Finance

What Is A Good Pension Pot

Published: November 27, 2023

Learn about what a good pension pot is and how it can help secure your financial future. Discover essential tips and strategies for managing your finance effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Pension Pot

- Factors Affecting a Good Pension Pot

- Assessing Your Pension Pot

- Maximizing Your Pension Pot

- Strategies for Boosting Your Pension Pot

- The Role of Investments in Building a Good Pension Pot

- Balancing Risk and Reward in Pension Pot Investments

- Tips for Managing Your Pension Pot

- Planning Ahead for a Good Pension Pot

- Conclusion

Introduction

Welcome to the world of pensions, where building a good pension pot is a key factor in ensuring a comfortable retirement. A pension pot refers to the total amount of money you have saved in your pension fund, which will provide you with income in your post-work years. This article will guide you through the process of understanding what makes a good pension pot and how you can maximize your savings to achieve your retirement goals.

Retirement planning is a crucial aspect of personal finance, as it determines the level of financial security you will have in your golden years. A good pension pot is one that is substantial enough to provide reliable income during retirement, allowing you to maintain your desired lifestyle and meet your financial obligations.

Building a good pension pot requires careful planning, foresight, and regular contributions. It is essential to understand the factors that can influence the size and stability of your pension pot, as well as the strategies you can employ to maximize its growth. Additionally, managing your pension pot effectively is crucial to ensure it lasts throughout your retirement.

In this article, we will explore the factors that affect a good pension pot, provide tips for assessing and managing your pension savings, discuss strategies for boosting your pension pot, and highlight the role of investments in building a robust retirement fund. By the end, you will have a clearer understanding of what it takes to build a good pension pot and the steps you can take to secure your financial future.

Understanding Pension Pot

A pension pot is essentially a sum of money that you accumulate throughout your working life in a pension scheme. It is designed to provide you with income during your retirement years when you are no longer earning a salary. The size of your pension pot will depend on various factors, including how much you contribute, the duration of your contributions, the performance of your investments, and any employer contributions.

There are different types of pension schemes available, such as workplace pensions, personal pensions, and self-invested personal pensions (SIPPs). These schemes allow you to save for retirement and receive tax benefits on your contributions. The funds within a pension pot are usually invested in a range of assets, including stocks, bonds, and other investments, with the aim of generating growth over time.

One of the key advantages of a pension pot is the tax relief you receive on your contributions. This means that for every pound you contribute, the government adds tax relief based on your income tax rate. This helps to boost the amount you save for retirement.

It’s important to note that there may be restrictions on accessing your pension pot, with the minimum retirement age currently set at 55 in many countries. However, changes to legislation have introduced more flexibility, such as allowing individuals to access their pensions earlier in certain circumstances, subject to tax implications.

Understanding your pension pot is essential for effective retirement planning. By knowing the size and value of your pension pot, you can make informed decisions about your retirement goals and the lifestyle you wish to maintain. Regularly reviewing your pension pot and assessing its growth will allow you to track your progress and make any necessary adjustments to ensure you are on track for a comfortable retirement.

Factors Affecting a Good Pension Pot

Several factors can significantly impact the size and overall value of your pension pot. Understanding these factors and taking them into consideration will help you make informed decisions to maximize the growth and stability of your retirement savings.

- Contribution Amount: The amount you contribute to your pension pot plays a crucial role in determining its size. The more you contribute, the larger your pot is likely to be at retirement. It’s important to strike a balance between contributing as much as possible while ensuring it aligns with your current financial situation.

- Duration of Contributions: The length of time you contribute to your pension pot has a significant impact on its growth. Starting to save for retirement early and maintaining consistent contributions over the years allows your savings to benefit from compounding and long-term growth.

- Investment Performance: The performance of the investments within your pension pot can have a substantial influence on its value. Choosing the right mix of investments and regularly reviewing and adjusting your portfolio can help optimize returns and mitigate risks.

- Employer Contributions: If you have a workplace pension, your employer may provide contributions to your pension pot. Taking full advantage of employer matching or additional contributions can significantly boost your retirement savings.

- Tax Relief: As mentioned earlier, pension contributions benefit from tax relief, effectively increasing the amount you save. Taking advantage of tax relief can provide a valuable incentive to save more for retirement.

- Inflation: The impact of inflation should not be underestimated when considering the value of your pension pot. Inflation erodes the purchasing power of money over time, and it’s important to take steps to ensure your pension savings keep pace with rising costs.

- Changes in Legislation: Changes in pension laws and regulations can affect how much you can contribute to your pension pot, how you can access it, and the tax treatment of your savings. Staying informed about any legislative changes will help you make appropriate adjustments to your retirement plans.

By considering these factors and regularly reviewing and adjusting your pension strategy, you can optimize your pension pot’s growth and increase its chances of providing a secure and comfortable retirement.

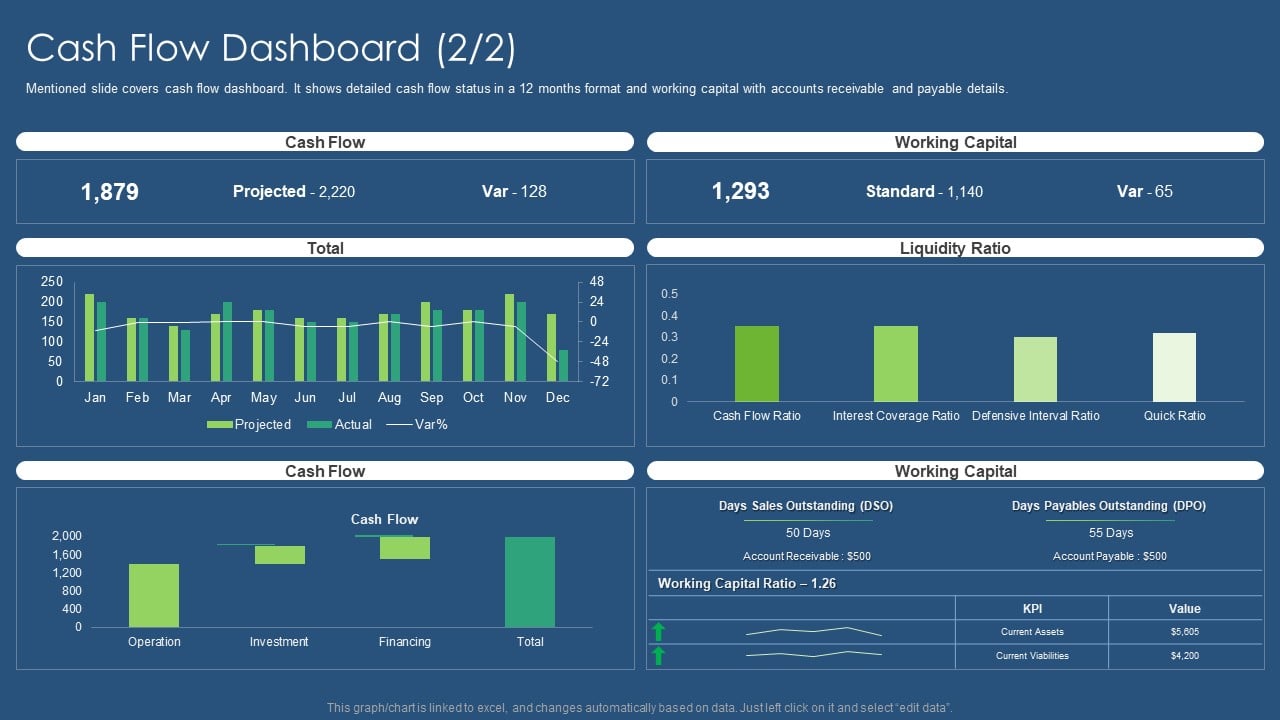

Assessing Your Pension Pot

Assessing your pension pot is an important step in planning for retirement and ensuring that you are on track to achieve your financial goals. Here are some key considerations when evaluating the status of your pension pot:

- Review the Value: Start by assessing the current value of your pension pot. This will give you an idea of how much you have saved so far.

- Set Your Retirement Goals: Determine the level of income you would like to have in retirement. Consider your desired lifestyle, living expenses, and any future financial obligations.

- Calculate Retirement Income: Use online retirement calculators or seek advice from a financial advisor to estimate the income your pension pot may generate during retirement.

- Consider Other Sources of Income: Take into account any additional sources of retirement income you may have, such as state pensions or other investments. This will give you a comprehensive overview of your overall retirement finances.

- Factor in Inflation: Adjust future income projections to account for inflation, as the cost of living is likely to increase over time. It is important to ensure that your pension pot retains its purchasing power in the face of inflation.

- Assess Investment Performance: Review the performance of the investments within your pension pot. Evaluate whether they have been meeting your expectations and if any adjustments need to be made to optimize growth.

- Consider Time Horizon: Assess the number of years remaining until your planned retirement date. This will help determine if you need to adjust your savings or investment strategy to meet your retirement goals.

- Seek Professional Advice: If you feel uncertain or overwhelmed, consider consulting with a financial advisor who specializes in retirement planning. They can provide personalized guidance based on your specific circumstances.

Regularly assessing your pension pot will help you stay informed about its progress and make any necessary adjustments along the way. It’s important to keep in mind that assessing your pension pot is not a one-time activity but an ongoing process as your financial situation and retirement goals may evolve over time.

Maximizing Your Pension Pot

Maximizing your pension pot involves adopting strategies to optimize its growth and increase your retirement savings. Here are some key steps you can take to make the most of your pension pot:

- Start Early: The earlier you start saving for retirement, the longer your contributions have to grow. Even small amounts saved in the early years can accumulate significantly over time.

- Contribute Regularly: Make consistent contributions to your pension pot, whether through automatic deductions or regular manual payments. This habit ensures that you are actively building your retirement savings.

- Take Advantage of Employer Contributions: If your employer offers a pension scheme with employer matching or additional contributions, make sure you take full advantage of these benefits. It’s essentially free money that boosts your pension savings.

- Increase Contributions as Your Income Rises: As your income grows throughout your career, consider increasing your pension contributions. This not only boosts your retirement savings but also takes advantage of tax relief on higher contributions.

- Consolidate Your Pension Pots: If you have multiple pension pots from different employers, consider consolidating them into a single scheme. This can simplify management and help you keep track of your overall savings.

- Make Use of Tax Relief: Take advantage of the tax relief available on pension contributions. Maximizing your contributions within the allowable limits can help you maximize tax benefits and boost your pension pot.

- Regularly Review and Adjust Investments: Keep an eye on the performance of your pension investments and consider making adjustments as needed. This ensures that your investments align with your risk tolerance and retirement goals.

- Consider Pension Contributions During Career Breaks: If you take a career break, such as for childcare or further education, explore options for continuing pension contributions during this time. This can help mitigate any gaps in your savings.

- Stay Informed: Keep up to date with changes in pension legislation and regulations. This allows you to make informed decisions regarding your pension pot, taking advantage of any new opportunities or benefits.

By implementing these strategies, you can take proactive steps to maximize your pension pot and ensure a more financially secure retirement. Remember, the key is to start early, contribute consistently, and regularly evaluate your pension strategy to align it with your retirement goals and ambitions.

Strategies for Boosting Your Pension Pot

When it comes to building a robust pension pot, there are several strategies you can employ to increase your retirement savings. These strategies can help you boost the growth of your pension pot and enhance its overall value. Here are some effective strategies to consider:

- Maximize Contributions: Aim to contribute the maximum amount allowed into your pension pot each year. This will help accelerate the growth of your savings, taking full advantage of tax relief and potential employer contributions.

- Take Advantage of Employer Matching: If your employer offers a matching contribution program, ensure that you contribute enough to receive the full matching benefit. This is essentially free money that can significantly boost your pension pot.

- Use Salary Sacrifice: If your employer offers a salary sacrifice scheme, consider taking advantage of it. By redirecting a portion of your salary directly into your pension pot before it is taxed, you can increase your pension savings and potential tax savings.

- Consider Additional Pension Contributions: If you have extra funds available, consider making additional contributions to your pension pot throughout the year. This can be done through lump sum payments or by increasing regular contributions.

- Delay Taking Your State Pension: If you have the flexibility to do so, consider delaying the start of your state pension. By deferring your state pension, you can receive higher monthly payments when you eventually begin taking it.

- Invest Wisely: Review your investment strategy regularly and consider diversifying your pension investments. This helps spread the risk and potentially increase returns over the long term. Seek advice from a financial advisor if needed.

- Reinvest Dividends or Returns: If your pension investments generate dividends or returns, consider reinvesting them back into your pension pot rather than taking them as cash. This can help compound your growth and increase the overall value of your savings.

- Consolidate High-Charging Pension Plans: If you have multiple pension plans with different providers, review the fees associated with each plan. Consider consolidating into a single plan with lower charges to save on costs and potentially increase your overall returns.

- Stay Engaged: Stay actively engaged with your pension pot and regularly review its performance, fees, and contribution levels. This ensures that you are maximizing its potential and making any necessary adjustments along the way.

Remember that boosting your pension pot requires a combination of consistent contributions, smart investment choices, and making the most of any available benefits and incentives. By implementing these strategies, you can significantly enhance the growth and value of your pension pot, setting yourself up for a more financially secure retirement.

The Role of Investments in Building a Good Pension Pot

Investments play a crucial role in building a good pension pot. The performance of your pension investments can significantly impact the growth and value of your retirement savings. Here’s a closer look at the role of investments in building a robust pension pot:

When you contribute to a pension scheme, your money is typically invested in various assets such as stocks, bonds, mutual funds, or other investment vehicles. The aim is to generate growth and increase the value of your pension pot over time. The growth potential of your investments depends on various factors, including market conditions, asset allocation, diversification, and the investment strategy you choose.

One of the key advantages of pension investments is their long-term nature. Since pensions are meant for retirement, you have years or even decades to invest your contributions. This extended time horizon allows you to take advantage of compounding returns, where your investment gains generate additional gains over time.

Asset allocation is an important consideration when it comes to pension investments. Diversifying your investments across different asset classes, such as equities, fixed income, and real estate, helps spread the risk and potentially enhance returns. The right balance of investments should consider your risk tolerance, time horizon, and retirement goals.

It’s important to regularly review and adjust your investment strategy based on changing market conditions and your own risk tolerance. As you approach retirement, you may want to gradually shift towards more conservative investments to protect your pension pot from potential market downturns.

Professional advice can be invaluable in designing an investment strategy that aligns with your financial goals. A financial advisor can help you determine the appropriate asset allocation, select suitable investments, and monitor performance to ensure your pension pot remains on track.

While investments can provide the potential for growth, they also come with risk. The value of investments can fluctuate, and there is always the possibility of losses. It’s important to consider your risk tolerance and investment knowledge when making decisions about your pension investments.

By harnessing the power of investments within your pension pot, you have the opportunity to achieve long-term growth and build a substantial retirement fund. Through careful asset allocation, diversification, and regular review, you can optimize the performance of your pension investments and enhance the overall value of your pension pot.

Balancing Risk and Reward in Pension Pot Investments

When it comes to investing your pension pot, striking the right balance between risk and reward is essential. Finding the optimal balance can help you maximize returns while ensuring the stability and security of your retirement savings. Here are some key considerations for balancing risk and reward in pension pot investments:

Understanding Risk: Risk refers to the potential for investment losses or volatility. Different investment types carry varying levels of risk. Generally, higher-risk investments, such as stocks, have the potential for greater returns but also higher volatility. Lower-risk investments, such as bonds or cash, offer more stability but may have lower returns.

Time Horizon: Your time horizon until retirement is a critical factor in determining the risk level of your pension investments. If you have many years until retirement, you may have a higher risk tolerance and can consider more aggressive investments. As retirement approaches, it is generally advisable to transition towards more conservative investments to protect your pension pot from potential market downturns.

Asset Allocation: Asset allocation refers to how you divide your investments across different asset classes. Diversifying your pension pot across a mix of asset classes, such as equities, bonds, and real estate, can help mitigate risk. Each asset class responds differently to market conditions, reducing the impact of any single investment on your overall portfolio.

Consider Long-Term Performance: Investments with higher potential returns generally come with increased short-term volatility. However, when investing for the long term, historical data suggests that riskier investments, such as stocks, have historically provided higher average returns compared to more conservative assets. It’s important to consider long-term performance when evaluating risk and reward.

Review and Rebalance: Regularly reviewing and rebalancing your pension pot investments is essential for maintaining the desired risk-reward balance. Over time, the performance of different assets may deviate, resulting in an imbalanced portfolio. Rebalancing helps you realign your investments to the target asset allocation and control risk exposure.

Seek Professional Advice: The complexities of investment risk and reward make it worthwhile to seek professional advice from a financial advisor. A professional can help assess your risk tolerance, create a suitable investment strategy, and guide you through market fluctuations to ensure your pension pot aligns with your retirement goals.

Taking a Prudent Approach: A prudent approach to balancing risk and reward involves diversifying your investments, understanding your risk tolerance, and regularly monitoring your portfolio’s performance. It’s important to ensure that the level of risk you take aligns with your comfort level and long-term financial objectives.

Remember that managing risk and reward is an ongoing process in pension pot investments. As your circumstances change and retirement approaches, regularly reassessing your risk appetite and adjusting your investment strategy accordingly is crucial. By striking the right balance, you can aim for steady growth while safeguarding your pension pot for a secure and comfortable retirement.

Tips for Managing Your Pension Pot

Managing your pension pot effectively is crucial to ensure that you are on track for a comfortable retirement. Here are some useful tips to help you navigate the complexities and make the most of your pension savings:

- Stay Informed: Keep yourself updated on the latest changes in pension legislation and regulations. Understanding the rules and options available to you will help you make informed decisions about your pension pot.

- Regularly Review Statements: Take the time to review your pension statements regularly. This allows you to keep track of your contributions, investment performance, and any administrative charges.

- Assess Pension Charges: Understand the charges associated with your pension provider. Assess the level of fees and consider switching providers if you find lower-cost options that offer similar benefits.

- Maximize Contributions: Aim to contribute as much as you can to your pension pot, taking full advantage of tax relief and potential employer contributions. Small increases in your contributions can make a significant difference to your retirement savings over time.

- Stay Engaged with Investments: Regularly review the performance of your pension investments. Consider seeking professional advice or adjusting your asset allocation to optimize growth and manage risk.

- Consider Consolidation: If you have multiple pension pots from different employers, consider consolidating them into a single pension scheme. This can simplify management and potentially reduce costs and administrative fees.

- Plan for Different Retirement Scenarios: Take the time to plan for various retirement scenarios. Consider the potential impact of factors such as changes in lifestyle, unexpected expenses, and changes in market conditions.

- Explore Pension Projections: Utilize pension calculators or seek advice from financial professionals to get a clear picture of how much income your pension pot is likely to generate in retirement. This will help you set realistic retirement goals.

- Consider Additional Savings: If your pension pot alone may not be enough to meet your retirement goals, consider supplementing it with additional retirement savings such as Individual Savings Accounts (ISAs) or other investment vehicles.

- Monitor Your State Pension: Keep track of your entitlement to the state pension and stay informed about any changes to its eligibility criteria. This will help you factor it into your overall retirement income planning.

Remember, effective management of your pension pot requires ongoing attention and proactive decision-making. Taking the time to stay informed, regularly reviewing your statements, maximizing contributions, and making informed investment decisions will put you on the path to a more secure and fulfilling retirement.

Planning Ahead for a Good Pension Pot

Planning ahead is crucial when it comes to building a good pension pot. By taking a proactive approach to your retirement planning, you can set yourself up for a financially secure future. Here are some key steps to consider when planning ahead for a good pension pot:

- Define Your Retirement Goals: Start by envisioning your desired retirement lifestyle. Consider factors such as where you want to live, the activities you want to pursue, and any financial obligations you expect to have. This will help you determine the level of income needed from your pension pot.

- Estimate Retirement Expenses: Assess your current living expenses and project how they may change during retirement. Consider factors such as inflation, healthcare costs, and potential leisure activities. This will help you estimate the amount of income you’ll need in retirement.

- Assess Your Current Situation: Evaluate your existing pension pot, including its value, performance, and contributions. Consider whether it aligns with your retirement goals or if adjustments need to be made.

- Create a Retirement Savings Plan: Develop a comprehensive plan for saving and investing towards your pension pot. Determine how much you need to save each month or year to reach your retirement goals and identify the most suitable investment strategies to achieve them.

- Consider Long-Term Planning: Evaluate the impact of long-term factors such as inflation, changes in legislation, and potential fluctuations in the market. Account for these variables in your pension pot planning to ensure its growth and sustainability over time.

- Regularly Review Your Plan: Review and reassess your retirement savings plan periodically, especially when major life events occur such as job changes, marriage, or the birth of a child. Adjust your contributions and goals as necessary to stay on track.

- Factor in Other Retirement Income Sources: Take into account other potential sources of retirement income, such as a state pension, personal savings, or investments. Understanding how these sources contribute to your overall retirement income will help you structure your pension pot accordingly.

- Seek Professional Advice: If you feel unsure about your retirement planning or need assistance in creating a comprehensive strategy, consider consulting with a financial advisor who specializes in retirement planning. They can guide you through the process and offer personalized advice based on your specific circumstances.

Planning ahead is key to building a good pension pot. Taking the time to assess your goals, estimate your retirement expenses, create a savings plan, and regularly review your progress will set you on the right path to achieving a financially secure retirement.

Conclusion

Building a good pension pot is a crucial aspect of securing a comfortable and financially stable retirement. By understanding the factors that affect your pension pot, assessing its value, and implementing effective strategies, you can maximize the growth and value of your savings.

Contributing regularly, taking advantage of employer contributions, and leveraging tax relief are fundamental steps to building a substantial pension pot. Managing your investments, balancing risk and reward, and staying engaged with your pension portfolio will further enhance growth potential. Regularly evaluating your pension pot, considering consolidation, and seeking professional advice will ensure that your pension strategy remains on track.

By adequately planning and preparing for retirement, you can make informed decisions that align with your desired lifestyle and ensure a financially secure future. Remember to regularly review and adjust your retirement plan, factor in potential changes, and seek professional guidance when needed.

Ultimately, a good pension pot is the result of careful planning, disciplined savings, prudent investment decisions, and staying informed about changes in pension regulations. With the right approach, you can build a solid foundation for a financially rewarding retirement and enjoy the peace of mind that comes with a well-funded pension pot.