Finance

What Are Working Capital Loans?

Published: February 18, 2024

Learn how working capital loans can help finance your business operations. Find out how to secure the right financing for your company's needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Working capital is the lifeblood of any business, enabling day-to-day operations and covering short-term expenses. However, maintaining an optimal level of working capital can be challenging, especially for small and medium-sized enterprises (SMEs). This is where working capital loans come into play, offering a vital financial solution for businesses to manage their cash flow effectively.

In the dynamic landscape of business, having access to adequate working capital is crucial for sustaining operations, managing inventory, paying suppliers, and meeting other short-term financial obligations. Working capital loans provide a flexible source of funding to bridge the gap between a company's short-term assets and liabilities, ensuring smooth operations and fostering growth opportunities.

Understanding the nuances of working capital loans is essential for businesses seeking to bolster their financial stability and resilience. From the various types of working capital loans available to the qualifications required for securing this type of funding, a comprehensive grasp of these financial instruments is indispensable for informed decision-making.

In this article, we will delve into the intricacies of working capital loans, exploring their types, advantages, disadvantages, and the qualification criteria. By gaining insights into the workings of working capital loans, businesses can make well-informed choices regarding their financial strategies, thereby propelling their growth and success in the competitive market landscape.

Understanding Working Capital

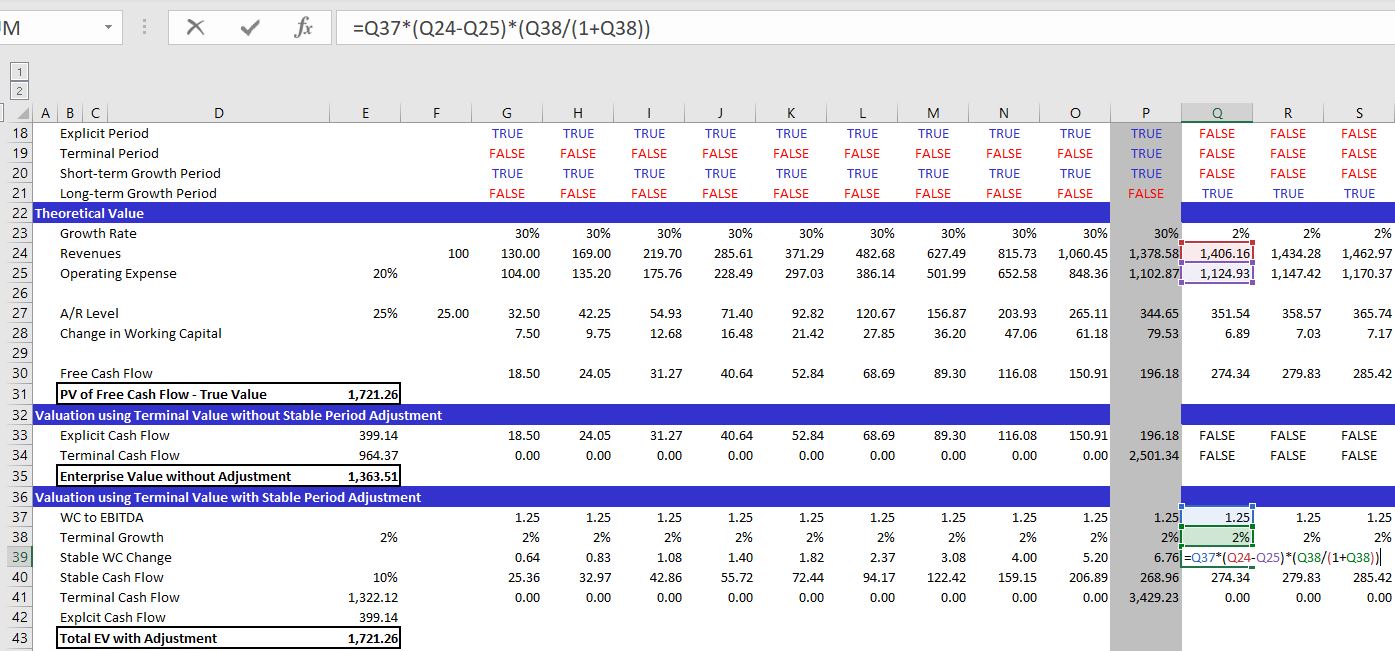

Working capital is the measure of a company’s operational efficiency and short-term financial health. It represents the capital available for conducting day-to-day operations, covering operational expenses, and managing short-term liabilities. Calculated as the difference between current assets (such as cash, accounts receivable, and inventory) and current liabilities (including accounts payable and short-term debt), working capital serves as a barometer of a company’s liquidity and ability to meet its short-term obligations.

For businesses, maintaining an optimal level of working capital is vital to ensure smooth operations and seize growth opportunities. Inadequate working capital can lead to cash flow disruptions, hampered production, missed business opportunities, and even insolvency. Conversely, excessive working capital may indicate inefficient capital deployment, signaling underutilized resources that could have been invested more lucratively.

Effective management of working capital involves striking a balance between the inflow and outflow of funds, optimizing inventory levels, streamlining accounts receivable and payable, and leveraging financial instruments such as working capital loans. By maintaining an optimal level of working capital, businesses can enhance their financial resilience, seize growth opportunities, and navigate through economic fluctuations with greater agility.

Understanding the dynamics of working capital is pivotal for businesses to sustain their day-to-day operations, fortify their financial position, and pursue strategic initiatives. Working capital loans play a pivotal role in augmenting a company’s working capital, providing the necessary financial cushion to navigate through short-term cash flow challenges and capitalize on growth prospects.

Types of Working Capital Loans

Working capital loans come in various forms, each tailored to address specific financial needs and circumstances. Understanding the different types of working capital loans is essential for businesses to choose the most suitable option that aligns with their operational requirements and financial objectives. Here are some common types of working capital loans:

- Traditional Term Loans: These loans involve borrowing a specific amount of capital, which is repaid over a predetermined period with fixed or variable interest rates. Traditional term loans provide businesses with a lump sum amount that can be utilized to bolster working capital, expand operations, or address short-term financial needs.

- Business Line of Credit: A business line of credit offers a revolving credit facility, allowing businesses to access funds up to a specified credit limit. This flexible arrangement enables companies to withdraw funds as needed, making it an ideal solution for managing fluctuating working capital requirements and unforeseen expenses.

- Invoice Financing: Also known as accounts receivable financing, this type of working capital loan involves using outstanding invoices as collateral to secure a cash advance from a lender. Invoice financing provides businesses with immediate access to funds tied up in unpaid invoices, thereby improving cash flow and working capital management.

- Merchant Cash Advance: This financing option allows businesses to receive a lump sum in exchange for a percentage of future credit card sales. It offers quick access to capital, making it suitable for businesses with consistent credit card sales but fluctuating cash flow needs.

Each type of working capital loan has its unique features, benefits, and considerations, catering to diverse business requirements and financial circumstances. By evaluating the specific needs and cash flow dynamics of their operations, businesses can select the most appropriate working capital loan to fortify their financial position and drive sustainable growth.

How Working Capital Loans Work

Working capital loans function as a crucial financial tool for businesses to bolster their short-term liquidity and navigate through cash flow challenges. Understanding the mechanics of how working capital loans operate is essential for businesses seeking to optimize their financial resources and sustain their day-to-day operations effectively.

When a business applies for a working capital loan, the lender evaluates various factors such as the company’s creditworthiness, financial statements, cash flow projections, and the purpose of the loan. Based on the assessment, the lender determines the loan amount, interest rates, repayment terms, and any collateral requirements.

Upon approval, the business receives the funds, which can be utilized to cover operational expenses, purchase inventory, manage accounts payable, or address any short-term financial needs. The terms of the loan dictate the repayment schedule, which may involve regular installments, lump-sum payments, or revolving credit arrangements, depending on the type of working capital loan obtained.

Businesses are responsible for repaying the loan amount along with any accrued interest within the agreed-upon timeframe. Timely repayment is crucial to maintain a positive credit profile and access future financing opportunities. By effectively managing working capital loans, businesses can optimize their cash flow, seize growth opportunities, and fortify their financial resilience in a dynamic business environment.

Furthermore, working capital loans offer the flexibility and agility that businesses need to address short-term financial exigencies and capitalize on strategic initiatives. Whether it’s managing seasonal fluctuations, investing in expansion opportunities, or navigating through economic uncertainties, working capital loans serve as a vital financial lifeline for businesses across diverse industries.

Advantages of Working Capital Loans

Working capital loans offer a myriad of benefits for businesses, empowering them to manage their short-term financial needs, seize growth opportunities, and enhance their operational agility. Understanding the advantages of working capital loans is crucial for businesses to leverage these financial instruments effectively. Here are some key advantages:

- Improved Cash Flow Management: Working capital loans provide businesses with the necessary funds to optimize their cash flow, ensuring smooth operations and timely payment of expenses.

- Flexibility and Agility: These loans offer flexibility in terms of usage, enabling businesses to address immediate financial needs, capitalize on growth prospects, and navigate through market fluctuations with agility.

- Opportunity for Expansion: Access to working capital loans can fuel business expansion initiatives, such as launching new product lines, entering new markets, or investing in marketing and promotional activities.

- Seasonal Support: For businesses with seasonal fluctuations in revenue and expenses, working capital loans provide essential support during lean periods, ensuring continuity of operations and sustained growth.

- Enhanced Financial Resilience: By bolstering working capital, businesses can enhance their financial resilience, withstand economic downturns, and capitalize on strategic opportunities without compromising their day-to-day operations.

- Preservation of Equity: Opting for a working capital loan allows businesses to maintain ownership and control, as opposed to seeking external investors who may demand equity stakes in the company.

These advantages underscore the pivotal role of working capital loans in fortifying a company’s financial foundation, fostering growth, and sustaining operational vitality. By harnessing the benefits of working capital loans, businesses can navigate through dynamic market conditions and position themselves for long-term success.

Disadvantages of Working Capital Loans

While working capital loans offer essential financial support for businesses, it is important to consider the potential drawbacks associated with these financing options. Understanding the disadvantages of working capital loans is crucial for businesses to make informed decisions and mitigate potential risks. Here are some key disadvantages to consider:

- Interest Costs: Acquiring a working capital loan entails interest costs, which can impact the overall cost of borrowing and reduce the profitability of the business.

- Debt Obligations: Taking on additional debt through working capital loans increases the financial obligations of the business, potentially affecting its debt-to-equity ratio and creditworthiness.

- Collateral Requirements: Some working capital loans may necessitate the provision of collateral, posing a risk to business assets in the event of default.

- Impact on Cash Flow: Repaying the loan amount and interest can exert pressure on the business’s cash flow, affecting its ability to meet other financial obligations and invest in growth initiatives.

- Risk of Overleveraging: Excessive reliance on working capital loans can lead to overleveraging, potentially straining the financial health of the business and limiting its ability to secure additional financing in the future.

- Qualification Challenges: Securing working capital loans may pose challenges for businesses with limited credit history, fluctuating revenues, or specific industry risks, potentially leading to rejection or unfavorable terms.

It is imperative for businesses to carefully assess the potential drawbacks of working capital loans and evaluate their financial capacity to meet the associated obligations. By weighing the advantages and disadvantages, businesses can make informed decisions regarding the utilization of working capital loans and explore alternative strategies to fulfill their short-term financial needs.

How to Qualify for a Working Capital Loan

Qualifying for a working capital loan involves meeting certain criteria and presenting a compelling case to lenders regarding the business’s financial stability and creditworthiness. Understanding the key factors that influence the qualification for a working capital loan is essential for businesses seeking to secure this vital form of financing. Here are the primary considerations for qualifying for a working capital loan:

- Business Financials: Lenders typically assess the financial health of a business by reviewing its financial statements, including balance sheets, income statements, and cash flow statements. A strong financial track record and positive cash flow demonstrate the business’s ability to manage its finances effectively.

- Credit Score: The creditworthiness of the business, as reflected in its credit score, plays a significant role in the loan approval process. A higher credit score indicates lower credit risk, increasing the likelihood of loan approval and favorable terms.

- Collateral: Some working capital loans may require collateral to secure the financing. Businesses can utilize assets such as real estate, equipment, inventory, or accounts receivable as collateral to strengthen their loan application.

- Business Plan and Purpose: Lenders evaluate the business’s operational plan, growth strategies, and the specific purpose for which the working capital loan will be utilized. A clear and compelling business plan demonstrates the strategic utilization of funds and the potential for positive returns.

- Industry and Market Conditions: The industry in which the business operates, market trends, and economic conditions can impact the loan approval process. Lenders assess the business’s position within its industry and its ability to navigate market challenges effectively.

- Repayment Capacity: Demonstrating the ability to repay the loan through stable cash flow, consistent revenues, and a well-defined repayment plan strengthens the business’s eligibility for a working capital loan.

By addressing these key factors and presenting a comprehensive and compelling loan application, businesses can enhance their prospects of qualifying for a working capital loan. Additionally, maintaining transparent communication with potential lenders and seeking professional guidance can further bolster the business’s loan application and increase the likelihood of securing the necessary financing to bolster its working capital.

Conclusion

Working capital loans serve as a vital financial resource for businesses, enabling them to fortify their short-term liquidity, manage operational expenses, and capitalize on growth opportunities. By understanding the intricacies of working capital loans, businesses can navigate through dynamic market conditions, sustain their day-to-day operations, and position themselves for long-term success.

From traditional term loans to flexible lines of credit and innovative financing options such as invoice financing and merchant cash advances, businesses have access to diverse working capital loan solutions tailored to their specific needs and financial circumstances. The advantages of working capital loans, including improved cash flow management, flexibility, and opportunities for expansion, underscore their pivotal role in bolstering a company’s financial resilience and operational vitality.

However, it is essential for businesses to weigh the potential disadvantages of working capital loans, such as interest costs, debt obligations, and collateral requirements, to make informed decisions regarding their financing strategies. By carefully evaluating the advantages and disadvantages, businesses can leverage working capital loans effectively while mitigating potential risks.

Qualifying for a working capital loan requires a strategic approach, encompassing strong financials, a favorable credit score, a clear business plan, and the ability to demonstrate repayment capacity. By addressing these key considerations and presenting a compelling loan application, businesses can enhance their eligibility for working capital financing and secure the necessary funds to bolster their operational resilience and pursue growth initiatives.

In conclusion, working capital loans play a pivotal role in sustaining the financial vitality of businesses, providing them with the necessary resources to navigate through short-term challenges and capitalize on strategic opportunities. By harnessing the benefits of working capital loans and navigating the associated considerations effectively, businesses can optimize their financial resources and propel their growth in a competitive business landscape.