Finance

What Is Infinite Banking Life Insurance?

Published: October 14, 2023

Learn everything about infinite banking life insurance, a powerful financial strategy that allows you to become your own banker and have control over your finances. Discover the benefits and how it can transform your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances and planning for the future, there are numerous options available. One strategy that has gained significant popularity in recent years is infinite banking life insurance. But what exactly does this mean, and how can it benefit you?

Infinite banking is a concept that revolves around using a specially designed whole life insurance policy as a personal banking system. It allows policyholders to build cash value over time and have access to funds for various financial needs, such as investments, emergencies, or major expenses. This unique approach to financial management has caught the attention of individuals looking for alternative ways to grow and protect their wealth.

Understanding how infinite banking works and its potential benefits is essential for anyone considering this strategy. In this article, we will delve deeper into the concept of infinite banking life insurance and explore its intricacies. We will also discuss the advantages and drawbacks associated with this strategy, helping you decide whether infinite banking life insurance is the right fit for your financial goals.

What Is Infinite Banking?

Infinite banking is a financial strategy that aims to provide individuals with a high level of control and flexibility over their money. At its core, infinite banking revolves around the use of a specially designed whole life insurance policy as a vehicle for personal banking.

Traditional whole life insurance policies typically provide a death benefit to beneficiaries upon the policyholder’s passing. In contrast, infinite banking life insurance focuses on the cash value component of the policy. Policyholders can contribute premiums into the policy, which then accumulate over time and grow on a tax-deferred basis.

One of the key principles of infinite banking is the ability to borrow against the cash value of the policy. This is known as a policy loan. Unlike traditional loans, policy loans offer more flexibility, as there are no credit checks or lengthy approval processes. Policyholders can borrow against their cash value at a competitive interest rate, and they have the freedom to repay the loan on their own terms.

Furthermore, when policyholders take out a policy loan, the cash value of the policy continues to grow, providing a dual benefit. This creates a powerful wealth-building strategy, as the cash value acts as a reserve that policyholders can tap into, while still earning interest on the remaining balance.

Infinite banking is often associated with the concept of becoming your own banker. By utilizing the cash value of the policy, individuals can fund various expenses, such as purchasing a home, starting a business, or funding education. This approach allows individuals to reduce their reliance on traditional lenders, potentially saving on interest payments and maintaining greater control over their financial choices.

It’s important to note that infinite banking requires discipline and a long-term commitment. Policyholders need to make regular premium payments to keep the policy in force and ensure continued growth of the cash value. Additionally, careful planning and consideration must be given to the repayment of policy loans to avoid any adverse impacts on the policy.

Now that we have a basic understanding of what infinite banking is, let’s delve into how infinite banking life insurance works and explore its potential benefits.

How Does Infinite Banking Life Insurance Work?

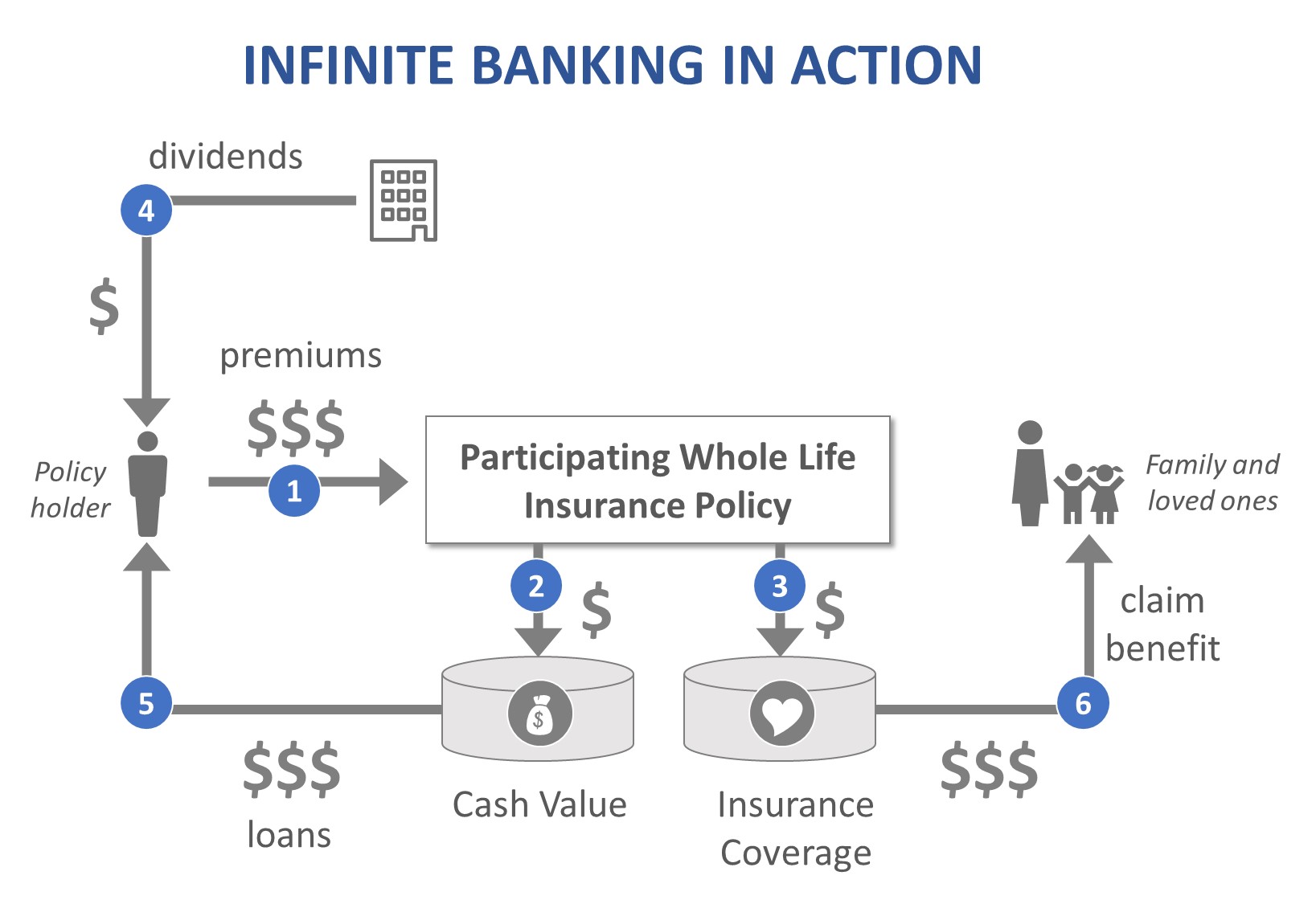

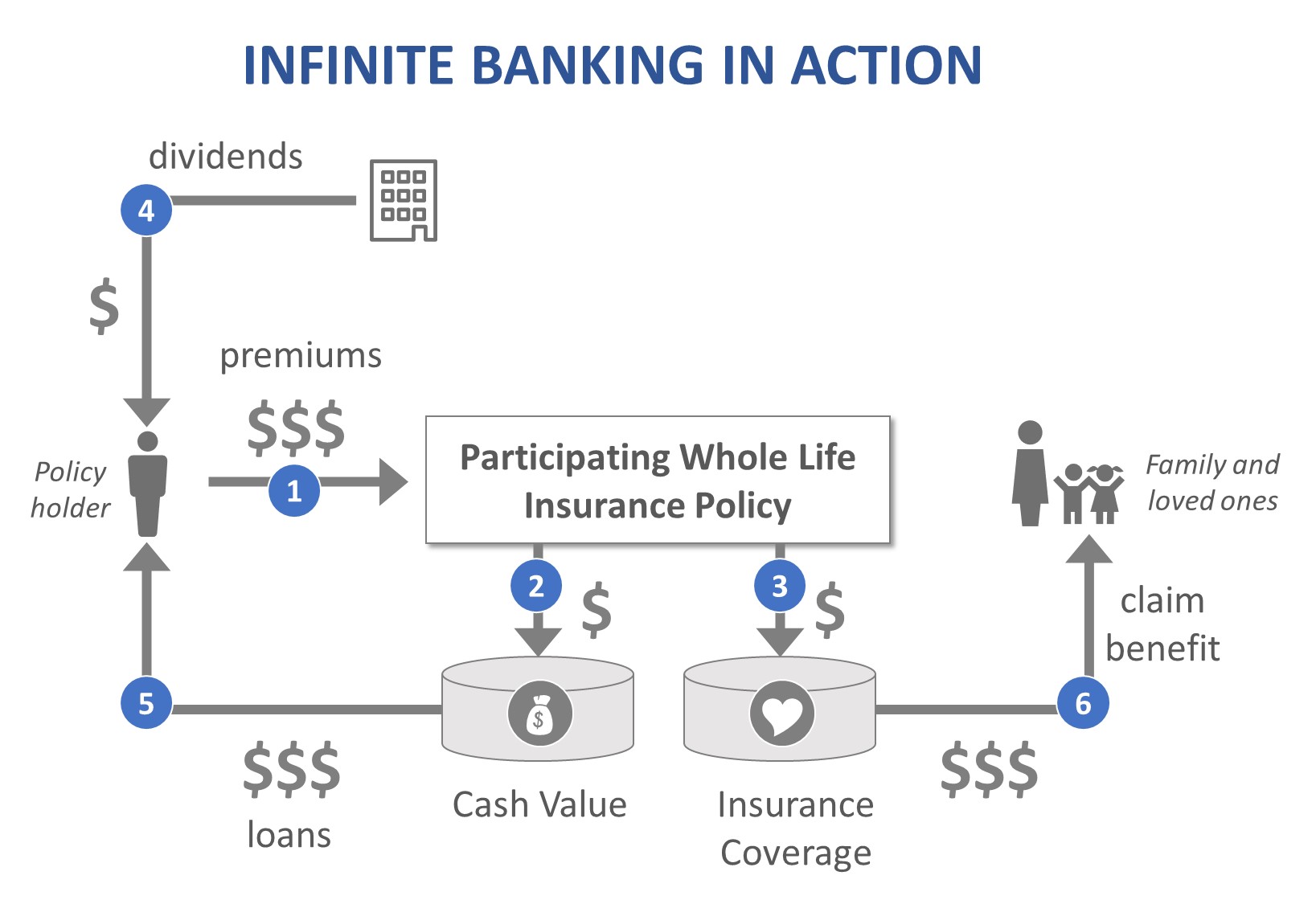

Infinite banking life insurance works by leveraging the cash value component of a specially designed whole life insurance policy. Here’s a breakdown of how the process works:

- Purchasing a Whole Life Insurance Policy: The first step in implementing an infinite banking strategy is to purchase a whole life insurance policy from a reputable insurance company. It’s important to work with a knowledgeable insurance agent who specializes in infinite banking to ensure you choose the right policy.

- Contributing Premiums: Once the policy is in place, policyholders make regular premium payments into their insurance policy. These payments contribute to both the death benefit for beneficiaries and the cash value component of the policy.

- Building Cash Value: As policyholders continue to make premium payments, the cash value of the policy begins to grow over time. The cash value accumulates on a tax-deferred basis and earns a guaranteed minimum interest rate determined by the insurance company.

- Borrowing Against the Cash Value: One of the unique features of infinite banking life insurance is the ability to borrow against the cash value of the policy. Policyholders have the option to take out a policy loan, using their cash value as collateral. These loans can be used for various financial needs, such as debt consolidation, investments, or unexpected expenses.

- Repaying the Policy Loan: When policyholders take out a policy loan, they have the flexibility to repay the loan on their own terms. Repayments can be made in the form of regular installments or through lump sum payments. It’s important to note that the interest on the policy loan is typically paid back to the policyholder, effectively allowing them to recapture the interest paid.

- Continued Growth of the Cash Value: Even when a policy loan is taken out, the cash value of the policy continues to grow, providing a dual benefit. This means that policyholders can access funds while still earning interest on the remaining cash value. The growth of the cash value can help replenish the policy and maintain its long-term sustainability.

By utilizing the cash value of the policy through policy loans, individuals can create a personal banking system that offers control, flexibility, and the potential for wealth accumulation. However, it’s important to carefully manage the policy and ensure timely repayment of policy loans to avoid any potential negative consequences, such as policy lapses or reduced death benefits.

Now that we understand how infinite banking life insurance works, let’s explore the benefits it can offer.

Benefits of Infinite Banking Life Insurance

Infinite banking life insurance comes with a range of potential benefits that may make it an attractive financial strategy for individuals. Here are some of the key advantages:

- Control and Flexibility: Infinite banking provides policyholders with a high level of control and flexibility over their finances. They have the ability to access funds through policy loans, which allows them to use their own money for various financial needs without relying on traditional lenders. This control enables individuals to make financial decisions on their own terms.

- Tax Advantages: The cash value component of an infinite banking policy grows on a tax-deferred basis. This means that policyholders do not have to pay taxes on the growth of their cash value until they withdraw the funds. Additionally, policy loans are typically considered tax-free, as they are not seen as income in the eyes of the IRS.

- Protection and Guarantees: Whole life insurance policies, which are the foundation of infinite banking, provide a death benefit that offers financial protection to beneficiaries. This can give policyholders peace of mind, knowing that their loved ones will be taken care of in the event of their passing. Additionally, the cash value component of the policy is guaranteed to grow at a minimum interest rate set by the insurance company.

- Wealth Accumulation: With the ability to borrow against the cash value of the policy and continue the growth of the cash value, infinite banking allows for potential wealth accumulation over time. Policyholders can borrow funds for investments or other opportunities, while still earning interest on the remaining cash value. This can lead to a powerful wealth-building strategy that provides both financial stability and potential growth.

- Diversification: Infinite banking can also provide individuals with an additional avenue for diversifying their financial portfolio. By utilizing the cash value of the policy for investments or other purposes, individuals can spread their wealth across different asset classes and reduce their reliance on traditional investment vehicles.

It’s important to note that while infinite banking offers many benefits, it may not be suitable for everyone. The benefits can vary depending on individual circumstances, financial goals, and risk tolerance. It’s crucial to work closely with a knowledgeable insurance professional or financial advisor to determine if infinite banking would be a good fit for your personal situation.

Now that we’ve explored the benefits of infinite banking life insurance, let’s turn our attention to the potential drawbacks associated with this strategy.

Drawbacks of Infinite Banking Life Insurance

While infinite banking life insurance can offer a range of benefits, it’s important to consider the potential drawbacks associated with this financial strategy. Here are some of the key drawbacks to keep in mind:

- Cost: Whole life insurance policies, which are the foundation of infinite banking, are generally more expensive compared to other types of life insurance policies. The premiums are typically higher, as a portion of the premium goes towards the cash value component of the policy. It’s important to assess whether the potential benefits outweigh the cost and fit within your budget.

- Commitment and Discipline: Infinite banking requires a long-term commitment and disciplined financial management. Policyholders need to make regular premium payments to keep the policy in force and ensure the growth of the cash value. Additionally, thoughtful planning and repayment of policy loans are crucial to maintain the sustainability of the policy.

- Reduced Death Benefit: Policy loans against the cash value can reduce the death benefit of the policy. If policy loans are not repaid, the outstanding balance plus interest can erode the death benefit over time. This reduction in the death benefit can impact the financial protection provided to beneficiaries.

- Opportunity Cost: By utilizing the cash value of the policy for policy loans, individuals miss out on potential investment opportunities or the potential growth of other assets. It’s important to weigh the potential returns of investing the cash value elsewhere against the benefits of using it for policy loans.

- Complexity: Infinite banking can be a complex financial strategy that requires a thorough understanding of the insurance policy’s terms and conditions. Policyholders need to navigate various aspects, such as interest rates, policy loans, and impact on the death benefit. Working with a knowledgeable insurance professional or financial advisor is crucial to fully comprehend the intricacies of infinite banking.

It’s essential to thoroughly evaluate these drawbacks and consider them in the context of your specific financial goals and circumstances. What may be a drawback for one individual may not be the same for another. Assessing the potential benefits and drawbacks will help you determine whether infinite banking life insurance is the right fit for your needs.

Now that we’ve explored the drawbacks of infinite banking, let’s move on to the next section and discuss whether infinite banking life insurance is the right strategy for you.

Is Infinite Banking Life Insurance Right for You?

Deciding whether infinite banking life insurance is the right strategy for you requires careful consideration of your financial goals, risk tolerance, and personal circumstances. Here are some key factors to assess when determining if infinite banking is a suitable option:

- Financial Goals: Consider your long-term financial goals. Are you looking for a strategy that offers both financial protection and potential wealth accumulation? Infinite banking can provide opportunities for both, but it’s important to align the strategy with your specific goals.

- Risk Tolerance: Evaluate your risk tolerance and your comfort level with using life insurance as a financial tool. Infinite banking involves leveraging the cash value of a life insurance policy, which carries risks and potential trade-offs. Assess whether you are comfortable with the potential outcomes and understand the impact on the death benefit.

- Financial Stability: Assess your current financial stability and ability to commit to regular premium payments. Infinite banking requires discipline and consistent premium payments to keep the policy in force and maintain the growth of the cash value. Ensure that your financial situation allows for these ongoing payments.

- Interest in Financial Management: Consider your interest and willingness to actively engage in financial management. Infinite banking may require more involvement compared to traditional banking methods. You need to actively monitor the cash value, make informed decisions about policy loans, and have a good understanding of the insurance policy’s terms and conditions.

- Expert Guidance: Seek the guidance of a knowledgeable insurance professional or financial advisor who specializes in infinite banking. They can provide valuable insights and help you navigate the complexities of this strategy. Working with an expert will ensure that you have a clear understanding of the benefits, drawbacks, and potential outcomes of implementing infinite banking.

Ultimately, the decision to pursue infinite banking life insurance should be based on a thorough evaluation of these factors in the context of your individual circumstances and financial goals. It’s important to take the time to educate yourself about the strategy, seek professional advice, and consider how infinite banking aligns with your long-term financial objectives.

Now that we’ve explored the factors to consider, let’s wrap up our discussion on infinite banking life insurance.

Conclusion

Infinite banking life insurance offers a unique approach to financial management, utilizing a specially designed whole life insurance policy as a personal banking system. While it has gained popularity in recent years, it’s important to carefully evaluate the benefits, drawbacks, and suitability of this strategy for your individual needs.

By leveraging the cash value component of the policy, infinite banking provides control, flexibility, and potential wealth accumulation. Policyholders can access funds through policy loans without credit checks or lengthy approval processes. The tax advantages, guaranteed growth of the cash value, and potential for diversification make infinite banking an attractive option for some individuals.

However, it’s crucial to consider the potential drawbacks, including the cost of whole life insurance premiums, the commitment and discipline required, the potential reduction in the death benefit, and the complexity of the strategy. Each individual’s financial circumstances, risk tolerance, and long-term goals must be carefully evaluated before implementing infinite banking.

Seeking the guidance of a knowledgeable insurance professional or financial advisor who specializes in infinite banking is highly recommended. They can provide expert advice, help you navigate the complexities, and determine if infinite banking is the right fit for you.

In conclusion, infinite banking life insurance can offer a powerful financial strategy for those seeking control, flexibility, and potential wealth accumulation. By understanding the benefits, drawbacks, and personal considerations involved, you can make an informed decision about whether infinite banking is the right path to achieve your financial goals.