Finance

What Are Outstanding Checks In Accounting

Published: October 7, 2023

Learn about outstanding checks in accounting and how they impact your finances. Gain insight into managing and reconciling your financial transactions effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of accounting, where numbers rule and financial transactions must be meticulously tracked and recorded. One crucial aspect of accounting is managing outstanding checks, which can have a significant impact on a company’s financial records and cash flow. In this article, we will explore the concept of outstanding checks in accounting, why they are important to track, common causes of outstanding checks, the consequences of not managing them, methods to identify and reconcile outstanding checks, and best practices for effectively managing them.

Outstanding checks refer to checks issued by a company that have not yet been presented to the bank for payment. They represent an ongoing financial obligation and should be closely monitored and reconciled regularly. Failure to track and manage outstanding checks can lead to discrepancies in financial records, inaccurate cash balances, and potential cash flow issues.

Accounting professionals understand the importance of keeping an accurate and up-to-date record of outstanding checks. This information is vital for financial reporting, budgeting, and decision-making. By accurately tracking and reconciling outstanding checks, businesses can maintain the integrity of their financial statements and ensure that cash outflows are properly accounted for.

There are multiple reasons why outstanding checks occur. They can be a result of timing differences between when a check is issued and when it is presented for payment. For example, if a company issues a check near the end of the month, but it is not deposited until the following month, it will appear as an outstanding check on the company’s records.

In addition to timing differences, outstanding checks can also arise from errors, such as when a check is lost or misplaced before it can be deposited. Other reasons include delays in the mail system, clerical errors, or discrepancies between the company’s records and the bank’s records. Regardless of the reason, it is crucial to identify outstanding checks and take appropriate action to bring them to resolution.

Definition of Outstanding Checks

In the world of accounting, an outstanding check refers to a check that has been issued by a company but has not yet been presented to the bank for payment. These checks represent an ongoing financial obligation for the company until they are cashed or deposited. Outstanding checks are recorded in the company’s financial records as a liability, as they represent funds that have been deducted from the company’s account but have not yet been received by the payee or cleared by the bank.

When a company issues a check, it reduces the balance in its bank account by the amount of the check. However, until the payee presents the check to the bank and the bank debits the company’s account for the corresponding payment, the check is considered outstanding. It is important for companies to keep track of outstanding checks in order to maintain accurate financial records and ensure that the cash balance reflects the true amount of funds available.

Outstanding checks are typically recorded in a company’s cash disbursement journal or check register. The check register includes details such as the check number, date of issuance, payee, and the amount of the check. By maintaining an organized and up-to-date check register, companies can easily identify outstanding checks and reconcile them with the bank statement.

It is worth noting that outstanding checks are different from voided checks. Voided checks are checks that have been rendered invalid and are no longer considered part of the company’s outstanding obligations. Voiding a check usually occurs when there is an error or when a check needs to be cancelled for any reason, such as a payment dispute or a duplicate payment.

Overall, understanding the concept of outstanding checks is crucial for accurate financial reporting and cash management. By keeping a close eye on outstanding checks and reconciling them regularly, companies can ensure the integrity of their financial records and effectively track their cash flow.

Importance of Tracking Outstanding Checks

Tracking outstanding checks is of utmost importance for businesses of all sizes. It allows for accurate financial reporting, effective cash management, and helps to prevent discrepancies that can impact a company’s financial stability. Here are some key reasons why tracking outstanding checks is essential:

1. Accurate Financial Reporting: By tracking outstanding checks, businesses can ensure that their financial statements are accurate and reflect the true cash position. Outstanding checks are considered a liability, and including them in financial reports provides a clear picture of the company’s financial obligations.

2. Cash Flow Management: Monitoring outstanding checks allows businesses to have a better understanding of their cash flow. By identifying and accounting for outstanding checks, companies can anticipate future cash outflows and plan their expenses accordingly, thereby avoiding potential cash shortages or financial stress.

3. Maintaining Bank Reconciliation: Bank reconciliation is a crucial process in accounting that ensures the company’s records match the transactions recorded by the bank. Tracking outstanding checks plays a key role in bank reconciliation, as it helps identify any discrepancies between the company’s records and the bank’s records.

4. Preventing Duplicate Payments: When outstanding checks are tracked and reconciled, it reduces the risk of making duplicate payments. Without proper tracking, there is a chance that a check issued by the company may be presented and cashed at a later date, resulting in a duplicate payment unless it is detected and resolved in a timely manner.

5. Improving Financial Stability: Accurate tracking of outstanding checks enhances a company’s financial stability. It ensures that all financial obligations are properly accounted for and managed, avoiding potential penalties from missed payments or inaccurate financial records. It also helps establish credibility with stakeholders, such as investors, lenders, and vendors, who rely on accurate financial information.

In summary, tracking outstanding checks is vital for businesses to maintain accurate financial records, manage cash flow effectively, and prevent discrepancies. By diligently monitoring and reconciling outstanding checks, companies can make informed financial decisions and ensure their financial stability and success.

Common Causes of Outstanding Checks

There are several common causes of outstanding checks in accounting. Understanding these causes can help businesses identify the reasons behind outstanding checks and take appropriate action to resolve them. Here are some of the most common causes:

1. Timing Differences: One of the primary causes of outstanding checks is timing differences between when a check is issued and when it is presented for payment. For example, if a company issues a check near the end of the month, but it is not deposited until the following month, it will appear as an outstanding check on the company’s records.

2. Lost or Misplaced Checks: Sometimes, checks may be lost or misplaced before they can be deposited. This can be due to human error, such as misplacing the check or forgetting to securely mail it. When a check goes missing, it remains outstanding until the payee contacts the company or the check is cancelled and reissued.

3. Mail Delays: Delayed mail delivery can also contribute to outstanding checks. If a company sends a check by mail, it may take longer than expected for the check to reach the payee and be deposited. In such cases, the check remains outstanding until it is presented to the bank for payment.

4. Bank Processing Time: Banks may have different processing times for checks. Even after a check is deposited, it can take a few days or more for the payee’s bank to process and clear the payment. During this processing period, the check is considered outstanding from the perspective of the issuing company.

5. Discrepancies between Company and Bank Records: Occasionally, there may be discrepancies between the company’s records and the bank’s records, leading to outstanding checks. This can occur due to errors in recording or processing the check transactions, and it is crucial to reconcile these discrepancies to ensure accurate financial records.

6. Clerical Errors: Human error in recording and tracking checks can result in outstanding checks. Simple mistakes such as not properly updating the check register or incorrectly entering information can lead to checks being overlooked or not properly accounted for.

7. Oversight or Lack of Reconciliation: Sometimes, outstanding checks occur due to oversights or failing to regularly reconcile the company’s records with the bank statement. If outstanding checks are not identified and resolved in a timely manner, they can accumulate over time and create discrepancies in financial records.

By understanding and addressing these common causes, businesses can actively manage outstanding checks and maintain accurate financial records. Regular monitoring, diligent record-keeping, and effective communication with payees and banks are key to minimizing outstanding checks and ensuring financial stability.

Consequences of Not Managing Outstanding Checks

Not managing outstanding checks can have significant consequences for a business. Failing to track and reconcile outstanding checks can lead to financial discrepancies, inaccurate reporting, and potential cash flow issues. Here are some of the consequences that can arise from neglecting to manage outstanding checks:

1. Inaccurate Financial Reports: Without proper management of outstanding checks, financial reports can be misleading and inaccurate. Outstanding checks represent a liability for the company, and their omission from financial records can lead to an inflated cash balance and misrepresentation of financial obligations. This can undermine the credibility of financial reports and make it challenging to assess the true financial position of the business.

2. Cash Flow Problems: Failing to manage outstanding checks can result in cash flow problems. If a company is not aware of the outstanding checks, it may mistakenly assume that it has more cash available than it actually does. This can lead to overestimating funds for planned expenses, causing cash shortages and potentially affecting the ability to pay suppliers, employees, or other financial obligations in a timely manner.

3. Potential Penalties and Fees: The mishandling of outstanding checks can result in missed or delayed payments to vendors, suppliers, or other payees. This can lead to penalties, late fees, or even damaged relationships with these stakeholders. In addition, bouncing checks or not honoring payment commitments can harm the company’s creditworthiness and reputation.

4. Difficulty in Bank Reconciliation: Neglecting to manage outstanding checks can make the bank reconciliation process more challenging. Reconciling the company’s records with the bank statement becomes complex when there are discrepancies caused by unaccounted outstanding checks. This can result in time-consuming and tedious efforts to identify and resolve these discrepancies, delaying the reconciliation process.

5. Potential Duplicate Payments: Failing to track outstanding checks increases the risk of making duplicate payments. If a check that has already been issued but is still outstanding is mistakenly reissued, it can result in duplicate payments, leading to financial losses for the business. Duplicate payments can strain cash flow and require additional time and effort to rectify the errors and recover the overpaid funds.

6. Loss of Financial Control: Not managing outstanding checks reflects a lack of financial control and oversight within the organization. It can create an environment of inefficiency and disorganization, making it difficult to maintain accurate financial records, monitor cash flow, and make informed financial decisions. This loss of financial control can hinder the overall financial health and stability of the business.

Overall, the consequences of not managing outstanding checks can be detrimental to the financial well-being of a business. It is crucial for companies to establish proper processes and systems to effectively track, reconcile, and resolve outstanding checks to ensure accurate financial reporting, maintain cash flow, and avoid potential penalties and financial complications.

How to Identify Outstanding Checks

Identifying outstanding checks is an essential step in effective cash management and ensuring accurate financial records. By following these strategies, businesses can easily identify outstanding checks:

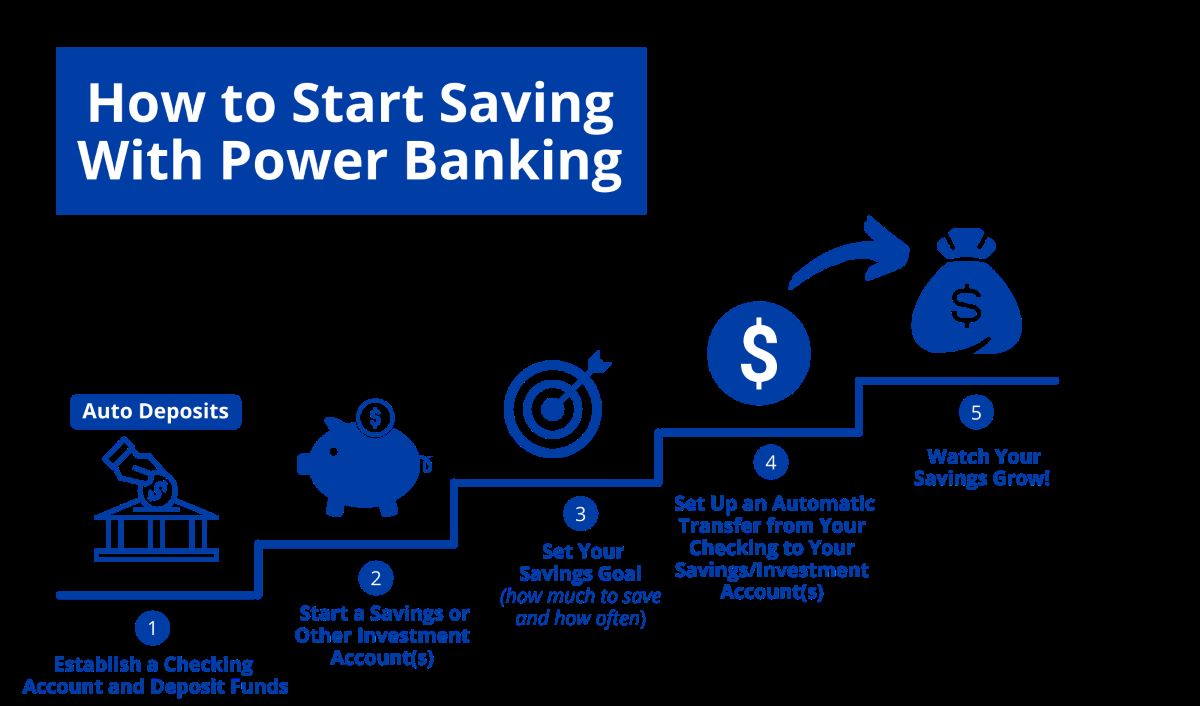

1. Maintain a Check Register: A check register is a valuable tool for tracking and identifying outstanding checks. It is a document where you record details of each check issued, including the check number, date, payee, and amount. Regularly update the check register with information on issued checks and mark them as outstanding until they have been cleared by the bank.

2. Compare with Bank Statements: Regularly compare your check register entries with the bank statements to identify any discrepancies. Look for checks in your register that have not cleared your bank account. These checks are the outstanding ones that need to be reconciled with the bank statement.

3. Utilize Accounting Software: If your business uses accounting software, take advantage of its features to help identify outstanding checks. Most accounting software includes a bank reconciliation module or report that can highlight outstanding checks and provide a clear view of your financial records.

4. Communicate with Payees: Reach out to the intended payees of checks that have not been cashed or deposited. Politely inquire if they have received the check and if there are any issues preventing them from depositing it. This communication can help verify the status of outstanding checks and prompt action if needed.

5. Review Open Invoices and Payment Records: Cross-reference your open invoices and payment records with the check register. If you have outstanding invoices that correspond to issued checks, it is an indication that those checks are still outstanding. This review process helps identify unpaid invoices and the associated outstanding checks.

6. Follow up with Bank or Financial Institution: If you are unable to reconcile a significant number of outstanding checks through other methods, consider contacting your bank or financial institution for assistance. They may have access to additional information or resources to help identify and resolve outstanding checks.

Remember, identifying outstanding checks requires regular monitoring and consistent record-keeping. It is crucial to maintain accurate and up-to-date financial records to ensure that outstanding checks are promptly identified and resolved. By implementing these practices, businesses can effectively manage outstanding checks and maintain accurate cash flow records.

Reconciling Outstanding Checks

Reconciling outstanding checks is an important process to ensure that the company’s records align with the bank statement and accurate financial information. Following these steps can help in reconciling outstanding checks:

1. Gather Bank Statements: Obtain the most recent bank statement(s) from your financial institution. Ensure that you have statements covering the period for which you want to reconcile outstanding checks.

2. Review Check Register: Refer to your check register, which should contain a record of all checks issued. Compare the check register to the bank statement and identify any checks that have not been cleared or processed by the bank.

3. Mark Outstanding Checks: In your check register, clearly mark the outstanding checks that have not yet cleared by the bank. You can use a specific symbol or notation (such as an “O” or “OC”) next to the corresponding check entry to indicate its outstanding status.

4. Verify Deposits: Along with outstanding checks, verify any deposits that have not yet been credited to your account. Ensure that all deposits made are accurately reflected in your check register and align with the bank statement.

5. Investigate Discrepancies: If there are discrepancies between the check register and the bank statement, thoroughly investigate the reasons behind them. It could be due to timing differences, delays in processing, or errors in recording. Carefully review your records, bank transactions, and communication with payees to resolve any discrepancies.

6. Update Check Register: Once you have identified and resolved outstanding check discrepancies, update your check register accordingly. Note the date when outstanding checks are cleared by the bank, and remove the outstanding status notation.

7. Balance the Checkbook: After reconciling outstanding checks, ensure that your check register balance matches the bank statement’s ending balance. If they do not match, recheck for errors, discrepancies, or omissions in either your records or the bank statement until the balances align.

8. Document the Reconciliation Process: Maintain a record of the reconciliation process, including the date of reconciliation, the bank statement period covered, and any adjustments made. This documentation is useful for auditing purposes and future reference.

Reconciling outstanding checks is a critical part of ensuring accurate financial records and tracking cash flow effectively. By regularly performing these reconciliation steps, businesses can maintain trustworthiness in their financial reporting and identify any discrepancies in a timely manner. It promotes financial transparency and aids in making informed decisions for the company’s financial well-being.

Best Practices for Managing Outstanding Checks

Effectively managing outstanding checks is essential for maintaining accurate financial records and ensuring smooth cash flow. By following these best practices, businesses can improve their management of outstanding checks:

1. Maintain an Organized Check Register: Keep a comprehensive check register that includes all pertinent information for each check issued, such as check numbers, dates, payees, and amounts. Regularly update the check register as checks are issued, cleared, or become outstanding.

2. Implement Regular Reconciliation: Reconcile your bank statements with your check register on a regular basis, ideally monthly. This practice helps identify outstanding checks and ensures that your records are in line with the bank’s records, improving the accuracy of your financial reporting.

3. Communicate with Payees: Maintain open lines of communication with payees regarding the status of outstanding checks. Promptly follow up with them to inquire about the status of checks that have not been presented for payment. This proactive approach helps prevent delays in depositing checks and facilitates timely clearing.

4. Monitor Timing Differences: Be mindful of timing differences between when checks are issued and when they are presented for payment. Understand the timelines and processing periods of your bank, as well as that of your payees’ banks. Consider adjusting your check issuance schedule to minimize the occurrence of outstanding checks due to timing differences.

5. Keep Track of Deposits: Maintain records of all deposits made and ensure they are accurately reflected in your check register. Compare the deposit dates on the bank statement to those in your records to confirm that all deposits have been appropriately credited to your account.

6. Utilize Accounting Software: Implement accounting software that can assist in effectively managing outstanding checks. Many accounting software solutions have built-in features for check tracking, bank reconciliations, and generating reports to easily identify outstanding checks.

7. Regularly Review Financial Statements: Periodically review your financial statements to assess the impact of outstanding checks. Ensure that your financial reports accurately reflect the liabilities represented by outstanding checks, and promptly resolve any discrepancies.

8. Backup Documentation: Maintain backup documentation for all checks issued, including copies of canceled checks. This documentation serves as evidence of payments made and can be helpful for auditing purposes or in cases of disputes or inquiries concerning outstanding checks.

9. Train and Educate Staff: Educate and train employees involved in financial transactions and record-keeping about the importance of managing outstanding checks. Ensure they understand the procedures for check issuance, recording, and reconciliation to minimize errors and promote consistency.

10. Regularly Assess and Improve Processes: Evaluate your check issuance and reconciliation processes periodically to identify any areas for improvement. Assess the effectiveness of your current practices, identify potential weaknesses, and implement necessary changes to enhance the management of outstanding checks.

By implementing these best practices, businesses can effectively manage outstanding checks, maintain accurate financial records, and ensure smooth cash flow. Consistent monitoring, timely reconciliation, and clear communication contribute to improved financial stability and credibility, allowing businesses to make informed decisions and operate with confidence.

Conclusion

Managing outstanding checks is a critical aspect of effective cash management and maintaining accurate financial records. By tracking outstanding checks, businesses can ensure the integrity of their financial reporting, manage cash flow effectively, and prevent discrepancies that can impact their financial stability. It is essential to understand the causes of outstanding checks, the consequences of not managing them, and the methods to identify and reconcile them.

Identifying outstanding checks requires maintaining a comprehensive check register, regularly comparing it with bank statements, and communicating with payees to inquire about the status of checks. Reconciling outstanding checks involves verifying deposits, investigating discrepancies, and updating the check register accordingly. Regular reconciliation ensures accuracy in financial reporting and helps prevent potential cash flow issues.

Implementing best practices for managing outstanding checks is crucial. These practices include maintaining an organized check register, regularly reconciling bank statements, communicating with payees, monitoring timing differences, utilizing accounting software, reviewing financial statements, and training staff. Adhering to these practices enhances financial control and transparency, reduces errors, and promotes efficient cash flow management.

In conclusion, a proactive approach to managing outstanding checks is essential for businesses to maintain accurate financial records and ensure smooth cash flow. By implementing proper tracking, effective reconciliation, and following best practices, businesses can mitigate the risk of financial discrepancies, improve financial stability, and make informed decisions for their success.