Finance

What Is Chase Secure Banking Account

Published: October 13, 2023

Learn about Chase secure banking account and how it can help you manage your finances. Open an account today and enjoy peace of mind with secure banking

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Chase Secure Banking Account, where financial security meets convenience. In today’s fast-paced and increasingly digital world, having a reliable and secure banking account is essential. Chase understands this need and has introduced the Chase Secure Banking Account to cater to individuals who prioritize the safety and protection of their hard-earned money.

With the rise of cyber threats and financial scams, it is crucial to have a banking account that provides robust security measures to safeguard your funds. Chase Secure Banking Account goes above and beyond to ensure that your financial transactions are protected and your personal information remains confidential.

Whether you’re an existing Chase customer or looking to open a new account, the Chase Secure Banking Account offers a range of features and benefits that will meet your banking needs. From easy account management tools to exceptional customer support, Chase has designed this account to provide a seamless banking experience.

In this article, we will dive deep into the world of Chase Secure Banking Account, exploring its key features, eligibility requirements, fees and costs, as well as the security measures put in place to protect your finances. By the end, you’ll have a clear understanding of why Chase Secure Banking Account is a top choice for individuals seeking a truly secure and convenient banking solution.

Overview of Chase Secure Banking Account

Chase Secure Banking Account is a comprehensive banking solution offered by JPMorgan Chase, one of the largest and most trusted financial institutions in the United States. It is designed specifically for individuals who prioritize financial security and want a hassle-free banking experience.

One of the key features that sets Chase Secure Banking Account apart is its focus on security. Chase understands the importance of safeguarding your funds and personal information from potential threats. With this account, you can have peace of mind knowing that your money is protected and your transactions are secure.

In addition to its strong security measures, the Chase Secure Banking Account offers a wide range of features and benefits to enhance your banking experience. These include:

- No minimum balance requirement: Unlike some traditional bank accounts, Chase Secure Banking Account does not require you to maintain a minimum balance. This means you can have full control over your funds without worrying about any additional fees.

- Debit card with Zero Liability Protection: The Chase Secure Banking Account comes with a debit card that offers Zero Liability Protection. This means that you will not be held responsible for any unauthorized transactions made with your card. If your card is lost or stolen, simply report it to Chase, and they will take care of the rest.

- Access to a network of ATMs: With a Chase Secure Banking Account, you can enjoy access to a large network of ATMs across the country. This makes it convenient for you to withdraw cash, check your balance, or make deposits whenever you need.

- Online and mobile banking: Chase Secure Banking Account provides you with the flexibility to manage your finances on the go. With their user-friendly online and mobile banking platforms, you can easily transfer funds, pay bills, and monitor your account activity from the comfort of your own home or while on the move.

Overall, the Chase Secure Banking Account offers a comprehensive and secure banking solution that ensures the safety of your funds while providing convenient features to simplify your financial transactions. Whether you’re a student, a working professional, or a retiree, this account can cater to your banking needs and give you peace of mind.

Features and Benefits

Chase Secure Banking Account offers a wide range of features and benefits that are designed to make your banking experience secure, convenient, and hassle-free. Let’s take a closer look at some of the key features and the advantages they bring:

- Online and Mobile Banking: With Chase Secure Banking Account, you gain access to their robust online and mobile banking platforms. This allows you to easily manage your accounts, track your transactions, pay bills, and transfer funds from the comfort of your own home or on the go. The user-friendly interfaces and intuitive design make navigating through your accounts effortless.

- Debit Card: Each Chase Secure Banking Account comes with a debit card that offers convenience and flexibility. You can use it to make purchases online and in-store, withdraw cash from ATMs, and even set up automatic bill payments. The debit card also comes with Zero Liability Protection, ensuring you won’t be held responsible for any unauthorized transactions.

- Access to a Nationwide Network of ATMs: Chase has an extensive network of ATMs across the United States, giving you easy access to your funds wherever you are. Whether you’re traveling or in your local area, you can find a Chase or partner ATM nearby to withdraw cash or deposit funds.

- Overdraft Protection: Managing your finances can sometimes be challenging, but Chase Secure Banking Account makes it easier with its optional overdraft protection feature. This allows you to link another Chase account, such as a savings account, to cover any overdrafts on your checking account, helping you avoid overdraft fees.

- Alerts and Notifications: Stay informed and in control of your finances with Chase Secure Banking Account’s alerts and notifications feature. You can set up personalized alerts to receive updates on your account balance, transactions, and any suspicious activity. This adds an extra layer of security and helps you keep track of your money.

- Customer Support: Chase is known for its excellent customer support. If you ever encounter any issues or have questions, their knowledgeable and friendly customer service representatives are available to assist you via phone, email, or through the secure messaging feature within your online banking account.

These features and benefits make Chase Secure Banking Account a preferred choice for individuals who value convenience, security, and exceptional customer support. With these tools at your disposal, managing your finances becomes easier, giving you more time to focus on what matters most to you.

Eligibility and How to Open an Account

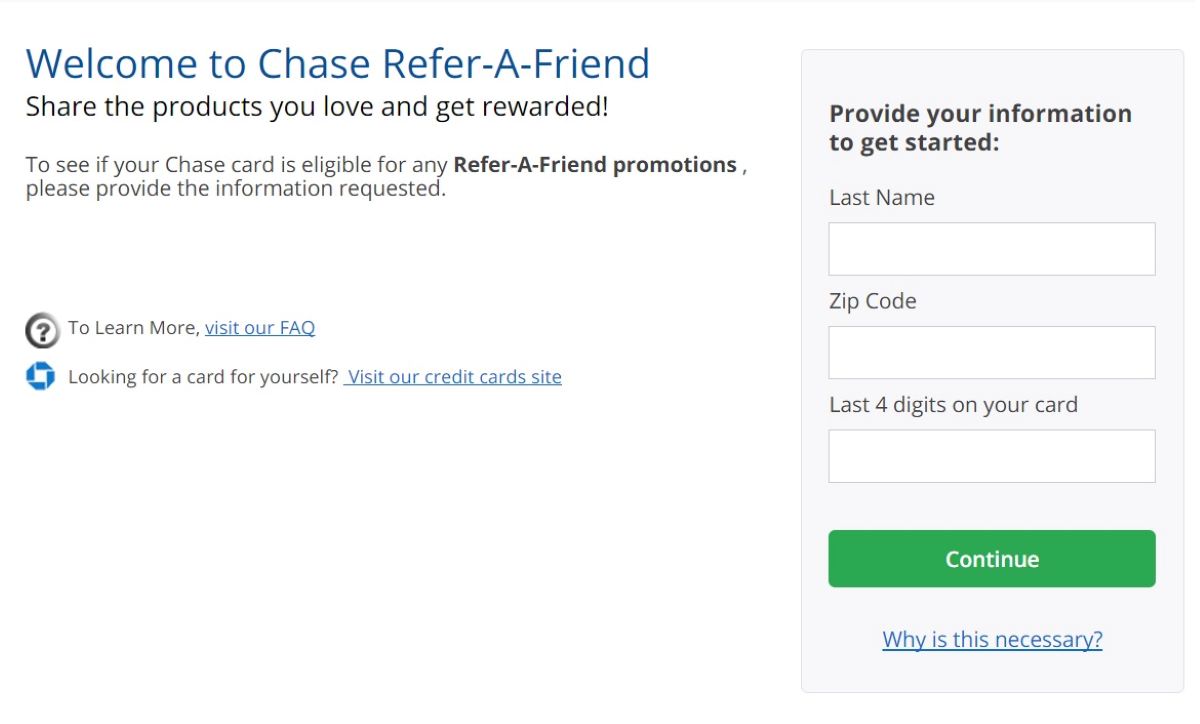

Opening a Chase Secure Banking Account is a straightforward process, and individuals can easily check if they meet the eligibility criteria. Here’s what you need to know:

To be eligible for a Chase Secure Banking Account, you must be at least 18 years old and have a valid Social Security Number. Additionally, you will need to provide a valid U.S. residential address and agree to Chase’s account terms and conditions.

Opening an account can be done in a few simple steps:

- Visit the Chase website or a local branch: You can start the account opening process by visiting the Chase website or a nearby Chase branch. If you prefer a face-to-face interaction, visiting a branch allows you to meet with a representative who can guide you through the process.

- Provide necessary documentation: During the account opening process, you will need to provide personal information such as your name, date of birth, Social Security Number, and residential address. It’s a good idea to have a valid government-issued identification, such as a driver’s license or passport, on hand.

- Deposit funds: To activate your account, you will need to make an initial deposit. The required minimum deposit amount may vary, so it’s recommended to check the current requirements.

- Review and verify the account details: Before finalizing the account opening, carefully review all the information you have provided. Ensure that the terms and conditions are acceptable to you and that you understand the features and fees associated with the Chase Secure Banking Account.

- Confirmation and account access: Once your account application is approved, you will receive confirmation of your new Chase Secure Banking Account. You can then access your account online, through the Chase mobile app, or by visiting a branch.

It’s important to note that the specific account opening requirements and procedures may vary slightly depending on your location and the branch or channel through which you choose to open your account.

By following these steps and meeting the eligibility requirements, you can easily open a Chase Secure Banking Account and begin enjoying its many benefits.

Fees and Costs

When considering a banking account, understanding the fees and costs associated with it is essential. Here is an overview of the fees and costs associated with Chase Secure Banking Account:

- Monthly Service Fee: The Chase Secure Banking Account has a monthly service fee of $___. However, this fee is waived for the first ___ months, providing you with an opportunity to experience the account benefits without incurring any charges.

- ATM Fees: While Chase has an extensive network of ATMs, using an ATM outside of their network may result in fees. It’s essential to be aware of any charges that may apply when using non-Chase ATMs.

- Overdraft Fees: If you opt for overdraft protection, Chase may charge a fee for each overdraft transaction. It’s important to keep track of your account balance and ensure sufficient funds are available to avoid these fees.

- Foreign Transaction Fees: If you use your Chase Secure Banking Account for international purchases or ATM withdrawals, foreign transaction fees may apply. It’s advisable to review the specific terms and conditions regarding these fees to avoid any surprises.

- Returned Item Fees: In the event that a check or electronic payment deposited into your account is returned unpaid, Chase may charge a fee. It’s crucial to ensure that you have sufficient funds or verify the legitimacy of any incoming payments to avoid these fees.

- Wire Transfer Fees: If you need to send or receive money through a wire transfer, Chase Secure Banking Account may involve fees for domestic and international wire transfers. These fees will vary depending on the transaction details, so it’s best to check with Chase for the most up-to-date information.

It’s important to note that fees and costs associated with banking accounts can change over time. Therefore, it’s advisable to review the current fee schedule provided by Chase or consult with a representative to ensure you have the most accurate and up-to-date information.

By understanding the associated fees and costs, you can make informed decisions and effectively manage your finances when using Chase Secure Banking Account.

Account Management Tools

Chase Secure Banking Account provides a wide range of account management tools to help you stay organized, monitor your finances, and conveniently access your banking services. These tools are designed to make managing your account simple and efficient. Here are some key account management tools offered by Chase:

- Online and Mobile Banking: Chase offers a user-friendly online and mobile banking platform where you can securely access and manage your account. Through these platforms, you can view your transaction history, check your account balance, transfer funds, pay bills, and set up alerts to stay updated on your account activity.

- Mobile Deposit: With Chase Secure Banking Account, you can easily deposit checks using your smartphone or tablet. Simply take a photo of the front and back of the endorsed check within the mobile banking app, and the funds will be deposited into your account. This feature eliminates the need to visit a branch or ATM to deposit checks.

- Bill Pay: Managing your bills becomes a breeze with Chase Secure Banking Account’s bill pay feature. You can set up one-time or recurring payments, ensuring that your bills are paid on time without the hassle of writing checks or visiting multiple websites.

- Account Alerts: Stay informed about your account activity with customizable alerts. Set up notifications to receive alerts when your balance reaches a certain limit, when a transaction exceeds a specified amount, or when there is suspicious activity on your account. These alerts help you better track and manage your finances.

- Budgeting Tools: Chase offers various budgeting tools to help you track your spending and manage your financial goals effectively. These tools provide insights into your spending patterns, categorize your expenses, and help you create personalized budgets to align your financial decisions with your objectives.

- Paperless Statements: Go green by signing up for paperless statements. With this feature, you can access your account statements online rather than receiving them via mail. Paperless statements are easily accessible, secure, and help reduce paper clutter.

These account management tools empower you to take control of your finances and easily manage your Chase Secure Banking Account. With their intuitive interfaces and convenient features, you can handle your banking needs at your own pace and on your preferred device.

Security Measures

Ensuring the security of your funds and personal information is a top priority for Chase Secure Banking Account. Chase has implemented several security measures to protect your account and give you peace of mind. Here are some of the key security features and measures:

- Two-Factor Authentication: Chase Secure Banking Account utilizes two-factor authentication, adding an extra layer of security to your account. This requires you to provide a verification code, in addition to your password, when logging in from a new or unrecognized device.

- Encryption and Secure Socket Layer (SSL) Technology: Chase employs industry-standard encryption and SSL technology to safeguard your sensitive information during online transactions. This ensures that your data remains protected and inaccessible to unauthorized parties.

- Real-Time Fraud Monitoring: Chase utilizes advanced fraud detection systems and real-time monitoring to detect and prevent unauthorized access to your account. Any suspicious activity or potential fraud triggers immediate alerts, allowing Chase to take prompt action to protect your account and notify you if necessary.

- Chip-Enabled Debit Card: Chase Secure Banking Account offers a chip-enabled debit card, which provides enhanced protection against counterfeit transactions. The embedded chip encrypts your card information, making it more secure compared to traditional magnetic stripe cards.

- Zero Liability Protection: With Chase Secure Banking Account’s Zero Liability Protection, you are not held responsible for any unauthorized transactions made on your account. If your card is lost, stolen, or compromised, report it to Chase immediately to ensure your funds remain safe.

- Secure Online and Mobile Banking: Chase’s online and mobile banking platforms incorporate numerous security features, including secure login credentials, session timeouts, and activity monitoring. These measures ensure that your account information remains protected while accessing your account online or through your mobile device.

Chase remains dedicated to staying at the forefront of digital security advancements and continuously works to enhance its security measures to protect its customers. By implementing these security features and measures, Chase Secure Banking Account provides you with peace of mind when it comes to the safety and security of your funds and personal information.

Customer Support

Chase Secure Banking Account understands the importance of providing exceptional customer support to ensure a smooth banking experience for its customers. With a dedicated team of knowledgeable professionals, Chase offers various channels and resources to assist you with any inquiries or concerns. Here are some of the customer support options available to Chase Secure Banking Account holders:

- 24/7 Customer Service: Chase provides round-the-clock customer service, allowing you to get assistance whenever you need it. Whether you have questions about your account, need help with online banking, or require support with a specific transaction, their customer service representatives are available to assist you.

- Phone Support: Chase offers a toll-free customer support hotline that you can contact to speak directly with a representative. Simply dial the customer service number provided on their website or the back of your debit card to connect with a knowledgeable professional who can address your concerns and provide guidance.

- Secure Messaging: If you prefer written communication, Chase provides a secure messaging feature within your online banking account. This allows you to send messages directly to their support team, enabling you to resolve issues or ask questions at your convenience.

- Branch Visits: Chase has a vast network of branches across the United States. If you prefer face-to-face assistance, you can visit a local branch and speak with a representative in person. They can provide personalized support, walk you through various banking services, and address any account-specific concerns.

- Online Resources: Chase offers a comprehensive online Help Center where you can find answers to frequently asked questions, access how-to guides, and browse through educational articles. The Help Center is a valuable resource that provides self-service options and can help you find solutions to common banking queries without needing to contact customer support.

Chase takes pride in delivering exceptional customer support and strives to ensure that your inquiries are addressed promptly and effectively. No matter how you choose to reach out for assistance, rest assured that Chase is committed to providing you with the highest level of customer service.

Conclusion

In conclusion, Chase Secure Banking Account offers a secure and convenient banking solution for individuals who prioritize the safety and protection of their finances. With its range of features and benefits, this account provides a seamless banking experience that meets the needs of modern consumers.

Chase understands the importance of security in today’s digital landscape, and they have implemented robust measures to safeguard your funds and personal information. From two-factor authentication to real-time fraud monitoring, Chase takes proactive steps to ensure that your account stays protected.

Opening a Chase Secure Banking Account is an easy and straightforward process, and once you have it, you’ll gain access to an array of account management tools. The online and mobile banking platforms, along with features like mobile deposit and budgeting tools, empower you to efficiently manage your finances on your terms.

Furthermore, Chase’s commitment to exceptional customer support ensures that you’re never far from assistance. Their 24/7 customer service, secure messaging, and extensive branch network provide various avenues for obtaining guidance and resolving any concerns you may have.

While there are fees associated with the Chase Secure Banking Account, they are transparent and can be easily managed by understanding the fee schedule and utilizing the account management tools available to you.

Overall, Chase Secure Banking Account combines financial security, convenience, and exceptional customer support to deliver a banking experience that is tailored to your needs. Whether you’re a student, a working professional, or a retiree, this account provides the peace of mind and convenience you deserve.

So, take the next step towards securing your financial future and open a Chase Secure Banking Account today. Experience the benefits of a reliable and secure banking partner that prioritizes your financial well-being.