Home>Finance>When Is An Expense Recognized In Accrual Accounting

Finance

When Is An Expense Recognized In Accrual Accounting

Published: October 10, 2023

Learn about the principles of accrual accounting and understand when expenses are recognized. Explore this finance topic and improve your financial knowledge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, accurately recognizing expenses is a critical aspect of financial reporting. Expense recognition is the process of identifying and recording expenses in a company’s financial statements, following a set of principles and guidelines. This process plays a vital role in helping businesses analyze their financial performance, make informed decisions, and comply with accounting regulations.

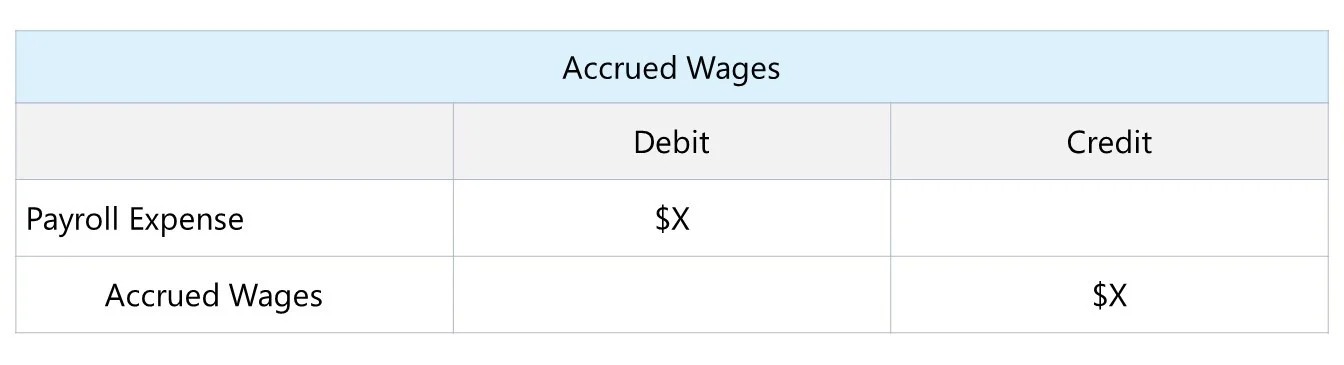

In accrual accounting, expenses are recognized when they are incurred, regardless of when the corresponding cash payment is made. This method provides a more accurate representation of a company’s financial position and performance by matching expenses with the revenues they help generate.

By understanding the fundamentals of expense recognition in accrual accounting, businesses can ensure they present reliable financial information to stakeholders and make informed strategic decisions.

In this article, we will explore the essential concepts of expense recognition and delve into the criteria and principles that govern its application in accrual accounting. We will also provide specific examples and discuss controversial issues surrounding expense recognition, shedding light on some of the challenges faced by financial professionals when dealing with the recognition of expenses.

So, let’s dive into the world of expense recognition and unravel its importance in the realm of finance.

Definition of Expense Recognition

Expense recognition, also known as expense matching, is the process of recording expenses in a company’s financial statements during a specific accounting period. It involves the identification, measurement, and classification of expenses to accurately reflect the costs incurred in generating revenues.

In accrual accounting, expenses are recognized when they are incurred, meaning when the goods or services are received or consumed, even if the actual payment occurs at a later date. This is in contrast to cash accounting, where expenses are recognized only when the cash payment is made.

The purpose of expense recognition is to provide a faithful representation of a company’s financial position and performance. By matching expenses with the revenues they help generate, accrual accounting offers a more comprehensive and accurate view of a business’s profitability and financial health.

Expense recognition follows the widely accepted matching principle, which states that expenses should be recognized in the same accounting period as the revenues to which they relate. This ensures that the financial statements accurately reflect the cause-and-effect relationship between expenses and revenues, allowing for more meaningful analysis and decision-making.

Overall, the goal of expense recognition is to present a realistic and transparent depiction of a company’s financial activities. By adhering to the principles and guidelines of expense recognition, businesses can provide stakeholders with reliable financial information for evaluating performance, assessing solvency, and making informed investment decisions.

In the next section, we will explore the basics of accrual accounting, as it forms the foundation for expense recognition in financial reporting.

Accrual Accounting Basics

Accrual accounting is a method of financial reporting that recognizes revenues and expenses when they are earned or incurred, regardless of the actual cash flow. It aims to provide a more accurate depiction of a company’s financial position and performance by matching revenues with the corresponding expenses.

In accrual accounting, transactions are recorded when they occur, rather than when the cash is exchanged. This means that revenues are recognized when they are earned, regardless of when the customer pays, and expenses are recognized when they are incurred, irrespective of when the payment is made.

The basic principles of accrual accounting include the revenue recognition principle and the matching principle. The revenue recognition principle states that revenues should be recognized when realized or realizable and earned, meaning when the products or services are delivered, and the payment is reasonably assured. The matching principle, on the other hand, requires expenses to be recognized in the same accounting period as the revenues they help generate.

Accrual accounting provides a more accurate representation of a company’s financials because it reflects the economic substance of transactions, rather than just the cash flow. It allows businesses to better assess their profitability, financial health, and performance over time.

Accrual accounting is widely used in various industries and is required for financial reporting by generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS). It is also essential for compliance with tax regulations in many countries.

By embracing accrual accounting, businesses can gain a clearer understanding of their financial performance, make more informed decisions, and provide stakeholders with reliable financial statements.

Now that we understand the basics of accrual accounting, let’s delve into the criteria for recognizing expenses in financial reporting.

Recognition Criteria for Expenses

Expense recognition involves applying specific criteria to determine when an expense should be recorded in a company’s financial statements. These criteria ensure that expenses are accurately matched with the revenues they help generate and provide a true reflection of a company’s financial performance. Let’s explore the key recognition criteria for expenses:

- Probability: An expense should be recognized when there is a likelihood of an outflow of resources. This means that if an expense is probable, it should be recognized, even if the exact amount is uncertain.

- Measurability: Expenses should be measurable in monetary terms with reasonable accuracy. This means that the amount of the expense can be reliably determined or estimated.

- Relevance: Expenses should be directly related to the generation of revenues or the production of goods and services. They should have a cause-and-effect relationship with the revenue recognition process.

- Reliability: The recognition of expenses should be based on verifiable evidence, such as invoices, purchase orders, or other supporting documentation. This ensures the reliability and credibility of the financial statements.

- Materiality: Expenses should be recognized if they are significant enough to influence the decision-making of users of the financial statements. Trivial or immaterial expenses may be expensed immediately or grouped together for recognition.

By applying these recognition criteria, businesses can ensure that expenses are recognized in the appropriate accounting period, providing a clear and accurate representation of their financial performance.

In the next section, we will explore the general principles that guide expense recognition in accrual accounting.

General Principles for Expense Recognition

Expense recognition in accrual accounting is governed by several general principles that guide the proper recording and reporting of expenses. These principles ensure that expenses are matched with the corresponding revenues and accurately reflect a company’s financial performance. Let’s explore these key principles:

- Matching Principle: The matching principle states that expenses should be recognized in the same accounting period as the revenues they help generate. This principle ensures a cause-and-effect relationship between expenses and revenues, providing a more accurate representation of a company’s profitability.

- Consistency: Consistency is crucial in expense recognition. It requires that businesses apply the same accounting methods and principles consistently over time and across similar transactions. This promotes comparability and helps users of financial statements understand and analyze a company’s financial performance.

- Materiality: Materiality refers to the significance of an expense in relation to the overall financial statements. Material expenses should be recognized and disclosed separately to provide users of financial statements with relevant and meaningful information. Immaterial expenses, on the other hand, may be expensed immediately or grouped together for simplicity.

- Prudence: The principle of prudence encourages caution in financial reporting. It suggests that expenses should be recognized as soon as they are probable and reasonably estimated, even if there is a degree of uncertainty. This ensures a conservative approach to financial reporting and avoids the overstatement of assets and incomes.

- Hierarchy of Accounting Standards: Expense recognition follows a hierarchy of accounting standards, with Generally Accepted Accounting Principles (GAAP) serving as the foundation. Businesses should adhere to the applicable accounting standards and guidelines to ensure consistent and accurate expense recognition.

By following these general principles, businesses can ensure the proper recognition and recording of expenses, leading to transparent and reliable financial statements.

In the next section, we will provide specific examples of expense recognition to further illustrate how it works in practice.

Specific Examples of Expense Recognition

To better understand how expense recognition works in practice, let’s explore some specific examples of common business expenses:

- Cost of Goods Sold (COGS): In industries involving the sale of goods, the cost of producing or acquiring those goods is recognized as an expense when the goods are sold. This includes the direct costs of materials, labor, and overhead related to the production or procurement of the goods.

- Selling and Marketing Expenses: Expenses incurred in promoting and selling products or services, such as advertising costs, sales commissions, and marketing campaigns, are recognized as expenses when these activities occur and contribute to generating revenues.

- Administrative Expenses: Expenses related to general administrative functions, such as salaries of administrative staff, office rent, utilities, and office supplies, are recognized as expenses in the accounting period they are incurred.

- Research and Development (R&D) Expenses: Expenses incurred in the research and development of new products or technologies are recognized as expenses when the R&D activities occur. These expenses are often difficult to estimate and may require judgment and reliable documentation.

- Depreciation and Amortization: Depreciation is the systematic allocation of the cost of tangible assets (e.g., buildings, vehicles, and equipment) over their useful lives, while amortization is the allocation of the cost of intangible assets (e.g., patents, copyrights, and trademarks). These expenses are recognized over time to reflect asset deterioration and obsolescence.

- Interest and Financing Costs: Expenses related to borrowing money and financing activities, such as interest payments, bank fees, and other financing charges, are recognized as expenses over the period in which the borrowing or financing occurs.

These are just a few examples of the various expenses that businesses encounter. The timing of expense recognition depends on the specific circumstances and criteria discussed earlier, ensuring that expenses are matched with the revenues they help generate.

It’s important for businesses to carefully evaluate their expenses and apply the appropriate recognition criteria and principles to ensure accurate financial reporting.

In the next section, we will discuss some controversial issues that arise in expense recognition and the challenges they pose.

Controversial Issues in Expense Recognition

Expense recognition in accrual accounting is not without its controversies and challenges. There are several issues that can arise, leading to debates and differing opinions. Let’s explore some of the controversial issues in expense recognition:

- Capitalization vs. Expense: Determining whether an expenditure should be capitalized or expensed can be subjective. Capital expenditures are recorded as assets and depreciated or amortized over time, while expenses are recognized immediately. Companies may have different approaches to determining what qualifies as a capital expenditure or an expense, leading to variations in financial reporting.

- Recognition of Contingent Liabilities: Contingent liabilities are potential obligations that depend on the occurrence or non-occurrence of future events. Determining when to recognize these liabilities as expenses can be challenging. Companies must assess the probability of the event occurring and whether the amount can be reasonably estimated to determine whether recognition is necessary.

- Lease Payments: The accounting treatment of lease payments has been a topic of debate. Under previous accounting standards, operating leases were not recognized as assets and liabilities, but now, they must be recognized on the balance sheet. This change has led to complexities in assessing the appropriate classification and recognition of lease-related expenses.

- Impairment of Assets: Assessing the impairment of long-term assets, such as goodwill, property, and equipment, can be subjective. Companies must determine whether there has been a significant decline in the value of the asset and whether it should be written down. This process involves judgment and estimation, which may differ from one company to another.

- Research and Development (R&D) Costs: Determining the classification of costs incurred in R&D activities can be challenging. Some costs may be recognized as expenses immediately, while others may be capitalized as intangible assets. Companies must carefully evaluate and support their decision-making process regarding which costs qualify for capitalization.

- Revenue-Related Expenses: Expenses incurred in generating revenues, such as sales and marketing expenses, can be difficult to allocate and match with specific revenue streams. Determining the appropriate allocation method or timing of recognition for these expenses can lead to differing opinions.

These controversial issues highlight the complexities and subjectivity involved in expense recognition. Companies must exercise professional judgment and apply consistent and transparent accounting policies to ensure the accuracy and reliability of their financial statements.

Now, let’s wrap up our discussion on expense recognition in the next section.

Conclusion

Expense recognition is a fundamental aspect of financial reporting in accrual accounting. By accurately recording and matching expenses with the revenues they help generate, businesses can provide stakeholders with reliable and transparent financial information.

In this article, we have explored the definition of expense recognition and the basic principles of accrual accounting that underpin its application. We discussed the recognition criteria for expenses, including probability, measurability, relevance, reliability, and materiality. We also highlighted the general principles that guide expense recognition, such as the matching principle, consistency, materiality, prudence, and the hierarchy of accounting standards.

Additionally, we provided specific examples of expense recognition, ranging from cost of goods sold (COGS) to depreciation and amortization. These examples demonstrate how different types of expenses are recognized in financial reporting.

Moreover, we acknowledged the controversial issues that can arise in expense recognition, including the capitalization vs. expense debate, recognition of contingent liabilities, lease payments, impairment of assets, R&D costs, and revenue-related expenses. These controversies require professional judgment and adherence to accounting standards to ensure consistent and accurate financial reporting.

Expense recognition is a crucial process that allows businesses to analyze their financial performance, make informed decisions, and comply with accounting regulations. By understanding the principles and criteria governing expense recognition, companies can present financial statements that are reliable, transparent, and useful to stakeholders.

As financial reporting standards evolve and business practices change, it is important for companies to stay updated and ensure their expense recognition practices align with the latest guidelines and regulations.

In conclusion, expense recognition in accrual accounting is a vital component of financial reporting, enabling businesses to accurately depict their financial position and performance. By following the principles and criteria outlined in this article, companies can provide stakeholders with meaningful and reliable financial information, fostering trust and informed decision-making.