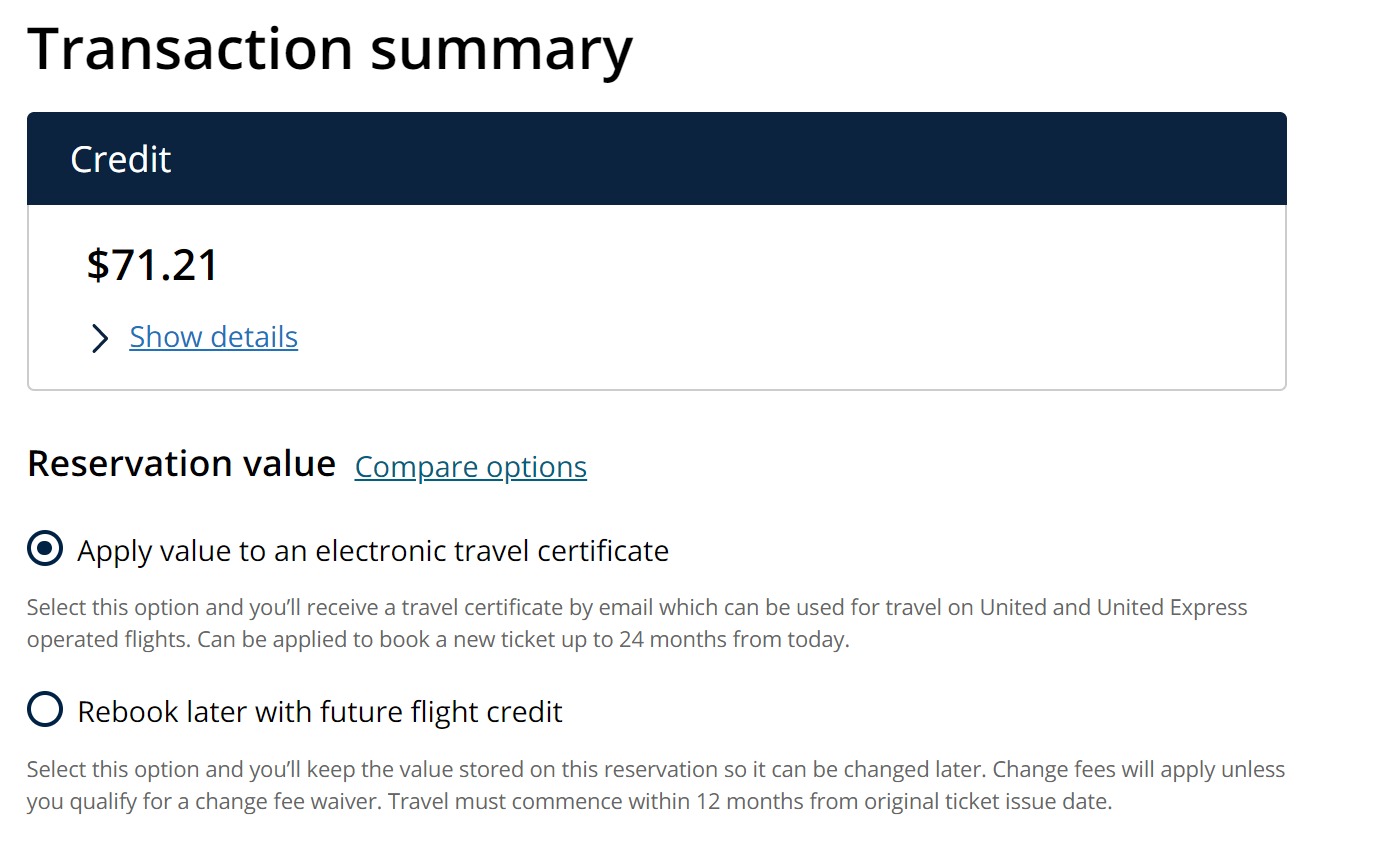

Finance

What Is A Financial Risk

Published: October 30, 2023

Learn about the various aspects of financial risk and its impact on the world of finance. Understand how managing financial risk is crucial for success in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the fascinating world of financial risk! In today’s dynamic and unpredictable market, understanding and managing financial risk is crucial for individuals, businesses, and even governments. Financial risk refers to the potential for loss or adverse impact on financial outcomes due to uncertain events or market fluctuations. These risks are inherent in various financial activities, such as investing, lending, borrowing, or operating in the global financial system.

Financial risk can arise from multiple sources, including credit risk, market risk, liquidity risk, operational risk, and regulatory risk. Each type of risk presents unique challenges and requires tailored strategies for effective risk management. In this article, we will delve into the different types of financial risk, explore their impact, and discuss potential approaches to mitigate them.

Understanding financial risk is essential because it allows individuals and organizations to make informed decisions, allocate resources efficiently, and safeguard against potential losses. By identifying and managing risk effectively, individuals and businesses can reduce the likelihood of financial distress and protect their financial stability. Furthermore, financial institutions and regulators rely on risk management practices to ensure the stability and integrity of the overall financial system.

Managing financial risk is a continuous process that involves assessing, measuring, monitoring, and mitigating risk exposures. It requires a deep understanding of the financial landscape, including economic trends, market conditions, regulatory frameworks, and individual risk appetite. With the right tools and strategies, individuals and businesses can navigate the complexities of financial risk and seize opportunities for growth and prosperity.

In the following sections, we will explore the various types of financial risk in detail and examine the measurement and management techniques employed to mitigate these risks. We will also discuss the importance of risk assessment and analysis in identifying potential risks and developing appropriate risk mitigation strategies. By the end of this article, you will have a comprehensive understanding of financial risk and be better equipped to navigate the dynamic world of finance.

Definition of Financial Risk

Financial risk refers to the potential for adverse outcomes or financial losses resulting from uncertainties and fluctuations in the market. It encompasses the probability of loss and the severity of that loss in various financial activities and transactions. In essence, it is the possibility that an investment or financial decision will not yield the expected returns.

Financial risk can arise from several factors, including economic conditions, market fluctuations, operational failures, credit defaults, liquidity constraints, and regulatory changes. These risks can impact individuals, businesses, and even entire economies. Understanding and managing financial risk is crucial for making informed decisions, protecting investments, and ensuring financial stability.

When assessing financial risk, it is important to consider both quantitative and qualitative factors. Quantitative aspects include measuring the likelihood and magnitude of potential losses, such as calculating Value at Risk (VaR) or evaluating credit ratings. Qualitative factors, on the other hand, involve subjective assessments of factors like management quality, market reputation, and regulatory environment.

Financial risk is an integral part of all financial activities, and it manifests differently depending on the specific context. For example, in investment management, financial risk involves the potential for negative returns or loss of principal. In banking, financial risk encompasses the likelihood of default by borrowers or the inability to meet liquidity obligations. Similarly, in the corporate sector, financial risk relates to the uncertainty surrounding revenue streams, currency fluctuations, and operational disruptions.

It is important to distinguish between risk and uncertainty. While risk refers to situations where the probability of outcome can be estimated, uncertainty refers to situations where the outcome is uncertain and difficult to quantify. Financial risk management aims to mitigate, monitor, and control risks within an acceptable level, considering both risk and uncertainty.

Financial risk is an ever-present aspect of the financial world, and it requires careful consideration and management to navigate successfully. By understanding the different types of financial risk, assessing their potential impact, and implementing appropriate risk management strategies, individuals and organizations can mitigate potential losses and safeguard their financial well-being.

Types of Financial Risk

Financial risk can manifest in various forms, each with different characteristics and impacts on individuals and organizations. Understanding the different types of financial risk is essential for effective risk management and developing appropriate mitigation strategies. Let’s explore the most common types of financial risk:

- Credit Risk: Credit risk refers to the potential for borrowers to default on their loan or debt obligations, causing financial losses to lenders. This risk arises from the uncertainty of repayment, deteriorating creditworthiness, or economic downturns. Lenders use credit analysis, credit ratings, and collateral to assess and mitigate credit risk.

- Market Risk: Market risk is the potential for losses due to fluctuations in financial markets. It includes the risks associated with changes in interest rates, exchange rates, commodity prices, and equity prices. Market risk impacts investment portfolios, trading activities, and overall market conditions.

- Liquidity Risk: Liquidity risk refers to the potential for an individual or organization to be unable to meet its financial obligations or access cash to fund operations. It arises from a lack of marketability or insufficient liquid assets. Liquidity risk can occur due to unforeseen events, economic stress, or poor cash management.

- Operational Risk: Operational risk is the potential for losses due to internal failures or inadequate procedures, systems, or controls. It spans a wide range of risks, including human error, technological failures, fraud, legal and compliance risks, and business disruptions. Effective risk management practices and robust internal controls are crucial for mitigating operational risk.

- Regulatory Risk: Regulatory risk refers to the potential for adverse impacts due to changes in laws, regulations, or government policies. Financial institutions and businesses must comply with evolving regulatory requirements, and failure to do so can result in regulatory penalties, reputational damage, or loss of business opportunities.

Each type of financial risk presents unique challenges and requires tailored risk management strategies. It is important to assess the potential impact of these risks, evaluate risk tolerance, and implement appropriate risk mitigation measures to protect against financial losses and ensure long-term financial stability.

Credit Risk

Credit risk is one of the most significant types of financial risk, particularly for lenders and financial institutions. It refers to the potential for borrowers to default on their loan or debt obligations, resulting in financial losses for the lender. This risk arises from the uncertainty of the borrower’s ability to repay the loan or meet the agreed-upon terms.

When assessing credit risk, lenders consider various factors such as the borrower’s creditworthiness, financial history, income stability, and existing debt obligations. They may also analyze the collateral provided by the borrower as security for the loan. The assessment aims to determine the probability of default and quantify the potential loss if a default were to occur.

There are several tools and techniques used to measure and manage credit risk, including credit scoring models, credit ratings, and loan loss provisions. Credit scoring models assign a numerical value to borrowers based on their credit history, income, and other factors, providing lenders with an indication of their creditworthiness. Credit ratings, issued by credit rating agencies, evaluate the creditworthiness of entities such as corporations or countries, enabling investors and lenders to make informed decisions.

Managing credit risk involves implementing strategies to mitigate potential losses and protect the lender’s financial position. This can include diversifying the loan portfolio, setting appropriate lending criteria, establishing credit limits, and implementing rigorous credit monitoring and collection procedures. Lenders may also use risk mitigation tools such as loan collateral, guarantees, or insurance to reduce their exposure to credit risk.

In addition, financial institutions rely on regulatory frameworks and risk management practices to manage credit risk effectively. Basel III, a set of international banking regulations, provides guidelines for capital requirements, risk assessment, and risk management practices to ensure the stability and resilience of the banking system.

Understanding and managing credit risk is essential for lenders, as it directly impacts their profitability and financial stability. By implementing robust credit risk management practices and staying informed about potential risks and industry trends, lenders can make informed lending decisions, protect their loan portfolio, and mitigate potential losses.

Market Risk

Market risk is a type of financial risk that arises from the potential for losses due to fluctuations in financial markets. It encompasses the risks associated with changes in interest rates, exchange rates, commodity prices, and equity prices. Market risk affects investors, traders, and businesses exposed to these market fluctuations.

Interest rate risk is one of the most prominent components of market risk. It refers to the potential for losses due to changes in interest rates, which impact borrowing costs, investment returns, and the valuation of fixed-income securities. Rising interest rates can reduce the value of existing fixed-rate securities, while falling interest rates can lead to lower investment returns for fixed-income investors.

Exchange rate risk arises from changes in currency exchange rates. Fluctuations in currency values can impact the profitability of international businesses, importers, and exporters. For example, a company that imports goods from overseas will face higher costs if its local currency weakens against the foreign currency.

Commodity price risk is relevant primarily for businesses involved in the production or consumption of commodities. Price fluctuations in commodities like oil, gas, metals, and agricultural products can significantly impact a company’s profitability. For instance, a sudden increase in oil prices can raise transportation costs and directly impact industries reliant on oil, such as airlines and logistics companies.

Equity market risk refers to the potential for losses due to changes in stock prices. Equity investors are exposed to market volatility and fluctuations in stock prices. Factors that can affect equity prices include economic conditions, company-specific news, changes in industry trends, and investor sentiment.

Managing market risk involves various strategies and techniques. Investors and fund managers diversify their portfolios across different asset classes and geographic regions to reduce exposure to specific market risks. Hedging techniques, such as derivatives and options, can also be employed to manage market risk by offsetting potential losses or protecting against adverse market movements.

For financial institutions, risk management practices such as value at risk (VaR) models, stress testing, and scenario analysis are used to measure and monitor market risk. Regulatory frameworks, like Basel III, impose capital requirement guidelines to ensure financial institutions have adequate capital buffers to withstand market fluctuations.

Market risk is an inherent part of investing and trading activities. By staying informed about market conditions, employing risk management strategies, and diversifying investments, individuals and organizations can navigate market risk and make more informed financial decisions.

Liquidity Risk

Liquidity risk is a type of financial risk that refers to the potential for an individual or organization to be unable to meet its financial obligations or access sufficient cash to fund its operations. It arises from a lack of marketability or the inability to convert assets into cash quickly and at a fair price.

Liquidity risk can occur in various forms. For individuals, liquidity risk may arise when facing unexpected expenses or a sudden loss of income, making it difficult to meet financial obligations such as mortgage payments or credit card bills. For businesses, liquidity risk can arise from a lack of cash to cover operational expenses, pay salaries, or invest in growth opportunities.

There are several factors that can contribute to liquidity risk. These include disruptions in financial markets, economic downturns, industry-specific issues, or regulatory changes that impact the availability of funding sources. Inadequate cash management practices and excessive reliance on short-term financing can also increase liquidity risk.

Managing liquidity risk involves maintaining sufficient cash reserves and ensuring access to alternative funding sources during times of financial stress. Cash flow forecasting and monitoring play a crucial role in assessing liquidity needs and identifying potential liquidity shortfalls in advance.

Businesses can employ various strategies to mitigate liquidity risk. This can include maintaining lines of credit or establishing relationships with multiple banks to ensure access to funding. Building a diverse funding portfolio, which may include a mix of short-term and long-term financing options, can also help mitigate liquidity risk.

For financial institutions, liquidity risk management is particularly important. Banks and other financial intermediaries must maintain adequate liquidity to meet deposit withdrawals and honor obligations. Regulators impose liquidity requirements to ensure financial institutions have sufficient liquidity buffers to withstand potential liquidity shocks.

Understanding and managing liquidity risk is vital for individuals, businesses, and financial institutions. By implementing robust liquidity risk management strategies, such as maintaining sufficient cash reserves, monitoring cash flows, and diversifying funding sources, individuals and organizations can mitigate potential liquidity shortfalls and ensure their financial stability in both expected and unexpected circumstances.

Operational Risk

Operational risk is a type of financial risk that arises from internal failures, inadequate procedures, systems, or controls within an organization. It encompasses a wide range of risks, including human error, technological failures, fraud, legal and compliance risks, and business disruptions.

Operational risk can have severe implications for both financial and non-financial institutions. It can result in financial losses, reputational damage, disruptions to business operations, and regulatory fines. Identifying, assessing, and managing operational risk is crucial for maintaining the stability and integrity of an organization.

Human error is a common source of operational risk. Mistakes in data entry, calculations, or decision-making can lead to financial losses or negatively impact business operations. Training, education, and establishing clear procedures and controls can help mitigate the risk of human error.

Technological failures, including system outages or cyber-attacks, are another significant source of operational risk. Disruptions in technology systems can lead to financial losses, compromised data security, and reputational damage. Implementing robust cybersecurity measures, disaster recovery plans, and regularly testing and updating technology systems are essential for managing technological operational risks.

Fraud is an operational risk that occurs when individuals or entities intentionally deceive or manipulate the organization for personal gain. This can involve embezzlement, unauthorized trading, or fraudulent financial reporting. Implementing strong internal controls, conducting background checks, and promoting a culture of ethics and integrity are crucial for mitigating fraud risk.

Legal and compliance risks arise from non-compliance with laws, regulations, and industry standards. Organizations must navigate complex regulatory environments and ensure adherence to legal and compliance requirements. Failure to do so can result in regulatory fines, reputational damage, and legal consequences. Strong compliance programs and effective risk management frameworks are essential for managing legal and compliance risks.

Business disruptions, such as natural disasters, supply chain interruptions, or pandemics, can also pose operational risks. These events can disrupt normal business operations, leading to financial losses and reputational damage. Business continuity planning, effective risk assessment, and insurance coverage are important tools for mitigating the impact of business disruptions.

Managing operational risk requires a comprehensive and proactive approach. Organizations must establish appropriate risk management frameworks, implement effective internal controls, and promote a culture of risk awareness and accountability. Regular risk assessments, ongoing monitoring, and continuous improvement are essential for identifying and addressing operational risks before they escalate.

By effectively managing operational risks, organizations can ensure the resilience and stability of their operations, protect their financial performance, and maintain the trust and confidence of their stakeholders.

Regulatory Risk

Regulatory risk is a type of financial risk that refers to the potential for adverse impacts due to changes in laws, regulations, or government policies. It affects businesses and financial institutions, requiring them to adapt their operations and strategies to comply with evolving regulatory requirements.

Regulatory risk can arise from various factors, including changes in legislation, new regulatory initiatives, shifts in government policies, or stricter enforcement of existing regulations. These changes can impact industries differently, depending on the nature of the business and the regulatory environment in which they operate.

Compliance with regulations is critical for businesses as failure to meet regulatory obligations can result in financial penalties, reputational damage, loss of business opportunities, or even legal consequences. Adequate identification and assessment of regulatory risks are necessary to develop effective risk management strategies and ensure compliance.

To manage regulatory risk, organizations must stay informed about regulatory developments, monitor changes in laws and regulations, and establish robust compliance programs. This includes conducting regular compliance audits, implementing proper internal controls and reporting mechanisms, and providing appropriate training to employees to ensure awareness and adherence to regulatory requirements.

Financial institutions, such as banks and insurance companies, face strict regulatory oversight due to their systemic importance to the stability of the financial system. Regulatory frameworks, such as Basel III, are established to ensure these institutions maintain adequate capital reserves, risk management systems, and compliance with various prudential regulations.

Regulatory risk is not limited to financial institutions; it affects businesses across all sectors. Companies operating in specific industries, such as healthcare, energy, or telecommunications, must navigate complex regulatory landscapes specific to their sector. Compliance with industry-specific regulations is essential to manage regulatory risk effectively.

In addition to compliance, organizations may engage in advocacy efforts and maintain constructive relationships with regulatory authorities and industry associations. By actively participating in the regulatory process, businesses can influence the development of regulations and policies that align with their interests and minimize potential regulatory risks.

Given the ever-changing nature of regulations and government policies, organizations must be proactive in addressing regulatory risk. By closely monitoring regulatory developments, implementing robust compliance frameworks, and actively engaging with regulatory authorities, businesses can effectively manage regulatory risk, ensure compliance with requirements, and mitigate potential adverse impacts.

Measurement and Management of Financial Risk

The measurement and management of financial risk are crucial aspects of effective risk management practices. It involves assessing the potential impact of risks, quantifying their likelihood and severity, and implementing appropriate strategies to mitigate their adverse effects. By understanding and managing financial risk, individuals and organizations can protect their financial well-being and make informed decisions.

Risk Assessment and Analysis: Risk assessment is the process of identifying and evaluating potential risks. It involves analyzing the probability of a risk occurring and assessing its potential impact on financial outcomes. Risk analysis utilizes various tools and techniques, such as historical data analysis, scenario analysis, stress testing, and sensitivity analysis, to quantify the potential impact of different risk factors.

Risk Mitigation Strategies: Once risks are identified and assessed, appropriate risk mitigation strategies can be implemented. These strategies aim to reduce the probability and impact of risks. Common risk mitigation techniques include diversification, hedging, insurance, establishing effective internal controls, implementing robust risk management systems, and incorporating contingency plans.

Insurance can serve as a powerful risk mitigation tool by transferring the financial impact of risks to an insurance provider. Hedging involves using derivative instruments to offset potential losses from unfavorable market movements. Diversification, both across different asset classes and geographically, helps to reduce exposure to specific risks and enhances portfolio resilience.

Effective risk management requires a comprehensive and integrated approach across different types of risks. This involves considering the interplay between various risks and the potential cascading effects they may have on financial outcomes. Risk management frameworks, such as Enterprise Risk Management (ERM), offer a systematic and holistic approach to managing risks across an organization.

Regulatory frameworks and guidelines play a crucial role in the measurement and management of financial risk. Regulators impose capital adequacy requirements, risk measurement, and reporting standards to ensure institutions maintain sufficient buffers to withstand potential losses. International frameworks, such as Basel III, provide guidelines for financial institutions in managing various types of risks, including credit risk, market risk, and liquidity risk.

Technology also plays a significant role in the measurement and management of financial risk. Advanced risk management systems and analytics tools enable organizations to assess risks more accurately, model potential scenarios, and make data-driven decisions. These technologies provide real-time risk monitoring and reporting capabilities, enhancing risk management efficiency and effectiveness.

Continual monitoring and evaluation of risk exposures and risk management strategies are vital for adapting to changing market conditions and ensuring the effectiveness of risk mitigation measures. Risk management is an ongoing process that requires regular reviews, adjustments, and updates to align with evolving market dynamics and regulatory changes.

By employing robust risk measurement techniques, implementing effective risk management strategies, and staying knowledgeable about emerging risks, individuals and organizations can better navigate potential financial risks, protect their financial stability, and seize opportunities for growth and success.

Risk Assessment and Analysis

Risk assessment and analysis are essential steps in the process of managing financial risk. They involve identifying potential risks, evaluating their likelihood and potential impact, and quantifying the level of risk exposure. By conducting thorough risk assessment and analysis, individuals and organizations can make informed decisions, allocate resources effectively, and implement appropriate risk mitigation strategies.

The first step in risk assessment is identifying and categorizing potential risks. This involves a comprehensive and systematic evaluation of various internal and external factors that may pose risks to financial outcomes. Risks can arise from different sources, such as market volatility, credit defaults, changes in regulations, operational failures, or external events like natural disasters.

Once risks are identified, the next step is to evaluate their likelihood of occurrence and potential impact. This requires analyzing historical data, industry trends, market conditions, and relevant factors that may influence the probability and severity of risks. Quantitative techniques, such as statistical analysis, scenario analysis, and stress testing, are often employed to assess risks objectively.

Quantitative risk assessment involves assigning probability distributions to different risk factors and using mathematical models to estimate the potential impact on financial outcomes. This can help individuals and organizations quantify the expected losses or gains associated with specific risks, allowing for better decision-making and resource allocation.

Qualitative risk assessment complements quantitative analysis by incorporating subjective factors, such as expert judgment, industry experience, and management assessment. It involves assessing the qualitative aspects of risks, such as the reputation risk associated with a particular decision or the potential operational disruptions caused by a technological failure. Qualitative assessments often involve risk matrices, risk registers, and risk heat maps to provide a visual representation of the level of risk exposure.

Risk analysis plays a critical role in understanding the potential impact of risks on financial objectives and outcomes. It involves evaluating the expected losses, the likelihood of extreme events, and the potential correlation between different risks. Sensitivity analysis helps identify the most influential risk factors and how changes in those factors can impact financial outcomes.

Thorough risk assessment and analysis allow individuals and organizations to prioritize risks based on their potential impact and likelihood. This helps in developing risk mitigation strategies tailored to each specific risk. Risk assessments provide valuable insights into the effectiveness of existing risk management practices and help in identifying gaps or areas of improvement.

Regular and ongoing risk assessment and analysis are crucial because risks are dynamic and can change over time due to market conditions, regulatory changes, or internal factors. By continually monitoring risks and updating risk assessments, individuals and organizations can adapt their risk management strategies and implement appropriate controls to mitigate potential losses effectively.

Risk assessment and analysis are iterative processes that require a combination of quantitative models, qualitative judgment, market knowledge, and experience. By embracing a systematic approach to risk assessment and analysis, individuals and organizations can better understand their risk exposures, make informed decisions, and improve their overall ability to manage financial risks effectively.

Risk Mitigation Strategies

Risk mitigation strategies are essential components of effective risk management practices. They aim to reduce the probability and impact of risks, safeguarding individuals and organizations against financial losses. By implementing appropriate risk mitigation strategies, individuals and organizations can navigate uncertainties and protect their financial well-being.

Diversification is a widely used risk mitigation strategy. It involves spreading investments across different asset classes, sectors, and geographical regions. Diversification helps reduce exposure to specific risks and ensures that losses in one area can be offset by gains in another. By building a diversified portfolio, individuals and organizations can mitigate the impact of market volatility and limit the concentration of risk.

Hedging is another common risk mitigation technique. It involves using derivative instruments, such as options or futures contracts, to offset potential losses from unfavorable market movements. For example, a farmer can hedge against price fluctuations in agricultural commodities by entering into futures contracts, ensuring a fixed selling price for their crops.

Insurance serves as a powerful risk mitigation tool in various areas. Individuals and businesses can protect themselves against potential losses by obtaining insurance coverage for property damage, liability claims, or unexpected events. Insurance transfers the financial risk to the insurance provider, offering a level of financial protection against unforeseen circumstances.

Setting appropriate credit limits and conducting thorough credit assessments are vital risk mitigation strategies when dealing with credit risk. Lenders and financial institutions assess the creditworthiness of borrowers, determine appropriate lending limits, and establish effective credit monitoring procedures. By carefully evaluating the creditworthiness of borrowers, lenders can mitigate the risk of default and potential financial losses.

Establishing strong internal controls and implementing robust risk management systems are crucial risk mitigation strategies for managing operational risk. Effective internal controls and risk management processes help identify potential operational failures, enhance transparency and accountability, and ensure compliance with laws and regulations. Regular internal audits and ongoing monitoring play a critical role in detecting potential weaknesses and addressing them promptly.

Contingency planning is essential for mitigating the impact of business disruptions. By developing comprehensive contingency plans, organizations can ensure they are prepared for unexpected events such as natural disasters, supply chain interruptions, or cyber-attacks. Contingency plans outline alternative strategies to maintain operations, minimize losses, and recover quickly from disruptions.

Educating and training employees on risk awareness and promoting a risk-conscious culture are important risk mitigation strategies. By fostering a culture of risk management, organizations can encourage employees to identify potential risks, proactively report issues, and actively participate in risk mitigation efforts. Regular training programs and communication channels ensure that risk awareness remains a priority throughout the organization.

Regular monitoring, evaluation, and reassessment of risk mitigation strategies are necessary to ensure their effectiveness. Risk landscapes evolve, and new risks may emerge over time. By continuously reviewing and adapting risk mitigation strategies, individuals and organizations can stay prepared, react promptly to changing circumstances, and strengthen their overall risk management framework.

Remember, risk mitigation strategies should be tailored to specific risks and the unique circumstances of individuals or organizations. By implementing a combination of these strategies and continuously improving risk management practices, individuals and organizations can effectively mitigate potential financial losses and protect their financial interests.

Conclusion

Financial risk is an ever-present aspect of the financial world, and understanding and managing it is essential for individuals, businesses, and financial institutions. The different types of financial risks, including credit risk, market risk, liquidity risk, operational risk, and regulatory risk, each present specific challenges and require tailored risk management strategies.

Through risk assessment and analysis, individuals and organizations can identify and evaluate potential risks, quantifying their likelihood and potential impact. This enables the development of effective risk mitigation strategies, such as diversification, hedging, insurance, internal controls, contingency planning, and promoting a risk-conscious culture.

Financial risk management is an ongoing process that requires regular monitoring, evaluation, and adjustment. By staying informed about market trends, regulatory changes, and emerging risks, individuals and organizations can adapt their risk management strategies and protect themselves against potential financial losses.

Additionally, compliance with regulatory requirements and adherence to industry standards are critical for managing financial risks effectively. Regulatory risk must be actively assessed, and compliance programs must be established to ensure legal obligations are met.

The measurement and management of financial risk are facilitated by advanced technologies and analytical tools that enable accurate risk assessment, scenario modeling, and data-driven decision-making. These tools enable individuals and organizations to make informed choices and allocate resources efficiently.

Ultimately, by understanding financial risk and implementing appropriate risk management strategies, individuals and organizations can navigate uncertainties, protect their financial stability, and seize opportunities for growth and success.

In conclusion, a comprehensive approach to managing financial risk involves continuous assessment, adaptation, and implementation of appropriate risk mitigation strategies. By staying vigilant, informed, and proactive, individuals and organizations can successfully navigate the dynamic financial landscape and protect their financial well-being.