(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is an Invoice in Accounting?

Introduction

An invoice is a crucial document in accounting that serves as a record of a financial transaction between a seller and a buyer. It provides a detailed breakdown of the goods or services provided, along with the corresponding charges and payment terms. Invoices are not only essential for tracking sales and revenue but also play a vital role in maintaining accurate financial records and facilitating smooth business operations.

In this article, we will explore the definition and purpose of an invoice in accounting, discuss the components that make up an invoice, emphasize the importance of accurate invoicing, delve into the invoice processing and recording procedures, highlight common types of invoices, and clarify the key differences between an invoice and a receipt.

Understanding the concept of invoicing and its significance in accounting is vital for business owners, accountants, and anyone involved in financial management. So, let’s dive in and explore the world of invoices and their role in maintaining financial stability and transparency.

What Is an Invoice in Accounting?

Definition of Invoice

An invoice is a commercial document issued by a seller to a buyer, containing detailed information about a specific transaction. It serves as a request for payment for goods or services provided by the seller to the buyer. In the realm of accounting, an invoice acts as a legally binding record of the sale and outlines the terms and conditions of the transaction.

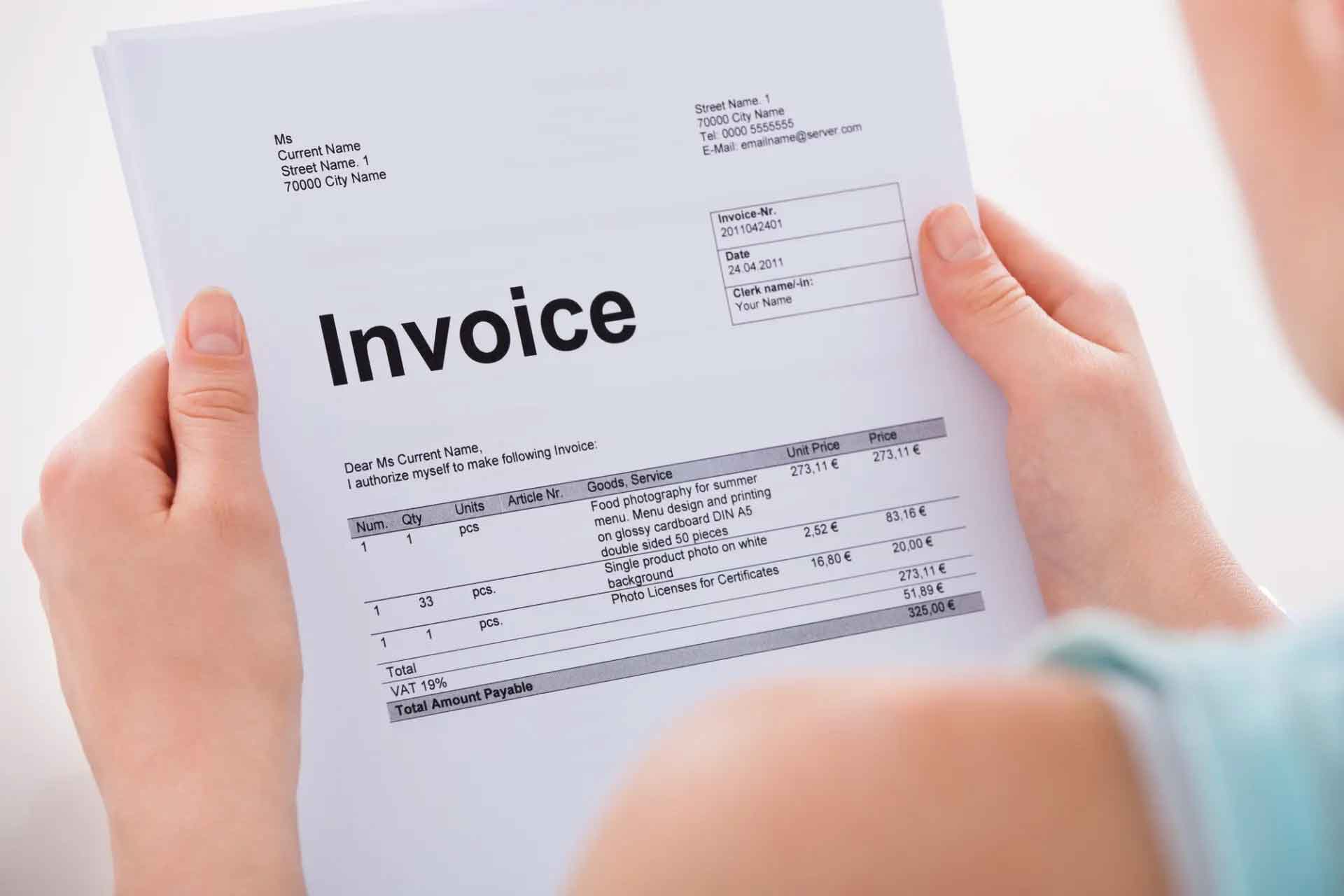

The invoice typically includes essential details such as the seller’s contact information, the buyer’s contact information, a unique invoice number, a description of the products or services rendered, the quantity, the price per unit, any applicable taxes, discounts or additional charges, the total amount due, and the payment due date. By providing this comprehensive information, an invoice ensures transparency and helps both parties involved in the transaction to verify and reconcile the financial details.

It is important to note that invoices differ from purchase orders. While a purchase order is initiated by the buyer to request goods or services, an invoice is generated and sent by the seller as a formal request for payment after the goods or services have been delivered. Therefore, an invoice marks the culmination of a transaction, indicating that the seller has fulfilled their obligations, and it is now time for the buyer to fulfill their payment obligations.

Invoices are critical for accurate bookkeeping and financial record-keeping. They provide a paper trail of transactions, enabling businesses to track sales, monitor revenue, calculate profits, and reconcile accounts. Additionally, invoices serve as a basis for auditing, taxation, and financial planning, making them an integral part of an organization’s financial ecosystem.

What Is an Invoice in Accounting?

Purpose of Invoice in Accounting

The primary purpose of an invoice in accounting is to facilitate accurate financial recording and ensure that all business transactions are properly documented. Invoices play a crucial role in the financial management of a company, serving multiple purposes that contribute to the overall success and sustainability of the business.

Here are some key purposes of invoices:

- Revenue Recognition: Invoices serve as evidence of revenue earned by a company. By issuing invoices for products sold or services rendered, businesses can track their sales and accurately record revenue in their financial statements. This is important for assessing the financial health of the company and making informed decisions.

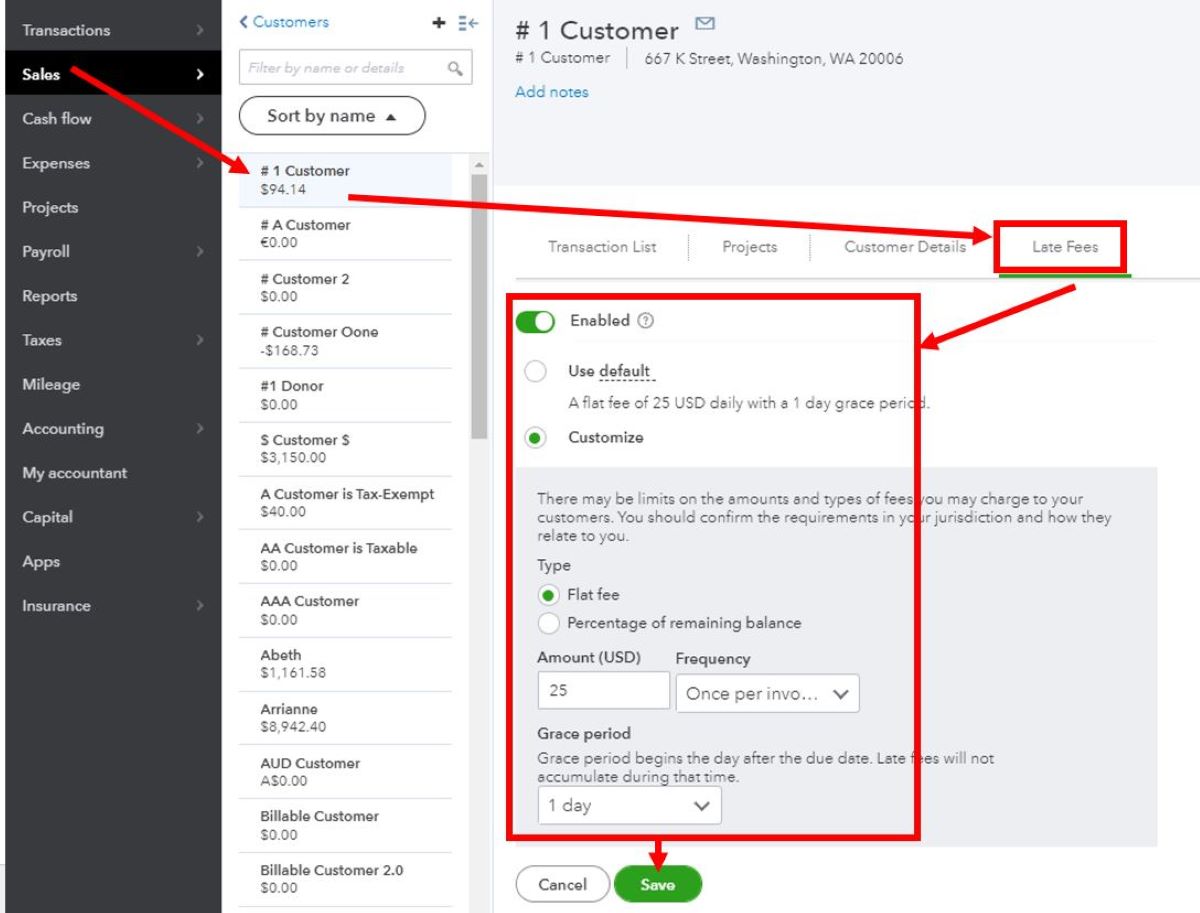

- Debt Collection: Invoices act as formal requests for payment, outlining the amount due and the payment terms. They provide a clear and concise breakdown of the charges, making it easier for the buyer to understand and settle their financial obligations. In the event of late payments or non-payment, the existence of an invoice helps companies in pursuing debt collection actions or legal recourse if necessary.

- Financial Analysis and Reporting: Invoices provide valuable data for financial analysis and reporting. They enable businesses to track sales trends, analyze revenue streams, and identify the most profitable products or services. Accurate invoicing also ensures that financial reports are comprehensive and reflective of the company’s actual performance.

- Audit and Compliance: Invoices serve as critical supporting documents during audits, enabling companies to provide evidence of sales, expenses, and taxable transactions. They help businesses comply with relevant regulations and tax requirements by providing a detailed record of transactions for both internal and external audits.

- Record Keeping: Invoices serve as a vital component of proper record-keeping. They provide a trail of financial transactions, allowing businesses to maintain accurate and organized financial records. This is crucial for internal purposes, such as monitoring cash flow, tracking customer payments, and reconciling accounts.

Overall, the purpose of an invoice in accounting is to ensure transparency, facilitate efficient financial management, and enable businesses to make informed decisions based on accurate and comprehensive financial data.

What Is an Invoice in Accounting?

Components of an Invoice

An invoice consists of several essential components that provide detailed information about a transaction. These components play a crucial role in ensuring clarity, accuracy, and transparency in financial transactions. Let’s explore the key components of an invoice:

- Seller’s Information: This includes the name, address, and contact details of the seller, making it easy for the buyer to identify and communicate with the seller if necessary.

- Buyer’s Information: The buyer’s information, including their name, address, and contact details, helps the seller identify the party responsible for making the payment. This is particularly important for businesses dealing with multiple customers.

- Invoice Number: Each invoice should have a unique identification number. This helps in organizing and tracking invoices, making it easier to refer to specific transactions when communicating or resolving any payment-related issues.

- Invoice Date: This is the date on which the invoice is issued. It serves as a reference point for both the seller and the buyer to determine the timelines and payment due dates associated with the transaction.

- Description of Goods or Services: The invoice should provide a clear and detailed description of the goods sold or services rendered, including the quantity and unit price. This ensures that both parties have a mutual understanding of what is being billed.

- Price and Total Amount: The invoice should clearly state the price per unit, along with any applicable taxes, discounts, or additional charges. It should also calculate the total amount due, taking into account the quantity and any adjustments made.

- Payment Terms: The payment terms outline the timeline within which the buyer should make the payment. This includes the due date, any late payment penalties, and the accepted payment methods. Clear payment terms help in avoiding confusion and ensure timely payments.

- Payment Instructions: This section provides instructions to the buyer on how to make the payment. It may include details such as the seller’s bank account information, payment reference number, and any specific instructions or requirements.

- Additional Notes or Terms: Depending on the nature of the transaction, there may be additional terms or notes provided on the invoice. This could include warranty information, return policies, or any other relevant information that the buyer needs to be aware of.

These components collectively make up an invoice, ensuring that all the necessary information is captured accurately and comprehensively. By including these details, both the seller and the buyer can have a clear understanding of the transaction and can effectively manage their financial obligations.

What Is an Invoice in Accounting?

Importance of Accurate Invoicing

Accurate invoicing is essential for the smooth operation and financial health of a business. It plays a vital role in maintaining transparency, facilitating timely payments, and ensuring accurate financial records. Let’s explore the importance of accurate invoicing:

- Transparency and Trust: Accurate invoicing promotes transparency between the buyer and the seller. It provides a clear breakdown of the products or services provided, enabling the buyer to verify and reconcile the charges. This fosters trust and strengthens the business relationship.

- Timely Payments: Accurate invoices clearly state the payment terms and due dates. By providing correct and detailed information, invoices improve the chances of prompt payments. This helps maintain a steady cash flow and avoids financial strain on the seller’s side.

- Financial Planning and Decision-Making: Accurate invoicing provides consistent and reliable data for financial planning and decision-making. It enables businesses to monitor revenue, track sales trends, and identify areas of growth or improvement. With accurate financial information, businesses can make informed decisions that drive their success.

- Compliance and Audit Trail: Accurate invoicing ensures compliance with tax regulations and provides an audit trail for financial record-keeping. Properly documented invoices substantiate revenue and expenses, making it easier to comply with tax obligations and respond to audits or inquiries from regulatory authorities.

- Customer Satisfaction: Accurate invoicing enhances customer satisfaction by providing clarity and accountability. It eliminates misunderstandings and disputes, ensuring that customers receive invoices that accurately reflect their purchases. This helps build strong customer relationships and encourages repeat business.

- Legal Protection: Accurate invoicing provides legal protection in case of payment disputes or non-payment. A well-documented invoice serves as evidence of the agreed-upon transaction and the buyer’s financial obligations. In the event of legal action, accurate invoicing can greatly support the seller’s case.

Considering these reasons, it is evident that accurate invoicing is not just important but critical for businesses of all sizes. By ensuring precision and completeness in the invoicing process, companies can maintain financial stability, improve cash flow, foster customer trust, and make informed decisions that drive growth and success.

What Is an Invoice in Accounting?

Invoice Processing and Recording

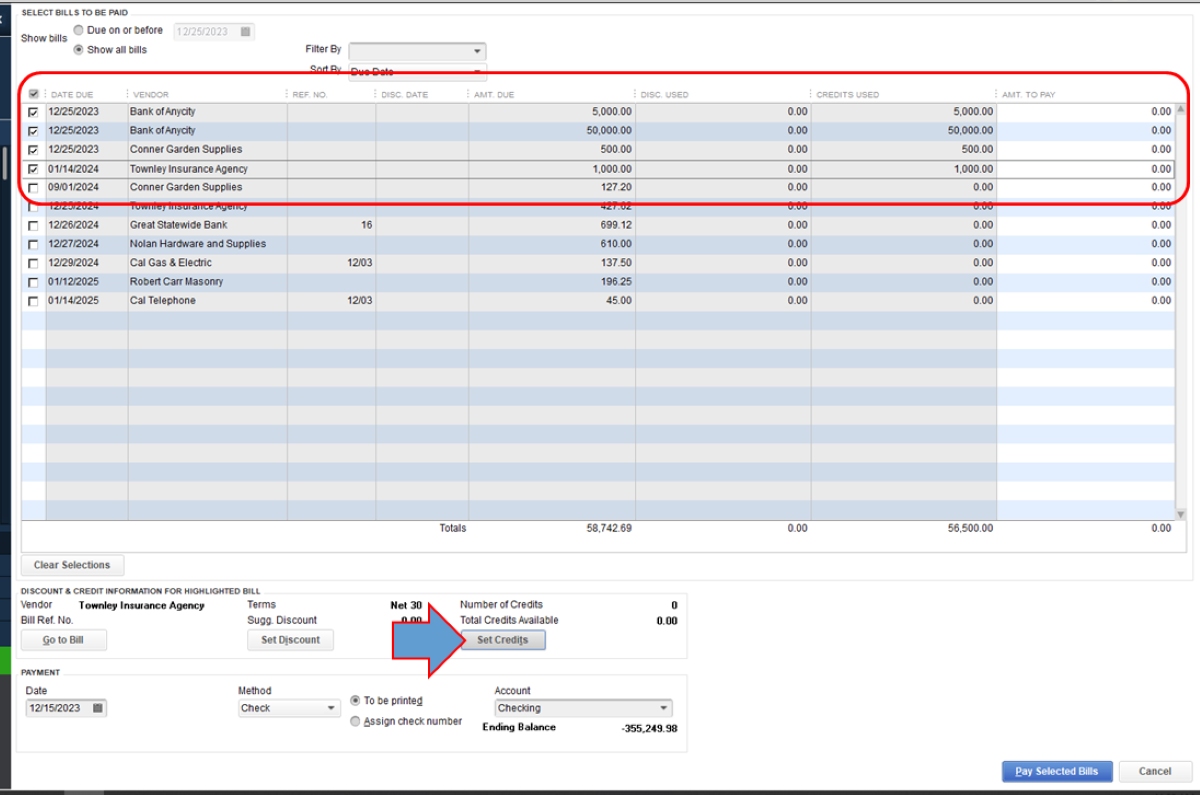

Invoice processing and recording are crucial steps in the financial management of a business. It involves a systematic approach to ensure accurate and timely recording of invoices and payments. Let’s explore the process of invoice processing and recording:

- Receiving the Invoice: The first step in the process is receiving the invoice from the seller. This can be done through various means such as email, mail, or electronic data interchange (EDI). The invoice should be carefully reviewed to ensure all necessary information is present and accurate.

- Verification and Approval: Once the invoice is received, it undergoes a verification process to ensure its authenticity and accuracy. This involves cross-checking the invoice details with the corresponding purchase order or contract. The invoice may also require approval from the relevant departments or individuals before it can be processed for payment.

- Recording the Invoice: After the invoice is verified and approved, it is recorded in the company’s accounting system. The invoice details, including the invoice number, date, vendor information, amount, and other relevant information, are entered into the system. This creates a digital record of the transaction for future reference.

- Matching and Reconciliation: Invoices are often matched with purchase orders or receipts to ensure that the goods or services have been received as expected. This helps in identifying any discrepancies and resolving them before making the payment. Reconciliation is performed to ensure the invoice matches the corresponding payment made.

- Payment Processing: Once the invoice is recorded and matched, the payment is processed according to the agreed-upon payment terms. This may involve issuing a check, making an electronic fund transfer, or using other payment methods. Proper documentation is maintained to track the payment made.

- Proper Documentation and Filing: It is essential to maintain a systematic record-keeping process for invoices. This includes organizing invoices in a structured manner and ensuring easy retrieval for future reference or audits. Digital archiving or using document management systems can streamline the documentation and filing process.

By following a well-defined and efficient process for invoice processing and recording, businesses can ensure accuracy, mitigate errors and discrepancies, and maintain a clear audit trail. This helps in maintaining financial transparency, facilitating smooth business operations, and complying with accounting standards and regulations.

What Is an Invoice in Accounting?

Common Types of Invoices

There are several types of invoices that businesses use in different situations. Each type serves a specific purpose and has its own unique characteristics. Let’s explore some of the common types of invoices:

- Standard Invoice: A standard invoice is the most common and straightforward type of invoice. It includes the details of the products or services provided, the quantity, the price, and the payment terms.

- Recurring Invoice: Recurring invoices are used for regular or subscription-based services. They are issued at predetermined intervals, such as monthly or annually, and typically include an ongoing arrangement with the customer.

- Commercial Invoice: A commercial invoice is used in international trade. It contains additional information required for customs clearance, such as the country of origin, the Harmonized System (HS) code, and details of the exporter and importer.

- Proforma Invoice: A proforma invoice is an estimated or preliminary invoice that is used to provide a quote or estimate to a customer. It is not a demand for payment but serves as a formal proposal.

- Credit Invoice: A credit invoice, also known as a credit memo, is issued when a correction or adjustment needs to be made to an original invoice. It may be used to provide refunds, correct billing errors, or adjust the amount owed by the customer.

- Debit Invoice: A debit invoice is the opposite of a credit invoice. It is issued when additional charges need to be applied to an original invoice. For example, it may be used to bill the customer for additional services or products.

- Interim Invoice: An interim invoice, also known as a progress invoice, is used when a project or service is ongoing and requires multiple payments at different stages. It allows for partial payment before the final completion of the project or service.

- Time-Based Invoice: Time-based invoices are commonly used by professionals who charge for their time, such as lawyers, consultants, or freelancers. They invoice based on the number of hours worked or a predefined rate for a specific period.

It’s important for businesses to understand the different types of invoices and use the appropriate one based on the nature of the transaction. Choosing the right invoice type ensures clarity, accuracy, and compliance with industry and legal requirements.

What Is an Invoice in Accounting?

Differences Between Invoice and Receipt

Although both invoices and receipts are important documents in accounting, they serve different purposes and are used at different stages of a transaction. Let’s explore the key differences between an invoice and a receipt:

- Purpose: An invoice is a document issued by the seller to request payment from the buyer for goods or services rendered. It serves as a formal record of the transaction and outlines the terms of payment. On the other hand, a receipt is issued by the seller after the payment has been made. It confirms that the payment has been received and serves as proof of the transaction.

- Timing: Invoices are issued before payment is made, indicating the amount owed by the buyer. They initiate the payment process. Receipts, on the other hand, are issued after the payment has been made and serve as proof of payment. They conclude the payment process.

- Content: Invoices contain detailed information about the goods or services provided, including descriptions, quantities, prices, and any applicable taxes or discounts. They also include the payment terms and due date. Receipts, on the other hand, typically include the seller’s information, the buyer’s information, the payment amount, the payment method, and the date of payment. They do not provide a breakdown of the goods or services.

- Legal Significance: Invoices are legally binding documents that establish an obligation for the buyer to pay the amount specified. They can be used as evidence in case of disputes or legal actions. Receipts, on the other hand, serve as proof of payment and can be used to support claims of payment.

- Accounting: Invoices play a crucial role in accounting as they are used to record revenue, track sales, and maintain financial records. They are essential for bookkeeping, financial analysis, and tax compliance. Receipts, although important for record-keeping, serve as a confirmation of payment and are not typically used for accounting purposes.

- Customer Perspective: From a customer’s perspective, an invoice represents an obligation to pay for the goods or services received. It provides a summary of the charges and payment terms. A receipt, on the other hand, serves as proof of payment and provides assurance that the transaction has been completed.

Understanding the differences between invoices and receipts is important for businesses and individuals to accurately track transactions, maintain financial records, and ensure proper compliance with accounting practices and legal requirements.

What Is an Invoice in Accounting?

Conclusion

In conclusion, an invoice is a critical document in accounting that serves as a record of a financial transaction between a seller and a buyer. It plays a vital role in maintaining accurate financial records, facilitating timely payments, and ensuring transparency and compliance in business transactions.

We explored the definition and purpose of an invoice, highlighting its role in revenue recognition, debt collection, financial analysis, audit and compliance, record-keeping, and legal protection. We also discussed the components that make up an invoice, emphasizing the importance of accuracy and clear documentation.

Furthermore, we explored the process of invoice processing and recording, including the steps of receiving, verifying, recording, matching, and processing payments. We also discussed the importance of proper documentation and filing for easy retrieval and auditing purposes.

Additionally, we delved into common types of invoices, such as standard invoices, recurring invoices, commercial invoices, proforma invoices, credit invoices, debit invoices, interim invoices, and time-based invoices. Each type serves a specific purpose and is used in different scenarios to meet the needs of various businesses and industries.

Finally, we explored the differences between an invoice and a receipt, highlighting their distinct purposes, timing, content, legal significance, and accounting implications. Understanding these differences can help businesses maintain accurate financial records and provide proper documentation for transactions.

In conclusion, invoices are an integral part of the accounting process, providing a foundation for financial management and facilitating effective business operations. Accurate invoicing promotes transparency, timely payments, and enables informed decision-making. By understanding and implementing proper invoicing practices, businesses can ensure financial stability, compliance with regulations, and long-term success.