Home>Finance>What Financial Statements Are Needed To Calculate Working Capital

Finance

What Financial Statements Are Needed To Calculate Working Capital

Modified: March 2, 2024

Learn how to calculate working capital in finance by understanding the essential financial statements needed. Explore the key components for accurate calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Working Capital

- Importance of Calculating Working Capital

- Overview of Financial Statements

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Relationship between Working Capital and Financial Statements

- Formula for Calculating Working Capital

- Adjustments and Considerations for Calculating Working Capital

- Conclusion

Introduction

Welcome to the world of finance, where numbers and data take center stage. In the realm of financial management, understanding working capital is crucial for businesses of all sizes. Properly managing working capital can significantly impact a company’s liquidity, profitability, and overall financial health. But before we dive into the details of working capital, let’s first define what it is.

Working capital refers to the funds that a company has available to meet its short-term financial obligations and to fund day-to-day operations. It represents the difference between a company’s current assets, such as cash, accounts receivable, and inventory, and its current liabilities, such as accounts payable and short-term debts. By analyzing working capital, businesses can assess their ability to pay off short-term debts, invest in growth opportunities, and sustain operations.

Calculating working capital is not a one-size-fits-all process but involves analyzing various financial statements to derive accurate figures. These statements provide a snapshot of a company’s financial position, performance, and cash flow.

In this article, we will explore the importance of calculating working capital, delve into the different financial statements involved, and understand the relationship between working capital and these statements. So, let’s begin our journey to unravel the mysteries of working capital!

Definition of Working Capital

Working capital is a fundamental concept in finance that represents the difference between a company’s current assets and current liabilities. It reflects the amount of liquid assets available to cover short-term obligations and sustain day-to-day operations.

To get a clearer understanding, let’s break down the components of working capital:

- Current Assets: These are the assets that can be readily converted into cash within a year or the operating cycle of a business. They include cash, accounts receivable, inventory, and short-term investments.

- Current Liabilities: These are the company’s short-term financial obligations that are due within a year or the operating cycle. Examples include accounts payable, short-term loans, and accrued expenses.

The formula for calculating working capital is:

Working Capital = Current Assets – Current Liabilities

A positive working capital signifies that a company has enough short-term assets to cover its short-term liabilities, providing a buffer for financial stability. On the other hand, a negative working capital indicates a potential liquidity issue, as the company may struggle to meet its financial obligations.

Working capital management is vital for a company’s financial health. A well-managed working capital ensures that the business has enough liquidity to meet its short-term obligations, reduces the risk of financial distress, improves creditworthiness, and supports growth initiatives.

Now that we have a clear understanding of the definition and importance of working capital, let’s explore how financial statements provide insights into a company’s working capital position.

Importance of Calculating Working Capital

Calculating working capital is essential for businesses as it provides valuable insights into their financial health. Understanding the importance of working capital enables companies to make informed decisions, manage cash flow effectively, and mitigate potential risks. Here are several reasons why calculating working capital is crucial:

- Liquidity Assessment: Working capital helps assess a company’s ability to meet its short-term obligations. By analyzing the current ratio, which is the ratio of current assets to current liabilities, businesses can determine their liquidity position. A healthy current ratio indicates that a company has sufficient working capital to cover its debts and operational expenses.

- Cash Flow Management: Working capital management is crucial for effective cash flow management. Businesses need to ensure a steady inflow of cash to cover day-to-day expenses, such as purchasing inventory, paying suppliers, and meeting payroll obligations. Calculating working capital allows companies to identify potential cash flow gaps and take proactive measures, such as optimizing inventory levels, improving collections, and negotiating favorable payment terms with suppliers.

- Business Growth: Adequate working capital is vital for business expansion and growth. It provides the resources necessary to invest in new opportunities, acquire assets, and support increased production. Insufficient working capital can hamper growth initiatives and limit a company’s ability to respond to market demands.

- Financial Stability: Proper working capital management enhances a company’s financial stability. A positive working capital position not only ensures that short-term obligations can be met but also safeguards against unexpected downturns or disruptions. It strengthens a company’s ability to withstand economic fluctuations, maintain supplier relationships, and build trust with stakeholders.

- Decision Making: Calculating working capital assists in making informed business decisions. By monitoring changes in working capital over time, companies can identify trends, assess the impact of different strategies, and evaluate the effectiveness of management practices. It provides a basis for analyzing the efficiency of operations, identifying areas for improvement, and making adjustments to optimize the use of resources.

In summary, calculating working capital is essential for businesses as it provides a comprehensive view of their financial position, liquidity, and ability to sustain operations. It enables effective cash flow management, supports business growth, enhances financial stability, and facilitates informed decision making. By actively managing and monitoring working capital, companies can improve their financial performance and position themselves for long-term success.

Overview of Financial Statements

Financial statements are essential documents that provide a comprehensive view of a company’s financial performance, position, and cash flows. They serve as the foundation for calculating working capital and are crucial for making informed business decisions. Let’s explore the three primary financial statements:

-

Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholder’s equity. The balance sheet is divided into two sides, with assets listed on the left and liabilities and equity on the right. It is important to note that the balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Shareholder’s Equity

The balance sheet helps gauge a company’s liquidity, solvency, and net worth.

-

Income Statement (Profit and Loss Statement): The income statement reports a company’s revenues, expenses, gains, and losses over a specific period. It provides information on the company’s profitability by calculating its net income or net loss. The income statement is structured as follows:

- Revenues: The total amount of money generated from the sale of goods or services.

- Expenses: The costs incurred in operating the business, including salaries, rent, utilities, and marketing expenses.

- Gains and Losses: Any non-operational income or expenses, such as gains from the sale of assets or losses from investments.

- Net Income (or Net Loss): The difference between total revenues and total expenses, reflecting the company’s profitability.

The income statement helps evaluate a company’s operating performance and assess its ability to generate profits.

-

Cash Flow Statement: The cash flow statement tracks the flow of cash in and out of a company over a specific period. It provides insights into a company’s operating, investing, and financing activities. The cash flow statement consists of three main sections:

- Operating Activities: Cash flows generated from the company’s core operations, such as sales and collections, payments to suppliers, and employee salaries.

- Investing Activities: Cash flows related to investments in long-term assets, such as the purchase or sale of property, plant, and equipment, or investments in financial assets.

- Financing Activities: Cash flows resulting from activities related to obtaining or repaying capital, such as issuing or repurchasing common stock, repaying loans, or paying dividends.

The cash flow statement provides insights into a company’s ability to generate cash and its overall liquidity.

These three financial statements play a crucial role in calculating working capital, as they provide the necessary information to assess a company’s financial position, profitability, and cash flows. By analyzing these statements, businesses can make informed decisions regarding their working capital management and overall financial strategy.

Balance Sheet

The balance sheet is one of the key financial statements that provides a snapshot of a company’s financial position at a specific point in time. It presents the company’s assets, liabilities, and shareholder’s equity, illustrating the balance between these three components. The balance sheet is divided into two sides, with assets listed on the left and liabilities and equity on the right.

The balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Shareholder’s Equity

Let’s take a closer look at each component of the balance sheet:

- Assets: These are the resources owned by the company that provide future economic benefits. Assets are further divided into current assets, which are expected to be converted into cash within a year, and non-current assets, which are expected to provide benefits beyond a year. Examples of assets include cash, accounts receivable, inventory, property, plant, and equipment.

- Liabilities: These represent the company’s obligations to external parties, such as creditors, suppliers, and lenders. Like assets, liabilities are also categorized into current liabilities and non-current liabilities. Current liabilities are due within a year, while non-current liabilities are long-term debts that are due beyond a year. Examples of liabilities include accounts payable, short-term loans, and long-term debts.

- Shareholder’s Equity: This represents the residual interest in the assets of the company after deducting liabilities. It includes the initial capital contributed by shareholders and retained earnings, which are the accumulated profits or losses of the company over time. Shareholder’s equity reflects the company’s net worth and is an important indicator of its financial health.

The balance sheet provides valuable insights into a company’s liquidity, solvency, and net worth. It helps stakeholders, such as investors, creditors, and management, assess the financial stability and health of the company. By analyzing the balance sheet, businesses can evaluate their working capital position, identify potential liquidity issues, and make informed decisions regarding financing, investment, and operational strategies.

It is important to note that the balance sheet is a static document that captures the financial position at a specific moment in time. To assess changes in a company’s financial position over time, it is necessary to compare balance sheets from different periods and analyze financial ratios, such as current ratio and debt-to-equity ratio, which provide insights into the company’s liquidity and financial structure.

In summary, the balance sheet is a vital financial statement that provides a snapshot of a company’s financial position by presenting its assets, liabilities, and shareholder’s equity. It offers valuable information for calculating working capital, assessing financial stability, and making informed business decisions.

Income Statement

The income statement, also known as the profit and loss statement, is a crucial financial statement that provides insights into a company’s financial performance over a specific period. It presents the company’s revenues, expenses, gains, and losses, ultimately calculating its net income or net loss.

The income statement is structured as follows:

- Revenues: This section includes the total amount of money generated from the sale of goods or services. Revenues can come from various sources, such as product sales, service fees, or rental income.

- Expenses: Expenses encompass the costs incurred in operating the business. They can include the cost of goods sold, employee salaries and benefits, rent, utilities, marketing expenses, and other operational costs.

- Gains and Losses: This section accounts for any non-operational income or expenses that do not directly relate to the company’s core operations. Examples include gains from the sale of assets, interest income, or losses from investment activities.

- Net Income (or Net Loss): Net income is calculated by subtracting total expenses and losses from total revenues and gains. It represents the company’s profit for the given period. If total expenses and losses exceed total revenues and gains, it results in a net loss.

The income statement provides valuable insights into a company’s profitability and helps assess its operating performance. By analyzing the income statement, businesses can evaluate the effectiveness of their revenue-generating activities and identify areas where expenses can be minimized.

The income statement is not only essential for internal decision-making but is also important for external stakeholders, such as investors and creditors. It helps them assess the company’s revenue-generating capabilities, determine its ability to generate profit, and assess its financial sustainability.

Furthermore, the income statement can be compared across different periods to analyze trends and identify patterns in revenue and expense growth. This allows businesses to make informed decisions regarding pricing strategies, cost control measures, and overall financial planning.

It is worth noting that the income statement represents a specific period and does not provide a complete view of a company’s financial health. To gain a more comprehensive understanding, it is crucial to analyze the income statement in conjunction with other financial statements, such as the balance sheet and cash flow statement.

In summary, the income statement provides insights into a company’s financial performance by detailing its revenues, expenses, gains, and losses over a specific period. It plays a critical role in assessing profitability, making informed business decisions, and evaluating the effectiveness of revenue generation and expense management strategies.

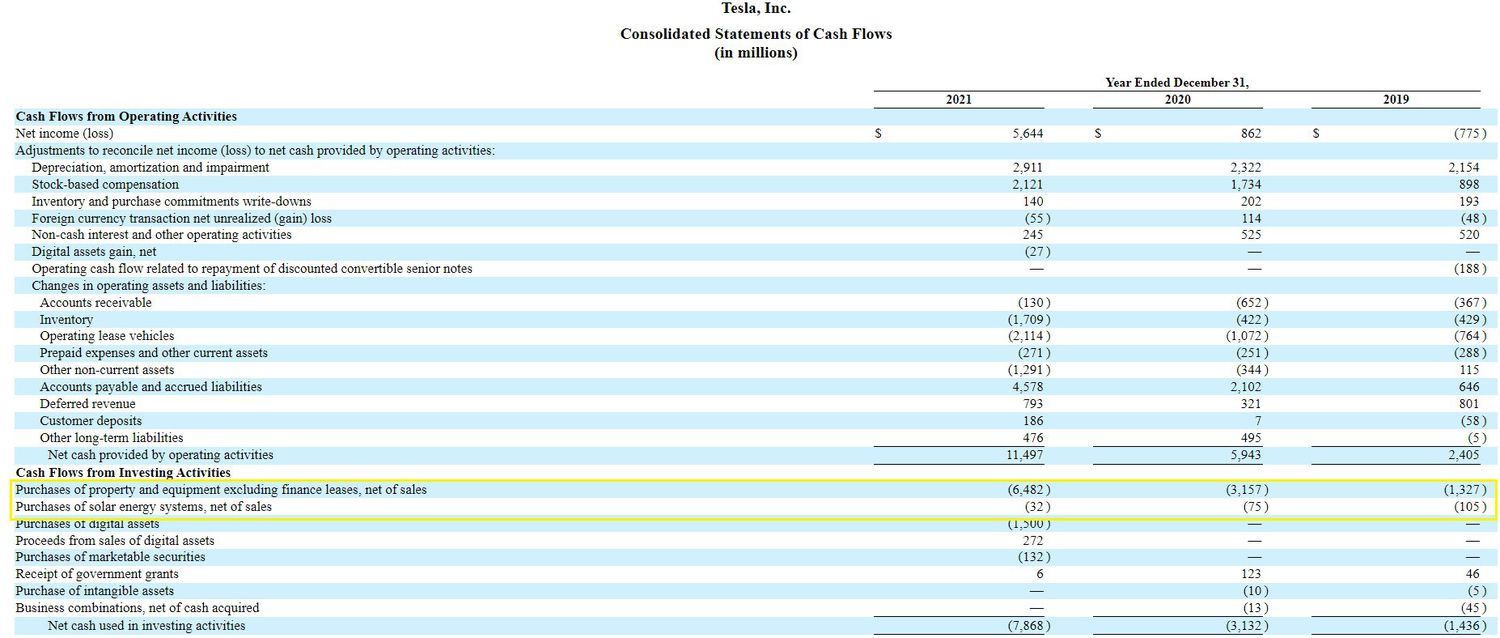

Cash Flow Statement

The cash flow statement is a vital financial statement that tracks the flow of cash in and out of a company over a specific period. It provides insights into a company’s operating, investing, and financing activities and helps assess its ability to generate cash and maintain liquidity.

The cash flow statement consists of three main sections:

- Operating Activities: This section captures the cash flows generated from the company’s core operations. It includes cash receipts from sales, interest and dividends received, and cash payments for expenses, inventory, salaries, and taxes. The operating activities section provides insights into the cash flow generated from the company’s day-to-day business operations.

- Investing Activities: This section accounts for the cash flows related to investments in long-term assets. These can include the purchase or sale of property, plant, and equipment, investments in financial assets, or loans made to other entities. The investing activities section helps assess the company’s investment decisions and their impact on cash flow.

- Financing Activities: The financing activities section tracks the cash flows resulting from activities related to obtaining or repaying capital. This includes issuing or repurchasing common stock, repaying loans, paying dividends, or borrowing funds. The financing activities section provides insights into how the company raises capital and manages its debt and equity.

The cash flow statement is structured using the indirect or direct method. The indirect method starts with the net income from the income statement and adjusts for non-cash items and changes in working capital to calculate the net cash provided or used by operating activities. The direct method directly reports the actual cash flows from operating, investing, and financing activities.

The cash flow statement is crucial for assessing a company’s cash generation and utilization. It helps identify if a company is generating enough cash from its core operations to cover its expenses, investments, and debt repayments. A positive cash flow indicates that the company has sufficient liquidity, while a negative cash flow could indicate potential financial difficulties.

Furthermore, the cash flow statement provides insights into a company’s ability to meet its short-term obligations and fund its growth initiatives. It helps stakeholders, such as investors and creditors, evaluate a company’s liquidity, cash flow management, and financial stability.

It is important to note that the cash flow statement complements the income statement and balance sheet, providing a more comprehensive view of a company’s financial position and performance. By analyzing the cash flow statement alongside these other statements, businesses can gain a holistic understanding of their financial health and make informed decisions regarding working capital management, investment strategies, and financing activities.

In summary, the cash flow statement tracks the inflow and outflow of cash from a company’s operating, investing, and financing activities. It assists in assessing liquidity, cash flow management, and financial stability. By analyzing this statement, businesses can make informed decisions regarding cash management, investments, and financing options.

Relationship between Working Capital and Financial Statements

The concept of working capital is closely intertwined with the various financial statements, as these statements provide the information necessary to calculate and understand a company’s working capital position. Let’s explore the relationship between working capital and the three primary financial statements: the balance sheet, income statement, and cash flow statement.

- Balance Sheet: The balance sheet plays a crucial role in calculating the working capital of a company. It provides the necessary information about a company’s current assets and current liabilities, which are the key components in determining working capital. By subtracting current liabilities from current assets, businesses can derive the working capital amount. Additionally, the balance sheet helps evaluate the liquidity position of a company, as it shows the availability of short-term assets to cover short-term obligations.

- Income Statement: The income statement provides insights into a company’s profitability and can indirectly impact working capital. When a company generates higher revenues and efficiently manages its expenses, it can lead to increased operating cash flows, which can boost the working capital position. Additionally, analyzing the income statement helps businesses identify areas where profitability can be improved and expenses can be optimized, contributing to better working capital management.

- Cash Flow Statement: The cash flow statement has a direct correlation with working capital. By analyzing the cash flow statement, businesses can identify the cash flows from operating activities, which form the basis of a company’s working capital. If the cash flow from operations is positive, it indicates that the company is generating enough cash to cover its working capital needs. However, if the cash flow from operations is negative, it suggests potential issues with working capital management and may require attention to improve cash generation and liquidity.

The financial statements collectively provide a comprehensive view of a company’s financial position, performance, and cash flow, which are integral to understanding and managing working capital effectively. They allow businesses to assess the liquidity, profitability, and cash generation capabilities necessary for maintaining a healthy working capital position.

By analyzing the financial statements, businesses can identify potential working capital issues, such as excessive inventory levels, delayed payments from customers, or high levels of short-term debt. This information enables companies to take appropriate measures to optimize working capital, such as implementing inventory management strategies, improving collections, renegotiating payment terms with suppliers, or exploring financing options to address short-term liquidity constraints.

Furthermore, monitoring working capital through the lens of the financial statements allows businesses to evaluate the impact of different strategies and actions on working capital management. It enables the identification of trends, facilitates forecasting, and aids in making informed decisions to maintain an optimal working capital position.

In summary, the financial statements provide the foundation for calculating and understanding working capital. The balance sheet quantifies the working capital position, the income statement aids in optimizing profitability and managing expenses, and the cash flow statement provides insights into the cash generation and utilization that directly impact working capital. By utilizing these financial statements, businesses can effectively manage their working capital and ensure financial stability.

Formula for Calculating Working Capital

Calculating working capital is a straightforward process that involves subtracting a company’s current liabilities from its current assets. The formula for calculating working capital is:

Working Capital = Current Assets – Current Liabilities

Let’s break down the components of this formula:

- Current Assets: Current assets are the company’s short-term assets that are expected to be converted into cash within a year or the operating cycle of the business. They include cash, accounts receivable, inventory, marketable securities, and prepaid expenses. These assets represent the company’s available resources to meet its short-term obligations.

- Current Liabilities: Current liabilities are the company’s short-term financial obligations that are due within a year or the operating cycle of the business. They include accounts payable, accrued expenses, short-term loans, and any other debts that need to be paid in the near future. These liabilities represent the financial claims and obligations on the company’s current assets.

By subtracting current liabilities from current assets, the formula for working capital provides a measure of the available liquid resources that a company has to cover its short-term obligations and sustain day-to-day operations. A positive working capital indicates that a company has more current assets than current liabilities, while a negative working capital suggests potential liquidity issues.

It is important to note that the calculation of working capital should be performed periodically and not just as a one-time assessment. By monitoring and analyzing changes in working capital over time, businesses can gain insights into their cash flow patterns, identify trends, and make adjustments to their financial strategies as needed.

While the formula for calculating working capital provides a general measure, it is essential to consider industry benchmarks and the specific context of the business. Different industries may have different working capital requirements, and companies’ working capital needs can vary based on factors such as seasonality, growth plans, and market conditions.

Overall, the formula for calculating working capital provides a starting point for assessing a company’s liquidity and financial health. By understanding and monitoring working capital, businesses can make informed decisions regarding cash flow management, financing, and day-to-day operations to ensure the availability of adequate resources to meet their short-term obligations.

Adjustments and Considerations for Calculating Working Capital

While the formula for calculating working capital is relatively simple, there are some adjustments and considerations to keep in mind to ensure an accurate representation of a company’s liquidity and financial health. Let’s explore these adjustments and considerations:

- Trade and Cash Discounts: Discounts offered to customers for early payment or cash transactions should be considered when calculating accounts receivable. If the company provides or takes advantage of such discounts, it may impact the actual amount of cash that will be received or paid.

- Inventory Valuation: When calculating working capital, businesses should consider the accurate valuation of inventory. This includes factoring in potential obsolescence, discounts on aging inventory, or any inventory reserves that need to be accounted for.

- Depreciation and Amortization: Non-cash expenses like depreciation and amortization should be excluded from working capital calculations. Since depreciation and amortization do not impact cash flow directly, they do not affect the availability of liquid resources to cover short-term obligations.

- Accruals and Prepaid Expenses: Accrued expenses and prepaid expenses should be carefully assessed to ensure their proper inclusion or exclusion from working capital calculations. Accrued expenses, such as salaries or utilities, represent expenses that have been incurred but not yet paid and should be considered as a liability. Prepaid expenses, on the other hand, represent future expenses that have been paid in advance and should be excluded from current assets.

- Debt and Equity: Working capital calculations should consider the appropriate inclusion or exclusion of long-term debt and equity. Long-term debt and equity are not typically part of working capital, as they represent long-term financing sources and are not readily available to cover short-term obligations.

- Currency Translation: If a company operates in multiple currencies, it is necessary to consider the impact of currency translation on current assets and current liabilities. Exchange rate fluctuations can affect the value of assets and liabilities denominated in foreign currencies and should be reflected accurately in the working capital calculation.

It is important to note that the adjustments and considerations mentioned above may vary based on the specific accounting practices, industry standards, and regulatory requirements that companies follow. Professional judgment and understanding of the unique circumstances of a business are essential to ensure the accuracy and relevance of working capital calculations.

Additionally, it is crucial to interpret the calculated working capital figure in the context of the company’s industry benchmarks and historical performance. Comparing working capital ratios with industry peers and understanding the company’s specific business model and operating cycle can provide additional insights into the adequacy and efficiency of the company’s working capital management.

In summary, adjustments and considerations are necessary to obtain an accurate portrayal of a company’s working capital. Taking into account factors such as trade and cash discounts, inventory valuation, non-cash expenses, accruals and prepaid expenses, long-term debt and equity, and currency translation ensures the reliability of the working capital calculation and aids in better decision-making regarding cash flow management and financial stability.

Conclusion

Working capital is a critical aspect of financial management that allows businesses to assess their liquidity, financial stability, and day-to-day operational needs. Calculating working capital provides insights into a company’s ability to meet short-term obligations, manage cash flow, and support growth initiatives. By analyzing working capital, businesses can make informed decisions to optimize their financial strategies and ensure sustainable operations.

The financial statements, including the balance sheet, income statement, and cash flow statement, play a vital role in understanding and calculating working capital. The balance sheet provides a snapshot of a company’s financial position, enabling the derivation of working capital by comparing current assets and liabilities. The income statement reflects profitability, indirectly influencing working capital through revenue generation and expense management. The cash flow statement showcases the cash flows from operating, investing, and financing activities, directly impacting working capital.

While the formula for calculating working capital is simple (Current Assets – Current Liabilities), it is important to consider adjustments and specific considerations to ensure accuracy and relevance. Factors such as trade and cash discounts, inventory valuation, non-cash expenses, accruals and prepaid expenses, and long-term debt and equity should be appropriately accounted for when calculating working capital.

Understanding the relationship between working capital and financial statements empowers businesses to effectively manage their resources, optimize cash flow, and make informed decisions. By actively monitoring working capital and analyzing trends over time, companies can identify potential issues, improve cash flow management, and enhance their overall financial performance.

In conclusion, working capital is a fundamental concept in finance, and calculating it provides valuable insights into a company’s financial health and sustainability. By utilizing the information provided by the financial statements and considering adjustments and factors specific to the business, companies can effectively manage their working capital, mitigate risks, and set the stage for long-term success.