Finance

What Is A Limited Credit File

Modified: March 1, 2024

Learn what a limited credit file is and how it can impact your finances. Understand the implications and steps you can take to build credit.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction:

Having a solid credit history is crucial for financial stability and opportunities. It enables individuals to secure loans, mortgages, and credit cards with favorable terms and interest rates. However, some individuals may find themselves in a situation where they have a limited credit file. A limited credit file refers to a lack of substantial credit history, making it difficult for lenders and financial institutions to assess an individual’s creditworthiness.

While having a limited credit file may seem like a minor issue, it can have significant impacts on one’s financial life. Without a robust credit history, individuals may face challenges when trying to obtain credit, rent an apartment, or even apply for a job. Therefore, it becomes essential to understand the causes, effects, and strategies to overcome the limitations of a limited credit file.

In this article, we will delve deeper into what a limited credit file means, explore its causes, discuss the effects it can have on individuals, and provide practical strategies to build credit when faced with this limitation. Additionally, we will highlight the importance of building credit and the long-term benefits it can bring to individuals’ financial well-being.

Definition of a Limited Credit File:

A limited credit file refers to a situation where an individual has a minimal or insufficient credit history. It means that there are not enough credit accounts or payment information available for lenders or credit bureaus to accurately assess a person’s creditworthiness.

When a person has a limited credit file, it usually means they have not had many credit-related activities, such as taking out loans, opening credit cards, or making regular payments on bills or debts. As a result, there is limited information available to evaluate their financial responsibility and reliability.

Having a limited credit file can stem from various reasons. It can occur for young individuals who are just starting their financial journey and have not had enough time to establish credit. Individuals who have recently immigrated to a new country may also face this issue, as their credit history from their home country may not be transferable or recognized.

In some cases, individuals may intentionally avoid using credit or taking on debt due to personal financial preferences or a lack of trust in the financial system. While this may be a valid choice, it can lead to a limited credit file and pose challenges when trying to access credit in the future.

It is important to note that a limited credit file is different from having a bad credit history. While both can create obstacles when seeking credit, a limited credit file implies a lack of credit history, whereas a bad credit history indicates a negative track record of late payments, defaults, or other credit-related issues.

In the next section, we will explore the various causes that can contribute to a limited credit file.

Causes of a Limited Credit File:

There are several factors that can contribute to the development of a limited credit file. Understanding these causes can shed light on why some individuals may find themselves in this situation. Below are some common causes:

- Young Age or Limited Financial History: Young individuals who are just starting their financial journey may not have had enough time to establish a substantial credit history. Without credit accounts or payment history, they may have a limited credit file.

- New Immigrants: Individuals who have recently immigrated to a new country often face difficulties in transferring or establishing their credit history. As a result, they may have a limited credit file until they can build a new credit history in their new country.

- Avoidance of Credit Usage: Some individuals may choose to avoid using credit or taking on debt for personal financial reasons. While this can be a valid choice, it can lead to a limited credit file as there is a lack of credit-related activities and payment information to assess creditworthiness.

- Lack of Awareness or Understanding: Some individuals may be unaware of the importance of building credit or may not fully understand how credit works. This lack of awareness or understanding can result in a limited credit file if they do not actively engage in credit-related activities.

It is essential to recognize that a limited credit file is not indicative of financial irresponsibility or poor money management. It can occur due to various circumstances and is often a temporary situation that can be addressed by taking proactive steps to build credit.

In the next section, we will discuss the potential effects of having a limited credit file.

Effects of a Limited Credit File:

Having a limited credit file can have significant impacts on various aspects of an individual’s financial life. From difficulty accessing credit to facing obstacles in rental applications or even job opportunities, the effects can be far-reaching. Let’s explore some of the common effects of a limited credit file:

- Difficulty Obtaining Credit: One of the most apparent effects is the challenge of obtaining credit. Lenders rely on credit history as a measure of creditworthiness, and with a limited credit file, it becomes harder for individuals to secure loans, credit cards, or other forms of credit.

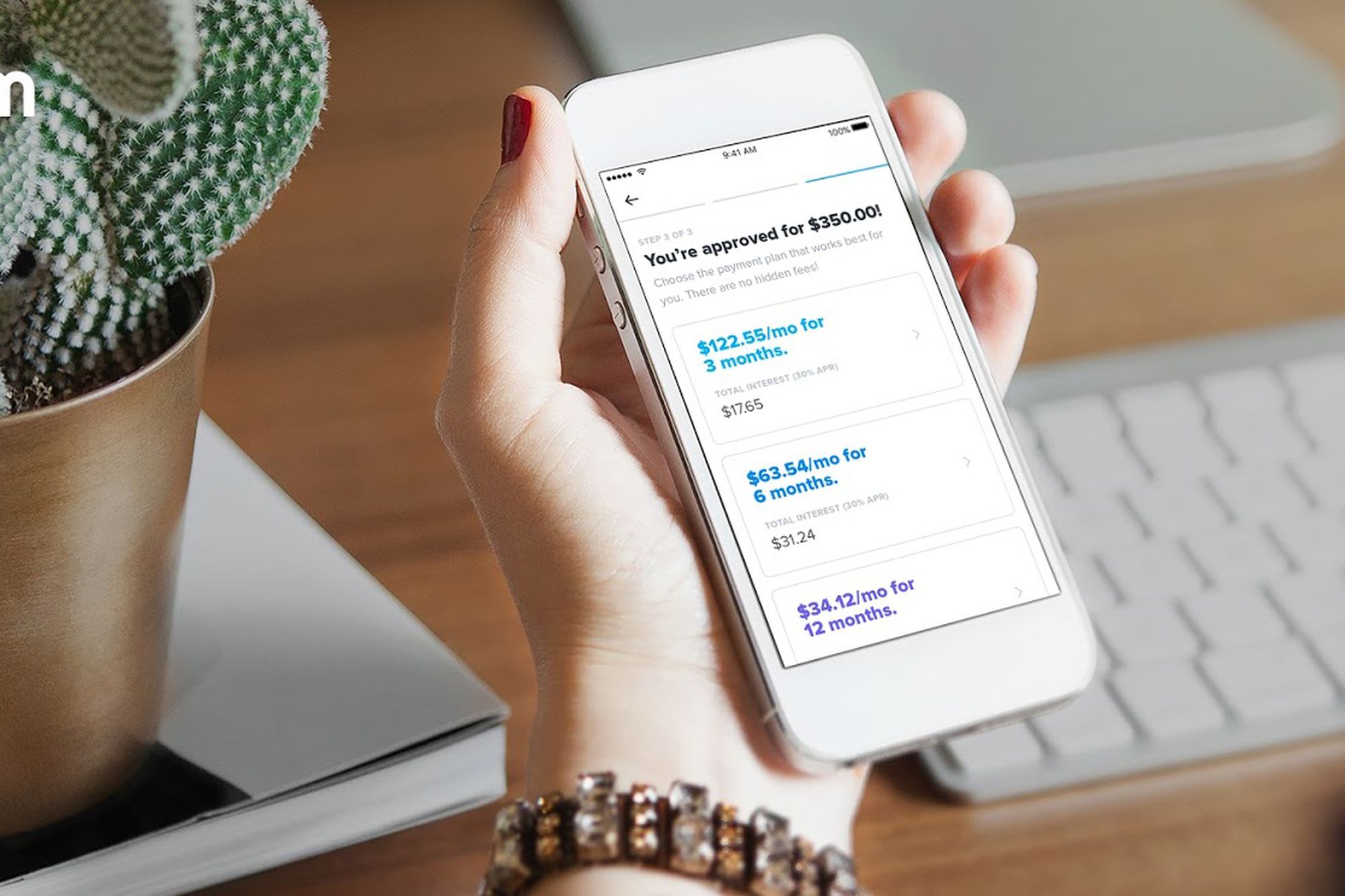

- Higher Interest Rates: Even if individuals with a limited credit file are able to obtain credit, they often face higher interest rates. Lenders consider limited credit history as a higher risk, and as a result, individuals may be offered credit terms with higher interest rates and less favorable repayment options.

- Limited Access to Rental Housing: Many landlords use credit reports as part of their screening process for potential tenants. A limited credit file can make it harder for individuals to secure rental housing, as landlords may view them as higher risk or prefer tenants with a more established credit history.

- Difficulty in Employment Opportunities: Some employers may review credit history as part of their hiring process, especially in positions that involve handling finances or sensitive information. A limited credit file could potentially impact an individual’s chances of securing certain job opportunities.

- Inability to Establish Business Credit: For entrepreneurs or individuals looking to start their own businesses, a limited credit file can pose challenges in establishing business credit. This can make it harder to obtain business loans or financing, hindering the growth and development of the business.

These effects highlight the importance of addressing a limited credit file and taking proactive steps to build credit. In the next section, we will discuss strategies that can be implemented to build credit when faced with this limitation.

Challenges Faced by Individuals with a Limited Credit File:

Having a limited credit file can present several challenges that individuals must navigate. These challenges can affect various aspects of their financial lives and can make it more difficult to achieve certain goals. Let’s explore some of the common challenges faced by individuals with a limited credit file:

- Limited Access to Credit: The primary challenge is the limited access to credit. Without a robust credit history, individuals may struggle to qualify for loans, credit cards, or other forms of credit. This can make it challenging to finance major purchases, such as a car or a home, or even cover unexpected expenses.

- Higher Interest Rates: Even if individuals are able to obtain credit, they may face higher interest rates. Lenders view a limited credit file as a higher risk, and as a result, individuals may be offered credit terms with higher interest rates. This can increase the cost of borrowing and make it more challenging to manage debt.

- Difficulty Renting an Apartment: Landlords often rely on credit checks when evaluating potential tenants. With a limited credit file, individuals may face difficulties in securing rental housing. This can limit their options and make it more challenging to find suitable and affordable housing.

- Limited Job Opportunities: Some employers consider credit history as part of their screening process, especially for positions that involve handling finances or sensitive information. A limited credit file could potentially hinder an individual’s chances of securing certain job opportunities, adding an extra hurdle in their career development.

- Higher Insurance Premiums: Insurance companies may use credit information to determine premium rates. With a limited credit file, individuals may be viewed as higher risk and may end up paying higher premiums for auto, home, or other types of insurance.

- Inability to Establish Business Credit: For entrepreneurs and business owners, a limited credit file can pose challenges in establishing business credit. This can make it more difficult to obtain business financing, secure vendor credit, or access trade lines that are essential for business growth and expansion.

These challenges highlight the need for individuals with a limited credit file to take proactive steps to build their credit. In the next section, we will discuss effective strategies that can be implemented to build credit and overcome these challenges.

Strategies to Build Credit with a Limited Credit File:

Building credit may seem daunting for individuals with a limited credit file, but it is certainly possible with the right strategies and consistent effort. By implementing the following strategies, individuals can start to establish a positive credit history and improve their creditworthiness:

- Apply for a Secured Credit Card: Secured credit cards are a great option for individuals with limited credit. These cards require a security deposit, which acts as collateral, minimizing the risk for the lender. Making small purchases and paying off the balance in full each month helps build a positive payment history and demonstrates responsible credit usage.

- Become an Authorized User: Another strategy is to become an authorized user on someone else’s credit card. This can be a family member or a trusted friend who has a good credit history. Their positive credit activity can be reported on the individual’s credit report and help establish a positive credit profile.

- Obtain a Credit-Builder Loan: Credit-builder loans are specifically designed to help individuals build credit. With these loans, the borrowed money is held in a savings account, and regular payments are reported to the credit bureaus. This allows individuals to build a positive payment history and demonstrate creditworthiness.

- Use Rent and Utility Payment Reporting Services: Some companies offer services that report rental and utility payments to credit bureaus. Timely payments for rent, utilities, and other monthly bills can help individuals establish a positive credit history, even with a limited credit file.

- Make Timely Payments and Keep Balances Low: Consistently making payments on time is crucial for building credit. Late payments can have a negative impact on credit scores. Additionally, keeping credit card balances low, ideally below 30% of the credit limit, can positively affect credit utilization ratios.

- Monitor Credit Reports: It is essential to regularly check credit reports for accuracy and any potential errors. Ensuring that all information is correct and up-to-date is important for maintaining a positive credit profile. If any discrepancies or errors are found, individuals should take immediate steps to dispute and correct them.

By implementing these strategies and practicing responsible credit habits, individuals with a limited credit file can gradually build a strong credit history and improve their creditworthiness. It is important to remember that building credit takes time and consistency, but the efforts will ultimately pay off in the form of increased access to credit and improved financial opportunities.

Importance of Building Credit:

Building credit is crucial for achieving financial stability and opening up a world of opportunities. It goes beyond simply obtaining credit cards or loans; it establishes a foundation for future financial endeavors. Here are some key reasons why building credit is important:

- Access to Credit: Building credit provides individuals with access to credit products such as loans, credit cards, and lines of credit. This is particularly important for major purchases like buying a home or a car. Having good credit increases the chances of obtaining credit with favorable terms and lower interest rates, saving individuals money in the long run.

- Financial Flexibility: Good credit opens up possibilities and provides financial flexibility. It allows individuals to handle unexpected expenses or emergencies by accessing credit when needed. It also enables them to take advantage of opportunities such as starting a business, furthering education, or investing in real estate.

- Lower Insurance Premiums: Many insurance companies use credit information when determining insurance premiums. A strong credit history can lead to lower insurance premium rates on auto, home, or other types of insurance. This means individuals can save money on insurance costs and use those savings towards other financial goals.

- Employment Opportunities: Some employers may review credit history as part of their hiring process, especially for positions that involve handling finances or sensitive information. Building good credit enhances job prospects and may give individuals a competitive edge in a competitive job market.

- Rental Applications: Landlords often check credit reports when reviewing rental applications. A solid credit history can increase the chances of securing a desired rental property. It demonstrates financial responsibility and gives landlords confidence in an individual’s ability to pay rent on time.

- Building Trust with Financial Institutions: Establishing and maintaining good credit builds trust with financial institutions. Over time, individuals with a strong credit history may qualify for higher credit limits, better loan terms, and exclusive financial products and services.

Building credit takes time and requires consistent financial responsibility. By making timely payments, keeping credit utilization low, and practicing good credit habits, individuals can build a solid credit foundation. It is important to remember that building credit is an ongoing process that requires discipline and vigilance.

By understanding and appreciating the importance of building credit, individuals can take control of their financial future and unlock a wide range of possibilities.

Conclusion:

Having a limited credit file can present challenges, but it should not be seen as an insurmountable obstacle. By understanding the causes and effects of a limited credit file, individuals can take proactive steps to build their credit and improve their financial well-being.

Strategies such as obtaining secured credit cards, becoming an authorized user, and using credit-builder loans can help individuals establish a positive credit history. Making timely payments, keeping credit utilization low, and monitoring credit reports are crucial habits for maintaining good credit. Over time, these efforts can lead to improved access to credit, lower interest rates, and increased financial opportunities.

Building credit is not only about accessing financial products and services. It is about establishing a foundation of trust with lenders, landlords, and potential employers. A strong credit history demonstrates financial responsibility and reliability, opening doors to better renting options, job opportunities, and lower insurance premiums.

It is important for individuals to recognize the long-term benefits and importance of building credit. Through financial discipline, regular monitoring, and responsible credit usage, individuals can overcome the challenges of a limited credit file and pave the way for a more secure financial future.

At the end of the day, building credit is an investment in one’s financial well-being and opens up a world of possibilities. By taking the necessary steps to build credit, individuals can achieve greater financial stability, flexibility, and the ability to seize opportunities that come their way.