Finance

What Is A Folio Number? Definition And Uses

Published: November 26, 2023

Discover the meaning and applications of a folio number in finance. Understand how this unique identifier is utilized in various financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Folio Numbers in Finance

When it comes to managing your finances, it’s crucial to have a clear understanding of various terms and concepts. One such term that you may come across in the financial world is a folio number. But what exactly is a folio number, and how does it relate to your financial activities? In this blog post, we will demystify the definition and uses of folio numbers, helping you navigate the world of finance with confidence.

Key Takeaways:

- A folio number is a unique identifier assigned to an investor’s portfolio or investment account.

- Folio numbers are used by financial institutions to track and manage investors’ holdings and transactions.

The Definition of a Folio Number

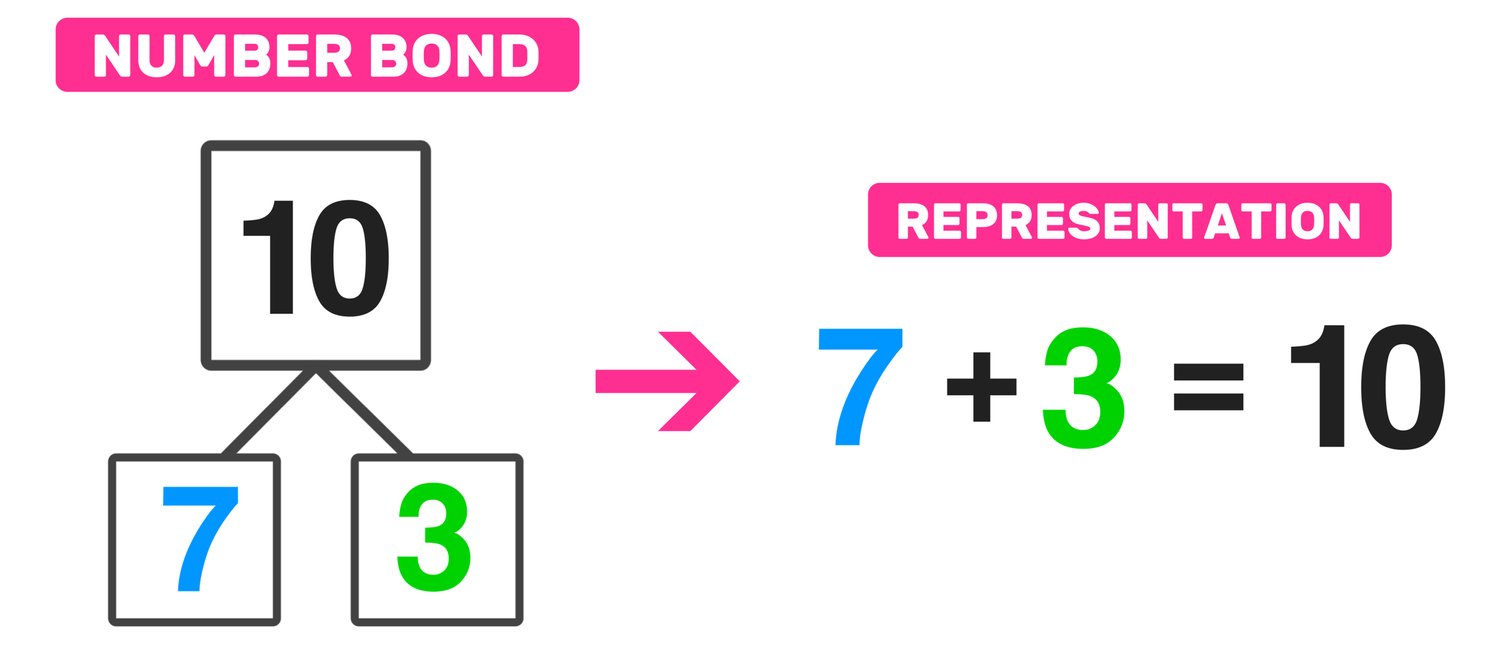

A folio number, also known as a portfolio number, is a unique identifier assigned to an investor’s portfolio or investment account. This number acts as a reference code that helps financial institutions keep track of an individual’s holdings and transactions.

Think of a folio number as a passport for your investments. Just as a passport uniquely identifies you as a traveler, a folio number uniquely identifies your investments within a financial institution. It serves as a way to differentiate your portfolio from others and allows for easier tracking and management of your holdings.

The Uses of Folio Numbers

Now that we understand what a folio number is, let’s explore its uses in the world of finance:

- Account Management: Financial institutions use folio numbers to manage and track investors’ accounts. This allows for efficient organization of client data, making it easier for institutions to provide accurate and up-to-date information regarding holdings, transactions, and performance.

- Reporting and Statements: Folio numbers play a crucial role in generating account statements and reports for investors. These statements provide a comprehensive overview of their investments, including details on purchases, sales, dividends, and other transactions. By including the folio number on these documents, investors can easily identify and cross-reference their holdings and transactions.

- Customer Service: When investors reach out to customer service representatives for assistance or inquiries, providing their folio number helps in expediting the process. It allows representatives to quickly access the relevant account information and address any concerns or questions more effectively.

- Personal Record-Keeping: From an investor’s perspective, having a folio number makes it easier to maintain a personal record of their investment activities. By referencing the folio number in their own records, investors can accurately track their portfolio’s performance, monitor transactions, and calculate gains or losses.

Overall, folio numbers serve as a vital tool in the financial industry, ensuring accurate record-keeping, efficient management, and seamless communication between investors and financial institutions.

In Conclusion

So now you know what a folio number is and how it is used in the realm of finance. This unique identifier enables financial institutions to manage and track investments, generate statements, provide customer support, and ensures accurate record-keeping for investors. Remember, the next time you come across a folio number, you can confidently understand its significance in managing your financial activities.