Home>Finance>When One Money Management Decision Is Made, An Alternative Must Be Given Up.

Finance

When One Money Management Decision Is Made, An Alternative Must Be Given Up.

Published: February 28, 2024

Discover the impact of financial decision-making and trade-offs in personal finance. Learn how to navigate money management effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Money management is a crucial aspect of our daily lives, impacting our financial well-being and future security. It involves making decisions about how to allocate our resources, such as income, expenses, investments, and savings. Every money management decision we make comes with an opportunity cost, a concept deeply rooted in economics. Understanding the opportunity cost of money management decisions is essential for making informed choices and achieving our financial goals.

When we choose to allocate our money in a particular way, we are effectively forgoing the benefits that could have been derived from alternative uses of those funds. This concept applies to various financial scenarios, from everyday spending to long-term investment strategies. By recognizing the trade-offs inherent in money management decisions, individuals can develop a more strategic and intentional approach to their finances.

In this article, we will explore the concept of opportunity cost in the context of money management, providing real-world examples to illustrate the trade-offs involved. Additionally, we will discuss how individuals can make informed money management decisions by weighing the potential benefits and drawbacks of different options. By gaining a deeper understanding of the opportunity cost associated with financial choices, readers will be better equipped to navigate their personal finances with confidence and foresight.

The Opportunity Cost of Money Management Decisions

At the core of every money management decision lies the concept of opportunity cost. This fundamental economic principle refers to the potential benefits that are foregone when a particular choice is made. In the realm of personal finance, the opportunity cost of a decision is the value of the next best alternative that was sacrificed as a result of choosing a specific course of action.

When individuals allocate their money towards a specific expense or investment, they are implicitly choosing to forgo the benefits that could have been derived from alternative uses of those funds. For example, if a person decides to spend a significant portion of their income on luxury items, the opportunity cost may manifest as the inability to save for a long-awaited vacation or to invest in a retirement fund. Similarly, opting to allocate a portion of income towards high-interest debt repayment represents a trade-off in terms of forgoing potential investment opportunities that could yield long-term returns.

Understanding the opportunity cost of money management decisions empowers individuals to evaluate the implications of their choices more comprehensively. By recognizing that every decision involves a trade-off, individuals can make more deliberate and informed financial choices, considering not only the immediate benefits but also the potential long-term consequences.

Moreover, the concept of opportunity cost extends beyond individual spending habits to encompass broader financial strategies. When evaluating investment options, for instance, individuals must weigh the potential returns and risks of each opportunity, recognizing that committing funds to one investment means forgoing the potential gains that could have been realized from alternative investments. This holistic consideration of opportunity cost is instrumental in shaping prudent and forward-thinking money management practices.

Examples of Trade-offs in Money Management

Trade-offs in money management are pervasive, influencing various aspects of personal finance. From everyday spending decisions to long-term investment strategies, individuals continually encounter situations where they must weigh the opportunity cost of their choices. Here are some common examples of trade-offs in money management:

- Everyday Spending: When individuals allocate a portion of their income towards discretionary expenses, such as dining out or entertainment, they are effectively choosing to forgo the potential savings or investments that could have been made with that money. This trade-off highlights the opportunity cost of immediate gratification versus long-term financial security.

- Debt Repayment: Prioritizing debt repayment, especially high-interest debt such as credit card balances, involves a trade-off in terms of forgoing potential investment opportunities. While reducing debt is essential for financial stability, individuals must consider the opportunity cost of allocating funds towards debt repayment rather than towards income-generating investments.

- Investment Choices: When evaluating investment options, individuals encounter trade-offs in terms of risk and potential returns. Opting for conservative, low-risk investments may provide stability but could result in lower returns compared to more aggressive investment strategies. This trade-off highlights the opportunity cost of forgoing higher potential returns in exchange for reduced risk.

- Education and Career: Pursuing higher education or career advancement often involves financial trade-offs. Investing in education can lead to enhanced earning potential but requires upfront costs and potential income foregone during the study period. Individuals must consider the opportunity cost of pursuing education versus entering the workforce immediately.

These examples underscore the pervasive nature of trade-offs in money management and the critical role of opportunity cost in shaping financial decisions. By recognizing the trade-offs inherent in various financial choices, individuals can develop a more nuanced understanding of the implications of their decisions and make informed choices that align with their long-term financial goals.

How to Make Informed Money Management Decisions

Making informed money management decisions involves a thoughtful evaluation of the trade-offs and opportunity costs associated with different financial choices. Here are essential steps to consider when striving to make informed money management decisions:

- Evaluate Financial Goals: Begin by clarifying your short-term and long-term financial goals. Whether it’s saving for a major purchase, building an emergency fund, or planning for retirement, understanding your objectives provides a framework for evaluating trade-offs and opportunity costs.

- Assess Trade-offs: When faced with financial decisions, consider the trade-offs involved. Reflect on the potential benefits of each option and the corresponding opportunity costs. For example, when contemplating a discretionary purchase, assess the trade-off between immediate gratification and the long-term impact on your savings or investment goals.

- Weight Immediate vs. Future Benefits: Consider the balance between immediate benefits and long-term consequences. While certain choices may yield immediate satisfaction, it’s essential to assess the potential impact on your future financial well-being. This involves weighing the opportunity cost of immediate consumption against the benefits of saving or investing for the future.

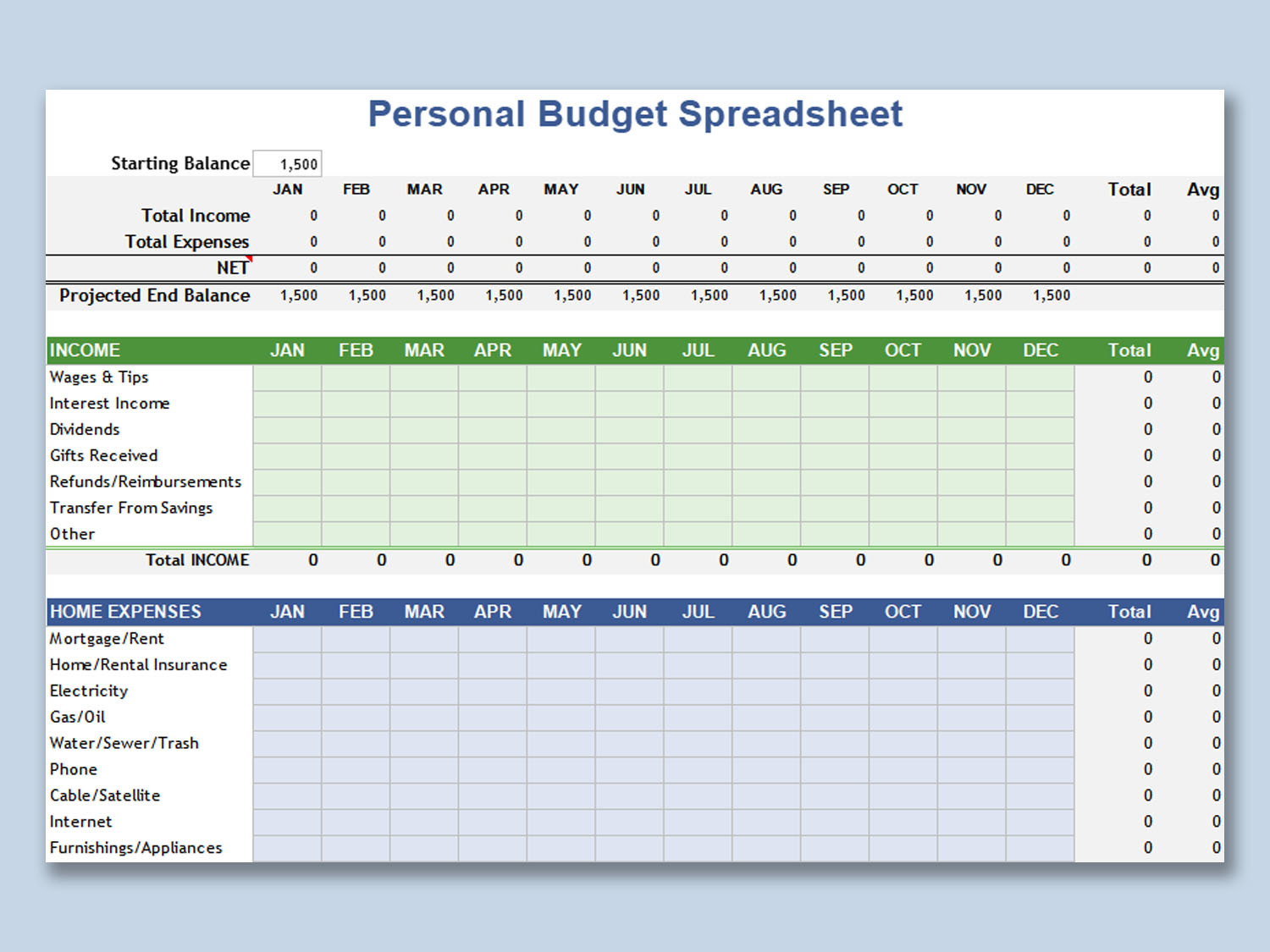

- Utilize Financial Tools: Leverage financial tools and resources to aid decision-making. Budgeting apps, investment calculators, and retirement planning tools can provide valuable insights into the trade-offs associated with different financial strategies. These tools enable individuals to assess the opportunity cost of their decisions more effectively.

- Seek Professional Advice: For complex financial decisions, consider seeking advice from financial advisors or professionals. Their expertise can offer valuable perspectives on the trade-offs inherent in various money management strategies, helping individuals make informed choices aligned with their financial objectives.

By following these steps and maintaining a deliberate awareness of the opportunity cost associated with financial decisions, individuals can cultivate a more informed and strategic approach to money management. Ultimately, this proactive mindset empowers individuals to navigate their personal finances with foresight and confidence, effectively balancing immediate needs with long-term financial security.

Conclusion

Understanding the opportunity cost of money management decisions is pivotal to achieving financial stability and realizing long-term goals. By recognizing the trade-offs inherent in various financial choices, individuals can make informed decisions that align with their priorities and aspirations.

Throughout this exploration, we have delved into the concept of opportunity cost, emphasizing its pervasive influence on personal finance. From everyday spending to investment strategies, trade-offs abound, shaping the trajectory of individuals’ financial well-being. By acknowledging the opportunity cost of their decisions, individuals can develop a more comprehensive understanding of the implications of their choices, fostering a proactive and intentional approach to money management.

Moreover, the process of making informed money management decisions involves a deliberate assessment of trade-offs and opportunity costs, guided by a clear understanding of financial goals and priorities. By evaluating the potential benefits and drawbacks of different options, individuals can navigate their financial journey with foresight and prudence, ensuring that their choices are aligned with their long-term aspirations.

Ultimately, the ability to weigh trade-offs and opportunity costs empowers individuals to make decisions that resonate with their values and financial objectives. Whether it’s prioritizing savings over discretionary expenses, assessing the trade-offs in investment choices, or considering the long-term implications of debt repayment, a nuanced understanding of opportunity cost enables individuals to chart a course towards financial security and prosperity.

By embracing the concept of opportunity cost and integrating it into their decision-making process, individuals can cultivate a resilient and informed approach to money management, fostering financial well-being and laying the groundwork for a secure future.