic concept, introduced by economist A.W. Phillips in the 1950s, suggests an inverse relationship between unemployment and inflation. According to the Phillips Curve, when unemployment is low, inflation tends to be high, and vice versa.

However, the relationship between unemployment and inflation is not always straightforward. There are several factors that can influence this relationship and lead to deviations from the traditional expectations of the Phillips Curve.

Historically, there have been various examples that illustrate the relationship between unemployment and inflation. These examples provide valuable insights into the dynamics of the relationship and the factors that can impact it. Additionally, there are criticisms and limitations to the Phillips Curve that highlight the complexity of understanding this relationship.

In recent years, the relationship between unemployment and inflation has been the subject of debate. With the emergence of new economic theories and changing market dynamics, economists are reassessing the traditional understanding of this relationship.

In this article, we will explore the relationship between unemployment and inflation in-depth, examining the theories, historical examples, and current trends. By gaining a better understanding of this relationship, we can grasp the complexities of economic dynamics and make more informed decisions to promote stable and sustainable growth.

Understanding Unemployment

Unemployment is a crucial economic indicator that measures the number of individuals who are actively seeking employment but are currently without a job. It reflects the underutilization of labor resources within an economy and has significant implications for both individuals and the overall economy.

There are different types of unemployment that can occur in an economy:

- Frictional Unemployment: This type of unemployment occurs when individuals are in between jobs or are searching for their first job. It is often considered temporary and is a result of the natural process of job turnover and information gaps between job seekers and employers.

- Structural Unemployment: Structural unemployment arises due to fundamental changes in the structure of an economy. It occurs when there is a mismatch between the skills and qualifications of workers and the available job opportunities. Technological advancements, changes in consumer preferences, and shifts in industries can contribute to structural unemployment.

- Cyclical Unemployment: Cyclical unemployment is closely tied to the business cycle and occurs during economic downturns. When demand for goods and services declines, businesses may lay off workers, leading to higher levels of unemployment. Conversely, during periods of economic expansion, cyclical unemployment tends to decrease as businesses hire more workers to meet increased demand.

- Seasonal Unemployment: Seasonal unemployment is associated with industries that experience regular fluctuations in demand due to seasonal variations. Examples include agriculture, tourism, and retail sectors. Workers in these industries may be unemployed during off-peak seasons but find employment during busy periods.

Measuring unemployment involves conducting surveys and collecting data from the labor force. Economists and policymakers often refer to the unemployment rate, which is the percentage of the labor force that is unemployed. Governments and statistical agencies typically calculate and release this data regularly to provide insights into the state of an economy.

Unemployment has significant social and economic consequences. Individuals who are unemployed face financial challenges, reduced social status, and a decline in overall well-being. It can also lead to social unrest and inequality. From an economic perspective, high levels of unemployment can lead to a decrease in aggregate demand, lower productivity, and a reduction in potential GDP.

Understanding the various types of unemployment and their implications is crucial for policymakers and economists. By analyzing the causes and trends of unemployment, strategies can be devised to mitigate its negative effects and promote job creation, ultimately fostering a more stable and prosperous economy.

Understanding Inflation

Inflation is an essential economic concept that measures the sustained increase in the general price level of goods and services over time. It affects the purchasing power of money and has widespread implications for individuals, businesses, and the overall economy.

Inflation can be caused by various factors, including:

- Demand-Pull Inflation: Demand-pull inflation occurs when aggregate demand exceeds the supply of goods and services in an economy. This can be fueled by factors such as increased consumer spending, government stimulus programs, or excessive money supply growth. As demand outpaces supply, businesses may raise prices to capitalize on the increased demand.

- Cost-Push Inflation: Cost-push inflation occurs when the cost of production increases, leading to higher prices for goods and services. Factors that can contribute to cost-push inflation include rising wages, increases in raw material prices, or higher taxes imposed on businesses. When businesses face higher costs, they may pass on these costs to consumers in the form of higher prices.

- Monetary Inflation: Monetary inflation is driven by an increase in the money supply in an economy. When there is an excessive amount of money in circulation relative to the output of goods and services, it can lead to an increase in prices. This can occur through actions taken by central banks, such as lowering interest rates, implementing quantitative easing, or printing more money.

Inflation is typically measured using various indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). These indices track the changes in the prices of a basket of goods and services over time, providing an indication of the overall inflation rate.

There are both benefits and drawbacks associated with inflation. Moderate inflation is often viewed as a sign of a healthy economy. It encourages businesses and consumers to spend and invest, as they anticipate future price increases. It also allows for wage growth and helps to reduce the burden of debt for borrowers.

However, high levels of inflation can have detrimental effects. It erodes the purchasing power of money, making it more costly for individuals and businesses to purchase goods and services. It can lead to a decrease in real income, create uncertainty, distort economic decision-making, and impact savings and investment rates.

Central banks play a crucial role in managing inflation through monetary policy. They aim to maintain price stability and keep inflation within a target range by adjusting interest rates, regulating the money supply, and implementing other measures. The goal is to strike a balance between promoting economic growth and keeping inflation in check.

Understanding inflation is vital for individuals, businesses, and policymakers. By monitoring inflation and its underlying causes, stakeholders can make informed financial decisions, plan for the future, and implement strategies to mitigate its effects on the economy.

Unemployment and Inflation: The Phillips Curve

The Phillips Curve is an economic concept developed by economist A.W. Phillips in the 1950s. It suggests an inverse relationship between unemployment and inflation. According to the Phillips Curve, when unemployment is low, inflation tends to be high, and vice versa.

The Phillips Curve is based on the observation that there is often a trade-off between unemployment and inflation in the short run. When the economy operates close to its full employment level, a decrease in the unemployment rate leads to an increase in wages. As wages rise, production costs increase, which can lead businesses to raise prices. This phenomenon is known as demand-pull inflation.

Conversely, when the economy experiences a downturn and unemployment rises, workers face increased competition for a limited number of job opportunities. This competition leads to downward pressure on wages, which can help to alleviate inflationary pressures. This relationship is referred to as cost-push deflation or disinflation.

The Phillips Curve served as a useful guide for economists and policymakers for many years. It implied that policymakers faced a trade-off between unemployment and inflation, often referred to as the “Phillips Curve trade-off.” Governments could manipulate the unemployment rate by implementing expansionary or contractionary monetary and fiscal policies to stimulate or dampen economic activity. However, this trade-off was mostly seen as a short-term phenomenon.

Over time, economists discovered that the Phillips Curve trade-off was not always stable and could shift due to various factors. For example, the curve can flatten, indicating a weaker relationship between unemployment and inflation. This shift is attributed to changes in expectations, global economic factors, structural changes in the labor market, and advancements in economic theory.

The Phillips Curve also faces criticisms and limitations. Critics argue that the relationship between unemployment and inflation is not constant and can vary across different economic conditions. Factors such as supply shocks, changes in inflation expectations, and structural changes in the economy can influence inflationary pressures independently of the unemployment rate.

In recent years, the traditional understanding of the Phillips Curve has been challenged by new economic theories and changing economic dynamics. The concept of “flattening” or “missing” Phillips Curve has gained attention, as central banks have struggled to see the expected relationship between inflation and low unemployment rates. This has led to debates and reevaluations of the effectiveness of traditional monetary policy tools.

Despite its limitations, the Phillips Curve remains an essential framework for understanding the relationship between unemployment and inflation. It provides valuable insights into the dynamics of the economy and helps policymakers make informed decisions to balance the dual objectives of promoting full employment and maintaining price stability.

The Relationship Between Unemployment and Inflation

The relationship between unemployment and inflation is a complex and dynamic one. While the Phillips Curve suggests an inverse relationship between the two, the actual connection is influenced by various factors and can deviate from traditional expectations.

At its core, the relationship between unemployment and inflation can be explained by the interplay of aggregate demand and aggregate supply in an economy. When aggregate demand exceeds the available supply of goods and services, inflationary pressures can arise. Conversely, when aggregate demand falls short of the available supply, deflationary pressures may emerge.

Low levels of unemployment often coincide with high aggregate demand, as more people are employed and have income to spend. This increased spending can stimulate consumer demand, leading to higher prices for goods and services. On the other hand, higher levels of unemployment can signal a decrease in aggregate demand, which can put downward pressure on prices as businesses compete for a limited number of customers.

However, it is important to note that the relationship between unemployment and inflation is not fixed or linear. It can be influenced by a variety of factors, including changes in inflation expectations, wage dynamics, productivity levels, and the overall structure of an economy.

Expectations play a crucial role in shaping the relationship between unemployment and inflation. If individuals and businesses anticipate future price increases (inflation expectations), they may negotiate higher wages or increase prices preemptively. This can lead to a self-fulfilling prophecy, where higher inflation is sustained even with low unemployment. Conversely, if inflation expectations are well-anchored and people expect price stability, it can mitigate the impact of low unemployment on inflation.

Wage dynamics are another important factor in the relationship between unemployment and inflation. If wages increase at a faster pace than productivity growth, it can lead to cost-push inflation. However, if productivity increases outpace wage growth, it can help suppress inflationary pressures even with low unemployment rates.

The structure of an economy and its ability to adjust effectively to changes also influence the relationship between unemployment and inflation. In economies with flexible labor markets and efficient resource allocation, the impact of unemployment on inflation may be more pronounced. Conversely, in economies with rigid labor markets or institutional barriers that hinder adjustments, the link between unemployment and inflation can be weaker.

In recent years, the relationship between unemployment and inflation has been less predictable than in the past. Despite low levels of unemployment, many advanced economies have experienced persistently low inflation. This has led to discussions about the potential existence of a “non-accelerating inflationary rate of unemployment” (NAIRU), which suggests that low unemployment may no longer generate significant inflationary pressures as it has traditionally done.

Overall, while the Phillips Curve provides a framework for understanding the relationship between unemployment and inflation, the actual dynamics are influenced by multiple factors and can vary over time. It is crucial for policymakers and economists to monitor these factors and adapt their strategies to ensure price stability and promote sustainable economic growth.

Factors Influencing the Relationship

The relationship between unemployment and inflation is influenced by several factors that shape the dynamics between these two key economic indicators. Understanding these factors is essential for comprehending the intricacies of the relationship and making informed economic decisions. Here are some of the significant factors that influence the relationship:

- Inflation Expectations: The expectations held by individuals and businesses regarding future levels of inflation can affect the relationship between unemployment and inflation. If expectations of higher inflation become ingrained in wage negotiations and pricing decisions, it can lead to a self-fulfilling prophecy. Conversely, well-anchored inflation expectations can help stabilize prices despite changes in the unemployment rate.

- Productivity Levels: Productivity growth can play a role in shaping the relationship between unemployment and inflation. When productivity increases outpace wage growth, it can contribute to lower production costs, thereby mitigating inflationary pressures. On the other hand, if wages grow at a faster rate than productivity, it can push up costs and potentially lead to higher inflation.

- Technology and Innovation: Technological advancements and innovation can impact the relationship between unemployment and inflation. Automation and advancements in labor-saving technology can lead to job displacement and structural changes in the labor market. This can affect the bargaining power of workers and alter wage dynamics, influencing the overall relationship between unemployment and inflation.

- Global Factors: Global economic conditions and external shocks can influence the relationship between unemployment and inflation. Factors such as changes in global demand, commodity prices, and exchange rates can impact the cost of production and, consequently, inflationary pressures. Additionally, global economic integration and trade dynamics can affect wage competitiveness and exert pressure on domestic inflation levels.

- Institutional Factors: Institutional factors, such as labor market regulations, minimum wage policies, and collective bargaining agreements, can also shape the relationship between unemployment and inflation. These factors can influence the ability of wages to adjust to changes in unemployment rates, leading to variations in the relationship across different economies or time periods.

It is important to recognize that the impact of these factors can vary depending on the specific context and economic conditions of a country or region. Economists and policymakers must continuously assess and analyze these factors to understand the dynamics of the relationship between unemployment and inflation and to devise appropriate policies.

Moreover, the relationship between unemployment and inflation is not static and can change over time due to shifts in these influencing factors. For instance, changes in inflation targeting regimes or shifts in central bank policy frameworks can alter the relationship by affecting inflation expectations and the conduct of monetary policy.

By identifying and studying the factors that influence the relationship between unemployment and inflation, policymakers can better understand the nuances of their economic environment. This enables them to adapt and implement effective strategies to promote stable economic growth, manage inflationary pressures, and address unemployment challenges.

Historical Examples of the Relationship

Throughout history, there have been various examples that highlight the complex relationship between unemployment and inflation. These examples provide valuable insights into the dynamics of the relationship and the factors that can influence it. Here are a few notable historical examples:

- The 1970s Stagflation: The 1970s were marked by a phenomenon known as “stagflation,” which challenged the traditional understanding of the relationship between unemployment and inflation. During this period, many economies experienced high levels of inflation and high unemployment rates simultaneously. This defied the expectations set by the Phillips Curve and posed a significant economic challenge for policymakers. Stagflation was largely attributed to supply shocks, such as the oil price shocks of the 1970s, which disrupted production and led to higher costs, pushing up both prices and unemployment.

- The Volcker Disinflation: In the early 1980s, the United States faced both high levels of unemployment and inflation. To combat this issue, then Federal Reserve Chairman Paul Volcker implemented a tight monetary policy to tackle rising inflation. This involved raising interest rates to significant levels, which led to a deep recession but successfully brought inflation under control. The Volcker disinflation episode demonstrated that policymakers could use monetary policy tools to address high inflation, even if it involved short-term increases in unemployment.

- The Great Recession and Post-Crisis Period: The global financial crisis and subsequent recession starting in 2008 witnessed a significant slowdown in economic activity, resulting in a rise in unemployment rates across many countries. However, the expected increase in inflation due to higher unemployment did not materialize to the same extent. Central banks implemented expansionary monetary policies, including quantitative easing and record-low interest rates, to stimulate the economy and prevent deflationary pressures. This period highlighted the potential challenges of achieving inflation targets in the presence of persistent unemployment.

These historical examples demonstrate that the relationship between unemployment and inflation is not always consistent and can be influenced by various external and internal factors. Supply shocks, changes in monetary policy, and shifts in global economic conditions can disrupt the traditional expectations of the relationship, leading to deviations from the Phillips Curve predictions.

It is important for policymakers and economists to study these historical examples and learn from them to develop a deeper understanding of how the relationship between unemployment and inflation can evolve over time. By doing so, they can navigate through economic challenges, implement effective policies, and foster stable economic conditions.

Criticisms and Limitations

The relationship between unemployment and inflation, as explained by the Phillips Curve, has faced criticisms and encountered limitations over time. While the concept has provided valuable insights into the dynamics of the economy, it is important to recognize its shortcomings and consider alternative theories. Here are some of the criticisms and limitations of the Phillips Curve:

- Unpredictable Expectations: The Phillips Curve assumes stable and predictable expectations of inflation. However, expectations can be influenced by a variety of factors, including economic conditions, fiscal and monetary policies, and public sentiment. Unpredictable expectations can disrupt the relationship between unemployment and inflation, as individuals and businesses may change their behavior in response to shifting expectations.

- Structural Changes: The Phillips Curve does not account for structural changes that can impact the relationship between unemployment and inflation. Globalization, technological advancements, and changes in labor market dynamics can alter wage dynamics and the bargaining power of workers. These structural shifts can lead to deviations from the traditional expectations of the Phillips Curve.

- Inflation Persistence: The Phillips Curve assumes that changes in unemployment will have an immediate impact on inflation. However, inflation can exhibit persistence, meaning that past inflation rates can influence future inflation. This persistence can be influenced by factors such as inflation expectations, pricing behavior, and wage negotiations. As a result, the relationship between unemployment and inflation may not be as direct or immediate as the Phillips Curve suggests.

- Supply Shocks: The Phillips Curve focuses primarily on demand-side factors but overlooks the impact of supply shocks. Supply shocks, such as changes in oil prices or disruptions in global supply chains, can have significant effects on inflationary pressures independent of changes in unemployment. These shocks can lead to simultaneous increases in unemployment and inflation, as seen during the stagflation of the 1970s.

- Non-Linear Relationships: The Phillips Curve assumes a linear relationship between unemployment and inflation, yet empirical evidence has shown that this relationship can exhibit non-linear patterns. For example, the speed and intensity of inflationary pressures may differ at various levels of unemployment. This non-linear relationship challenges the simplicity of the Phillips Curve model.

It is important to acknowledge these criticisms and limitations to avoid relying solely on the Phillips Curve as a definitive guide for explaining the relationship between unemployment and inflation. Alternative theories, such as the expectations-augmented Phillips Curve and the New Keynesian framework, offer additional insights into the complexities of the relationship and provide a more nuanced understanding of inflation dynamics.

By considering the criticisms and limitations of the Phillips Curve, economists and policymakers can develop a more comprehensive and robust framework for analyzing the relationship between unemployment and inflation. This allows for better decision-making and policy formulation to effectively manage macroeconomic challenges and promote stable economic growth.

Current Trends and Debates

The relationship between unemployment and inflation continues to be a topic of ongoing debate and analysis among economists. As economic conditions evolve and new theories and models emerge, there are several current trends and debates regarding this relationship. Here are some key trends and debates in recent years:

Flattening Phillips Curve: One notable trend is the observation of a “flattening” Phillips Curve, indicating a weaker relationship between unemployment and inflation than in the past. Despite low levels of unemployment, many advanced economies have experienced persistently low inflation. This trend has led economists to question the traditional understanding of the relationship and explore alternative explanations for low inflation.

Missing Inflation: The “missing inflation” problem refers to the disconnect between low levels of unemployment and the expected rise in inflation. Central banks have implemented expansionary monetary policies, including quantitative easing and record-low interest rates, to stimulate economic growth. However, inflation has remained subdued, leading to debates about the efficacy of traditional monetary policy tools and the potential re-evaluation of inflation targets.

Globalization and Inflation: The increasing interconnectedness of global economies and the impact of globalization on inflation dynamics has been a subject of debate. Globalization has led to the outsourcing of labor-intensive production to countries with lower wages, which has affected the bargaining power of workers in advanced economies. This can contribute to suppressed wage growth and, consequently, lower inflationary pressures even in the presence of low unemployment.

Role of Technology: Technological advancements, particularly in automation and artificial intelligence, have raised questions about the impact on the relationship between unemployment and inflation. The adoption of technology in the workforce can disrupt labor markets and alter wage dynamics. It is debated whether technological progress exerts downward pressure on wages, potentially mitigating inflationary pressures despite low unemployment rates.

Reassessment of NAIRU: The concept of the non-accelerating inflation rate of unemployment (NAIRU) has come under scrutiny. NAIRU represents the unemployment rate below which inflation is expected to accelerate. However, the persistence of low inflation in the face of low unemployment has prompted a reassessment of the validity of NAIRU and has led economists to consider alternative theories to explain the relationship between unemployment and inflation.

Inflation Expectations and Central Bank Communication: The influence of inflation expectations on the relationship between unemployment and inflation has gained significant attention. Central banks have emphasized the importance of managing inflation expectations through clear communication and effective policy frameworks. Ensuring that inflation expectations remain well-anchored is seen as crucial in maintaining price stability despite changes in unemployment rates.

These trends and debates reflect the evolving understanding of the relationship between unemployment and inflation in light of changing economic conditions and theoretical advancements. As economists continue to explore and analyze these factors, the understanding of this relationship and its implications for policymaking will continue to evolve.

Conclusion

The relationship between unemployment and inflation is a complex and multifaceted issue that has captivated the attention of economists, policymakers, and analysts for decades. While the Phillips Curve provides a conceptual framework for understanding the inverse relationship between unemployment and inflation, the actual dynamics between these two economic indicators are influenced by a variety of factors.

Throughout history, we have seen examples that challenge the traditional expectations of the relationship between unemployment and inflation. Events such as stagflation in the 1970s, the Volcker disinflation period, and the global financial crisis have demonstrated the complexities and limitations of the Phillips Curve. These examples have highlighted the importance of considering additional factors such as supply shocks, changing expectations of inflation, technological advancements, and global economic conditions.

In recent years, trends and debates have emerged, reshaping our understanding of the relationship. The flattening Phillips Curve, missing inflation, the impact of globalization and technology, reassessment of NAIRU, and the role of inflation expectations have all contributed to a deeper analysis of this relationship. These trends and debates reflect the ongoing evolution of economic theories and the need for policymakers to adapt their approaches to address contemporary challenges.

It is essential to recognize the criticisms and limitations of the Phillips Curve and explore alternative frameworks and models to enhance our understanding of the relationship between unemployment and inflation. By doing so, economists and policymakers can develop more robust strategies to mitigate economic fluctuations, maintain price stability, and promote sustainable economic growth.

In conclusion, the relationship between unemployment and inflation is not a straightforward one, and it is influenced by a myriad of economic, structural, and global factors. While the Phillips Curve provides a helpful starting point, it is crucial to consider the complexity and potential deviations from its traditional assumptions. By continually studying and analyzing this relationship, economists and policymakers can gather valuable insights and make informed decisions to navigate the challenges of unemployment and inflation, nurture resilient economies, and enhance the well-being of individuals and societies at large.