Home>Finance>Where To Post Merchant Fees In TurboTax For LLC

Finance

Where To Post Merchant Fees In TurboTax For LLC

Published: February 24, 2024

Learn where to post merchant fees in TurboTax for your LLC and optimize your finance reporting for tax purposes. Get step-by-step guidance now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding Merchant Fees

Merchant fees are an essential aspect of running a business, particularly for limited liability companies (LLCs) engaged in e-commerce or retail operations. These fees, charged by payment processing services such as credit card companies and online payment platforms, are incurred for processing customer transactions. While these fees are necessary for facilitating electronic payments, they can significantly impact a company's financial records and tax obligations.

As a business owner, it's crucial to understand how merchant fees affect your LLC's financial statements and tax returns. Properly accounting for these expenses is essential for accurately assessing the company's profitability and complying with tax regulations.

In this guide, we will delve into the intricacies of reporting merchant fees for an LLC using TurboTax, a popular tax preparation software. By following the steps outlined in this article, LLC owners can ensure that their merchant fees are accurately recorded in TurboTax, thereby facilitating the seamless preparation of their tax returns.

Throughout this article, we will provide comprehensive insights into the nature of merchant fees, their impact on an LLC's financials, and the specific procedures for reporting them in TurboTax. By the end of this guide, readers will have a clear understanding of how to navigate the complexities of merchant fee reporting, empowering them to effectively manage this aspect of their LLC's financial responsibilities.

Understanding Merchant Fees

Merchant fees, also known as credit card processing fees or payment processing fees, are charges incurred by businesses for processing customer payments through credit and debit cards, as well as digital payment platforms such as PayPal, Square, and Stripe. These fees are typically calculated as a percentage of the transaction amount, along with a fixed per-transaction charge.

For LLCs engaged in e-commerce or retail operations, merchant fees are an inevitable component of conducting business in the digital age. While these fees enable businesses to offer convenient payment options to customers, they can impact the company’s bottom line. It’s important to recognize that these fees directly affect the LLC’s revenue and expenses, influencing its overall financial performance.

Merchant fees are categorized as operating expenses on the LLC’s income statement, reflecting the costs associated with processing sales transactions. These expenses directly reduce the company’s net income, thereby influencing its profitability. Understanding the nuances of merchant fees is crucial for accurately assessing the LLC’s financial health and making informed business decisions.

Moreover, from a tax perspective, properly accounting for merchant fees is essential for maximizing deductions and ensuring compliance with regulatory requirements. By accurately reporting these fees, LLCs can minimize their tax liability and avoid potential issues during tax audits.

It’s important to note that the specific terms and rates of merchant fees can vary based on the payment processing service provider and the nature of the transactions. Different payment methods, such as credit cards, debit cards, and online payment platforms, may entail distinct fee structures, further adding to the complexity of managing these expenses.

Overall, gaining a comprehensive understanding of merchant fees is fundamental for LLC owners, as it empowers them to make informed financial decisions, optimize tax planning, and maintain accurate financial records. With this knowledge as a foundation, LLCs can effectively navigate the process of reporting merchant fees in TurboTax, ensuring that these expenses are appropriately reflected in their tax returns.

Reporting Merchant Fees in TurboTax for LLC

When it comes to preparing tax returns for a limited liability company (LLC), accurately reporting merchant fees is crucial for ensuring compliance with tax regulations and maximizing deductions. TurboTax, a widely used tax preparation software, provides LLC owners with a user-friendly platform to navigate the complexities of tax filing, including the proper handling of merchant fees.

Within the TurboTax interface, LLC owners have the opportunity to categorize merchant fees as deductible business expenses, allowing them to offset their taxable income and potentially reduce their overall tax liability. By accurately reporting these fees, LLCs can optimize their tax returns and minimize the impact of processing expenses on their bottom line.

It’s important to recognize that TurboTax offers specific sections and prompts for entering business expenses, including merchant fees, in a streamlined manner. This simplifies the process for LLC owners, enabling them to input the relevant information and ensure that their tax returns reflect a comprehensive overview of their business expenditures.

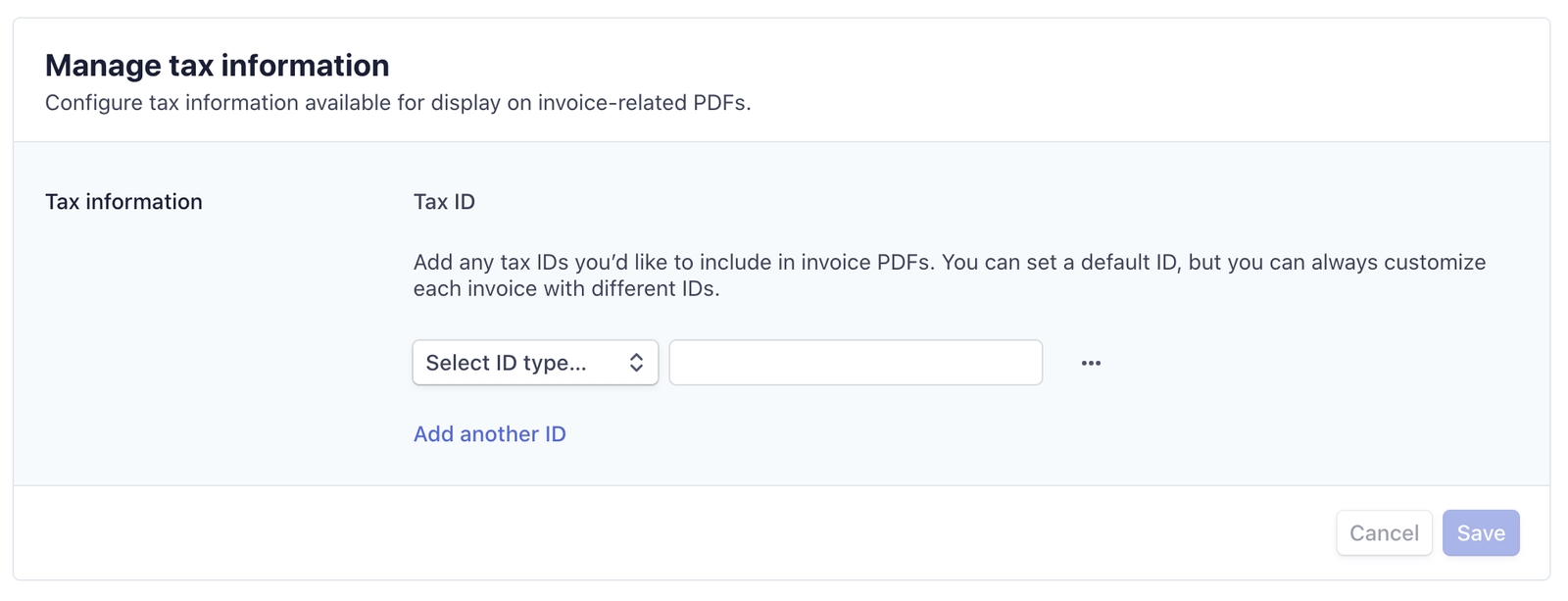

Moreover, TurboTax provides guidance on the documentation and substantiation of business expenses, including merchant fees, to support the accuracy of the reported figures. This feature helps LLC owners maintain thorough records and adhere to the substantiation requirements set forth by the Internal Revenue Service (IRS).

By leveraging the capabilities of TurboTax, LLC owners can effectively capture the impact of merchant fees on their business operations and financial performance. This not only facilitates compliance with tax laws but also empowers businesses to make strategic financial decisions based on a clear understanding of their operating expenses.

Throughout the reporting process in TurboTax, LLC owners should remain attentive to the specific categorization of merchant fees and ensure that they are allocated to the appropriate expense accounts within the software. This meticulous approach contributes to the accurate representation of the LLC’s financial activities and enhances the integrity of the tax return.

Overall, TurboTax serves as a valuable tool for LLC owners, providing them with the means to methodically report merchant fees and other business expenses. By effectively utilizing the features and guidance offered by TurboTax, LLCs can streamline their tax preparation process and position themselves for financial success.

Steps to Post Merchant Fees in TurboTax for LLC

Posting merchant fees in TurboTax for your LLC involves a series of straightforward yet critical steps to ensure the accurate representation of these expenses in your tax return. By following the guidelines below, LLC owners can effectively navigate the process of reporting merchant fees within the TurboTax platform:

- Accessing Business Expenses Section: Upon entering your LLC’s tax information in TurboTax, navigate to the “Business” section, which is specifically designed for reporting business-related income and expenses. Within this section, locate the category for “Expenses” or “Deductions” to proceed with entering your business expenses, including merchant fees.

- Identifying Merchant Fees: Within the “Expenses” or “Deductions” category, look for the option to add or enter specific expenses related to your LLC’s operations. Select the relevant subcategory that pertains to payment processing expenses or merchant fees. TurboTax may provide a designated field for inputting these fees, allowing you to itemize and document them accordingly.

- Inputting Fee Details: Once you have accessed the section for reporting merchant fees, enter the pertinent details, including the total amount of fees incurred during the tax year. TurboTax may prompt you to provide additional information, such as the nature of the fees (e.g., credit card processing fees, online payment platform fees) and any associated transaction details.

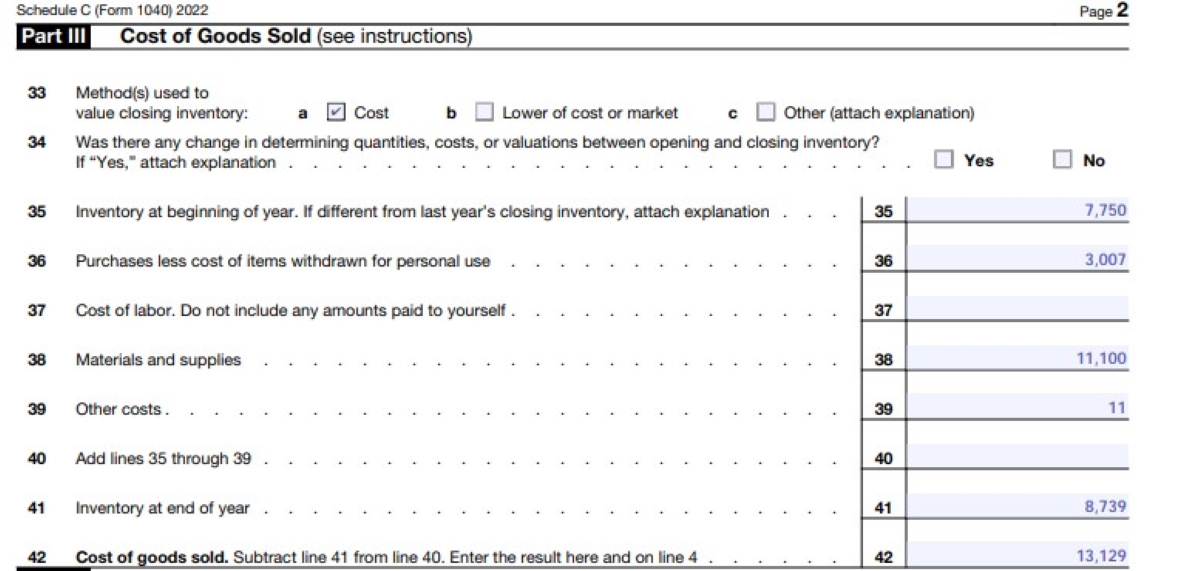

- Allocating to Expense Accounts: TurboTax may offer the option to allocate merchant fees to specific expense accounts within your LLC’s financial records. Ensure that the fees are accurately categorized and allocated to the appropriate expense accounts, aligning with your LLC’s accounting practices and financial reporting.

- Reviewing and Confirming Entries: Before finalizing the reporting of merchant fees, carefully review the entered information to verify its accuracy. Confirm that the figures align with your LLC’s financial records and supporting documentation. TurboTax may provide a summary of the entered expenses for your review before proceeding.

By diligently following these steps, LLC owners can effectively post their merchant fees in TurboTax, ensuring that these expenses are accurately reflected in their tax returns. It’s essential to maintain meticulous records of the merchant fees incurred by your LLC, as these records serve as the foundation for the accurate reporting of expenses in TurboTax.

Additionally, LLC owners should leverage any guidance or prompts provided by TurboTax throughout the reporting process, as the software is designed to facilitate the accurate and comprehensive disclosure of business expenses, including merchant fees. By embracing the features and functionalities of TurboTax, LLCs can streamline their tax preparation and optimize their financial outcomes.

Conclusion

As an LLC owner, navigating the complexities of reporting merchant fees in TurboTax is a critical aspect of managing your business’s financial responsibilities. By gaining a thorough understanding of merchant fees and leveraging the capabilities of TurboTax, you can effectively capture these expenses in your tax return, thereby optimizing your tax planning and compliance efforts.

Throughout this guide, we have underscored the significance of recognizing merchant fees as essential operating expenses for LLCs, particularly those engaged in e-commerce and retail activities. These fees directly impact your company’s profitability and financial performance, making their accurate reporting a fundamental component of your tax obligations.

By comprehensively understanding the nature of merchant fees and their implications for your LLC, you are better equipped to utilize TurboTax as a strategic tool for managing these expenses. TurboTax offers a user-friendly interface and specific sections for entering business expenses, including merchant fees, enabling you to methodically document and allocate these costs within your tax return.

Moreover, the meticulous steps outlined for posting merchant fees in TurboTax provide a clear roadmap for LLC owners, ensuring that these expenses are accurately represented and categorized. By following these steps and leveraging the guidance provided by TurboTax, you can streamline your tax preparation process and position your LLC for financial success.

Ultimately, the accurate reporting of merchant fees in TurboTax empowers you to maximize deductions, optimize tax planning, and maintain compliance with regulatory requirements. By embracing the capabilities of TurboTax and maintaining thorough records of your LLC’s financial activities, you can navigate the complexities of tax filing with confidence and precision.

As you proceed with reporting your LLC’s merchant fees in TurboTax, remember that this process is not only a regulatory obligation but also an opportunity to gain valuable insights into your business’s financial dynamics. By effectively managing these expenses, you are laying a solid foundation for informed decision-making and sustainable financial growth for your LLC.

With a comprehensive understanding of merchant fees and the seamless utilization of TurboTax, LLC owners can confidently navigate the tax reporting process, ensuring that their businesses are positioned for continued success in an ever-evolving economic landscape.