Finance

What Is Budgeting Process

Published: October 11, 2023

Learn about the finance-focused budgeting process and gain insights to effectively manage your money. Discover the importance of budgeting and take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of budgeting. Whether you are an individual, a family, or a business, budgeting is a crucial financial practice that helps you plan and manage your money effectively. It allows you to gain control over your finances, make informed decisions, and work towards your financial goals. In this article, we will delve into the budgeting process, its definition, importance, and the steps involved in creating a budget.

The budgeting process is the systematic approach of forecasting and allocating financial resources to various expenses and income sources. It serves as a financial roadmap, providing a detailed plan of how your money will be utilized and ensuring that you have enough funds to cover your expenses while maintaining financial stability.

Whether you are looking to save for a big purchase, pay off debt, or grow your business, a well-executed budget is the foundation to achieve your financial objectives. It enables you to make informed decisions and prioritize your spending, ensuring that your money is allocated to the areas that matter most to you.

By implementing a budgeting process, you gain a better understanding of your financial situation. It helps you identify any potential cash flow issues, eliminate unnecessary expenses, and make adjustments to achieve financial stability. Budgeting also provides you with the ability to track your progress towards your financial goals, which can be a great motivator and keep you on the right path.

Throughout this article, we will explore the steps involved in the budgeting process, starting from gathering information and setting goals, to developing a financial plan, allocating resources, monitoring and evaluating performance, and making necessary adjustments. Understanding and implementing these steps will not only help you create a budget but also establish a strong financial foundation for the future.

Definition of Budgeting Process

The budgeting process is a systematic and ongoing approach to creating and managing a budget. It involves forecasting and allocating financial resources to various expenses and income sources, allowing individuals, families, and businesses to effectively plan and control their finances.

A budget is essentially a financial plan that outlines income, expenses, and savings targets over a specified period, which is usually monthly, quarterly, or annually. The budgeting process involves a series of steps undertaken to create this plan and ensure it is followed consistently.

At its core, the budgeting process involves analyzing past financial data, evaluating current financial situations, setting realistic goals, and allocating resources accordingly. It requires a thorough understanding of income sources, expenses, debt obligations, and financial objectives.

A key aspect of the budgeting process is tracking and monitoring actual income and expenses compared to the budgeted amounts. This helps identify discrepancies and deviations from the planned financial path, allowing for adjustments and modifications to be made in order to stay on track.

The budgeting process can be adapted to fit different needs and circumstances. For individuals and families, it may involve budgeting for household expenses, savings, and debt repayments. In contrast, businesses often have more complex budgets that encompass various departmental expenses, revenue projections, and investment plans.

While the specific steps and techniques may vary, the purpose of the budgeting process remains consistent – to help individuals and organizations make informed financial decisions, ensure financial stability, and work towards their desired financial outcomes.

Overall, the budgeting process is a fundamental tool for effective financial management. It provides structure, control, and direction by establishing financial goals, allocating resources, and facilitating informed decision-making. By following a comprehensive budgeting process, individuals and businesses can achieve financial success and maintain financial health in both the short and long term.

Importance of Budgeting Process

The budgeting process plays a vital role in personal and business finance, providing numerous benefits and creating a solid financial foundation. Here are some key reasons why the budgeting process is crucial:

1. Financial Control: Budgeting gives individuals and businesses a clear overview of their income and expenses. It helps identify areas where money is being spent unnecessarily and allows for better control over financial resources. With a budget in place, one can make informed decisions about where to allocate funds, reduce expenses, and increase savings.

2. Goal Setting and Planning: A budget acts as a roadmap to achieve financial goals. It enables individuals to establish clear objectives, such as saving for a down payment on a house or paying off debt. Through the budgeting process, one can set realistic targets, track progress, and make adjustments as needed to stay on course.

3. Debt Management: Budgeting is essential for effective debt management. By including debt payments in the budget, individuals and businesses can allocate funds accordingly, ensuring timely payments and reducing the risk of accumulating more debt. A budget also helps identify opportunities for debt reduction strategies, such as debt consolidation or refinancing.

4. Financial Stability: A well-executed budget provides financial stability by ensuring that there are enough funds to cover expenses and unexpected costs. It helps individuals and businesses build an emergency fund for unforeseen circumstances and acts as a safety net during challenging times.

5. Asset Allocation: Budgeting facilitates informed decision-making when it comes to allocating financial resources. It allows individuals and businesses to evaluate investment opportunities and make choices based on their financial goals and risk tolerance. Whether it’s saving for retirement or expanding a business, a budget helps prioritize and allocate funds appropriately.

6. Improved Decision-Making: By having a budget in place, individuals and businesses have a framework for making financial decisions. It helps assess the potential impact of choices on overall financial well-being and allows for informed trade-offs between spending and saving. Budgeting ensures that decisions align with long-term financial goals and minimize impulsive or unnecessary expenses.

7. Financial Awareness: Budgeting promotes financial awareness by fostering a deeper understanding of income, expenses, and saving patterns. It helps individuals and businesses become more conscious of their financial habits and identify areas where improvements can be made. This heightened awareness can lead to better money management and a more secure financial future.

In summary, the budgeting process is of utmost importance for both individuals and businesses. It empowers individuals to take control of their finances, achieve goals, and build financial security. For businesses, it serves as a roadmap to success, enabling effective resource allocation and informed decision-making. By embracing the budgeting process, one can pave the way to a healthier financial future.

Steps in the Budgeting Process

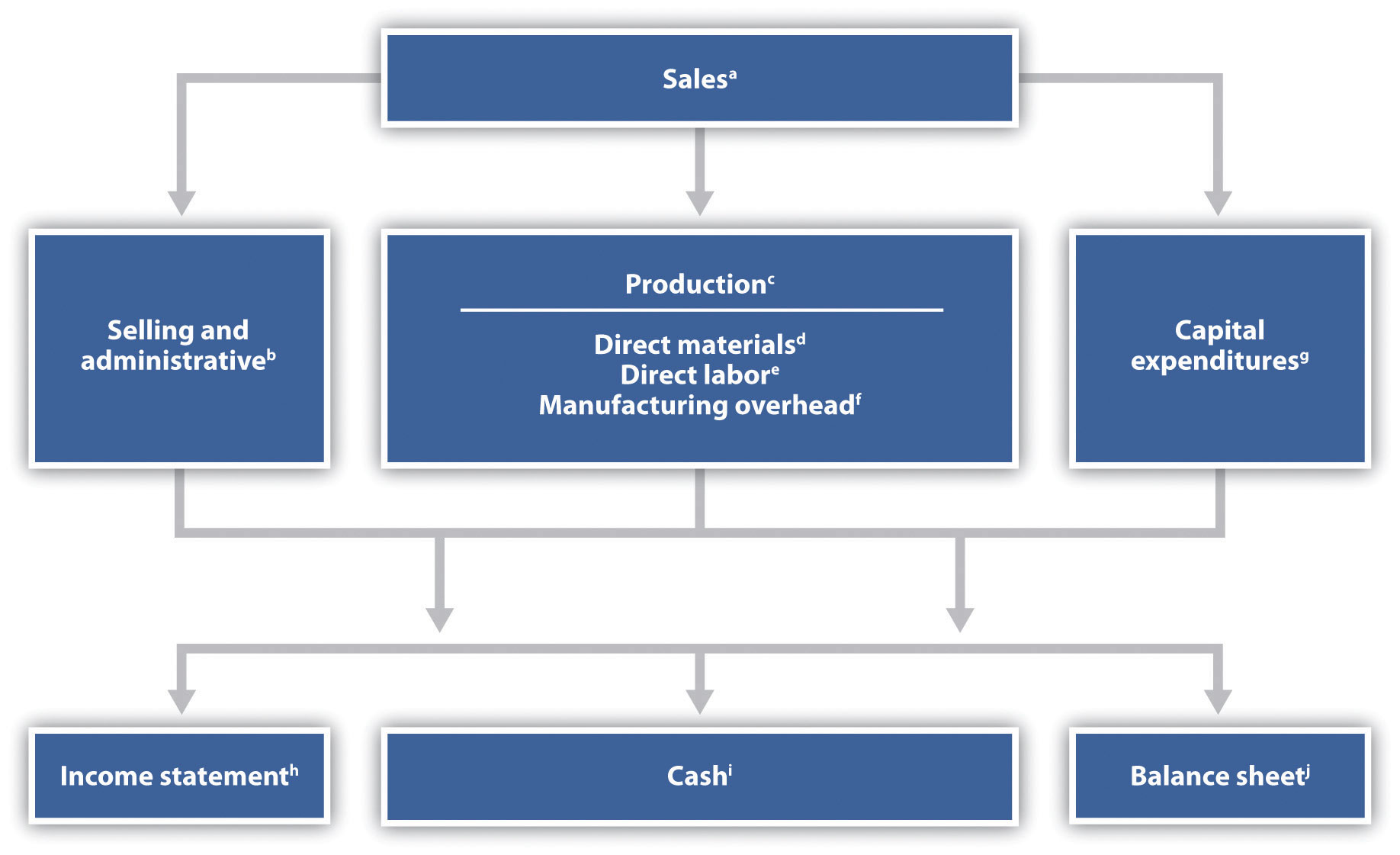

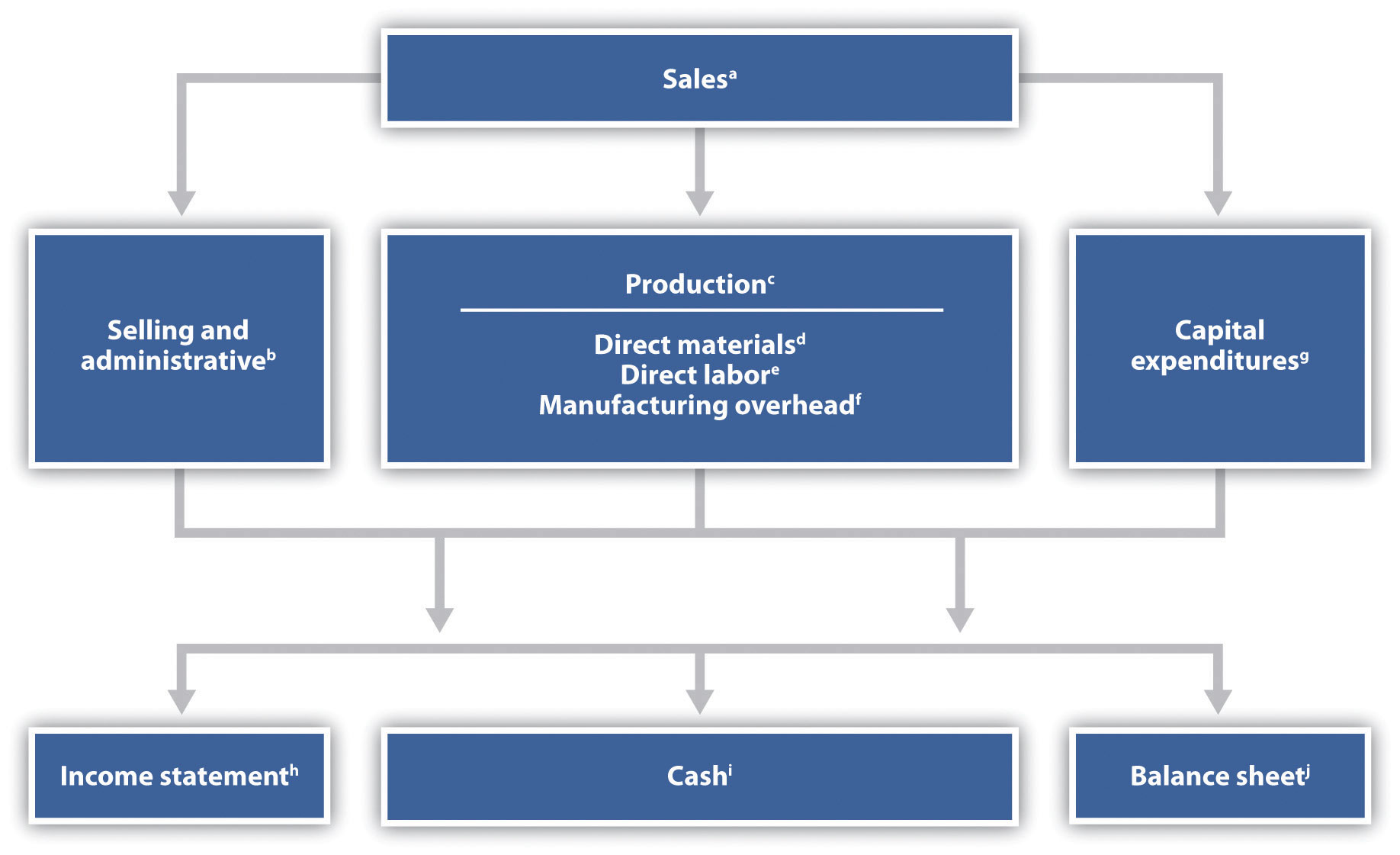

The budgeting process consists of several key steps that help individuals and businesses create and manage their budgets effectively. Each step plays a crucial role in developing a comprehensive and realistic financial plan. Here are the main steps involved in the budgeting process:

1. Gathering Information and Setting Goals: The first step in the budgeting process is to gather relevant financial information and identify your financial goals. This includes assessing your current income, expenses, debt obligations, and savings. Determine what you want to achieve financially, whether it’s saving for a down payment, paying off debt, or starting a business.

2. Developing a Financial Plan: With your financial goals in mind, develop a detailed financial plan that outlines how you will allocate your resources. Start by categorizing your expenses into essential (such as rent, utilities, and groceries) and discretionary (such as entertainment and dining out). Set realistic targets for savings, debt repayment, and investments.

3. Allocating Resources: After establishing your financial plan, allocate your financial resources accordingly. Assign a specific amount to each expense category and determine how much you need to save or invest each month. Ensure that your income is sufficient to cover your expenses and goals. Consider making adjustments to prioritize essential expenses and savings.

4. Monitoring and Evaluating Performance: Regularly monitor your actual income and expenses to assess how well you are sticking to your budget. Keep track of every financial transaction and compare it to the budgeted amounts. This will help identify any deviations or areas where adjustments may be necessary. Monitoring your budget allows you to stay accountable and make informed decisions.

5. Making Adjustments and Revising the Budget: As you monitor your budget, you may discover that certain expenses are higher than expected or that your income has changed. Based on these insights, make necessary adjustments to your budget to ensure it remains realistic and aligned with your financial goals. This may involve cutting back on certain expenses, re-evaluating savings targets, or finding ways to increase income.

6. Periodic Review and Reflection: It’s important to periodically review your budget to assess its effectiveness and make any necessary changes. Take time to reflect on your financial progress and adjust your goals if needed. Use this review as an opportunity to celebrate achievements and learn from any financial challenges you have encountered.

Following these steps in the budgeting process will help you maintain control over your finances and work towards achieving your financial objectives. Remember, budgeting is an ongoing practice that requires discipline and adaptability. By regularly assessing and adjusting your budget, you can stay on track and make financial decisions that align with your priorities and values.

Gathering Information and Setting Goals

The first step in the budgeting process is gathering relevant financial information and setting clear financial goals. This crucial step lays the foundation for creating an effective budgeting plan. Here’s how to approach gathering information and setting goals for your budget:

1. Assess your Financial Situation: Start by taking a comprehensive look at your financial situation. Gather all relevant documents, such as bank statements, bills, and pay stubs. Calculate your total income by considering all sources, including regular employment, side gigs, investments, or rental income. Additionally, scrutinize your expenses by categorizing them into fixed (e.g., rent, mortgage, utilities) and variable (e.g., groceries, entertainment).

2. Evaluate your Debt Obligations: Determine your current debt obligations, such as credit card balances, student loans, or mortgage payments. Include any outstanding debts and their respective interest rates. This assessment helps you understand the impact of your debts on your overall financial health and allows you to incorporate debt repayment into your budgeting plan.

3. Identify Your Financial Goals: Setting clear financial goals is crucial to give your budget direction and purpose. Ask yourself what you want to achieve financially. Common goals may include building an emergency fund, saving for a down payment on a house, paying off debt, or starting a business. Ensure that your goals are specific, measurable, attainable, relevant, and time-bound (SMART).

4. Prioritize Your Goals: Once you’ve identified your financial goals, prioritize them based on importance and urgency. Determine which goals are short-term (less than a year), medium-term (one to five years), and long-term (over five years). By prioritizing your goals, you can focus your financial resources and allocate them accordingly in your budget.

5. Set Realistic Targets: When setting financial goals, it’s essential to consider your income, expenses, and current financial situation. Set realistic targets that take into account your income level, existing financial commitments, and other factors. Be mindful of your limitations and avoid setting goals that are overly ambitious and unachievable in the given timeframe.

6. Make your Goals Specific: Clearly define your goals by adding specific details. For example, if you want to save for a down payment, determine the exact amount you need to save and the timeframe within which you aim to achieve it. Having specific and measurable goals makes it easier to track your progress and stay motivated.

7. Review and Refine: Regularly review and refine your financial goals. As you progress through the budgeting process and gain a better understanding of your financial situation, you may find it necessary to adjust or modify your goals. It’s important to ensure that your goals are still relevant and aligned with your current financial circumstances.

By gathering accurate financial information and setting clear goals, you establish a solid foundation for creating an effective budget. This initial step provides crucial insights into your income, expenses, debts, and aspirations, enabling you to make informed decisions throughout the budgeting process. Remember to regularly revisit and reassess your goals as your financial situation evolves, ensuring that your budget remains relevant and aligned with your aspirations.

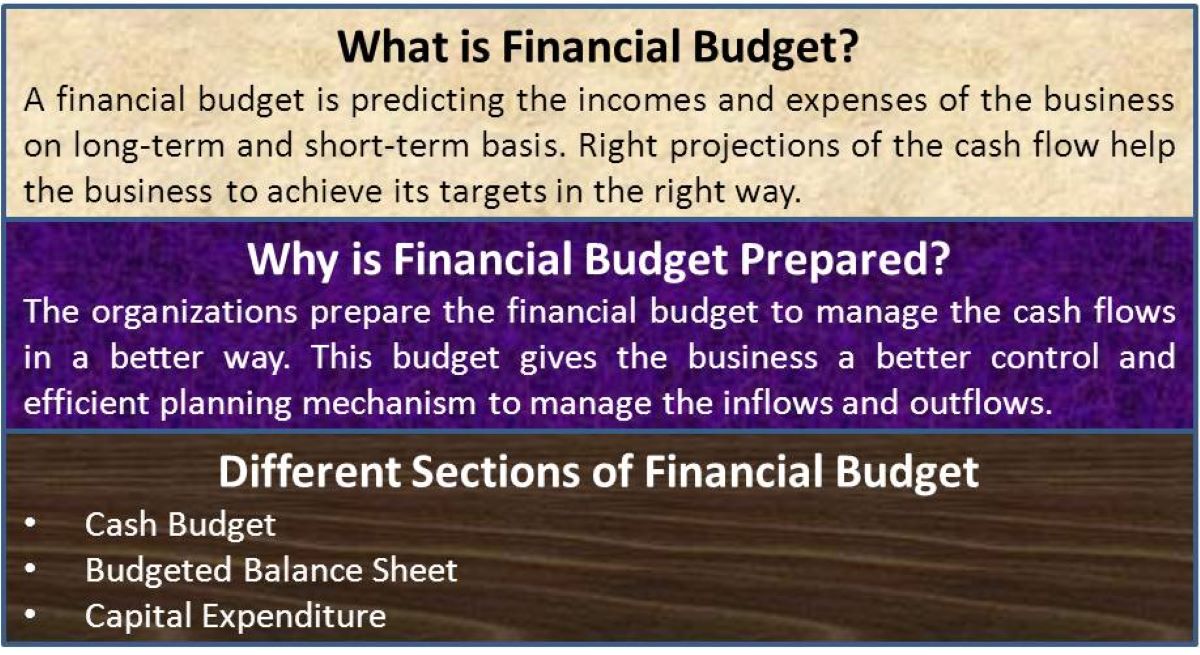

Developing a Financial Plan

Once you have gathered information and established your financial goals, the next step in the budgeting process is developing a comprehensive financial plan. A sound financial plan serves as a roadmap to guide your spending, saving, and investing decisions. Here are the key factors to consider when developing your financial plan:

1. Track Your Income and Expenses: Begin by analyzing your income and expenses. Identify your total income from all sources and categorize your expenses into different categories such as housing, transportation, groceries, entertainment, and savings. This will give you a clear understanding of where your money is coming from and where it is going.

2. Set Realistic Budget Categories: Based on your expense categories, assign specific budget amounts to each category. Prioritize essential expenses such as housing, utilities, and food, and allocate a portion of your income to savings and debt repayments. This step helps you establish spending limits and ensures that your income is properly allocated.

3. Create a Monthly Budget: Use the data from your income and expenses to create a monthly budget. Make sure to include all sources of income and account for both fixed and variable expenses. The goal is to allocate your income in a way that covers all necessary expenses while leaving room for savings and debt repayments. Be realistic about your spending habits and adjust the allocations as needed.

4. Build an Emergency Fund: A key component of your financial plan is setting aside funds for emergencies. Aim to build an emergency fund that covers at least three to six months’ worth of living expenses. This fund will provide a safety net and protect you from unexpected financial setbacks.

5. Address Debt Repayment: If you have outstanding debts, develop a strategy for debt repayment as part of your financial plan. Determine the most efficient way to pay off your debts, whether it’s by focusing on high-interest debts first or using a debt snowball or debt avalanche method. Allocate a portion of your budget towards debt repayment while continuing to make minimum payments on all debts.

6. Set Savings Targets: Your financial plan should also include specific savings targets. Set goals for short-term savings, such as a vacation or home renovation, as well as long-term savings, such as retirement or education funds. Determine how much you need to save each month to reach these goals and build it into your budget.

7. Review and Adjust: Regularly review your financial plan and make adjustments as needed. This includes tracking your actual income and expenses against your budgeted amounts and making changes to ensure that you are staying on track. Life circumstances and financial goals may change over time, so be flexible and modify your plan accordingly.

Remember, a well-developed financial plan is essential for effective budgeting. It serves as a guiding framework to help you make informed financial decisions, manage your expenses, save for the future, and work towards your financial goals. By creating a comprehensive financial plan, you are setting yourself up for long-term financial success and stability.

Allocating Resources

Allocating resources is a key step in the budgeting process that involves determining how to distribute your financial resources to different expense categories and financial goals. This step ensures that your income is allocated effectively to cover expenses, savings, debt repayment, and other financial priorities. Here are some important considerations when allocating resources:

1. Essential Expenses: Start by allocating funds for essential expenses that are necessary for your daily living. This includes housing costs, utilities, transportation, groceries, insurance premiums, and healthcare expenses. Set aside a portion of your income to cover these fixed expenses and ensure they are given top priority in your budget.

2. Savings and Investments: Allocate a portion of your income towards savings and investments. This can include building an emergency fund, saving for specific goals (e.g., down payment on a home, education expenses), contributing to retirement accounts, or investing in stocks or mutual funds. Aim to allocate a percentage of your income to savings consistently to build wealth and achieve long-term financial goals.

3. Debt Repayment: If you have outstanding debts, allocating resources for debt repayment is crucial. Determine how much you can afford to allocate towards paying off your debts each month. Consider paying more than the minimum payment to accelerate the debt payoff process and save on interest charges. Prioritize higher-interest debts to eliminate costly debt obligations sooner.

4. Discretionary Expenses: Discretionary expenses are non-essential spending that can be adjusted based on your financial situation and priorities. Examples include dining out, entertainment, hobbies, and vacations. Allocate a reasonable amount of your income towards these categories, keeping in mind your financial goals and the need for balance in your budget.

5. Review and Adjust: Regularly review your budget to ensure that your resources are allocated according to your priorities. As your financial situation or goals change, you may need to reallocate resources. Analyze your spending patterns and make adjustments to align with your financial goals. It’s important to strike a balance between enjoyment and responsible financial management.

6. Be Realistic: When allocating resources, be realistic about your income and expenses. Consider the fluctuations in your income if you have irregular earnings. It’s essential to ensure that your allocated resources do not exceed your income and that you have enough to cover your expenses and savings targets. Adjust your allocations accordingly if needed.

7. Seek Professional Guidance: If you find it challenging to allocate resources in your budget, consider seeking professional guidance from financial advisors or budgeting experts. They can provide valuable insights and help develop a customized budgeting plan that aligns with your financial goals and circumstances.

Remember, the key to successfully allocating resources is to prioritize your expenses and financial goals based on your unique situation. By carefully considering your income, expenses, debts, and financial aspirations, you can allocate your resources effectively and make informed decisions that lead to financial stability and success.

Monitoring and Evaluating Performance

Monitoring and evaluating the performance of your budget is a critical step in the budgeting process. It involves regularly assessing your actual income and expenses, comparing them to your budgeted amounts, and making adjustments as necessary. This step is essential to ensure that you are staying on track with your financial goals and maintaining control over your finances. Here’s how to effectively monitor and evaluate the performance of your budget:

1. Track Your Expenses: Keep a record of all your expenses, both fixed and variable. Use budgeting tools or apps to track your spending and categorize your expenses. This will help you have a clear picture of where your money is going and whether you are staying within your budgeted amounts for each category.

2. Compare Actuals to Budget: Regularly compare your actual income and expenses to your budgeted amounts. This will allow you to identify any discrepancies or areas where you might be overspending. Pay close attention to expenses that tend to fluctuate and adjust your budget as needed to accommodate those changes.

3. Review Income Sources: Assess your actual income against your budgeted income. Identify any changes in your income sources or unexpected fluctuations. This will help you understand the stability of your income and make adjustments to your budget if necessary.

4. Identify Variances: Take note of any significant variances between your actual and budgeted amounts. Analyze the reasons behind these variances. It could be due to unexpected expenses, changes in income, or overspending in certain categories. Understanding these variances will guide you in making appropriate adjustments.

5. Make Adjustments: Based on your evaluation, make adjustments to your budget as needed. If you find that you are consistently overspending in a specific category, consider reallocating funds from other categories or finding ways to reduce expenses. Similarly, if you have surplus funds in certain categories, consider reallocating them towards other financial goals.

6. Plan for Upcoming Expenses: Anticipate future expenses and incorporate them into your budget. This can include upcoming bills, planned events, or other financial obligations. By planning ahead, you can ensure that you have allocated enough resources to cover these expenses without impacting your other financial goals.

7. Regularly Review Your Budget: Schedule regular reviews of your budget to check your progress and make any necessary adjustments. Aim to do this on a monthly basis or whenever significant changes occur in your financial situation. Regular reviews will help you stay accountable and ensure that you are consistently working towards your financial goals.

Remember, monitoring and evaluating the performance of your budget is an ongoing process. By regularly tracking your income and expenses, comparing them to your budgeted amounts, and making adjustments as necessary, you can maintain control over your finances and stay on track with your financial goals.

Making Adjustments and Revising the Budget

The budgeting process is not static; it requires ongoing monitoring, evaluation, and the flexibility to make adjustments when necessary. As you navigate through your financial journey, you may encounter changes in income, unexpected expenses, or shifts in financial priorities. Making adjustments and revising your budget ensures that it remains relevant and aligned with your current circumstances. Here’s how to effectively make adjustments and revise your budget:

1. Regularly Assess Your Budget: Schedule regular check-ins to assess the performance of your budget. This could be monthly, quarterly, or semi-annually, depending on your preference and the stability of your financial situation. Regular assessments allow you to identify areas where adjustments may be needed.

2. Monitor Changing Income: If your income changes, such as receiving a raise, starting a new job, or experiencing a decrease in income, it is important to adjust your budget accordingly. Re-evaluate your income sources and determine how this change impacts your ability to meet your financial goals.

3. Accommodate Unexpected Expenses: Unexpected expenses can arise at any time. When faced with unforeseen circumstances, such as medical bills, home repairs, or car maintenance, assess the impact on your budget. Consider reallocating funds from other categories or adjusting your savings goals to accommodate these unexpected expenses.

4. Revisit Financial Goals: As your financial circumstances and priorities evolve, it may be necessary to revise your financial goals. Review your long-term objectives and assess if they are still relevant and attainable. Adjust your budget to align with new goals or modify existing goals to reflect your current situation.

5. Reallocate Resources: Periodically review each expense category in your budget. Assess if the allocated amounts reflect your current needs and priorities. If you find that certain areas are consistently under or overspending, consider reallocating resources to ensure that your budget is better aligned with your spending patterns and financial goals.

6. Seek Balance: Striking a balance between your needs and wants is crucial for maintaining a sustainable budget. As you make adjustments and revisions, ensure that you are allocating resources not only toward essential expenses and financial goals but also leaving room for discretionary spending and enjoyment.

7. Flexibility and Adaptability: Remember that your budget is a flexible financial tool that should adapt to your changing circumstances. Be open to revising your budget as needed to reflect your current financial reality. Embrace the mindset of continuous improvement and adaptability as you navigate through different stages of your financial journey.

8. Track Your Progress: As you make adjustments and revisions to your budget, continue to monitor your progress and evaluate the impact of those changes. Regularly track your actual income and expenses against your revised budget to ensure that you are on the right path towards achieving your financial goals.

Making adjustments and revising your budget are essential components of effective financial management. By staying proactive, flexible, and responsive to changes, you can create a budget that remains relevant, supports your financial aspirations, and empowers you to make informed financial decisions.

Conclusion

The budgeting process is a fundamental tool for individuals and businesses to achieve financial stability, make informed decisions, and work towards their financial goals. By following the steps outlined in this article, you can create a comprehensive and effective budget that aligns with your income, expenses, and financial priorities.

The budgeting process starts with gathering relevant financial information and setting clear financial goals. This provides the foundation for developing a financial plan that outlines how you will allocate your resources. Allocating resources involves strategically distributing your income to cover essential expenses, savings, debt repayment, and discretionary spending.

Monitoring and evaluating the performance of your budget is crucial to maintain control over your finances. By regularly tracking your income and expenses, comparing them to your budgeted amounts, and making adjustments when necessary, you can stay on track towards your financial goals and make informed financial decisions.

Making adjustments and revising your budget is a natural and necessary part of the budgeting process. As your financial circumstances change, unexpected expenses arise, or goals shift, it is important to adapt your budget accordingly. Being flexible and open to revising your budget ensures that it remains relevant and supportive of your current financial situation.

In conclusion, the budgeting process empowers individuals and businesses to take control of their finances, achieve financial stability, and work towards their financial goals. By implementing a budgeting process, you can make informed decisions about your money, prioritize your expenses, save for the future, and ultimately achieve financial success.