Home>Finance>What Is Exempt From Flood Insurance Requirements?

Finance

What Is Exempt From Flood Insurance Requirements?

Modified: February 21, 2024

Learn what types of properties or situations may be exempt from flood insurance requirements and how it can impact your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to protecting your property from potential damage, flood insurance is a crucial consideration. Floods can cause significant destruction, leading to costly repairs and losses. In certain cases, insurance companies require property owners to obtain flood insurance as a mandatory requirement. However, there are certain exemptions to these flood insurance requirements, depending on various factors such as location, property type, and specific circumstances.

In this article, we will explore the concept of flood insurance requirements and the exemptions that can apply to certain properties. Whether you are a homeowner, business owner, or farmer, understanding these exemptions can help you navigate the intricacies of flood insurance and potentially save you money on insurance premiums.

Before we delve into the exemptions, let’s establish a clear understanding of what flood insurance requirements entail. Flood insurance requirements are typically determined by insurance companies and are based on factors such as the property’s location in a flood zone, risk assessment, and government regulations.

Flood insurance is designed to provide coverage for property damage and loss caused by flooding. It can help homeowners, business owners, and farmers recover financially in the event of a flood, which is not covered by standard homeowners or property insurance policies. However, certain properties may be exempt from these requirements, depending on their unique circumstances.

Understanding the exemptions from flood insurance requirements is valuable information, as it directly affects the insurance coverage you need for your property. By staying informed, you can make informed decisions about insuring your property against potential flood damage.

Definition of Flood Insurance Requirements

Flood insurance requirements refer to the obligation imposed by insurance companies on property owners to obtain flood insurance coverage. These requirements are typically based on several factors, including the property’s location in a designated flood zone, the risk assessment of potential flood damage, and government regulations. The purpose of flood insurance requirements is to ensure that property owners have adequate coverage in the event of a flood, which is not covered by standard homeowners or property insurance policies.

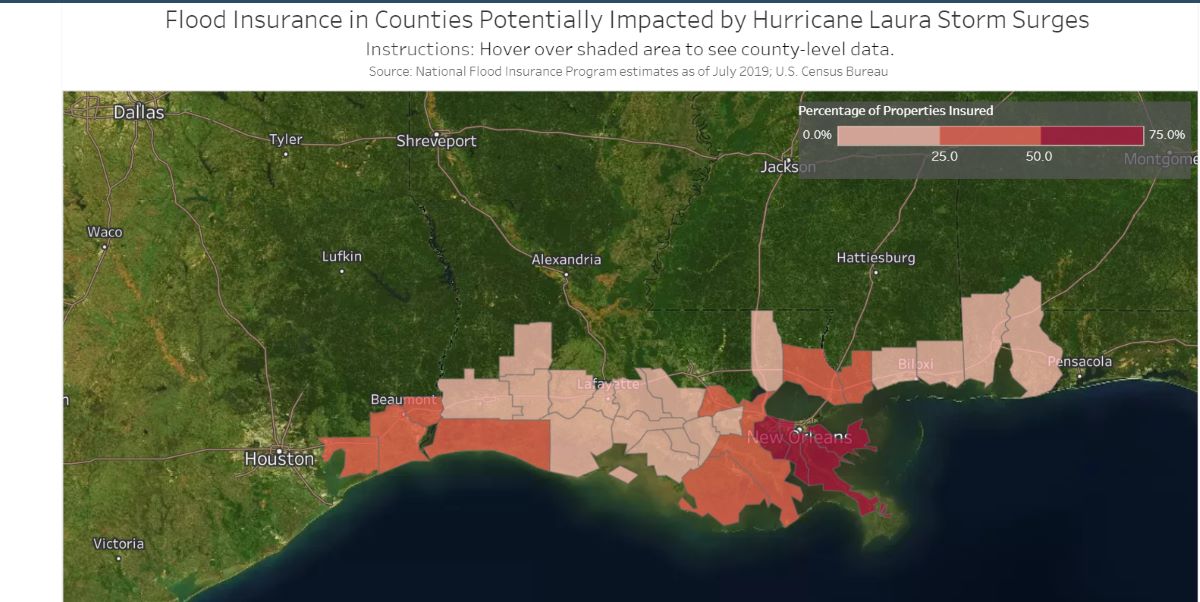

In the United States, the Federal Emergency Management Agency (FEMA) plays a significant role in regulating flood insurance requirements. FEMA establishes flood zones and assigns each area a specific risk designation based on the likelihood of flooding. Properties located in high-risk flood zones, also known as Special Flood Hazard Areas, are subjected to stricter flood insurance requirements.

Insurance companies use the FEMA flood maps and risk assessments as guidelines when determining the necessity of flood insurance for a specific property. If a property is located in a designated flood zone or has a high risk of flooding, the insurance company may require the property owner to purchase flood insurance as a condition of obtaining a mortgage or to protect their investment.

Flood insurance requirements vary depending on the property’s location and the level of risk. In some cases, property owners may be required to purchase full coverage for both the structure and its contents, while in other cases, only coverage for the structure may be required. Premiums for flood insurance are typically determined by factors such as the property’s elevation, proximity to bodies of water, construction type, and the desired coverage amount.

It is important for property owners to familiarize themselves with the flood insurance requirements applicable to their properties. Failure to comply with these requirements may result in financial losses in the event of a flood, as standard homeowners or property insurance policies typically do not cover flood damage.

Now that we have a clear understanding of what flood insurance requirements entail, let’s explore the exemptions that may apply to certain properties.

Exemptions from Flood Insurance Requirements

While flood insurance requirements are mandatory for many properties located in flood-prone areas, there are certain exemptions that can apply in specific circumstances. These exemptions relieve property owners from the obligation to purchase flood insurance, potentially providing significant cost savings. The exemptions can vary depending on the property type, location, and specific conditions. Let’s take a look at some of the common exemptions from flood insurance requirements.

- Properties outside designated flood zones: One of the most common exemptions applies to properties located outside designated flood zones. If your property is not situated in a high-risk flood zone or a Special Flood Hazard Area, your insurance company may not require you to purchase flood insurance. However, it is important to note that while not mandatory, it may still be advisable to obtain coverage, as floods can occur in unexpected areas.

- Properties with a low flood risk: Even if your property is located within a designated flood zone, if it has a low risk of flooding, you may be exempt from flood insurance requirements. Insurance companies take into account factors such as the property’s elevation, proximity to bodies of water, and flood mitigation measures in determining the level of risk. If these factors indicate a minimal flood risk, you may be exempt from the insurance requirement.

- Properties with no mortgages: If you own your property outright and do not have a mortgage, you are not legally obligated to carry flood insurance. However, it is still recommended to evaluate the potential risks and consider obtaining coverage to protect your investment.

- Properties with federally-backed loans: While most properties with federally-backed mortgages are required to carry flood insurance, there are certain exemptions for properties such as agricultural buildings or structures with minimal value. These exemptions are provided under specific circumstances, so it is important to consult with your insurance provider or lender to determine if you qualify for an exemption.

It’s crucial to note that even if your property is exempt from flood insurance requirements, it doesn’t mean that you are immune to the risk of flooding or the potential financial consequences. Flooding can occur even in areas with a lower risk, and the damage caused can still be significant. Thus, it is prudent to carefully assess the flood risk in your area and consider obtaining flood insurance voluntarily to protect your property and assets.

Next, let’s explore some of the specific exemptions that apply to residential properties.

Common Exemptions

In addition to the general exemptions from flood insurance requirements, there are specific exemptions that commonly apply to different types of properties. These exemptions provide relief from obtaining flood insurance coverage, depending on the property’s classification and other factors. Let’s explore some of the common exemptions in more detail.

- Residential properties: In many cases, residential properties that are used as primary residences are exempt from flood insurance requirements if they are located in low-risk flood zones or areas with minimal flood hazards. This exemption applies to single-family homes, condominiums, and certain types of mobile homes.

- Historical properties: Historical properties that are listed on the National Register of Historic Places or protected by local historic preservation ordinances may be exempt from flood insurance requirements. These exemptions aim to reduce the financial burden on owners of historically significant properties, while still encouraging proper preservation and maintenance.

- Properties with flood mitigation measures: Some properties that have implemented flood mitigation measures to reduce the risk of flooding may qualify for exemptions from flood insurance requirements. These measures can include elevating the structure, installing flood barriers or flood vents, or implementing proper drainage systems. The effectiveness of such measures in mitigating flood risk is taken into consideration in granting exemptions.

- Low-value properties: Properties with low values, as determined by the insurance company, may be exempt from flood insurance requirements. The threshold for determining low-value properties can vary among insurance providers, but this exemption generally applies to properties with a minimal replacement cost and where the risk of financial loss due to flooding is deemed relatively low.

It is essential to note that the specific exemptions may vary depending on the insurance provider, state regulations, and the property’s unique circumstances. Therefore, it is advisable to consult with your insurance agent or company to determine if your property qualifies for any exemptions from flood insurance requirements.

While exemptions can provide relief from the mandatory requirement of flood insurance coverage, it is important to remember that floods can occur unexpectedly and can cause substantial damage to your property and belongings. Even if your property is exempt, it may still be prudent to consider purchasing voluntary flood insurance to protect your investment and mitigate potential financial losses.

Next, let’s examine the exemptions that may apply to commercial properties.

Residential Exemptions

Residential properties, including single-family homes, condominiums, and certain types of mobile homes, may qualify for exemptions from flood insurance requirements under specific circumstances. These exemptions aim to provide relief to homeowners living in low-risk flood zones or areas with minimal flood hazards, while still encouraging responsible protection measures. Let’s explore some of the residential exemptions in more detail.

- Low-risk flood zones: Residential properties located in low-risk flood zones or areas with minimal flood hazards are commonly exempt from flood insurance requirements. These areas are typically designated as zones with a low probability of flooding, based on factors such as elevation, historical flood data, and flood mitigation efforts. It’s important to note that flood risks can vary within a specific area, so property owners should still be aware of local conditions and consider obtaining coverage.

- Primary residences: Properties used as primary residences may be exempt from flood insurance requirements, even if they are located in designated flood zones. This exemption recognizes the importance of providing relief to homeowners, as their primary residences are crucial for their well-being and security. However, it is always advisable to evaluate the flood risk in the area and consider obtaining coverage voluntarily, even if not mandated.

- Properties with low-value structures: Residential properties with structures of minimal value may be exempt from flood insurance requirements. The determination of low-value structures can vary among insurance providers, but generally, this exemption applies to properties where the cost of replacing the structure and potential financial loss due to flooding is considered relatively low. Property owners should consult with their insurance company to determine if their structures qualify for this exemption.

- Owner-occupied multifamily properties: Owner-occupied multifamily properties with four or fewer units are generally exempt from flood insurance requirements. This exemption applies when the property is the primary residence of the owner and meets other specific criteria. However, it’s important to stay informed about flood risks in the area and consider obtaining coverage if necessary.

It’s crucial to note that flood risks can change over time due to various factors such as weather patterns, climate change, or alterations to the surrounding environment. Therefore, even if your residential property is exempt from flood insurance requirements, it is still advisable to monitor flood conditions, stay informed about any changes in flood zones, and consider obtaining voluntary flood insurance coverage to protect your home and belongings.

Now, let’s explore the exemptions that may apply to commercial properties.

Commercial Exemptions

Commercial properties can also qualify for exemptions from flood insurance requirements under certain circumstances. These exemptions provide relief for business owners, helping to alleviate the financial burden of obtaining flood insurance coverage. Let’s delve into some of the common exemptions that may apply to commercial properties.

- Low-risk flood zones: Similar to residential properties, commercial properties located in low-risk flood zones or areas with minimal flood hazards are often exempt from flood insurance requirements. These areas are typically determined based on factors such as elevation, historical flood data, and mitigation efforts. While this exemption may apply, it’s still important for business owners to consider the potential impact of flooding and evaluate the need for voluntary coverage.

- Properties with substantial flood mitigation measures: Commercial properties that have implemented significant flood mitigation measures may qualify for exemptions from flood insurance requirements. These measures can include constructing flood barriers or levees, implementing drainage systems, or elevating the structure above the base flood elevation. The effectiveness of these measures in mitigating flood risk is taken into consideration when granting exemptions.

- Business properties with low-value structures: Commercial properties with structures of minimal value may be exempt from flood insurance requirements. This exemption is similar to the residential exemption for low-value structures, where the cost of replacing the structure and potential financial loss due to flooding is considered relatively low. Business owners should consult with their insurance company to determine if their structures meet the criteria for this exemption.

- Properties outside designated flood zones: Commercial properties located outside designated flood zones or areas with minimal flood hazards are generally exempt from flood insurance requirements. If the property is not in a high-risk flood area or Special Flood Hazard Area, the insurance company may not require the business owner to obtain flood insurance. However, it’s still essential to assess the flood risk carefully and consider voluntary coverage, as floods can still occur unexpectedly.

While these exemptions provide relief to commercial property owners, it’s important to note that flooding can lead to significant financial losses for businesses. Even if a property is exempt from flood insurance requirements, business owners should assess the potential risks, evaluate the value of their assets, and consider obtaining voluntary flood insurance coverage to protect their business and ensure business continuity in the event of a flood.

Now that we have explored the exemptions applicable to commercial properties, let’s discuss exemptions that may apply to agricultural properties.

Agricultural Exemptions

Agricultural properties, including farms, ranches, and agricultural buildings, may qualify for exemptions from flood insurance requirements under specific circumstances. These exemptions recognize the unique nature of agricultural operations and provide relief to farmers and ranchers from the mandatory purchase of flood insurance. Let’s explore some of the common agricultural exemptions in more detail.

- Agricultural structures with minimal value: Agricultural buildings or structures with minimal value may be exempt from flood insurance requirements. The determination of low-value structures can vary among insurance providers, but generally, this exemption applies to structures where the replacement cost and potential financial loss due to flooding are considered relatively low. Farmers should consult with their insurance company to determine if their structures meet the criteria for this exemption.

- Agricultural properties outside designated flood zones: Agricultural properties located outside designated flood zones or areas with minimal flood hazards are commonly exempt from flood insurance requirements. If the property is not situated in a high-risk flood area or Special Flood Hazard Area, the insurance company may not require farmers or ranchers to obtain flood insurance. However, it’s essential to assess the flood risk carefully and consider voluntary coverage, as floods can occur unexpectedly.

- Properties with limited agricultural activity: Agricultural properties with limited agricultural activity may qualify for exemptions from flood insurance requirements. The definition of limited activity can vary among insurance providers and may depend on factors such as crop cultivation, livestock raising, or other agricultural operations. Farmers should consult with their insurance company to determine if their agricultural activities meet the criteria for this exemption.

- Small agricultural structures: Small agricultural structures, such as storage sheds or greenhouses, may be exempt from flood insurance requirements. The specific size limitations for these structures vary among insurance providers. Farmers should consult with their insurance company to determine if their small agricultural structures qualify for this exemption.

While these exemptions provide relief for agricultural properties, it is important to recognize the potential risks that flooding can pose to farming operations. Even if a property is exempt from flood insurance requirements, farmers and ranchers should carefully evaluate the potential impact of flooding on their crops, livestock, and equipment. It may be advisable for agricultural property owners to consider obtaining voluntary flood insurance coverage to protect their farming investment and ensure business continuity in the face of a flood event.

Now that we have explored the exemptions that may apply to agricultural properties, let’s wrap up our discussion on flood insurance exemptions.

Exemptions for Properties Outside Flood Zones

While flood insurance requirements primarily focus on properties located within designated flood zones or areas with a higher risk of flooding, there are exemptions that can apply to properties outside these flood zones. These exemptions provide relief for property owners in areas with lower flood risks, recognizing that the likelihood of experiencing significant flood damage is minimal. Let’s explore some of the common exemptions for properties outside flood zones.

- Low-risk flood areas: Properties located in low-risk flood areas, which are not designated as flood zones, may be exempt from flood insurance requirements. These areas typically have a relatively low probability of flooding based on factors such as elevation, proximity to water sources, and historical flood data. However, it’s important to remember that no area is completely immune to the risk of flooding, and property owners should still assess their potential exposure to flood risks and consider obtaining coverage voluntarily.

- Natural land elevations: If a property’s elevation is significantly higher than the surrounding area, it may qualify for an exemption from flood insurance requirements. The natural land elevation acts as a natural barrier against floodwaters, reducing the property’s exposure to flood-related hazards. Insurance companies may consider these natural elevations as justification for exempting the property from flood insurance requirements.

- Properties with no mortgages: If a property is owned outright and does not have a mortgage, the property owner is not legally obligated to carry flood insurance. This exemption recognizes that the decision to obtain flood insurance should be voluntary for property owners who have full ownership and financial responsibility for their properties.

- Properties with no federal assistance: Properties that have not received federal assistance in the form of loans or grants are generally exempt from flood insurance requirements. This exemption applies to properties without any financial ties or obligations to the federal government, as they are not subject to mandatory flood insurance requirements as a condition of receiving federal aid.

It’s important to note that even though a property may be exempt from flood insurance requirements, property owners should still consider the potential risks and impacts of flooding. Unforeseen circumstances or drastic weather changes can still result in flooding, causing significant damage and financial loss. Therefore, property owners should carefully evaluate their flood risk exposure and consider obtaining voluntary flood insurance coverage to protect their property and assets.

Now let’s conclude our discussion on flood insurance exemptions.

Conclusion

Flood insurance requirements are an important consideration for property owners, as they ensure proper coverage and protection against flood-related damages. However, certain exemptions may apply to relieve property owners from mandatory flood insurance requirements. Understanding these exemptions is crucial for homeowners, business owners, and farmers alike, as it can help save on insurance premiums while still maintaining appropriate coverage.

Exemptions from flood insurance requirements can vary depending on factors such as property type, location, and specific circumstances. Common exemptions include properties located outside designated flood zones, properties with low flood risk, properties with no mortgages, and properties with specific mitigation measures in place. Residential properties, commercial properties, and agricultural properties each have their own set of exemptions that property owners should be aware of.

However, it is important to note that even if a property is exempt from flood insurance requirements, it does not mean that the property is immune to the risk of flooding. Floods can occur unexpectedly and cause significant damage, regardless of location or risk level. Property owners should carefully evaluate their flood risk, considering factors such as elevation, proximity to bodies of water, and historical flood data.

While exemptions may relieve property owners from mandatory flood insurance, it is still advisable to consider obtaining voluntary coverage to protect one’s property and assets. Voluntary flood insurance provides an added layer of protection and financial security against unforeseen flood events.

In conclusion, being aware of the flood insurance requirements and exemptions applicable to your property is essential. By understanding these exemptions, property owners can make informed decisions about their insurance coverage, safeguarding their investments, and mitigating potential financial losses in the event of a flood.