Finance

What Is IRS Form 4506-C?

Published: November 1, 2023

Learn about IRS Form 4506-C and its importance for your finance. Get key insights on how to effectively utilize this form for IRS audits and financial record verification.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where complex forms and regulations are as common as the numbers that govern our economic lives. In this article, we will be shedding light on one such form that plays a crucial role in the realm of taxation – IRS Form 4506-C.

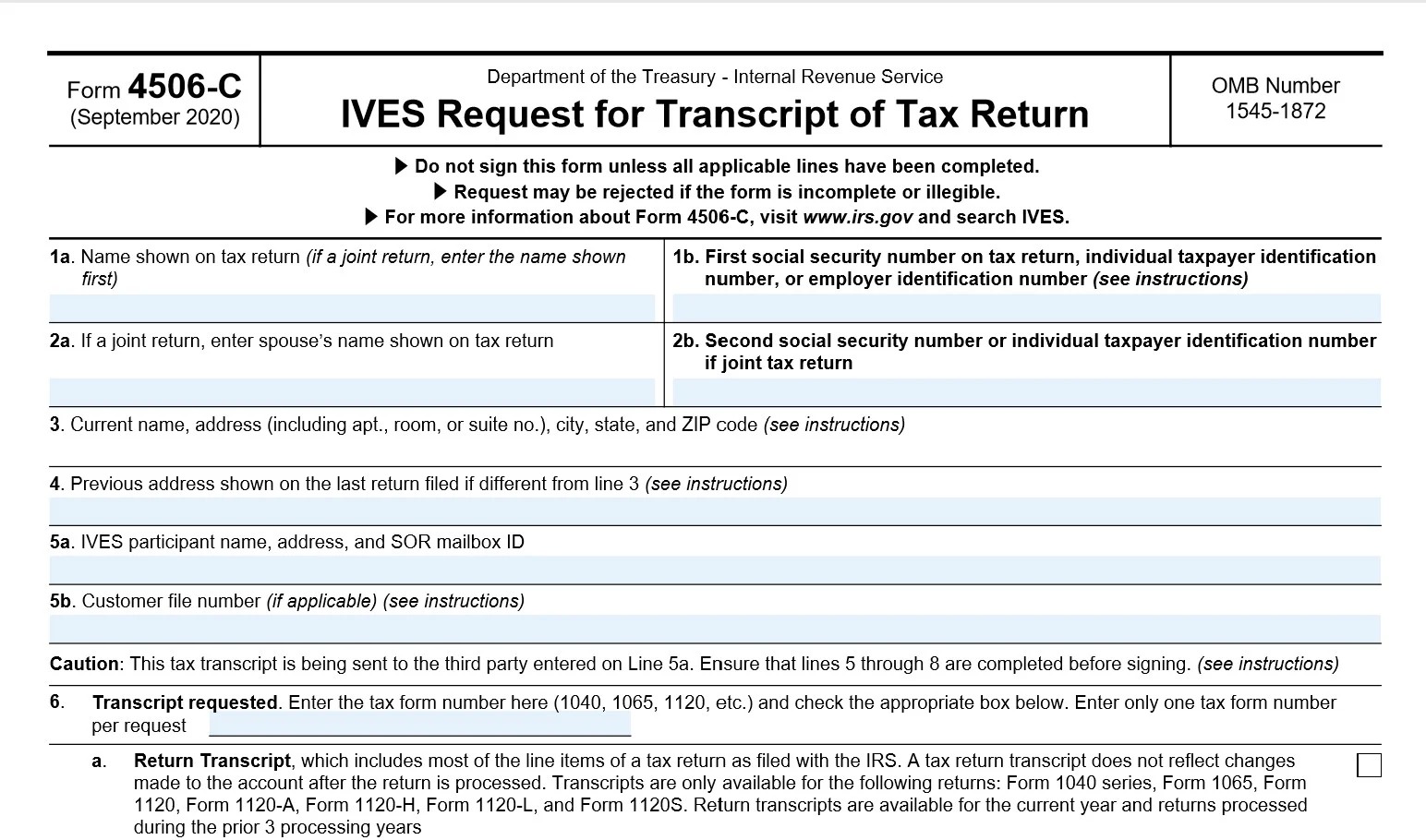

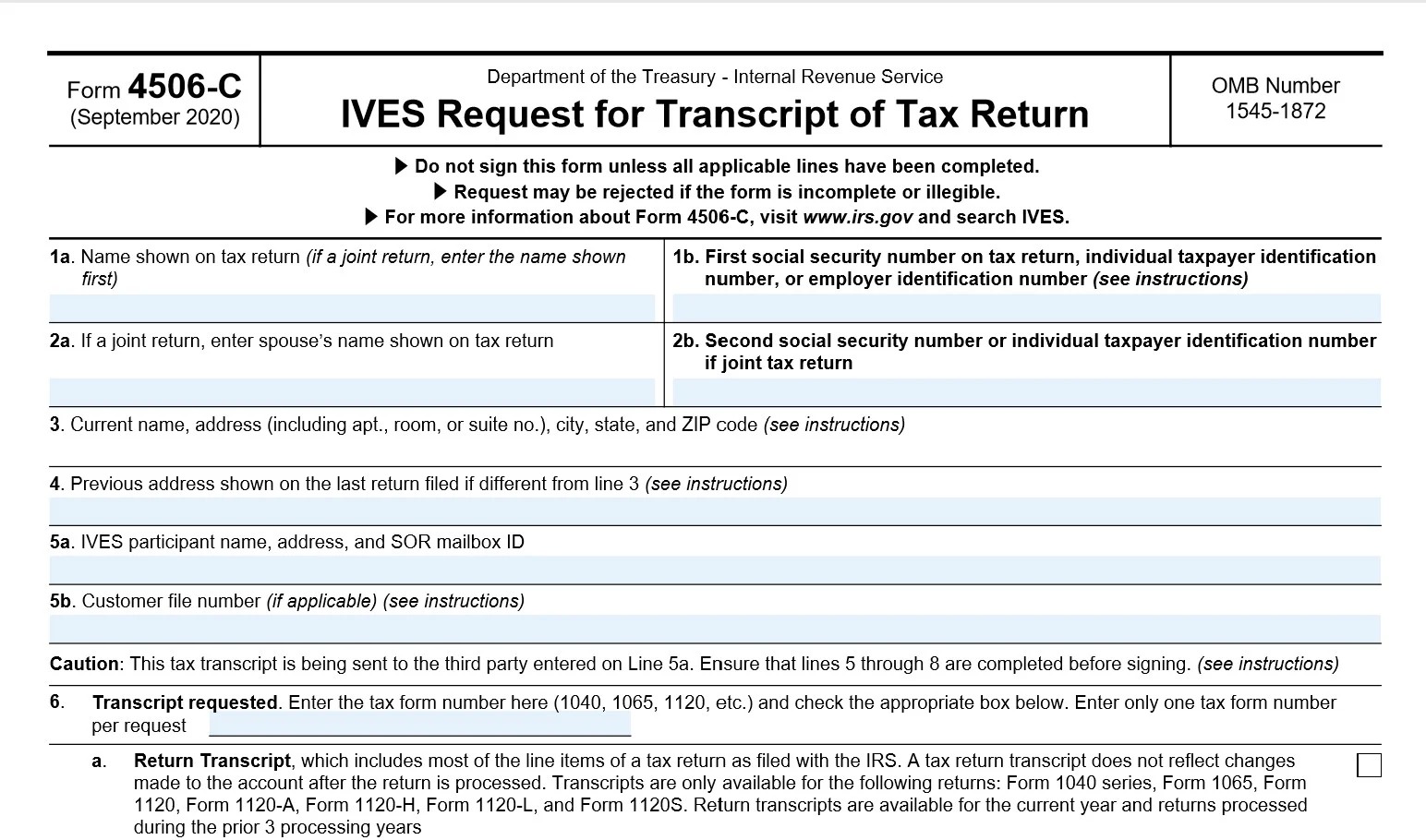

Form 4506-C, also known as the “Request for Transcript of Tax Return,” is a document issued by the Internal Revenue Service (IRS) in the United States. Its purpose is to allow individuals or organizations to request copies or transcripts of previously filed tax returns and other related documents.

Whether it’s for personal financial planning, loan application, mortgage verification, or legal purposes, Form 4506-C serves as the gateway to accessing crucial tax information that can have a significant impact on financial decisions and legal proceedings.

Understanding the purpose, the process of filling out, and submitting Form 4506-C will help individuals navigate the intricate landscape of tax compliance and financial documentation. So let’s dive deeper into the intricacies of this form and uncover its key aspects.

Purpose of IRS Form 4506-C

The primary purpose of IRS Form 4506-C is to provide a streamlined method for individuals and organizations to obtain copies or transcripts of their previously filed tax returns. This form is especially useful in situations where tax return information is required for various financial and legal purposes.

One of the main reasons individuals may need to request copies of their tax returns is for personal financial planning purposes. By reviewing previous tax returns, individuals can gain insights into their income, deductions, and credits, allowing them to make informed decisions about their financial future. This information can be particularly useful when applying for loans, mortgages, or even when considering investment opportunities.

In addition to personal financial planning, Form 4506-C also serves a critical role in verifying income and tax information for loan applications. Lenders often require borrowers to provide proof of their tax returns to assess their financial stability and capability to repay the loan. By submitting Form 4506-C, individuals can authorize the IRS to release their tax transcripts directly to the lender, ensuring a reliable and accurate documentation process.

Furthermore, Form 4506-C is essential in legal proceedings where tax return records are needed. Attorneys, court officials, and other authorized entities may utilize this form to obtain tax transcripts for litigation or other legal purposes. It helps provide a comprehensive view of an individual’s financial history, ensuring transparency and compliance with tax regulations.

By facilitating easy access to tax return information, IRS Form 4506-C simplifies administrative processes for both individuals and organizations, ensuring compliance with tax regulations and promoting financial transparency. Now that we understand the purpose of this form, let’s explore how to fill it out correctly in the next section.

How to Fill Out Form 4506-C

Filling out IRS Form 4506-C requires careful attention to detail to ensure accurate and complete information. Here is a step-by-step guide to help you navigate the process:

- Personal Information: Begin by entering your name, social security number, and current address in the designated fields. Make sure to provide your accurate and up-to-date contact information.

- Third Party Designee: If you want to authorize someone else to discuss your tax return transcript request with the IRS, you can designate them as a third party designee. Enter their name, phone number, and their relationship to you, if applicable.

- Type of Transcript Requested: Specify the type of transcript you need by checking the appropriate box. You can choose from tax return transcript, tax account transcript, record of account transcript, and wage and income transcript. Provide the year or years for which you are requesting the transcript.

- Verification of Nonfiling: If you are requesting a verification of nonfiling letter, check the box indicating so and provide the tax year or years for which you did not file a tax return.

- Signature: Sign and date the form to certify that the information provided is true and accurate. If you have designated a third party designee, they must also sign and date the form.

It’s important to note that there may be additional requirements or instructions depending on your specific circumstances. Be sure to review the instructions provided by the IRS for any specific requirements related to your request.

Once you have completed the form, you can either mail it to the IRS or submit it electronically. The submission method will depend on the instructions provided by the IRS and the options available for your specific request.

Now that you know how to fill out Form 4506-C, let’s move on to the next section to learn about the process of submitting the form.

Submitting Form 4506-C

After carefully filling out IRS Form 4506-C, it’s crucial to submit the form using the appropriate method to ensure timely processing of your transcript request. Here are the common methods for submitting Form 4506-C:

- Mail: The traditional method of submitting Form 4506-C is by mailing the completed form to the address specified in the IRS instructions. It’s important to double-check the address to ensure accurate delivery. Allow sufficient time for the form to reach the IRS, as processing times can vary.

- Electronic Submission: Depending on the type of transcript requested and the available options, the IRS may offer the option to submit Form 4506-C electronically. This method is often faster and more convenient than mailing the form, as it eliminates the time required for physical delivery. Follow the instructions provided by the IRS for electronic submission, which may include uploading the completed form through their designated online portal.

When submitting Form 4506-C, it’s important to include any accompanying documentation or fees, if required by the IRS. Failure to include the necessary documents or fees may result in delays or rejection of your request.

Once the IRS receives your Form 4506-C, they will process your request and provide the requested tax return transcripts or nonfiling verification letter, depending on your specific request. Processing times for Form 4506-C can vary, so it’s advisable to allow ample time for the IRS to complete the processing. You can check the status of your request through the IRS online portal or by contacting the IRS directly.

Now that you know the submission options for Form 4506-C, let’s delve into the processing time and potential fees associated with this form in the next section.

Processing Time and Fees

The processing time for IRS Form 4506-C can vary depending on various factors, including the volume of requests received by the IRS and the complexity of the information being requested. It’s important to note that the IRS does not provide real-time processing updates, so it’s advisable to plan ahead and allow sufficient time for processing.

Generally, the processing time for Form 4506-C can range from a few weeks to several months. It’s recommended to check the IRS website or contact the IRS directly for the most up-to-date information regarding processing times. Additionally, if there are any discrepancies or issues with the information provided on the form, it may further delay the processing time.

When it comes to fees associated with Form 4506-C, it’s essential to understand that there may be costs involved in obtaining tax return transcripts or nonfiling verification letters. As of the time of writing, the fees for Form 4506-C are as follows:

- For tax return transcripts: The IRS charges a fee per tax year requested. The fee may vary depending on the delivery method chosen (mail or electronic). The fee is typically lower for electronic delivery compared to mail.

- For nonfiling verification letter: There is generally no fee associated with obtaining a verification of nonfiling letter.

It’s important to check the IRS instructions or the IRS website for the most accurate and up-to-date information regarding fees. In some cases, there may be exceptions or waivers for certain individuals or circumstances.

Remember, timely submission of Form 4506-C and payment of any applicable fees is crucial to ensure the prompt processing of your request. Now that we’ve covered the processing time and fees associated with Form 4506-C, let’s explore the various uses of this form in the next section.

Uses of IRS Form 4506-C

IRS Form 4506-C is a versatile document that serves various purposes in the realm of taxation, financial planning, and legal proceedings. Here are some common uses of this form:

- Personal Financial Planning: Individuals often utilize Form 4506-C to obtain copies of their previously filed tax returns for personal financial planning purposes. By reviewing past tax returns, individuals can analyze their income, deductions, and credits, gaining insights that can aid in making informed financial decisions and developing effective financial strategies.

- Loan and Mortgage Applications: Lenders and financial institutions often require tax return information as part of the application process for loans and mortgages. By submitting Form 4506-C, individuals can authorize the IRS to release their tax return transcripts directly to the lender or mortgage provider. This helps lenders assess borrowers’ financial stability and ability to repay the loan accurately.

- Income Verification: Employers, government entities, and other organizations may request Form 4506-C to verify an individual’s income for various purposes. This form provides a reliable source of information regarding an individual’s tax history, which can be crucial in assessing eligibility for programs, benefits, or employment.

- Legal Proceedings: Attorneys, court officials, and other authorized entities rely on Form 4506-C to access tax return records for legal proceedings. Whether for litigation, divorce settlements, or other legal matters, this form provides a comprehensive view of an individual’s financial history, ensuring transparency and compliance with tax regulations.

- Tax Compliance: Form 4506-C plays a significant role in ensuring tax compliance by allowing taxpayers and tax authorities to access accurate and up-to-date tax return information. This form helps to verify the accuracy of tax returns and serves as a critical tool in investigations and audits conducted by the IRS and other tax authorities.

These are just a few of the many uses of IRS Form 4506-C. The versatility and importance of this form make it a valuable resource in the financial and legal landscape, ensuring transparency, compliance, and accurate financial decision-making.

Now that we’ve explored the uses of Form 4506-C, let’s conclude our article with a summary of the key points discussed.

Conclusion

IRS Form 4506-C, the Request for Transcript of Tax Return, is a vital document in the world of finance and taxation. By understanding the purpose, process, and uses of this form, individuals and organizations can navigate the complex landscape of tax compliance and financial planning more effectively.

Form 4506-C serves as a gateway to accessing important tax return information for personal financial planning, loan applications, income verification, and legal proceedings. It allows individuals to review their financial history, make informed decisions about their finances, and provide accurate documentation when needed.

When filling out Form 4506-C, attention to detail is of utmost importance. Providing accurate personal information, designating a third party if necessary, and specifying the type of transcript requested are essential steps in completing this form correctly. Additionally, choosing the appropriate submission method, whether by mail or electronically, is crucial for the timely processing of the request.

It’s important to note that there may be processing times associated with Form 4506-C, which can range from weeks to months. Being prepared and allowing sufficient time is advised to ensure the completion of the request within the required timeframe.

Moreover, it’s crucial to be aware of any fees associated with the form, as the costs may vary depending on the type of transcript and the delivery method chosen. Checking the IRS instructions and their official website for the most accurate and up-to-date fee information is recommended.

IRS Form 4506-C plays a vital role in ensuring tax compliance, promoting financial transparency, and aiding individuals and organizations in making informed financial decisions. By understanding and utilizing this form effectively, individuals can navigate the complex financial landscape with confidence and compliance.

Now that you have gained a comprehensive understanding of IRS Form 4506-C, you can confidently utilize this form in various financial and legal situations, knowing its purpose and importance. Make informed decisions, comply with tax regulations, and plan your financial future with this valuable tool at your disposal.