Finance

What Is Limited Credit

Published: January 9, 2024

Learn about limited credit and its impact on your financial situation. Find out what limited credit means and how it can affect your ability to obtain loans and credit cards. Gain a better understanding of the importance of building and improving credit history.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Overview

When it comes to managing finances, creditworthiness plays a pivotal role. But what happens when you have limited credit? Limited credit refers to having a thin credit file, meaning there is not enough credit history to accurately assess your creditworthiness. This can occur for individuals who are new to borrowing or those who have primarily used cash for their transactions.

Having limited credit can present challenges when it comes to achieving financial goals, such as obtaining a loan for a mortgage or car purchase. Lenders rely on credit scores and credit reports to evaluate the risk of lending money, and with limited credit, it becomes difficult to demonstrate a track record of responsible borrowing and timely repayments.

Fortunately, there are strategies for building credit and expanding your credit history. By understanding the factors that contribute to limited credit and adopting smart financial habits, you can establish a solid foundation for a positive credit profile.

In this article, we will delve into the definition of limited credit, explore the factors that contribute to it, discuss how it impacts borrowing, provide strategies for building credit with limited history, and highlight common mistakes to avoid. By the end, you will have a comprehensive understanding of limited credit and the steps you can take to improve your financial standing.

Definition of Limited Credit

Limited credit refers to a situation where an individual has a thin or minimal credit history. It means that there is not enough information available to accurately assess their creditworthiness. Creditworthiness is a measure of an individual’s ability to repay borrowed funds based on their financial behavior and credit history.

Credit history is typically reflected in a credit report, which is a record of an individual’s past borrowing and repayment activities. It includes information such as credit accounts, payment history, outstanding debts, and public records such as bankruptcies or liens. A credit score is also derived from this information, representing a numerical assessment of an individual’s creditworthiness.

When someone has limited credit, it means they have a short or non-existent credit history, making it challenging for lenders to gauge their level of risk when extending credit. Limited credit is often associated with individuals who are new to borrowing, such as recent graduates or young adults, as well as those who have primarily used cash for their transactions rather than credit cards or loans.

Having limited credit can present obstacles when trying to secure financing or obtain favorable terms for loans. It is because lenders rely on credit reports and scores as a way to assess the likelihood of borrowers repaying their debts on time. Without sufficient credit history, lenders may view an applicant as higher risk or may offer less favorable interest rates and terms.

It is important to note that limited credit is different from bad or poor credit. While limited credit refers to a lack of credit history, bad credit refers to a negative credit history with a track record of delinquencies, defaults, or high levels of debt. However, having limited credit can be a form of risk in itself as lenders are uncertain about an individual’s ability to handle credit responsibly.

Now that we have a clear understanding of what limited credit means, let’s explore the factors that contribute to this situation.

Factors That Contribute to Limited Credit

Several factors can contribute to limited credit and result in a thin credit history. Understanding these factors can help individuals make informed decisions when it comes to building their credit profiles. Here are some common factors that can lead to limited credit:

- No Credit Accounts: One of the primary reasons for limited credit is the absence of credit accounts. If you have never taken out a loan or opened a credit card, you may not have any credit history.

- Limited Credit Card Usage: Even if you have a credit card, minimal or infrequent usage can result in limited credit. Lenders want to see a consistent credit usage pattern to evaluate your creditworthiness.

- Short Credit History: If your credit history is relatively short, it can contribute to limited credit. Lenders prefer to see a longer credit history to assess your ability to manage credit responsibly over time.

- No Diverse Credit Mix: Having only one type of credit account, such as a credit card or a student loan, can contribute to limited credit. A diverse credit mix, including different types of loans or lines of credit, indicates your ability to handle various financial responsibilities.

- Lack of Payments or Late Payments: Consistently missing payments or making late payments on loans or credit cards can negatively impact your credit history and contribute to limited credit.

- No Credit Inquiries: Applying for credit, such as loans or credit cards, may result in credit inquiries. If you have not applied for credit, you may lack credit inquiries, which can contribute to limited credit.

It’s important to note that having limited credit does not necessarily mean your credit score will be low. Your credit score is determined by various factors, including payment history, credit utilization, length of credit history, and types of credit used. However, limited credit can make it more difficult to establish a strong credit score.

Now that we have explored the factors that contribute to limited credit, let’s discuss how it impacts borrowing and the strategies to build credit with limited history.

How Limited Credit Impacts Borrowing

Having limited credit can significantly impact your ability to borrow money and obtain favorable terms. When lenders evaluate loan applications, they rely on credit reports and scores to assess the level of risk associated with lending to an individual. Limited credit makes it challenging for lenders to determine your creditworthiness and the likelihood of you repaying the borrowed funds.

Here are some ways in which limited credit can impact borrowing:

- Difficulty in Obtaining Loans: With limited credit history, lenders may be hesitant to extend credit or approve loan applications. They prefer borrowers with a track record of responsible borrowing and timely repayments.

- Higher Interest Rates: If you are approved for a loan with limited credit, you may be offered higher interest rates compared to someone with an established credit history. Lenders view limited credit as a higher risk and compensate for it by charging higher interest rates.

- Lower Credit Limits: Even if you are approved for a credit card or a line of credit with limited credit, the lender may assign you a lower credit limit. This is done to mitigate the risk associated with lending to someone with limited credit history.

- Co-Signer or Collateral Requirement: In some cases, when you have limited credit, lenders may require a co-signer or collateral as a form of security. This provides assurance to the lender that the borrowed funds will be repaid even in the absence of an extensive credit history.

- Limited Access to Credit Cards and Rewards: With limited credit, you may not qualify for credit cards with attractive rewards or benefits. These cards typically require a more established credit history to demonstrate responsible credit usage.

It’s important to understand that having limited credit doesn’t mean you will be unable to borrow money entirely. There are options available for individuals with limited credit, such as secured credit cards or loans specifically designed for building credit.

In the next section, we will discuss strategies for building credit with limited history to overcome these challenges and improve your creditworthiness.

Strategies for Building Credit with Limited History

Building credit with limited history may seem challenging, but with the right strategies, you can establish a solid credit foundation and improve your creditworthiness. Here are some effective strategies for building credit:

- Open a Secured Credit Card: A secured credit card is a type of credit card that requires a security deposit as collateral. By responsibly using a secured credit card and making timely payments, you can demonstrate your ability to manage credit and build a positive credit history.

- Become an Authorized User: If you have a family member or close friend with good credit, you can ask them to add you as an authorized user on their credit card. This allows you to benefit from their positive credit history and build your credit as their payment activity is reported on your credit report.

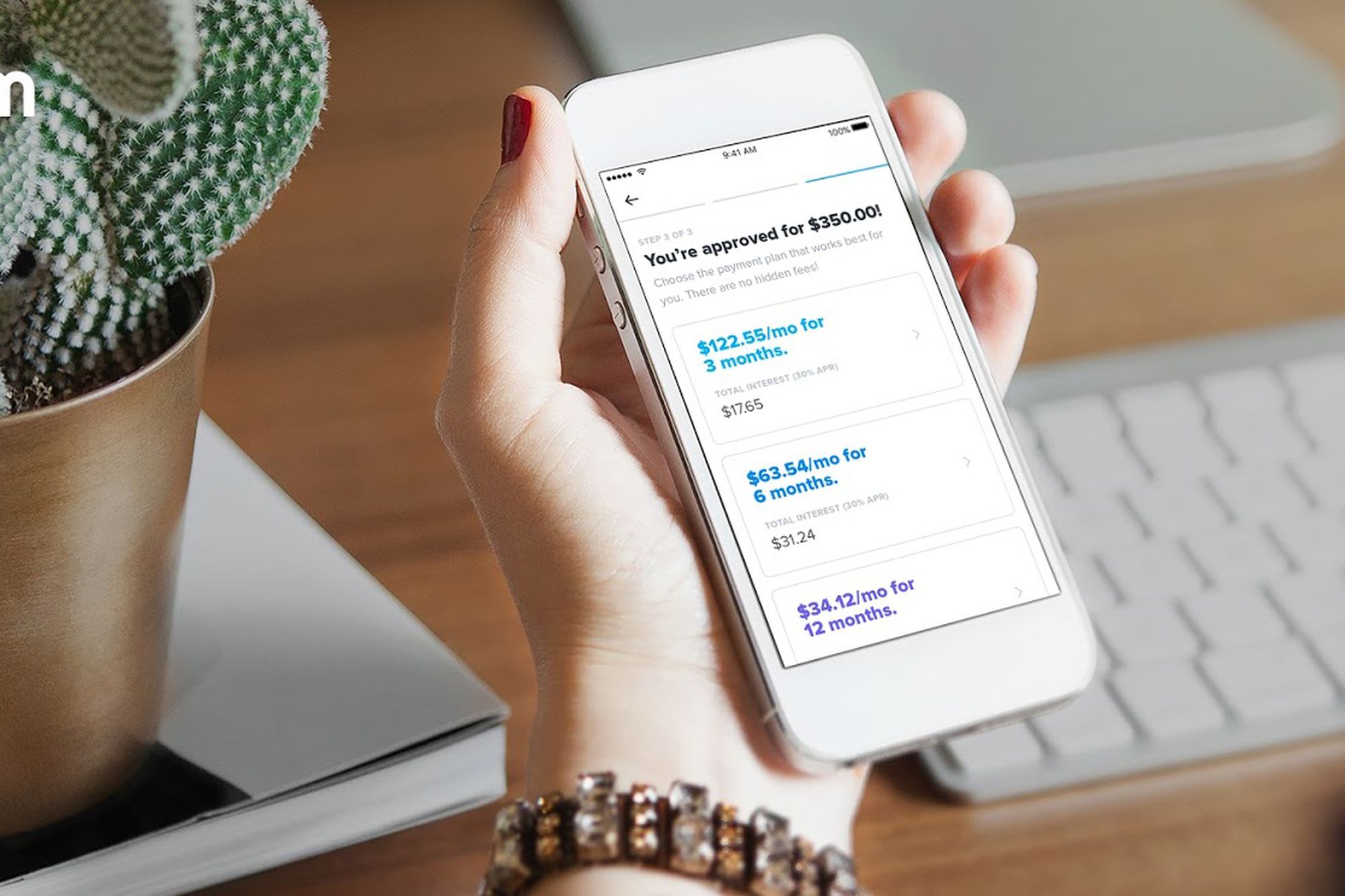

- Apply for a Credit Builder Loan: Credit builder loans are specifically designed for individuals with limited credit history. These loans work by borrowing a small amount of money, which is held in a savings account, and making monthly payments. Once the loan is repaid, you receive the funds, and your positive payment history is reported to the credit bureaus, helping build your credit.

- Pay Bills on Time: While not all bills are reported to the credit bureaus, consistent on-time payment of bills, such as rent, utilities, and phone bills, can help establish a positive payment history. Some credit scoring models consider alternative data, including utility and rent payments, in calculating credit scores.

- Maintain a Low Credit Utilization: Credit utilization refers to the percentage of your available credit that you are using. It is recommended to keep your credit utilization below 30% to demonstrate responsible credit management. Consider paying off credit card balances in full each month or keeping your overall balances low.

- Monitor Your Credit: Regularly checking your credit report allows you to identify any errors or unauthorized accounts that could negatively impact your credit. You can request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year.

It’s important to remember that building credit takes time and consistent effort. Be patient and stay committed to your financial goals. By following these strategies, you can gradually build a positive credit history and improve your creditworthiness.

In the next section, we will highlight some common mistakes to avoid when dealing with limited credit.

Common Mistakes to Avoid with Limited Credit

When dealing with limited credit, it is crucial to be aware of common pitfalls that can hinder your credit-building efforts. By avoiding these mistakes, you can establish a strong credit profile and improve your financial standing. Here are some common mistakes to avoid:

- Missing Payments: Making late payments or missing payments altogether can have a significant negative impact on your credit score. Always prioritize making payments on time to establish a positive payment history.

- Maxing Out Credit Cards: Utilizing a large portion of your available credit can negatively impact your credit score. Aim to keep your credit card balances well below their limits to demonstrate responsible credit management.

- Closing Old Credit Accounts: Closing old credit accounts, especially those with a long credit history, can shorten your overall credit history and potentially lower your credit score. Instead, consider keeping these accounts open and occasionally using them to maintain a positive credit history.

- Applying for Multiple Credit Cards or Loans: While it’s important to build credit, applying for too many credit cards or loans within a short period can raise concerns among lenders. Each application typically results in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Ignoring Your Credit Report: Regularly monitoring your credit report is essential, as it allows you to identify any errors or fraudulent activity. Regularly reviewing your credit report can help you address issues promptly and maintain an accurate credit profile.

- Co-Signing Loans for Others: While helping someone else by co-signing a loan may seem noble, it also puts your own credit at risk. If the borrower defaults or makes late payments, it can negatively impact your credit history. Be cautious when considering co-signing loans.

By avoiding these mistakes and practicing responsible credit management, you can build a positive credit history and improve your creditworthiness over time. Remember, establishing good credit habits early on will set a strong foundation for your financial future.

Now, let’s recap what we have discussed so far.

Conclusion

Having limited credit can pose challenges when it comes to borrowing and achieving financial goals. However, with the right strategies and financial habits, you can build credit and improve your creditworthiness. By understanding the factors that contribute to limited credit, such as a lack of credit accounts or a short credit history, you can take proactive steps to establish a solid credit foundation.

Opening a secured credit card, becoming an authorized user, or applying for a credit builder loan are effective strategies for building credit with limited history. Additionally, maintaining a good payment history, keeping credit utilization low, and regularly monitoring your credit report are crucial habits to develop.

It is important to avoid common mistakes that can hinder your credit-building efforts, such as missing payments, maxing out credit cards, or closing old credit accounts. By being mindful of these pitfalls and practicing responsible credit management, you can gradually improve your credit profile and enhance your chances of obtaining favorable loan terms and better financial opportunities.

Remember, building credit takes time, consistency, and patience. Stay committed to your financial goals and continue practicing smart financial habits. With determination and perseverance, you can overcome the limitations of limited credit and establish a strong credit foundation for a brighter financial future.

Thank you for reading, and best of luck on your journey to building credit!