Finance

What Is A Financial Risk Of Being A Homeowner?

Modified: February 21, 2024

Learn about the financial risks associated with homeownership and how to manage them effectively. Explore valuable insights and tips to secure your finances as a homeowner.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Being a homeowner is a dream for many individuals. It signifies stability, independence, and the opportunity to build equity over time. However, along with the many benefits of homeownership come several financial risks that should not be overlooked. Understanding and preparing for these risks is crucial for homeowners to safeguard their long-term financial well-being.

In this article, we will explore the various financial risks that homeowners face and how they can impact your financial stability. By being aware of these risks, you can make informed decisions and take appropriate measures to mitigate them.

From market fluctuations and interest rate risks to property value depreciation and mortgage default risks, being a homeowner exposes you to a variety of financial vulnerabilities. Natural disasters can also wreak havoc on your property, leading to significant financial burdens. Moreover, the costs associated with maintenance, repairs, and insurance coverage gaps can add further strain to your financial resources.

Lastly, changes in tax laws can have a considerable impact on your finances as a homeowner. Understanding these risks will help you navigate the challenges and uncertainties that may arise and take proactive steps to minimize their potential impact.

Let’s dive deeper into each of these financial risks to gain a comprehensive understanding of the potential challenges that come with homeownership and explore strategies to mitigate them effectively.

Market Fluctuations

One of the inherent risks of being a homeowner is the volatility of the real estate market. Property values can fluctuate significantly over time, impacting the equity in your home. During periods of economic downturn, property values may decrease, leading to a potential decrease in the overall value of your investment.

Market fluctuations can have various implications for homeowners. If the value of your property declines, it may become challenging to sell your home for a profit or refinance your mortgage. This can limit your options and potentially hinder your financial plans.

Additionally, market fluctuations can affect the availability of home equity loans and lines of credit. Lenders often rely on the appraised value of your property when determining the amount of credit they are willing to extend. If the market value of your home drops significantly, it may impact your ability to access additional funds when needed.

To mitigate the impact of market fluctuations, it is essential to stay informed about the local real estate market trends. Work with a competent real estate agent or financial advisor who can provide valuable insights into the current market conditions. Regularly reviewing your home’s value and monitoring market trends can help you make informed decisions regarding refinancing, selling, or accessing home equity.

Furthermore, it is important to maintain your property to ensure its value remains competitive in the market. Regular maintenance and necessary upgrades or renovations can help preserve and even increase the value of your home. By keeping your property in good condition, you are better positioned to withstand market fluctuations and potentially benefit from future appreciation.

While it is impossible to completely eliminate the risks associated with market fluctuations, staying proactive and informed can help you navigate through these uncertainties effectively.

Interest Rate Risk

Interest rate risk is a significant financial risk of being a homeowner, particularly for those with an adjustable-rate mortgage (ARM) or planning to refinance their existing mortgage. Changes in interest rates can have a direct impact on the monthly mortgage payments, potentially increasing the financial burden on homeowners.

If you have an ARM, your interest rate is typically fixed for a certain period, after which it adjusts periodically based on prevailing market rates. Depending on the terms of your mortgage, these adjustments can lead to significant increases in your monthly payments, making it more challenging to manage your finances.

Even if you have a fixed-rate mortgage, interest rate changes can still impact your financial situation. If interest rates drop significantly, you may consider refinancing your mortgage to secure a lower interest rate. However, refinancing comes with its own costs, such as closing fees and potential prepayment penalties. Therefore, it is important to carefully analyze the potential savings versus the associated costs to determine if refinancing is truly beneficial.

To mitigate the impact of interest rate risk, homeowners should closely monitor market trends and keep an eye on interest rate movements. Look for opportunities to refinance when interest rates are substantially lower than the rate on your current mortgage. However, it is crucial to factor in all associated costs and consider the potential timeframe required to recoup those costs through monthly savings.

If you have an ARM, be prepared for potential increases in your monthly mortgage payments. Budget and plan accordingly to ensure you can comfortably manage the increased expenses. Consider refinancing to a fixed-rate mortgage if you anticipate interest rates rising significantly in the future.

Working with a reputable mortgage broker or financial advisor can provide valuable guidance on managing interest rate risk. They can help you understand your options, assess the potential impact of interest rate changes on your finances, and make informed decisions that align with your long-term financial goals.

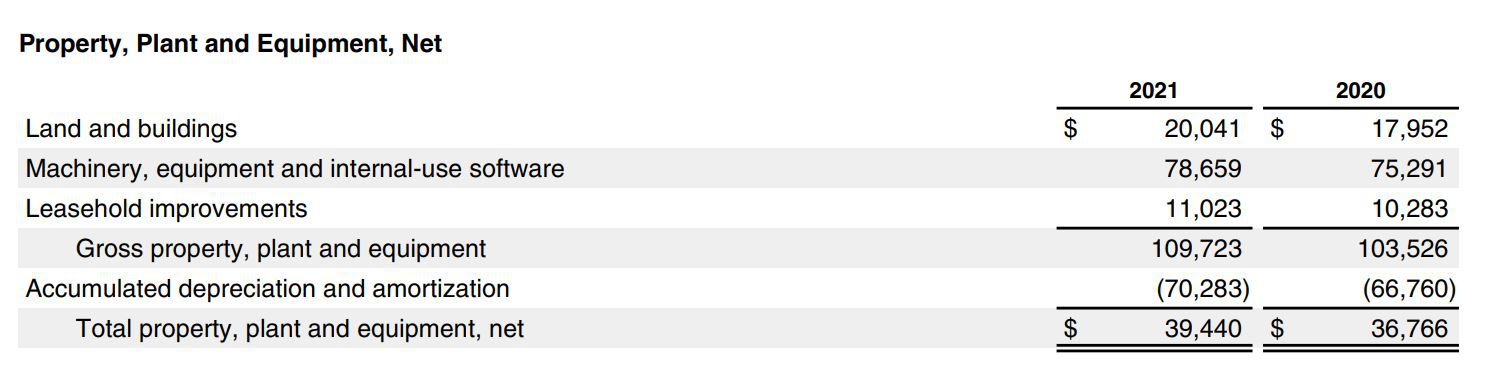

Property Value Depreciation

Another financial risk of being a homeowner is the potential for property value depreciation. Property values can fluctuate not only due to market conditions but also as a result of various factors such as changes in the neighborhood, local economy, or infrastructure.

If the value of your property depreciates, it can have a significant impact on your overall net worth. The equity you have built in your home may decrease, which can affect your ability to access credit or sell your home for a profit in the future.

Several factors can contribute to property value depreciation, including a decline in the quality of the neighborhood, increased crime rates, decreased demand for housing in the area, or the presence of undesirable elements such as pollution or noise. Additionally, changes in nearby amenities, such as the closure of schools or the loss of major employers, can also have an adverse effect on property values.

To mitigate the risk of property value depreciation, it is vital to consider the location and neighborhood carefully when purchasing a home. Look for areas with strong economic fundamentals, such as job growth, low crime rates, quality schools, and desirable amenities. These factors can help maintain or increase the value of your property over time.

Regular property maintenance, improvements, and upgrades can also help preserve or enhance the value of your home. Keeping your home in good condition and making strategic improvements can boost its appeal and make it more attractive to potential buyers in the future.

Lastly, staying informed about local market trends and developments in your neighborhood is crucial. Be aware of any changes that may impact property values, such as new construction or planned infrastructure projects. Stay connected with local real estate professionals who can provide insights into market dynamics and potential risks.

While it is impossible to completely eliminate the risk of property value depreciation, being proactive, and making informed decisions can help safeguard your long-term financial investment in your home.

Mortgage Default Risk

Mortgage default risk is a significant financial risk that homeowners must be cautious of. If you are unable to make your mortgage payments due to financial difficulties or unforeseen circumstances, you could face the risk of defaulting on your loan.

Defaulting on your mortgage can have severe consequences, including damage to your credit score and potential foreclosure by the lender. Foreclosure is the legal process by which the lender takes possession of the property to recover the amount owed on the mortgage.

Several factors can contribute to mortgage default, including job loss, a decrease in income, medical emergencies, or unexpected expenses. It is crucial to have a solid financial plan and emergency fund in place to help navigate through challenging times and continue making timely mortgage payments.

To mitigate the risk of mortgage default, it is important to budget effectively and ensure that your monthly mortgage payments align with your income and expenses. Avoid taking on more debt than you can comfortably manage and carefully consider any financial decisions that may impact your ability to make mortgage payments.

If you encounter financial difficulties that hinder your ability to make mortgage payments, reach out to your lender as soon as possible. Many lenders offer assistance programs to borrowers facing financial hardship. These programs can include loan modifications, forbearance options, or the possibility of refinancing to more affordable terms.

It is also essential to stay informed about your rights and obligations as a homeowner. Understand the terms and conditions of your mortgage, including any penalties or fees associated with defaulting. Consulting with a housing counselor or financial advisor can provide valuable guidance and support in navigating through financial challenges.

By being proactive, staying informed, and having a contingency plan in place, you can reduce the risk of mortgage default and ensure the long-term financial stability of your homeownership.

Natural Disasters

Natural disasters pose a significant financial risk for homeowners. Whether it’s hurricanes, earthquakes, floods, wildfires, or tornadoes, these events can cause extensive damage to properties and lead to significant financial burdens.

In regions prone to specific natural disasters, homeowners may be required to carry additional insurance coverage specifically designed to protect against these risks. However, it’s important to note that even with insurance, there may still be out-of-pocket expenses, deductibles, and limitations on coverage.

Depending on the severity of the disaster, homeowners may be faced with the cost of repairing or rebuilding their property, as well as the expenses associated with temporary housing during the recovery process. In some cases, homeowners may also experience a temporary loss of income if their place of employment is affected.

To mitigate the financial impact of natural disasters, homeowners should take proactive measures to prepare their properties and themselves. This includes having a disaster preparedness plan in place, such as securing necessary supplies, creating an emergency fund to cover unexpected expenses, and ensuring appropriate insurance coverage.

Maintaining the integrity of your property is essential in reducing the risk of damage during a natural disaster. Regular maintenance, such as clearing gutters and trimming trees, can help mitigate potential hazards. Additionally, fortifying your home against specific risks, such as installing storm shutters or reinforcing the structure against earthquakes, can provide added protection.

While natural disasters are unpredictable, staying informed about potential risks in your area is crucial. Pay attention to weather alerts, follow evacuation orders if necessary, and have a plan in place to keep yourself and your family safe.

Lastly, consider the potential risks of natural disasters when purchasing a home. Research the history of the area for past incidents and assess the property’s vulnerability to specific risks. This information can help you make an informed decision and potentially save you from future financial burdens.

By being proactive, prepared, and taking appropriate precautions, homeowners can minimize the financial impact of natural disasters and ensure the safety and security of their homes.

Maintenance and Repair Costs

Maintenance and repair costs are an ongoing financial responsibility for homeowners. Over time, wear and tear, as well as aging infrastructure, can lead to the need for regular maintenance and occasional repairs.

From fixing a leaky roof or plumbing issues to HVAC system maintenance or painting, these expenses can quickly add up and impact your finances. It’s important to budget for these costs and set aside funds for unexpected repairs that may arise.

One way to mitigate maintenance and repair costs is through proactive home maintenance. Conduct regular inspections of your property and address any minor issues before they escalate into major repairs. Performing routine maintenance tasks such as cleaning gutters, changing air filters, and having your HVAC system serviced can help prevent costly breakdowns and extend the lifespan of these systems.

Additionally, consider investing in a home warranty or home maintenance plan. These plans often cover the repair or replacement of major home systems and appliances, providing financial assistance when unexpected breakdowns occur. However, it’s important to review the terms and coverage of these plans, as there may be limitations and exclusions.

When planning for homeownership, it’s crucial to account for ongoing maintenance and repair costs in your budget. By setting aside funds regularly, you can ensure you’re prepared for any unexpected expenses that may arise.

Furthermore, carefully consider the condition and age of a property when purchasing a home. An older home or a property in need of significant renovations may come with higher maintenance and repair costs compared to a newer or well-maintained property.

Lastly, it’s important to stay informed about current market rates for maintenance and repair services in your area. Research local contractors and service providers to find reliable and reputable professionals who offer fair pricing.

By being proactive, budgeting for maintenance and repair costs, and taking preventative measures, homeowners can effectively manage these expenses and ensure the ongoing upkeep and value of their property.

Insurance Coverage Gaps

Insurance coverage is a critical component of protecting your home and finances as a homeowner. However, it’s important to be aware of potential coverage gaps that could leave you financially vulnerable in certain situations.

Insurance coverage gaps occur when there are limitations or exclusions in your insurance policy that may not fully protect you in specific circumstances. This can include gaps in coverage for natural disasters, certain types of damage, or high-value personal belongings.

One common coverage gap homeowners face is inadequate coverage for natural disasters. Standard homeowner’s insurance policies typically do not cover damage caused by floods, earthquakes, or hurricanes. If you live in an area prone to these events, it’s essential to consider purchasing separate policies, such as flood insurance or earthquake insurance, to ensure adequate protection.

Additionally, it’s important to review the coverage limits of your policy to ensure they align with the value of your home and possessions. Standard policies may have limits on coverage for high-value items, such as jewelry or artwork. If you own valuable items, you may need to purchase additional coverage, such as a floater or endorsement, to adequately protect them.

Another coverage gap to be aware of is the potential for underinsuring your property. When determining the appropriate amount of coverage, it’s crucial to consider the cost of rebuilding your home in the event of a total loss. Underinsuring your property could leave you financially responsible for the difference between the coverage limit and the actual cost of rebuilding.

Regularly reviewing and updating your insurance policies is essential to identify and address any potential coverage gaps. Periodically reassess the value of your home and possessions, and communicate any significant changes to your insurance provider to ensure that your coverage adequately protects your assets.

Consulting with an insurance professional can provide valuable guidance in identifying and addressing potential coverage gaps. They can help you understand the specific risks in your area and recommend appropriate insurance products to meet your needs.

By staying informed, reviewing your policies regularly, and addressing any coverage gaps, you can ensure that you have comprehensive and adequate insurance coverage to protect your home and finances.

Changes in Tax Laws

Homeowners must be aware of the potential financial impact of changes in tax laws. Tax laws can change over time, and these changes can directly influence the amount of taxes homeowners are required to pay.

One significant aspect of tax laws that affects homeowners is the tax deduction for mortgage interest. This deduction allows homeowners to reduce their taxable income by deducting the interest paid on their mortgage. Changes in tax laws can either increase or decrease the available mortgage interest deduction, which can impact your tax liability.

Property tax deductions are another important consideration for homeowners. Property taxes paid on your home may be eligible for deduction on your federal income tax return. However, changes in tax laws can limit or modify the amount of property tax you can deduct, potentially affecting your overall tax burden.

Additionally, changes in tax laws can impact homeowners who rely on rental income from their properties. Rental income is subject to certain tax regulations, and alterations in tax laws can modify the deductions and credits available to landlords.

It’s crucial for homeowners to stay informed about any proposed or enacted changes in tax laws. Monitoring news outlets, consulting tax professionals, and engaging with local and national real estate associations can provide valuable insights into any potential tax law changes that may affect homeownership.

Planning and budgeting for potential changes in tax laws is essential. Consult with a tax professional to understand the potential impact on your specific circumstances and explore strategies to minimize your tax liability.

Lastly, it’s important to note that tax laws can vary depending on your jurisdiction. What may apply at the federal level could differ from state or local tax regulations. Understanding the specific tax laws in your area is crucial to ensure accurate tax planning and compliance.

By staying informed, seeking professional guidance, and proactively adjusting your tax planning strategies when necessary, you can navigate the potential financial implications of changes in tax laws as a homeowner.

Conclusion

Being a homeowner offers many benefits, but it also comes with its fair share of financial risks. Understanding and preparing for these risks is crucial to safeguarding your long-term financial well-being.

Market fluctuations, interest rate risks, property value depreciation, mortgage default risks, natural disasters, maintenance and repair costs, insurance coverage gaps, and changes in tax laws are all factors that can impact your financial stability as a homeowner.

While it is impossible to completely eliminate these risks, there are strategies you can employ to mitigate their impact. Staying informed about market trends, maintaining your property, budgeting for maintenance and repairs, reviewing and updating insurance coverage, and staying updated on changes in tax laws are all important steps in protecting your financial interests.

Working with experienced professionals, such as real estate agents, financial advisors, insurance agents, and tax professionals, can provide valuable guidance and support in managing these risks. They can help you navigate through uncertainties, make informed decisions, and take proactive measures to protect your home and finances.

Remember to regularly reassess and review your financial situation, insurance coverage, and tax planning strategies. By staying proactive and informed, you can effectively navigate the financial risks of homeownership and secure your long-term financial stability.

Owning a home is a significant achievement, and by understanding and managing these financial risks, you can enjoy the many rewards and benefits that come with homeownership while minimizing potential financial setbacks.