Finance

How Much Is Flood Insurance In Houston?

Published: November 5, 2023

Find out the cost of flood insurance in Houston and protect your finances from potential damages.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

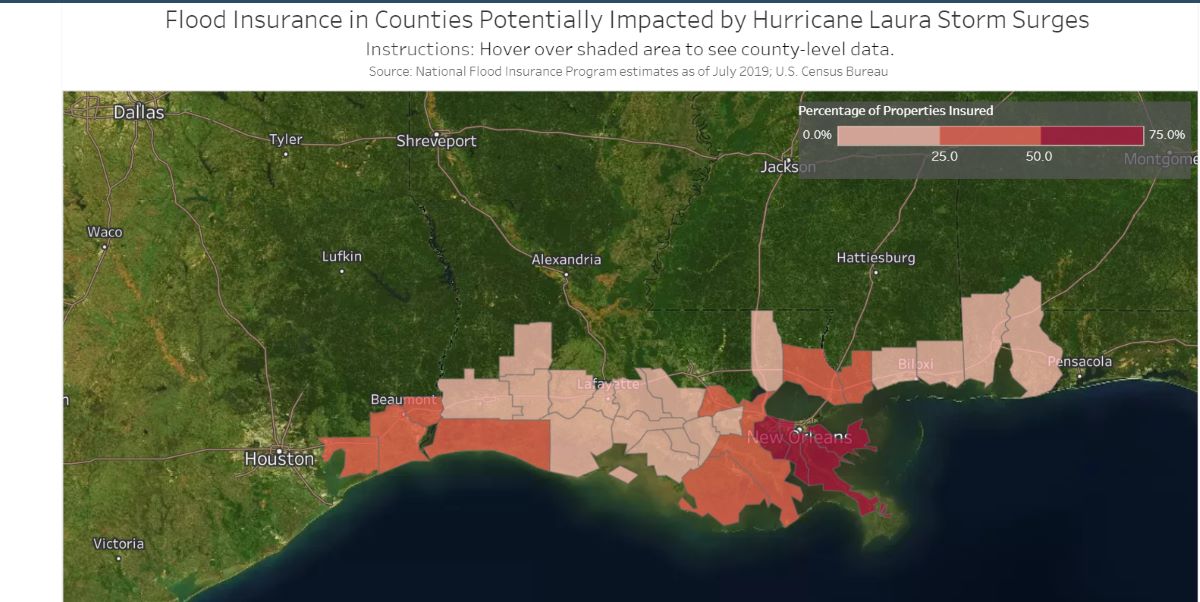

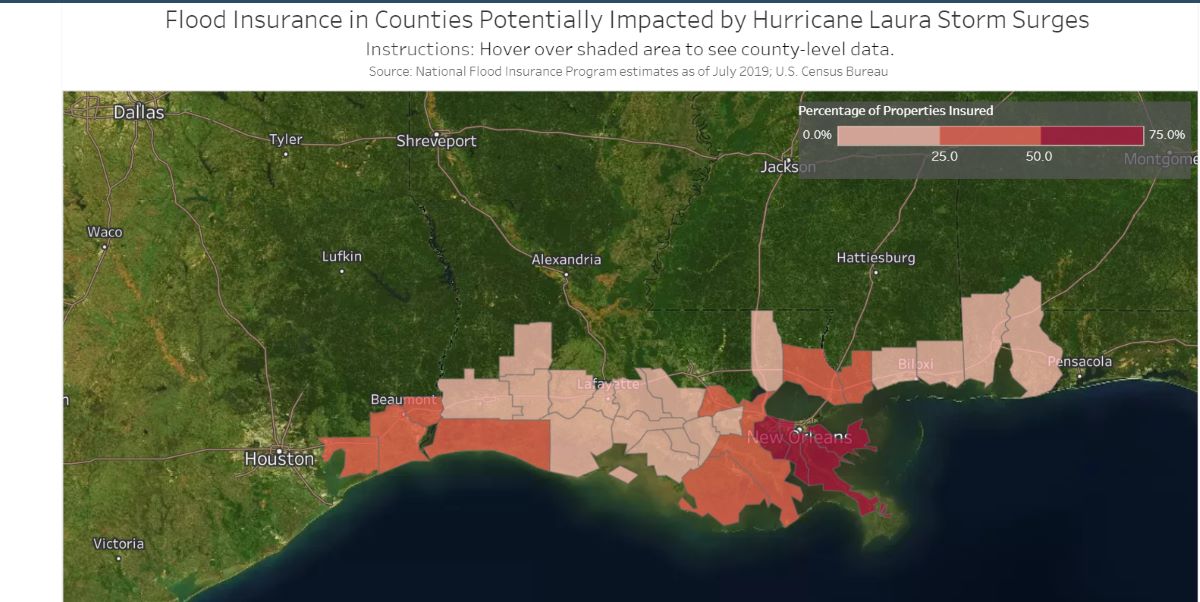

Welcome to Houston, a vibrant city in Texas known for its rich culture, thriving economy, and diverse population. While Houston offers many opportunities and advantages, it also faces a unique set of challenges, one of which is the risk of flooding. Due to its proximity to bodies of water like the Gulf of Mexico and the heavy rainfall it experiences, Houston is particularly prone to flooding.

As a resident or property owner in Houston, it is crucial to understand the importance of protecting your home or business from potential flood damage. One effective way to do this is by obtaining flood insurance. In this article, we will delve into the factors that determine flood insurance rates in Houston and provide insights into the average cost of flood insurance in the area.

Before diving into the specifics, let’s take a moment to understand what flood insurance is and why it is essential in a city like Houston. Flood insurance is a specialized insurance policy that covers property damage caused by flooding. Unlike standard homeowner’s insurance policies, flood insurance specifically addresses the risks associated with floods, ensuring that you have financial protection should your property be affected by a flood event.

In Houston, where heavy rainstorms and hurricanes can result in catastrophic flooding, having flood insurance can be a lifeline in helping you recover and rebuild after a disaster. With the right flood insurance policy in place, you can have peace of mind knowing that you are financially safeguarded against potential flood-related damages.

Now that we have established the importance of flood insurance in Houston, let’s explore the factors that influence flood insurance rates in the city.

Understanding Flood Insurance

Flood insurance is a specialized type of insurance coverage designed to protect property owners from financial loss due to flood damage. It is important to note that flood damage is not typically covered by standard homeowner’s insurance policies, which is why obtaining separate flood insurance is necessary.

Flood insurance policies, usually offered through the National Flood Insurance Program (NFIP) or private insurance companies, provide coverage for both residential and commercial properties. These policies help to offset the costs associated with repairing or rebuilding your property, replacing damaged belongings, and covering any additional living expenses you may incur while your home is uninhabitable.

When it comes to understanding flood insurance, it’s essential to familiarize yourself with some common terms:

- Base Flood Elevation (BFE): This refers to the elevation at which floodwaters are anticipated to reach during a base flood, which has a 1% chance of occurring in any given year. The BFE is used to determine flood risk and insurance rates for properties.

- Special Flood Hazard Area (SFHA): This refers to an area that is at high risk of flooding. If your property is located within an SFHA, you may be required to carry flood insurance.

- Deductible: Similar to other types of insurance, flood insurance policies often include a deductible, which is the amount you must pay out of pocket before coverage kicks in.

- Maximum Coverage Limit: This represents the maximum amount that an insurance policy will pay out for flood-related damages.

It is worth noting that flood insurance coverage and rates can vary depending on whether you opt for a policy through the NFIP or a private insurer. While NFIP policies are available to all property owners in participating communities, private flood insurance may offer additional coverage options and flexibility, but often comes at a higher cost.

Now that we have a basic understanding of flood insurance, let’s delve into the factors that influence flood insurance rates in Houston.

Factors that Determine Flood Insurance Rates in Houston

When it comes to determining flood insurance rates in Houston, several factors come into play. These factors help insurance companies assess the level of risk associated with a particular property and calculate the appropriate premium. Understanding these factors can give you insights into why your flood insurance rates may vary.

- Location: The location of your property is a significant factor in determining flood insurance rates. Houston, being a coastal city and prone to heavy rainfall, is at a higher risk of flooding. Properties located in Special Flood Hazard Areas (SFHAs), such as those near the bayous or coastal areas, may face higher insurance rates due to the increased flood risk.

- Elevation: The elevation of your property, specifically its Base Flood Elevation (BFE), is another crucial factor. If your property sits at a higher elevation and is less susceptible to floodwaters, your flood insurance rates may be lower compared to properties located at lower elevations.

- Construction: The construction and design of your property can impact flood insurance rates. Properties that are built to withstand flood damage, such as those built on stilts or with elevated foundations, may be eligible for lower insurance premiums compared to properties that are more vulnerable to floodwaters.

- Age of the Property: The age of your property can also influence flood insurance rates. Older properties may have outdated construction techniques or insufficient flood mitigation measures, making them more susceptible to flood damage and resulting in higher insurance premiums.

- Risk Mitigation Measures: Insurance companies take into account any risk mitigation measures you have implemented on your property. Features such as flood barriers, levees, or floodproofing systems can help reduce the risk of flood damage and potentially lower your insurance rates.

- Prior Flood History: If your property has a history of flood claims, it may impact your flood insurance rates. Properties that have experienced flooding in the past are viewed as higher risk and may result in higher premiums.

Keep in mind that these factors are not absolute determinants of flood insurance rates, as each insurance provider may have their own specific assessment criteria. Additionally, factors like the coverage amount and deductible you choose, as well as the type of flood insurance policy you opt for (NFIP or private insurance), can also affect your rates.

Now that we have explored the factors that influence flood insurance rates in Houston, let’s delve into the average cost of flood insurance in the city.

Average Cost of Flood Insurance in Houston

The average cost of flood insurance in Houston can vary based on several factors, including the location of the property, the level of flood risk, the property’s value, and the coverage options chosen. On average, flood insurance premiums in Houston range from a few hundred dollars to several thousand dollars per year.

According to data from the National Flood Insurance Program (NFIP), the average annual premium for flood insurance in Houston is around $700 to $900. However, it is important to note that this is just an average, and individual premiums can be higher or lower depending on the specific circumstances of each property.

The specific factors that influence the cost of flood insurance in Houston include the property’s elevation, proximity to flood zones, and the coverage limits and deductibles chosen. For instance, properties located in high-risk flood zones or areas with a history of flooding will generally have higher premiums compared to properties in lower-risk areas.

Additionally, the amount of coverage and the deductible selected will also impact the cost of the policy. Higher coverage limits and lower deductibles will result in higher premiums, while lower coverage limits and higher deductibles can help reduce the annual cost of flood insurance.

It is worth noting that flood insurance rates in Houston can be subject to change based on updates to flood maps and changes in flood risk assessment. Therefore, it is essential to regularly review your policy and discuss any changes with your insurance provider to ensure that you have adequate coverage.

Lastly, it is crucial to consider that flood insurance is typically separate from standard homeowner’s insurance, which means that you will need to budget for both types of coverage to fully protect your property from various risks.

Now that we have discussed the average cost of flood insurance in Houston, let’s explore how flood insurance rates are calculated in the city.

How Flood Insurance Rates are Calculated in Houston

Flood insurance rates in Houston are calculated based on several factors to determine the appropriate premium for a property. These factors are assessed by insurance providers to evaluate the level of flood risk associated with a specific location. Understanding how flood insurance rates are calculated can help property owners better anticipate the costs associated with protecting their properties.

The key factors taken into account when determining flood insurance rates in Houston include:

- Flood Zone: The flood zone in which the property is located plays a significant role in determining flood insurance rates. Houston has various flood zones, ranging from low to high risk areas. Properties in high-risk flood zones are more prone to flooding and therefore typically have higher insurance premiums.

- Base Flood Elevation (BFE) and Elevation Certificate: The BFE is the height at which floodwaters are expected to reach during a base flood. Properties with a lower BFE or those located at a lower elevation are at higher risk of flooding and may have higher insurance rates. Additionally, an Elevation Certificate, obtained by a licensed surveyor or engineer, provides detailed information about the property’s elevation and flood risk, which helps determine insurance rates.

- Property Characteristics: Factors such as the age, construction type, and occupancy of the property are taken into consideration when calculating flood insurance rates. Older properties or those with less flood-resistant construction may have higher premiums due to the increased risk of flood damage.

- Coverage Amount and Deductible: The coverage amount and deductible selected by the property owner also influence the insurance rates. Higher coverage limits and lower deductibles result in higher premiums, while lower coverage amounts and higher deductibles can lead to lower premiums.

- Previous Flood History: The property’s flood history can impact insurance rates. If the property has previously experienced flood damage and filed insurance claims, it may indicate a higher risk of future losses and result in higher premiums.

These factors, along with other considerations, are used by insurance companies to determine the appropriate premium for flood insurance coverage in Houston. It is important to note that premiums can vary between insurance providers, as they may have different risk assessment models and pricing structures.

It is recommended to consult with insurance experts or agents who specialize in flood insurance to understand the specific factors that apply to your property and to obtain accurate quotes tailored to your circumstances.

Now that we have explored how flood insurance rates are calculated, let’s discuss the importance of flood insurance in Houston.

Importance of Flood Insurance in Houston

Flood insurance plays a vital role in protecting homes and properties in Houston, a city prone to flooding due to its geographic location and weather patterns. The importance of having flood insurance cannot be overstated, as it provides financial security and peace of mind in the face of potential flood-related risks.

Here are some key reasons why flood insurance is essential in Houston:

- High Flood Risk: Houston is no stranger to severe weather events, including heavy rainfall, hurricanes, and tropical storms, which can lead to devastating floods. With its vast network of bayous, rivers, and coastal areas, the city is particularly susceptible to flash flooding. Flood insurance is the best way to protect your property and belongings from the financial burden of flood damage.

- Standard Home Insurance Exclusions: It is crucial to understand that standard homeowner’s insurance policies do not typically cover flood damage. Without a separate flood insurance policy, you could be left with significant expenses to repair or rebuild your property after a flood.

- Financial Protection: Flood damage can be costly to repair. From structural damage to damage to personal belongings and furnishings, the financial burden of flood-related losses can be overwhelming. Flood insurance offers a layer of financial protection, covering the costs of repairs, replacements, and other necessary expenses associated with flood damage.

- Peace of Mind: Knowing that you are adequately insured against flood damage provides peace of mind. Instead of worrying about the potential financial consequences of a flood, you can focus on taking necessary precautions to safeguard your property and the well-being of your loved ones.

- Community Requirements: Living in certain flood-prone areas of Houston may require you to have flood insurance as a condition of obtaining a mortgage. Lenders often require flood insurance to protect their investment in areas categorized as high-risk flood zones.

- Assistance in Recovery and Rebuilding: In the unfortunate event of a flood, having flood insurance can greatly ease the recovery and rebuilding process. With the financial support provided by your policy, you can promptly restore your property and resume normalcy in your life.

Given the unpredictable nature of weather events and the inherent flood risks in Houston, investing in flood insurance is a wise and proactive decision. It is crucial to review your insurance coverage regularly, especially before the start of hurricane and rainy seasons, to ensure that you have adequate protection in place.

Now that we understand the importance of flood insurance in Houston, let’s explore some tips for reducing flood insurance premiums.

Tips for Reducing Flood Insurance Premiums in Houston

While flood insurance is crucial for protecting your property against potential flood damage in Houston, there are ways to potentially lower your flood insurance premiums. Implementing certain measures can help mitigate the risk of flood damage and demonstrate to insurance providers that your property is less susceptible to flooding. Here are some tips to consider:

- Elevate Your Property: Raising your property’s elevation can significantly reduce the risk of flood damage. Elevating the lowest floor level, installing flood vents, or using fill to increase the height of your property can demonstrate to insurers that your property is less likely to experience flood-related losses.

- Install Flood-Resistant Building Materials: Using flood-resistant building materials and techniques can make your property more resilient to flood damage. This can include installing impact-resistant doors and windows, using water-resistant flooring, and elevating electrical systems above the expected flood level.

- Install Flood Protection Devices: Adding flood protection devices such as flood barriers, backflow preventers, and sump pumps can help reduce the risk of flood damage and potentially lower your insurance premiums. Consult with flood protection specialists to determine the most suitable devices for your property.

- Mitigate External Risks: Clearing any debris or potential obstructions around your property, such as tree branches or cluttered gutters, can help to prevent water from pooling and potentially reduce flood damage risks.

- Obtain an Elevation Certificate: Getting an Elevation Certificate from a licensed surveyor or engineer can provide accurate information about your property’s elevation and flood risk. This document can help insurers assess the potential for flood damage and potentially result in lower insurance premiums.

- Consider Private Flood Insurance Options: While the National Flood Insurance Program (NFIP) provides flood insurance coverage, private insurers may offer alternative policies with additional coverage options. Shopping around and comparing quotes from different insurers can help you find the best coverage at the most competitive rates.

- Review and Adjust Coverage Limits: Regularly review your flood insurance coverage limits to ensure that they accurately reflect the value of your property and belongings. Adjusting coverage limits to reflect changes in property value or renovations can help avoid overpaying for unnecessary coverage.

- Participate in Community Floodplain Management Programs: Active participation in community floodplain management programs and initiatives, such as adopting and implementing flood mitigation measures, can demonstrate your commitment to reducing flood risks. This engagement can potentially lead to lower flood insurance rates.

It’s important to note that while implementing these tips may help reduce flood insurance premiums, the specifics and impact on rates can vary depending on insurance providers and individual circumstances. Consult with insurance professionals knowledgeable about flood insurance in Houston to determine the most effective strategies for reducing your premiums without compromising coverage.

By taking proactive measures to reduce flood risks and exploring different options available, you can potentially lower your flood insurance premiums in Houston while maintaining the necessary coverage to protect your property.

Now that we’ve discussed tips for reducing flood insurance premiums, let’s conclude our article.

Conclusion

Flood insurance is a crucial aspect of protecting your property in Houston, a city susceptible to flooding due to its geographic location and weather patterns. Understanding the factors that influence flood insurance rates and the average cost of flood insurance in Houston can help you make informed decisions about obtaining the necessary coverage.

Factors such as location, elevation, construction, and flood history are considered when determining flood insurance rates. Average premiums in Houston range from a few hundred to several thousand dollars annually, depending on the specific circumstances of each property.

Having flood insurance is of utmost importance in Houston due to the significant flood risks associated with heavy rainfall, hurricanes, and tropical storms. Flood insurance provides financial protection, peace of mind, and assistance in recovering and rebuilding after a flood event.

To potentially lower your flood insurance premiums in Houston, consider implementing measures such as elevating your property, installing flood-resistant building materials, and using flood protection devices. Obtaining an Elevation Certificate and exploring private insurance options can also help reduce costs. Active participation in community floodplain management programs demonstrates your commitment to mitigating flood risks.

Remember to review your flood insurance coverage regularly, especially before the start of hurricane and rainy seasons, to ensure that your policy adequately protects you against potential flood damage.

By understanding the importance of flood insurance, evaluating the factors that affect rates, and implementing risk mitigation measures, you can safeguard your property and minimize the financial impact of flood-related losses in Houston.

Take action today, and secure the necessary flood insurance coverage to protect your property from the unpredictable and devastating effects of flooding in Houston.