Finance

What Is FIU In Banking

Published: October 14, 2023

Discover what FIU means in the banking industry and how it relates to finance. Gain insights into the role of FIU and its impact on financial institutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

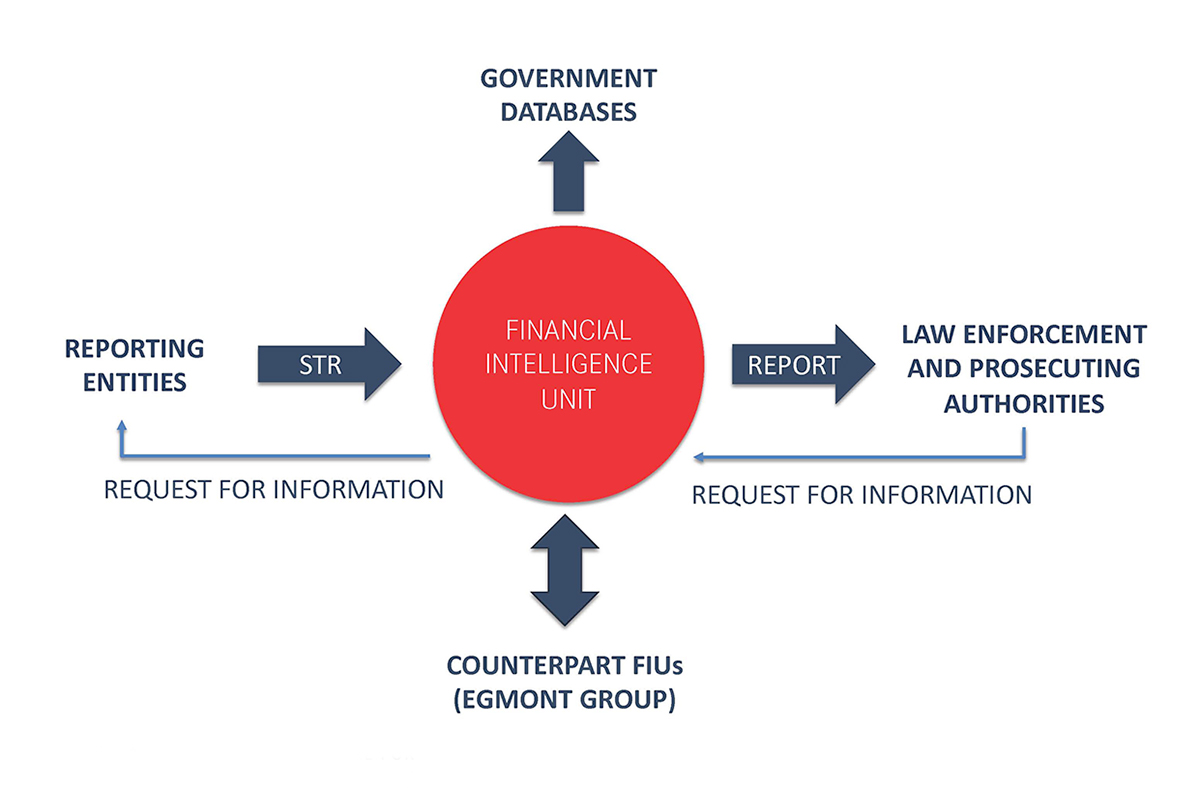

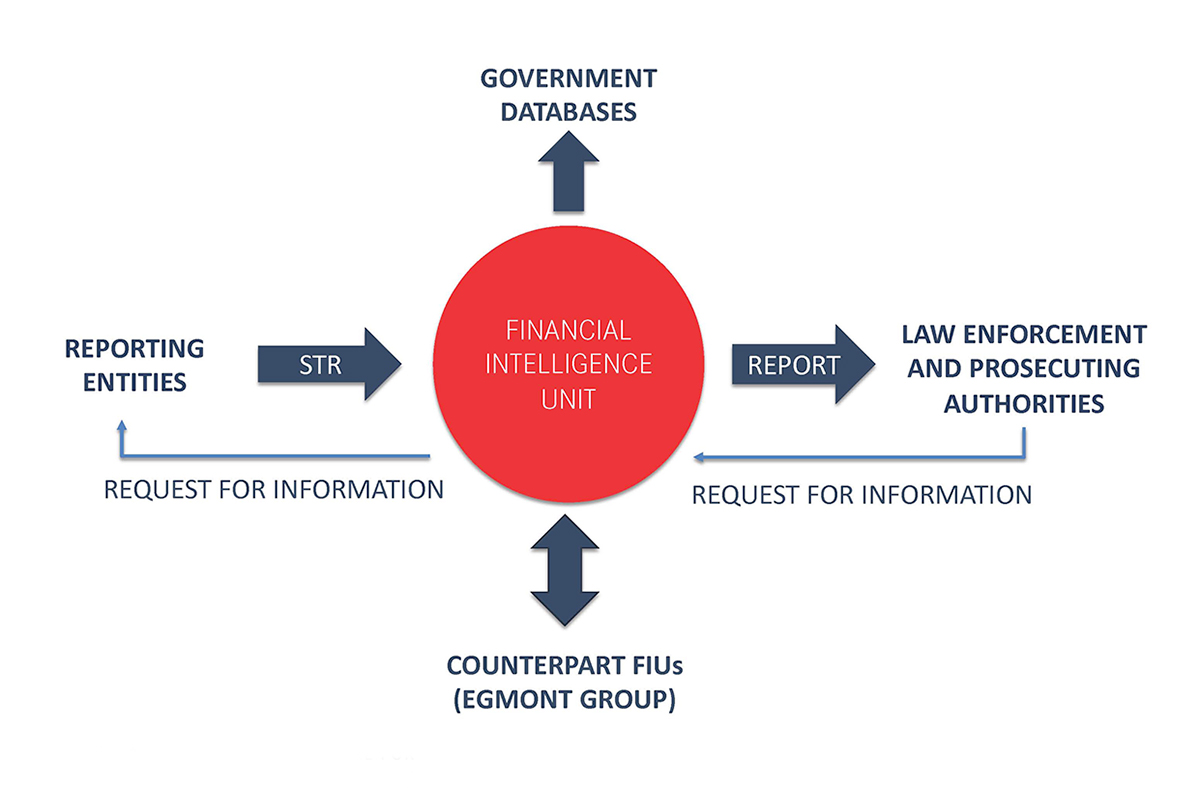

When it comes to ensuring the integrity of the financial system and preventing money laundering and illicit activities, banks play a crucial role. To support this effort, there is a specialized entity known as the Financial Intelligence Unit (FIU). The FIU serves as the central hub for gathering, analyzing, and disseminating financial intelligence to combat financial crimes.

The FIU acts as a vital link between banks and law enforcement agencies, acting as the channel for reporting suspicious transactions and activities. It plays a pivotal role in monitoring and detecting potential money laundering, terrorist financing, and other illicit financial activities.

In this article, we will explore the concept of FIU in banking, its role, significance, functions, reporting requirements for banks, collaboration between FIU and banks, challenges faced by the FIU, and initiatives to strengthen its effectiveness.

By understanding the FIU’s role in the banking sector, we can gain insight into the measures and processes in place to maintain the integrity of the financial system and safeguard against financial crimes.

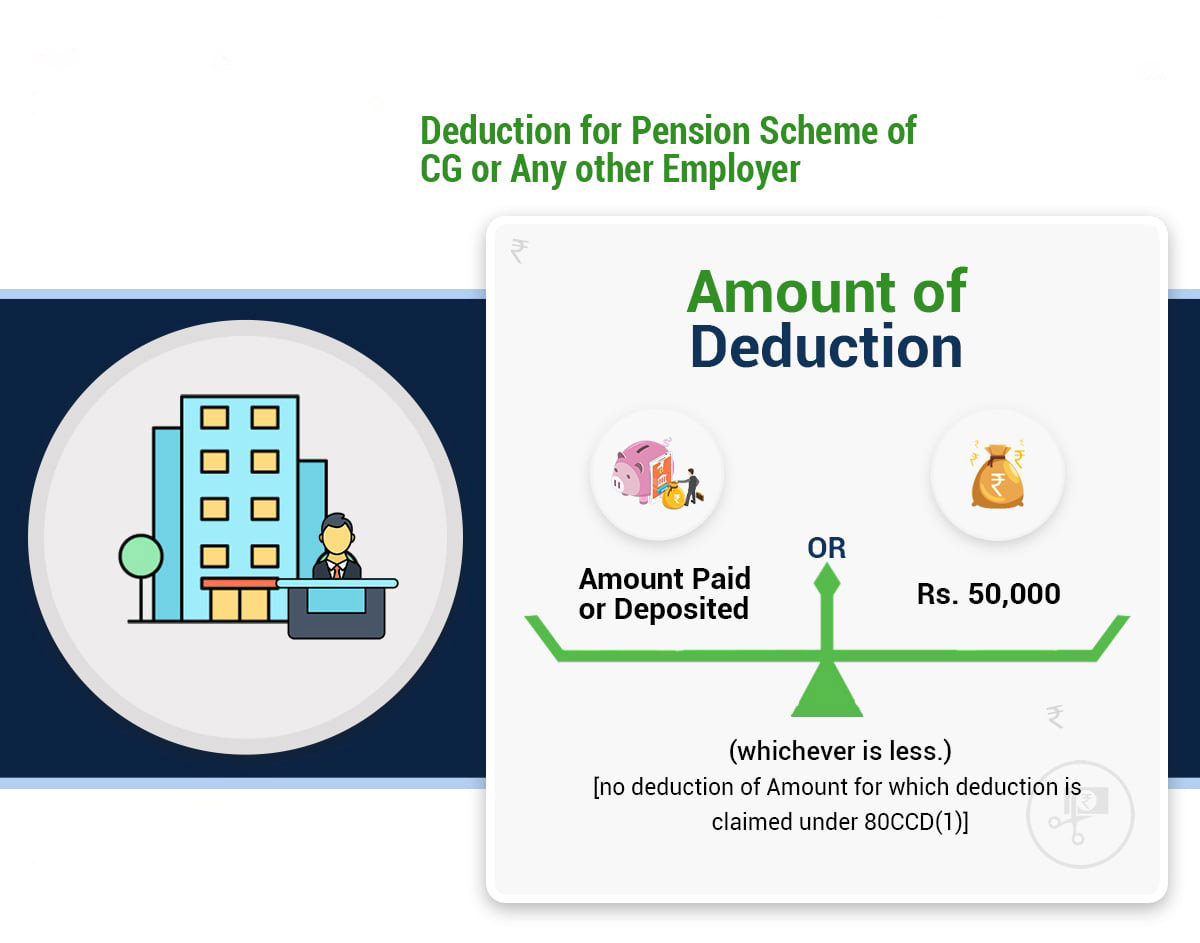

Definition of FIU

The Financial Intelligence Unit (FIU) is a specialized government agency or department responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorist financing, and other financial crimes. It serves as a central authority for banks and other financial institutions to report suspicious activities, ensuring the integrity of the financial system.

The FIU acts as a pivotal intermediary between banks, law enforcement agencies, and regulatory authorities. It receives and processes the suspicious activity reports (SARs) provided by banks and other reporting entities, and conducts investigations to identify patterns, trends, and anomalies indicative of financial crimes.

The primary objective of an FIU is to ensure the transparency and integrity of financial systems, safeguarding them against illicit activities. It operates in conjunction with local and international law enforcement agencies, sharing critical financial intelligence and collaborating in investigations and prosecutions of financial crimes.

Each country typically has its own FIU, which functions under the jurisdiction of their respective government or regulatory bodies. The FIU operates with a high degree of confidentiality, protecting the sensitive information it receives from banks and other reporting entities. This allows for effective tracking and analysis of suspicious financial activities, maintaining the integrity of the financial system.

Role of FIU in Banking

The Financial Intelligence Unit (FIU) plays a crucial role in the banking sector by acting as a bridge between banks and law enforcement agencies. Its primary objective is to enhance the integrity of the financial system by detecting and preventing money laundering, terrorist financing, and other financial crimes. The following are the key roles and responsibilities of the FIU in banking:

- Suspicious Activity Reporting: One of the primary functions of the FIU is to receive and analyze suspicious activity reports (SARs) from banks and other financial institutions. Banks are required to report any transactions or activities that they suspect may be related to money laundering or other financial crimes. The FIU reviews these reports, identifies patterns, and assesses potential risks.

- Analysis and Investigation: The FIU conducts in-depth analysis of the reported suspicious activities, leveraging advanced tools and techniques. Through data analysis and collaboration with other law enforcement agencies, the FIU uncovers potential money laundering networks, identifies individuals or entities involved in illegal activities, and provides actionable intelligence to support investigations.

- Information Sharing: The FIU serves as a central repository of financial intelligence, gathering data from various reporting entities. It shares relevant information and intelligence with domestic and international counterparts, facilitating the exchange of crucial knowledge to combat financial crimes globally.

- Policy Development and Implementation: The FIU contributes to the development and implementation of anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, policies, and guidelines. It collaborates with regulatory bodies to ensure compliance with international standards and best practices.

- Training and Awareness: The FIU plays a vital role in raising awareness and providing training to banks and other reporting entities regarding the identification and reporting of suspicious transactions. It promotes a culture of compliance and vigilance, helping financial institutions stay updated on emerging trends and typologies of financial crimes.

By fulfilling these roles, the FIU acts as a proactive safeguard against financial crimes in the banking sector. It strengthens the overall resilience of the financial system and contributes to the protection of both individual institutions and the global economy.

Importance of FIU in Banking

The Financial Intelligence Unit (FIU) plays a crucial role in the banking sector, and its importance cannot be overstated. Here are some key reasons why the FIU is vital in ensuring the integrity of the financial system:

- Preventing Money Laundering: Money laundering poses a significant threat to the global economy, enabling criminals to disguise the origins of illegally obtained funds. The FIU plays a critical role in detecting and preventing money laundering by receiving and analyzing suspicious activity reports from banks. Its expertise in identifying red flags and suspicious patterns helps in disrupting illegal activities and safeguarding the integrity of the banking system.

- Combating Terrorist Financing: Terrorism financing has become a major concern worldwide. The FIU works closely with banks to identify and report any suspicious transactions that may be linked to terrorist activities. By detecting and preventing the flow of funds to terrorist organizations, the FIU helps in disrupting their operations and safeguarding national security.

- Strengthening Regulatory Compliance: Banks are subject to stringent regulations and compliance requirements to prevent financial crimes. The FIU ensures that banks adhere to these regulatory obligations by conducting regular assessments, reviewing reports, and providing guidelines on AML and CTF measures. This helps in creating a culture of compliance and reducing the risk of banks being targeted for regulatory penalties.

- Enhancing International Cooperation: Money laundering and financial crimes often transcend national borders. The FIU serves as a platform for international collaboration, fostering cooperation among FIUs worldwide. By sharing vital financial intelligence with their counterparts, the FIU helps in identifying and tracking cross-border criminal activities, contributing to global efforts in combating money laundering and terrorist financing.

- Maintaining Financial Stability: The integrity of the banking system is paramount to maintaining overall financial stability. The FIU plays a vital role in ensuring that illicit funds do not infiltrate the system, contributing to the resilience and trustworthiness of the financial sector. By proactively combating financial crimes, the FIU helps protect customers, investors, and the broader economy.

Overall, the FIU’s importance in the banking sector lies in its ability to prevent financial crimes, strengthen regulatory compliance, enhance international cooperation, and maintain a stable and trustworthy financial system. By working hand in hand with banks, the FIU helps create a secure and transparent environment for financial transactions, fostering economic growth and prosperity.

Functions of FIU in Banking

The Financial Intelligence Unit (FIU) performs a range of critical functions in the banking sector to combat financial crimes and safeguard the integrity of the financial system. Here are the key functions of the FIU:

- Receipt of Suspicious Activity Reports (SARs): The FIU acts as the central repository for SARs submitted by banks and other reporting entities. It receives reports on transactions or activities that appear suspicious or potentially related to money laundering, terrorist financing, or other financial crimes. This function allows for the centralized collection of crucial information to identify and analyze potential risks.

- Analysis and Intelligence Gathering: The FIU employs sophisticated tools and techniques to analyze the reported suspicious activities. It conducts in-depth assessments to identify patterns, trends, and anomalies that may indicate illicit financial behavior. By gathering intelligence from various sources and leveraging advanced data analytics, the FIU is equipped to detect and investigate potential financial crimes.

- Dissemination of Financial Intelligence: Once the analysis is complete, the FIU disseminates relevant financial intelligence to appropriate law enforcement agencies, regulatory bodies, and other relevant stakeholders. This sharing of information helps inform investigations, support prosecutions, and contribute to a coordinated approach in combating financial crimes.

- Collaboration and Networking: The FIU actively collaborates with domestic and international counterparts to share information, intelligence, and best practices. This collaboration strengthens the collective efforts in detecting and preventing financial crimes across borders. The FIU also participates in international forums and networks, amplifying knowledge sharing and fostering cooperation in combating money laundering and terrorist financing.

- Development of Policies and Guidelines: The FIU contributes to the development and implementation of anti-money laundering (AML) and counter-terrorism financing (CTF) policies and guidelines. It works closely with regulatory authorities to establish and enforce regulatory frameworks that promote transparency, due diligence, and compliance with AML/CTF regulations.

- Training and Awareness: The FIU plays an essential role in providing training and raising awareness among banks and other reporting entities. It educates these entities on identifying and reporting suspicious transactions and activities. By enhancing the knowledge and understanding of AML/CTF measures, the FIU helps establish a robust compliance culture within the banking sector.

Through these functions, the FIU serves as a critical pillar in the fight against financial crimes in the banking sector. It facilitates the detection and prevention of money laundering, terrorist financing, and other illicit activities, thereby safeguarding the integrity and stability of the financial system.

Reporting Requirements for Banks

Reporting requirements are vital for ensuring the effectiveness of the Financial Intelligence Unit (FIU) and maintaining the integrity of the banking system. Banks are obligated to fulfill certain reporting obligations to contribute to the detection and prevention of financial crimes. Here are the key reporting requirements for banks:

- Suspicious Activity Reports (SARs): Banks are required to submit Suspicious Activity Reports to the FIU when they encounter transactions or activities that raise suspicions of money laundering, terrorist financing, or other financial crimes. SARs provide detailed information about the transaction, including the parties involved, transaction amounts, and any indicators of suspicious behavior.

- Large Cash Transaction Reports (LCTRs): Banks are typically required to report large cash transactions to the FIU. These reports are triggered when customers deposit or withdraw substantial amounts of cash over a specified threshold. LCTRs help in monitoring and detecting potential money laundering or illicit activities involving large sums of cash.

- Know Your Customer (KYC) Reports: Banks must conduct due diligence on their customers to verify their identity and assess the potential risk of involvement in financial crimes. KYC reports provide the FIU with information about the customer, their source of funds, and their business activities. This information is crucial for identifying any suspicious transactions or patterns.

- Transaction Monitoring Reports: Banks are required to implement robust transaction monitoring systems to track and flag potentially suspicious transactions. These reports highlight transactions that deviate from the customer’s regular behavior or that exhibit other red flags. The FIU can analyze these reports to detect potential money laundering or terrorist financing activities.

- Compliance Reports: Banks must regularly submit compliance reports to the FIU, providing an overview of their internal controls, policies, procedures, and training programs related to anti-money laundering (AML) and counter-terrorism financing (CTF) measures. These reports help ensure that banks are adhering to regulatory requirements and implementing effective risk management systems.

- Foreign Account Tax Compliance Act (FATCA) Reports: In jurisdictions where FATCA applies, banks are required to report on the financial accounts held by U.S. persons to comply with tax regulations. These reports help in identifying potential tax evasion and ensuring compliance with tax obligations.

By fulfilling these reporting requirements, banks contribute to the effectiveness of the FIU and enhance the ability to detect and prevent financial crimes. Timely and accurate reporting provides the FIU with vital information to analyze and identify potential risks, aiding in the fight against money laundering, terrorist financing, and other illicit activities within the banking sector.

Collaboration between FIU and Banks

Collaboration between the Financial Intelligence Unit (FIU) and banks is crucial for effectively combating financial crimes and maintaining the integrity of the financial system. By working together, the FIU and banks can leverage their respective expertise and resources to enhance financial intelligence, detection, and prevention efforts. Here are key aspects of collaboration between the FIU and banks:

- Information Sharing: The FIU and banks engage in the exchange of information to identify and track potential financial crimes. Banks provide the FIU with suspicious activity reports (SARs), transaction records, and other relevant data. Conversely, the FIU shares financial intelligence, analysis, and typologies of financial crimes with banks to improve their risk assessment and compliance processes.

- Joint Analysis and Investigations: The FIU and banks may collaborate on joint analysis of suspicious transactions or investigations into suspected financial crimes. This joint effort allows for the pooling of resources and expertise, facilitating more comprehensive investigations and the identification of complex money laundering networks or terrorist financing schemes.

- Training and Awareness Programs: The FIU plays a vital role in providing training and raising awareness among banks regarding AML/CTF measures. The FIU conducts workshops, seminars, and training sessions to educate bank employees on the detection and reporting of suspicious activities. By enhancing banks’ knowledge and understanding, the FIU helps to strengthen the overall compliance culture in the banking sector.

- Feedback and Guidance: The FIU provides feedback and guidance to banks regarding their suspicious activity reporting processes, highlighting areas for improvement. This feedback loop helps banks enhance their detection and reporting capabilities and ensures the quality and accuracy of the information provided to the FIU.

- Policy Development and Regulatory Compliance: Banks collaborate with the FIU during the development of anti-money laundering (AML) and counter-terrorism financing (CTF) policies and guidelines. The FIU seeks input from banks to ensure that regulations are practical, effective, and in alignment with the industry’s needs. Banks also work closely with the FIU to ensure compliance with regulatory requirements and to implement robust AML/CTF programs.

- Participation in Stakeholder Forums: The FIU and banks engage in regular participation in stakeholder forums, task forces, or working groups focused on combating financial crimes. These collaborative platforms provide an opportunity for knowledge sharing, best practice exchange, and coordination to address emerging threats and challenges.

By fostering a collaborative relationship, the FIU and banks enhance their collective ability to detect, prevent, and combat financial crimes. This collaborative approach promotes a strong compliance culture, improves risk assessment and mitigation strategies, and strengthens the overall financial system’s resilience against illicit activities.

Challenges Faced by FIU in Banking

The Financial Intelligence Unit (FIU) faces several challenges in its role of combating financial crimes within the banking sector. Understanding these challenges is essential to strengthen the effectiveness of the FIU and address any existing gaps. Here are some common challenges faced by the FIU:

- Volume and Complexity of Data: The FIU must process and analyze vast amounts of financial data from banks and other reporting entities. The sheer volume and complexity of this data pose challenges in identifying suspicious patterns and activities, often requiring sophisticated analytical tools and technologies.

- Evolving Financial Crimes: Financial criminals continually adapt their methods to exploit vulnerabilities within the banking system. The FIU must stay ahead of these evolving techniques and typologies to effectively detect and prevent new forms of money laundering, terrorist financing, and other illicit activities.

- Cross-Border Transactions: Financial crimes often involve cross-border transactions, making it challenging for the FIU to track and investigate suspicious activities that extend beyond national jurisdictions. Cooperation and information sharing with international counterparts are crucial to overcome these challenges and maintain effective cross-border collaboration.

- Technological Advancements: Rapid advancements in technology have both positive and negative implications for the FIU. On one hand, technology offers new tools for data analysis and detection. On the other hand, it can be utilized by criminals to hide illicit activities, such as the use of cryptocurrencies or offshore accounts. The FIU needs to adapt to these technological changes to effectively combat emerging threats.

- Resource Constraints: FIUs often face resource constraints, both in terms of funding and skilled personnel. Adequate resources are necessary to support the implementation of advanced analytical tools, training programs, and ongoing capacity-building initiatives. Insufficient resources can impede the FIU’s ability to thoroughly analyze data and investigate potential financial crimes.

- Legal and Regulatory Challenges: FIUs must navigate complex legal and regulatory frameworks, varying from country to country. Ensuring uniformity in reporting requirements, information sharing agreements, and legal frameworks enhances the FIU’s effectiveness. Additionally, ensuring balancing of privacy concerns and the need for timely access to financial information is crucial.

Addressing these challenges requires a multi-faceted approach, involving collaboration between the FIU, regulatory authorities, banks, and international partners. Investing in technology, skill development, and resource allocation, along with robust regulatory frameworks, can enable the FIU to overcome these challenges and enhance its ability to combat financial crimes effectively.

Initiatives to Strengthen FIU in Banking

Recognizing the critical role of the Financial Intelligence Unit (FIU) in combating financial crimes within the banking sector, various initiatives have been implemented to strengthen its effectiveness. These initiatives aim to enhance the FIU’s capabilities, improve collaboration, and address emerging challenges. Here are some key initiatives to strengthen the FIU in banking:

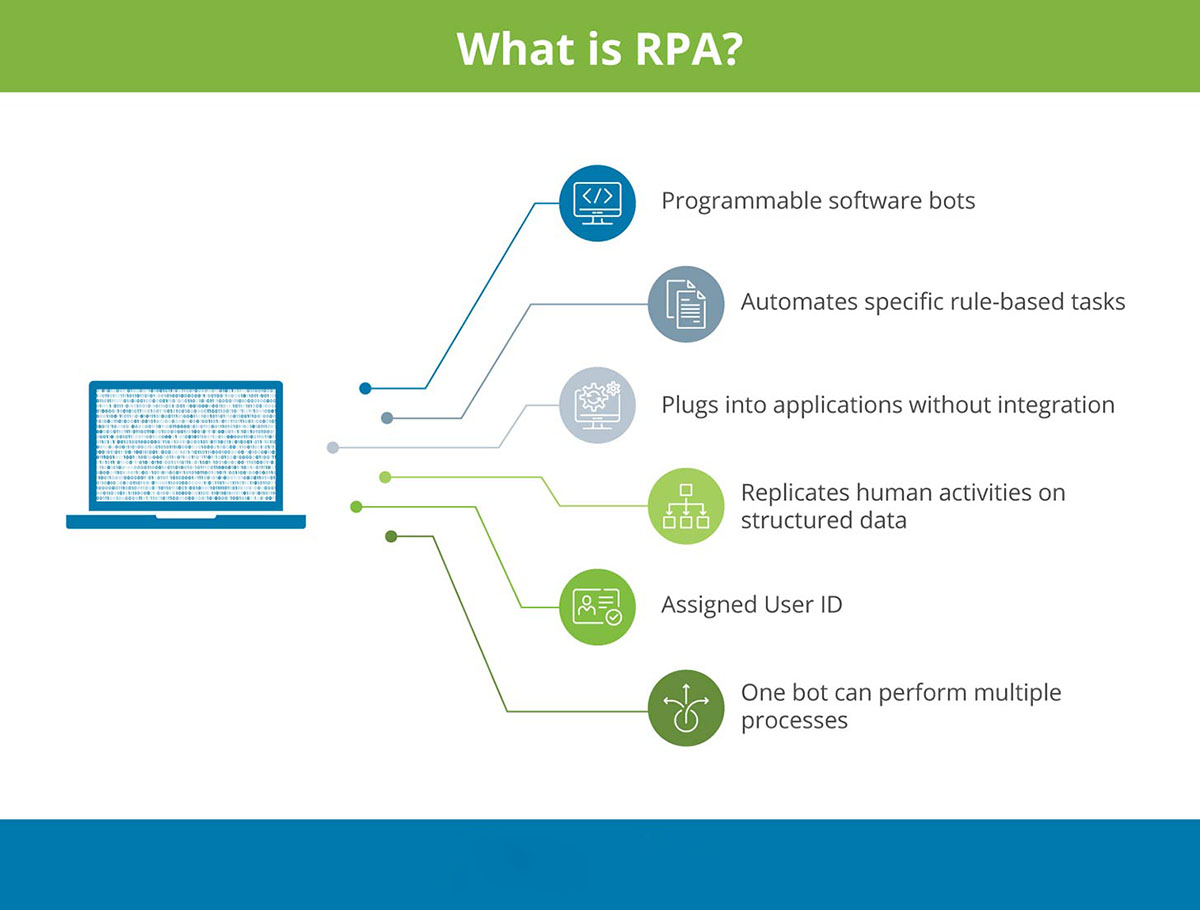

- Enhanced Technological Infrastructure: Investing in advanced technologies, such as artificial intelligence, machine learning, and data analytics, can significantly bolster the FIU’s capabilities. These technologies can automate processes, analyze vast amounts of data, detect suspicious patterns, and enhance the efficiency and accuracy of financial intelligence analysis.

- Capacity Building and Training: Providing comprehensive training programs to FIU personnel and banking professionals is crucial to keep abreast of evolving financial crimes. Training initiatives focus on raising awareness, improving skill sets, and sharing best practices in identifying, investigating, and reporting suspicious transactions. Continuous education helps build a robust AML/CTF culture and strengthens the overall effectiveness of the FIU in the banking sector.

- International Cooperation and Information Sharing: Strengthening collaboration and information sharing among FIUs at both the domestic and international levels is vital in addressing cross-border financial crimes. Establishing formalized collaboration frameworks, bilateral agreements, and participation in international networks facilitate the exchange of financial intelligence, best practices, and expertise, enhancing the collective ability to combat money laundering and terrorist financing.

- Streamlined Reporting Process: Simplifying and standardizing the reporting process for banks can improve the efficiency of the FIU’s operations. Clear guidelines, user-friendly reporting systems, and feedback mechanisms can encourage accurate and timely reporting by banks, ensuring that the FIU receives comprehensive and actionable information to identify and investigate potential financial crimes.

- Regulatory Harmonization: Harmonizing AML/CTF regulations and frameworks across jurisdictions can facilitate seamless cooperation between the FIU and banks. Consistent regulatory requirements enhance compliance efforts and reduce the burden on banks operating across multiple jurisdictions. International standards, such as those set by the Financial Action Task Force (FATF), play a crucial role in establishing a unified approach to combating financial crimes.

- Public-Private Partnerships: Collaboration between the FIU, banks, and other private sector entities is crucial in fighting financial crimes. Establishing public-private partnerships encourages information sharing, joint initiatives, and collaborative efforts in developing new tools and strategies to combat money laundering, terrorist financing, and other illicit activities.

By implementing these initiatives, the FIU in banking can strengthen its capabilities, expand its analytical capacities, foster greater collaboration, and adapt to the evolving landscape of financial crimes. These efforts contribute to the overall objective of maintaining the integrity of the financial system and safeguarding against illicit activities.

Conclusion

The Financial Intelligence Unit (FIU) holds a critical role in the banking sector, serving as the frontline defense against financial crimes such as money laundering, terrorist financing, and other illicit activities. The FIU acts as the central hub for receiving, analyzing, and disseminating financial intelligence, facilitating collaboration with banks, law enforcement agencies, and regulatory bodies.

Throughout this article, we have explored the definition, role, and importance of the FIU in banking. We have delved into its functions, reporting requirements for banks, collaboration initiatives, and the challenges faced by the FIU. We have also discussed various initiatives to strengthen the FIU, including technological advancements, capacity building, international cooperation, streamlined reporting processes, regulatory harmonization, and public-private partnerships.

By understanding the vital role of the FIU, we recognize the significance of maintaining the integrity of the financial system. The FIU’s continuous efforts, along with the collaboration of banks and other stakeholders, are crucial in detecting, preventing, and combating financial crimes.

In conclusion, the FIU serves as a crucial pillar in the fight against money laundering, terrorist financing, and other illicit activities within the banking sector. With ongoing technological advancements, streamlined reporting processes, and strengthened collaboration, the FIU can further enhance its effectiveness and contribute to the resilience and integrity of the global financial system.