Finance

What Is Modified Accrual Accounting

Modified: February 21, 2024

Learn about modified accrual accounting, a finance concept that combines elements of cash and accrual accounting. Gain a deeper understanding of its importance in financial reporting and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Modified Accrual Accounting

- Key Differences between Modified Accrual Accounting and Other Accounting Methods

- Application of Modified Accrual Accounting in Government and Nonprofit Organizations

- Components of Modified Accrual Accounting

- Advantages and Disadvantages of Modified Accrual Accounting

- Examples and Case Studies of Modified Accrual Accounting Implementation

- Conclusion

Introduction

In the realm of finance and accounting, various methods and principles have been developed to record and report financial transactions. One of these methods is Modified Accrual Accounting, which is widely used by government and nonprofit organizations.

Modified Accrual Accounting is a specific form of accounting that combines elements of cash-basis accounting and accrual accounting. It is designed to provide a more accurate representation of an organization’s financial position and performance, especially for entities that receive and spend funds over an extended period of time.

Understanding Modified Accrual Accounting is essential for finance professionals, as well as anyone who deals with government or nonprofit financial statements. In this article, we will delve into the definition of Modified Accrual Accounting, its key differences from other accounting methods, its application in various sectors, the components involved, and the advantages and disadvantages it presents.

By the end of this article, you will have a comprehensive understanding of Modified Accrual Accounting and its significance in financial reporting.

Definition of Modified Accrual Accounting

Modified Accrual Accounting is a hybrid accounting method that combines features of both cash-basis accounting and accrual accounting. In this system, revenue is recognized when it becomes both measurable and available, while expenses are recognized when they result in a decrease in financial resources that are both measurable and expected to be paid within a specific time period.

Unlike cash-basis accounting, which records revenue and expenses when cash is received or paid out, and accrual accounting, which records revenue when earned and expenses when incurred, Modified Accrual Accounting strikes a balance between the two. It aims to provide a more accurate representation of an organization’s financial position, particularly for entities that rely on government funding or engage in long-term projects.

Under Modified Accrual Accounting, revenue is recognized when it is both measurable and available. Measurable means that the amount can be reasonably determined, while available means that it can be collected within a reasonable timeframe. This approach ensures that revenue is not recognized until it can be used to fund current or future obligations.

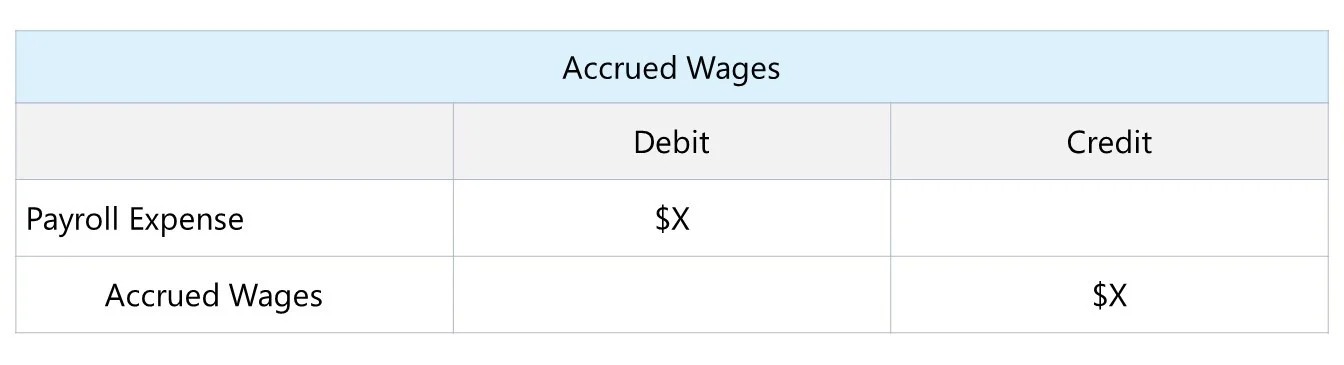

Expenses, on the other hand, are recognized when they result in a decrease in financial resources and are both measurable and expected to be paid in the near future. This means that expenses are recorded as soon as they are incurred, even if they have not been paid for yet.

Modified Accrual Accounting also incorporates a concept known as “encumbrances.” Encumbrances refer to obligations for which funds have been set aside but have not yet been spent. This allows organizations to track committed funds and better manage their financial resources.

Overall, Modified Accrual Accounting strikes a balance between the simplicity of cash-basis accounting and the accuracy of accrual accounting. It provides a more comprehensive and transparent view of an organization’s financial position, making it ideal for government and nonprofit entities that have unique reporting requirements and complex financial activities.

Key Differences between Modified Accrual Accounting and Other Accounting Methods

Modified Accrual Accounting stands out from other accounting methods, such as cash-basis accounting and full accrual accounting, due to its unique principles and practices. Let’s explore the key differences between Modified Accrual Accounting and these other methods:

- Cash-Basis Accounting: Cash-basis accounting records revenue when cash is received and expenses when cash is paid out. This method does not consider when revenue is earned or when expenses are incurred. In contrast, Modified Accrual Accounting recognizes revenue when it is both measurable and available, and expenses when they result in a decrease in financial resources that are measurable and expected to be paid within a specific period. This distinction ensures a more accurate representation of an organization’s financial position.

- Accrual Accounting: Full accrual accounting recognizes revenue when it is earned, irrespective of when cash is received, and expenses when they are incurred, irrespective of when cash is paid out. This method provides a more comprehensive view of an organization’s financial activities. Modified Accrual Accounting, while incorporating accrual principles, differs in terms of timing. It recognizes revenue when it is both measurable and available, and expenses when they are measurable and expected to be paid within a specific period.

- Encumbrances: One of the key differences between Modified Accrual Accounting and other methods is the inclusion of encumbrances. This concept allows organizations using Modified Accrual Accounting to set aside funds for specific purposes, indicating the commitment of funds for future expenses. Cash-basis accounting does not recognize encumbrances, while full accrual accounting may use the concept of commitments or appropriations to achieve a similar purpose.

- Reporting: Modified Accrual Accounting is primarily used in government and nonprofit organizations, which have specific reporting requirements. It provides a unique framework for these entities to present their financial position and performance. Cash-basis accounting is often used by small businesses or individuals who do not have complex financial activities. Full accrual accounting is prevalent in the corporate sector and provides a comprehensive view of an organization’s financial activities regardless of industry.

- Complexity: Modified Accrual Accounting falls between cash-basis accounting and full accrual accounting in terms of complexity. While it requires more detailed tracking of revenue and expenses compared to cash-basis accounting, it is less complex and resource-intensive than full accrual accounting. This makes Modified Accrual Accounting a practical choice for government and nonprofit organizations that need to balance accuracy with administrative efficiency.

By understanding the key differences between Modified Accrual Accounting and other accounting methods, finance professionals can make informed decisions on which method is most suitable for their organization’s unique financial needs and reporting requirements.

Application of Modified Accrual Accounting in Government and Nonprofit Organizations

Modified Accrual Accounting is widely used in government and nonprofit organizations as it provides a financial reporting framework that takes into account the unique characteristics and requirements of these entities. Let’s explore the application of Modified Accrual Accounting in these sectors:

Government Organizations: Modified Accrual Accounting is the preferred method of accounting for government entities at the local, state, and federal levels. These organizations often have complex financial activities, including receiving funds from various sources, such as taxes and grants, and disbursing funds for public services and infrastructure projects. Modified Accrual Accounting allows governments to accurately track revenue and expenses within specific time periods, ensuring appropriate allocation of funds and facilitating transparency in financial reporting.

Nonprofit Organizations: Nonprofit organizations, including charities, foundations, and educational institutions, also benefit from using Modified Accrual Accounting. These organizations rely on donations, grants, and other sources of funding to support their operations and fulfill their missions. Modified Accrual Accounting enables nonprofits to track and report revenue and expenses related to specific programs and projects. This method helps demonstrate accountability to donors and stakeholders, ensuring that funds are utilized effectively for the organization’s intended purposes.

Both government and nonprofit organizations often have long-term commitments and specific guidelines when it comes to financial management. Modified Accrual Accounting allows these organizations to adhere to regulations and best practices while providing financial statements that accurately reflect their financial position and performance.

Government and nonprofit entities using Modified Accrual Accounting also benefit from the ability to analyze financial data over multiple fiscal periods. This analysis helps in budgeting, forecasting, and decision-making processes, allowing organizations to allocate funds strategically and effectively.

Furthermore, Modified Accrual Accounting facilitates compliance with legal and regulatory requirements. It helps government entities conform to governmental accounting standards and nonprofit organizations to follow Generally Accepted Accounting Principles (GAAP) or other relevant guidelines, enhancing credibility and trust among stakeholders.

In summary, Modified Accrual Accounting is an invaluable tool for government and nonprofit organizations. By providing a structured financial reporting framework, it allows these entities to effectively manage their finances, demonstrate accountability, and fulfill their missions of serving the public and advancing social causes.

Components of Modified Accrual Accounting

Modified Accrual Accounting involves several key components that are integral to accurately measuring an organization’s financial position and performance. These components include:

- Revenue Recognition: One of the fundamental components of Modified Accrual Accounting is the recognition of revenue. Revenue is recognized when it becomes both measurable and available. Measurable means that the amount can be reasonably determined, while available means that it can be collected within a reasonable timeframe. This approach ensures that revenue is recorded when it can be used to fund the organization’s current or future obligations.

- Expense Recognition: Expenses are recognized when they result in a decrease in financial resources and are both measurable and expected to be paid within a specific time period. This means that expenses are recorded when they are incurred, even if they have not been paid. This component allows organizations to accurately track and report their financial obligations, reflecting the true costs associated with their operations.

- Encumbrances: Modified Accrual Accounting incorporates the concept of encumbrances, which are commitments of funds for specific purposes. Encumbrances indicate that funds have been set aside to cover future expenses or obligations. By recognizing encumbrances, organizations can better manage their financial resources, track committed funds, and avoid overspending in specific budget categories.

- Fund Accounting: In government and nonprofit organizations, Modified Accrual Accounting often utilizes a fund-based approach. Each fund represents a separate entity or activity with its own set of financial records. Fund accounting allows for the segregation of resources, ensuring that financial reports are accurate and transparent for each specific fund.

- Reporting and Disclosure: Modified Accrual Accounting requires organizations to prepare comprehensive financial statements, including balance sheets, income statements, and cash flow statements. These reports provide a snapshot of the organization’s financial position, performance, and cash flow activities. Additionally, disclosures are made in the financial statements to provide further information and transparency about significant accounting policies and potential risks and uncertainties.

By incorporating these components, Modified Accrual Accounting enables organizations to adhere to specific financial reporting requirements and accurately reflect their financial activities. These components help in assessing an organization’s fiscal health, making informed financial decisions, and providing stakeholders with the necessary information to evaluate the organization’s performance and financial stewardship.

Advantages and Disadvantages of Modified Accrual Accounting

Modified Accrual Accounting offers several advantages and disadvantages for organizations using this accounting method. Let’s explore these benefits and drawbacks:

Advantages:

- Accurate Financial Reporting: Modified Accrual Accounting provides a more accurate representation of an organization’s financial position and performance compared to cash-basis accounting. By recognizing revenue when it becomes both measurable and available and expenses when they are expected to be paid within a specified period, organizations can present a more comprehensive view of their financial activities.

- Improved Decision-Making: The use of Modified Accrual Accounting allows for better financial analysis and budgeting. Organizations can track revenue and expenses over specific periods, facilitating effective decision-making based on reliable financial data. This method enables entities to make informed choices about resource allocation, funding priorities, and program planning.

- Transparency and Accountability: Modified Accrual Accounting promotes transparency and accountability in financial reporting for government and nonprofit organizations. By following recognized accounting principles and disclosing financial information, entities can build trust among stakeholders, such as donors, taxpayers, and funding agencies. This transparency also helps ensure compliance with regulatory requirements and fosters good governance practices.

- Effective Financial Management: Modified Accrual Accounting allows organizations to manage their financial resources more effectively. By incorporating encumbrances, entities can track and control commitments of funds, prevent overspending, and ensure that funds are allocated to meet specific goals or obligations. This helps in maintaining fiscal discipline and optimizing financial performance.

Disadvantages:

- Complexity: Modified Accrual Accounting can be more complex and require additional record-keeping compared to cash-basis accounting. The need to track revenue recognition criteria, measure expenses, and manage encumbrances can introduce complexities for organizations, particularly those with limited resources and accounting expertise.

- Inaccuracy in Certain Circumstances: Although Modified Accrual Accounting aims to provide more accuracy, there are still potential limitations. For example, revenue recognition requirements might not align perfectly with the timing of actual cash inflows, resulting in a temporary mismatch. Additionally, the estimation of expenses can introduce variability, impacting the reliability of financial statements.

- Compliance Challenges: Organizations using Modified Accrual Accounting must comply with specific reporting requirements and accounting standards for government or nonprofit entities. These standards might change over time, requiring continuous monitoring and training to ensure adherence and avoid any compliance issues.

- Less Comprehensive than Full Accrual Accounting: While Modified Accrual Accounting strikes a balance between cash-basis accounting and full accrual accounting, it may not provide the same level of comprehensive financial reporting as the latter. Full accrual accounting captures more nuanced financial information, including long-term liabilities, contingent liabilities, and future obligations.

Despite these drawbacks, Modified Accrual Accounting remains a valuable tool for government and nonprofit organizations, offering a practical balance between simplified accounting methods and comprehensive financial reporting.

Examples and Case Studies of Modified Accrual Accounting Implementation

To better understand the practical application of Modified Accrual Accounting, let’s explore some examples and case studies of organizations that have successfully implemented this accounting method:

Example 1: City Government Accounting

A city government decides to adopt Modified Accrual Accounting to improve financial reporting and accountability. Under this approach, the city recognizes revenue from property taxes when it becomes measurable and available, meaning that it can be reasonably determined and collected within a specific timeframe. The city also records expenses when they result in a decrease in financial resources and are both measurable and expected to be paid within a certain period.

By implementing Modified Accrual Accounting, the city government can provide more accurate financial statements, including balance sheets and income statements. It enables them to track revenue and expenses over time, facilitating efficient budgeting and resource allocation. The inclusion of encumbrances allows the city to effectively manage committed funds for future expenses, such as infrastructure projects or public services.

Case Study 2: Nonprofit Organization Accounting

A nonprofit organization focuses on providing healthcare services in underserved communities. To enhance financial transparency and improve donor trust, the organization adopts Modified Accrual Accounting. This method helps them accurately record revenue from grants, donations, and government contracts when measurable and available. Expenses related to patient care and program operations are recognized when measurable and expected to be paid within a specific period.

By implementing Modified Accrual Accounting, the nonprofit organization can generate comprehensive financial reports. These reports allow them to provide detailed information to donors, grantors, and regulatory bodies about the allocation of funds for various programs and initiatives. The use of encumbrances assists in tracking committed funds for specific projects, ensuring efficient utilization of resources and avoiding overspending.

Example 3: School District Accounting

A school district adopts Modified Accrual Accounting to accurately track and report its financial activities. Revenue, such as property taxes and state funding, is recognized when measurable and available. The school district records expenses when they result in a decrease in financial resources and are both measurable and expected to be paid within the fiscal year.

Modified Accrual Accounting enables the school district to present a comprehensive financial picture, including key components like encumbrances for committed funds related to capital projects and instructional materials. These reports allow the district to demonstrate accountability to the community and ensure transparency in financial management.

These examples and case studies showcase how Modified Accrual Accounting is applied in various sectors, including government, nonprofit organizations, and school districts. The adoption of this accounting method provides these entities with a structured framework for accurate financial reporting, effective resource management, and enhanced transparency.

Conclusion

Modified Accrual Accounting is a valuable accounting method that combines elements of cash-basis accounting and accrual accounting. It strikes a balance between simplicity and accuracy, making it particularly suitable for government and nonprofit organizations with unique reporting requirements and complex financial activities.

Throughout this article, we have explored the definition of Modified Accrual Accounting and its key differences from other accounting methods. We have discussed its application in government and nonprofit organizations, highlighting its role in ensuring accurate financial reporting, transparency, and effective financial management.

The components of Modified Accrual Accounting, including revenue recognition, expense recognition, encumbrances, and fund accounting, contribute to its reliability and usefulness for these organizations. By adhering to these components, entities can present comprehensive financial statements, make informed decisions, and demonstrate financial accountability.

While Modified Accrual Accounting offers benefits such as accurate financial reporting, improved decision-making, transparency, and effective financial management, organizations should also be aware of its complexities and the need for compliance with specific reporting requirements.

Overall, Modified Accrual Accounting plays a crucial role in the finance and accounting practices of government and nonprofit organizations. It provides a framework that ensures financial transparency, accountability, and strategic resource allocation. By implementing Modified Accrual Accounting, organizations can effectively manage their financial activities, build trust among stakeholders, and fulfill their mission of serving the public and advancing social causes.