Finance

What Is Private Flood Insurance

Published: November 21, 2023

Looking for private flood insurance? Learn all about this financial option and how it can protect your property and finances in times of flooding.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Private Flood Insurance?

- Benefits of Private Flood Insurance

- Coverage Options

- Eligibility Criteria

- How Does Private Flood Insurance Work?

- The Difference Between Private Flood Insurance and the National Flood Insurance Program (NFIP)

- Comparison of Private Flood Insurance and the National Flood Insurance Program (NFIP)

- Common Misconceptions about Private Flood Insurance

- How to Purchase Private Flood Insurance

- Conclusion

Introduction

When it comes to protecting your property from natural disasters, flood insurance plays a crucial role. While most homeowners are familiar with the National Flood Insurance Program (NFIP), there is another option known as private flood insurance that is worth considering.

Private flood insurance is a type of coverage provided by private insurance companies, rather than the government-backed NFIP. It offers an alternative to homeowners who may not find adequate coverage or affordable premiums through the NFIP. Private flood insurance policies are becoming increasingly popular due to their customizable coverage options and potential cost savings.

Understanding the basics of private flood insurance and how it differs from the NFIP is essential for homeowners looking to protect their most valuable investments. In this article, we will dive deep into the world of private flood insurance, exploring its benefits, coverage options, eligibility criteria, and more.

Financescape is here to guide you through the complexities of flood insurance so you can make an informed decision that meets your specific needs. Let’s start by understanding what private flood insurance is and how it can provide you with enhanced protection.

What is Private Flood Insurance?

Private flood insurance is a type of insurance coverage offered by private insurance companies to protect homeowners against flood damage. Unlike the National Flood Insurance Program (NFIP), which is backed by the government, private flood insurance is underwritten by private insurers and follows their own guidelines and risk assessments.

Private flood insurance allows homeowners to obtain coverage that goes beyond the standard policies offered by the NFIP. It provides more flexibility and customization options to meet the unique needs of individual properties. Private insurers often offer higher policy limits, allowing homeowners to insure their properties for their full value, including the cost of rebuilding.

Private flood insurance policies can provide coverage for the structure of the home, personal belongings, and additional living expenses if you are unable to reside in your home due to flood damage. Some policies may also offer coverage for features such as swimming pools, detached garages, and other structures on your property.

One of the major advantages of private flood insurance is the ability to tailor the coverage to your specific needs. With private insurers, you can choose from a range of deductibles, policy limits, and additional coverage options that suit your risk tolerance and budget. This level of customization can provide peace of mind knowing that you are adequately protected in the event of a flood.

It’s important to note that private flood insurance is not available in all areas. Insurers typically evaluate the flood risk of specific properties before determining whether to provide coverage. So, homeowners located in high-risk flood zones or flood-prone areas may have more limited options for private flood insurance coverage.

Now that we have a better understanding of what private flood insurance entails, let’s explore the benefits it offers.

Benefits of Private Flood Insurance

Private flood insurance offers homeowners a range of benefits that can make it a compelling option for protecting their properties. Here are some key advantages of private flood insurance:

- Customized Coverage: One of the significant benefits of private flood insurance is the ability to customize your coverage. Unlike the NFIP, which has standard policy limits and coverage options, private insurers offer a more tailored approach to meet your specific needs. This means you can select the coverage limits, deductibles, and additional coverage options that work best for you.

- Higher Policy Limits: Private flood insurance often allows for higher policy limits than the NFIP. This means that you can insure your home and personal belongings for their full value, including the cost of rebuilding and replacing items that are damaged or destroyed in a flood.

- More Comprehensive Coverage: Private flood insurance policies may provide additional coverage options that go beyond the standard coverage offered by the NFIP. This can include coverage for additional structures on your property, such as detached garages or swimming pools, as well as coverage for living expenses if you are displaced from your home due to flood damage.

- Flexible Deductible Options: Private insurers offer a range of deductible options, allowing you to choose a deductible that aligns with your financial situation and risk tolerance. This flexibility can help you find a balance between a manageable premium and the level of out-of-pocket expense you are comfortable with.

- Potential Cost Savings: While private flood insurance premiums may vary depending on the location and flood risk of your property, in some cases, private policies can offer cost savings compared to the NFIP. This is especially true for homeowners who have lower flood risk or have taken proactive measures to mitigate their property’s flood risk, such as elevating their home or installing flood-resistant features.

Private flood insurance provides homeowners with the opportunity to obtain coverage that is tailored to their unique needs and offers potentially more comprehensive protection than the standard options provided by the NFIP. The choice between private flood insurance and the NFIP ultimately depends on various factors, such as your property’s location, flood risk, and budget. It’s important to carefully consider your options and compare quotes from different insurers to determine the best solution for your flood insurance needs.

Next, let’s explore the coverage options available with private flood insurance.

Coverage Options

Private flood insurance offers homeowners a range of coverage options to meet their specific needs. These coverage options can vary between insurance providers, but here are some common elements to consider:

- Building Coverage: This coverage option provides protection for the physical structure of your home in the event of flood damage. It typically includes the walls, foundation, roof, and other permanent fixtures. Make sure to review the policy details to understand the specific coverage limits and exclusions.

- Contents Coverage: Contents coverage helps protect your personal belongings, such as furniture, appliances, clothing, and electronics, in the event of flood damage. It’s important to take an inventory of your possessions and determine the appropriate coverage limit to ensure you have adequate protection for your belongings.

- Additional Living Expenses: If your home becomes temporarily uninhabitable due to flood damage, additional living expenses coverage can help cover the costs associated with temporary accommodation, meals, and other living expenses while your home is being repaired or rebuilt.

- Other Structures Coverage: This coverage option extends protection to other structures on your property, such as detached garages, sheds, or fences. Check the policy terms to understand the coverage limits and any exclusions that may apply.

- Replacement Cost Coverage: Some private flood insurance policies offer replacement cost coverage, which ensures that you receive the full replacement value for your damaged or destroyed property, rather than the actual cash value. This can be particularly beneficial for homeowners who want to fully recover their losses without depreciation deductions.

It’s important to carefully review the coverage options provided by private flood insurance policies and assess your specific needs. Consider factors such as the value of your property, the contents you want to protect, and any additional structures or features on your premises. Additionally, be aware of any exclusions or limitations outlined in the policy documents to ensure you have a comprehensive understanding of your coverage.

Now that we understand the coverage options available, let’s discuss the eligibility criteria for private flood insurance.

Eligibility Criteria

Eligibility for private flood insurance can vary between insurance providers and is often determined based on factors such as the location and flood risk of your property. While each insurer may have their own specific criteria, here are some common considerations:

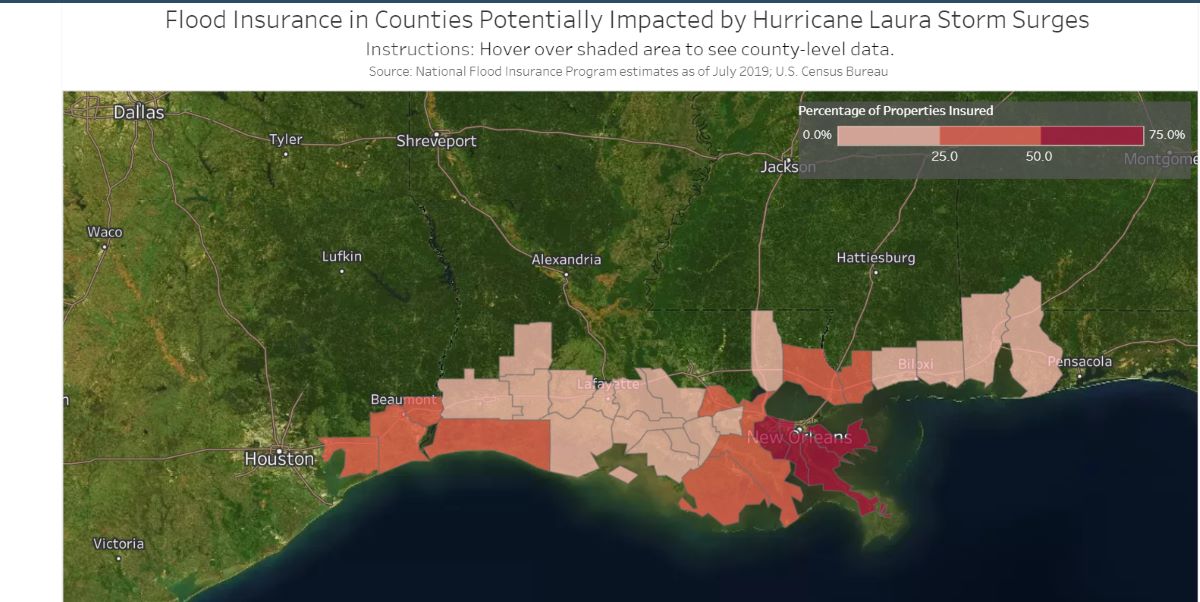

- Flood Zone: Private insurers assess the flood zone classification of your property to determine eligibility. Properties located in high-risk flood zones, such as Special Flood Hazard Areas (SFHAs), may have more limited options for private flood insurance coverage.

- Property Elevation: The elevation of your property is a key factor in flood risk assessment. Homes located at higher elevations are generally considered to have a lower risk of flooding and may be more eligible for private flood insurance coverage.

- Flood Mitigation Measures: If you have implemented flood mitigation measures to reduce the flood risk of your property, such as installing flood-resistant features or elevating your home, you may be seen as a lower-risk applicant by private insurers, increasing your eligibility for coverage.

- Claim History: Private insurance companies may also consider your previous flood insurance claim history when determining your eligibility. A history of frequent or substantial claims may affect your eligibility or premium rates.

- Property Value: The value of your property is another factor that insurance providers may consider. Higher-value properties may have more options for private flood insurance coverage due to the potential for higher premiums.

- Availability in the Area: Private flood insurance availability can vary by location. While some areas have multiple insurers offering coverage, others may have limited options or none at all. It’s important to research and compare insurance providers to find those that offer coverage in your area.

It’s worth noting that eligibility for private flood insurance is not guaranteed for all properties. If your property is located in an area with high flood risk or in a flood-prone zone, you may have limited options for private coverage. In such cases, the NFIP may be the primary flood insurance option available to you.

Now that we understand the eligibility criteria, let’s delve into how private flood insurance works.

How Does Private Flood Insurance Work?

Private flood insurance operates similarly to other types of property insurance. Here’s a step-by-step breakdown of how it typically works:

- Evaluation and Application: To obtain private flood insurance, you will first need to contact insurance providers that offer this coverage in your area. They will evaluate your property based on factors such as location, flood risk, and eligibility criteria. You will then need to submit an application with relevant information about your property.

- Underwriting: Once your application is received, the insurance provider will assess the flood risk associated with your property. They may use various methods, including flood zone maps, elevation models, and historical flood data, to determine the risk level. Based on their evaluation, the insurer will decide whether to offer coverage and what premiums and coverage limits will be applicable to your policy.

- Policy Terms and Premiums: If your application is accepted, the insurance provider will issue a private flood insurance policy. The policy terms will outline the coverage options, exclusions, deductibles, and policy limits. The premium amount, which is the cost of the insurance, will also be specified based on the assessed flood risk of your property.

- Payment of Premiums: As with other insurance policies, you will be required to pay the premium for your private flood insurance coverage. Premiums can be paid annually or in installments, depending on the terms and conditions set by the insurance provider.

- Effective Date and Coverage: Your private flood insurance coverage becomes effective on the specified policy start date. From that point onward, your property will be protected against flood damage as outlined in the policy. It’s important to note any waiting periods specified in the policy before coverage becomes fully effective.

- Filing a Claim: In the event of flood damage to your insured property, you should promptly contact your insurance provider to initiate the claims process. This typically involves providing details of the damage, supporting documentation, and any required proof of loss forms. The insurance company will assess the claim and determine the amount of coverage to be provided based on the policy terms.

- Claim Payment: If your claim is approved, the insurance provider will issue a payment to cover the costs of the eligible damages, up to the policy limits and after the deductible is met. The claim payment can be used to repair or rebuild your property and replace damaged belongings, as specified in the policy.

It’s important to carefully review the terms and conditions of your private flood insurance policy to understand the coverage provided, claim procedures, and any applicable limitations or exclusions. Additionally, maintaining open communication with your insurance provider and promptly reporting any changes or updates regarding your property is crucial to ensure the continued coverage and effectiveness of your policy.

Next, let’s explore the key differences between private flood insurance and the National Flood Insurance Program (NFIP).

The Difference Between Private Flood Insurance and the National Flood Insurance Program (NFIP)

Private flood insurance and the National Flood Insurance Program (NFIP) are two distinct options for homeowners seeking flood insurance coverage. Understanding the differences between these two options is crucial to make an informed decision. Here are the main distinctions:

- Source of Coverage: The most notable difference between private flood insurance and the NFIP is the source of coverage. Private flood insurance is offered by private insurance companies, while the NFIP is a government-backed program administered by the Federal Emergency Management Agency (FEMA).

- Premium Pricing: Private flood insurance premiums are typically determined based on the individual property’s flood risk, coverage options, and customization. The NFIP, on the other hand, has standardized rates based on flood zone classifications and the year of construction of the property. This means that private flood insurance may offer more flexibility in terms of premium pricing.

- Policy Limits: Private flood insurance policies often have higher policy limits compared to the NFIP. This means that homeowners can potentially obtain coverage for the full value of their property, including the cost of rebuilding or replacement of belongings. The NFIP, on the other hand, has coverage limits that are capped at certain levels for both building and contents coverage.

- Coverage Options: Private flood insurance offers more flexibility and customizable coverage options compared to the NFIP. Private insurers may provide additional coverage for items such as detached structures, personal property, and living expenses. The NFIP, on the other hand, offers more standardized coverage options with fewer customizable features.

- Claims Processing: The claims process for private flood insurance is typically handled directly between the homeowner and the insurance provider. Private insurers may have streamlined processes and quicker claims settlements. In contrast, the NFIP claims process is managed by FEMA, which means there may be more bureaucracy and potentially longer wait times for claim settlements.

- Availability: Private flood insurance is not available in all areas. Insurance providers assess the flood risk of individual properties to determine whether to offer coverage and at what terms. The NFIP, on the other hand, is available nationwide and provides coverage in communities that participate in the program.

It’s important to carefully consider your needs, budget, and the unique characteristics of your property when deciding between private flood insurance and the NFIP. Homeowners located in high-risk flood zones or areas where private flood insurance is not readily available may find the NFIP to be their primary option. However, for those seeking more customizable coverage options and potentially lower premiums, private flood insurance may be the preferred choice.

Now, let’s compare private flood insurance and the NFIP in more detail.

Comparison of Private Flood Insurance and the National Flood Insurance Program (NFIP)

When it comes to flood insurance, homeowners have the option to choose between private flood insurance and the National Flood Insurance Program (NFIP). Here is a detailed comparison of these two options:

- Source of Coverage: Private flood insurance is provided by private insurance companies, while the NFIP is a government program administered by FEMA.

- Coverage Options: Private flood insurance offers more flexibility and customizable coverage options compared to the NFIP. Private insurers often provide additional coverage for detached structures, personal belongings, and living expenses, whereas the NFIP has standardized coverage options.

- Premium Pricing: Private flood insurance premiums are determined based on the individual property’s flood risk, coverage options, and customization. The NFIP has standardized rates based on flood zone classifications and the year of construction of the property.

- Policy Limits: Private flood insurance policies typically have higher policy limits than the NFIP. This means homeowners can potentially obtain coverage for the full value of their property, including the cost of rebuilding. The NFIP has capped coverage limits for both building and contents coverage.

- Claims Process: Private flood insurance claims are typically processed directly between the homeowner and the insurance provider, with potentially faster claims settlements. The NFIP claims process is managed by FEMA, which may involve more bureaucracy and potentially longer wait times for claim settlements.

- Availability: Private flood insurance availability varies by location and the flood risk of individual properties. The NFIP, on the other hand, is available nationwide and provides coverage in communities that participate in the program.

- Premium Subsidies: The NFIP offers subsidized premiums for properties located in certain flood zones, which may provide cost savings for homeowners. Private flood insurance premiums are not subsidized but may still offer competitive rates depending on the property’s flood risk.

Ultimately, the choice between private flood insurance and the NFIP depends on factors such as individual needs, property location, desired coverage options, and budget. Homeowners located in high-risk flood zones or areas where private flood insurance is not readily available would typically rely on the NFIP as their primary option. However, homeowners seeking customizable coverage options, higher policy limits, and potentially lower premiums may find private flood insurance to be a more suitable choice.

It’s important to carefully evaluate your options, compare quotes from different insurers, assess your property’s flood risk, and consider your budget before deciding on the best flood insurance coverage for your needs.

In the next section, we will address common misconceptions about private flood insurance.

Common Misconceptions about Private Flood Insurance

There are several misconceptions surrounding private flood insurance that can impact homeowners’ decision-making process. Let’s debunk some of these common misconceptions:

- Only the NFIP provides reliable flood insurance: While the NFIP is a well-known and widely used flood insurance option, private flood insurance can also provide reliable coverage. Private insurers are regulated by state insurance departments and follow guidelines to ensure financial stability and claims payment ability.

- Private flood insurance is only for high-value properties: Private flood insurance is not exclusive to high-value properties. Whether you own a modest home or a high-value property, you can explore private flood insurance options that suit your needs and budget. The coverage and premium rates can be customized to your specific property and flood risk.

- Private flood insurance is always more expensive than the NFIP: Private flood insurance premiums are determined based on the individual property’s flood risk, coverage limits, and customization options. In some cases, private flood insurance can be more cost-effective compared to the NFIP, especially for lower-risk properties or homeowners who have taken flood mitigation measures.

- Private flood insurance covers all types of water damage: Private flood insurance policies specifically cover damage caused by flooding, which is defined as an excess of water on normally dry land. Damage caused by other sources of water, such as burst pipes or sewer backups, may require separate coverage, such as homeowners insurance or water backup coverage.

- Only high-risk properties are eligible for private flood insurance: While flood risk is a consideration for private insurers, they provide coverage to a wide range of properties, including those in moderate and low-risk flood zones. Insurers assess the unique characteristics of each property, such as elevation, flood history, and flood mitigation measures, to determine eligibility and coverage options.

- Private flood insurance is not regulated like the NFIP: Private flood insurance is regulated by state insurance departments, which oversee insurance companies operating within their jurisdiction. These regulations provide consumer protections, ensure financial solvency, and enforce compliance with industry standards.

Debunking these misconceptions can help homeowners make an informed decision when considering private flood insurance. It’s important to gather information, compare quotes from different insurers, and carefully review policy terms to ensure you have a comprehensive understanding of the coverage and benefits provided.

Next, let’s explore the process of purchasing private flood insurance.

How to Purchase Private Flood Insurance

Purchasing private flood insurance is a fairly straightforward process, and it begins with a few key steps. Here’s a guide on how to purchase private flood insurance:

- Research Insurance Providers: Start by researching insurance companies that offer private flood insurance in your area. Look for reputable insurers with strong financial stability and a track record of providing reliable coverage. You can check online resources, customer reviews, or seek recommendations from friends, family, or professionals in the insurance industry.

- Obtain Quotes: Reach out to the selected insurance providers and request quotes for private flood insurance coverage. Provide the necessary information about your property, such as its location, flood zone classification, year of construction, and any flood mitigation measures you have implemented. This information will help the insurers assess your flood risk and provide accurate quotes.

- Evaluate Coverage Options: Review the coverage options offered by each insurance provider. Consider factors such as building coverage, contents coverage, additional living expenses, and other structures coverage. Ensure that the coverage options align with your protection needs and budget.

- Compare Premiums and Deductibles: Compare the premiums and deductibles associated with each private flood insurance quote. Assess how the premiums fit within your budget and evaluate the deductibles you are comfortable with. Be mindful that a higher deductible may result in lower premiums but would require you to pay more out of pocket in the event of a claim.

- Review Policy Terms: Carefully read the policy terms and conditions provided by each insurance provider. Pay attention to details such as coverage limits, exclusions, claim procedures, and any additional features or endorsements offered. Ensure that the policy terms meet your coverage requirements and address any concerns or questions you may have.

- Contact Insurance Provider: Once you have made a decision, contact the insurance provider to finalize the purchase of your private flood insurance policy. Provide the necessary information and complete the required paperwork. The insurance company will guide you through the process and explain any additional steps that need to be taken.

- Premium Payment: Pay the premium for your private flood insurance policy according to the payment schedule agreed upon with the insurer. Keep track of your premium due dates to ensure continuous coverage and avoid any potential lapses.

Remember that each insurance provider may have slightly different procedures and requirements, so it’s important to follow their specific instructions. Regularly review your policy and coverage to ensure it continues to meet your needs, and promptly notify the insurance provider of any changes to your property or circumstances that may impact your coverage.

By following these steps, you can purchase private flood insurance that provides the tailored protection you seek for your property. As always, it’s advisable to consult with insurance professionals or agents who can answer your questions and provide guidance throughout the process.

Finally, let’s summarize the key points discussed in this article.

Conclusion

Private flood insurance offers homeowners a viable alternative to the National Flood Insurance Program (NFIP), providing customizable coverage options and potential cost savings. By understanding the basics of private flood insurance, including its benefits, coverage options, eligibility criteria, and purchasing process, homeowners can make informed decisions to protect their properties from flood-related risks.

Private flood insurance stands out for its ability to offer tailored coverage, higher policy limits, and flexibility in premium pricing. It provides homeowners with the opportunity to customize their coverage based on their specific needs, ensuring they have adequate protection in the event of a flood. With coverage options for buildings, contents, additional living expenses, and other structures, private flood insurance can provide comprehensive protection for homeowners.

While eligibility for private flood insurance varies by location and flood risk, it is important to research and compare insurance providers to find those that offer coverage in your area. Obtaining quotes, evaluating coverage options, and comparing premiums and deductibles are critical steps in selecting the right private flood insurance policy for your property.

Moreover, it is essential to debunk common misconceptions surrounding private flood insurance, such as its availability only for high-value properties or that it is always more expensive than the NFIP. Understanding the differences between private flood insurance and the NFIP enables homeowners to make an informed decision based on their specific needs and circumstances.

Ultimately, private flood insurance offers a valuable option for homeowners seeking comprehensive and customizable flood insurance coverage. By carefully considering coverage options, assessing flood risk, and working with reputable insurance providers, homeowners can protect their properties and gain peace of mind against the potential financial and emotional impact of flooding.

Remember to regularly review your flood insurance coverage, update it as needed, and maintain open communication with your insurance provider. Each property and homeowner have unique requirements, and finding the right balance of coverage, cost, and protection is crucial.

Now armed with the knowledge of private flood insurance, take the steps necessary to secure the coverage that best suits your needs and ensure the protection of your property against the unpredictable forces of nature.