Home>Finance>Cash-on-Cash Return In Real Estate: Definition, Calculation

Finance

Cash-on-Cash Return In Real Estate: Definition, Calculation

Published: October 24, 2023

Learn how to calculate cash-on-cash return in real estate and understand its definition. Boost your finance knowledge with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cash-on-Cash Return in Real Estate: Definition, Calculation

Welcome to our blog post on cash-on-cash return in real estate! If you’re interested in investing in real estate or simply want to gain a better understanding of financial concepts, then you’ve come to the right place. In this article, we’ll dive into the definition and calculation of cash-on-cash return and why it’s an essential metric for any real estate investor. So grab your pen, take notes, and let’s get started!

Key Takeaways:

- Cash-on-cash return is a ratio that measures the profitability of a real estate investment in relation to the amount of cash invested.

- It is calculated by dividing the annual net operating income (NOI) by the total cash investment.

What is Cash-on-Cash Return?

Cash-on-cash return is an indicator of how much cash an investor can expect to receive on their invested capital in a real estate property. It measures the return on the actual cash invested, rather than the overall value of the property. This metric is crucial for evaluating the profitability and efficiency of an investment, allowing investors to assess if a property is a good financial opportunity.

Let’s take a deeper look at how cash-on-cash return is calculated and what it tells us about the potential return on investment.

How to Calculate Cash-on-Cash Return

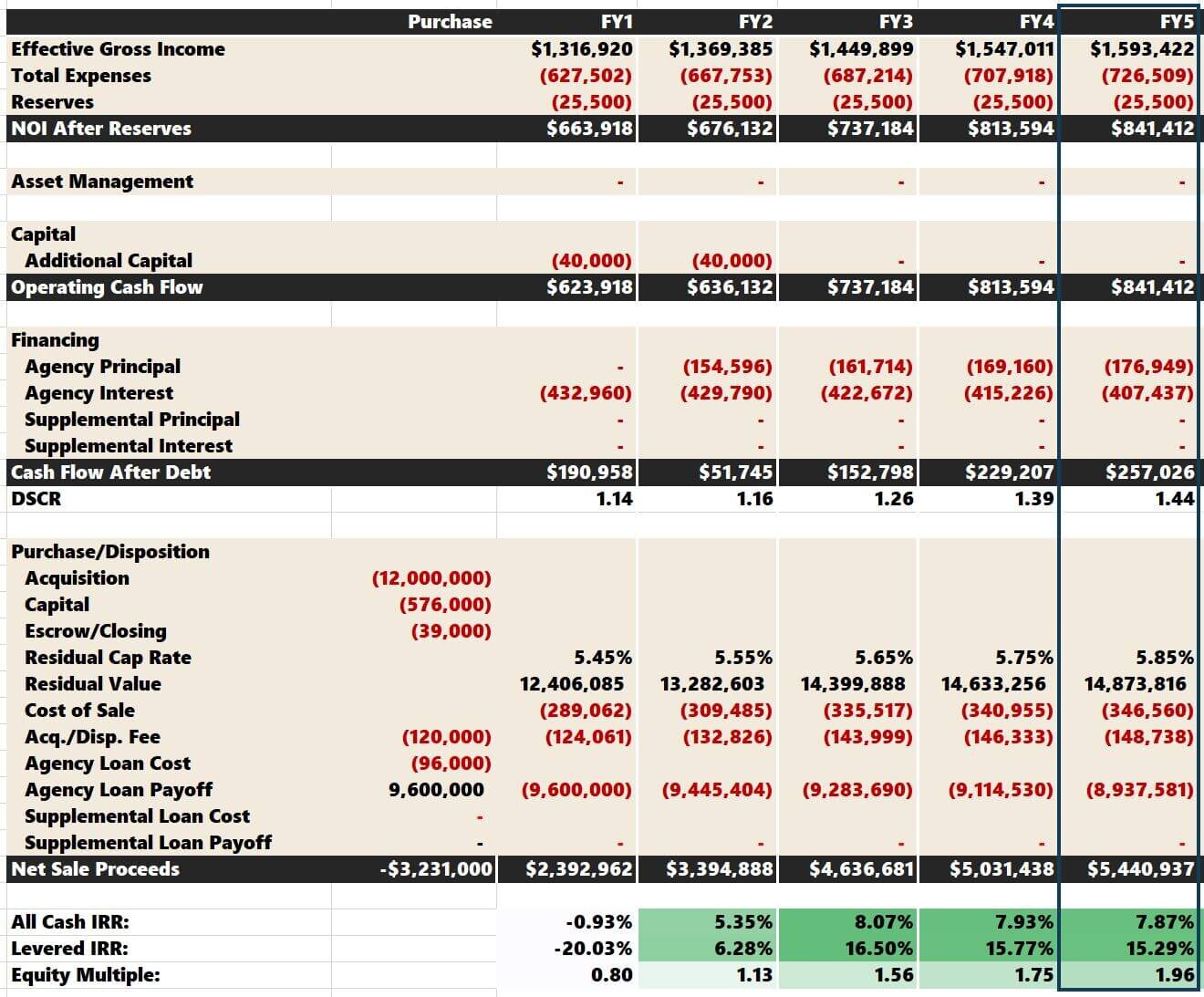

Calculating the cash-on-cash return is a relatively straightforward process. It involves dividing the property’s net operating income (NOI) by the total cash investment. Here’s the formula:

Cash-on-Cash Return = (Annual Net Operating Income / Total Cash Investment) x 100

The NOI represents the potential income from the property after subtracting operating expenses. The total cash investment includes the down payment, closing costs, and any additional upfront expenses. By plugging in the numbers, you can calculate the cash-on-cash return as a percentage.

For example, if an investment property has an annual NOI of $30,000 and the total cash investment is $200,000, the cash-on-cash return would be (30,000 / 200,000) x 100 = 15%. This indicates that the investor can expect a 15% return on their cash investment.

Why is Cash-on-Cash Return Important?

Understanding the cash-on-cash return is crucial for investors as it provides a clear picture of the return they can expect on their cash investment. Here are a few reasons why it is important:

- Identifying Profitable Investments: Cash-on-cash return allows investors to evaluate the profitability of different investment opportunities and make informed decisions.

- Comparing Investment Options: By calculating the cash-on-cash return for multiple properties, investors can compare the potential returns and choose the most lucrative option.

- Risk Assessment: Cash-on-cash return provides insights into the risk associated with the investment. A higher cash-on-cash return typically indicates a lower risk, as it suggests a higher return relative to the initial investment.

- Factoring in Financing: This metric is especially important for investors who rely on financing to fund their real estate purchases. It helps in assessing the overall return, considering both the cash invested and the borrowed amount.

In conclusion, cash-on-cash return is a powerful tool that allows real estate investors to evaluate the profitability and efficiency of their investments. By understanding how to calculate and interpret this metric, investors can make informed decisions and maximize their returns. So the next time you’re analyzing a potential real estate investment, don’t forget to consider the cash-on-cash return!